Digital X-ray Market Size by Portability (Fixed, Portable), Applications (Orthopedic, Dental, Diagnostic, Cancer, Pediatric), Technology (Direct, Computed), System (Retrofit, New), End Users, Price Range, Type, and Region - Global Forecast to 2029

The size of global digital X-ray market in terms of revenue was estimated to be worth $5.4 billion in 2024 and is poised to reach $6.6 billion by 2029, growing at a CAGR of 4.0% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

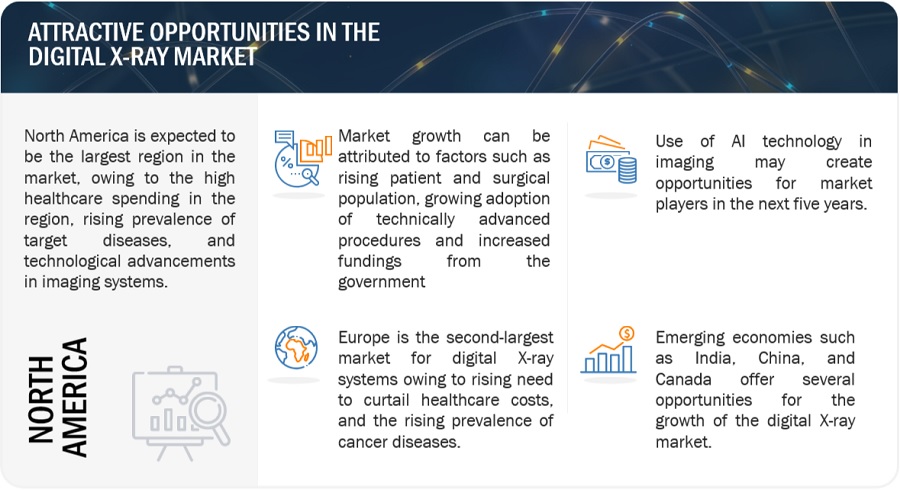

One primary driver is the rising patient population and incidence of musculoskeletal disorders and sports-related injuries. Ongoing technological advancements, coupled with favorable government initiatives and investments in healthcare infrastructure, are further fueling market growth. Overall, these factors collectively contribute to the expanding digital X-ray market as it continues to revolutionize medical imaging practices.

Global Digital X-Ray Market

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Digital X-ray Market Dynamics

Driver: Growing geriatric population and subsequent growth in disease incidence

Rapid growth in the global geriatric population is an important cause for the rising incidence of target diseases. According to the United Nations (UN), in 2019, there were approximately 703 million people aged 65 or older globally, and this population segment is projected to reach 1.5 billion by 2050. According to the ‘World Population Prospects: the 2019 Revision’ data, one in six people in the world will be over age 65 by 2050. The number of persons aged 80 years or over is projected to triple, from 143 million in 2019 to 426 million in 2050.

With the rapid growth in the geriatric population globally, the prevalence of age-associated diseases such as cardiovascular diseases, cancer, arthritis, and dementia is expected to increase as well. These diseases call for early diagnosis and improved diagnostic imaging capabilities, thereby promoting the adoption of digital X-ray systems among end users. Arthritis prevalence increases with age. According to the CDC, ~54.4 million (22.7% of the total adult population) adults in the US suffer from arthritis annually. The data further suggested that out of the total patient population, only 7.1% were aged between 18–44, while 29.3% were between 45–64, and 49.6% were aged 65 or older.

Orthopedic imaging is one of the major applications of digital X-ray systems. Due to insufficient nutrition, lifestyle-related issues, and age-associated bone density depletion, the geriatric population is more prone to developing orthopedic complexities. Moreover, osteoporosis, an age-related condition, is responsible for over 80% of all fractures in people aged 50 years and above (Source: Osteoporosis Canada). According to the International Osteoporosis Foundation, approximately 1.6 million hip fractures occur each year globally; this figure is estimated to increase to between 4.5 million to 6.3 million by 2050. Physicians perform bone density scans and dual X-ray absorptiometry, also called DXA, for the prognosis of osteoporosis. Thus, the rising incidence of osteoporosis and related bone-related fractures is expected to increase the need for X-ray scans. This, in turn, will fuel the need for digital X-rays globally.

