Wireless Health Market by Technology (WPAN, WLAN/Wifi, WiMAX), Component (Hardware, Software, & Services), Application (Patient Specific and Provider/Payer Specific), & by End Users (Providers, & Payers) - Global Forecast to 2020

The global Wireless Health Market size is projected to grow at a CAGR of 23.1%. Growth in the overall market can largely be attributed to factors such as increasing advancements in wireless communication technologies, growing internet penetration, increasing utilization of connected devices in the management of chronic diseases, rising adoption of a patient-centric approach by healthcare providers, robust penetration of 3G and 4G networks in healthcare services, and mainstreaming of cloud computing.

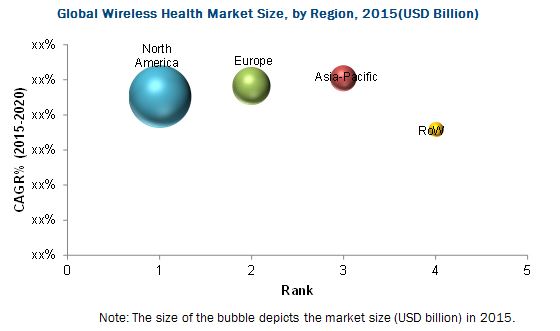

The market is expected to witness the highest growth in the Asia-Pacific region in the coming years. Growth in the Asia-Pacific region can be attributed to factors such as increasing population, growing internet penetration, rising medical tourism, increasing government initiatives for eHealth, and growing demand for quality healthcare.

The report segments the market of wireless health based on technologies, components, applications, end users, and regions. On the basis of technologies, the market is further segmented into WPAN, WLAN/WiFi, WiMAX, and WWAN. The WPAN technology market segment accounts for the largest share of the global market in 2015. The WPAN technology segment is further segmented into Bluetooth, RFID, Ant+, Zigbee, Z-wave, and UWB. The Bluetooth segment accounts for the largest share of the WPAN market in 2015. The large share of WPAN technologies can be attributed to the fact that these technologies are user friendly, secure, and affordable.

Allscripts Healthcare Solutions, Inc. (U.S.), AT &T, Inc. (U.S.), Cerner Corporation (U.S.), Omron Corporation (U.S.), Philips Healthcare (U.S.), Verizon Communications, Inc. (U.S.), Qualcomm, Inc. (U.S.), Aerohive Networks, Inc.(U.S.), Vocera Communications, Inc. (U.S.), and Alcatel-Lucent (U.S.) are some of the key players in the wireless health market worldwide.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience for the Report

- Healthcare institutions/providers (hospitals, medical groups, physicians’ practices, diagnostic centers, pharmacies, ambulatory centers, and outpatient clinics)

- Healthcare insurance companies/payers

- Healthcare IT service providers

- Venture capitalists

- Government bodies

- Corporate entities

- Accountable Care Organizations (ACOs)

Wireless Health Market Report Scope

This research report categorizes the global wireless health market into the following segments:

By Technology

- WLAN/Wi-Fi

-

WPAN

- ZigBee

- Bluetooth

- Ant+

- Ultra-wide Band (UWB)

- Z-wave

- RFID, RTLS, and IPS

- WiMAX

-

WWAN

- 3G and 4G

- GPRS

- CDMA

- GPS

By Component

- Software

- Hardware

- Services

By Application

- Patient-specific

- Physiological Monitoring

- Patient Communication and Support

- Provider/Payer-specific

By End User

- Providers

- Payers

- Patients/Individuals

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia-Pacific

- Japan

- China

- India

- Rest of APAC (ROAPAC)

- Rest of the World (RoW)

Available Customizations

- With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization option is available for the report:

- Portfolio Assessment

- Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies in the market

Wireless health is expected to transform the existing traditional and paper-based healthcare systems, ensuring quality care along with patient safety. Wireless health solutions can help reduce healthcare costs, streamline workflows in healthcare systems, and facilitate compliance with regulatory guidelines.

