5G Infrastructure Market by Communication Infrastructure (Small Cell & Macro Cell), Core Network (SDN & NFV), Network Architecture (Standalone & Non-standalone), Operational Frequency (Sub 6GHz & Above 6GHz), End User & Geography - Global Forecast to 2027

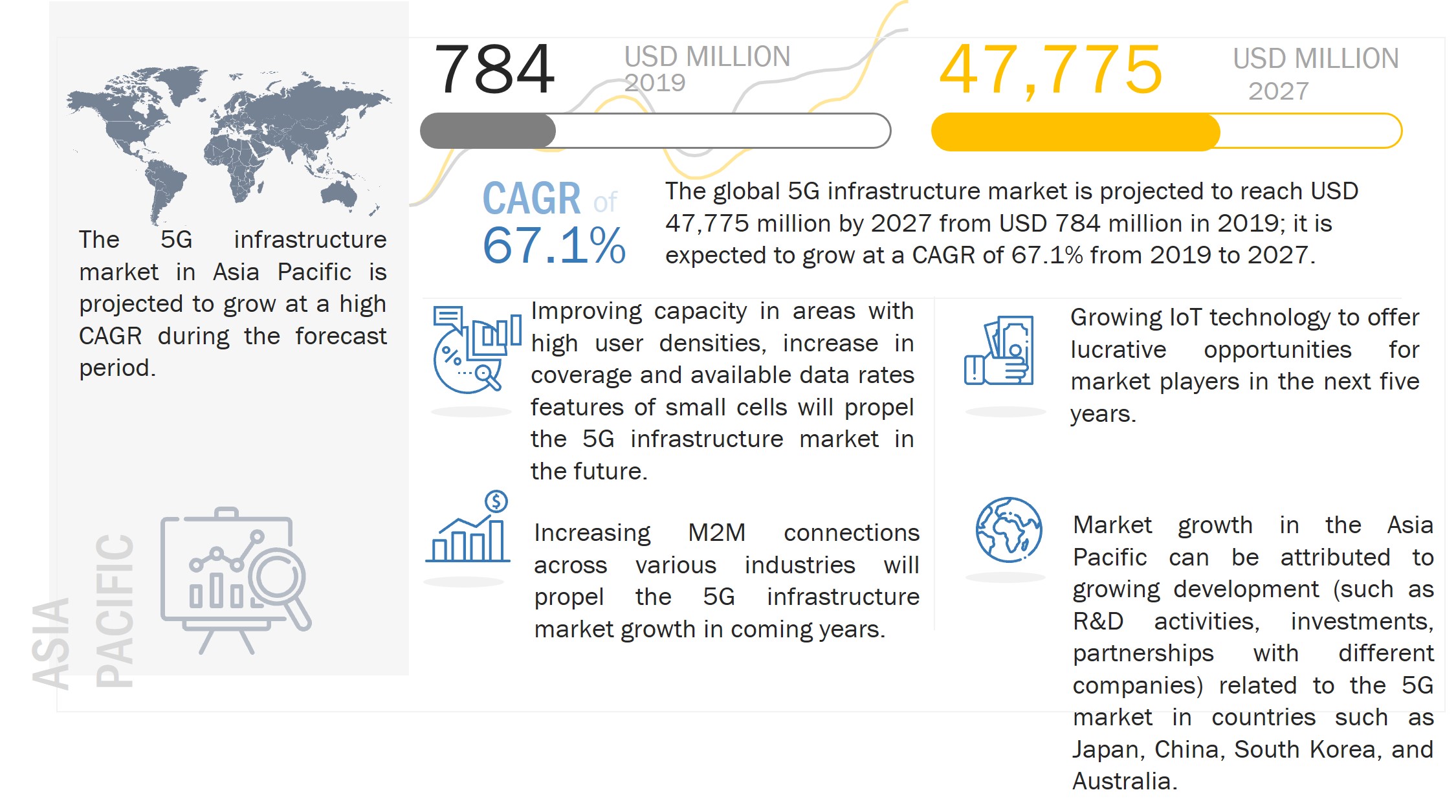

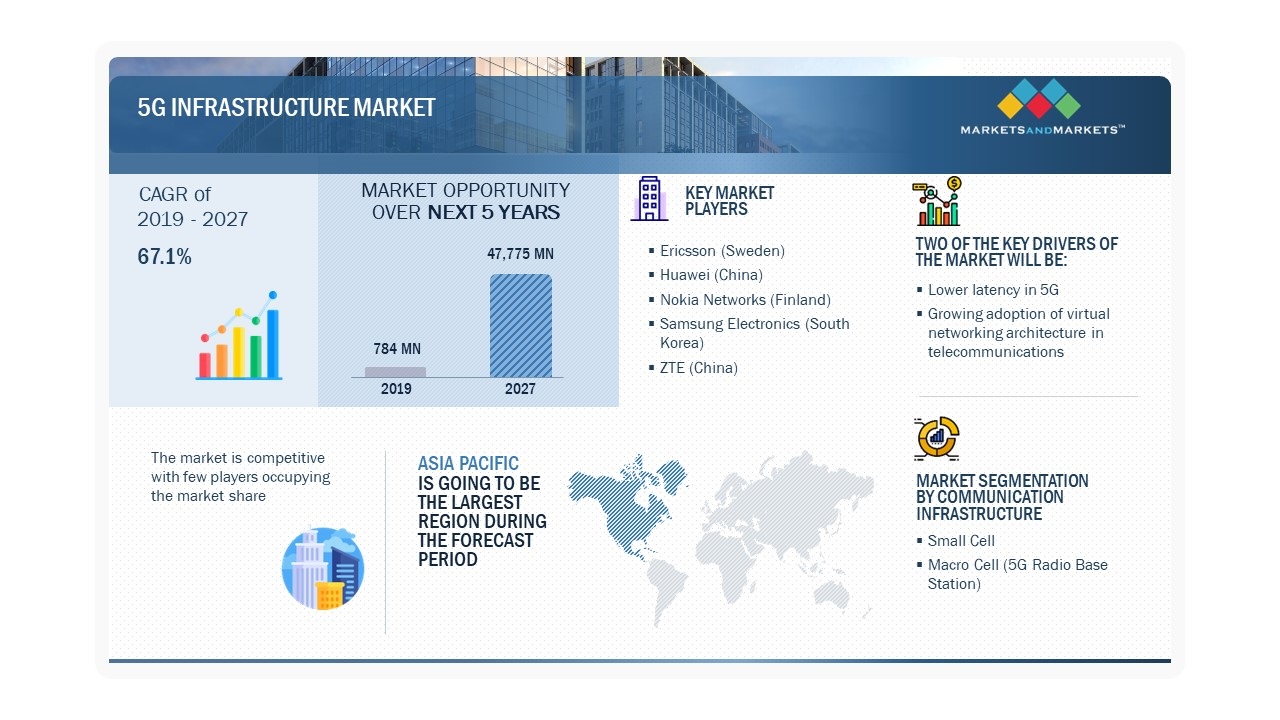

[206 Pages Report] The 5G Infrastructure Market is projected to reach USD 47.78 Billion by 2027, at a CAGR of 67.1% during the forecast period.

Fifth generation (5G) wireless system, or fifth generation mobile network, is an advanced telecommunication technology that enables high-speed data transfer and high system spectral efficiency (implies larger data volume) with relatively low battery consumption, as well as offers the provision of connecting several devices simultaneously. 5G is likely to be the key enabler for the Internet of Things (IoT) that would provide a platform to connect a large number of sensors, edge devices, and actuators across various end-use industries.

5G Infrastructure Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

The use of 5G infrastructure has been prevalent across consumers, commercial & enterprise, industrial, and government. 5G connectivity would be a key enabler for connected cars and autonomous vehicles as it can be used for vehicle-to-vehicle and vehicle-to-infrastructure communication. Several vendors are actively involved in offering 5G solutions for commercial users by launching commercial 5G networks and carrying out R&D activities to upgrade these commercial network solutions.

The 5G infrastructure network is witnessing high adoption from the commercial sector. Self-driving car is an upcoming idea with 5G wireless networks. High performance wireless network connectivity with low latency is preferred for autonomous driving. In the future, cars can communicate with intelligent traffic signs, surrounding objects, and other vehicles on the road. Every millisecond will be vital for self-driving vehicles as the decision has to be made in a split second to avoid collision and ensure passenger safety. Drones are gaining attention owing to multiple operations ranging from entertainment, video capturing, medical, and emergency access to smart delivery solutions, security and surveillance, and others. 5G network will enable high-speed wireless internet connectivity for drone operation in various applications.

In intelligent buildings and infrastructure systems, many devices and components (such as smart sensors, measuring meters, lighting systems, and alarm systems) are connected over a network to carry out specific tasks, such as smoke monitoring, temperature control, and HVAC system control. An operator needs a quick real-time response with low latency to operate these systems remotely. With the introduction of 5G network, an operator can efficiently control activities related to the smart building system. The 5G network features high response time, high-speed data transfer rate, and reliable connectivity, which, in turn, makes it well-suited for intelligent buildings and infrastructure applications. This is expected to fuel the growth of 5G infrastructure market in coming years.

5G Infrastucture Market Dynamics:

Driver: Growing adoption of virtual networking architecture in telecommunications

