Air Insulated Switchgear Market by Installation (Indoor, Outdoor), Voltage (Low, Medium, High), Application (Transmission & Distribution Utilities, Industrial, Commercial & Residential, Transportation) and Region - Global Forecast to 2029

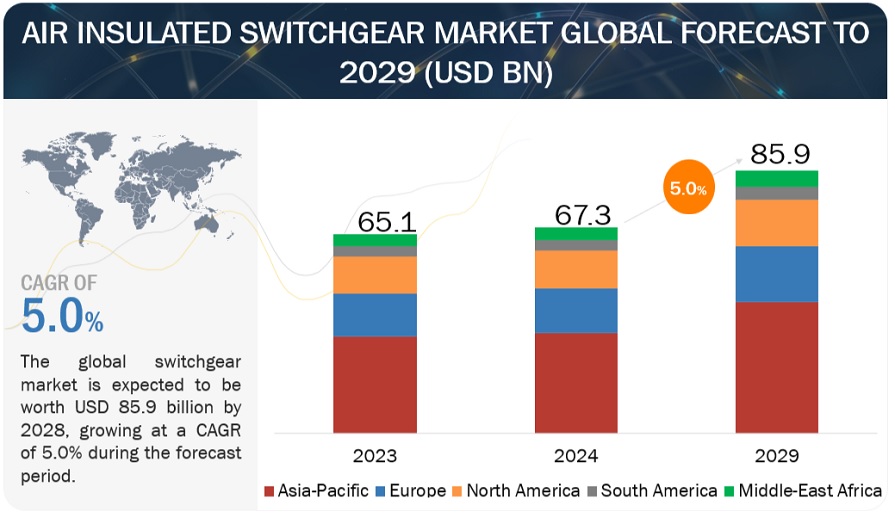

[224 Pages Report] The air insulated switchgear market is estimated at USD 67.3 billion in 2024, with a projected growth to USD 85.9 billion by 2029, exhibiting a Compound Annual Growth Rate (CAGR) of 5.0%. The dominant force in the market is the Asia Pacific region, followed by Europe and North America. A surge in infrastructure development demand, attributed to factors such as rising population, industrialization, and urbanization, has been significant. The infrastructure development industry offers promising prospects for air-insulated switchgear (AIS) owing to escalating electricity demand and robust financial backing for expanding power plants. The infrastructure & transportation segment is projected to grow rapidly in the global air-insulated switchgear market due to the presence of expanding power plants and the need for efficient and reliable power distribution systems. Infrastructure development projects and transportation systems require resilient and highly reliable electrical networks, making AIS a crucial component for these applications.

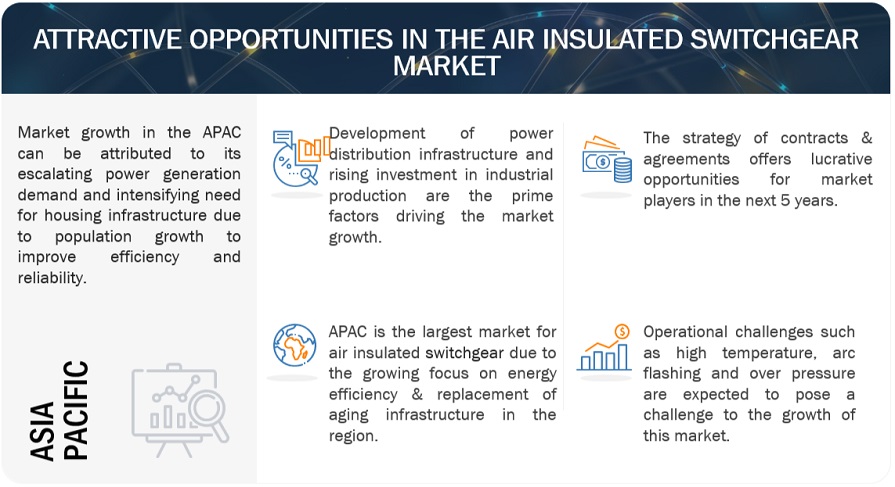

The Asia Pacific region is experiencing a rapid development phase, particularly in major economies, driving growth across various sectors including power transmission, distribution, industries, commercial and residential applications, and transportation. With escalating power generation demand, aligned with population growth, significant strides are being taken towards adopting clean energy sources. Ambitious targets for natural gas and renewable power generation in countries like China, Japan, and India underscore this transition. Furthermore, the robust marine industry concentrated in Japan, South Korea, and China is fueling demand for air insulated switchgear, crucial for safeguarding electrical equipment aboard marine vessels.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Air Insulated Switchgear Market Dynamics