The global market is segmented on the basis of technologies, components, applications, and end users. The market is expected to be dominated by North America, followed by Europe, Asia-Pacific, and the Rest of the World (RoW). The Asia-Pacific region is expected to grow at the highest CAGR during the forecast period.

On the basis of components, the market is segmented into hardware, software, and services. The software segment accounts for the largest share of the global market in 2015. Increasing adoption of healthcare IT solutions and growing need for upgrading the existing software are the major driving factors for the growth of this market.

On the basis of technology, the market of wireless health is further segmented into WPAN, WLAN/WiFi, WiMAX, and WWAN. The WPAN technology market segment accounts for the largest share in the market in 2015. WPAN technologies are highly secure and affordable, making them one of the most widely adopted wireless health technologies. The WPAN technology segment is further segmented into Bluetooth, RFID, Ant+, ZIgbee, Z-wave, and UWB.

On the basis of applications, the market of wireless health is further segmented into patient-specific applications and provider/payer-specific applications. Patient-specific applications account for a major share of the global market in 2015 due to increasing adoption of wireless devices and rising need for quality care.

On the basis of end users, the market of wireless health is further segmented into providers, payers, and patients/individuals. The providers segment accounts for the major share of the global market in 2015.

Lack of skilled IT professionals and data security concerns are expected to restrain the growth of the market to a certain extent. In addition, lack of data management and interoperability issues pose as major challenges for the market. On the basis of region, this market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

Source: U.S. Department of Health and Human Services, Healthcare Information and Management Systems Society (HIMSS), National Association of Healthcare Quality, Centers for Disease Control and Prevention (CDC), Centers for Medicare and Medicaid Services (CMS), U.S. Department of Labor, The Agency for Healthcare Research and Quality (AHRQ), Medical Records Institute, General Physician Hospital Organization (GPHO), Association of Information and Image Management (AIIM), The Economist Intelligence Unit, American Health Information Management Association (AHIMA), World Health Organization (WHO), Healthcare IT News, Annual Reports, SEC Filings, Press Releases, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis

Frequently Asked Questions (FAQ):

What is the size of Wireless Health Market ?

The global Wireless Health Market size is growing at a CAGR of 23.1%

What are the major growth factors of Wireless Health Market ?

Growth in the overall market can largely be attributed to factors such as increasing advancements in wireless communication technologies, growing internet penetration, increasing utilization of connected devices in the management of chronic diseases, rising adoption of a patient-centric approach by healthcare providers, robust penetration of 3G and 4G networks in healthcare services, and mainstreaming of cloud computing.

Who all are the prominent players of Wireless Health Market ?

Allscripts Healthcare Solutions, Inc. (U.S.), AT &T, Inc. (U.S.), Cerner Corporation (U.S.), Omron Corporation (U.S.), Philips Healthcare (U.S.), Verizon Communications, Inc. (U.S.), Qualcomm, Inc. (U.S.), Aerohive Networks, Inc.(U.S.), Vocera Communications, Inc. (U.S.), and Alcatel-Lucent (U.S.) are some of the key players in the wireless health market worldwide. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 24)

2.1 Research Approach

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium in sights (Page No. - 36)

4.1 Global Wireless Health Market

4.2 Market, By Technology and Region

4.3 Market, By Region

4.4 Market, By Application (2015 vs 2020)

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Advancements in Wireless Communication Technology

