Steel Fiber Market by Type (Hooked, Straight, Deformed, Crimped), Manufacturing Process (Cold Drawn, Cut Wire, Melt Extract, Slit Sheet), Application (Concrete Reinforcements, Composite Reinforcements, Refractories), & Region- Global Forecast to 2029

Updated on : May 22, 2024

Steel Fiber Market

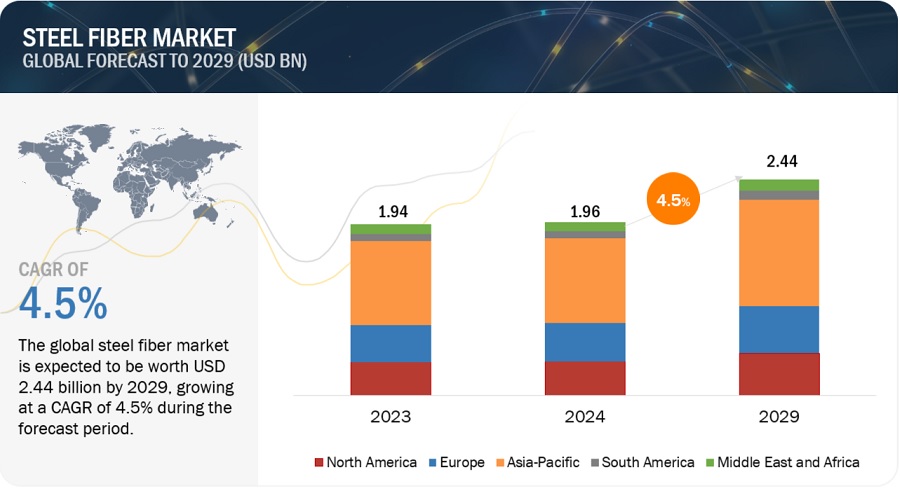

The global steel fiber market size was valued at USD 1.96 billion in 2024 and is projected to reach USD 2.44 billion by 2029, growing at 4.5% cagr from 2024 to 2029. Increasing construction and infrastructural development across Asia Pacific, Middle East & Africa is increasing the demand for steel fibers.

Steel fibers are thin, elongated steel strands measuring 0.5-1.5mm in diameter and up to 50mm in length. They are added to concrete, mortar, or shotcrete mixtures to increase their tensile strength, toughness, and crack resistance. The fibers are randomly distributed throughout the matrix, generating a three-dimensional network of reinforcement that minimizes crack propagation and increases the overall durability and load-bearing capability of the composite material.

Attractive Opportunities in Steel Fiber Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Steel Fiber Market Dynamics

Driver: Increasing demand for steel fibers in construction & building industry

China, India, and other Southeast Asian countries are seeing steady population growth. The need for residential and commercial structures rises in tandem with population growth. Steel fiber reinforced concrete is an ideal choice for high-rise buildings and other constructions that demand more structural strength and crack resistance than conventional materials. As a result, it has become a preferred option for such constructions.

Builders, architects, and engineers are adopting sustainable construction methods. Steel fibers manufactured from recycled steel are a better alternative to synthetic fibers. Steel fibers require fewer repairs, which reduces resource use.

Restraint: Surge in use of glass and synthetic fibers

The usage of conventional materials like synthetic and glass fibers, which have been around for a while and are well-known to engineers and contractors for use in concrete reinforcement, is one of the main factors restricting the expansion of the steel fiber trade. This familiarity may cause one to favor different kinds of reinforcing materials. Because the benefits of steel fibers over conventional materials are not well known, traditional materials are being used in construction projects.

Opportunity: Research and development of new manufacturing techniques

Research & development spending in the fields of manufacturing technologies and material science is expanding quickly. This opens up new possibilities for improving the mechanical characteristics of steel fibers.

A current research focus is on the investigation of high-performance steel fibers in combination with silica fumes or fly ash. It is anticipated that this combination will improve the concrete's flowability and mechanical qualities. Furthermore, it has been demonstrated that adding nano-silica enhances the mechanical qualities of steel fiber reinforced concrete even more.