In the current scenario, networks are implemented with various hardware developed for dedicated application-specific purposes. Such customized hardware is incapable to scale up and are cost sensitive to manage and maintain. With technological advancements, the life cycle of such application-specific hardware is limited. In 5G infrastructure, it is necessary to design a network architecture that can offer flexibility and scale-up options as millions of devices are estimated to get connected to communicate with each other. Considering this, there is a high demand for agile and flexible networks that can easily be changed and designed in accordance with requirements. This can be achieved through software network technologies such as network functions virtualization (NFV) and software-defined networking (SDN). SDN and NFV allow network flexibility by partitioning network architectures into virtual elements. Further, 5G network slicing will allow network operators to deploy only those functions necessary to support a particular set of customers and specific market segments. Such software-driven network technologies would further drive the 5G infrastructure market in terms of the ease of deployment and efficient operation of 5G network.

Restraint: Delay in standardization of spectrum allocation

The use of higher frequencies is a major advantage in the development of 5G network. However, all high frequencies (radio spectrum) are already used for different applications, such as telecommunications services and government agencies. Accessing these high-frequency spectrums is crucial for the development of 5G infrastructure. As it is already allocated for different applications, there is a conflict in accessing these frequency bands. However, there is no clarity on the definite timeframe as to when wireless operators would be given access to these spectrums to implement 5G infrastructure. As of now, different regulations are being set by different government agencies across all regions. For instance, Ofcom (UK), UK’s communications regulator, has suggested allocating a 6 GHz frequency band for 5G infrastructure, while the FCC in the US has allocated frequencies from ~24 GHz. As of February 2022, Ofcom has proposed to add the upper 6 GHz band (6425-7070 MHz) to its Shared Access license framework for low-power, indoor use. The standardization of spectrum allocation across regions and countries is extremely important for the development of 5G infrastructure as it impacts the economies of scale, and it also gives clarity to equipment vendors to develop suitable products. Hence, delay in the standardization of spectrum allocation is among the restraining factors for the 5G infrastructure market.

Opportunity: Growth of IoT technology would offer new opportunities for 5G infrastructure

Wide adoption and continuous advancements in the Internet of Things (IoT) are among the factors transforming various industries by connecting several types of devices, appliances, systems, and services. IoT is among the use cases that 5G network would support; for instance, it enables the communication between a large number of sensors and connected devices. IoT application requirements can be categorized as high-power, low-latency applications (e.g., mobile video surveillance), low-power, and long-range IoT applications (e.g., smart cities and smart factories). To support these requirements of emerging IoT applications, categorized as massive machine-type communication and mission-critical applications, the 5G infrastructure market is expected to gain traction. Also, the need to provide uninterrupted Internet connectivity to the increasing number of devices, along with a reduction in power consumption, is driving the growth of the 5G infrastructure market.

