Digital Map Market by Solution (Mapping Data, Geographic Information System [GIS], Web Mapping, GPS-enabled), Mapping Type (3D & 4D Metaverse, Indoor, Outdoor), Purpose (Real-time Traffic, Satellite, Navigation, Thematic Maps) - Global Forecast to 2029

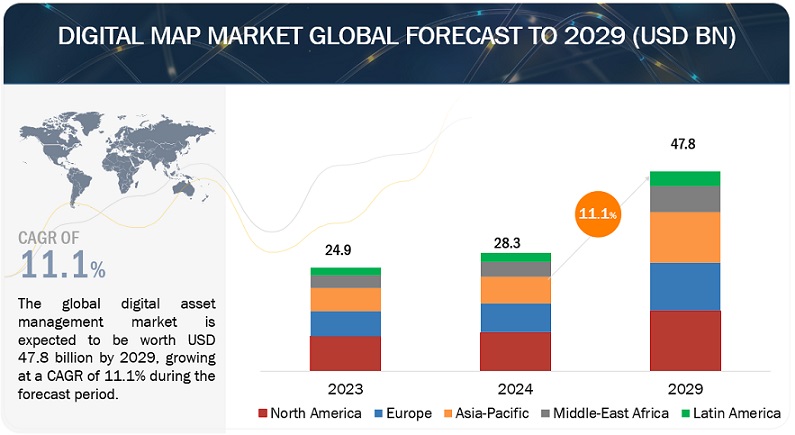

[314 Pages Report] The digital map market is expected to grow from USD 28.3 billion in 2024 to USD 47.8 billion by 2029, at a CAGR of 11.1% during the forecast period. Digital maps have revolutionized how we navigate and interact with the world. These dynamic representations of geographic data provide invaluable insights, from guiding us on our daily commutes to facilitating complex urban planning initiatives. They have become integral to countless industries, including transportation, logistics, urban development, and tourism.

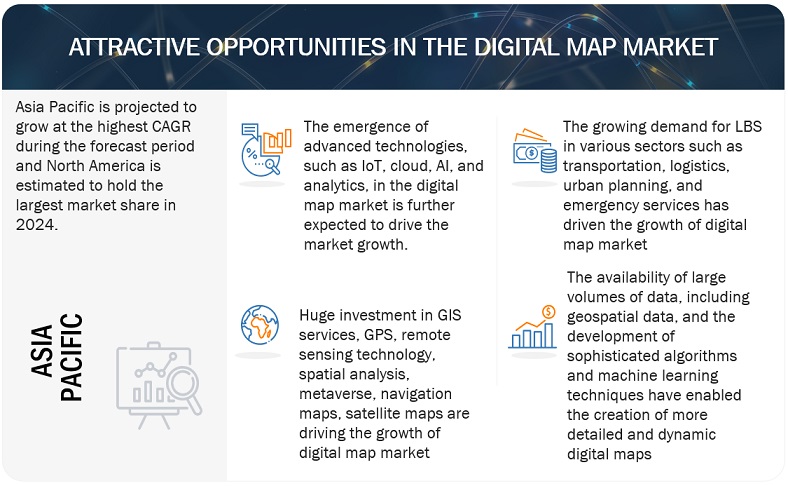

The evolution of digital maps traces back to the early days of geographic information systems (GIS) and cartography, where static paper maps were digitized to create digital counterparts. However, technological advancements have propelled digital maps to the forefront of modern navigation and spatial analysis. In recent years, integrating satellite imagery, GPS technology, and real-time data streams has vastly improved the accuracy and functionality of digital maps. These technologies have enabled turn-by-turn navigation, live traffic updates, and geolocation services on mobile devices, making them indispensable tools for personal and professional use. Also, the rise of artificial intelligence (AI) and machine learning has further enhanced the capabilities of digital maps, allowing for predictive analytics, route optimization, and even the creation of 3D maps with augmented reality overlays.

Emerging technologies like LiDAR (Light Detection and Ranging) are poised to revolutionize digital mapping by capturing highly detailed 3D representations of the environment. As well, advancements in sensor technology and data processing algorithms promise to make digital maps even more dynamic, adaptive, and responsive to user needs.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Digital Map Market

The impact of a recession on the market is primarily medium-term. During a recession, consumers tighten their belts, reducing spending on non-essential items, including digital map services; this can result in a decline in demand for premium mapping solutions. Businesses may reduce expenses, including licensing fees for advanced mapping software or services; this can affect revenues for digital map providers, particularly those reliant on corporate clients. Additionally, economic downturns can intensify competition among digital map providers as companies vie for a shrinking pool of customers; this may lead to pricing pressure and aggressive marketing tactics to maintain market share.

Digital Map Market Dynamics

Driver: Rise in smartphone and internet usage driving demand for digital maps

The rise in smartphone and internet usage globally has significantly heightened the demand for digital maps, particularly for navigation and real-time tracking. As per the GSMA (Global System for Mobile Communications) report, the number of mobile internet users is projected to reach 5.5 billion by 2030, with smartphone connections expected to rise to 92% by the same year; the necessity for accurate and accessible Digital mapping solutions becomes increasingly evident. This surge in smartphone and internet adoption fuels the need for reliable navigation tools, driving the growth and relevance of digital mapping technologies. Consequently, businesses and individuals seek comprehensive mapping solutions to facilitate efficient route planning, location-based services, and seamless navigation experiences in an increasingly connected world. One of the newest smartphone features is map software, which is pre-installed on devices. Smartphone users use mapping applications on their devices for navigation and driving assistance.

Restraint: Risk of unauthorized access and data breaches hindering the digital map market

Data privacy and security concerns hinder the digital map market. As digital maps collect vast amounts of location-based data, including personal information, the risk of unauthorized access and data breaches becomes evident. Striking a balance between location-based services and user privacy is challenging, particularly with the evolution of real-time tracking and personalized recommendations. Compliance with data protection regulations like GDPR adds complexity and costs to digital mapping services, necessitating robust data protection measures and transparent data handling processes.

Opportunity: Geospatial data analytics driving optimized resource allocation and sustainable development

Geospatial Data Analytics presents a significant opportunity in the Digital Map market, aligning with the UN 2030 Agenda for Sustainable Development and initiatives like the upcoming UN Committee of Experts session. The recent announcement of the National Geospatial Policy 2022 in India underscores the global recognition of the transformative potential of geospatial information, focusing on achieving high-resolution mapping and digital elevation models by 2030. By leveraging advanced analytics tools, businesses and governments can optimize resource allocation, drive sustainable development, and navigate complex challenges effectively. This convergence of global initiatives and policy frameworks underscores the pivotal role of geospatial data analytics in shaping a more resilient and sustainable future. The use of geospatial information has increased considerably over the last couple of years. Geospatial information-based maps and visualizations greatly assist enterprises in understanding business situations and making business decisions. It is a new language that improves communication between different teams, departments, disciplines, professional fields, organizations, and the public.