Driver: Modernization of power distribution infrastructure

New regulations have emerged to reduce power blackouts and enhance power distribution networks. To mitigate power blackouts and improve power distribution networks, new regulations have been introduced, leading to a rapid expansion in the market for power equipment, especially monitoring solutions and advanced AIS. These technologies enable maintenance teams to access real-time data, identify aging or stressed equipment, proactively prevent failures, and enhance grid efficiency. Investing in these solutions is essential to guarantee a dependable and robust electricity supply amidst rising demand and changing climate conditions.

Restraints: Challenges of Spacing Requirements in Air Insulated Switchgear

Air Air-insulated switchgear (AIS) is a type of electrical switchgear that uses air as the primary insulating medium. It consists of various components such as circuit breakers, disconnect switches, and busbars, which are arranged in open-air compartments. The use of air as the insulation medium between its electrical components is the traditional approach to switchgear design. One of the key considerations when selecting AIS is the spacing requirements. Due to the use of air as the insulator, AIS requires larger spacing between components to prevent arcing and ensure safety. This is a significant restraint as it can lead to a larger physical footprint compared to other types of switchgear such as Gas Insulated Switchgear (GIS).

Opportunities: Air-Insulated Switchgear Adoption in Infrastructure Development

The infrastructure development industry offers promising prospects for air-insulated switchgear (AIS) owing to escalating electricity demand and robust financial backing for expanding power plants. The infrastructure & transportation segment is projected to grow rapidly in the global air-insulated switchgear market due to the presence of expanding power plants and the need for efficient and reliable power distribution systems. Infrastructure development projects and transportation systems require resilient and highly reliable electrical networks, making AIS a crucial component for these applications. AIS is suitable for smaller installations, making it a suitable option for residential areas and other applications where smaller substations are needed.

Challenges: Operational Hurdles in High-Voltage Air Insulated Switchgear Systems

Air insulated switchgear (AIS) components, particularly in high-voltage systems, demand regular inspections and maintenance to uphold peak performance. This involves scrutinizing for indications of deterioration, loose connections, and any other issues that might compromise the reliability of the switchgear. Routine testing of AIS, such as insulation resistance checks and circuit breaker tests, is crucial for detecting potential faults and averting unforeseen breakdowns. Managing AIS, particularly in large setups, can be laborious due to the substantial electrical power they handle, necessitating specialized components for insulation, arc interruption, and system reliability in high-voltage environments.

