Organic pigments Market by Source (Synthetic and Natural), Type (Azo, Phthalocyanine, High-Performance Pigments(HPPs)), Application (Printing inks, Paints & Coatings, Plastics), and Region - Global Forecast to 2029

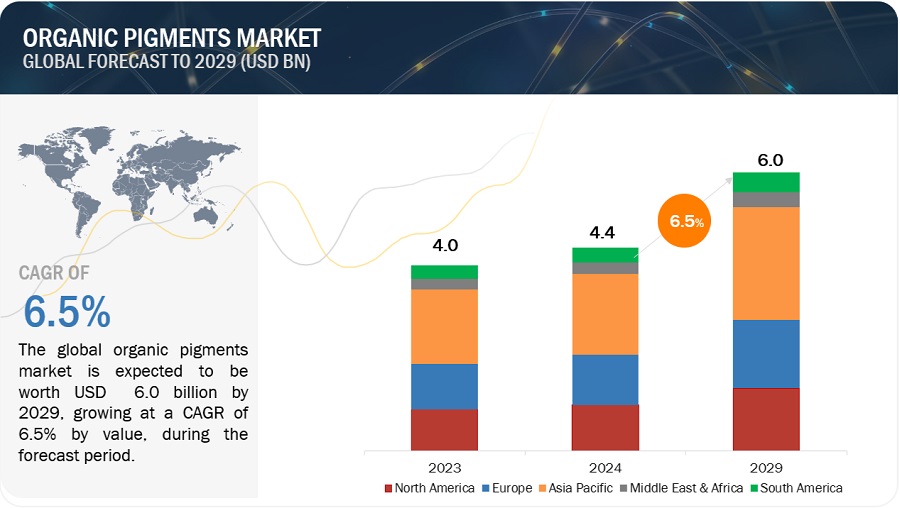

The organic pigments market is projected to grow from USD 4.4 billion in 2024 to USD 6.0 billion by 2029, at a CAGR of 6.5%. The global organic pigments market was down by around 16.7% from 2022 due to the weak demand in the Western Market. The Western market was challenged by the rise in inflation, volatility in commodity prices, and disruption in the supply chain, resulting in recessionary trends and thereby hampering the demand for organic pigments.

However, It is expected to witness moderate growth during the forecast period, owing to the increasing demand for paints & coatings, printing inks, and plastics applications. Most of the demand is for high-performance pigments (HPPs). The major applications of organic pigments are printing inks, paints & coatings, plastics and other applications.

Attractive Opportunities in Organic Pigments Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Organic Pigments Market Dynamics

Driver: High demand for enhanced aesthetics in various applications areas

The growing competition in the printing ink sector is pushing companies to offer better shades and vivid colors to printed text. The demand for different printing finishes has risen due to the increasing competition among brands and their need to place their product distinctly. Organic pigments in the form of color concentrates and masterbatches provide a variety of color shades, and customized colors can also be manufactured according to customer requirements. Continuous innovations in the market are expected to be driven by the increasing need for enhanced aesthetics in printing inks for better marketing.

Restraint: Higher cost of organic pigments

Organic pigments are more expensive than inorganic pigments, which is a major restraint for the market. Usually, pigments constitute upwards of 50% of the total cost of the final products. These are limited to paints, inks, and coatings applications. The market is witnessing a normal growth rate; however, the size is smaller than that of the inorganic pigments. Inorganic pigment producers experience economies of scale in their production processes, while organic pigments are produced in small quantities. Hence, the production cost for organic pigments is higher, increasing the final product's price.

Opportunity: Growing demand for color filters

The color filter is a major liquid crystal display component, directly determining the picture quality. The increasing demand for notebooks/PCs, mobiles, and televisions drives the market quickly. The color filters used in these display devices employ colored pigments (organic), UV-curable carrier resins, photoinitiators, organic solvents, and dispersants. Organic pigments are used in these filters for specific primary color (RGB), spectral hue, vividness, and durability. This has drastically reduced the power consumption of display devices, thereby helping grow organic pigments in the display market. The following table analyses the growth in demand for electronics that use LCD/LED displays. This increase in demand for LCD/LEDs is expected to boost the demand for organic pigments in the color filter application.

