Heat Transfer Fluids Market by Product Type (Mineral Oils, Synthetic Fluids, Glycol-Based Fluids), End-use Industry (Chemical & Petrochemicals, Oil & Gas, Automotive, Food & Beverages, Pharmaceuticals, HVAC, Renewable Energy) - Global Forecast to 2029

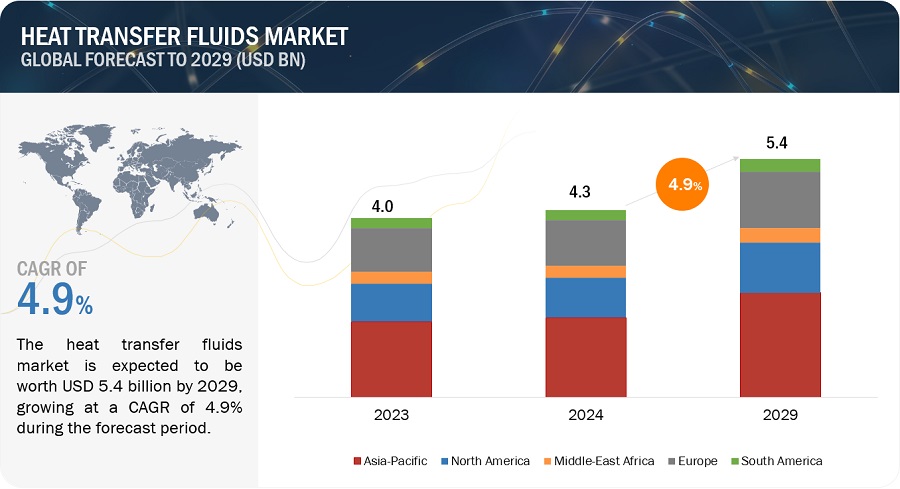

The heat transfer fluids market is projected to reach USD 5.4 billion by 2029, at a CAGR of 4.9% from USD 4.3 billion in 2024. The market is mainly led by the growing demand for energy-efficient solutions and rapid industrialization. The global emphasis on sustainable practices is a major driver for the growth of the heat transfer fluids market.

To know about the assumptions considered for the study, Request for Free Sample Report