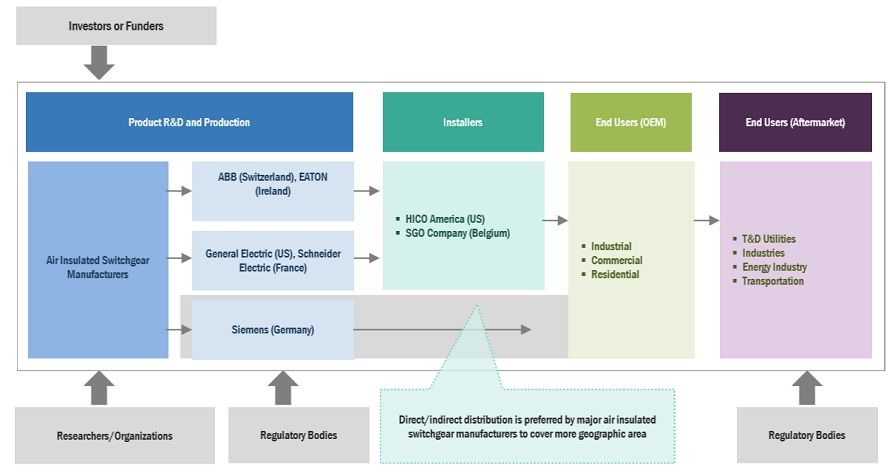

Air Insulated Switchgear Market Ecosystem

The market for AIS is marked by the participation of leading companies that are firmly established, financially robust, and possess substantial expertise in the production of AIS and related components. These companies hold a significant market presence and provide a wide array of product offerings. They harness advanced technologies and maintain extensive global sales and marketing networks. Among the notable players in this market are Eaton (Ireland), ABB (Switzerland), Siemens (Germany), General Electric (US), and Schneider Electric (France).

Medium voltage segment, by voltage, to grow at highest CAGR from 2024 to 2029.

AIS with a voltage rating of 2-36 kV are classified as medium-voltage switchgears. Widely employed across various end-user sectors, especially in manufacturing, process industries, and Transmission & Distribution (T&D) utilities, these switchgear encompass equipment like circuit breakers, paralleling switchgear, AIS (Air-Insulated Switchgear), main ring units, motor control centers, railway & marine switchgear, and surge arresters. Their role involves safeguarding industrial equipment such as generators, motors, compressors, HVAC & air conditioning systems, heating & lighting equipment, providing overload current protection, and supporting T&D sub-stations. Medium-voltage switchgear are integral to railway AC & DC traction power supply substations. The railway sector is witnessing a shift from diesel-electric locomotives to electric or battery-electric ones to curb emissions, particularly notable in the Asia Pacific region, thereby stimulating the growth of the medium-voltage (2-36 kV) AIS market.

Transmission and distribution segment, by application, to emerge as largest segment of air insulated switchgear market.

In 2023, the transmission and distribution segment dominated the air insulated switchgear market with a 35.6% share. Air insulated switchgear (AIS) is a crucial component in the transmission and distribution of electrical energy. It is an auxiliary distribution unit that disperses the electrical energy of the main transmission unit fed by a large distribution transformer. The AIS adopts air as the insulation media, with a designed voltage ranging from 11KV to 36KV for medium voltage power distribution systems. It plays a controlling and protecting role in the power system, ensuring the safe and reliable distribution of electrical energy. The AIS is a secondary power distribution device and is a medium voltage switchgear that redistributes the power of a primary power distribution device that is powered by a high voltage distribution transformer. It is widely used in power distribution stations and compact substations in load centers such as residential areas, high-rise buildings, large public buildings, and factory enterprises.

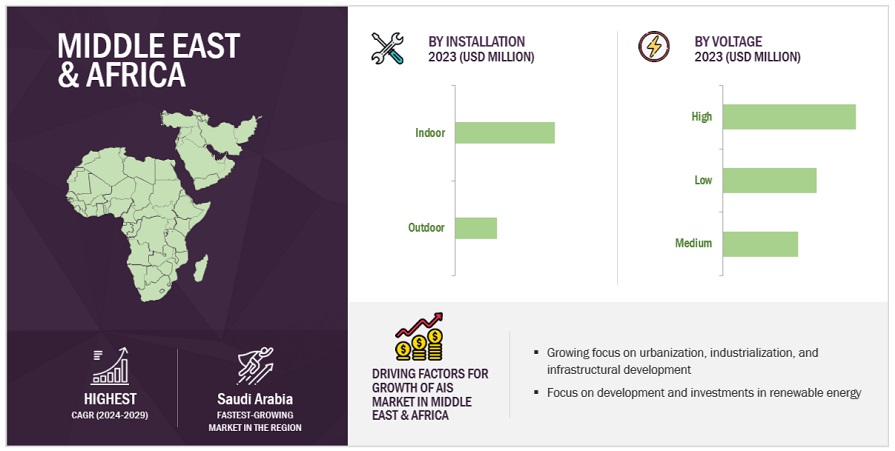

The Middle East & Africa Air Insulated Switchgear market is poised to achieve the second-highest CAGR throughout the forecast period.

