Analytics as a Service Market by Offering ((Software by Type, Integration, Cloud Type) and Services), Data Type, Data Processing, Analytics Type (Marketing Analytics, Finance Analytics), Vertical and Region - Global Forecast to 2029

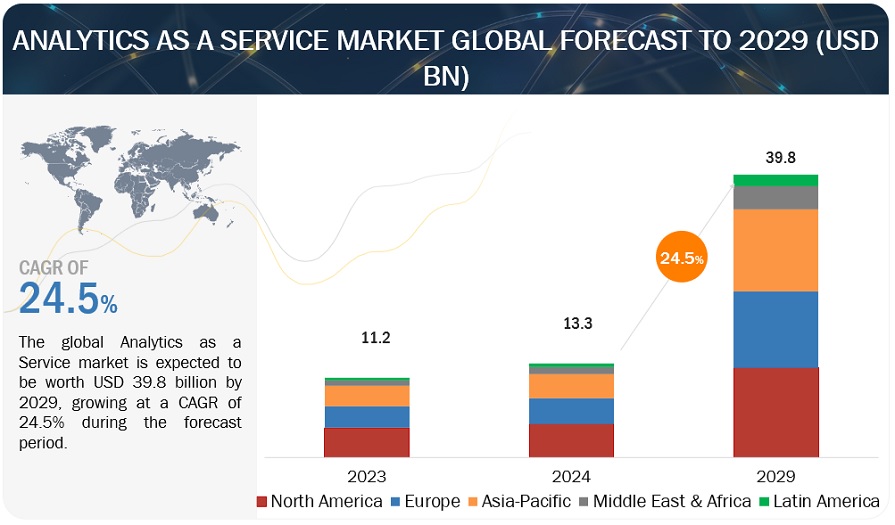

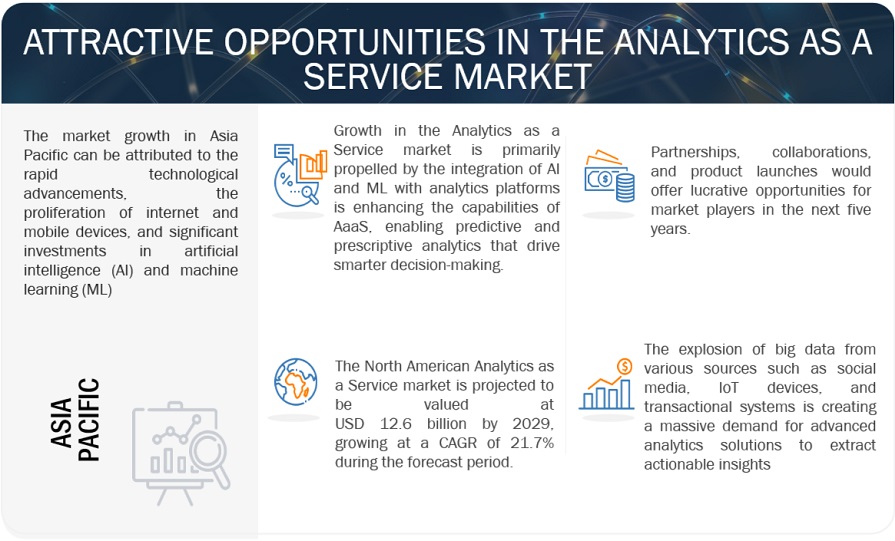

[327 Pages Report] The Analytics as a Service market is projected to grow from USD 13.3 billion in 2024 to USD 39.8 billion by 2029, at a compound annual growth rate (CAGR) of 24.5% during the forecast period. Due to various business drivers, the AaaS market is expected to grow significantly during the forecast period. The market is experiencing significant growth due to the proliferation of Big Data, IoT devices, and digital transformation initiatives across industries, increasing availability of data connectivity through multi-cloud and hybrid environments, and rise in demand for advanced analytic techniques due to increasing data volumes.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Increasing availability of data connectivity through multi-cloud and hybrid environments