Challenge: Susceptibility of steel fibers to corrosion

Despite efforts to increase their resilience, steel fibers are susceptible to corrosion. Their corrosion resistance may be impacted by the manufacturing method; melt extract or cold-drawn wire are less resistant to corrosion than mill-cut fibers. Corrosion can also be caused by the kind of steel fiber that is utilized, the existence of chloride ions, and the surface and size of the fibers. Important players in the steel fiber industry must make significant investments in R&D to create new and enhanced corrosion-resistant steel fibers in order to address this problem.

Steel Fiber Market Ecosystem

Based on the Application, the composite reinforcement application segment is estimated to account for the highest CAGR in the Steel fiber market share during the forecast period.

The use of steel fiber in composite reinforcement aims to improve the mechanical characteristics of composite materials, including their toughness, strength, and stiffness. Because steel fibers offer better anchoring between fibers and the matrix, they are frequently utilized in composite reinforcement, which improves pull-out resistance and structural performance. Specialized steel fibers with hooks are preferred because of their anchoring systems. Due to the importance of this application segment in a variety of industries needing high durability and tensile strength, steel fiber demand in composite reinforcement applications has expanded. Applications for reinforced composite are found in the sports and leisure and textile industries. It has a very low water-absorbent quality and is recyclable. Stainless steel fiber is utilized for reinforcing in composites.

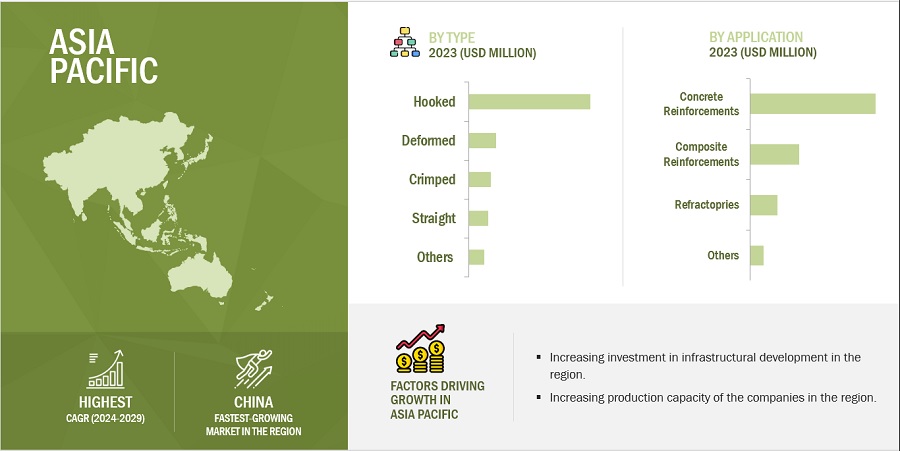

Based on type, Hooked type is anticipated to register the highest CAGR in the Steel fiber market.

Numerous end-use industries, including refractories, composite reinforcement, and concrete reinforcement, use hooked end steel fibers. In these application areas, the product's overall structural integrity is improved through the employment of hooked end steel fiber. These fibers find employment in a variety of settings, including equipment foundations, blast-resistant concrete, airport pavements, and industrial slabs. Generally, hooked end steel fiber has a density of 7.8 g/cm3. Depending on the production technique and the alloy used to create the hooked steel fiber, the density may change slightly.

Based on manufacturing process, cold drawn is anticipated to register the highest CAGR in the Steel fiber market.

Pulling steel wire through a die reduces the diameter of the wire, producing higher mechanical properties, dimensional accuracy, and surface finish in cold-drawn steel fiber. Excellent surface finishes and precise tolerances are provided by this cost-effective technique for a range of applications. Cold drawing provides better dimensional tolerance, surface finish, and precision than alternative manufacturing processes like hot extrusion. Hooked steel fibers are often made from cold-drawn fibers due to their excellent pullout behavior and bonding.

Asia Pacific to hold the largest market share during the forecast period.

The major markets for steel fiber are in Asia Pacific, followed by North America and Europe. The rising urbanization and industrialization of the Asia Pacific region, coupled with significant expenditures in the building and construction sector, are the primary drivers of market expansion. An additional driver of economic expansion is the growing populace of China and India. The purchasing power parity (PPP) measure of the global gross domestic product (GDP) places the region at nearly one-third of the total.