Companies like Atos use GIS platforms with LBS to offer services to businesses involved in supply chain management, data centers, infrastructure development, urban planning, risk and emergency management, navigation, and healthcare. Moreover, various technological advancements in Digital Maps have delivered information related to roadblocks, traffic updates, updated places of interest, and landmarks, making them user-friendly. Geospatial data collected from various sources is stored, processed, analyzed, and extracted for meaningful outputs, thus utilizing the geospatially analyzed information for decision-making by multiple end-users. Integrating geospatial technology with mainstream technologies, such as IT, telecommunication, and the Internet, enables harnessing the true potential of geospatial information.

Challenge: Limited infrastructure and internet access in underdeveloped countries poses challenges

According to the United Nations, 3.7 billion people currently lack access to the Internet. Limited infrastructure and internet access, affecting approximately half of the global population, present significant challenges for the Digital Map market. Particularly in regions with inadequate connectivity and infrastructure, accessing and updating Digital Maps becomes compromised. With only 19% online, the least developed countries face the most significant connectivity disparities. Network coverage, bandwidth, and reliability further exacerbate the challenge, impacting the delivery of real-time mapping data and user experience. Addressing this hurdle necessitates investment in expanding connectivity, improving network infrastructure, and promoting digital inclusion efforts. Bridging the digital divide through initiatives like broadband expansion and mobile network deployment is crucial for unlocking the full potential of Digital Mapping solutions in underserved regions.

Digital Map Market Ecosystem

Based on application, the geocoding and geopositioning segment will grow to the second-largest market share during the forecast period.

Geocoding is used to identify the respective geographic coordinates expressed from other geographic data, such as street addresses or ZIP codes. The geographic coordinates are often represented as latitudes and longitudes. The geocoding software helps organizations quickly find an associated textual location or street address from geographic coordinates. Geocoding enables firms to have a real-time impact on customer experience. Furthermore, it assists in detecting customers' locations. It helps analyze the time spent, such as whether it is eating, shopping, or traveling, providing valuable insights. Retailers and social media marketers have already tapped into reverse geocoding to deliver relevant and real-time messaging to their clients. Geopositioning in digital maps refers to determining the precise geographic location of a point or device on the Earth's surface using geographical coordinates. Geopositioning accuracy depends on various factors, such as the number and geometry of visible satellites, atmospheric conditions, and signal interference. Generally, GNSS receivers can achieve accuracy within a few meters under optimal conditions, although more advanced receivers can achieve sub-meter accuracy.

By purpose, the navigation maps segment will hold the largest market size during the forecast period.

Navigation maps depict roads, streets, highways, and other transportation infrastructure, including lane information, traffic signals, and road signs. Different types of roads are typically represented with varying line styles or colors to indicate their classification (e.g., highways, arterials, local roads). Navigation maps provide turn-by-turn directions to guide users along their chosen route from the starting point to the destination. Directions include information about upcoming turns, intersections, exits, and distances, as well as visual cues and voice guidance for navigation.

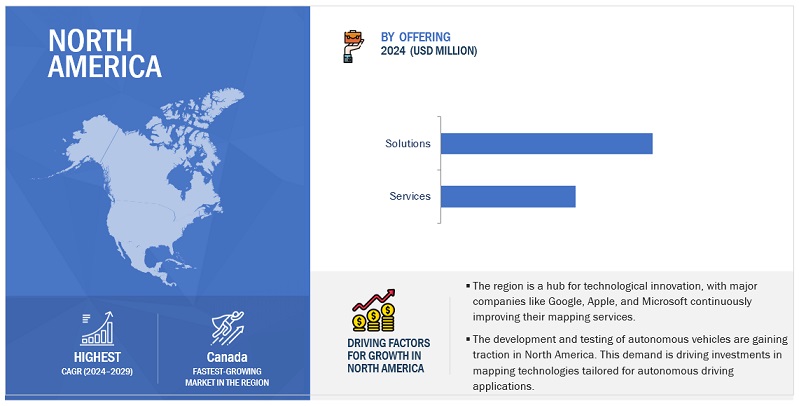

As per region, North America will witness the largest market share during the forecast period.

The adoption of digital map solutions is expected to be the highest in North America compared to other regions. The high adoption rate of technology is changing the market environment and boosting the practice of digital maps in North America. Implementing digital map solutions by tech giants, such as Google, Apple, Esri, Microsoft, and Maxar Technologies, increases the growth of the digital map market in the region. The market is growing due to the many applications of technologies, such as indoor positioning, indoor security, indoor tracking, and more. The growth in the adoption of digital map solutions in various industries, such as automotive, energy and utilities, government and defense, and transportation, to achieve accuracy is adding to the growth in this region.

Governments at the federal, state, and municipal levels in North America invest in digital mapping infrastructure for urban planning, emergency response, environmental management, and public services. These initiatives create opportunities for mapping companies to collaborate with government agencies and provide specialized solutions. In the future, there will be a growing trend towards indoor mapping solutions for navigation within large venues like shopping malls, airports, and stadiums.

Key Market Players

The digital map market is dominated by a few globally established players such as Google (US), Apple (US), TomTom (Netherlands), NearMap (Australia), Esri (US), INRIX (US), HERE Technologies (Netherlands), LightBox (US), ServiceNow (US), Inpixon (US), Microsoft (US), Maxar Technologies (US), Emapa (Poland), Dabeeo (South Korea), Caliper (US), MapmyIndia (India), GeoVerra (Canada), among others, are the key vendors that secured digital map market contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have limited expertise. In the thriving digital map market, the IoT and cloud adoption boom is pivotal in reshaping traditional digital map practices. Companies leveraging cloud-based solutions, digital map capitalizes on several advantages.