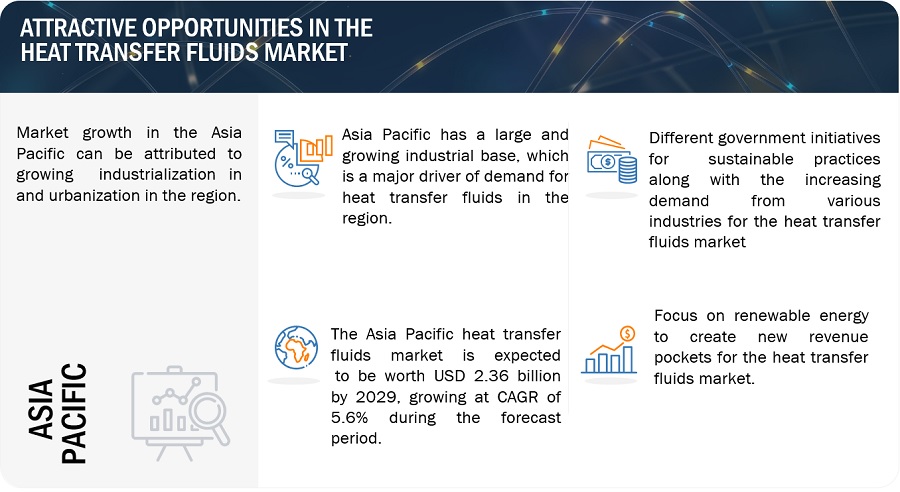

Attractive Opportunities in the Heat Transfer Fluids Market

Market Dynamics

Driver: Increasing industrialization and urbanization globally

Increasing industrialization and urbanization globally are significant drivers for the heat transfer fluids market. As countries industrialize, particularly in emerging economies, the demand for efficient thermal management solutions in various industrial processes intensifies. Industries such as chemical and petrochemical, manufacturing, food and beverages, and automotive rely heavily on heat transfer fluids to maintain optimal operating temperatures, ensure process efficiency, and enhance energy conservation. The expansion of these industries, fueled by rapid industrialization, creates substantial demand for heat transfer fluids. Urbanization further boosts this demand by driving infrastructure development and the growth of HVAC systems. As urban areas expand, the need for residential, commercial, and industrial buildings equipped with efficient heating, ventilation, and air conditioning systems increases. Heat transfer fluids are crucial in these systems for effective thermal management, ensuring comfort and energy efficiency in urban environments. Moreover, urbanization often accompanies advancements in public services and utilities, such as district heating systems, which also utilize heat transfer fluids. The combined effect of industrial growth and urban development accelerates the adoption of heat transfer fluids across various applications. This trend is reinforced by the global push for energy efficiency and sustainability, prompting industries and urban infrastructure to adopt advanced heat transfer technologies to meet these goals, thereby driving market growth.

Driver: Rising demand for energy-efficient solutions

The rising demand for energy-efficient solutions is a major driver for the heat transfer fluids market due to the increasing emphasis on reducing energy consumption and optimizing operational efficiency across various industries. As global energy costs continue to rise and environmental concerns grow, industries are seeking ways to minimize their energy usage and carbon footprint. Heat transfer fluids play a critical role in achieving these goals by enhancing the efficiency of thermal management systems in processes such as heating, cooling, and power generation. In industrial applications, efficient heat transfer is essential for maintaining optimal temperatures, improving process efficiency, and reducing energy losses. High-performance heat transfer fluids ensure better thermal conductivity and stability, leading to significant energy savings and improved system performance. In HVAC systems, particularly in commercial and residential buildings, energy-efficient heat transfer fluids contribute to lower energy consumption and reduced operating costs, aligning with the increasing demand for sustainable building solutions. Furthermore, the push for renewable energy sources, such as solar thermal and wind power, amplifies the need for advanced heat transfer fluids that can efficiently store and transfer energy. These fluids are crucial for maximizing the energy output and reliability of renewable energy systems. Overall, the drive for energy efficiency across industrial, commercial, and renewable energy sectors is propelling the growth of the heat transfer fluids market, as these fluids are integral to achieving energy-efficient and sustainable operations.

Driver: Technological development in HTF formulation

Technological development in heat transfer fluid (HTF) formulations is a major driver for the heat transfer fluids market due to the enhanced performance characteristics and expanded application range these advancements provide. Innovative HTF formulations offer superior thermal stability, improved heat transfer efficiency, and extended operational lifespans. These advancements allow HTFs to function effectively in extreme temperatures, both high and low, which is crucial for industries with stringent thermal management requirements such as chemical processing, pharmaceuticals, and high-temperature manufacturing. New formulations also address specific challenges such as oxidation resistance, reduced fouling, and lower maintenance needs, resulting in more reliable and efficient thermal systems. For instance, enhanced oxidative stability prevents the degradation of fluids, thereby extending their useful life and reducing the frequency of fluid replacement and system downtime. This not only improves operational efficiency but also lowers maintenance costs. Furthermore, technological advancements have led to the development of environmentally friendly HTFs that meet stringent environmental and safety regulations. These formulations are non-toxic, biodegradable, and have lower global warming potential, aligning with the global push towards sustainability. This makes them highly attractive for use in HVAC systems, renewable energy applications like solar thermal plants, and other industries looking to reduce their environmental impact. Overall, technological progress in HTF formulations drives market growth by offering tailored solutions that meet evolving industry needs, enhance system performance, and support environmental sustainability.

Restraints: Stringent regulatory compliances

Stringent regulatory compliance poses a major restraint for the heat transfer fluids (HTF) market due to the complex and evolving nature of regulatory requirements. HTFs are subject to various regulations and standards related to environmental impact, safety, and performance. Meeting these standards often requires extensive testing, documentation, and certification processes, which can be time-consuming and costly for manufacturers. Additionally, regulatory changes and updates may necessitate reformulation or adjustments to existing HTF products, further adding to compliance challenges. Failure to comply with regulatory requirements can result in fines, legal issues, and damage to brand reputation, leading to market setbacks. Consequently, navigating and adhering to stringent regulatory frameworks poses a significant barrier for HTF manufacturers, impacting market growth and innovation.