5.3.1.2 Increasing Internet Penetration

5.3.1.3 Emergence of Wearable Devices

5.3.1.4 Increasing Utilization of Connected Devices in the Management of Chronic Diseases

5.3.1.5 Favorable HCIT Environment to Promote Wireless Health

5.3.1.6 Adoption of Patient-Centric Approach By Healthcare Providers

5.3.1.7 Robust Penetration of 3G and 4G Networks to Provide Uninterrupted Healthcare Services

5.3.1.8 Mainstreaming of Cloud Computing

5.3.2 Restraints

5.3.2.1 Resistance From Traditional Healthcare Providers

5.3.2.2 Fragmented End-User Market

5.3.2.3 Poor Internet Availability in Underdeveloped and Developing Countries

5.3.2.4 High Initial Price of Wearable Health Devices

5.3.2.5 Lack of Skilled It Professionals in the Healthcare Industry

5.3.3 Opportunities

5.3.3.1 Molecular Communications

5.3.3.2 Developments of Key Enabling Technologies

5.3.4 Challenges

5.3.4.1 Data Privacy & Security Concerns

5.3.4.2 Integration of Wireless Health Solutions Within Healthcare Organizations

5.3.4.3 Lack of Data Management and Interoperability

5.3.5 Regulatory Implications

5.3.5.1 ISO Standards – ISO 27799:2008 & ISO/Tr 27809:2007

5.3.5.2 Health Insurance Portability and Accountability Act (HIPAA)

5.3.5.2.1 HIPAA Privacy Rule

5.3.5.2.2 HIPAA Security Rule

5.3.5.3 Health Information Technology for Economic and Clinical Health Act (Hitech)

5.3.5.4 Federal Communications Commission (FCC)

5.3.5.5 CEN ISO/IEEE 11073

5.3.5.6 CEN/Cenelec

5.3.5.7 ETSI

6 Wireless Health Market, By Component (Page No. - 53)

6.1 Introduction

6.2 Hardware

6.3 Software

6.4 Services

7 Global Wireless Health Market, By Technology (Page No. - 58)

7.1 Introduction

7.1.1 WPAN

7.1.1.1 Bluetooth

7.1.1.2 RFID

7.1.1.3 ANT+

7.1.1.4 Zigbee

7.1.1.5 Z-Wave

7.1.1.6 UWB (Ultra-Wideband)

7.1.2 Wlan/Wi-Fi

7.1.3 Wimax

7.1.4 WWAN

7.1.4.1 3G

7.1.4.2 GPRS

7.1.4.3 CDMA

7.1.4.4 Global Positioning System (GPS)

8 Wireless Health Market, By Application (Page No. - 71)

8.1 Introduction

8.2 Patient-Specific Applications

8.2.1 Physiological Monitoring

8.2.2 Patient Communication and Support

8.3 Provider/Payer-Specific Applications

9 Wireless Health Market, By End User (Page No. - 78)

9.1 Introduction

9.2 Providers

9.3 Payers

9.4 Individuals/Patients

10 Wireless Health Market, By Region (Page No. - 83)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.1.1 Increasing Use of Data-Driven Technologies

10.2.1.2 Consolidation in the U.S. Healthcare Industry

10.2.1.3 Increasing Healthcare Spending

10.2.1.4 Regulatory Mandates in the U.S.

10.2.1.5 Venture Capital Funding

10.2.1.6 Growing Utilization of Mhealth Solutions in the U.S.

10.2.1.7 Violation of Healthcare Data Regulations Forms A Barrier in the Adoption of Wireless Healthcare Solutions in the U.S.