Want to explore hidden markets that can drive new revenue in Digital Map Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Digital Map Market?

|

Report Metrics |

Details |

|

Market Size Available For Years |

2019–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Mapping Type, Purpose, Scale, Application, and Vertical |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Google (US), Apple (US), TomTom (Netherlands), NearMap (Australia), Esri (US), INRIX (US), HERE Technologies (Netherlands), LightBox (US), ServiceNow (US), Inpixon (US), Microsoft (US), Maxar Technologies (US), Emapa (Poland), Dabeeo (South Korea), Caliper (US), MapmyIndia (India), GeoVerra (Canada), Orbital Insight (US), DigiMap (US), MapQuest (US), IndoorAtlas (Finland), Mapsted (Canada), Mapidea (Portugal), Geocento (UK), Geospin (Germany), Jawg Maps (France), and Barikoi (Bangladesh) |

This research report categorizes the digital map market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

-

Solution

- Mapping Data

- Web Mapping

- GPS-enabled Services

- Geographic Information System (GIS) Services

-

Services

- Consulting

- Support & Maintenance

- Deployment & Integration

By Mapping Type:

- Outdoor Mapping

- Indoor Mapping

- 3D & 4D Metaverse

By Purpose:

- Navigation Maps

- Thematic Maps

- Satellite Imagery

- Real-Time Traffic Maps

By Scale:

- Large Scale Maps

- Small Scale Maps

By Application:

- Real-Time Location Data Management

- Geocoding and Geopositioning

- Routing and Navigation

- Asset Tracking

- Reverse Geocoding

- Other Applications

By Vertical:

- Government & Defense

- Infrastructure Development & Construction

- Travel, Transportation, & Logistics

- Automotive

- Retail

- Finance & Insurance

- Manufacturing

- Energy, Utility, & Natural Resources

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- With the latest upgrades, Google Maps offers an enriched user experience through AI-powered functionalities; this includes Lens in Maps for improved location comprehension, upgraded map visuals for enhanced navigation accuracy, and expanded electric vehicle charging information. Additionally, Immersive View for routes offers comprehensive previews, while advanced search delivers photo-centric results and themed recommendations. These advancements signify a new era in navigation, blending cutting-edge technology with user-centric design.

- Esri introduced Landsat Explorer, an online app offering easy access and analysis of Landsat multispectral imagery. It will provide decision-makers with intuitive tools to explore land changes over time, aiding in natural resource management and environmental monitoring.

- Here Technologies and Targa Telematics collaborated to integrate HERE Platform APIs, enhancing fleet management solutions. This partnership aimed to provide real-time insights, optimize operations, and promote sustainable mobility practices, empowering fleet managers with valuable tools for informed decision-making and improved driver safety.

- Nearmap acquired Betterview, a top property intelligence and risk management platform in the insurance industry. This strategic move aimed to bolster Nearmap's offerings for insurance customers by integrating Betterview's AI solutions into its technology stack, enhancing visualization capabilities, and improving underwriting processes.

Frequently Asked Questions (FAQ):

What is a Digital Map?

A digital map is a computerized representation of geographic information, typically displayed on a screen or other digital device. It visually depicts geographic features such as roads, landmarks, bodies of water, and terrain, as well as various spatial data layers such as population density, land use, and environmental conditions. Digital maps can be interactive, allowing users to zoom in, zoom out, pan, and customize the displayed information according to their needs.

Which country is the leader in North America for digital map solutions?

The US leads the digital map solutions market in North America.

Which are the key vendors exploring digital map solutions?

Some of the significant vendors offering digital map solutions across the globe include Google (US), Apple (US), TomTom (Netherlands), NearMap (Australia), Esri (US), INRIX (US), HERE Technologies (Netherlands), LightBox (US), ServiceNow (US), Inpixon (US), Microsoft (US), Maxar Technologies (US), Emapa (Poland), Dabeeo (South Korea), Caliper (US), MapmyIndia (India), GeoVerra (Canada), Orbital Insight (US), DigiMap (US), MapQuest (US), IndoorAtlas (Finland), Mapsted (Canada), Mapidea (Portugal), Geocento (UK), Geospin (Germany), Jawg Maps (France), and Barikoi (Bangladesh).

What is the total CAGR recorded for the digital map market during 2024-2029?

The digital map market will record a CAGR of 11.1% from 2024-2029.

What is the projected market value of the digital map market?

The digital map market will grow from USD 28.3 billion in 2024 to USD 47.8 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 11.1% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in smartphone and internet usage driving demand for digital maps- Growth in usage of 3D platforms reshaping map visualization and accuracy- GIS leverages AI & ML integration, enabling personalized services and complex spatial analysis tasks- High emphasis on real-time guidance, route options, and nearby amenities via advanced navigation systems- Growing demand for Location-based Services (LBS)RESTRAINTS- Risk of unauthorized access and data breaches- Regulations and legal issuesOPPORTUNITIES- Geospatial data analytics driving optimized resource allocation and sustainable development- Increase in focus on SDKs and APIs, empowering indoor mapping solutions- Integration of IoT and smart cities, allowing informed decision-making, predictive maintenance, and real-time monitoring- Increase in implementation of 5G networksCHALLENGES- High initial investment and maintenance costs- Limited infrastructure and internet access in underdeveloped countries- Technical difficulties with reliability and quality of data

-

5.3 CASE STUDY ANALYSISGOOGLE MAP HELPED ABAX TO DECREASE FLEET FUEL CONSUMPTIONOHIO USED ESRI’S GIS TO BRIDGE STATE’S DIGITAL DIVIDEALTO ENDEAVORED TO IMPROVE OVERALL EFFICIENCY AND REDUCE OPERATIONAL EXPENSES THROUGH GOOGLE MAPSTB INT GOT FASTER AND MORE EFFICIENT ECOMMERCE WAREHOUSE PROCESSES THROUGH INTRANAVPHONEPE ENHANCED USER EXPERIENCES WITH MAPPLS MAPS SDK FOR SEAMLESS NEARBY MERCHANT DISCOVERYAIRSPACE GENERATED PROTOTYPES OF DATA ANALYTICS AND METRICS THROUGH ARCGIS INSIGHTS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM MAPPING

-

5.6 TECHNOLOGICAL ANALYSISKEY TECHNOLOGIES- GIS- Global Positioning System (GPS)- Remote Sensing- Cartographic Design- Spatial AnalysisCOMPLEMENTARY TECHNOLOGIES- Internet of Things (IoT)- Artificial Intelligence (AI)- Augmented Reality (AR)ADJACENT TECHNOLOGIES- Autonomous Vehicles- Smart Cities

- 5.7 PRICING ANALYSIS

-

5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSKEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY REGION

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 BUSINESS MODEL ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 INVESTMENT AND FUNDING SCENARIO

