Vehicle Scanner Market by Scanner (fixed, portable), Structure (drive-through, UVSS), Application (Critical Infrastructure Protection, Commercial), Technology (Sensing, Illuminating, Scanning, Imaging, Processing), Component - Global Forecast to 2025

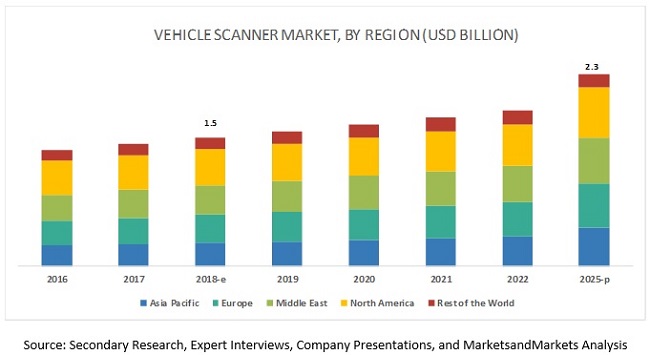

[131 Pages report] The global vehicle scanner market is projected to grow at a CAGR of 6.28% during the forecast period to reach $2.3 billion by 2025 from an estimated $1.5 billion in 2018. A significant focus on safety and security concerns by governments and private and commercial properties along with development in infrastructure are the key factors that have led to an increase in the installation of vehicle scanner systems. Further, the continuous rise in terrorist activities worldwide has also fueled the demand for high safety and security systems within countries. Governments and private and commercial properties are focusing more on the safety concerns to combat threats. To ensure safety and security, properties are installing under vehicle scanners and overhead X-ray systems for full vehicle body scanning.

Drive-through vehicle scanner estimated to account for the largest vehicle scanner market size during the forecast period

Drive-through vehicle scanners are also known as full body scanners. Governments, military premises, and highly restricted areas are now focusing on the installation of drive-through vehicle scanners. These systems mostly use X-ray technology to scan vehicles, which help in identifying bombs, drugs, contraband, and other possible threats. This system is best suitable for scanning large vehicles at places such as airports, seaports, tolls, oil plants, and cross-border checkpoints. Manufacturers such as Rapiscan provide drive-through full vehicle body scanning systems.

Fixed/Static segment is expected to be the largest contributor to the global vehicle scanner market during the forecast period

The fixed/static segment market is the largest contributor due to the high adoption rate in countries such as the US, Saudi Arabia, Germany, and the UK. A fixed/static vehicle scanner is usually installed in permanent vehicle scanning checkpoints. It involves high installation cost as compared with the portable/mobile vehicle scanner system because fixed/static vehicle scanner is installed under the ground surface. The static vehicle scanner is capable of scanning the vehicle with speed ranging from 30 to 60 km/h. The system can scan, detect, and compare images automatically, making the security personal’s job easier, safer, and more effective.

In application type, government/critical infrastructure protection segment is expected to be the largest vehicle scanner market during the forecast period

The growth of the government/critical infrastructure protection sector is estimated to be the largest market. There is a higher demand for vehicle scanner systems from government institutes to secure sensitive places such as nuclear plants and oil plants. Governments of various countries install vehicle scanner systems to safeguard various military bases, defense facilities, and cross-borders checkpoints. It also includes critical infrastructures such as nuclear power plants, prison facilities, and ancient monuments.

North America is expected to account for the largest vehicle scanner market size during the forecast period

North America is the largest market for vehicle scanner. The North American market has huge potential for vehicle scanners because the region has developed infrastructure such as airports, seaports, and high security measures to combat illegal activities and terrorism. Further, the continuous rise in terrorist activities in the region has fueled the demand for high safety and security systems within many countries. Governments and private and commercial properties are focusing more on the safety concerns to combat threats. To ensure safety and security, properties are installing under vehicle scanners and overhead X-ray systems for full vehicle body scanning. To minimize illegal entries of vehicles at borders, RFID system and Under Vehicle Scanning System (UVSS) can be installed. Such factors are driving the global vehicle scanner market in the North American region.