Restraints: Volatility in raw material prices

Volatility in raw material prices presents a significant restraint for the heat transfer fluids (HTF) market. HTFs are often derived from petroleum-based or synthetic sources, and their prices are closely linked to fluctuations in crude oil prices and other raw materials. Sudden spikes or fluctuations in these prices can lead to increased production costs for HTF manufacturers, impacting profit margins and pricing strategies. Moreover, uncertainty in raw material prices makes it challenging for manufacturers to forecast and plan effectively, potentially leading to supply chain disruptions and inventory management issues. This volatility can also influence market competitiveness, as manufacturers may struggle to maintain competitive pricing amid fluctuating costs. Additionally, price volatility can affect investment decisions and research and development efforts in the HTF industry, hindering innovation and product development. Overall, the unpredictability of raw material prices poses a significant challenge for HTF manufacturers, contributing to market restraints.

Opportunity: Focus on renewable energy coupled with government schemes and initiatives

The focus on renewable energy, combined with government schemes and initiatives, presents a significant opportunity for the heat transfer fluids (HTF) market. Governments worldwide are increasingly promoting and incentivizing the adoption of renewable energy sources like solar, wind, and geothermal power to reduce carbon emissions and combat climate change. This drive towards renewable energy creates a growing demand for HTFs, as these fluids play a crucial role in energy storage, transfer, and thermal management in renewable energy systems. Additionally, government schemes and initiatives such as subsidies, tax incentives, and research funding encourage investments in renewable energy projects, further driving the demand for HTFs. Moreover, regulations mandating the use of environmentally friendly and sustainable HTFs align with the global push towards green technologies, positioning HTF manufacturers to capitalize on this trend by offering innovative and eco-friendly solutions. Overall, the focus on renewable energy coupled with supportive government policies presents a favorable opportunity for the HTF market to expand and thrive.

Challenge: Fire & explosion hazard related to heat transfer fluids

Fire and explosion hazards related to heat transfer fluids (HTF) pose significant risks in industries where these fluids are used. HTFs are often flammable or combustible, especially those derived from petroleum-based sources. In the event of a leak or spill, HTFs can create a fire hazard if they come into contact with ignition sources such as hot surfaces, electrical equipment, or open flames. Additionally, high temperatures and pressure conditions in HTF systems increase the risk of explosions if there are malfunctions, equipment failures, or inadequate safety measures in place. These hazards can result in property damage, production downtime, injuries, and even loss of life. Therefore, proper handling, storage, and maintenance procedures, along with comprehensive risk assessment and safety protocols, are essential to mitigate fire and explosion risks associated with HTFs and ensure workplace safety.

Challenge: Competition from alternative technologies

Competition from alternative technologies presents a significant challenge for the heat transfer fluids (HTF) market. As industries evolve and seek more efficient and sustainable solutions, alternative technologies such as direct heating systems, phase change materials (PCMs), and advanced thermal insulation methods emerge as competitors to traditional HTFs. These alternatives often offer benefits such as higher energy efficiency, reduced environmental impact, and lower operating costs, which can attract customers away from HTFs. Direct heating systems, for example, eliminate the need for HTFs by directly heating the process fluid, reducing thermal losses and improving system efficiency. PCMs can store and release heat energy, providing thermal management benefits without the continuous circulation of fluids. Advanced insulation materials also contribute to energy savings by minimizing heat loss in systems. Additionally, advancements in renewable energy technologies, such as molten salt systems in solar power plants, further reduce the reliance on traditional HTFs. The competitive landscape pushes HTF manufacturers to innovate, improve performance, and offer eco-friendly solutions to remain competitive in the market. Overall, competition from alternative technologies underscores the need for HTF manufacturers to adapt, invest in research and development, and differentiate their products to address evolving customer demands and market trends.