-

5.16 DIGITAL MAP MARKET, BASED ON CONTENTGENERAL REFERENCE MAPS- Political Maps- Physical Maps- Road Maps- Hybrid MapsSPECIALIZED MAPS- Soil Maps- Geological Hazard Maps- Vegetation Maps- Water Resource Maps

-

5.17 DIGITAL MAP MARKET, BASED ON MAP SCALEMACRO-SCALE MAPSMICRO-SCALE MAPS

-

6.1 INTRODUCTIONOFFERING: DIGITAL MAP MARKET DRIVERS

-

6.2 SOLUTIONSMAPPING DATA- Base Map Data- Routing and Navigation Data- Historical Data Archives- 3D Mapping DataWEB MAPPING- Tile Maps- Interactive Maps- Customizable Maps- Real-time Data MapsGPS-ENABLED SERVICES- Location-based Services (LBS)- Navigation Services- Geofencing- Fitness and Activity TrackingGEOGRAPHIC INFORMATION SYSTEM (GIS) SERVICES- Vector Maps- Raster Maps- 3D Maps- Spatial Analysis Maps

-

6.3 SERVICESCONSULTINGSUPPORT & MAINTENANCEDEPLOYMENT & INTEGRATION

-

7.1 INTRODUCTIONMAPPING TYPE: DIGITAL MAP MARKET DRIVERS

-

7.2 OUTDOOR MAPPINGTOPOGRAPHIC MAPPINGROAD MAPPINGSATELLITE MAPPINGARIAL PHOTOGRAPHYOTHER OUTDOOR MAPPING

-

7.3 INDOOR MAPPINGINDOOR NAVIGATION AND WAYFINDINGINDOOR POSITIONING SYSTEM (IPS)INDOOR MAPPING APPLICATIONSINDOOR ASSET TRACKINGOTHER INDOOR MAPPING

-

7.4 3D AND 4D METAVERSE3D METAVERSE4D METAVERSE

-

8.1 INTRODUCTIONPURPOSE: DIGITAL MAP MARKET DRIVERS

-

8.2 NAVIGATION MAPSTURN-BY-TURN NAVIGATION MAPSREAL-TIME TRAFFIC NAVIGATION MAPSPEDESTRIAN NAVIGATION MAPSPUBLIC TRANSPORT MAPS

-

8.3 THEMATIC MAPSDEMOGRAPHIC MAPSENVIRONMENTAL MAPSECONOMIC MAPSHEALTH MAPS

-

8.4 SATELLITE MAPSAERIAL IMAGERYREMOTE SENSING IMAGERYMULTISPECTRAL IMAGERYRADAR IMAGERY

-

8.5 REAL-TIME TRAFFIC MAPSCONGESTION HEAT MAPSINCIDENT MAPSPREDICTIVE TRAFFIC MAPSALTERNATIVE ROUTE MAPS

- 8.6 OTHER PURPOSES

-

9.1 INTRODUCTIONSCALE: DIGITAL MAP MARKET DRIVERS

-

9.2 LARGE-SCALE MAPSCITY MAPSCAMPUS MAPSFACILITY MAPSSITE PLANS

-

9.3 SMALL-SCALE MAPSWORLD MAPSREGIONAL MAPSCONTINENTAL MAPSHEMISPHERIC PLANS

-

10.1 INTRODUCTIONAPPLICATION: DIGITAL MAP MARKET DRIVERS

- 10.2 REAL-TIME LOCATION DATA MANAGEMENT

- 10.3 GEOCODING AND GEOPOSITIONING

- 10.4 ROUTING AND NAVIGATION

- 10.5 ASSET TRACKING

- 10.6 REVERSE GEOCODING

- 10.7 OTHER APPLICATIONS

-

11.1 INTRODUCTIONVERTICAL: DIGITAL MAP MARKET DRIVERS

-

11.2 GOVERNMENT & DEFENSEGOVERNMENT & DEFENSE: APPLICATION AREAS- Urban Planning & Development- Emergency Management & Disaster Preparedness- Border Security & Defense- Law Enforcement & Crime Mapping- Other Government & Defense Applications

-

11.3 INFRASTRUCTURE DEVELOPMENT & CONSTRUCTIONINFRASTRUCTURE DEVELOPMENT & CONSTRUCTION: APPLICATION AREAS- Site Planning & Layout Optimization- Construction Progress Monitoring and Reporting- BIM (Building Information Modeling) Integration- Infrastructure Development Planning- Other Infrastructure Development & Construction Applications

-

11.4 TRAVEL, TRANSPORTATION, AND LOGISTICSTRAVEL, TRANSPORTATION, AND LOGISTICS: APPLICATION AREAS- Route Optimization- Warehouse & Inventory Management- Freight Transportation & Vehicle Tracking- Supply Chain Visibility & Monitoring- Other Travel, Transportation, and Logistics Applications

-

11.5 AUTOMOTIVEAUTOMOTIVE: APPLICATION AREAS- Advanced Driver Assistance Systems (ADAS)- Autonomous Vehicle Navigation & Localization- Vehicle Tracking & Fleet Management- Other Automotive Applications

-

11.6 RETAIL & E-COMMERCERETAIL & E-COMMERCE: APPLICATION AREAS- Store Location Analysis & Site Selection- Location-based Advertising & Promotions- Omnichannel Retail Strategy Optimization- Other Retail & E-commerce Applications

-

11.7 FINANCE & INSURANCEFINANCE & INSURANCE: APPLICATION AREAS- Risk Assessment & Underwriting for Property Insurance- Insurance Claims Processing & Fraud Detection- Branch Network Optimization- Other Finance & Insurance Applications

-

11.8 MANUFACTURINGMANUFACTURING: APPLICATION AREAS- Facility Layout Planning- Asset Tracking- Supply Chain Optimization- Other Manufacturing Applications

-

11.9 ENERGY, UTILITY, AND NATURAL RESOURCESENERGY, UTILITY, AND NATURAL RESOURCES: APPLICATION AREAS- Network Planning & Design- Resource Management- Renewable Energy Planning- Other Energy, Utility, and Natural Resources Applications

- 11.10 OTHER VERTICALS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: DIGITAL MAP MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Increasing adoption of LBS demand and presence of major vendors to drive marketCANADA- Advancements in map-making technologies and surveying techniques and increasing adoption across industries to spur market growth

