1,4-Butanediol Market by Type (Synthetic, and Bio-Based), Applications (THF, PBT, GBL and PU), Technology Type (Reppe , Davy , Butadiene , Propylene Oxide) and Region (Asia Pacific, Europe, and North America) - Global Forecast to 2029

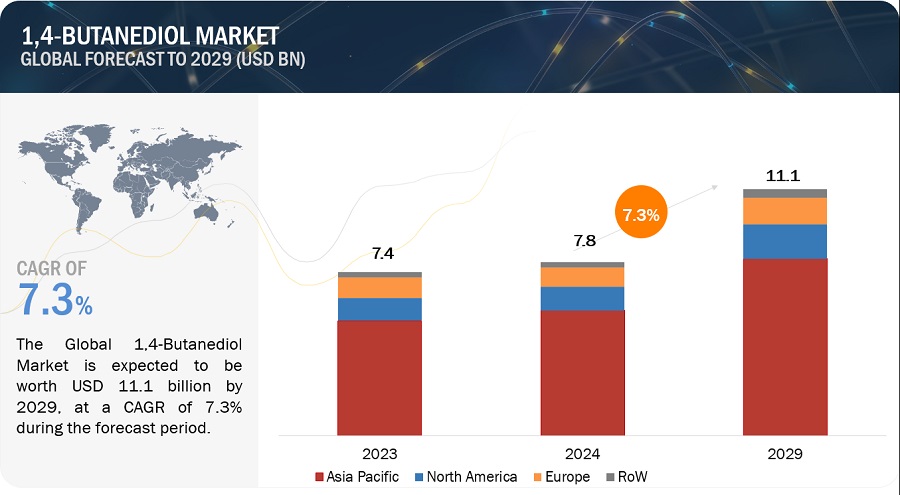

The global 1,4-butanediol market is projected to grow from USD 7.8 billion in 2024 to USD 11.1 billion by 2029, at a CAGR of 7.3% during the forecast period. The 1,4-butanediol market is driven by rising demand for its applications in producing tetrahydrofuran (THF) and polyurethane (PU) and this therefore drives the growth in 1,4-butanediol market. 1,4-Butanediol find applications in multiple industries such as automotive, electronics, and textile industries.

Attractive Opportunities in the 1,4-Butanediol Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growing demand in applications such as tetrahydrofuran and polyurethane

The expanding applications of tetrahydrofuran (THF) and polyurethane (PU) in industries such as automotive, construction, and electronics are driving the demand for 1,4-butanediol. tetrahydrofuran is utilized in the production of various resins, coatings, and elastomers, while polyurethane finds extensive use in foams, adhesives, and sealants. As these industries continue to grow, so does the need for 1,4-butanediol as a key intermediate in the synthesis of these essential chemicals, highlighting its pivotal role in meeting the evolving demands of modern manufacturing processes.

Restraints: Health concerns related to 1,4-butanediol

Health concerns associated with 1,4-butanediol pose significant constraints on its market growth. The compound's potential for misuse as a recreational drug precursor raises regulatory challenges and public safety issues. Additionally, exposure to 1,4-butanediol vapors or direct contact can lead to respiratory irritation and skin sensitization, necessitating stringent safety measures in handling and storage. These health risks prompt industry players to invest in safer alternatives and stringent safety protocols, which may impact market expansion.

Opportunity: Increasing production of bio-based 1,4-butanediol

The increasing production of bio-based 1,4-butanediol presents significant opportunities in the market. With rising environmental concerns and a shift towards sustainability, bio-based alternatives offer a compelling solution. This trend aligns with consumer preferences for eco-friendly products, driving demand across various industries. Moreover, advancements in biotechnological processes are enhancing the efficiency and scalability of bio-based production, making it increasingly competitive with traditional methods. As companies prioritize sustainable practices and governments incentivize renewable technologies, the market for bio-based 1,4-butanediol is poised for substantial growth and market penetration.

Challenge: Fluctuations in raw materials prices

The Fluctuations in raw material prices present a notable challenge in the 1,4-butanediol market. Variations in the costs of key feedstocks, such as acetylene, butadiene, and formaldehyde, directly impact production expenses and profit margins for manufacturers. Moreover, these price fluctuations can disrupt supply chains and affect pricing agreements with customers, leading to uncertainties in revenue forecasts. To mitigate these challenges, companies may implement hedging strategies, negotiate long-term contracts with suppliers, or invest in alternative feedstock sources to stabilize their operations amidst volatile market conditions.

1,4-butanediol market: Ecosystem

Prominent companies in this market include well-established, and financially stable manufacturers of 1,4-butanediol market. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market DCC (Taiwan), BASF-SE (Germany), Xinjiang Tianye Group Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan), Nan Ya Plastics Corporation (Taiwan).

" Gamma-Butyrolactone, by application, is estimated to grow at the fastest rate during the forecast period."