Market Ecosystem

A market ecosystem refers to the interconnected network of businesses, consumers, suppliers, and regulators in a particular market, influencing and interacting with each other. The major players in this market are Dow (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron Corporation (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant (Switzerland), Wacker Chemie AG (Germany), Indian Oil Corporation Ltd. (India), Schultz Canada Chemicals Ltd. (Canada) etc.

Heat Transfer Fluids Market: Ecosystem

"Mineral oils is the largest sub-segment amongst the product type segment in the heat transfer fluids market in 2024, in terms of value."

Mineral oils hold the largest subsegment share in the heat transfer fluids (HTF) market due to several key advantages that make them a preferred choice across various industries. Firstly, mineral oils are significantly cheaper compared to synthetic fluids and glycol-based fluids, making them an economical option for companies looking to optimize their operational budgets without compromising performance. Their low production and refining costs contribute to their cost-effectiveness. Secondly, mineral oils are widely available and benefit from a well-established global supply chain, ensuring a steady and reliable supply for industries with high and continuous demand for HTFs. This availability reduces the risk of shortages and supply chain disruptions, making mineral oils a dependable choice for many applications. Thirdly, mineral oils offer a good balance of thermal stability, heat transfer efficiency, and operating temperature range. They can effectively handle temperatures required in numerous industrial processes, making them suitable for various sectors like chemicals, petrochemicals, and manufacturing. Moreover, mineral oils are versatile and compatible with most materials used in HTF systems, reducing the risk of corrosion or degradation of system components. This compatibility extends equipment lifespan and lowers maintenance costs, further enhancing their economic appeal. Overall, the combination of cost-effectiveness, availability, performance characteristics, versatility, and compatibility positions mineral oils as the largest subsegment in the HTF market, catering to a wide range of industrial applications globally.

“Chemicals & petrochemicals accounted for the largest end-use industry segment of the heat transfer fluids market in 2024” in terms of value.

The chemicals and petrochemicals industry is the largest end-use segment for the heat transfer fluids (HTF) market due to its extensive and continuous demand for precise thermal management solutions. This sector encompasses a wide range of processes, such as distillation, polymerization, and chemical synthesis, which require accurate temperature control to maintain product quality and process efficiency. Heat transfer fluids are essential in these processes for maintaining optimal reaction conditions, ensuring process safety, and enhancing energy efficiency. The large scale and complexity of operations in the chemicals and petrochemicals industry necessitate substantial volumes of HTFs to manage significant heat loads. These fluids help in efficiently transferring heat in various stages of production, storage, and transportation of chemicals and petrochemical products. Moreover, the industry's stringent operational reliability and safety requirements favor the use of high-quality HTFs that can withstand harsh conditions and offer long-term stability. Additionally, the continuous growth of the chemical and petrochemical sector, driven by rising global demand for chemicals and materials, further solidifies its dominant position in the HTF market. This growth is particularly pronounced in regions with significant chemical production capacities, such as North America, Europe, and Asia-Pacific. As the industry continues to expand and innovate, the demand for effective heat transfer solutions remains strong, reinforcing the chemicals and petrochemicals industry's leading share in the HTF market.

