Workforce Management Market

Workforce Management Market By Solution (Time & Attendance Management, Compliance & Payroll, AI/ML Scheduling, Labor Planning, Cost & Productivity, Leave & Absence Management, Predictive Workforce Analytics, Performance Monitoring) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global workforce management market is witnessing significant growth from USD 8.38 billion in 2025 to 13.03 billion by 2030, reflecting a CAGR of 9.2% as manufacturers and enterprises face rising labor complexity, stricter compliance requirements, and increasing pressure to improve productivity with limited staffing. Companies are adopting WFM tools to streamline scheduling, time and attendance, demand forecasting, and labor optimization, especially as skill shortages widen across industries. The push toward digital transformation, automation, and AI-driven decision-making is further accelerating WFM deployments. Cloud-based platforms are also expanding adoption by offering faster implementation and lower upfront costs. Additionally, hybrid work models and multi-shift operations are driving demand for real-time workforce visibility and better resource allocation.

KEY TAKEAWAYS

-

BY REGIONThe North America is expcted to hold largest market value of USD 2,943.7 million in 2025.

-

BY OFFERINGThe solution segment is expected to hold largest market value in 2025

-

BY SERVICE TYPEThe support & maintenance segement is expected to grow at highest CAGR during forecast period.

-

BY DEPLOYMENT TYPEThe on-presmises deployment is expected to hold largest market share in the market in 2025.

-

BY VERTICALThe BFSI segment is expected to hold largest market value in 2025.

-

COMPETITIVE LANDSCAPEThe workforce management market is highly competitive, with leaders like ADP, SAP, Workday, Ceridian and Oracle positioned as top “stars” offering robust, enterprise-grade WFM and HR solutions. These vendors distinguish themselves with integrated platforms, cloud scalability, AI-powered analytics, global compliance support, and deep enterprise-level functionality making choices for large organizations and complex workforce environments.

-

COMPETITIVE LANDSCAPENICE, TimeClock Plus, and SumTotal are recognized as strong startup/SME-focused players in the workforce management market due to their agile, cost-efficient, and easy-to-deploy solutions. These vendors specialize in flexible scheduling, time and attendance, and compliance capabilities tailored for smaller and mid-sized businesses.

The workforce management market is expanding as organizations prioritize smarter labor planning to handle skill gaps, fluctuating demand, and growing operational complexity. Adoption is rising because modern WFM platforms offer real-time insights, automated scheduling, and improved compliance management. Cloud-based and AI-enabled solutions are accelerating this shift by making workforce optimization faster, more accurate, and easier to scale.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The workforce management market is being reshaped by rising adoption of AI-driven scheduling, predictive analytics, and automation, which are transforming how companies plan labor and manage day-to-day operations. Cloud-native WFM platforms are becoming the default choice, enabling faster deployment, seamless integrations, and broader scalability across multi-site operations. Real-time workforce visibility, enriched by IoT and mobile apps, is improving on-floor decision-making in manufacturing and logistics. At the same time, disruptions such as widening skill shortages, stricter labor regulations, and increasing union scrutiny are pushing businesses to rely on more precise, compliant workforce planning. Hybrid work patterns and flexible shift models are also redefining how organizations balance productivity, employee preferences, and labor cost efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Widespread Shift to Cloud/SaaS Licensing

-

Regulatory Compliance Complexity

Level

-

Implementation Complexity

-

Integration & Data Sync Complexity

Level

-

Vertical Specialized Solution

-

Mobile-First Workforce Experience

Level

-

Regulatory Localization

-

Talent Shortage in WFM Implementation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver :Widespread Shift to Cloud/SaaS Licensing

The widespread shift to cloud and SaaS licensing is a major driver for the workforce management market, as organizations increasingly prioritize scalability, lower upfront costs, and faster deployment. Cloud-based WFM platforms enable real-time visibility into staffing, attendance, and productivity across distributed operations, supporting hybrid and remote workforce models. Automatic updates, built-in security, and seamless integration with HR, payroll, and ERP systems further accelerate adoption. SMEs, in particular, favor SaaS models for their affordability and reduced IT burden. Together, these advantages make cloud deployment a key catalyst for modernizing workforce operations and sustaining long-term market growth.