10.2.2 Canada

10.2.2.1 Digital Health Measures in Canada to Act as A Stimulus for the Wireless Health Market

10.2.2.2 Increasing Accessibility of Wireless Healthcare in Canada

10.2.2.3 Growing Data Breach Cases in Canada

10.3 Europe

10.3.1 Germany

10.3.1.1 Presence of A Strong Insurance System and Government Initiatives to Modernize the Healthcare System in Germany

10.3.2 U.K.

10.3.2.1 Government Initiatives in the U.K. to Improve Service Quality and Reduce Healthcare Costs

10.3.2.2 Increasing Healthcare It Penetration in the U.K.

10.3.3 France

10.3.3.1 Rising Geriatric Population to Create A Potential Market for Digital Healthcare in France

10.3.3.2 Government Support to Promote Wireless Health

10.3.4 Italy

10.3.4.1 Growing Focus of Players on the Market in Italy

10.3.5 Spain

10.3.5.1 Government Support to Digitalize Healthcare

10.3.5.2 Initiatives Taken By Domestic Players to Boost the Wireless Healthcare Market in Spain

10.3.6 Rest of Europe (RoE)

10.4 Asia-Pacific

10.4.1 Japan

10.4.1.1 Rising Aging Population in Japan to Create Need for Wireless Health Technology

10.4.1.2 Growing Focus of Stakeholders on the Japanese Market

10.4.2 China

10.4.2.1 Increased Venture Funding in China to Develop Digital Healthcare

10.4.2.2 Initiatives to Digitalize Healthcare in China

10.4.3 India

10.4.3.1 Low Doctor–Patient Ratio and High Internet Penetration

10.4.3.2 Digital India Initiative

10.4.4 Rest of Asia-Pacific

10.5 Rest of the World

10.5.1 Rising Awareness of Wireless Health Solutions in Brazil

11 Competitive Landscape (Page No. - 149)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 Agreements, Partnerships, and Collaborations

11.2.3 Product Launches and Enhancements

11.2.4 Expansions

11.2.5 Acquisitions

11.2.6 Other Developments

12 Company Profiles (Page No. - 157)

(Overview, Financials, Products & Services, Strategy, & Developments)*

12.1 Introduction

12.2 AT&T, Inc.

12.3 Philips Healthcare (A Subsidiary of Royal Philips Electronics)

12.4 Qualcomm, Inc.

12.5 Aerohive Networks, Inc.

12.6 Vocera Communications, Inc.

12.7 Allscripts Healthcare Solutions, Inc.

12.8 Alcatel-Lucent

12.9 Cerner Corporation

12.10 Omron Corporation

12.11 Verizon Communications, Inc.

*Details on Financials, Product & Services, Strategy, & Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 190)

13.1 Discussion Guide

13.2 Other Developments, By Company (2013–2015)

13.2.1 Cerner Corporation

13.2.2 AT&T, Inc.

13.2.3 Philips Healthcare (A Subsidiary of Royal Philips Electronics)

13.2.4 Omron Corporation

13.2.5 Verizon Communications, Inc.

13.2.6 Qualcomm, Inc.

13.2.7 Aerohive Networks, Inc.

13.2.8 Vocera Communication, Inc.

13.2.9 Allscripts Healthcare Solutions, Inc.

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (139 Tables)

Table 1 Technological Advancements and Growing Internet Penetration are Propelling the Growth of the Global Market

Table 2 Average Market Prices for Various Wearable Devices (2014)

Table 3 Market Growth Restrained By Resistance From Traditional Healthcare Providers & Poor Internet Availability

Table 4 Molecular Communications, A Key Area of Opportunity for Market Players

Table 5 Data Privacy and Security Concerns & Integration Issues in Wireless Health: Challenges to Market Growth

Table 6 Global Market Size, By Component, 2013–2020 (USD Million)

Table 7 Global Market Size for Hardware, By Region, 2013–2020 (USD Million)

Table 8 Global Market for Software, By Region, 2013–2020 (USD Million)

Table 9 Global Market Size for Services, By Region, 2013–2020 (USD Million)

Table 10 Market Size, By Technology, 2013–2020 (USD Million)

Table 11 Market Size for WPAN, By Region, 2013–2020 (USD Million)

Table 12 Market Size for WPAN, By Type, 2013–2020 (USD Million)

Table 13 Market Size for Bluetooth, By Region, 2013–2020 (USD Million)

Table 14 Market Size for RFID, By Region, 2013–2020 (USD Million)

Table 15 Market Size for ANT+, By Region, 2013–2020 (USD Million)

Table 16 Market Size for Zigbee, By Region, 2013–2020 (USD Million)

Table 17 Market Size for Z-Wave, By Region, 2013–2020 (USD Million)

Table 18 Market Size for UWB, By Region, 2013–2020 (USD Million)

Table 19 Market Size for Wlan/Wi-Fi, By Region, 2013–2020 (USD Million)

Table 20 Market Size for Wimax, By Region, 2013–2020 (USD Million)

Table 21 Market Size for WWAN, By Region, 2013–2020 (USD Million)

Table 22 Global Market Size, By Application, 2013–2020 (USD Million)