The increasing availability of data connectivity through multi-cloud and hybrid environments is a significant driving factor in the adoption of Analytics as a Service (AaaS) market. As organizations continue to generate and store vast amounts of data across various cloud platforms, the need for seamless data integration and real-time analytics has become crucial. Multi-cloud and hybrid environments enable organizations to leverage the strengths of different cloud providers and infrastructure, allowing them to optimize costs, improve resilience, and meet regulatory requirements. This flexibility in data storage and processing has led to a surge in the adoption of AaaS, which provide organizations with the ability to analyze data from multiple sources in a centralized manner. AaaS platforms offer a range of analytics capabilities, including predictive modeling, machine learning, and real-time data processing, without the need for significant upfront investments in infrastructure. Moreover, the increasing adoption of Internet of Things (IoT) devices and the growing volume of data generated by these devices have further fueled the demand for AaaS offerings. IoT data, combined with other data sources such as customer interactions, sales records, and market trends, can provide valuable insights for decision-making. AaaS platforms enable organizations to process and analyze IoT data in real-time, allowing them to make informed decisions and optimize their operations.

Restraints: Discrepancy among data sources impedes the advancement of AaaS

The discrepancy among data sources significantly impedes the advancement of Analytics as a Service (AaaS) by creating inconsistencies, inaccuracies, and a lack of trust in the data. This issue arises from the use of multiple data sources with different tracking methods, naming conventions, and data definitions. For instance, a mobile marketing platform like Adjust counts an app install when a user opens an app for the first time, whereas the Apple Store counts an install when a person downloads an app. Such differences lead to discrepancies in reporting, making it challenging for organizations to extract insights, attribute revenue, identify trends, and implement personalization. The impact of data discrepancies is substantial, with 44% of CRM users estimating that poor-quality CRM data causes their company to lose over 10% of annual revenue. Moreover, 77% of data engineers, analysts, and scientists reported that their organization has data quality issues, with 91% stating that poor data quality impacts business performance. To overcome these challenges, organizations must invest in robust data integration tools and technologies that can seamlessly connect and consolidate data from multiple sources, ensuring data accuracy and enabling more comprehensive reporting. Additionally, establishing standardized data collection and reporting processes, implementing data governance frameworks, and conducting regular data validation and verification processes are crucial in minimizing data discrepancies and ensuring the reliability of data reporting.

Opportunity: Exploiting Generative AI for enhanced data democratization

Exploiting Generative AI for enhanced data democratization presents a significant opportunity in the adoption of the Analytics as a Service (AaaS) market. By leveraging Generative AI to democratize data access and insights, AaaS providers can offer innovative solutions that empower individuals across organizations to make data-driven decisions. Generative AI enables the creation of user-friendly applications that allow non-technical users to interact with data meaningfully, such as chatbots that provide clear explanations and visualizations. Moreover, Generative AI can automate processes, store insights over time, and execute actions based on user-defined parameters, streamlining data analysis and decision-making. Additionally, the ability of Generative AI to translate data into different languages and formats enhances global data sharing capabilities, while also identifying and mitigating bias in data, ensuring fair and unbiased insights. This transformative approach aligns with the growing demand for democratized access to data and insights, driving the evolution and growth of the AaaS market. According to a recent study, 70% of Chief Marketing Officers are already utilizing Generative AI, showcasing its value and rapid adoption across industries. The widespread recognition of Generative AI's impact on market research, with insight generation being a popular application, highlights its role as a powerful tool for gaining a competitive edge. Furthermore, Generative AI's efficiency in gathering diverse data, revolutionizing data management by organizing vast datasets, and uncovering hidden patterns within complex data sets underscores its potential to drive innovation and growth in the analytics landscape.