Challenge: Increasing environmental regulations and lower supply

Asia Pacific is the major hub of raw materials and intermediaries for organic pigments. China and India are the major producers due to the lower raw materials and labor costs. Pigment quality is determined by the manufacturing process and raw materials' quality. With the increasing restrictions in China, India, and other countries worldwide, many producers are forced to refine their products and optimize their manufacturing processes to reduce pollution. These pigments are mainly used in the food, cosmetics, and coating & paints industries. As these end users continuously demand changes in chemistry as per changing regulations, the smaller players lack the competitive edge. Only players with exceptional R&D teams and financial means can survive in the market. The prominent and exceptional players immediately imply the required changes and cope with the recent trends and requirements in the market.

Ecosystem: Organic Pigments Market

Based on the source, natural source segment is estimated to be the fastest-growing source during the forecast period in terms of value.

Natural pigments use materials occurring naturally in the environment. These pigments were mostly extracted from various parts of plants to provide different shades. Flowers were the most used parts, along with peels, pulps, and seeds. Natural pigments also used animal by-products, such as blood and microbial products, as raw materials. Nowadays, bio-based chemical compounds such as ethanol are used to manufacture pigments. These pigments are very sensitive and require special care in preserving and storing.

Based on the type, High-performance pigments (HPPs) segment is estimated to be the fastest-growing type during the forecast period, in terms of value.

HPPs have excellent lightfastness and heat stability; they are resistant to various chemicals, which makes them suitable for applications requiring high performance. Different types of organic HPPs are benzimidazolones, quinacridone, perylene, dioxazine violet, isoindolinones and isoindolines, disazo condensations, phthalocyanines, and diketo-pyrrolo-pyrroles. Due to their superior properties, HPPs are widely accepted in the printing ink, coatings, and paints industries.

Based on application, the paints & coatings application segment is anticipated to register the highest CAGR in organic pigments market.

The paints & coatings application is expected to be the fastest-growing segment of the market during the forecast period. Organic pigments are preferred for these applications as they offer a higher gloss and color finish. They are mostly non-toxic and compatible for use in contact with food items, further expanding their application range. Organic pigments are used in various coating applications owing to their high-performance characteristics, which impart qualities such as good weather fastness, good light fastness, low migration, and solvent & bleeding fastness to the end products. Organic pigments are widely used in decorative coatings, marine coatings, automotive coatings, and industrial coatings.