Table 23 Global Market Size for Patient-Specific Applications, By Region, 2013–2020 (USD Million)

Table 24 Global Market Size for Patient-Specific Applications, By Type, 2013–2020 (USD Million)

Table 25 Global Market Size for Physiological Monitoring, By Region, 2013–2020 (USD Million)

Table 26 Global Market Size for Patient Communication and Support, By Region, 2013–2020 (USD Million)

Table 27 Global Market Size for Provider/Payer-Specific Applications, By Region, 2013–2020 (USD Million)

Table 28 Global Market Size, By End User, 2013–2020 (USD Million)

Table 29 Global Market Size for Providers, By Region, 2013–2020 (USD Million)

Table 30 Global Market for Payers, By Region, 2013–2020 (USD Million)

Table 31 Global Market Size for Patients/Individuals, By Region, 2013–2020 (USD Million)

Table 32 North America: Market Size, By Country, 2013–2020 (USD Million)

Table 33 North America: Market Size, By Technology, 2013–2020 (USD Million)

Table 34 North America: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 35 North America: Market Size, By Component, 2013–2020 (USD Million)

Table 36 North America: Market Size, By Application, 2013–2020 (USD Million)

Table 37 North America: Patient-Specific Applications Market, By Type, 2013–2020 (USD Million)

Table 38 North America: Market, By End User, 2013–2020 (USD Million)

Table 39 Digital Healthcare Deals in the U.S., 2015

Table 40 U.S.: Macroeconomic Indicators for the HCIT Market

Table 41 Top 10 Data Breaches in the U.S. in 2015

Table 42 Healthcare Data Breach, By Type of Entity

Table 43 U.S.: Market Size, By Technology, 2013–2020 (USD Million)

Table 44 U.S.: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 45 U.S.: Market Size, By Component, 2013–2020 (USD Million)

Table 46 U.S.: Market Size, By Application, 2013–2020 (USD Million)

Table 47 U.S.: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 48 U.S.: Market Size, By End User, 2013–2020 (USD Million)

Table 49 Recent Data Breach Cases in Canada

Table 50 Canada: Market Size, By Technology, 2013–2020 (USD Million)

Table 51 Canada: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 52 Canada: Market Size, By Component, 2013–2020 (USD Million)

Table 53 Canada: Market Size, By Application, 2013–2020 (USD Million)

Table 54 Canada: Patient-Specific Applications Market, By Type, 2013–2020 (USD Million)

Table 55 Canada: Market, By End User, 2013–2020 (USD Million)

Table 56 Europe: Market Size, By Country, 2013–2020 (USD Million)

Table 57 Europe: Market Size, By Technology, 2013–2020 (USD Million)

Table 58 Europe: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 59 Europe: Market Size, By Component, 2013–2020 (USD Million)

Table 60 Europe: Market Size, By Application, 2013–2020 (USD Million)

Table 61 Europe: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 62 Europe: Market Size, By End User, 2013–2020 (USD Million)

Table 63 Germany: Market Size, By Technology, 2013–2020 (USD Million)

Table 64 Germany: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 65 Germany: Market Size, By Component, 2013–2020 (USD Million)

Table 66 Germany: Wireless Health Market Size, By Application, 2013–2020 (USD Million)

Table 67 Germany: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 68 Germany: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 69 U.K.: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 70 U.K.: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 71 U.K.: Wireless Health Market Size, By Component, 2013–2020 (USD Million)

Table 72 U.K.: Market Size, By Application, 2013–2020 (USD Million)

Table 73 U.K.: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 74 U.K.: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 75 France: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 76 France: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 77 France: Market Size, By Component, 2013–2020 (USD Million)

Table 78 France: Market Size, By Application, 2013–2020 (USD Million)

Table 79 France: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 80 France: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 81 Italy: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 82 Italy: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 83 Italy: Market Size, By Component, 2013–2020 (USD Million)

Table 84 Italy: Market Size, By Application, 2013–2020 (USD Million)