Challenge: Ensuring data quality and consistency

Ensuring data quality and consistency is a significant challenge in the adoption of Analytics as a Service (AaaS) market. Many organizations struggle with data silos, multiple data sources, and inconsistent data formats, making it difficult to obtain a unified view of their data. One major reason for the failure of AI and machine learning initiatives is inadequate data, with an IDC report estimating that nearly a third (28%) of all such projects fail. For example, a large U.S. manufacturing firm working on an analytics adoption project had 50 to 60 different source systems, each with varying data quality. Many business users are not trained in advanced statistics and math, making it difficult to establish trust in the data and results. Companies need to invest in creating a data culture where decisions are based on data and department leaders create data-based key performance indicators. Furthermore, the adoption time for advanced analytics solutions can vary depending on resources, data quality, and the nature of each business and its technology infrastructure. Aligning the business area and technology areas is crucial for developing and implementing processes and applications. To overcome these challenges, organizations need to create a solid framework for their data by establishing consistent business rules and cleaning up inconsistencies. Moving data and analytics to the cloud can help address increased complexity and costs.

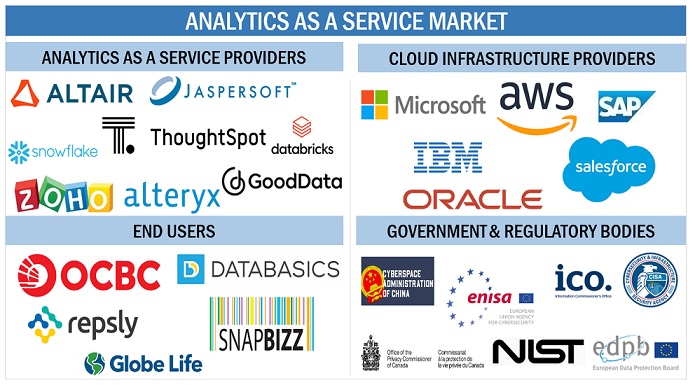

Analytics as a Service market Ecosystem

By services, the business intelligence services segment registered the highest CAGR during the forecast period.

Business Intelligence (BI) services are significantly driving the growth of the AaaS market, as organizations increasingly recognize the value of transforming raw data into actionable insights. The demand for BI services within the AaaS framework is surging due to their ability to enhance decision-making, improve operational efficiency, and uncover new business opportunities. The integration of advanced BI tools with cloud-based analytics platforms allows businesses to access real-time data and perform sophisticated analyses without the need for substantial upfront investments in infrastructure. This is particularly appealing to small and medium-sized enterprises (SMEs), which seek cost-effective solutions to stay competitive. Additionally, the growing complexity of data ecosystems and the need for comprehensive data visualization and reporting tools are propelling the adoption of BI services, making them a cornerstone of the AaaS market's expansion.

By data processing, real-time analytics to register the largest market size during the forecast period.

The growth of real-time analytics within the Analytics as a Service market is accelerating, driven by the increasing need for immediate data insights to enhance decision-making processes and operational efficiency. Businesses across various sectors, such as finance, retail, and healthcare, are leveraging real-time analytics to gain instant visibility into their operations, enabling quicker responses to market changes, customer behavior, and potential issues. The rise of IoT devices and the expanding digital ecosystem have significantly boosted the demand for real-time data processing and analytics. Cloud-based AaaS solutions are particularly well-suited for real-time analytics due to their scalability, flexibility, and cost-effectiveness, allowing companies to analyze large volumes of streaming data without substantial infrastructure investments.

By vertical, Healthcare & Life Sciences segment to register the highest CAGR during the forecast period.

The healthcare and life sciences industry is significantly driving the growth of the AaaS market, as organizations increasingly rely on advanced analytics to enhance patient care, optimize operational efficiency, and accelerate medical research. The adoption of AaaS enables healthcare providers to analyze vast amounts of patient data for predictive analytics, leading to improved diagnosis and personalized treatment plans. Additionally, life sciences companies leverage AaaS for drug discovery and development, using big data and machine learning algorithms to identify potential drug candidates and optimize clinical trials. The push for value-based care models, along with regulatory requirements for data transparency and compliance, further amplifies the demand for AaaS in this sector.