In 2024, the Middle East & Africa region secured the second-highest market share of the air insulated switchgear market, with Saudi Arabia taking the lead, succeeded by UAE. The Middle East air insulated switchgear market has been further segmented based on country into GCC countries like Saudi Arabia, U.A.E., and Rest of GCC countries, South Africa, and Rest of the Middle East. The region is the fourth largest market for air insulated switchgear, and is expected to grow at the second fastest rate, after Asia-Pacific, owing to industrialization. The demand for air insulated switchgear in the Middle Eastern countries is rising, owing to increased infrastructural developments and rising oil & gas production activities. Also, the countries in the region have plans to restructure their power sectors, thereby, encouraging the private sector to invest in this industry, which is expected to decrease the financial burden to construct utility projects. The major applications of air insulated switchgear in the region include T&D and infrastructure, among others.

Key Market Players

Key players in the air insulated switchgear market, including ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), Eaton Corporation (Ireland), Larsen & Toubro (India), Toshiba (Japan), Alfanar Group (Saudi Arabia), leveraging their strong brands, diverse product portfolios, and effective distribution networks.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Voltage, By Installation, and By Application |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric Corporation (Japan), Eaton Corporation (Ireland), Toshiba (Japan), Larsen & Toubro (India), CG Power And Industrial Solutions Ltd. (India), Elatec Power Distribution (Germany), JST Power Equipment (US), Epe Malaysia (Malaysia), Alfanar Group (Saudi Arabia), Efacec (Portugal), C&S Electric Limited (India), Orecco (China), Hitachi Energy (Japan), Medelec (Switzerland), Switchgear Company (Belgium), Tavrida Electric (Russia), Hubbell Power Systems (US), S&C Electric Company (US), Federal Pacific (US), Radiant Enterprises (India), Fritz Drescher & Söhne GmBH (Germany), Terasaki Electric Co. Ltd. (Japan), Al Hamad Industries Int’l Switchgear (UAE). |

The air insulated switchgear (AIS) market is classified in this research report based on installation, voltage, application, and region.

Based on installation, the AIS market has been segmented as follows:

- Indoor

- Outdoor

Based on voltage, the AIS market has been segmented as follows:

- Low

- Medium

- High

Based on application, the AIS market has been segmented as follows:

- Transmission & Distribution Utilities

- Industrial

- Commercial & Residential

- Transportation

- Others

Based on regions, the AIS market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In August 2023, ABB expanded its partnership with Northvolt to electrify the world’s largest battery recycling facility, Revolt Ett, established by Northvolt in Skellefteå, northern Sweden.

- In April 2023, Siemens Energy and Spain's Dragados Offshore has signed a framework agreement with German-Dutch transmission system operator TenneT to supply high-voltage direct current (HVDC) transmission technology for three grid connections in the German North Sea.

- In April 2023, Eaton announced it has completed the acquisition of a 49% stake in Jiangsu Ryan Electrical Co. Ltd. (Ryan), a manufacturer of power distribution and sub-transmission transformers in China.

Frequently Asked Questions (FAQ):

What is the current size of the global air insulated switchgear (AIS) market?

The global air insulated switchgear market is estimated to be USD 85.9 billion in 2029.

What are the major challenges for AIS market?

Harsh environmental conditions, like extreme temperatures, humidity, and corrosive atmospheres, can hasten the wear and corrosion of AIS components, impacting their longevity. Furthermore, sourcing spare parts for older AIS models can pose challenges as manufacturers phase out specific product lines or components, complicating the upkeep and repair of existing infrastructure. Overcoming these operational hurdles demands a proactive approach from AIS manufacturers, operators, and maintenance personnel.

Which application has the third largest market share in the AIS market?

Commercial & Residential hold the third-largest market share in the AIS market. Air Insulated Switchgear (AIS) represents a cornerstone in electrical switchgear solutions, leveraging air as the insulation medium between live components and the grounded enclosure. Its widespread adoption spans across commercial and residential sectors, serving crucial roles in safeguarding, managing, and isolating electrical equipment. AIS stands out as a conventional yet indispensable element within power systems, delivering a cost-efficient alternative for medium-voltage applications. Its versatility finds application in various settings, including office complexes, retail centers, healthcare facilities, and residential developments.