To know about the assumptions considered for the study, download the pdf brochure

Steel Fiber Market Players

The Steel fiber market is dominated by a few globally established players. The major active players in the market are Bekaert (Belgium), ArcelorMittal (Luxembourg), Nippon Seisen Co., Ltd. (Japan), Fibrometals (Romania), Sika AG (Switzerland), Jiangsu Shagang Group Co., Ltd. (China), Zhejiang Boen Metal Products Co., Ltd. (China), Green Steel Group (Italy), Spajic Doo (Serbia), Kosteel Co., Ltd. (South Korea), Severstal (Russia), Enviromesh Pty Ltd. (Australia), Hunan Shuanxing Steel Fiber Co., Ltd., and Kerakoll SPA (Italy), among others, are the main producers who have won significant contracts recently. Since global requirements are changing, contracts and new product development have received the majority of attention.

These companies are attempting to establish themselves in the Steel fiber market by employing a range of inorganic and organic approaches. A thorough competitive analysis of these major Steel fiber market participants is included in the research, along with information on their company profiles, most recent advancements, and important market strategies.

Read More: Steel Fiber Companies

Steel Fiber Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2020 –2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024 –2029 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

By Type, By Application, By Manufacturing Process, and By Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

|

Companies covered |

Bekaert (Belgium), ArcelorMittal (Luxembourg), Nippon Seisen (Japan), Fibrometals (Romania), Sika AG (Switzerland), Jiangsu Shagang Group (China), Zhejiang Boen Metal Products Co., Ltd. (China), Green Steel Group (Italy), Spajic Doo (Serbia), Kosteel Co., Ltd. (South Korea), Severstal (Russia), Enviromesh Pty ltd. (Australia), Hunan Shuanxing Steel Fiber Co., Ltd. (China), and Kerakoll SPA (Italy). |

The study categorizes the steel fiber market based on Type, Application, Manufacturing Process, and Region.

Steel Fiber Market by Type

- Hooked

- Straight

- Deformed

- Crimped

- Others (Arched, Corrugated, Double Arched, etc.)

Steel Fiber Market by Manufacturing Process

- Cut Wire

- Cold Drawn

- Slit Sheet

- Melt Extract

- Others

Steel Fiber Market by Application

- Concrete

- Composites

- Refractories

- Others

Steel Fiber Market by Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In December 2023, Sika AG acquired a stake of 30% in Concria OY, specializing in highly innovative concrete floors.

- In November 2023, ArcelorMittal and Schneider Electric announced a partnership whereby ArcelorMittal will supply Schneider Electric with XCarb recycled and renewably produced steel and steel fiber for its floor-standing enclosures.

- In April 2023, ArcelorMittal joined forces with BP2, the manufacturer of complete solutions for residential construction, to supply low carbon emissions steel and steel fiber for BP2’s latest product, the SOLROOF integrated photovoltaic roof.

- In March 2023, Arcelor Mittal completed the acquisition of Companhia Siderúrgica do Pecém (‘CSP’) in Brazil for an enterprise value of approximately USD 2.2 billion.

Frequently Asked Questions (FAQ):

Which are the major companies in the Steel fiber market? What are their major strategies to strengthen their market presence?

Some of the key players in the Steel fiber market are Bekaert (Belgium), ArcelorMittal (Luxembourg), Nippon Seisen Co., Ltd. (Japan), Fibrometals (Romania), Sika AG (Switzerland), Jiangsu Shagang Group Co., Ltd.(China), Zhejiang Boen Metal Products Co., Ltd. (China), Green Steel Group (Italy), Spajic Doo (Serbia), Kosteel Co., Ltd. (South Korea), Severstal (Russia), Enviromesh Pty ltd. (Australia), Hunan Shuanxing Steel Fiber Co., Ltd. (China), and Kerakoll SPA (Italy) are the key manufacturers that secured contracts deals in the last few years. Contracts and deals were the key strategies adopted by these companies to strengthen their position in the Steel fiber market.

What are the drivers and opportunities for the Steel fiber market?

Increasing demand for steel fibers in the construction & building industry, while the ongoing R&D in advancing manufacturing techniques to provide an opportunity for the market to grow.

Which region is expected to hold the highest market share?

Asia Pacific Steel fiber market has been experiencing growth and significant industry demand. Asia Pacific is experiencing increased investments in infrastructural developments, contributing to the increasing adoption of Steel fiber products.