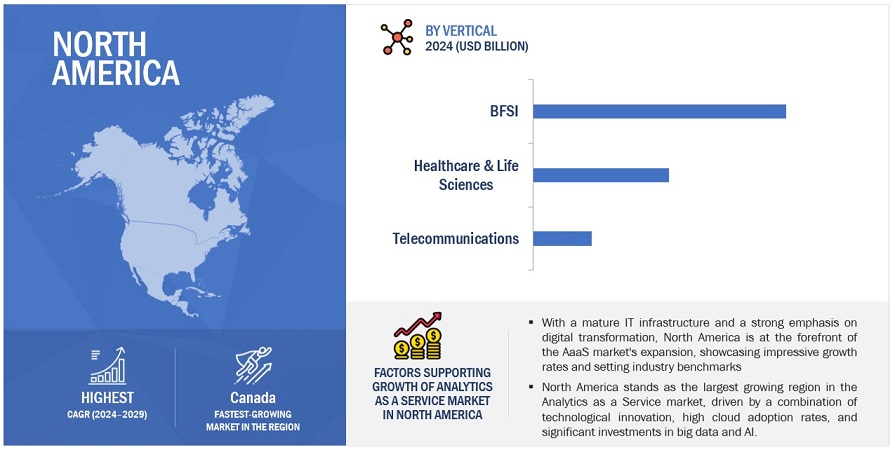

By region, North America to witness the largest & fastest market size during the forecast period.

North America stands as the largest and fastest-growing region in the AaaS market, driven by a combination of technological innovation, high cloud adoption rates, and significant investments in big data and AI. The presence of leading technology companies and startups fosters a competitive environment that accelerates advancements in analytics solutions. Additionally, sectors such as finance, healthcare, and retail in North America are increasingly leveraging AaaS to gain strategic insights, enhance operational efficiencies, and improve customer experiences. The region's regulatory landscape, which supports data security and privacy, further boosts the adoption of analytics services. With a mature IT infrastructure and a strong emphasis on digital transformation, North America is at the forefront of the AaaS market's expansion, showcasing impressive growth rates and setting industry benchmarks.

Key Market Players

The AaaS solution and service providers have implemented various types of organic and inorganic growth strategies, such as product upgrades, new product launches, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the AaaS market include Microsoft (US), IBM (US), Google (US), Oracle (US), SAP (Germany), AWS (US), SAS Institute (US), Teradata (US), Qlik (US), Salesforce (US), MicroStrategy (US), Cloudera (US), Altair (US), TIBCO Software (US), Kellton (India), Innowise (US), Alteryx (US), Jaspersoft (US), MSys Technologies (India), Synoptek (US), Flatworld Solutions (India), Protiviti (US), Unisys (US), Polestar Solutions (India), Rapyder (India), ScienceSoft (US), GoodData (US), Kyvos Insights (US), DataToBiz (India), ThoughtSpot (US), Sisense (Israel), and eCloudChain (Germany).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD (Billion) |

|

Segments Covered |

Software, services, data type, data processing, analytics type, vertical and region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), Google (US), Oracle (US), SAP (Germany), AWS (US), SAS Institute (US), Teradata (US), Qlik (US), Salesforce (US), MicroStrategy (US), Cloudera (US), Altair (US), TIBCO Software (US), Kellton (India), Innowise (US), Alteryx (US), Jaspersoft (US), MSys Technologies (India), Synoptek (US), Flatworld Solutions (India), Protiviti (US), Polestar Solutions (India), Rapyder (India), ScienceSoft (US), GoodData (US), Kyvos Insights (US), DataToBiz (India), ThoughtSpot (US), Sisense (Israel), and eCloudChain (Germany). |

This research report categorizes the Analytics as a Service market based on software, service, data type, data processing, analytics type, vertical, and region.