Key Market Players

The global vehicle scanner market is dominated by major players such as Gatekeeper Security (US), SecuScan (Germany), UVIScan (Netherlands), Leidos (US), and IRD (Canada). These companies have strong distribution networks at the global level. In addition, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Want to explore hidden markets that can drive new revenue in Vehicle Scanner Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Vehicle Scanner Market?

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Type, Component, Application, Technology, Structure, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East and Rest of the World |

|

Companies covered |

Gatekeeper Security (US), Secuscan (Germany), Chemring technology Solutions (UK), Uviscan (Netherlands) |

This research report categorizes the global vehicle scanner market on the basis of scanner type, scanner structure, component, application, technology, and region.

On the basis of scanner type, the global vehicle scanner market has been segmented as follows:

- Portable/Mobile

- Fixed/Static

On the basis of structure type, the global market has been segmented as follows:

- Drive-through

- UVSS

On the basis of component, the global market has been segmented as follows:

- Camera

- Lighting unit

- Barriers

- Software

- Others

On the basis of application, the global vehicle scanner market has been segmented as follows:

- Government/Critical infrastructure protection

- Private/Commercial facilities

On the basis of technology, the global market has been segmented as follows:

- Sensing

- Illuminating

- Scanning

- Imaging

- Processing

On the basis of region, the global vehicle scanner market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest Of Asia Pacific

-

Europe

- France

- Germany

- Russia

- Turkey

- Uk

- Spain

- Rest Of Europe

-

North America

- Canada

- Mexico

- Us

-

Middle East

- Israel

- Saudi Arabia

- Uae

- Rest Of Middle East

-

Rest Of The World (Row)

- Brazil

- Iran

Critical Questions:

- Which are the major components in vehicle scanner system?

- Will the industry cope with the challenge of high cost of vehicle scanners?

- How do you see the impact of security issues in the global vehicle scanner market?

- What are the upcoming trends in vehicle scanner market? What impact do they make post 2020?

- What are the key strategies adopted by the top players to increase their revenue?

Frequently Asked Questions (FAQ):

What is the market size of the vehicle scanner?

The vehicle scanner market size is estimated to be USD 1.5 billion in 2018 and is projected to reach USD 2.3 billion by 2025, growing at a CAGR of 6.28% during the forecast period.

What is the major application type in the vehicle scanner market – Government or private/commercial facilities?

Government institutions and critical infrastructure sectors will have largest share in the market. These authorities install vehicle scanner systems to secure facilities such as military bases, nuclear plants, checkpoints, prisons, heritage sites, and others.

Who are the key players in the vehicle scanner market?

The vehicle scanner market is led by established players such as Gatekeeper Security (US), Secuscan (Germany), UVIScan (Netherlands), Leidos (US), and IRD (Canada).

What are the major growth drivers of the vehicle scanner market?

Heightened safety and security protocols by the government institutions and rapid infrastructure development would be major drivers of the vehicle scanner market.

What is the most preferred vehicle scanner type - fixed/static scanners or portable/mobile scanners?

The fixed/static vehicle scanner will have largest share in the market due to their effectiveness and easy operations compared to portable or mobile scanners. These vehicle scanners can scan, detect, and compare images automatically. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Vehicle Scanner Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Ket Data From Primary Sources

2.4 Vehicle Scanner Market Size Estimation

2.4.1 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Global Vehicle Scanner Market to Grow at A Significant Rate During the Forecast Period