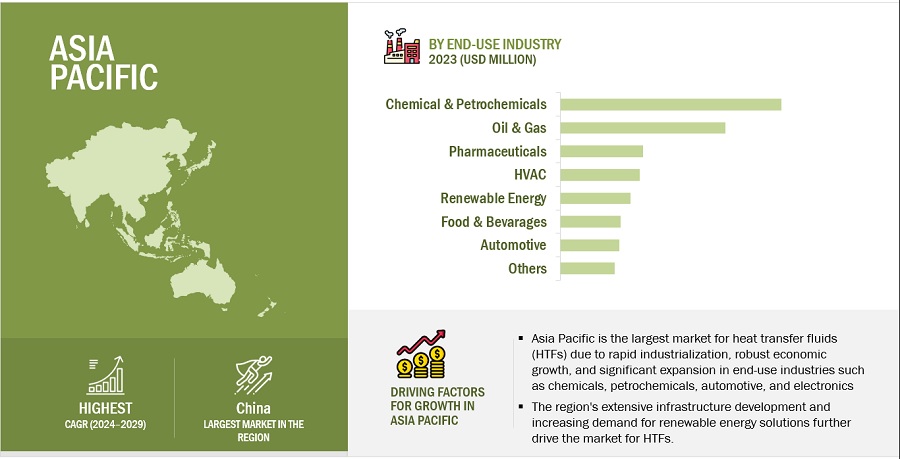

"Asia pacific is the largest market for heat transfer fluids Market in 2024, in terms of value."

Asia Pacific is the largest market for heat transfer fluids (HTFs) due to a confluence of several key factors, including rapid industrialization, robust economic growth, and the presence of significant end-use industries. This region's dynamic economic landscape and ongoing industrial expansion have created substantial demand for efficient thermal management solutions across various sectors. Rapid industrialization in countries like China, India, and Japan has driven the demand for HTFs. The chemical and petrochemical sectors, in particular, are significant consumers of HTFs due to their extensive thermal management needs in processes such as distillation, polymerization, and chemical synthesis. These industries require large volumes of HTFs to maintain optimal operating conditions, enhance energy efficiency, and ensure process safety. The region's expanding manufacturing base, including automotive, electronics, and food and beverage industries, further boosts demand for HTFs. These industries rely on HTFs for applications such as cooling, heating, and maintaining precise temperatures during production processes. The growth of these sectors, driven by increasing consumer demand and export activities, contributes to the overall market expansion. Asia Pacific's rapid urbanization and significant infrastructure development also play a crucial role. The surge in construction activities and the development of smart cities increase the demand for HVAC systems, where HTFs are essential for efficient thermal management. The region's urban centers require advanced HVAC systems to provide comfortable living and working environments, driving the demand for HTFs. The push for renewable energy sources, such as solar and wind power, in countries like China and India, fuels the need for HTFs in energy storage and transfer applications. Government initiatives and policies promoting renewable energy projects further support the growth of the HTF market. HTFs are crucial for optimizing the performance and efficiency of renewable energy systems, making them integral to the region's energy transition efforts. Supportive government policies and investments in industrial projects also contribute to market growth. Policies aimed at improving energy efficiency and reducing environmental impact encourage the adoption of advanced HTFs that offer better performance and sustainability. These regulatory frameworks create a conducive environment for HTF market expansion.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are Dow (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron Corporation (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant (Switzerland), Wacker Chemie AG (Germany), Indian Oil Corporation Ltd. (India), Schultz Canada Chemicals Ltd. (Canada) etc. Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of heat transfer fluids have opted for new product launches and technological advancements to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020-2029 |

|

Base Year |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Billion/Million), Volume (Kiloton) |

|

Segments |

Product Type, End-use Industry and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Dow (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron Corporation (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant (Switzerland), Wacker Chemie AG (Germany), Indian Oil Corporation Ltd. (India), Schultz Canada Chemicals Ltd. (Canada) |

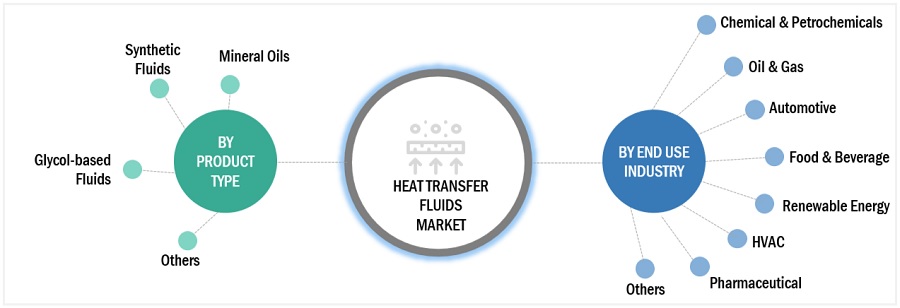

Segmentation

This report categorizes the global heat transfer fluids market based on product type, end-use industry and region.