By Offering:

-

Software by Type

- Data Mining

- Data Warehousing & Data Lakes

- Data Integration

- Predictive Modelling

-

BI & Visualization

-

OLAP & Reporting

- Dashboards

-

OLAP & Reporting

-

Advanced Analytics

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

-

Software by Integration

- Standalone

- Embedded

-

Cloud Type

- Public

- Private

- Hybrid

-

Services

- Consulting & Engineering Services

- Data Governance Services

- Data Storage Services

- Business Intelligence Services

- Data Warehousing Services

By Data Type:

- Structured

- Unstructured

By Data Processing:

- Real-time Analytics

- Batch Processing

By Analytics Type:

-

HR Analytics

- Workforce Planning & Optimization

- Talent Acquisition & Recruitment

- Employee Engagement & Retention

- Training & Development

- Performance Management

- Others

-

Marketing Analytics

- Customer Segmentation And Targeting

- Campaign Performance Analysis

- Social Media Analytics

- Customer Lifetime Value Prediction

- Market Basket Analysis

- Others

-

Sales Analytics

- Sales Forecasting

- Pipeline Management

- Customer Churn Prediction

- Sales Performance Optimization

- Territory and Quota Planning

- Others

-

Finance Analytics

- Financial Planning and Budgeting

- Risk Management

- Fraud Detection

- Financial Performance Analysis

- Cash Flow Analysis

- Others

-

Operations Analytics

- Supply Chain Optimization

- Inventory Management

- Production Planning and Scheduling

- Quality Control and Defect Analysis

- Maintenance and Asset Management

- Others

By Vertical:

-

BFSI

- Algorithmic Trading & Investment Analysis

- Loan Portfolio Management

- Credit Scoring & Risk Assessment

- Financial Fraud Detection & Prevention

- Personalized Financial Planning

- Others

-

Telecommunications

- Network Performance Monitoring

- Subscriber Management

- Network Infrastructure Predictive Maintenance

- Telecom Revenue Assurance

- Network Capacity Planning

- Others

-

Retail & Consumer Goods

- Customer behavior modelling

- Retail Inventory Management

- E-commerce management

- Price Optimization

- Point-of-Sale management

- Others

-

Healthcare & Life Sciences

- Clinical Data Management

- Personalized Treatment

- Population Health Management

- Drug Discovery & Development

- Patient Outcome Prediction

- Others

-

Government & Defense

- Predictive Policing & Crime Pattern Analysis

- Cybersecurity & Threat Intelligence

- Tax & Welfare Management

- Emergency Response Optimization

- Resource Allocation & Planning

- Others

-

Automotive

- Autonomous Vehicle Development

- Connected Car Services

- Vehicle Predictive Maintenance

- Telematics & Usage-Based Insurance

- Vehicle Production Optimization

- Others

-

Education

- Student Performance Management

- Customized Courses & Personalized Learning

- Conflict Anticipation & Behavior Detection

- Adaptive Testing & Grading

- Academic Research

- Others

-

Manufacturing

- Equipment & Machinery Predictive Maintenance

- Quality Control & Defect Analysis

- Smart Manufacturing

- Energy Management & Efficiency

- Production Process Optimization

- Others

-

Transportation & Logistics

- Route Optimization & Traffic Management

- Fleet Management

- Vehicles & Equipment maintenance

- Supply Chain Visibility

- Logistics & Inventory Management

- Others

- Other Applications

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia and New Zealand (ANZ)

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- Qatar

- Turkey

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In April 2024 Dataproc introduces the ability to deploy clusters with Compute Engine machine types. This enhancement offers greater flexibility in resource allocation, allowing users to tailor cluster configurations to their specific workload requirements more precisely.

- In March 2024, The March 2024 update of Oracle Analytics Cloud brought forth numerous improvements spanning exploring, dashboarding, storytelling, data connectivity, modeling, preparation, augmented analytics, machine learning, performance, compliance, and administration.