Restraint :Implementation Complexity

Implementation complexity is expected to be restraint for the workforce management market, as deploying WFM systems often requires extensive integration with existing HR, payroll, and ERP platforms. Organizations may face challenges related to data migration, customization, and aligning the software with diverse workforce policies and compliance rules. The need for training employees and IT teams further prolongs implementation timelines and increases costs. For large enterprises with multiple locations, standardizing processes across units adds additional difficulty. These factors can delay adoption and limit the pace of WFM deployment, especially among resource-constrained businesses.

Opportunities: Vertical Specialization

Vertical specialization is expected to present strong opportunity for the workforce management market as vendors increasingly tailor solutions to the unique operational needs of industries such as manufacturing, healthcare, retail, and logistics. Sector-specific functionalities like compliance tracking in healthcare, advanced scheduling in retail, or shift optimization in manufacturing enable organizations to achieve higher efficiency and faster ROI. This specialization enhances solution relevance, driving deeper adoption and long-term customer retention. As industries face distinct labor regulations and operational challenges, customized WFM capabilities become a key differentiator. Consequently, vertical-focused innovation opens new revenue streams and strengthens market penetration.

Challenge:Regulatory Localization

Regulatory localization is expected to be challenge for the WFM market because labor laws, compliance requirements, overtime rules, and union regulations vary significantly across countries, states, and even regions. Vendors must continuously update their platforms to reflect evolving legal standards, which increases development complexity and costs. Ensuring accuracy in areas like payroll, time tracking, and leave management becomes difficult when regulations change frequently. This also slows global deployments, as solutions must be customized for each jurisdiction. As a result, regulatory fragmentation creates operational hurdles for both vendors and enterprises adopting WFM systems.

workforce-management-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

MileOne Autogroup modernized its outdated workforce management practices by adopting Workday’s unified scheduling, time tracking, and absence management solutions. The new system gave frontline employees greater control over their schedules while enabling managers to plan labor needs more accurately using real-time data. This shift improved operational efficiency, reduced guesswork, and strengthened employee engagement across all dealerships. | MileOne consolidated five payroll systems into one, eliminated 100% of paper-based scheduling, and reduced manual HR administration time by 75%. Off-cycle payroll checks dropped by 70%, employee retention improved, and the company saved around $100K annually by digitizing records and reducing storage costs. The unified system boosted productivity, streamlined operations, and elevated overall workforce satisfaction. |

|

Omega Healthcare Management Services (Omega Healthcare) which had grown rapidly through acquisitions was struggling with fragmented, legacy IT systems across HR, finance, procurement and operations. To standardize processes, improve scalability and data visibility, the company implemented Oracle Fusion Cloud Applications (ERP, EPM and HCM), consolidating all acquired entities onto a unified platform. | As a result, Omega Healthcare slashed its quarterly financial close from 25 days to just 2 days and significantly improved capacity-planning, project and expense management. It also centralized HR/payroll and workforce management, enhanced data governance and compliance, and enabled faster, insight-driven decision-making across its global operations. |

|

SunOpta, a US and Canada-based manufacturer of beverages, broths, and snacks, transitioned from multiple disconnected HR and time-keeping systems to a unified Dayforce platform in 2019. By consolidating payroll, HR, time and attendance, recruiting, onboarding, and analytics into a single system of record, the company streamlined its workforce operations and reduced process complexity across all locations. | The shift to Dayforce enabled SunOpta to reduce HR headcount by more than 50% and cut payroll recalculation time by roughly 90%. Automated time and payroll processes improved compliance, enhanced accuracy, reduced manual effort, and, through Dayforce Wallet, provided faster wage access—strengthening overall employee experience and retention. |