4.2 North America to Lead the Global Market

4.3 Market in North America, By Scanner Type and Country

4.4 Market, By Structure Type

4.5 Market, By Application

4.6 Market, By Component

5 Vehicle Scanner Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Security and Safety Concerns

5.2.1.2 Infrastructure Development

5.2.2 Restraints

5.2.2.1 Limited Growth

5.2.3 Opportunities

5.2.3.1 Rise in Demand for Full Vehicle Body Scanning

5.2.3.2 Encouragement From Government Facilities

5.2.4 Challenges

5.2.4.1 High Cost of the System

5.2.4.2 Saturated Market Demand for UVSS in Developed Countries

5.2.5 Impact of Market Dynamics

6 Industry Trends (Page No. - 43)

6.1 Technological Overview

6.1.1 Floor-Mounted & Overhead Vehicle Scanner

6.1.2 Underground Vehicle Scanner

6.2 Value Chain Analysis

6.3 Macroindicator Analysis

6.3.1 Growth of Vehicle Scanner Market

6.3.2 GDP (USD Billion)

6.3.3 GNI Per Capita, Atlas Method (USD)

6.3.4 GDP Per Capita PPP (USD)

6.3.5 Macroindicators Influencing Market, Top 3 Countries

6.3.5.1 US

6.3.5.2 Germany

6.3.5.3 China

7 Global Market, By Technology Type (Page No. - 50)

7.1 Introduction

7.2 Sensing

7.3 Illuminating

7.4 Scanning

7.5 Imaging

7.6 Processing

8 Global Market, By Scanner Type (Page No. - 52)

8.1 Introduction

8.2 Research Methodology

8.3 Fixed/Static Scanner

8.3.1 North America to Lead the Market

8.4 Portable/Mobile Scanner

8.4.1 Asia Pacific Market for Portable/Mobile Scanner to Grow With the Highest CAGR Due to Exponential Growing Infrastructure

9 Global Vehicle Scanner Market, By Structure Type (Page No. - 58)

9.1 Introduction

9.2 Research Methodology

9.3 Drive-Through

9.3.1 North America to Lead the Market

9.4 UVSS

9.4.1 Asia Pacific Market for UVSS to Grow With the Highest CAGR Due to Growing Awareness Regarding Security System

10 Global Vehicle Scanner Market, By Application (Page No. - 63)

10.1 Introduction

10.2 Research Methodology

10.3 Government/Critical Infrastructure Protection

10.3.1 Military, Defense Facilities, and Borders

10.3.2 Government Buildings, Palaces, Presidential Complexes

10.3.3 Prison Facilities

10.3.4 Entrances of Energy Plants (Nuclear Power Plants, Natural Gas Facilities, Oil Refineries, and Water Reservoirs)

10.4 Private/Commercial Facilities

10.4.1 Commercial Parking Facilities

10.4.2 Stadiums and Other Public Venues

10.4.3 Others (Hotels, Casinos, Resorts)

11 Global Vehicle Scanner Market, By Component (Page No. - 68)

11.1 Introduction

11.2 Research Methodology

11.3 Camera

11.3.1 North America to Lead the Market for Vehicle Scanner Camera in 2018

11.4 Lighting Unit

11.4.1 North America to Lead the Market for Vehicle Scanner Lighting Unit in 2018

11.5 Barrier

11.5.1 Asia Pacific to Have the Highest CAGR Growth for Barrier

11.6 Vehicle Scanning Software

11.6.1 North America to Lead the Market of Vehicle Scanning Software in 2018

11.7 Others

11.7.1 Asia Pacific to Have the Highest CAGR Growth for Others

12 Global Vehicle Scanner Market, By Region (Page No. - 75)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.1.1 Government Initiatives to Enhance Surveillance and Security are Expected to Drive this Market in China

12.2.2 India

12.2.2.1 Immense Scope for Improvement in Infrastructure is Expected to Drive this Market in India

12.2.3 Japan

12.2.3.1 The Developed Infrastructure in Japan has Created the Demand for the Market

12.2.4 South Korea

12.2.4.1 Rising Commercial Real Estate in South Korea is Expected to Drive the Portable/Mobile Scanner Market for Vehicle