-

12.3 EUROPEEUROPE: DIGITAL MAP MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Rise in investments by firms, governments, and defense and awareness about science to keep track of data in real-time to propel marketFRANCE- Government's focus on accurate geospatial data and navigation solutions and initiatives to promote sustainable transportation to accelerate marketGERMANY- Growing demand for digital maps for self-driving cars in automobile industry to foster market growthITALY- Technological advancements, adoption of newer technologies, and evolving customer intelligence landscapes to boost market growthREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: DIGITAL MAP MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Increasing use of smartphones and internet and advancements in connected and semi-autonomous vehicles to drive marketJAPAN- Need to enhance effectiveness of administrative work planning and formulation of government policies using digital maps and geospatial information to propel marketINDIA- Expanding digital economy, smartphone adoption, and government initiatives such as Digital India and Smart Cities Mission to fuel market growthREST OF ASIA PACIFIC

-

12.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DIGITAL MAP MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTGCC COUNTRIES- Surge in demand for seamless digital experiences, personalized services, and efficient government-citizen interactions to drive market- UAE- Saudi Arabia- Rest of GCC CountriesSOUTH AFRICA- Growing demand for location-based services in everyday life and reliability on digital maps for accurate information delivery to propel marketREST OF MIDDLE EAST & AFRICA

-

12.6 LATIN AMERICALATIN AMERICA: DIGITAL MAP MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing adoption of geospatial information, rising use of portable computers for navigation, and growing focus on digital technologies to spur market growthMEXICO- Widespread adoption of intelligent PDAs, increasing use of IoT devices, and expanding influence of social networking platforms to foster market growthREST OF LATIN AMERICA

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 BRAND/PRODUCT COMPARISON

-

13.6 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023

-

13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

-

13.9 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

-

14.1 KEY PLAYERSGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAPPLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOMTOM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewESRI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHERE TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEARMAP- Business overview- Products/Solutions/Services offered- Recent developmentsINRIX- Business overview- Products/Solutions/Services offered- Recent developmentsLIGHTBOX- Business overview- Products/Solutions/Services offered- Recent developmentsSERVICENOW- Business overview- Products/Solutions/Services offered- Recent developmentsINPIXON- Business overview- Products/Solutions/Services offered- Recent developmentsMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developmentsMAXAR TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSEMAPADABEEOCALIPER CORPORATIONMAPMYINDIAGEOVERRAORBITAL INSIGHTDIGIMAPMAPQUESTINDOORATLASMAPSTEDMAPIDEAGEOCENTOGEOSPINJAWG MAPSBARIKOI

- 15.1 INTRODUCTION

-

15.2 DIGITAL MAP MARKET ECOSYSTEM AND ADJACENT MARKETS

- 15.3 LIMITATIONS

-

15.4 GEOSPATIAL IMAGERY ANALYTICS MARKETGEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPEGEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUMGEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION

-

15.5 GEOGRAPHIC INFORMATION SYSTEM MARKETGEOGRAPHIC INFORMATION SYSTEM MARKET, BY OFFERINGGEOGRAPHIC INFORMATION SYSTEM MARKET, BY FUNCTIONGEOGRAPHIC INFORMATION SYSTEM MARKET, BY INDUSTRY

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DIGITAL MAP MARKET SIZE AND GROWTH, 2019–2023 (USD MILLION, Y-O-Y %)

- TABLE 4 DIGITAL MAP MARKET SIZE AND GROWTH, 2024–2029 (USD MILLION, Y-O-Y %)

- TABLE 5 INDICATIVE PRICING ANALYSIS OF DIGITAL MAP VENDORS, BY OFFERING

- TABLE 6 TOP 10 PATENT APPLICANTS (US)

- TABLE 7 PORTER’S FIVE FORCES IMPACT ON DIGITAL MAP MARKET

- TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 15 DIGITAL MAP MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 17 DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 18 DIGITAL MAP MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

- TABLE 19 DIGITAL MAP MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 20 DIGITAL MAP SOLUTIONS MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 21 DIGITAL MAP SOLUTIONS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 22 MAPPING DATA: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 23 MAPPING DATA: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 24 WEB MAPPING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 25 WEB MAPPING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 26 GPS-ENABLED SERVICES: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 27 GPS-ENABLED SERVICES: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 28 GIS SERVICES: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 29 GIS SERVICES: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 30 DIGITAL MAP MARKET, BY SERVICE, 2019–2023 (USD MILLION)

- TABLE 31 DIGITAL MAP MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 32 DIGITAL MAP SERVICES MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 33 DIGITAL MAP SERVICES MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 34 CONSULTING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 35 CONSULTING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 36 SUPPORT & MAINTENANCE: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 37 SUPPORT & MAINTENANCE: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 38 DEPLOYMENT & INTEGRATION: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 39 DEPLOYMENT & INTEGRATION: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 40 DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 41 DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 42 OUTDOOR MAPPING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 43 OUTDOOR MAPPING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 44 INDOOR MAPPING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 45 INDOOR MAPPING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 46 3D AND 4D METAVERSE: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 47 3D AND 4D METAVERSE: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 48 DIGITAL MAP MARKET, BY PURPOSE, 2019–2023 (USD MILLION)

- TABLE 49 DIGITAL MAP MARKET, BY PURPOSE, 2024–2029 (USD MILLION)

- TABLE 50 NAVIGATION MAPS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 51 NAVIGATION MAPS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 52 THEMATIC MAPS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 53 THEMATIC MAPS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 54 SATELLITE MAPS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 55 SATELLITE MAPS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 REAL-TIME TRAFFIC MAPS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 57 REAL-TIME TRAFFIC MAPS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 58 OTHER PURPOSES: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 59 OTHER PURPOSES: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 60 DIGITAL MAP MARKET, BY SCALE, 2019–2023 (USD MILLION)

- TABLE 61 DIGITAL MAP MARKET, BY SCALE, 2024–2029 (USD MILLION)

- TABLE 62 LARGE-SCALE MAPS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 63 LARGE-SCALE MAPS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 64 SMALL-SCALE MAPS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 65 SMALL-SCALE MAPS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 66 DIGITAL MAP MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 67 DIGITAL MAP MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 68 REAL-TIME LOCATION DATA MANAGEMENT: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 69 REAL-TIME LOCATION DATA MANAGEMENT: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 70 GEOCODING AND GEOPOSITIONING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 71 GEOCODING AND GEOPOSITIONING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 72 ROUTING AND NAVIGATION: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 73 ROUTING AND NAVIGATION: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 ASSET TRACKING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 75 ASSET TRACKING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 76 REVERSE GEOCODING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 77 REVERSE GEOCODING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 80 DIGITAL MAP MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