What is the total CAGR expected to be recorded for the Steel fiber market during 2024-2029?

The CAGR is expected to record a CAGR of 4.5% from 2024-2029

How is the Steel fiber market aligned?

The market is growing at a considerable pace. The market is a highly consolidated market, and many manufacturers are planning business strategies to expand their existing production capacities of Steel fiber. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

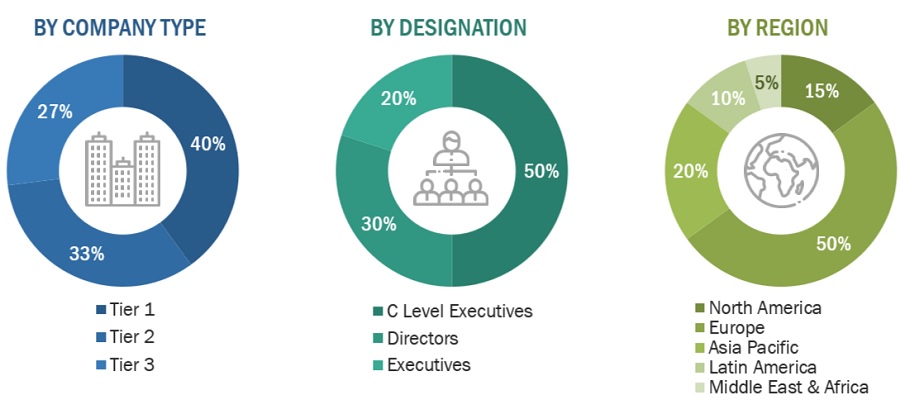

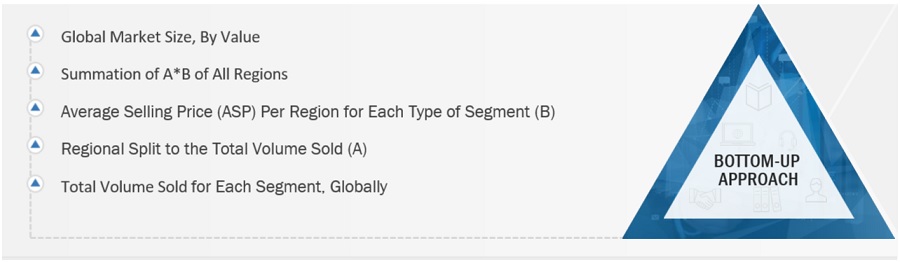

The study involves two major activities in estimating the current market size for the steel fiber market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering steel fiber products and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the steel fiber market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the steel fiber market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from steel fiber industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using steel fiber products were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of steel fiber and outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the steel fiber market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in steel fiber products in different applications at a regional level. Such procurements provide information on the demand aspects of the steel fiber industry for each application. For each application, all possible segments of the steel fiber market were integrated and mapped.

Steel fiber market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Steel fiber market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A steel fiber is a small steel wire rod having a length to diameter ratio between 20 to 100. The steel used to manufacture steel fibers comprises carbon and stainless steel. This carbon and stainless-steel fibers can be classified into hooked, straight, deformed, crimped, and others. These fibers are classified into type I - type V based on their manufacturing technology. The various manufacturing methods used in steel fiber production are cold drawn, cut wire, slit sheet, melt extract, and others. These steel fibers are used in various applications such as concrete reinforcement, composite reinforcement, refractories, and others (vaults, filters, material plastics).

The steel fiber market is segmented by type, manufacturing process, application, and geography, with major players including Bekaert, ArcelorMittal, and Nippon Seisen Co., Ltd. The market is expected to continue expanding in the coming years, driven by technological advancements, changing consumer behaviors, regulatory shifts, and global trends.

Key Stakeholders

- Steel fiber Manufacturers

- Raw Materials Suppliers

- Distributors and Suppliers

- End-use Industries

- Industry Associations

- R&D Institutions

- Environment Support Agencies

Report Objectives

- To define, describe, and forecast the steel fiber market size in terms of volume and value.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global steel fiber market by type, application, and region.

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape.

- To strategically profile the key market players and comprehensively analyze their core competencies.

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the steel fiber market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market.

Growth opportunities and latent adjacency in Steel Fiber Market