|

Plains Commerce Bank with over 400 employees across more than 25 states was struggling with manual, paper-heavy HR and onboarding processes, disparate systems, and limited employee self-service. By implementing Paycor as a unified HR platform, the bank automated onboarding, payroll, benefits, time tracking, and employee lifecycle management. Paycor+1 | Plains Commerce Bank saved over 330 administrative hours annually by automating onboarding, and eliminated thousands of hours of manual work through automated workflows and notifications. They also realized cost savings for example, handling 600+ background checks via integrated tools saved about USD 20,000 while boosting employee engagement, self-service, and overall HR efficiency. |

|

Pilot Flying J a large fuel and retail-service network operating more than 950 travel-center locations across North America replaced its fragmented legacy HR/time and attendance systems with Infor Workforce Management (WFM). The organization moved from multiple disparate systems and manual processes to a unified, mobile-enabled solution that works across all sites. | With Infor WFM in place, Pilot Flying J replaced all disparate workforce systems with a single integrated platform, digitized time-tracking, scheduling, PTO requests, and payroll data collection. This reduced weekly payroll-data collection and verification time by about five hours, improved scheduling accuracy and attendance tracking, and allowed staff and managers to spend less time on admin and more on customer service ultimately improving operational efficiency and guest experience. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The workforce management ecosystem includes software vendors, service providers, system integrators, and cloud platform partners working together to deliver end-to-end workforce optimization. Core WFM solution providers offer modules for time tracking, scheduling, payroll, and analytics, while implementation partners ensure smooth deployment and integration with HRIS, ERP, and payroll systems. Cloud providers support scalable, secure infrastructure required for large-scale workforce operations. Technology partners specializing in AI, IoT, and analytics enhance system capabilities with forecasting, automation, and real-time insights. End users including enterprises across manufacturing, retail, healthcare, and BFSI form the demand side of the ecosystem, supported by compliance bodies and regulatory authorities that shape legal requirements. Together, these stakeholders create a connected environment enabling efficient and compliant workforce operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Workforce Management Market, By Offering

The solutions segment leads the workforce management market because organizations increasingly rely on advanced tools for scheduling, timekeeping, absence management, and labor analytics to optimize workforce efficiency. Growing adoption of AI-driven forecasting, automated shift planning, and cloud-based WFM suites strengthens demand for integrated solutions over standalone tools. Enterprises prefer unified platforms that enhance productivity, ensure compliance, and reduce labor costs. Additionally, rising digital transformation across manufacturing, retail, and healthcare accelerates investments in comprehensive WFM solutions, solidifying their dominant market share.

Workforce Management Market, By Solution Type

Time and attendance solutions are expected to hold the largest market share in the workforce management market due to their fundamental role in tracking employee work hours, managing shifts, and ensuring accurate payroll processing. These systems help organizations reduce time theft, improve compliance with labor regulations, and minimize manual errors. As industries face rising labor costs and tightening regulatory environments, businesses prioritize automated time-tracking tools to enhance visibility and control over workforce utilization. The shift toward biometric systems, mobile attendance, and cloud-based platforms further strengthens the dominance of time and attendance solutions across sectors.

Workforce Management Market, By Deployment Type

Cloud deployment is expected to grow at the highest CAGR in the workforce management market as organizations increasingly prioritize scalable, low-maintenance, and cost-efficient solutions. Cloud-based WFM platforms enable real-time data access, faster updates, and seamless integration with HR, payroll, and ERP systems. Their flexibility supports remote and hybrid work models, driving rapid adoption across industries. Additionally, reduced upfront investment and subscription-based pricing make cloud deployment especially attractive for SMEs, further accelerating its growth.

Workforce Management Market, By Vertical

The manufacturing segment is expected to hold the largest market share in the workforce management market due to its highly complex, multi-shift operations and strict compliance requirements. Manufacturers rely heavily on WFM tools to manage large hourly workforces, optimize shift planning, and maintain productivity across distributed plants. Rising automation, skill shortages, and stringent safety regulations further increase the need for accurate time tracking, labor forecasting, and workforce allocation. Additionally, growing adoption of digital manufacturing and Industry 4.0 accelerates the integration of advanced WFM systems to enhance operational efficiency and labor utilization.