Challenge: Deployment and coverage challenges

Regulations and local authority policies have slowed the deployment of small cells through excessive administrative and financial obligations on operators, thereby reducing investment. Lengthy permitting processes and procuring exercises are among the major constraints for deploying small cells. The time taken by local authorities to approve planning applications for small cell implementations can take months, resulting in delays. High fees charged by local authorities to utilize street furniture such as utility poles is another major challenge faced by companies toward 5G network deployment.

Even though 5G offers significantly high speed and bandwidth, it has a limited range that will require additional infrastructure. 5G antennas can handle more users and data but can beam out radio waves over shorter distances. This will lead to the installation of extra repeaters to spread waves for an extended range.

5G Infrastructure Market Segment Insights

Based on communication infrastructure, small cells to hold higher market share from 2019 to 2027

Based on communication infrastructure, the 5G infrastructure market has been segmented into small cells and macro cells. The small cells segment is expected to hold high market share over the forecast period. Currently, mobile and communication network operators are facing imminent challenges with regard to growth in the levels of data traffic and signaling on a communication network, rise in user expectations of service quality, need to support variety of data traffic (including data, audio, and video) with high speed and reliability, and improve capacity and coverage to target new revenue opportunities. To address these challenges, operators are developing and deploying small cells on a large scale at a faster pace. The small cell offers certain benefits, such as improving capacity in areas with high user densities, increase in coverage and available data rates, and enhance handset battery life by reduced power consumption. Hence, in 5G network infrastructure, small cells are among the critical components.

Based on core network technology, the network function virtualization (NFV) segment registered the larger share during forecast timeframe

Based on core network technology, the 5G infrastructure market has been classified into network function virtualization (NFV) and software-defined networking (SDN). Network function virtualization (NFV) is projected to hold the larger size of the 5G infrastructure market from 2019 to 2027. In 5G network, the NFV will play a significant role in providing network operators the flexibility to expand their network functionality and provide effective and efficient operation of the network. In 5G, NFV will enable network slicing and distributed cloud, which would supplement it to create flexible and programmable networks for future needs. 5G network operators desire for network infrastructure that is fast operating, accessible from anywhere, efficient in using resources, and able to scale up according to the requirement to meet the dynamic needs of the network services. All such needs can be effectively addressed with the help of NFV technology. Therefore, this segment will register high market share over the forecast timeframe.

Based on network architecture, the 5G standalone (SA) network segment to account for larger size of the 5G infrastructure market during forecast period

Based on network architecture, the 5G infrastructure market is segmented into 5G standalone (SA) network (NR + Core) and Non-standalone (NSA) 5G network (LTE Combined). 5G Standalone (SA) refers to an independent 5G network. 5G SA includes both New Radio and Core. The SA network can interoperate with the existing 4G or LTE network to provide service continuity between the 2 network generations. 5G Core uses a cloud-aligned service-based architecture (SBA) that supports control plane function interaction, reusability, flexible connections, and service discovery that spans all functions. With the operating data rate of 20 Gbps or 10Gbps, it has a latency of 1 ms (comparatively lower than NSA) and network density of 1 million devices/km2.

Based on operational frequency, above 6 GHz frequency to hold the larger share of the 5G infrastructure market during forecast period

The 5G infrastructure market has been segmented by operation frequency into Sub 6 GHz and above 6 GHz. Above 6 GHz frequencies such as 26 GHz and 28 GHz bands have strong momentum. As they are adjacent, they tend to support spectrum harmonization, and thus reduce handset complexity, economies of scale, and early equipment availability. Above 6 GHz frequencies such as 26 GHz and 28 GHz bands have strong momentum. As they are adjacent, they tend to support spectrum harmonization and thus reduce handset complexity, economies of scale, and early equipment availability.

Based on end user, industrial end user segment to grow at the highest rate

By end user, the 5G infrastructure market has been segmented into residential, commercial, government, and industrial. The industrial market is estimated to grow at the highest rate because of the growing demand for process automation in various manufacturing and process industries. To carry out various processes effectively in these industries, the flow of data and information at right time and place is crucial. With the implementation of 5G network, a strong data network, in terms of high speed with minimal delay can be easily achieved.

Regional Insights:

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

The growth of the 5G infrastructure market in Asia Pacific can be attributed to dynamic changes in the adoption of new technologies and advancements in organizations across various industries. The growth of the 5G infrastructure market in Asia Pacific will mainly be driven by the growing development (such as R&D activities, investments, and partnerships with different companies) related to the 5G market in countries such as Japan, China, South Korea, and Australia.

5G Infrastructure Market by Region

To know about the assumptions considered for the study, download the pdf brochure

In the Asia Pacific region, 5G is well-suited as it provides simultaneous connectivity for multiple devices and has low latency, which, in turn, improves the overall performance of systems. The 5G infrastructure market in Asia Pacific has huge opportunities in smart cities. Various countries in Asia have either initialized the implementation of smart city projects or are in the planning phase. China is the biggest marketplace in Asia Pacific for the development of smart cities. It is one of the major countries involved in the development of the 5G network infrastructure. The Chinese government has coordinated and stimulated 5G research in China. As a result, the market for 5G infrastructure in Asia Pacific is expected to grow at the highest CAGR in the coming years.