12.2.5 Rest of Asia Pacific

12.2.5.1 Increasing Safety and Security Concerns are Expected to Drive the Portable/Mobile Vehicle Scanner Market

12.3 Europe

12.3.1 France

12.3.1.1 The Legal Empowerment to Enhance Security Measures is Likely to Drive Market in France

12.3.2 Germany

12.3.2.1 Systems Assisting Police and Border Security Forces in Germany Will Boost the Market

12.3.3 Spain

12.3.3.1 Rising Safety and Security Concerns in Spain Will Boost the Market

12.3.4 Russia

12.3.4.1 Huge Investment Potential in Infrastructure Development is Expected to Drive this Market in Russia

12.3.5 United Kingdom

12.3.5.1 Increasing Transport of Goods Through Sea and Air Creates the Demand for Vehicle Scanner Market in the UK

12.3.6 Turkey

12.3.6.1 Rising Safety Concerns Will Increase the Demand for Vehicle Scanners in Turkey

12.3.7 Rest of Europe

12.3.7.1 Increasing Transport of Goods Will Increase the Demand for Vehicle Scanners

12.4 North America

12.4.1 Canada

12.4.1.1 Portable/Mobile Vehicle Scanner in Canada is Expected to Witness the Fastest Growth Rate

12.4.2 Mexico

12.4.2.1 Implementing Safety Measures Will Boost Vehicle Scanner Market in Mexico

12.4.3 US

12.4.3.1 The US Accounted for the Largest Vehicle Scanner Market Size in the Drive-Through Vehicle Scanning System in North America

12.5 Middle East

12.5.1 Saudi Arabia

12.5.1.1 Securing Border Premises in the Country Will Boost the Market for Vehicle Scanner

12.5.2 UAE

12.5.2.1 Concerns About Industrial and Commercial Establishments Safety Will Increase the Demand for Vehicle Scanning System in UAE

12.5.3 Israel

12.5.3.1 Continuous Threats at Borders are Likely to Drive the Vehicle Scanner Market in Israel

12.5.4 Rest of Middle East

12.5.4.1 UVSS for Industrial and Commercial Application is Likely to Grow

12.6 Rest of the World

12.6.1 Brazil

12.6.1.1 Increasing Focus on Border Security Will Drive the Demand for Market

12.6.2 Iran

12.6.2.1 Iran is Expected to Witness the Largest Share in RoW

13 Competitive Landscape (Page No. - 98)

13.1 Overview

13.2 Vehicle Scanner Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 Collaborations/Joint Ventures/Supply Contracts/ Partnerships/Agreements/Mergers & Acquisitions

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Innovators

13.4.3 Dynamic Differentiators

13.4.4 Emerging Companies

14 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Godrej & Boyce

14.2 Uviscan

14.3 Omnitec

14.4 Secuscan

14.5 Tescon AG

14.6 Gatekeeper Security

14.7 Intelliscan

14.8 Leidos

14.9 Uveye

14.10 International Road Dynamics

14.11 El-Go Team

14.12 Infinite Technologies

14.13 Key Players From Other Regions

14.13.1 North America

14.13.1.1 Advanced Detection Technology

14.13.1.2 Rapiscan Systems

14.13.2 Europe

14.13.2.1 Chemring Group

14.13.2.2 Amba Defence

14.13.3 Asia Pacific

14.13.3.1 Dahua Technology

14.13.3.2 Vehant Technologies

14.13.3.3 Bharat Electronics

14.13.3.4 Safeways Systems

14.13.3.5 Parknsecure

14.13.3.6 Shenzhen Zhonganxie Technology

14.13.4 Rest of the World (RoW)

14.13.4.1 Cass Parking

14.13.4.2 Vmi Security

14.13.4.3 Guardian Industries

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 125)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Report

15.5 Author Details

List of Tables (44 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Global Vehicle Scanner Market Size, By Scanner Type, 2016–2025 (USD Million)

Table 3 Fixed/Static Scanner: Market, By Region, 2016–2025 (USD Million)

Table 4 Portable/Mobile Scanner: Market, By Region, 2016–2025 (USD Million)

Table 5 Global Market Size, By Structure Type, 2016–2025 (USD Million)

Table 6 Drive-Through: Market, By Region, 2016–2025 (USD Million)

Table 7 UVSS: Market, By Region, 2016–2025 (USD Million)

Table 8 Global Vehicle Scanner Market Size, By Application, 2016–2025 (USD Million)

Table 9 Global Market Size, Government/Critical Infrastructure Protection Application, 2016–2025 (USD Million)

Table 10 Global Market Size, Private/Commercial Application, 2016–2025 (USD Million)

Table 11 Global Market, By Component, 2016–2025 (USD Million)

Table 12 Camera: Market, By Region, 2016–2025 (USD Million)

Table 13 Lighting Unit: Market, By Region, 2016–2025 (USD Million)