On the basis of product type, the market has been segmented as follows:

- Mineral oils

- Synthetic fluids

- Glycol-based fluids

- Others

On the basis of end-use industry, the market has been segmented as follows:

- Chemical & petrochemicals

- Oil & gas

- Automotive

- Food & beverages

- Pharmaceuticals

- HVAC

- Renewable energy

- Others

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2022, Eastman Chemical Company (US) and Krahn Chemie GmbH (KRAHN) (Greece) revised their distribution agreement to extend the market reach for Eastman’s heat transfer fluids (HTF) in southeastern Europe. Under the revised agreement, KRAHN is authorized to distribute Eastman’s Therminol® and Marlotherm® product lines throughout Greece. These fluids are designed for the indirect transfer of process heat in a variety of single- or multiple-use heat systems. They are known for their outstanding thermal stability, precise temperature control, and minimal maintenance requirements.

- In December 2022, Chevron completed the acquisition of the Renewable Energy Group. This acquisition is expected to help company leverage its strengths to deliver lower carbon energy.

- In July 2022, Eastman Chemical Company announced a planned expansion of its manufacturing capacity for Eastman Therminol® 66 heat transfer fluid in Anniston, Alabama. The expansion, slated for completion in 2024, will boost U.S.-based capacity for this product by 50%.

- In February 2022, Shell PLC (UK) acquired Powershop (Australia). Powershop will now operate as a fully integrated subsidiary of Shell PLC under the Powershop brand within Shell Energy's operations in Australia, a key component of Shell’s global Renewables and Energy Solutions division. This acquisition of Powershop aligns with Shell‘s existing investments in zero and low-carbon assets and technologies in Australia. It positions Shell to provide innovative products and services that cater to the evolving needs of customers seeking low-carbon and smarter energy solutions.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the heat transfer fluids market?

This study's forecast period for the heat transfer fluids market is 2024-2029. The market is expected to grow at a CAGR of 4.9% in terms of value, during the forecast period.

Who are the major key players in the heat transfer fluids market?

Dow (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron Corporation (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant (Switzerland), Wacker Chemie AG (Germany), Indian Oil Corporation Ltd. (India), Schultz Canada Chemicals Ltd. (Canada) etc. are the leading manufacturers and service provider of heat transfer fluids market.

What are the emerging trends in the Heat transfer fluids market?

Emerging trends in the heat transfer fluids (HTF) market are driven by advancements in technology, increasing demand for energy-efficient solutions, and growing environmental awareness. One significant trend is the development of high-performance synthetic fluids that offer superior thermal stability, lower maintenance, and longer service life compared to traditional mineral oils. These synthetic fluids are increasingly preferred in applications requiring extreme temperature conditions and enhanced efficiency. Another trend is the rising use of bio-based and environmentally friendly HTFs, as industries seek sustainable alternatives to reduce their environmental footprint. These eco-friendly fluids, derived from renewable sources, help in meeting stringent regulatory standards and addressing environmental concerns. The integration of advanced monitoring and control systems in HTF applications is also gaining traction. These systems enable real-time monitoring of fluid performance and predictive maintenance, enhancing operational efficiency and reducing downtime. Additionally, the growth of renewable energy sectors, such as solar and wind power, is boosting the demand for HTFs in energy storage and transfer applications. The need for efficient thermal management solutions in these sectors is driving innovations in HTF formulations tailored for renewable energy systems. Overall, the heat transfer fluids market is evolving with a focus on sustainability, efficiency, and technological advancements, aligning with global trends towards greener and more efficient industrial processes.

What are the drivers and opportunities for the heat transfer fluids market?

Growing industrialization and urbanization globally, rising demand for energy-efficient solutions along with technological developments in HTF formulations are the drivers for this market. The opportunity is increasing focus on renewable energy sector along with government schemes and initiatives.

What are the restraining factors in the heat transfer fluids market?

