Dental Bone Graft Substitute Market Size, Share & Trends by Type ( Xenograft, Allograft, Synthetic Bone Grafts, Alloplast), Application (sinus Lift, Ridge Augumentation, Socket Preservation), Product (BioOss, Osteograf, Grafton), End User, Region- Global Forecast to 2029

Dental Bone Graft Substitute Market Size, Share & Trends

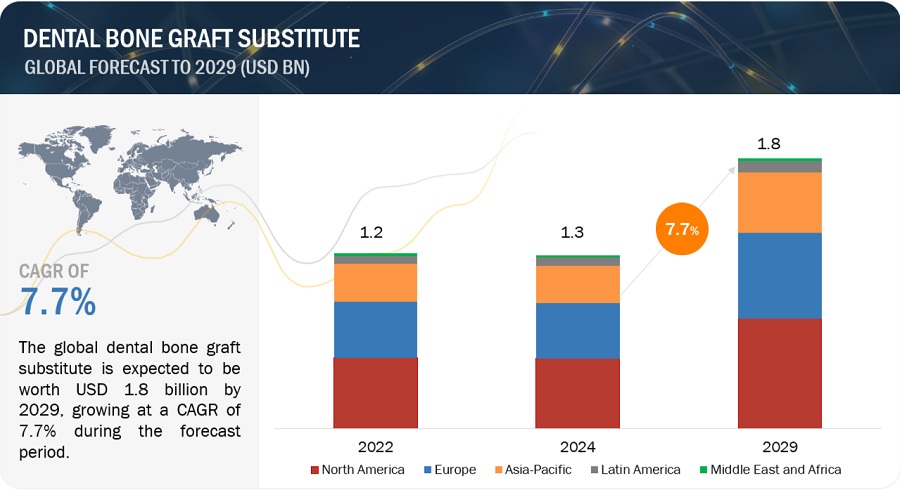

The size of global dental bone graft substitute market in terms of revenue was estimated to be worth $1.3 billion in 2024 and is poised to reach $1.8 billion by 2029, growing at a CAGR of 7.7% from 2024 to 2029. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

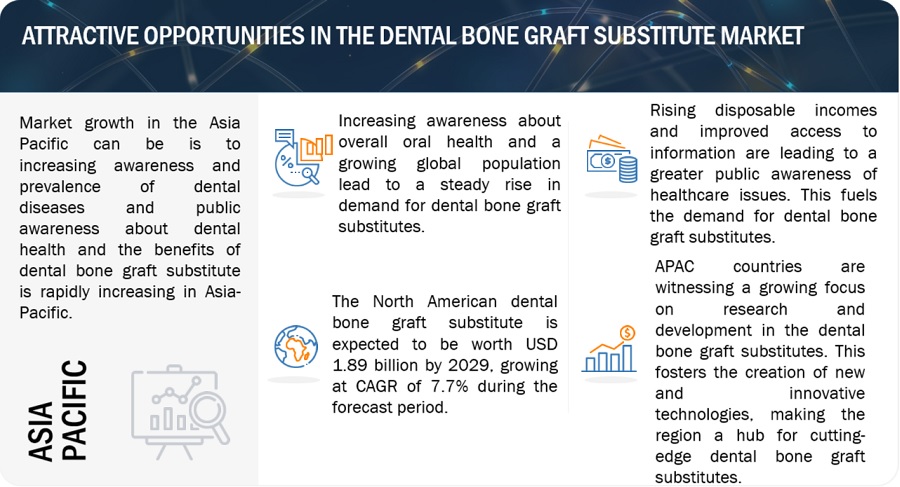

The increasing popularity of dental implants as a tooth replacement option creates a direct need for bone graft substitutes. Implants require sufficient jawbone density for successful placement and long-term stability. When natural bone is insufficient, bone grafts provide the necessary foundation for implants which is expected drive the dental bone graft substitute.

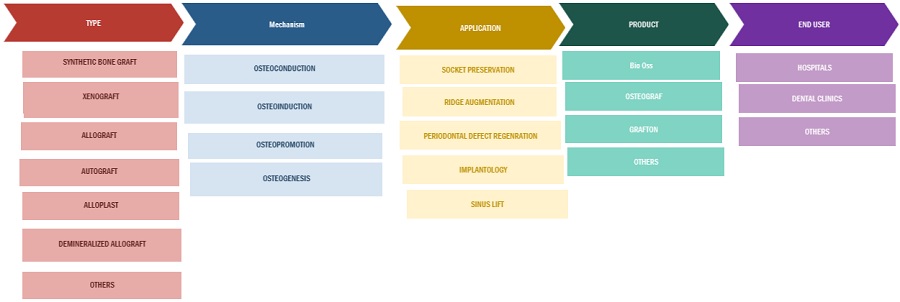

In this report, the dental bone graft substitute is segmented into – type, application, mechanism, product, end user and region.