Table 14 Barrier: Market, By Region, 2016–2025 (USD Million)

Table 15 Software: Market, By Region, 2016–2025 (USD Million)

Table 16 Others: Market, By Region, 2016–2025 (USD Million)

Table 17 Global Vehicle Scanner Market, By Region, 2016–2025 (USD Million)

Table 18 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 19 China: Market, By Scanner Type, 2016–2025 (USD Million)

Table 20 India: Market, By Scanner Type, 2016–2025 (USD Million)

Table 21 Japan: Market, By Scanner Type, 2016–2025 (USD Million)

Table 22 South Korea: Market, By Scanner Type, 2016–2025 (USD Million)

Table 23 Rest of Asia Pacific: Vehicle Scanner Market, By Scanner Type, 2016–2025 (USD Million)

Table 24 Europe: Market, By Country, 2016–2025 (USD Million)

Table 25 France: Market, By Scanner Type, 2016–2025 (USD Million)

Table 26 Germany: Market, By Scanner Type, 2016–2025 (USD Million)

Table 27 Spain: Market, By Scanner Type, 2016–2025 (USD Million)

Table 28 Russia: Market, By Scanner Type, 2016–2025 (USD Million)

Table 29 UK: Market, By Scanner Type, 2016–2025 (USD Million)

Table 30 Turkey: Market, By Scanner Type, 2016–2025 (USD Million)

Table 31 Rest of Europe: Market, By Scanner Type, 2016–2025 (USD Million)

Table 32 North America: Market, By Country, 2016–2025 (USD Million)

Table 33 Canada: Market, By Scanner Type, 2016–2025 (USD Million)

Table 34 Mexico: Market, By Scanner Type, 2016–2025 (USD Million)

Table 35 US: Market, By Scanner Type, 2016–2025 (USD Million)

Table 36 Middle East: Vehicle Scanner Market, By Country, 2016–2025 (USD Million)

Table 37 Saudi Arabia: Market, By Scanner Type, 2016–2025 (USD Million)

Table 38 UAE: Market, By Scanner Type, 2016–2025 (USD Million)

Table 39 Israel: Market, By Scanner Type, 2016–2025 (USD Million)

Table 40 Rest of Middle East: Market, By Scanner Type, 2016–2025 (USD Million)

Table 41 RoW: Vehicle Scanner Market, By Country, 2016–2025 (USD Million)

Table 42 Brazil: Market, By Scanner Type, 2016–2025 (USD Million)

Table 43 Iran: Market, By Scanner Type, 2016–2025 (USD Million)

Table 44 Collaborations/Joint Ventures/Supply Contracts/Acquisition & Merger/Partnerships/Agreements, 2016–2018

List of Figures (43 Figures)

Figure 1 Global Vehicle Scanner Market Segmentation

Figure 2 Global Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for Vehicle Scanner: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market Dynamics

Figure 8 Global Vehicle Scanner Market, By Region, 2018–2025 (USD Million)

Figure 9 Fixed/Static Segment Held the Largest Share of this Market in 2018

Figure 10 Lucrative Growth Opportunities for the Vehicle Scanner Between 2018 and 2025

Figure 11 Global Market Share, By Region, (USD Million), 2018

Figure 12 Fixed/Static Vehicle Scanner and the US Accounted for the Largest Shares of this Market in 2018

Figure 13 Drive-Through Segment to Hold the Largest Market Share, USD Million, 2018 vs 2025

Figure 14 Government/Critical Infrastructure Protection Segment to Hold the Largest Market Share, USD Million, 2018 vs 2025

Figure 15 Software Market to Play A Major Role in this Market (2018–2025)

Figure 16 Market Dynamics of Vehicle Scanner

Figure 17 Military Expenditure, 2017

Figure 18 Value Chain Analysis of Global Vehicle Scanner Market: Major Value Added By Component Manufacturers and Product Manufacturers

Figure 19 Portable/Mobile Scanner Segment is Expected to Grow at A Higher CAGR During the Forecast Period (2018–2025)

Figure 20 Key Primary Insights

Figure 21 Drive-Through Segment is Expected to Grow at A Higher CAGR During the Forecast Period (2018–2025)