The North America region held the major share of the 5G Infrastructure market in 2018

North America is one of the leading markets for 5G infrastructure in terms of R&D activities in 5G technology, network design/deployment, and presences of key market players. North America is well known for its high adoption rate of new advanced technologies, including Internet of Things (IoT), wearable technology, and autonomous car/connected cars. Reliable and fast connectivity required for these technologies is addressed by 5G. Therefore, high growth opportunities for the said market in North America can be expected. For instance, Qualcomm, Intel, Cisco, and AT&T are among the major companies in the 5G market that are actively participating in the development of 5G technology. With full-fledged 5G implementation in North America, it is expected to boost on-demand video services. In the current scenario, the market for such services is growing continuously.

Key Market Players:

Some of the Major players in the 5G infrastructure market are Ericsson (Sweden), Huawei (China), Nokia Networks (Finland), Samsung Electronics (South Korea), ZTE (China). These players have adopted various growth strategies such as agreement, collaboration, partnerships, new product development, product launch to further expand their presence in the 5G infrastructure market.

Ericsson (Sweden) held the leading position in the 5G infrastructure as it is working closely with various telecom companies toward the deployment of 5G network. The company provides high-performing solutions for networks, IT & cloud, and media to the telecom industry. It aims to capture more market share as the market shifts from 4G to 5G. Moreover, the company aims to strengthen its position in the emerging 5G market. With its offerings, the company plans to expand and grow in utilities, transport, and public safety verticals. The company is aggressively adopting inorganic growth strategies, including agreements and partnerships.

Huawei (China) is the frontrunner among network access equipment providers, primarily on the back of its R&D investment, product portfolio, market perception, and geographic reach. It is among the major suppliers of network products to telecom and private network operators across the world. Its equipment has been a major part of LTE rollouts in China, Europe, East Asia, and many emerging markets. In terms of key business strategies in the 5G infrastructure market, the company considers partnerships/collaborations necessary for its growth, product launches, continuous enhancements of its existing products, and investments in R&D.

5G Infrastructure Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 0.8 Billion in 2019 |

| Projected Market Size | USD 47.78 billion by 2027 |

| Growth Rate | CAGR of 67.1% |

|

Market size available for years |

2018–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Growing adoption of virtual networking architecture in telecommunications |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Network Function Virtualization (NFV) Segment |

This report categorizes the 5G infrastructure market based on Communication Infrastructure, Core Network, Network Architecture, Operational Frequency, End User, and Region.

Based on Communication Infrastructure, the 5G Infrastructure Market been Segmented as follows:

- Small Cell

- Macro Cell

Based on Core Network, the 5G Infrastructure Market been Segmented as follows:

- Software-Defined Networking (SDN)

- Network Function Virtualization (NFV)

Based on Network Architecture, the 5G Infrastructure Market been Segmented as follows:

- 5G NR Non-Standalone (LTE Combined)

- 5G Standalone (NR + Core)

Based on Operational Frequency, the 5G Infrastructure Market been Segmented as follows:

- Sub 6 GHz

- Above 6 GHz

Based on End User, the 5G Infrastructure Market been Segmented as follows:

- Residential

- Commercial

- Industrial

- Government

Based on Region, the 5G Infrastructure Market been Segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

5G Infrastructure Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The 5G infrastructure has witnessed numerous technological advancements over the years. The 5G network is mainly driven by software technologies such as network function virtualization (NFV) and software-defined networking to improve the operational efficiency of a network operator by offering functional flexibility.

-

Emerging Technology Trends

- Network functions virtualization (NFV)

- Software-Defined Networking (SDN)

- Internet of Things (IoT)

- Addition/refinement in segmentation–Increase in depth or width of segmentation of the market.

-

5G Infrastructure Market, by End User Vertical

- Residential

- Commercial

- Industrial

- Government

-

5G Infrastructure Market, by Network Architecture

- 5G Standalone (NR + CORE)

- 5G NR Non-Standalone (LTE COMBINED)

-

5G Infrastructure Market, by Operational Frequency

- Sub 6 GHz

- Above 6 GHz

- Coverage of new market players and change in the market share of existing players of the 5G infrastructure market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have total 24 players (12 major, 12 Startups/SME).

- Updated financial information and product portfolios of players operating in the 5G infrastructure market.

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the context of the 5G infrastructure market till 2018/20 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment and investment on research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2019 to 2027. For instance, in September 2022, Tusass A/S (Greenland) announced a collaboration with Ericsson (Sweden) for the joint vision of a wireless Greenland. Starting as a pilot in 2022, non-standalone (NSA) Fixed Wireless Access (FWA) 5G will be rolled out in Sisimiut, Maniitsoq, and Narsaq, before it is realized in several places in the rest of the country.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- In the new edition of the report, 5G chipset providers have been removed and market players have been updated as the report focuses only on 5G infrastructure equipment providers and network operators.

- In the previous version, market size was provided from 2020 to 2026, since 5G was not commercialized at that time. In the latest report market size has been provided from 2018 to 2027. We have provided an additional forecast of 1 years (till 2027) to project the extensive growth of the market and showcase growth opportunities for industry stakeholders.

Recent Developments

- In October 2022, Nokia (Finland) announced that it has been selected as a major supplier by Reliance Jio to supply 5G Radio Access Network (RAN) equipment from its comprehensive AirScale portfolio countrywide in a multi-year deal. Under the contract, Nokia will supply equipment from its AirScale portfolio, including base stations, high-capacity 5G Massive MIMO antennas, and Remote Radio Heads (RRH) to support different spectrum bands, and self-organizing network software. Reliance Jio plans to deploy a 5G standalone network which will interwork with its 4G network.

- In October 2022, Ericsson (Sweden) entered into a long-term strategic 5G contract with Indian communications service provider (CSP) Reliance Jio Infocomm Ltd. (Jio) to roll out 5G Standalone (SA) in the country. This is the first partnership between Jio and Ericsson for radio access network deployment in the country.

- In October 2022, Ericsson (Sweden) and Becker Mining Systems AG (Germany) unearthed the future of smart mining, following the signing of a multi-country reselling agreement. Becker Mining Systems AG has selected Ericsson as the 5G network partner of choice to provide Ericsson Private 5G (EP5G) and private network solutions. The frame agreement covers many countries including Canada, US, Mexico, Chile, France, Germany and Poland. There are plans to expand the agreement to new countries in the future.