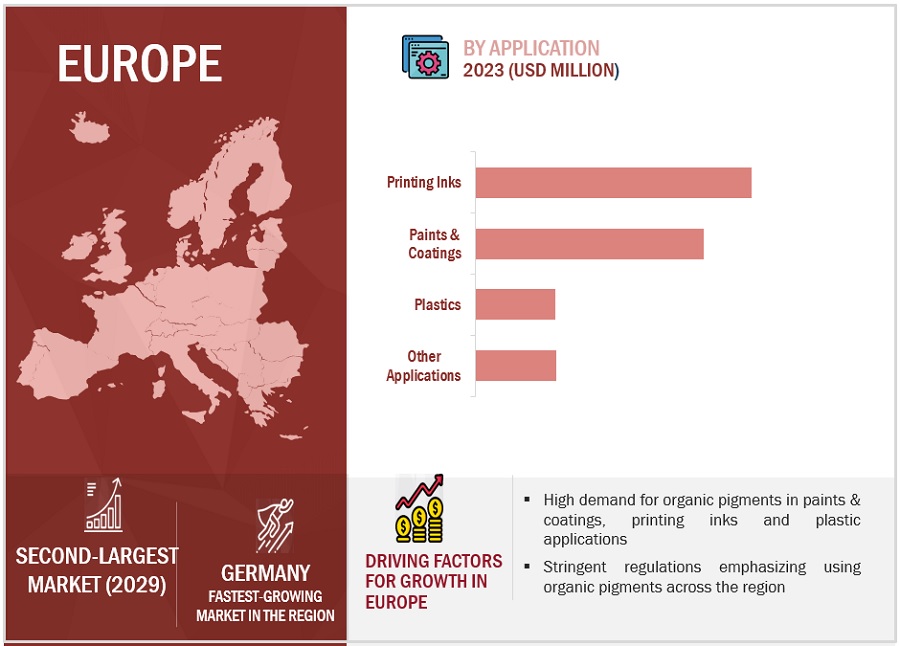

Europe to be the second-largest market for Organic Pigments during the forecast period, in terms of value.

Europe is the second-largest organic pigments market globally. The major industries in the region include automotive, building & construction, and packaging. These industries consume plastics in large volumes, which is increasing the consumption of organic pigments. The demand for organic pigments is high in the paints & coatings application in the building & construction and automotive industries. Germany is the key organic pigments market in Europe, which has a high growth potential due to the increasing use of these pigments in the automotive industry for paints & coatings applications.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The organic Pigments market is dominated by a few globally established players, DIC Corporation (Japan), Heubach GmbH (Germany), Dainichiseika Color & Chemicals Mfg. Co., Ltd. (Japan), Lily Group Co. Ltd. (China), Sunlour Pigment Co., Ltd. (China), Anshan Hifichem Co., Ltd. (China), and Meghmani Organics Ltd. (India), among others, are the main producers in the global market.

These companies are attempting to establish themselves in the organic pigments market by employing a range of inorganic and organic approaches. A thorough competitive analysis of these major organic pigments market participants is included in the research, along with information on their company profiles, most recent advancements, and important market strategies.

Read More: Organic Pigments Companies

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

Source, Type, Application and Region |

|

Geographies covered |

Europe, North America, Asia Pacific, South America, Middle East, and Africa |

|

Companies covered |

DIC Corporation (Japan), Heubach GmbH (Germany), and Dainichiseika Color & Chemicals Mfg. Co., Ltd. (Japan), Lily Group Co. Ltd. (China), Sunlour Pigment Co., Ltd. (China), Anshan Hifichem Co., Ltd. (China), Longkou Union Chemical Co., Ltd. (China), Meghmani Organics Ltd. (India), Asahi Songwon Colors Ltd. (India), and Sudarshan Chemical Industries Limited (India). |

The study categorizes the organic pigments market based on Type, Source, Application, and Region.

By Source of organic pigments:

- Synthetic

- Natural

By Type:

- Azo Pigments

- Phthalocyanine Pigments

- HPPs

- Other Types

By Application:

- Printing inks

- Paints & coatings

- Plastics

- Other Applications

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2022, Sudarshan Chemical Industries Limited introduced two pigments under their organic pigments portfolio. These products have applications in plastics and coating applications.

- In July 2022, DIC Corporation announced a second-phase agreement with Debut Biotechnology, Inc. to create natural red pigments for nutrition, food, and cosmetic applications.

- In January 2022, Heubach completed the acquisition of Clariant’s global pigment business. This acquisition allows the company to expand and improve its pigments business and more future growth opportunities.

Frequently Asked Questions (FAQ):

Which are the major companies in the Organic Pigments market? What are their major strategies to strengthen their market presence?

Some of the key players in the Organic Pigments market are DIC Corporation (Japan), Heubach GmbH (Germany), and Dainichiseika Color & Chemicals Mfg. Co., Ltd. (Japan), Lily Group Co. Ltd. (China), Sunlour Pigment Co., Ltd. (China), Anshan Hifichem Co., Ltd. (China), Longkou Union Chemical Co., Ltd. (China), Meghmani Organics Ltd. (India), Asahi Songwon Colors Ltd. (India), and Sudarshan Chemical Industries Limited (India).

What are the drivers and opportunities for the Organic Pigments market?