What is the major opportunity for AIS market growth?

The infrastructure development industry offers promising prospects for air-insulated switchgear (AIS) owing to escalating electricity demand and robust financial backing for expanding power plants. The Infrastructure & transportation segment is projected to grow rapidly in the global air-insulated switchgear market due to the presence of expanding power plants and the need for efficient and reliable power distribution systems. Infrastructure development projects and transportation systems require resilient and highly reliable electrical networks, making AtS a crucial component for these applications. AIS is suitable for smaller installations, making it a suitable option for residential areas and other applications where smarter substations are needed. The increasing focus on renewable energy sources and the modernization of power distributton systems also present opportunities for AIS in the infrastructure development industry. The aging grid infrastructure and the need for upgrades, replacements, or augmentations of existing, aging substations highlight the need for many new substations, where AIS is expected to represent a significant portion of these new substations.

Which is the second largest-growing region during the forecast period in the AIS market?

During the forecast period, Europe is expected to be the second largest growing region in the AIS market. Europe is emphasizing enhancements in existing production efficiency and lowering energy use, rather than just increasing total installed capacity. Residential and commercial buildings across the continent are focused on modernizing and improving electrical systems to boost efficiency. Additionally, Europe boasts leading manufacturers of air insulated switchgear such as ABB in Switzerland, Schneider Electric in France, and Siemens in Germany, which significantly contributes to the region's market expansion. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study encompassed significant efforts in determining the present size of the air insulated switchgear market. It commenced with a thorough secondary research process to gather data related to the market, similar markets, and the overarching industry. Subsequently, these findings, assumptions, and market size calculations were rigorously validated by consulting industry experts across the entire value chain through primary research. The total market size was assessed by conducting an analysis specific to each country. Following that, the market was further dissected, and the data was cross-referenced to estimate the size of various segments and sub-segments within the market.

Secondary Research

In this research study, a wide range of secondary sources were utilized, including directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a crucial role in gathering valuable data for a comprehensive analysis of the global air insulated switchgear (AIS) market, covering technical, market-oriented, and commercial aspects. Additional secondary sources included annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by well-respected experts, information from industry associations, trade directories, and various database resources.

Primary Research

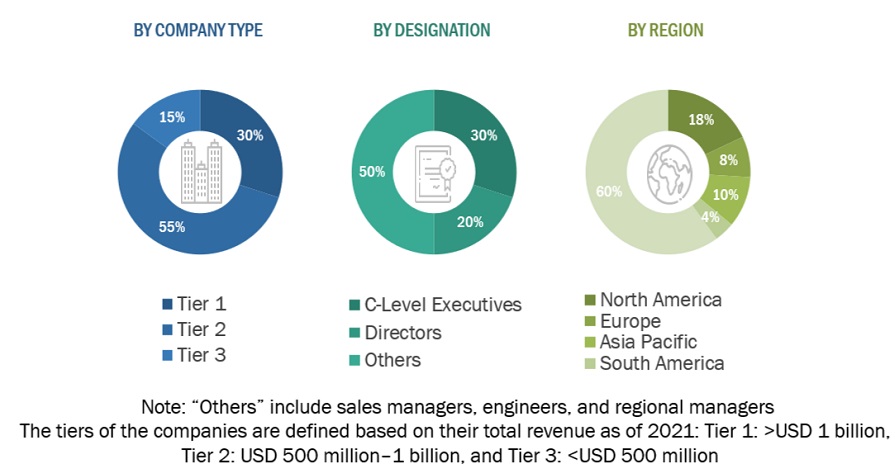

The AIS market involves a range of stakeholders, including component manufacturers, product manufacturers/assemblers, service providers, distributors, and end-users within the supply chain. The demand for this market is primarily driven by transmission and distribution applications. On the supply side, there is a notable trend of heightened demand for contracts from the industrial sector and a significant presence of mergers and acquisitions among major players.