REGION

Asia Pacific is expected to register a CAGR of 10.9% in the workforce management market during the forecast period.

Asia-Pacific is expected to grow at the highest CAGR in the workforce management market due to rapid industrial expansion, a large and diverse labor force, and accelerated digital transformation across manufacturing, retail, BFSI, and services sectors. Governments in countries like India, China, and Southeast Asian nations are promoting labor compliance modernization, boosting adoption of advanced WFM tools. SMEs and large enterprises are shifting quickly toward cloud-based solutions for scalability and cost efficiency. Additionally, rising workforce mobility and increasing investments in HR tech and automation further drive strong demand for modern WFM platforms across the region.

workforce-management-market: COMPANY EVALUATION MATRIX

In the workforce management market, Workday is evaluated as a Star due to its strong global presence, comprehensive WFM suite, and continuous innovation in payroll, time tracking, and workforce analytics. Its integrated cloud platform and large enterprise customer base position it as a top-tier vendor with strong market influence. IBM, meanwhile, is viewed as an Emerging Leader, gaining momentum through its advanced workforce scheduling, time management, and compliance-focused solutions, particularly in Europe. Its specialization in complex labor environments and growing adoption across retail, manufacturing, and logistics strengthen its upward trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ADP (US)

- SAP (Germany)

- Workday (US)

- Ceridian (US)

- Oracle (US)

- Paycor (US)

- Paychecx (US)

- Infor (US)

- BambooHR (US)

- Atoss Software (Germany)

- Nice (Israel)

- IBM (US)

- Ramco Systems (India

- Timeclock Plus (US)

- Sumtotal (US)

- Avature (UK)

- Sisqual Workforce Management (Portugal)

- ActiveOps (UK)

- Ultimate Software (US)

- Verint (US)

- Mark Information (US)

- Reflexis System (US)

- Authority Software (US)

- Paylocity (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 8.38 Billion |

| Market Forecast in 2030 (Value) | USD 13.03 Billion |

| Growth Rate | CAGR of 9.2% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: workforce-management-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | In-depth segmentation of the North America workforce management market Extended regional breakdowns for: Europe Asia Pacific Middle East & Africa Latin America | Identifies high-growth opportunities across digital transformation, cloud adoption, and enterprise modernization Enables tailored integration strategies aligning applications, infrastructure, and data systems Supports optimized technology investments and resource alignment to enhance interoperability, scalability, and operational efficiency across connected business environments |

| Leading Solution Provider (EU) | Detailed profiling of additional market players (up to 5 vendors), including product portfolios, strategic initiatives, and regional presence | Enhances competitive intelligence for strategic planning and go-to-market execution Reveals market gaps and white spaces for differentiation and innovation Supports targeted growth initiatives by aligning product development and sales strategies with unmet customer needs and emerging demand clusters |

RECENT DEVELOPMENTS

- September 2025 : ADP unveiled a suite of AI-powered features under its ADP Assist platform at Innovation Day, integrated into Workforce Now, ADP Global Payroll, and ADP Lyric HCM. These enhancements are designed to reduce manual HR workload by automatically detecting payroll anomalies, delivering instant HR analytics, monitoring global compliance, and providing AI-driven employee development recommendations. By embedding generative AI into core HR, payroll, and workforce workflows, ADP aims to help organizations operate faster, more accurately, and strategically, minimizing administrative burdens while improving compliance, insights, and overall workforce productivity.

- September 2025 : Oracle introduced new AI agents within Oracle Fusion Cloud Applications to streamline HR workflows from hire to retire. These agents automate tasks across recruitment, career development, performance management, payroll, and employee lifecycle processes, enabling HR leaders, managers, and employees to make data-driven decisions, improve workforce productivity, and enhance employee experience. Embedded natively within Oracle Cloud, the AI agents offer real-time guidance, personalized career insights, and operational efficiency across all HR functions.