The Gamma-Butyrolactone is projected to grow rapidly across multiple industries due to its versatility and essential role as a precursor in various chemical processes. Its use as a solvent is particularly vital in industries such as pharmaceuticals, cosmetics, automotive, and electronics. Ongoing innovation and research continue to uncover new applications, while advancements in production technologies enhance efficiency and drive down costs. With expanding global markets and favorable regulatory compliance, GBL is expected to experience sustained growth in demand.market.

"Bio-Based 1,4-butanediol, by type, is estimated to grow at the fastest rate during the forecast period."

Bio-based 1,4-butanediol is projected to grow rapidly due to its environmental benefits, including a lower carbon footprint and reduced reliance on fossil fuels. Government incentives and consumer demand for sustainable products further drive this trend. Technological advancements are making its production more cost-effective. Additionally, corporate sustainability goals are accelerating its adoption in various industries.

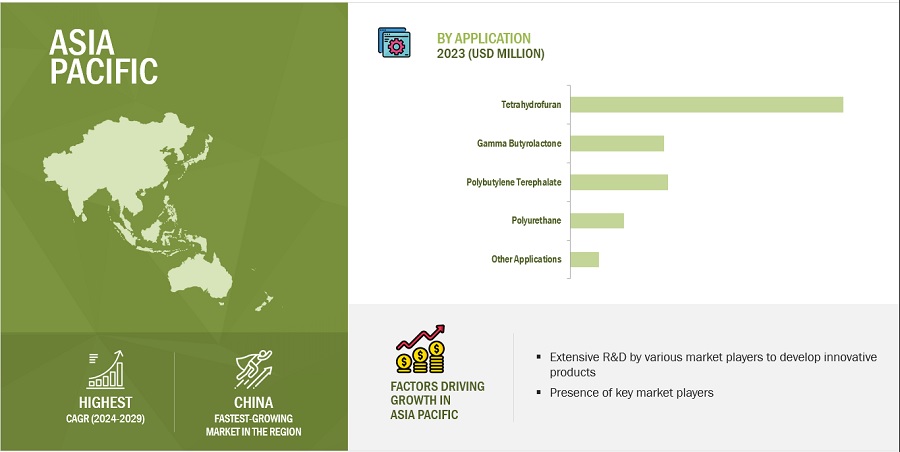

"Asia Pacific is estimated to account for the largest market share CAGR during the forecast period."

Asia Pacific holds the largest market share in 1,4-Butanediol (BDO) primarily due to the region's rapidly growing industrial and manufacturing sectors. High demand from end-user industries such as automotive, textiles, electronics, and pharmaceuticals drives significant consumption of 1,4-butanediol. Additionally, the region benefits from lower production costs due to the availability of cheap labor and raw materials. Major economies like China and India are heavily investing in infrastructure and industrial development, further boosting 1,4-butanediol production and consumption. Furthermore, the presence of large-scale chemical manufacturing companies and favorable government policies supporting industrial growth and foreign investments contribute to Asia Pacific's dominance in the 1,4-butanediol market.

To know about the assumptions considered for the study, download the pdf brochure

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Key Market Players

Major companies in the 1,4-butanediol market DCC (Taiwan), BASF-SE (Germany), Xinjiang Tianye Group Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan), Nan Ya Plastics Corporation (Taiwan) and others. A total of 19 players have been covered. These players have adopted product launches, agreements, joint ventures, investments, acquisitions, mergers, and expansions as the major strategies to consolidate their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) and Volume (Kilotons) |

|

Segments Covered |

1,4-Butanediol by type, technology, application, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America and Rest of World |

|

Companies Covered |

The major market players include DCC (Taiwan), BASF-SE (Germany), Xinjiang Tianye Group Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan), Nan Ya Plastics Corporation (Taiwan) , SIPCHEM Company (Saudi Arabia), Ashland (US), INEOS (UK), Genomatica Inc. (UK) Marck KGaA (Germany) , Evonik Industries AG (Germany) and others. |

This research report categorizes the 1,4-butanediol Market based on 1,4-butanediol Type, Technology Type, Application, and Region.

Based on Type, the 1,4-Butanediol Market has been segmented as follows:

- Synthetic

- Bio-Based

Based on Technology Type, the 1,4-Butanediol Market has been segmented as follows:

- Reppe Process

- Davy Process

- Butadiene Process

- Propylene Oxide Process

- Other Technlogies

Based on Application, the 1,4-Butanediol Market has been segmented as follows:

- Tetrahydrofuran

- Polybutylene Terephthalate

- Gamma Butyrolactone

- Polyurethane

- Other Applications

Based on Region, the 1,4-Butanediol Market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Rest of World

Recent Development

- In August 2021, Evonik Industries announced the upgrade of its R&D center, located in the Shanghai Xinzhuang Industry Park, to Evonik Shanghai Innovation Park. With this upgrade, the company expanded its R&D activities in China to drive profitable and sustainable business growth.