Another application of digital X-ray imaging is the diagnosis of metastatic tumors in body tissues. The incidence of cancer is expected to increase in developed as well as developing countries across the globe in the coming years. For instance,

- In 2020, around 276,480 new cases of invasive breast cancer and 48,530 new cases of non-invasive breast cancer were reported in the US (Source: Breastcancer.org).

- According to the American Cancer Society, in 2018, around 1.8 million new cases of cancer were diagnosed in the US.

- Approximately 1,026,171 breast cancer cases were diagnosed among women in Asia in 2020 (Source: GLOBOCAN 2020).

It can be surmised that with the rising geriatric population and subsequent growth in target disease incidence, the demand for X-ray systems is expected to increase across the globe.

Restraint: High cost of digital X-ray systems

The price range of digital systems varies from USD 80,000 to USD 400,000. The high cost of digital X-ray systems poses a significant restraint on the digital X-ray market in several ways. Firstly, the initial investment required for purchasing and installing digital X-ray equipment can be prohibitive for many healthcare facilities, especially smaller clinics and hospitals with limited financial resources. Additionally, digital X-ray systems' ongoing maintenance and upgrade expenses can further strain budgets over time. Moreover, the expense of digital X-ray systems may lead to longer replacement cycles for existing equipment, delaying the adoption of newer, more advanced technology and inhibiting market growth.

Opportunity: Development of AI-based digital X-ray systems

The development of AI-based digital X-ray systems presents a significant opportunity for the digital X-ray market on multiple fronts. Firstly, AI integration enhances diagnostic accuracy and efficiency by enabling automated analysis of X-ray images, aiding radiologists in detecting abnormalities and making more informed decisions. This increased accuracy can lead to earlier detection of diseases, improving patient outcomes and reducing healthcare costs associated with missed diagnoses or unnecessary procedures. Secondly, AI algorithms can optimize imaging parameters and enhance image quality, resulting in clearer and more detailed X-ray images, which can further aid in diagnosis and treatment planning. Additionally, AI-driven systems have the potential to streamline workflow by automating routine tasks, allowing radiologists to focus more on complex cases and patient care. Overall, the development of AI-based digital X-ray systems offers a compelling opportunity to revolutionize the digital X-ray market by improving diagnostic capabilities, workflow efficiency, and patient outcomes.

Challenge: Hospital budget cuts

Hospital budget cuts can significantly challenge the digital X-ray market in several ways. Firstly, reduced budgets may lead hospitals to prioritize spending on immediate patient care over investments in new technology, including digital X-ray systems. Secondly, limited financial resources might prompt hospitals to extend the lifespan of existing X-ray equipment rather than upgrading to newer, more advanced digital systems. Additionally, budget constraints could hinder hospitals from expanding their imaging departments or adopting innovative technologies, thereby slowing the overall growth of the digital X-ray market. Moreover, decreased funding may result in delayed or canceled purchases of digital X-ray machines, impacting the revenue and market share of manufacturers and suppliers in the digital X-ray industry. Overall, hospital budget cuts pose a significant challenge to the digital X-ray market by constraining investment and adoption of this technology within healthcare facilities.

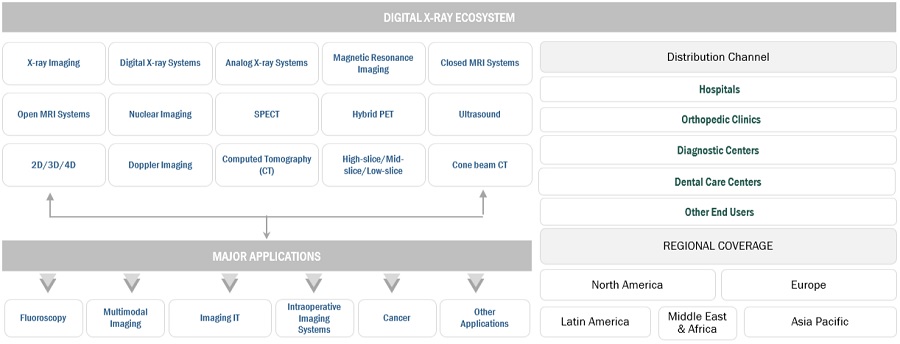

Market Ecosystem:

By type, the digital X-ray segment accounted for the digital X-ray industry largest share in 2023.