- In August 2022, Nokia (Finland) announced that it has secured a deal with leading telecom operator Bharti Airtel, for 5G radio access network (RAN) deployment. This multi-year deal follows the recently concluded 5G spectrum auctions and allocation of pan-India spectrum to Bharti Airtel, supporting their ambition to take India into the 5G era.

- In June 2022, Cisco (US) announced its expanded relationship with General Dynamics Information Technology (GDIT), a business unit of General Dynamics, to deliver Cisco Private 5G services to a broad set of government entities. Cisco’s Private 5G service is built on its industry-leading mobile core technology and IoT portfolio – spanning IoT sensors and gateways, device management software, as well as monitoring tools and dashboards.

Key Benefits of the Report/Reason to Buy:

Target Audience:

Frequently Asked Questions (FAQs):

What is the current size of the 5G infrastructure market?

The 5G infrastructure market is projected to grow from USD 784 million in 2019 to USD 47,775 Million by 2027, at a CAGR of 67.1% from 2019 to 2027.

Who are the winners in the 5G infrastructure market?

Ericsson (Sweden), Huawei (China), Nokia Networks (Finland), Samsung Electronics (South Korea) and ZTE (China).

What are some of the technological advancements in the market?

Network functions virtualization (NFV) is a network architecture concept that leverages IT virtualization technologies to virtualize entire classes of network node functions into building blocks that may connect or chain together to create and deliver communication services. NFV will play a significant role in terms of providing network operators the flexibility to expand their network functionality as well as provide effective and efficient operation of the network.

Software-defined networking (SDN) is a network technology that focuses on making a network flexible and responsive in terms of scaling up in terms of network requirement. In 5G, SDN will be helpful to network/cloud engineers in terms of providing effective control over network operation.

What are the factors driving the growth of the market?

Growing adoption of virtual networking architecture in telecommunications, lower latency in 5G, are some of the factors responsible for driving the market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Secondary Sources

2.1.3 Primary Data

2.1.3.1 Breakdown of Primaries

2.1.3.2 Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in 5G Infrastructure Market

4.2 Market, By Communication Infrastructure

4.3 Market, By Core Network Technology

4.4 Market, By Network Architecture

4.5 Market for Commercial, By Type & Region

4.6 Market, By Geography

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Lower Latency in 5G

5.2.1.2 Growth in Mobile Data Traffic

5.2.1.3 Growing Adoption of Virtual Networking Architecture in Telecommunications

5.2.1.4 Increasing M2M Connections Across Various Industries

5.2.2 Restraints

5.2.2.1 Delay in Standardization of Spectrum Allocation

5.2.3 Opportunities

5.2.3.1 Growing Demand From Different Business Verticals

5.2.3.2 Growth of IoT Technology Would Offer New Opportunities for 5G Infrastructure

5.2.4 Challenges

5.2.4.1 Technological Design Challenges

5.2.4.1.1 Heat Dissipation in Massive Multiple Input and Multiple Output (Mimo)

5.2.4.1.2 Inter-Cell Interference Management

5.2.4.2 Deployment and Coverage

5.3 Value Chain Analysis

5.4 5G Trial Spectrum

5.5 5G Use Cases

5.5.1 Connected Transportation

5.5.2 Connected Health

5.5.3 Smart Manufacturing

5.5.4 Ar/Vr

6 5G Infrastructure Market, By Communication Infrastructure (Page No. - 50)

6.1 Introduction

6.2 Small Cell

6.2.1 Micro Cell

6.2.1.1 Micro Cells have A Greater Coverage Area Than Femtocells and Pico Cells

6.2.2 Femtocell

6.2.2.1 Femtocells are Usually Deployed in Homes Or Small Businesses Because of Its Short Range Small Cell Types

6.2.3 Pico Cell

6.2.3.1 Pico Cells are Usually Installed in Larger Indoor Areas Such as Shopping Malls, Offices, Or Train Stations.

6.3 Macro Cell (5G Radio Base Station)

6.3.1 A Macro Cell in Wireless Cellular Networks Provides Radio Access Coverage to A Large Area of Mobile Network

7 5G Infrastructure Market, By Core Network Technology (Page No. - 66)

7.1 Introduction

7.2 SDN

7.2.1 SDN Allows Network/Cloud Operators to Make Instant Changes in Their Network Through A Centralized Control System

7.3 NFV

7.3.1 NFV is an Advanced Network Technology That Employs Virtualized Network Services

8 5G Infrastructure Market, By Network Architecture (Page No. - 78)

8.1 Introduction

8.2 5G Nr Non-Standalone (LTE Combined)

8.2.1 5G Non-Standalone Architecture Operates in Master–Slave Configuration

8.3 5G Standalone (NR + Core)

8.3.1 5G Standalone Network Provides an End-To-End 5G Experience to Users

9 5G Infrastructure Market, By Operational Frequency (Page No. - 81)

9.1 Introduction

9.2 Sub 6 GHz

9.2.1 Sub 6 GHz Band Offers an Amalgamation of Coverage and Capacity Benefits

9.3 Above 6 GHz

9.3.1 Above 6 GHz Band is Essential to Meet Ultra-High Broadband Speeds Projected for 5G

10 5G Infrastructure Market, By End User (Page No. - 85)

10.1 Introduction

10.2 Residential

10.2.1 Smart Home, Synchronized Watches, Smartphones, and Fitness Apps are Gaining Traction and Expected to Grow at High Rate Due to Performance Capabilities of 5G

10.3 Commercial

10.3.1 Commercial is A Major Sector That Mobile Service Providers Target

10.4 Industrial

10.4.1 IoT and M2M Communication are Key Technologies Employing Industrial Automation

10.5 Government

10.5.1 Several Governments Across the World Would Play Major Role in Growth of 5G Market By Deploying 5G Networks at Government Schools and Colleges