- TABLE 81 DIGITAL MAP MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 82 GOVERNMENT & DEFENSE: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 83 GOVERNMENT & DEFENSE: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 84 INFRASTRUCTURE DEVELOPMENT & CONSTRUCTION: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 85 INFRASTRUCTURE DEVELOPMENT & CONSTRUCTION: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 86 TRAVEL, TRANSPORTATION, AND LOGISTICS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 87 TRAVEL, TRANSPORTATION, AND LOGISTICS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 88 AUTOMOTIVE: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 89 AUTOMOTIVE: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 90 RETAIL & E-COMMERCE: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 91 RETAIL & E-COMMERCE: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 92 FINANCE & INSURANCE: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 93 FINANCE & INSURANCE: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 94 MANUFACTURING: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 95 MANUFACTURING: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 96 ENERGY, UTILITY, AND NATURAL RESOURCES: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 97 ENERGY, UTILITY, AND NATURAL RESOURCES: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 98 OTHER VERTICALS: DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 99 OTHER VERTICALS: DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 100 DIGITAL MAP MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 101 DIGITAL MAP MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 103 NORTH AMERICA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: DIGITAL MAP MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

- TABLE 105 NORTH AMERICA: DIGITAL MAP MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: DIGITAL MAP MARKET, BY SERVICE, 2019–2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: DIGITAL MAP MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 109 NORTH AMERICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: DIGITAL MAP MARKET, BY PURPOSE, 2019–2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: DIGITAL MAP MARKET, BY PURPOSE, 2024–2029 (USD MILLION)

- TABLE 112 NORTH AMERICA: DIGITAL MAP MARKET, BY SCALE, 2019–2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: DIGITAL MAP MARKET, BY SCALE, 2024–2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: DIGITAL MAP MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 115 NORTH AMERICA: DIGITAL MAP MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 116 NORTH AMERICA: DIGITAL MAP MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

- TABLE 117 NORTH AMERICA: DIGITAL MAP MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 118 NORTH AMERICA: DIGITAL MAP MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 119 NORTH AMERICA: DIGITAL MAP MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 120 US: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 121 US: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 122 US: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 123 US: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 124 CANADA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 125 CANADA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 126 CANADA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 127 CANADA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 128 EUROPE: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 129 EUROPE: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 130 EUROPE: DIGITAL MAP MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

- TABLE 131 EUROPE: DIGITAL MAP MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 132 EUROPE: DIGITAL MAP MARKET, BY SERVICE, 2019–2023 (USD MILLION)

- TABLE 133 EUROPE: DIGITAL MAP MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 134 EUROPE: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 135 EUROPE: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 136 EUROPE: DIGITAL MAP MARKET, BY PURPOSE, 2019–2023 (USD MILLION)

- TABLE 137 EUROPE: DIGITAL MAP MARKET, BY PURPOSE, 2024–2029 (USD MILLION)

- TABLE 138 EUROPE: DIGITAL MAP MARKET, BY SCALE, 2019–2023 (USD MILLION)

- TABLE 139 EUROPE: DIGITAL MAP MARKET, BY SCALE, 2024–2029 (USD MILLION)

- TABLE 140 EUROPE: DIGITAL MAP MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 141 EUROPE: DIGITAL MAP MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 142 EUROPE: DIGITAL MAP MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

- TABLE 143 EUROPE: DIGITAL MAP MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 144 EUROPE: DIGITAL MAP MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 145 EUROPE: DIGITAL MAP MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 146 UK: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 147 UK: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 148 UK: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 149 UK: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 150 FRANCE: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 151 FRANCE: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 152 FRANCE: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 153 FRANCE: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 154 GERMANY: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 155 GERMANY: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 156 GERMANY: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 157 GERMANY: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 158 ITALY: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 159 ITALY: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 160 ITALY: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 161 ITALY: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 162 REST OF EUROPE: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 163 REST OF EUROPE: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 164 REST OF EUROPE: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 165 REST OF EUROPE: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 166 ASIA PACIFIC: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 167 ASIA PACIFIC: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 168 ASIA PACIFIC: DIGITAL MAP MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

- TABLE 169 ASIA PACIFIC: DIGITAL MAP MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: DIGITAL MAP MARKET, BY SERVICE, 2019–2023 (USD MILLION)

- TABLE 171 ASIA PACIFIC: DIGITAL MAP MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 172 ASIA PACIFIC: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 173 ASIA PACIFIC: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 174 ASIA PACIFIC: DIGITAL MAP MARKET, BY PURPOSE, 2019–2023 (USD MILLION)

- TABLE 175 ASIA PACIFIC: DIGITAL MAP MARKET, BY PURPOSE, 2024–2029 (USD MILLION)

- TABLE 176 ASIA PACIFIC: DIGITAL MAP MARKET, BY SCALE, 2019–2023 (USD MILLION)

- TABLE 177 ASIA PACIFIC: DIGITAL MAP MARKET, BY SCALE, 2024–2029 (USD MILLION)

- TABLE 178 ASIA PACIFIC: DIGITAL MAP MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 179 ASIA PACIFIC: DIGITAL MAP MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 180 ASIA PACIFIC: DIGITAL MAP MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

- TABLE 181 ASIA PACIFIC: DIGITAL MAP MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 182 ASIA PACIFIC: DIGITAL MAP MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 183 ASIA PACIFIC: DIGITAL MAP MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 184 CHINA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 185 CHINA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 186 CHINA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 187 CHINA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 188 JAPAN: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 189 JAPAN: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 190 JAPAN: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 191 JAPAN: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 192 INDIA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 193 INDIA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 194 INDIA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 195 INDIA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY SERVICE, 2019–2023 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY PURPOSE, 2019–2023 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY PURPOSE, 2024–2029 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY SCALE, 2019–2023 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY SCALE, 2024–2029 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY COUNTRY/REGION, 2019–2023 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY COUNTRY/REGION, 2024–2029 (USD MILLION)

- TABLE 218 GCC COUNTRIES: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 219 GCC COUNTRIES: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 220 GCC COUNTRIES: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 221 GCC COUNTRIES: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 222 SOUTH AFRICA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 223 SOUTH AFRICA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 224 SOUTH AFRICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 225 SOUTH AFRICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 230 LATIN AMERICA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 231 LATIN AMERICA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 232 LATIN AMERICA: DIGITAL MAP MARKET, BY SOLUTION, 2019–2023 (USD MILLION)

- TABLE 233 LATIN AMERICA: DIGITAL MAP MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

- TABLE 234 LATIN AMERICA: DIGITAL MAP MARKET, BY SERVICE, 2019–2023 (USD MILLION)