Dental Bone Graft Substitute Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Dental Bone Graft Substitute Dynamics

Driver: Rising aging population

Life expectancy is increasing globally, while birth rates are declining in many countries. This leads to a larger proportion of older adults in the population pyramid, the United Nations reports that the global population aged 60 years or over is projected to nearly double from 1 billion in 2020 to 2.1 billion by 2050 an aging population creates a higher demand for healthcare services, particularly those related to age-related conditions like dental disorders which is expected to drive the market growth.

Restraint: Stringent regulatory guidelines for medical devices.

Meeting all regulatory requirements can lead to a lengthy and expensive approval process for new bone graft substitutes, potentially delaying patient access to innovative technologies also complying with stringent regulations can be costly for manufacturers, impacting the affordability of these materials which is expected to restrain the market growth. Regulations imposed by regulatory agencies, such as the European Medicines Agency (EMA) in the European Union or the Food and Drug Administration (FDA) in the United States, must be followed by medical devices. The guidelines and procedures for the creation, production, labeling, and promotion of medical devices are outlined in these regulations.

Opportunity: Growing Prevalence of Dental Disorders

Tooth loss can result from dental problems like trauma, gum disease, and decay. Because the tooth root isn't stimulating the jawbone as much as teeth fall out, this might happen over time. In order to provide a strong basis for dental implants or other restorative procedures, dental bone grafting can aid in the regeneration of missing bone.

Bone graft substitutes play a crucial role in jawbone regeneration and reconstruction, enabling dentists to perform implant procedures and other dental treatments requiring a strong bone base which is expected to create opportunities for the growth of the market.

Challenge: High Surgical Procedures Costs

Bone grafting procedures, while minimally invasive in some cases, still incur surgical costs associated with hospital or clinic fees, surgeon fees, and anesthesia. Procedures for dental bone grafting can be expensive, especially when paired with other medical interventions like implant insertion. The cost of these procedures out of pocket may be too high for a lot of individuals, particularly those without sufficient dental insurance. These combined costs can be a barrier for some patients which is expected to challenge the market growth.

DENTAL BONE GRAFT SUBSTITUTE INDUSTRY ECOSYSTEM

The dental bone graft substitute is becoming increasingly competitive, with new players entering the market and established players vying for market share. This competition drives down prices as companies try to undercut each other. The cost of materials, equipment, and labor is increasing, putting pressure on dental businesses to maintain profitability while keeping prices competitive. Consolidation within the dental industry, particularly the rise of dental laboratories creates larger entities with greater purchasing power. This can lead to lower prices for supplies and equipment, further pressuring smaller players also government regulations and changes in insurance coverage can impact reimbursement rates for dental procedures, forcing providers to adjust their pricing strategies

By type, synthetic bone graft is expected to show the highest CAGR of the dental bone graft substitute industry from 2024 to 2029.

The type segment is segmented into synthetic bone graft, xenograft, allograft, autograft, alloplastic, demineralized allograft, others.

Synthetic bone grafts are a vital segment of the growing dental bone graft substitute market. They offer a readily available, safe, and versatile alternative to traditional bone graft options. As technology advances and costs decrease, synthetic bone grafts are expected to play an increasingly prominent role in jawbone reconstruction and implant placement procedures. which is expected to drive the segment growth.

By application, ridge augmentation is expected to show the second highest CAGR of the dental bone graft substitute industry from 2024 to 2029.

The dental bone graft substitute market plays a vital role in facilitating successful ridge augmentation procedures, ultimately enabling the placement and stability of dental implants. As the market evolves, advancements in materials, minimally invasive techniques, and potentially regenerative technologies are expected to further improve patient outcomes and drive continued growth in the ridge augmentation segment which is expected to drive the market growth.