To gather qualitative and quantitative insights, various primary sources from both the supply and demand sides of the market were interviewed. The following breakdown presents the primary respondents involved in the research study.

To know about the assumptions considered for the study, download the pdf brochure

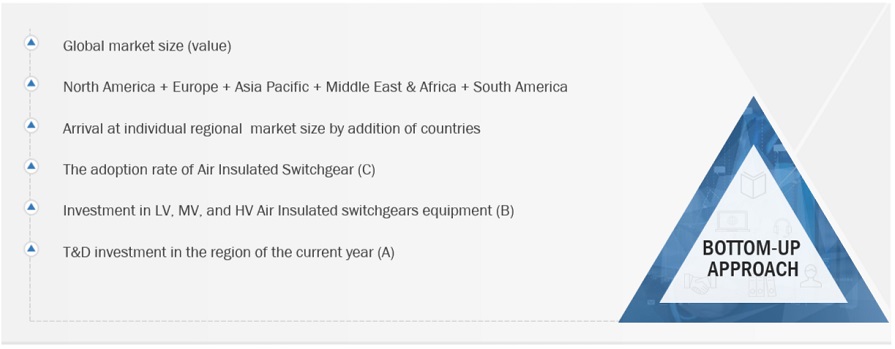

Market Size Estimation

The estimation and validation of the AIS market size have been conducted using a bottom-up approach. This approach was rigorously employed to ascertain the dimensions of multiple subsegments within the market. The research process comprises the following key stages.

In this method, the production statistics for each type of AIS have been examined at both the country and regional levels.

Thorough secondary and primary research has been conducted to gain a comprehensive understanding of the global market landscape for various categories of AIS.

Numerous primary interviews have been undertaken with key experts in the field of AIS system development, encompassing important OEMs and Tier I suppliers.

When calculating and forecasting the market size, qualitative factors such as market drivers, limitations, opportunities, and challenges have been taken into account.

Global AIS Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The process of determining the overall market size involved the methodologies described earlier, followed by segmenting the market into multiple segments and subsegments. To finalize the comprehensive market analysis and obtain precise statistics for each market segment and subsegment, data triangulation and market segmentation techniques were applied, as appropriate. Data triangulation was accomplished by examining various factors and trends from both the demand and supply perspectives within the ecosystem of the air insulated switchgear market.

Market Definition

Air Insulated Switchgear (AIS) is a crucial component in the electrical distribution system, providing a safe and reliable means of distributing electrical energy from the transmission system to the point of consumption. Air Insulated Switchgear (AIS) is a type of switchgear that uses air as an insulating medium. AIS is mostly used at high voltages due to the large size of the equipment required. However, it is susceptible to environmental conditions such as dust, humidity, and temperature. There are different types of AIS based on voltage levels: low voltage (LV), medium voltage (MV), and high voltage (HV) AIS, each with varying levels of complexity and protection requirements.

The market encompasses a wide range of stakeholders, from component manufacturers and product assemblers to service providers and end-users and is influenced by factors such as development of power distribution infrastructure, rapid growth in renewable energy-based capacity, likewise.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Air Insulated Switchgear manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Air-insulated Switchgear Raw Material and Component Manufacturers

- Air-insulated Switchgear Manufacturers, Dealers, and Suppliers

- Electrical Equipment Manufacturers’ Associations and Groups

- Power Utilities and Other End User Companies

- Consulting Companies in the Energy and Power Domain

- Investment Banks

Objectives of the Study

- The air insulated switchgear market will be defined, described, segmented, and forecasted based on installation, voltage, and application.

- To forecast market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East and Africa, as well as the key countries within each region.

- To provide comprehensive information about market growth drivers, restraints, opportunities, and industry-specific challenges.

- To strategically analyze the subsegments in terms of individual growth trends, prospects, and contributions to overall market size.

- To examine market opportunities for stakeholders and the competitive landscape for market leaders.

- To profile the key players strategically and thoroughly analyze their market shares and core competencies.

- To monitor and analyze competitive developments in the air insulated switchgear market, such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments.

- This report examines the value of the air insulated switchgear market.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Air Insulated Switchgear Market