Based on type, the global digital X-ray market is segmented into analog and digital X-ray system. In 2023, the digital X-ray segment accounted for the largest market share. The increasing prevalence of chronic diseases that require imaging, such as cancer and cardiovascular diseases, drives the demand for advanced imaging technologies like DR. Moreover, continuous advancements in DR technology, such as improved detectors and image processing algorithms, contribute to its growth

By technology, the computed digital radiography segment of the digital X-ray industry to register significant growth in the near future.

Based on technology, the digital X-ray market is divided into direct and computed digital radiography. This growth is primarily driven by several factors. Firstly, computed DR systems offer advantages such as higher image resolution, improved image quality, and faster image acquisition compared to DDR systems. These features enable more accurate diagnoses and enhanced workflow efficiency in healthcare settings. Additionally, computed DR systems are increasingly favored due to their compatibility with existing X-ray equipment, allowing healthcare facilities to upgrade their imaging capabilities without the need for complete system replacements.

By end user, the hospitals segment of the digital X-ray industry accounted for the largest share in 2023

On the basis of end user, the digital X-ray market has been segmented into hospitals, orthopedic clinics, diagnostic centers, dental care centers and other end users. However, the hospitals and surgical centers segment is estimated to grow at the highest CAGR during the forecast period.

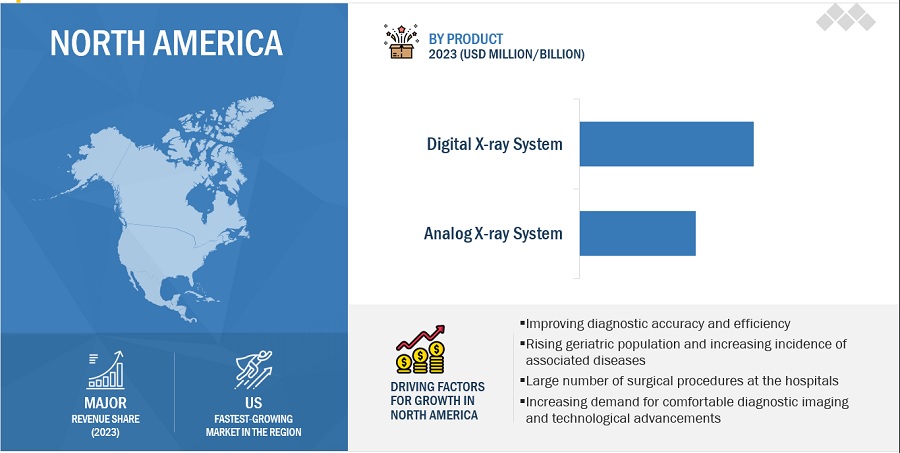

By region, North America is expected to be the largest market of the digital X-ray industry during the forecast period.

North America, comprising the US and Canada, accounted for the largest market share in 2023. The rising incidence of chronic diseases and the aging demographic in North America are driving an escalating need for diagnostic imaging services to manage and treat these conditions effectively. Favorable reimbursement policies and government initiatives aimed at improving healthcare access and quality further stimulate the adoption of digital X-ray systems among healthcare providers. Additionally, ongoing technological advancements and the presence of leading market players contribute to the innovation and expansion of the digital X-ray market in North America, driving sustained growth in the region.

To know about the assumptions considered for the study, download the pdf brochure