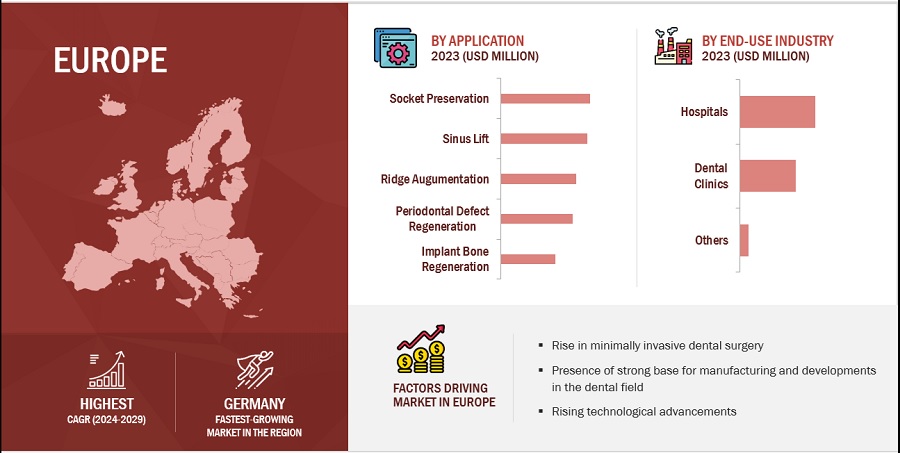

Europe accounted for the second largest CAGR of the global dental bone graft substitute industry, by region in the forecast period.

The dental bone graft substitute in Europe is expected to grow at the second largest CAGR due to a combination of factors that highlight the region's changing healthcare landscape. Some European governments are promoting diagnostic health awareness and offering subsidies for several treatments, further stimulating market growth. The aging population in Europe is increasing the demand for dental bone graft substitutes to address several oral diseases. Increasing wealth in European countries is leading to higher spending on healthcare, including dental bone graft substitute.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the dental bone graft substitute include Dentsply Sirona Inc. (US), Envista Holdings Corporation (US), JOHNSON & JOHNSON (US), Stryker Corporation (US), Medtronic, Plc (Ireland), Institut Straumann AG (Switzerland), Zimvie Inc. (US), Henry Schein Inc. (US), RTI Surgical Holdings Inc.(US), Lifenet Health (US), Dentium (US), Geistlich Pharma AG (Switzerland), Integra Lifesciences Holdings Corporation (US), Tissue Regenix Group (UK), Kuraray Co. Ltd. (Japan), BEGO GmbH & Co. KG (Germany), Young Innovations (US), Keystone Dental (US), Novabone LLC. (US), Biotiss Biomaterials LLC (US), Collagen Matrix Inc.(US), Osteogenics Biomedical (US), Hannox International Corp.(Taiwan), Meyer Haake GMBH (Germany) and Arora Biosurgery Ltd. (New Zealand).

Scope of the Dental Bone Graft Substitute Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2024 |

$1.3 billion |

|

Projected Revenue Size by 2029 |

$1.8 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.7% |

|

Market Driver |

Rising aging population |

|

Market Opportunity |

Growing Prevalence of Dental Disorders |

The study categorizes the dental bone graft substitute market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Synthetic Bone Graft

- Xenograft

- Allograft

- Autograft

- Alloplast

- Deminerlized Allograft

- Others

By Application

- Socket Preservation

- Ridge Augmentation

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Sinus Lift

By Mechanism

- Osteoconduction

- Osteoinduction

- Osteopromotion

- Osteogenesis

By Product

- Bio OSS

- Osteograf

- Grafton

- Others

By End User

- Hospitals

- Dental Clinics

- Others (Ortho Clinics, Research)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

Recent Developments of Dental Bone Graft Substitute Industry:

- In April 2023, Henry Schein acquired a majority ownership position in Biotech Dental, aiming to create a digital workflow that provides a seamless journey for customers to increase case acceptance and improve clinical outcomes for practitioners

- In March 2022, Dentsply Sirona Inc. partnered with Platform for Better Oral Health in Europe. The goal is to improve oral health and the prevention of oral diseases - as well as address oral health inequalities and challenges.

- In February 2022, Envista Holdings Corporation (US) partnered with Vitaldent Group (Spain). This extended agreement positions Envista as the preferred supplier of implants (Nobel Biocare) and clear aligners (Spark).

- In January 2022, Johnson & Johnson partnered with Microsoft Corporation, Inc. The Johnson & Johnson Medical Devices Companies (JJMDC) collaborated with Microsoft Corporation Inc, (US) to enable and expand JJMDC’s secure and compliant digital surgery ecosystem.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global dental bone graft substitute market?

The global dental bone graft substitute market boasts a total revenue value of $1.8 billion by 2029.

What is the estimated growth rate (CAGR) of the global dental bone graft substitute market?