- In March 2024, Microsoft expanded its collaboration with NVIDIA to bring the power of generative AI, the cloud and accelerated computing to healthcare and life sciences organizations. The collaboration will bring together the global scale, security and advanced computing capabilities of Microsoft Azure with NVIDIA DGX Cloud and the NVIDIA Clara suite. Stability AI accelerated its work Amazon to make its open-source tools and models accessible to startups, academics, and businesses worldwide.

- In February 2024, IBM Planning Analytics for Excel version 2.0.93 brings significant improvements, including enhanced performance, increased stability, and new features such as dynamic charting capabilities and improved report formatting options.

- In January 2024, Azure Stream Analytics introduces new features and improvements in its no-code editor. The updates include improved error handling, enhanced debugging capabilities, and increased support for complex queries, empowering users to efficiently build and deploy streaming data processing pipelines for cloud analytics applications.

Frequently Asked Questions (FAQ):

What is Analytics as a Service?

Analytics as a Service (AaaS) involves delivering analytics software and operations via web-based technologies. This model allows organizations to leverage sophisticated data analysis tools and techniques without the need for substantial initial investments in infrastructure. AaaS providers usually offer their platforms on a subscription basis, enabling businesses to access and analyze large datasets in real-time, while also enjoying the benefits of scalability and flexibility.

What is the total CAGR expected to be recorded for the AaaS market during the forecast period?

The market is expected to record a CAGR of 24.5% during the forecast period.

Which are the key drivers supporting the growth of the AaaS market?

Some factors driving the growth of the AaaS market are increasing availability of data connectivity through multi-cloud and hybrid environments, rise in demand for advanced analytic techniques due to increasing data volumes, and proliferation of Big Data, IoT devices, and digital transformation initiatives across industries.

Which are the key verticals prevailing in the AaaS market?

The key verticals gaining a foothold in the AaaS market are BFSI, retail & consumer goods, telecommunications, healthcare & life sciences, manufacturing, automotive, transportation & logistics, government & defense, education, and others.

Who are the key vendors in the AaaS market?

Some major players in the AaaS market include Microsoft (US), IBM (US), Google (US), Oracle (US), SAP (Germany), AWS (US), SAS Institute (US), Teradata (US), Qlik (US), Salesforce (US), MicroStrategy (US), Cloudera (US), Altair (US), TIBCO Software (US), Kellton (India), Innowise (US), Alteryx (US), Jaspersoft (US), MSys Technologies (India), Synoptek (US), Flatworld Solutions (India), Protiviti (US), Unisys (US), Polestar Solutions (India), Rapyder (India), ScienceSoft (US), GoodData (US), Kyvos Insights (US), DataToBiz (India), ThoughtSpot (US), Sisense (Israel), and eCloudChain (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The Analytics as a Service market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred AaaS providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, AaaS spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on software, services, market classification, and segmentation according to offerings of major players, industry trends related to software, services, cloud type, data type, data processing, analytics type, vertical and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and AaaS expertise; related key executives from AaaS software vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AaaS software, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AaaS software and services, which would impact the overall Analytics as a Service market.