Growing demand from printing inks applications is one of the major drivers of the organic pigments market and one of the major opportunities lies in rising demand for HPPs.

Which region is expected to hold the highest market share?

Asia Pacific, and Europe’s organic pigments market has been experiencing growth and significant industry demand.

What is the total CAGR expected to be recorded for the Organic Pigments market during 2024-2029?

The CAGR is expected to record a CAGR of 6.5% from 2024-2029.

How is the Organic Pigments market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

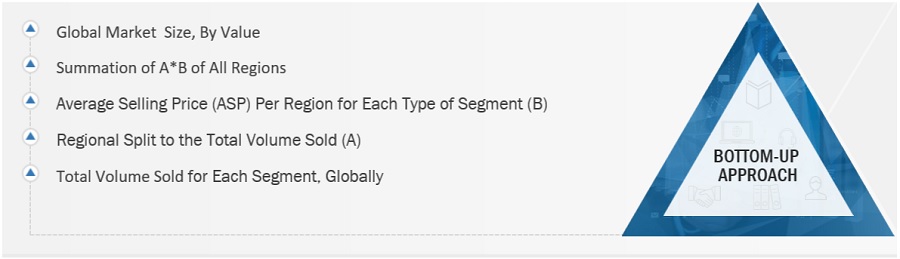

The study involves two major activities in estimating the current market size for the organic pigments market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering organic pigments products and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the organic pigments market, which was validated by primary respondents.

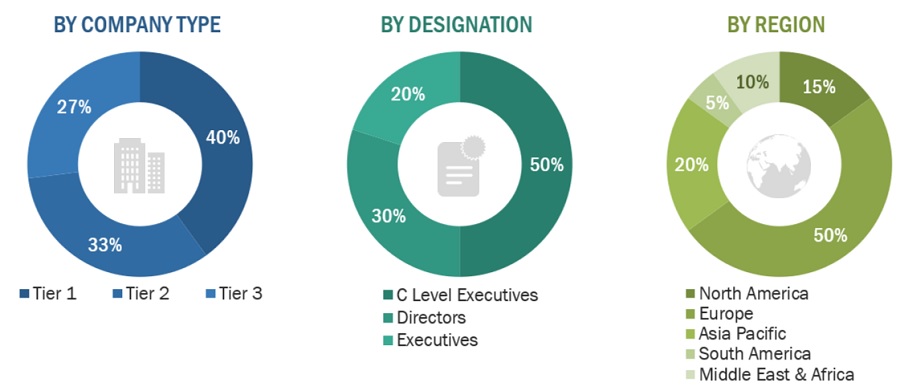

Primary Research

Extensive primary research was conducted after obtaining information regarding the organic pigments market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from organic pigments industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using organic pigments products were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of organic pigments and outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the organic pigments market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in organic pigments products in different applications at a regional level. Such procurements provide information on the demand aspects of the organic pigments industry for each application. For each application, all possible segments of the organic pigments market were integrated and mapped.

Organic Pigments Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Organic Pigemnts Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Organic pigments belong to the class of insoluble organic compounds of high coloring strength and are composed of carbon compounds. These pigments are insoluble in water, organic solvents, and various kinds of media like agar. The organic compounds used to make pigments have characteristics such as resistance to sunshine, flooding, acid, alkali, organic solvents, heat, and excellent dispersion properties in the application medium. Organic pigments provide outstanding durability, mobility, viscosity to inks, and color to plastics and synthetic fibers. They are used as reinforcing agents and fillers in rubber.

Key Stakeholders

- Organic pigments manufacturers

- Organic pigments suppliers

- Raw material suppliers

- End-use industries

- Government bodies

- Universities, governments, and research organizations

- Research and consulting firms

- R&D institutions

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the organic pigments market size in terms of volume and value.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global organic pigments market by type, source, application, and region.

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa, and analyze the significant region-specific trends.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape.

- To strategically profile the key market players and comprehensively analyze their core competencies.

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the organic pigments market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Organic pigments Market