11 Geographic Analysis (Page No. - 96)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US Being in Forefront of Adoption of IoT, Wearable Technology to Drive Growth of 5G Market

11.2.2 Canada

11.2.2.1 Adoption of Advanced Technologies, Particularly Forthcoming 5G and the Proliferating IoT, to Rise in Canada

11.2.3 Mexico

11.2.3.1 Mexico to Exhibit Highest Growth in North American 5G Infrastructure Market During 2019–2027

11.3 Europe

11.3.1 UK

11.3.1.1 UK Government is Heavily Investing in 5G Infrastructure for Quick Deployment of 5G Networks in Various Parts of Europe

11.3.2 Germany

11.3.2.1 Germany is Powerhouse of Industrial and Automobile Electronics Manufacturing Within Europe

11.3.3 France

11.3.3.1 IoT Would Catalyze 5G Market in France as IoT Implementation Requires Large Number of Interconnected and Communicating Devices

11.3.4 Italy

11.3.4.1 IoT Italian 5G Infrastructure Market Growth Will Be Propelled By Heavy Investments in Establishing High-Speed and Robust Networks

11.3.5 Rest of Europe

11.3.5.1 Advanced Network Equipment That Can Establish Seamless Connectivity Plays A Vital Role in Automation

11.4 APAC

11.4.1 China

11.4.1.1 China is Among Fast-Growing Economies Involved in 5G Network Infrastructure Development

11.4.2 Japan

11.4.2.1 Companies in Japan have Made Significant Investments in R&D to Gain Competitive Edge in the Market

11.4.3 South Korea

11.4.3.1 South Korea is Home to Various Large-Scale Manufacturing Companies Operating in Semiconductor Displays, Transport, and Logistics Verticals

11.4.4 India

11.4.4.1 Widespread Proliferation of Broadband Connectivity and Penetration of Advanced Technologies Across Indian Organizations to Drive Demand for 5G Network in India

11.4.5 Rest of APAC

11.4.5.1 Countries Such as Singapore and Australia are Likely to Launch 5G Networks Because of Active Participation of Government Bodies

11.5 RoW

11.5.1 Middle East and Africa

11.5.1.1 Companies Conduct Research on 5G and M2M Communication Technologies for IoT and Smart City Applications, Which Would Surge Demand for 5G Networks

11.5.2 South America

11.5.2.1 Growing Internet Users in South America to Drive Growth of 5G Infrastructure Market

12 Competitive Landscape (Page No. - 133)

12.1 Overview

12.2 Market Ranking Analysis, 2019

12.3 Competitive Situation and Trends

12.3.1 Partnerships, Collaborations, and Agreements

12.3.2 Product Launches

12.3.3 Expansions

12.3.4 Acquisitions

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

13 Company Profiles (Page No. - 151)

13.1 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1.1 Ericsson

13.1.2 Huawei

13.1.3 Nokia Networks

13.1.4 Samsung

13.1.5 ZTE

13.1.6 NEC

13.1.7 Cisco

13.1.8 Commscope

13.1.9 Comba Telecom Systems

13.1.10 Alpha Networks

13.1.11 Siklu Communication

13.1.12 Mavenir

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13.2 Other Key Players

13.2.1 Airspan Networks

13.2.2 VMware

13.2.3 Extreme Networks

13.2.4 American Tower

13.2.5 Fujitsu

13.2.6 Verizon Communications

13.2.7 AT&T

13.2.8 SK Telecom

13.2.9 T-Mobile

13.2.10 Hewlett Packard Enterprise

13.2.11 Korea Telecom

13.2.12 China Mobile

14 Appendix (Page No. - 203)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Report

14.6 Author Details

List of Tables (108 Tables)

Table 1 Market, By Communication Infrastructure, 2018–2027 (USD Million)

Table 2 Market, By Communication Infrastructure, 2018–2027 (Thousand Units)

Table 3 5G Communication Infrastructure Market, By Region, 2018–2027 (USD Million)

Table 4 5G Communication Infrastructure Market in North America, By Country, 2018–2027 (USD Million)

Table 5 5G Communication Infrastructure Market in Europe, By Country, 2018–2027 (USD Million)

Table 6 5G Communication Infrastructure Market in APAC, By Country, 2018–2027 (USD Million)

Table 7 5G Communication Infrastructure Market in RoW, By Region, 2018–2027 (USD Million)

Table 8 5G Communication Infrastructure Market, By End User, 2018–2027 (USD Million)

Table 9 5G Small Cell Market, By Network Architecture, 2018–2027 (Thousand Units)

Table 10 5G Small Cell Market, By Deployment Type, 2018–2027 (Thousand Units)

Table 11 5G Small Cell Market, By Type, 2018–2027 (Thousand Units)

Table 12 5G Small Cell Market, By Type, 2018–2027 (USD Million)

Table 13 5G Small Cell Market, By Region, 2018–2027 (USD Million)

Table 14 5G Small Cell Market in North America, By Country, 2018–2027 (USD Million)

Table 15 5G Small Cell Market in Europe, By Country, 2018–2027 (USD Million)

Table 16 5G Small Cell Market in APAC, By Country, 2018–2027 (USD Million)

Table 17 5G Small Cell Market in RoW, By Region, 2018–2027 (USD Million)

Table 18 Comparison of Various Types of Cells in 5G Infrastructure Market

Table 19 5G Macro Cell Market, By Region, 2018–2027 (USD Million)

Table 20 5G Macro Cell Market in North America, By Country, 2018–2027 (USD Million)

Table 21 5G Macro Cell Market in Europe, By Country, 2018–2027 (USD Million)

Table 22 5G Macro Cell Market in APAC, By Country, 2018–2027 (USD Million)

Table 23 5G Macro Cell Market in RoW, By Region, 2018–2027 (USD Million)