- In July 2020, Ashland Global Holdings Inc. entered into an agreement to sell its maleic anhydride business and production plant in Neal, West Virginia, with AOC Materials LLC for USD 100 million. This development strengthened Ashland's strategic aim to consolidate its portfolio and focus on specialty ingredients and higher profitability.

- In May 2019, Sipchem completed its multibillion-dollar merger with Sahara Petrochemicals Company. This development strengthened the strategic goal of Vision 2030, which is to create a national entity with strong local and international reach in a field designated important to Saudi Arabia's future economy.

Frequently Asked Questions (FAQ):

What is the key driver for the 1,4-butanediol market?

Growing demand in applications such as tetrahydrofuran, polyurethane is a driving force for the 1,4-butanediol market

Which region is expected to register the highest CAGR in the 1,4-butanediol market during the forecast period?

The Rest of World is estimated to register the highest CAGR during the forecast period.

What is the major source of 1,4-butanediol?

1,4-Butanediol is primarily synthesized from acetylene and formaldehyde through the Reppe process, which involves a series of reactions including acetylene dimerization and subsequent hydrogenation. It can also be produced from butadiene via hydrolysis and hydrogenation, or from maleic anhydride by catalytic hydrogenation. Additionally, bio-based methods use renewable feedstocks, such as sugars and starches, through microbial fermentation processes.

Who are the major players of the 1,4-butanediolmarket?

The key players operating in the market DCC (Taiwan), BASF-SE (Germany), Xinjiang Tianye Group Co., Ltd. (China), Mitsubishi Chemical Group Corporation (Japan) and Nan Ya Plastics Corporation (Taiwan).

What is the total CAGR expected to record for the 1,4-butanediol market during 2024-2029 by value?

The market is expected to record a CAGR of 7.3% from 2024-2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

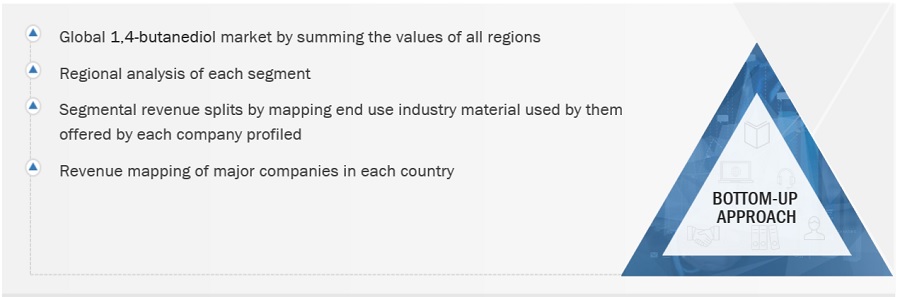

The study involved four major activities in estimating the current size of the 1,4-butanediol Market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the 1,4-butanediol value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; 1,4-butanediol manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

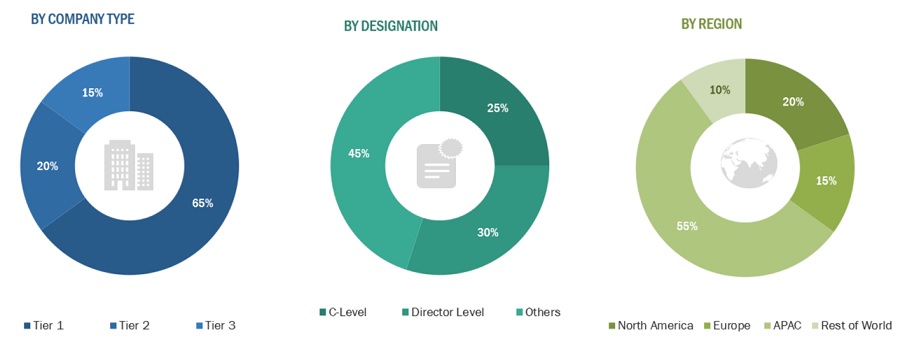

The 1,4-butanediol Market comprises several stakeholders, such as raw material suppliers, technology support providers, 1,4-butanediol manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the 1,4-butanediol Market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the 1,4-butanediol Market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the 1,4-butanediol Market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global 1,4-Butanediol Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global 1,4-Butanediol Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in chemical sector.

Market Definition

1,4-Butanediol, or BDO, is an organic compound primarily used as a solvent in industrial cleaners and adhesive removers like tetrahydrofuran (THF). This saturated, four-carbon, straight-chain diol is a colorless, nearly odorless, viscous liquid at room temperature.

BDO is a crucial intermediate chemical for producing tetrahydrofuran, polytetramethylene ether glycol (PTMEG), polybutylene terephthalate (PBT), gamma butyrolactone (GBL), polyurethane (PU), and various other solvents.

- Raw material manufacturers

- Technology support providers

- Manufacturers of 1,4-butanediol

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of 1,4-butanediol Market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global 1,4-butanediol Market on the basis of type, technology type, , and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on three major regions: Asia Pacific, Europe, and North America, along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Additional country-level analysis of the 1,4-Butanediol Market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 1,4-Butanediol Market