Stringent regulatory complaints and volatility in raw material prices are the major restraining factors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the heat transfer fluids market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The heat transfer fluids market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the heat transfer fluids market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the heat transfer fluids industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, end-use industry and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, fabricators, and their current usage of heat transfer fluids and the outlook of their business, which will affect the overall market.

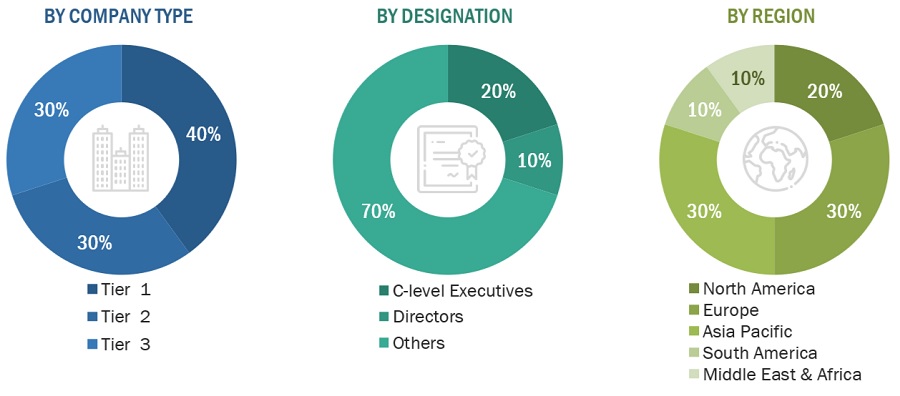

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company name |

Designation |

|

Chevron Corporation (US) |

Individual Industry Expert |

|

Dow (US) |

Sales Manager |

|

Eastman Chemical Company (US) |

Manager |

|

ExxonMobil (US) |

Marketing Manager |

|

Shell PLC (UK) |

Senior Scientist |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the heat transfer fluids market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Heat Transfer Fluids Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Heat Transfer Fluids Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Heat transfer fluids (HTFs) are specialized liquids or gases used to transfer thermal energy from one system or component to another, playing a crucial role in maintaining optimal operating temperatures and enhancing the efficiency of various industrial processes. These fluids are engineered to possess specific thermal properties, such as high thermal conductivity, low viscosity, and stability over a wide temperature range, making them suitable for diverse applications. The heat transfer fluids market encompasses a variety of products, including water, glycol-based fluids, mineral oils, silicone oils, and synthetic fluids, each tailored for specific industry requirements. HTFs are integral to numerous industries, including chemicals and petrochemicals, oil and gas, automotive, food and beverages, pharmaceuticals, HVAC, and renewable energy. In the automotive sector, they are vital for engine cooling and HVAC systems, while in renewable energy, they facilitate efficient energy transfer and storage in solar and wind power systems. The market is driven by the increasing demand for energy-efficient and sustainable thermal management solutions, advancements in fluid technologies, and stringent environmental regulations. As industries continue to prioritize operational efficiency and sustainability, the heat transfer fluids market is poised for substantial growth, driven by innovation and the development of environmentally friendly and high-performance fluids.

Key Stakeholders

- Heat transfer fluids manufacturers

- Heat transfer fluids traders, distributors, and suppliers

- End-use industry participants of the heat transfer fluids market

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms.

- Research & development (R&D) institutions.

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the heat transfer fluids market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, end-use industry and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Heat Transfer Fluids Market

Market overview and dynamics

General information on Heat Transfer Fluid and Synthetic market

General information on Heat Transfer Fluids Market

General information on Heat Transfer Fluids

Market growth trends and major company profiles along with the strategies adopted by key players present in the market

Heat transfer fluids by application segment, i.e. HVAC, Oil and Gas, Automotive, etc.

General information on Heat Transfer Fluids in auomotive and power generation

Detailed information of Heat Transfer Fluids Market

Glycol based thermal Fluids market

General information on Heat Transfer Fluids in North America

Interested in the report

Interested in Heat (Cold) transfer fluids Market for low temp.