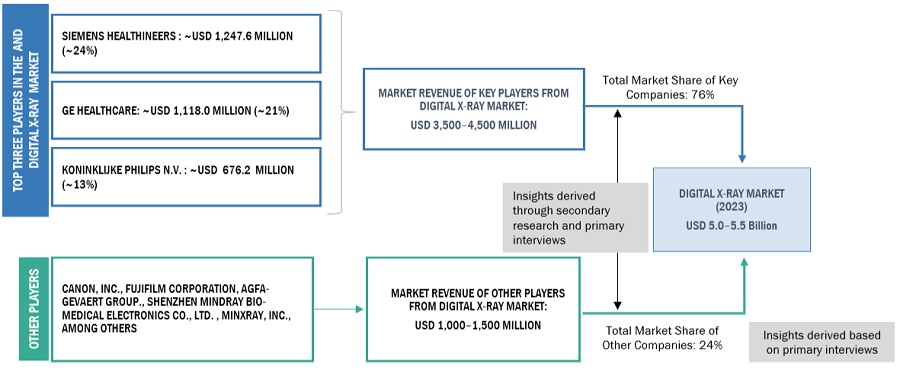

As of 2023, prominent players in the market are Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), GE Healthcare (US), Canon, Inc. (Japan), Carestream Health (US), FUJIFILM Holdings Corporation (Japan), Shimadzu Corporation (Japan), Agfa-Gevaert Group (Belgium), Samsung Medison (South Korea), Konica Minolta (Japan), Shenzhen Mindray Bio-Medical Electronics Co. (China), MinXray, Inc. (US), ACTEON (France), BPL Medical Technologies (India), Control-X Medical Ltd. (US), Allengers Medical Systems Ltd. (India)

Scope of the Digital X-Ray Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$5.4 billion |

|

Projected Revenue by 2029 |

$6.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 4.0% |

|

Market Driver |

Growing geriatric population and subsequent growth in disease incidence |

|

Market Opportunity |

Development of AI-based digital X-ray systems |

This report has segmented the global digital X-ray market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Analog X-ray systems

- Digital X-ray systems

By Technology

- Direct Radiography

- Computed Radiography

By Portability

-

Fixed Digital X-ray system

- Floor-To-Ceiling -Mounted Systems

- Ceiling -Mounted Systems

-

Portable Digital X-ray system

- Mobile X-Ray Systems

- Handheld X-Ray Systems

By System

- Retrofit Digital X-ray system

- New Digital X-ray system

By Price Range

- Low-end Digital X-ray system

- Mid Range Digital X-ray system

- High-end Digital X-ray system

By Application

- Chest Imaging

- Orthopedic

- Cardiovascular Imaging

- Pediatric Imaging

- Dental

- Cancer

- Other Applications

By End User

- Hospitals

- Orthopedic Clinics

- Diagnostic Centers

- Dental Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of The Digital X-Ray Industry:

- In March 2021, Koninklijke Philips N.V. (Netherlands)’s CombiDiagnost R90 received US FDA 510(k) clearance for CombiDiagnost R90, a high-end digital radiography-based fluoroscopy system.

- In May 2021, Royal Philips (Netherlands) and Viamed (Spain) entered into an agreement with Viamed to install Philips’ diagnostic imaging solutions in clinical centers throughout Viamed’s network, including 11 hospitals and 15 healthcare centers, in the Andalusia, Aragon, Catalonia, La Rioja, Murcia, and Madrid regions of Spain

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global digital X-ray market?

The global digital X-ray market boasts a total revenue value of $6.6 billion by 2029.

What is the estimated growth rate (CAGR) of the global digital X-ray market?

The global digital X-ray market has an estimated compound annual growth rate (CAGR) of 4.0% and a revenue size in the region of $5.4 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