- TABLE 235 LATIN AMERICA: DIGITAL MAP MARKET, BY SERVICE, 2024–2029 (USD MILLION)

- TABLE 236 LATIN AMERICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 237 LATIN AMERICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 238 LATIN AMERICA: DIGITAL MAP MARKET, BY PURPOSE, 2019–2023 (USD MILLION)

- TABLE 239 LATIN AMERICA: DIGITAL MAP MARKET, BY PURPOSE, 2024–2029 (USD MILLION)

- TABLE 240 LATIN AMERICA: DIGITAL MAP MARKET, BY SCALE, 2019–2023 (USD MILLION)

- TABLE 241 LATIN AMERICA: DIGITAL MAP MARKET, BY SCALE, 2024–2029 (USD MILLION)

- TABLE 242 LATIN AMERICA: DIGITAL MAP MARKET, BY APPLICATION, 2019–2023 (USD MILLION)

- TABLE 243 LATIN AMERICA: DIGITAL MAP MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 244 LATIN AMERICA: DIGITAL MAP MARKET, BY VERTICAL, 2019–2023 (USD MILLION)

- TABLE 245 LATIN AMERICA: DIGITAL MAP MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 246 LATIN AMERICA: DIGITAL MAP MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 247 LATIN AMERICA: DIGITAL MAP MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 248 BRAZIL: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 249 BRAZIL: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 250 BRAZIL: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 251 BRAZIL: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 252 MEXICO: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 253 MEXICO: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 254 MEXICO: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 255 MEXICO: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 256 REST OF LATIN AMERICA: DIGITAL MAP MARKET, BY OFFERING, 2019–2023 (USD MILLION)

- TABLE 257 REST OF LATIN AMERICA: DIGITAL MAP MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 258 REST OF LATIN AMERICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2019–2023 (USD MILLION)

- TABLE 259 REST OF LATIN AMERICA: DIGITAL MAP MARKET, BY MAPPING TYPE, 2024–2029 (USD MILLION)

- TABLE 260 OVERVIEW OF STRATEGIES ADOPTED BY KEY DIGITAL MAP MARKET VENDORS

- TABLE 261 DIGITAL MAP MARKET: DEGREE OF COMPETITION

- TABLE 262 DIGITAL MAP MARKET: REGION FOOTPRINT

- TABLE 263 DIGITAL MAP MARKET: OFFERING FOOTPRINT

- TABLE 264 DIGITAL MAP MARKET: APPLICATION FOOTPRINT

- TABLE 265 DIGITAL MAP MARKET: VERTICAL FOOTPRINT

- TABLE 266 DIGITAL MAP MARKET: KEY STARTUPS/SMES

- TABLE 267 DIGITAL MAP MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 268 DIGITAL MAP MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JULY 2020–OCTOBER 2023

- TABLE 269 DIGITAL MAP MARKET: DEALS, FEBRUARY 2021–MARCH 2024

- TABLE 270 GOOGLE: COMPANY OVERVIEW

- TABLE 271 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 273 GOOGLE: DEALS

- TABLE 274 APPLE: COMPANY OVERVIEW

- TABLE 275 APPLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 APPLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 277 APPLE: DEALS

- TABLE 278 TOMTOM: COMPANY OVERVIEW

- TABLE 279 TOMTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 TOMTOM: DEALS

- TABLE 281 ESRI: COMPANY OVERVIEW

- TABLE 282 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ESRI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 284 ESRI: DEALS

- TABLE 285 HERE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 286 HERE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 HERE TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 288 HERE TECHNOLOGIES: DEALS

- TABLE 289 NEARMAP: COMPANY OVERVIEW

- TABLE 290 NEARMAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 NEARMAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 292 NEARMAP: DEALS

- TABLE 293 INRIX: COMPANY OVERVIEW

- TABLE 294 INRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 INRIX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 296 INRIX: DEALS

- TABLE 297 LIGHTBOX: COMPANY OVERVIEW

- TABLE 298 LIGHTBOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 LIGHTBOX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 300 LIGHTBOX: DEALS

- TABLE 301 SERVICENOW: COMPANY OVERVIEW

- TABLE 302 SERVICENOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 SERVICENOW: DEALS

- TABLE 304 INPIXON: COMPANY OVERVIEW

- TABLE 305 INPIXON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 INPIXON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 307 INPIXON: DEALS

- TABLE 308 MICROSOFT: COMPANY OVERVIEW

- TABLE 309 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 MICROSOFT: DEALS

- TABLE 311 MAXAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 312 MAXAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 MAXAR TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 314 MAXAR TECHNOLOGIES: DEALS

- TABLE 315 ADJACENT MARKETS AND FORECASTS

- TABLE 316 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 317 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 318 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2016–2020 (USD MILLION)

- TABLE 319 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2021–2026 (USD MILLION)

- TABLE 320 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 321 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 322 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY OFFERING, 2018–2025 (USD MILLION)

- TABLE 323 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY FUNCTION, 2018–2025 (USD BILLION)

- TABLE 324 GEOGRAPHIC INFORMATION SYSTEM MARKET, BY INDUSTRY, 2018–2025 (USD BILLION)

- FIGURE 1 DIGITAL MAP MARKET SEGMENTATION

- FIGURE 2 DIGITAL MAP MARKET SEGMENTATION, BY REGION

- FIGURE 3 YEARS CONSIDERED

- FIGURE 4 DIGITAL MAP MARKET: RESEARCH DESIGN

- FIGURE 5 PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 7 DIGITAL MAP MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 10 DIGITAL MAP MARKET: RESEARCH FLOW

- FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 12 BOTTOM-UP APPROACH FROM SUPPLY SIDE: REVENUE FROM SOLUTIONS AND SERVICES

- FIGURE 13 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 14 DEMAND-SIDE APPROACH: DIGITAL MAP MARKET

- FIGURE 15 DIGITAL MAP MARKET: DATA TRIANGULATION

- FIGURE 16 GLOBAL DIGITAL MAP MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 17 FASTEST-GROWING SEGMENTS IN DIGITAL MAP MARKET, 2024–2029

- FIGURE 18 DIGITAL MAP MARKET: REGIONAL SNAPSHOT

- FIGURE 19 SHIFT TOWARD GPS-ENABLED SOLUTIONS, CONNECTED VEHICLES, AND NAVIGATION APPS TO DRIVE MARKET GROWTH

- FIGURE 20 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 MAPPING DATA SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 CONSULTING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 OUTDOOR MAPPING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 24 NAVIGATION MAPS TO ACCOUNT FOR LARGEST ADOPTION IN DIGITAL MAP MARKET DURING FORECAST PERIOD