The global dental bone graft substitute market has an estimated compound annual growth rate (CAGR) of 7.7% and a revenue size in the region of $1.3 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

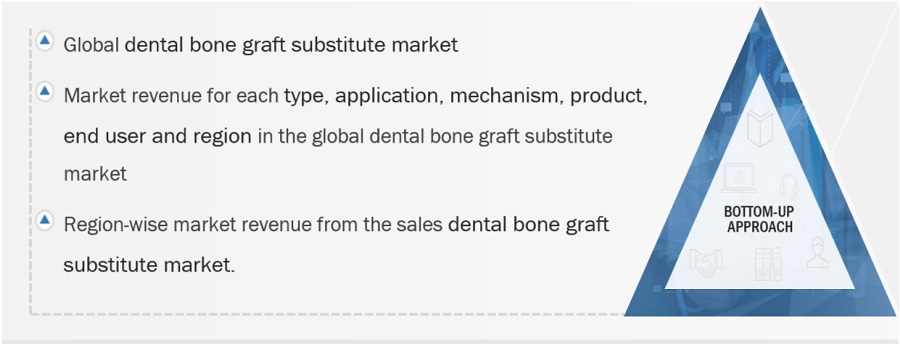

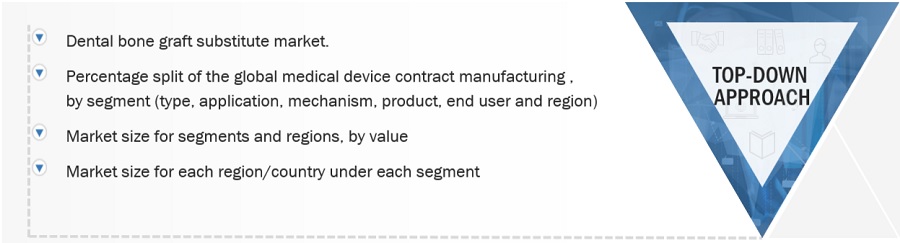

The study involved four major activities in estimating the current size of the dental bone graft substitute market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the dental bone graft substitute market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the dental bone graft substitute market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

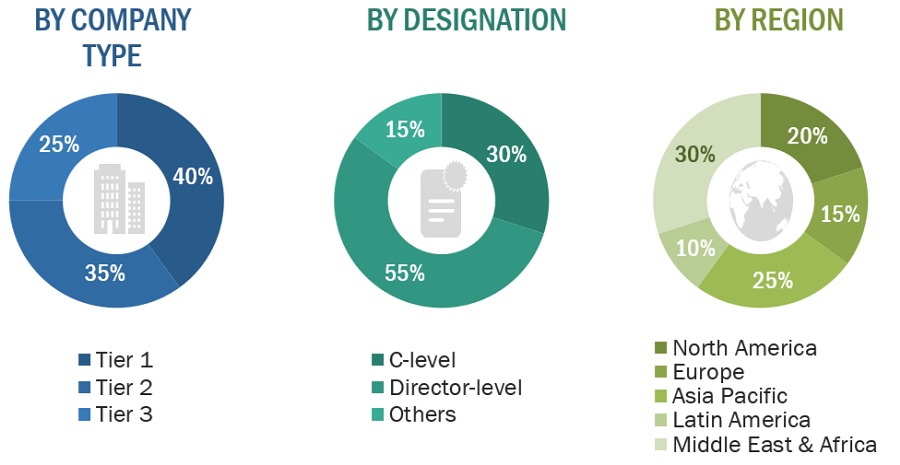

A breakdown of the primary respondents for the dental bone graft substitute market is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used to estimate the size of the dental bone graft substitute market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the dental bone graft substitute market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall dental bone graft substitute market was obtained from secondary data and validated by primary participants to arrive at the total dental bone graft substitute market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall dental bone graft substitute market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Dental Bone Graft Substitute Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Dental bone graft substitute Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A dental bone graft substitute is a biocompatible material used by dentists to rebuild or augment jawbone tissue lost due to various reasons. These substitutes act as a scaffold or supportive structure to promote the growth of new bone tissue in the jaw. They essentially fill the defect or gap where bone loss has occurred.

Key Stakeholders

- Manufacturers and distributors of dental bone graft substitute

- Manufacturers and distributors of dental bone graft substitute components

- Dental bone graft substitute companies

- Healthcare institutes

- Diagnostic laboratories

- Dental Hospitals and clinics

- Academic institutes

- Research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Objectives of the Study

- To define, describe, segment, analyze, and forecast the global dental bone graft substitute market by type, application, mechanism, product, end user and region.

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the dental bone graft substitute market in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa and GCC countries.

- To profile the key players in the dental bone graft substitute market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches and approvals in the dental bone graft substitute market.

- To analyze the impact of the recession on the dental bone graft substitute market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific dental bone graft substitute market into Indonesia, Philippines, Vietnam, Hong Kong, and other countries

- Further breakdown of the Rest of Europe dental bone graft substitute market into Belgium, Russia, the Netherlands, Switzerland, and other countries.

- Further breakdown of the Rest of Latin America dental bone graft substitute market into Argentina, Peru, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Bone Graft Substitute Market