- October 2024 : SAP SuccessFactors introduced AI-enhanced capabilities across its HCM suite to improve workforce management, upskilling, and organizational agility. The updates feature a talent intelligence hub for centralizing skills data, AI-assisted onboarding, 360-degree reviews, generative text support, and predictive role matching, streamlining HR processes and enhancing employee experience. These innovations reinforce SAP’s focus on intelligent, data-driven workforce management and talent development.

Table of Contents

Methodology

This research study on the workforce management market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), and directors specializing in business development, marketing, and workforce management providers. It also included key executives from system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the workforce management market. The first approach involved estimating the market size by the companies’ revenue generated through the sales of the workforce management market.

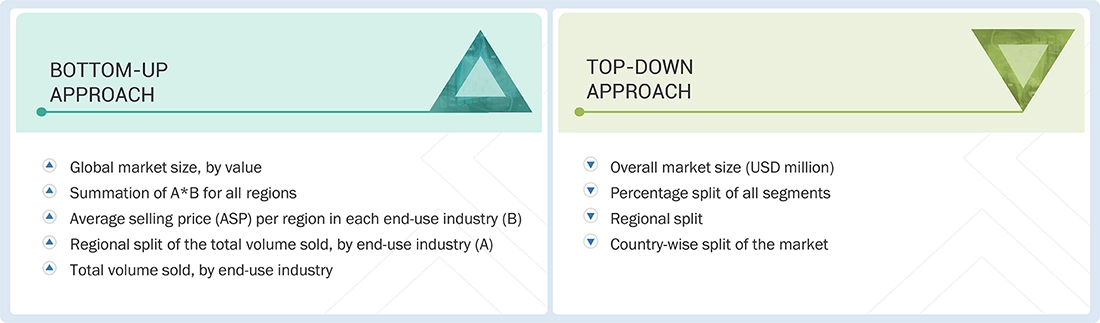

Market Size Estimation Methodology: Top-down Approach

The top-down approach estimates the overall workforce management market size by starting with a macro-level view, such as total IT spending or expenditures related to digital transformation. High-level industry or market values are divided and allocated into segments based on identified proportions by solution type, deployment model, organization size, or geography using researched splits. This approach uses broad market trends, industry reports, and expert insights to proportionately distribute the total value among various sub-markets, regions, and countries. It ensures that the overall estimation remains aligned with recognized industry benchmarks, enabling accurate segmentation and a holistic market perspective.

Market Size Estimation Methodology: Bottom-up Approach

The bottom-up approach for estimating the workforce management market size involves aggregating data at the most granular level, such as company revenues, to build up to the global figure. This process begins by collecting company-wise revenue data directly related to workforce management solutions and services. By analyzing the market share and revenue of key players and integrating percentage splits for different segments, such as by service line or industry, the total market size is calculated. Additional segmentation is performed by region or vertical, ensuring comprehensive coverage. The method then validates market estimates by comparing and consolidating segment results, providing a robust and detailed market size assessment derived from concrete, ground-level business activity.

Workforce Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down approach to estimate the size of other individual markets by applying percentage splits to the market segmentation.

Market Definition

Considering the views of various associations and sources, MarketsandMarkets defines a “Workforce management (WFM) refers to the integrated set of processes and tools that organizations use to optimize the productivity, scheduling, and utilization of their employees. It includes time and attendance tracking, labor forecasting, shift planning, leave and absence management, and compliance with labor regulations. By aligning staffing with operational demand, WFM helps organizations reduce costs, improve efficiency, and enhance employee experience.”

Key Stakeholders

- HR leaders

- HR operations teams

- Line managers

- Supervisors

- Employees

- Payroll teams

- Finance teams

- IT teams

- System administrators

- Compliance teams

Report Objectives

- To define, describe, and forecast the workforce management market based on offering, deployment mode, organization size, and vertical

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis Based on Feasibility

- Further breakup of the North American workforce management market

- Further breakup of the European workforce management market

- Further breakup of the Asia Pacific workforce management market

- Further breakup of the Middle East & Africa workforce management market

- Further breakup of the Latin American workforce management market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Workforce Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Workforce Management Market