- FIGURE 25 LARGE-SCALE MAPS TO ACCOUNT FOR LARGER ADOPTION IN DIGITAL MAP MARKET DURING FORECAST PERIOD

- FIGURE 26 ROUTING AND NAVIGATION TO ACCOUNT FOR LARGEST SHARE OF DIGITAL MAP MARKET DURING FORECAST PERIOD

- FIGURE 27 TRAVEL, TRANSPORTATION, AND LOGISTICS VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 28 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL MAP MARKET

- FIGURE 30 DIGITAL MAP MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 DIGITAL MAP MARKET: ECOSYSTEM

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, 2013-2023

- FIGURE 33 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 34 DIGITAL MAP MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 35 DIGITAL MAP MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 38 DIGITAL MAP MARKET: BUSINESS MODEL

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO OF MAJOR DIGITAL MAP COMPANIES

- FIGURE 40 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 41 MAPPING DATA SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 42 SUPPORT & MAINTENANCE SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 51 REVENUE ANALYSIS OF KEY DIGITAL MAP MARKET PLAYERS

- FIGURE 52 MARKET SHARE ANALYSIS, 2023

- FIGURE 53 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- FIGURE 54 DIGITAL MAP MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 55 DIGITAL MAP MARKET: COMPANY FOOTPRINT

- FIGURE 56 DIGITAL MAP MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 58 GOOGLE: COMPANY SNAPSHOT

- FIGURE 59 APPLE: COMPANY SNAPSHOT

- FIGURE 60 TOMTOM: COMPANY SNAPSHOT

- FIGURE 61 SERVICENOW: COMPANY SNAPSHOT

- FIGURE 62 MICROSOFT: COMPANY SNAPSHOT

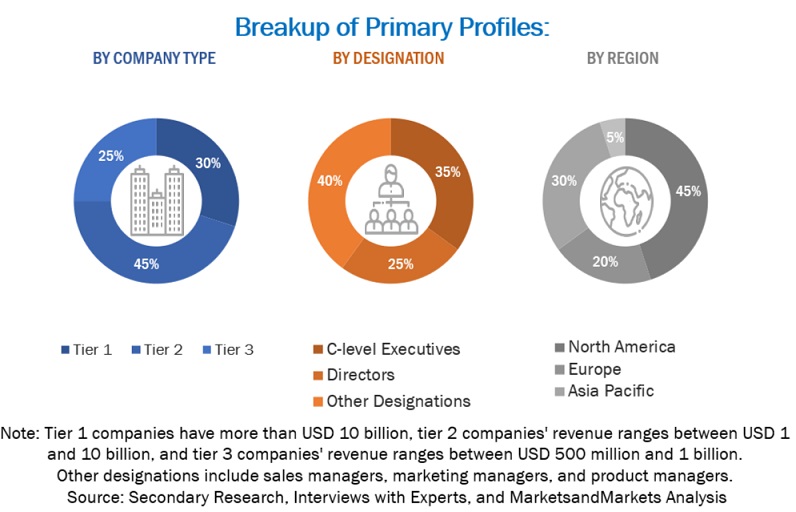

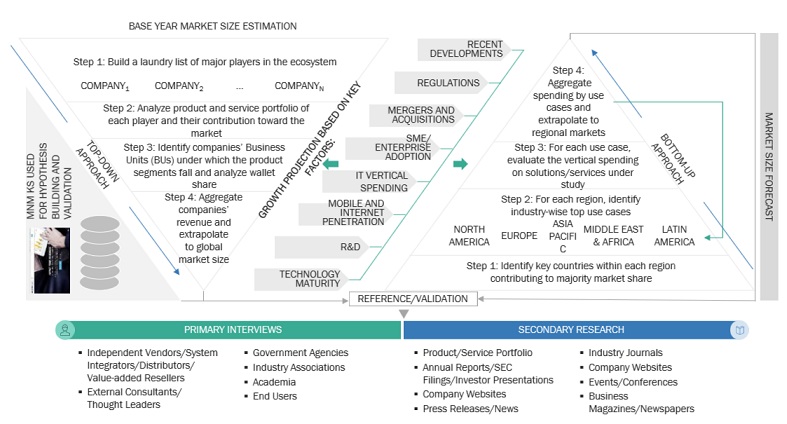

This research study used extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information for the technical, market-oriented, and commercial study of the digital map market. The primary sources are mainly several industry experts from core and related industries and suppliers, manufacturers, distributors, service providers, technology developers, technologists from companies, and organizations related to all segments of this industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future prospects. The following figure shows the research methodology applied in making this report on the digital map market.

The market has been predicted by analyzing the driving factors, such as the emergence of IoT, cloud computing, the growing need for cost-effective businesses, business agility, and faster time to market.

Secondary Research

The market for the companies offering digital map solutions and services was arrived at based on the secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

We used secondary research to obtain critical information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, we interviewed various primary sources from both the supply and demand sides to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related executives from digital map vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technology, offerings, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using digital maps, and digital initiatives project teams were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall digital map market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the digital map and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the digital map market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This entire procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Digital Map Market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the demand and supply sides in the digital map market.

Market Definition

Considering the views of various sources and associations, digital maps, also known as electronic maps or online maps, are graphical representations of geographical areas or spaces stored and viewed electronically on digital devices such as computers, smartphones, tablets, and GPS navigation systems. They visually represent spatial information, including streets, landmarks, topography, transportation networks, points of interest, and more.

Digital maps utilize various data sources and technologies, including satellite imagery, aerial photography, geographic information systems (GIS), and crowdsourced data, to create detailed and interactive representations of the physical world. Key players in the digital maps market include technology companies that develop mapping solutions and services, such as Google Maps, Apple Maps, HERE Technologies, and TomTom. These companies often use a combination of satellite imagery, aerial photography, GIS, and crowdsourced data to create and maintain their digital maps.

Key Stakeholders

- IT service providers

- Support infrastructure equipment providers

- Component providers

- Professional service providers

- Distributors and resellers

- Cloud providers

- Digital map vendors

- Telematics vendors

- Global Positioning System (GPS) vendors

- Cartography players

- Digital map solution providers

- Digital map service providers

- System integrators

- Consultancy and advisory firms

- Regulatory agencies

- Government entities

Report Objectives

- To define, describe, and forecast the digital map market based on offerings, solutions, services, mapping type, scale, purpose, application, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size concerning five central regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market for individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the digital map market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Map Market