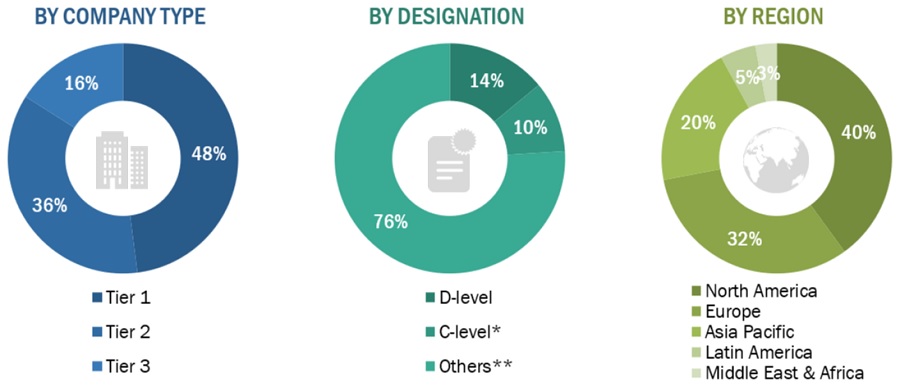

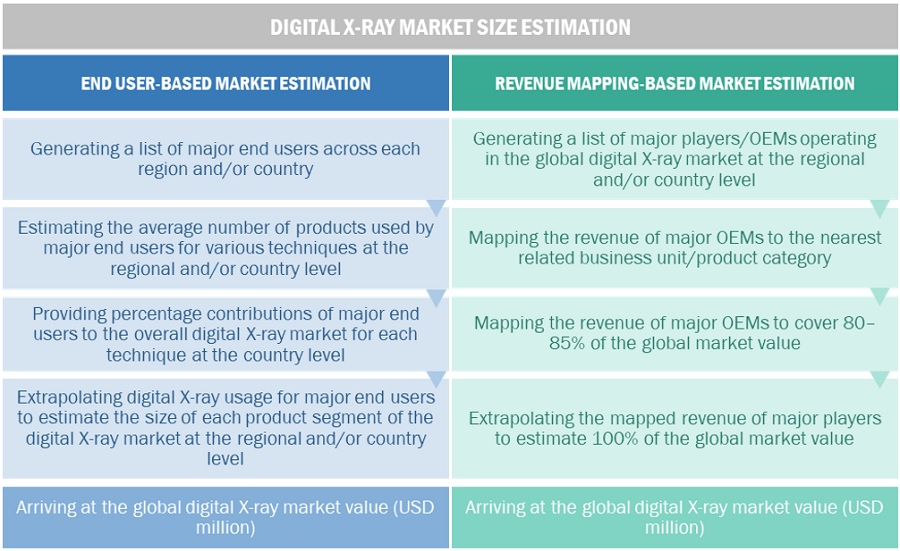

The study involved four major activities in estimating the current size of the digital X-ray market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial digital X-ray market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the digital X-ray market. The primary sources from the demand side include hospitals, orthopedic clinics, diagnostic centers, dental clinics and other end users. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2023: Tier 1 => USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the digital X-ray market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the digital X-ray market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2023

- Extrapolating the global value of the digital X-ray market industry

Bottom-up approach

In this report, the size of the global digital X-ray market was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the digital X-ray business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Approach 1: Company revenue estimation approach

Segmental revenues were calculated based on the revenue mapping of major solution/product providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the digital X-ray market

- Mapping the annual revenues generated by major global players from the digital X-ray segment (or the nearest reported business unit/product category)

- Mapping the revenues of major players to cover at least 80–85% of the global market share as of 2022

- Extrapolating the global value of the digital X-ray industry

Market Size Estimation For Digital X-Ray: Approach 1 (Company Revenue Estimation)I

To know about the assumptions considered for the study, Request for Free Sample Report

Approach 2: Customer-based market estimation

During preliminary secondary research, the total sales revenue of digital X-ray was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of digital X-ray product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall digital X-ray expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

- Identifying the percentage contributions of individual market segments and subsegments to the overall digital X-ray market at the regional/country level

Digital X-Ray Market Size Estimation: Bottom-Up Approach

Source: MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global digital X-ray market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the digital X-ray market was validated using top-down and bottom-up approaches.

Market Definition

The digital X-ray market encompasses a diverse range of medical devices designed to provide external support, stabilization, and relief for musculoskeletal conditions. These products include braces, supports, and orthoses tailored for various anatomical areas such as the knee, ankle, spine, wrist, and shoulder. The market addresses the growing demand for solutions related to orthopedic injuries, post-surgical recovery, and chronic musculoskeletal disorders, driven by factors such as an aging population, increased awareness of preventive healthcare, and advancements in materials and technology. With a focus on enhancing patient comfort and mobility, the digital X-ray market plays a crucial role in promoting non-invasive treatment options and comprehensive musculoskeletal care within healthcare settings.

Key Stakeholders

- Digital X-ray product manufacturers

- Original equipment manufacturers (OEMs)

- Suppliers, distributors, and channel partners

- Healthcare service providers

- Hospitals and academic medical centers

- Radiologists

- Research laboratories

- Health insurance providers

- Government bodies/organizations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists and other public-private funding agencies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the digital X-ray market based on technology, systems, portability, price range, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global digital X-ray market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe digital X-ray market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific digital X-ray market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of Latin America (RoLATAM), which comprises Argentina, Chile, Peru, Colombia, and Cuba

- Further breakdown of the RoW market into Latin America and MEA regions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital X-ray Market