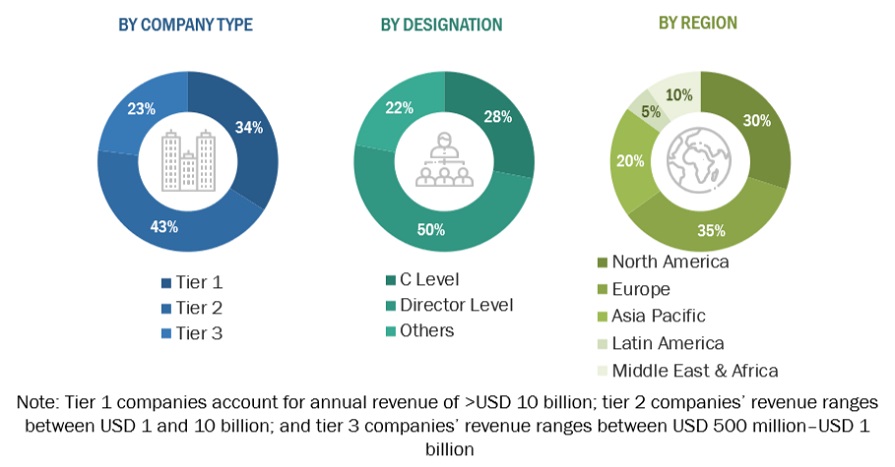

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

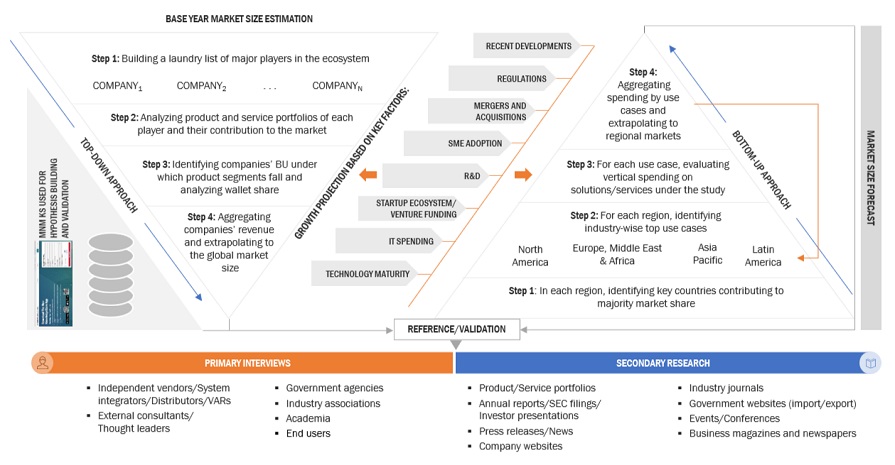

Market Size Estimation

In the bottom-up approach, the adoption rate of AaaS among different end users in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of AaaS software and services among industries and different use cases concerning their regions was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the AaaS market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AaaS providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall AaaS market size and segments’ size were determined and confirmed using the study.

Global Analytics as a Service Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the Analytics as a Service market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AaaS providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall Analytics as a Service market size and segments’ size were determined and confirmed using the study.

Market Definition

Analytics as a Service (AaaS) is a type of Cloud service. It provides access to data analysis software and tools through the Cloud, rather than having to invest in on-premise software. AaaS services are complete and customizable solutions for organizing, analyzing and visualizing data. The objectives are the same as for on-premise solutions, namely, to provide information that can be used to make better decisions. These tools offer different data analysis methods and technologies such as Data Mining, Predictive Analysis, Dataviz or even advanced techniques such as Artificial Intelligence and Machine Learning. One of the main advantages of AaaS solutions is that these services are based on a subscription model. As with other types of Cloud services, the user pays only for the resources he or she consumes. This typically saves money compared to purchasing on-premise software and the accompanying license.

Stakeholders

- Application design and software developers

- Business owners/executives

- Service managers

- Cloud service providers

- Consulting service providers

- Data scientists

- Quality assurance analysts

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISVs)

- Market research and consulting firms

- Support and maintenance service providers

- System Integrators (SIs)/Migration service providers

- Technology providers

- Analytics Service Providers

- Chief Data Officers (CDOs)

- Academic and Research Institutions

Report Objectives

- To define, describe, and predict the Analytics as a Service market by offering (software (type, integration) and services), data type, data processing, analytics type, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Analytics as a Service market

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze the competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the Analytics as a Service market

- To analyze the impact of recession across all regions in the Analytics as a Service market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American Analytics as a Service market

- Further breakup of the European Analytics as a Service market

- Further breakup of the Asia Pacific Analytics as a Service market

- Further breakup of the Middle Eastern & African Analytics as a Service market

- Further breakup of the Latin America Analytics as a Service market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Analytics as a Service Market

Detailed understanding of the Analytics as a Service Market

Interested in the SMB and its revenue size.