Table 24 Market, By Core Network Technology, 2018–2027 (USD Million)

Table 25 5G Core Network Technology, By Region, 2018–2027 (USD Million)

Table 26 5G Core Network Technology in North America, By Country, 2018–2027 (USD Million)

Table 27 5G Core Network Technology in Europe, By Country, 2018–2027 (USD Million)

Table 28 5G Core Network Technology in APAC, By Country, 2018–2027 (USD Million)

Table 29 5G Core Network Technology in RoW, By Region, 2018–2027 (USD Million)

Table 30 5G Core Network Technology, By End User, 2018–2027 (USD Million)

Table 31 5G SDN Market, By Region, 2018–2027 (USD Million)

Table 32 5G SDN Market in North America, By Country, 2018–2027 (USD Million)

Table 33 5G SDN Market in Europe, By Country, 2018–2027 (USD Million)

Table 34 5G SDN Market in APAC, By Country, 2018–2027 (USD Million)

Table 35 5G SDN Market in RoW, By Region, 2018–2027 (USD Million)

Table 36 5G NFV Market, By Region, 2018–2027 (USD Million)

Table 37 5G NFV Market in North America, By Country, 2018–2027 (USD Million)

Table 38 5G NFV Market in Europe, By Country, 2018–2027 (USD Million)

Table 39 5G NFV Market in APAC, By Country, 2018–2027 (USD Million)

Table 40 5G NFV Market in RoW, By Region, 2018–2027 (USD Million)

Table 41 Market, By Network Architecture, 2018–2027 (USD Million)

Table 42 Market, By Operational Frequency, 2018–2027 (USD Million)

Table 43 Market for Sub 6 GHz Frequency, By Region, 2018–2027 (USD Million)

Table 44 Market for Above 6 GHz, By Region, 2018–2027 (USD Million)

Table 45 Market, By End User, 2018–2027 (USD Million)

Table 46 Market for Residential, By Region, 2018–2027 (USD Million)

Table 47 Market for Residential, By Type, 2018–2027 (USD Million)

Table 48 Market for Commercial, By Region, 2018–2027 (USD Million)

Table 49 Market for Commercial, By Type, 2018–2027 (USD Million)

Table 50 Market for Industrial, By Region, 2019–2027 (USD Million)

Table 51 Market for Industrial, By Type, 2019–2027 (USD Million)

Table 52 Market for Government, By Region, 2019–2027 (USD Million)

Table 53 Market for Government, By Type, 2019–2027 (USD Million)

Table 54 Market, By Region, 2018–2027 (USD Million)

Table 55 Market in North America, By Country, 2018–2027 (USD Million)

Table 56 Market in North America, By Communication Infrastructure, 2018–2027 (USD Million)

Table 57 Market in North America, By Operational Frequency, 2018–2027 (USD Million)

Table 58 Market in North America, By End User, 2018–2027 (USD Million)

Table 59 Market in North America, By Core Network Technology, 2018–2027 (USD Million)

Table 60 Market in US, By Communication Infrastructure, 2018–2027 (USD Million)

Table 61 Market in US, By Core Network Technology, 2018–2027 (USD Million)

Table 62 Market in Canada, By Communication Infrastructure, 2020–2027 (USD Million)

Table 63 Market in Canada, By Core Network Technology, 2020–2027 (USD Million)

Table 64 Market in Mexico, By Communication Infrastructure, 2020–2027 (USD Million)

Table 65 Market in Mexico, By Core Network Technology, 2020–2027 (USD Million)

Table 66 Market in Europe, By Country, 2018–2027 (USD Million)

Table 67 Market in Europe, By Communication Infrastructure, 2018–2027 (USD Million)

Table 68 Market in Europe, By Operational Frequency, 2018–2027 (USD Million)

Table 69 Market in Europe, By End User, 2018–2027 (USD Million)

Table 70 Market in Europe, By Core Network Technology, 2018–2027 (USD Million)

Table 71 Market in UK, By Communication Infrastructure, 2019–2027 (USD Million)

Table 72 Market in UK, By Core Network Technology, 2019–2027 (USD Million)

Table 73 Market in Germany, By Communication Infrastructure, 2019–2027 (USD Million)

Table 74 Market in Germany, By Core Network Technology, 2019–2027 (USD Million)

Table 75 Market in France, By Communication Infrastructure, 2019–2027 (USD Million)

Table 76 Market in France, By Core Network Technology, 2019–2027 (USD Million)

Table 77 Market in Italy, By Communication Infrastructure, 2019–2027 (USD Million)

Table 78 Market in Italy, By Core Network Technology, 2019–2027 (USD Million)

Table 79 Market in Rest of Europe, By Communication Infrastructure, 2018–2027 (USD Million)

Table 80 Market in Rest of Europe, By Core Network Technology, 2018–2027 (USD Million)

Table 81 Market in APAC, By Country, 2018–2027 (USD Million)

Table 82 Market in APAC, By Communication Infrastructure, 2018–2027 (USD Million)

Table 83 Market in APAC, By Operational Frequency, 2018–2027 (USD Million)

Table 84 Market in APAC, By End User, 2018–2027 (USD Million)

Table 85 Market in APAC, By Core Network Technology, 2018–2027 (USD Million)

Table 86 Market in China, By Communication Infrastructure, 2019–2027 (USD Million)

Table 87 Market in China, By Core Network Technology, 2019–2027 (USD Million)

Table 88 Market in Japan, By Communication Infrastructure, 2019–2027 (USD Million)

Table 89 Market in Japan, By Core Network Technology, 2019–2027 (USD Million)

Table 90 Market in South Korea, By Communication Infrastructure, 2018–2027 (USD Million)

Table 91 Market in South Korea, By Core Network Technology, 2018–2027 (USD Million)

Table 92 Market in India, By Communication Infrastructure, 2021–2027 (USD Million)

Table 93 Market in India, By Core Network Technology, 2021–2027 (USD Million)