Figure 22 Key Primary Insights

Figure 23 Governement/Critical Infrastructure Protection Segment is Expected to Grow at A Higher CAGR During the Forecast Period (2018–2025)

Figure 24 Key Primary Insights

Figure 25 Software is Expected to Grow at the Highest CAGR During the Forecast Period (2018–2025)

Figure 26 Key Primary Insights

Figure 27 North America to Dominate the Market During the Forecast Period

Figure 28 Asia Pacific: Vehicle Scanner Market Snapshot

Figure 29 Europe: Market Snapshot

Figure 30 North America: Market Snapshot (2018)

Figure 31 Middle East: Market

Figure 32 Iran is Estimated to Be the Largest Market (2018)

Figure 33 Key Primary Insights

Figure 34 Key Developments By Leading Players in the Vehicle Scanner Market, 2016–2018

Figure 35 Ranking of Key Players, 2018

Figure 36 Global Vehicle Scanner Market : Competitive Leadership Mapping, 2018

Figure 37 Godrej & Boyce: Company Snapshot

Figure 38 Godrej & Boyce: SWOT Analysis

Figure 39 Uviscan: SWOT Analysis

Figure 40 Omnitec: SWOT Analysis

Figure 41 Secuscan: SWOT Analysis

Figure 42 Tescon AG: SWOT Analysis

Figure 43 Gatekeeper Security: SWOT Analysis

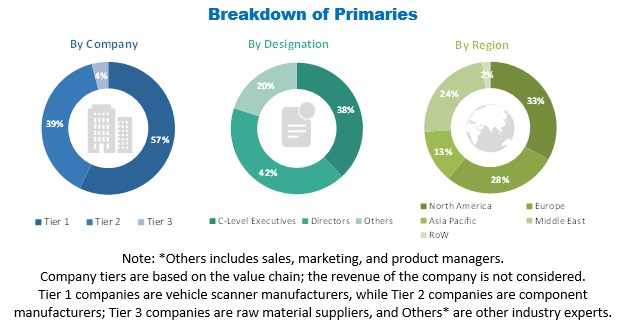

The study involved 5 major activities in estimating the current size of the vehicle scanner market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include safety & security industry organizations such as the Organization for Security and Co-operation in Europe (OSCE), United Nations Counter-Terrorism Implementation Task Force (CTITF), corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of vehicle scanner market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side system integrators, distributors, system installers [(in terms of component supply), country-level government associations, and trade associations], and supply-side vehicle scanner and component manufacturers across major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World. Approximately, 19% and 81% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Vehicle Scanner Market Size Estimation

The top-down approach has been used to estimate and validate the size of the global market by scanner type, application, structure, component and region, in terms of value. In this approach, the global market size is derived by calculating the segmental revenue of vehicle scanners for key market players. After deriving the total market size, the market share of each region is identified. Regional market is derived by multiplying regional penetration with global market. To calculate the country-level market, mapping of government and commercial facilities has been done to identify the penetration ratio for each country in their respective regions. To derive the country-level market, penetration ratio for each country is multiplied by the total market of that particular region.

All country-level data is added to derive the global vehicle scanner market, by application, structure, and scanner type.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To segment and forecast the global vehicle scanner market size in terms of value (USD million)

- To define, describe, and forecast the global market on the basis of scanner type, application, technology, structure, component, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size by scanner type (portable/mobile and fixed/static)

- To segment and forecast the market size by application (government/critical infrastructure protection and commercial/private)

- To segment and forecast the vehicle scanner market size by structure [drive-through and under vehicle scanning systems (UVSS)]

- To segment and forecast the market size by component (camera, lighting unit, barrier, software and others)

- To forecast the market size with respect to key regions, namely, North America, Europe, Middle East, Asia Pacific, and the Rest of the World

- To segment the market and provide the qualitative data on the basis of technology—sensing, imaging, illuminating, scanning, and processing

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities for stakeholders and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in vehicle scanner market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

Company Information

- Profiling of Additional Vehicle Scanner Market Players (Up to 5)

- Additional countries (Up to 3)

Growth opportunities and latent adjacency in Vehicle Scanner Market