Table 94 Market in Rest of APAC, By Communication Infrastructure, 2019–2027 (USD Million)

Table 95 Market in Rest of APAC, By Core Network Technology, 2019–2027 (USD Million)

Table 96 Market in RoW, By Region, 2018–2027 (USD Million)

Table 97 Market in RoW, By Communication Infrastructure, 2018–2027 (USD Million)

Table 98 Market in RoW, By Operational Frequency, 2018–2027 (USD Million)

Table 99 Market in RoW, By End User, 2018–2027 (USD Million)

Table 100 Market in RoW, By Core Network Technology, 2018–2027 (USD Million)

Table 101 Market in Middle East and Africa, By Communication Infrastructure, 2018–2027 (USD Million)

Table 102 Market in Middle East and Africa, By Core Network Technology, 2018–2027 (USD Million)

Table 103 Market in South America, By Communication Infrastructure, 2020–2027 (USD Million)

Table 104 Market in South America, By Core Network Technology, 2020–2027 (USD Million)

Table 105 Partnership, Collaboration, and Agreement, 2017–2019

Table 106 Product Launch, 2017–2019

Table 107 Expansion, 2018–2019

Table 108 Acquisition, 2018–2019

List of Figures (52 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, By Communication Infrastructure, 2019 vs 2027 (USD Million)

Figure 7 Market, By Core Network Technology, 2019 vs 2027 (USD Million)

Figure 8 Market, By Network Architecture, 2019 vs 2027 (USD Million)

Figure 9 Market, By Operational Frequency, 2019 vs 2027 (USD Million)

Figure 10 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 11 Lower Latency in 5G and Growth in Mobile Data Traffic to Drive 5G Infrastrucutre Market During 2019–2027

Figure 12 Commercial End-User Segment to Hold Largest Size of 5G Communication Infrastructure Market By 2027

Figure 13 APAC to Lead 5G Core Network Market During Forecast Period

Figure 14 5G Standalone to Dominate Market for Network Architecture During Forecast Period

Figure 15 Communication Infrastructure and APAC Region Likely to Be Largest Shareholders in Overall Market By Commercial End User Industry

Figure 16 China to Grow at Highest CAGR in Market During Forecast Period

Figure 17 Continuous Increase in Demand for Mobile Data Services Drive Market

Figure 18 Mobile Data Traffic, 2017–2022

Figure 19 Cellular IoT Connections, 2018 vs 2024

Figure 20 5G Technology Ecosystem: Value Chain Analysis

Figure 21 5G Trial Spectrum (GHz)

Figure 22 Market, By Communication Infrastructure

Figure 23 APAC to Lead 5G Communication Infrastructure Market By 2027

Figure 24 Commercial to Hold Largest Size End-User Market for 5G Communication Infrastructure During Forecast Period

Figure 25 APAC to Lead 5G Small Cell Market During Forecast Period

Figure 26 Germany to Grow at Highest CAGR for Macro Cell During Forecast Period

Figure 27 Market, By Core Network Technology

Figure 28 Industrial End User to Grow at Highest CAGR for 5G Core Technologies During Forecast Period

Figure 29 APAC to Witness Fastest Growth in 5G NFV Market During Forecast Period

Figure 30 5G Standalone to Lead Network Architecture Market During Forecast Period

Figure 31 Above 6 GHz Frequency to Lead Operational Frequency Market During Forecast Period

Figure 32 Market, By End User

Figure 33 North America Held Largest Market Size for Commercial End User in 2019

Figure 34 Core Network Technology to Witness Higher CAGR for Government End User

Figure 35 Market, By Geography

Figure 36 North America: Snapshot of Market

Figure 37 Europe: Snapshot of Market

Figure 38 APAC: Snapshot of Market

Figure 39 RoW: Snapshot of Market

Figure 40 Companies Adopted Product Launch and Partnerships & Collaborations as the Key Growth Strategies From 2017 to 2019

Figure 41 Ranking of the Key Players in the Market, 2019

Figure 42 Market (Global) Competitive Leadership Mapping, 2018

Figure 43 Ericsson: Company Snapshot

Figure 44 Huawei: Company Snapshot

Figure 45 Nokia Corporation: Company Snapshot

Figure 46 Samsung: Company Snapshot

Figure 47 ZTE: Company Snapshot

Figure 48 NEC: Company Snapshot

Figure 49 Cisco: Company Snapshot

Figure 50 Commscope: Company Snapshot

Figure 51 Comba Telecom Systems: Company Snapshot

Figure 52 Alpha Networks: Company Snapshot

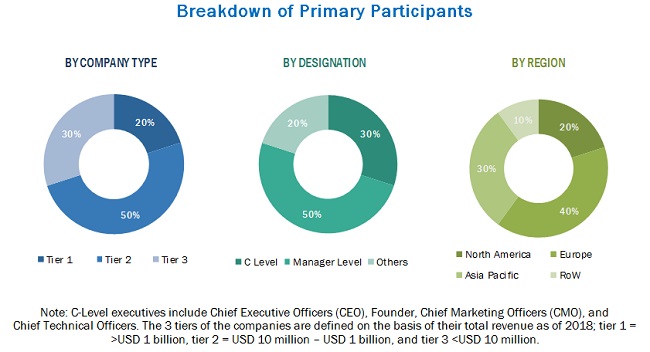

The study involved 4 major activities in estimating the current size of the 5G infrastructure market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the 5G infrastructure market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the 5G infrastructure market. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the 5G infrastructure market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the 5G infrastructure market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the 5G infrastructure market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the 5G infrastructure market, in terms of value, by communication infrastructure, core network technology, network architecture, operational frequency, and end user

- To describe and forecast the market size, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the 5G infrastructure market for stakeholders and detail the competitive landscape for market players

- To map competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in 5G Infrastructure Market

Need Forecast for 2019-2024, what is driving spending in 5G?