Table 85 Italy: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 86 Italy: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 87 Spain: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 88 Spain: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 89 Spain: Market Size, By Component, 2013–2020 (USD Million)

Table 90 Spain: Market Size, By Application, 2013–2020 (USD Million)

Table 91 Spain : Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 92 Spain: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 93 RoE: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 94 RoE: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 95 RoE: Market Size, By Component, 2013–2020 (USD Million)

Table 96 RoE: Market Size, By Application, 2013–2020 (USD Million)

Table 97 RoE: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 98 RoE: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 99 APAC: Wireless Health Market Size, By Country, 2013–2020 (USD Million)

Table 100 APAC: Market Size, By Technology, 2013–2020 (USD Million)

Table 101 APAC: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 102 APAC: Market Size, By Component, 2013–2020 (USD Million)

Table 103 APAC: Market Size, By Application, 2013–2020 (USD Million)

Table 104 APAC: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 105 APAC: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 106 Japan: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 107 Japan: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 108 Japan: Market Size, By Component, 2013–2020 (USD Million)

Table 109 Japan: Market Size, By Application, 2013–2020 (USD Million)

Table 110 Japan: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 111 Japan: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 112 China: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 113 China: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 114 China: Market Size, By Component, 2013–2020 (USD Million)

Table 115 China: Market Size, By Application, 2013–2020 (USD Million)

Table 116 China: Patient-Specific Applications Market, By Type, 2013–2020 (USD Million)

Table 117 China: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 118 India: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 119 India: WPAN Market Size, By Type, 2013–2020 (USD Million)

Table 120 India: Wireless Health Market Size, By Component, 2013–2020 (USD Million)

Table 121 India: Wireless Health Market Size, By Application, 2013–2020 (USD Million)

Table 122 India: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 123 India: Wireless Health Market, By End User, 2013–2020 (USD Million)

Table 124 RoAPAC: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 125 RoAPAC: WPAN Market Size, By Technology, 2013–2020 (USD Million)

Table 126 RoAPAC: Market Size, By Component, 2013–2020 (USD Million)

Table 127 RoAPAC: Market Size, By Application, 2013–2020 (USD Million)

Table 128 RoAPAC: Patient-Specific Applications Market Size, By Type, 2013–2020 (USD Million)

Table 129 RoAPAC: Wireless Health Market Size, By End User, 2013–2020 (USD Million)

Table 130 RoW: Wireless Health Market Size, By Technology, 2013–2020 (USD Million)

Table 131 RoW: WPAN Market Size, By Type, 2013–2020 (USD Million)

Table 132 RoW: Market Size, By Component, 2013–2020 (USD Million)

Table 133 RoW: Market Size, By Application, 2013–2020 (USD Million)

Table 134 RoW: Patient-Specific Applications Market, By Type, 2013–2020 (USD Million)

Table 135 RoW: Wireless Health Market, By End User, 2013–2020 (USD Million)

Table 136 Agreements, Partnerships, and Collaborations, 2013–2015

Table 137 Product Deployments, 2013–2015

Table 138 Product Launches & Enhancements, 2013–2015

Table 139 Other Developments, 2013–2015

List of Figures (37 Figures)

Figure 1 Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Software Solutions to Register Highest CAGR During the Forecast Period

Figure 6 WPAN Technology Segment to Dominate the Global Wireless Health Market in the Forecast Period

Figure 7 Healthcare Providers Holds Largest Share of the End-Users Market

Figure 8 Geographic Analysis: Global Wireless Health Market (2015)

Figure 9 North America Accounts for the Major Share in the Global Wireless Health Market

Figure 10 North America Dominated the Market in 2015

Figure 11 Asia-Pacific Region to Witness Highest Growth Rate During the Forecast Period

Figure 12 Patient-Specific Applications Command the Largest Share

Figure 13 Global Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Software Segment to Register the Highest Growth During the Forecast Period

Figure 15 WPAN to Dominate the Global Market in the Forecast Period

Figure 16 Bluetooth Technology to Dominate the Global WPAN Market During the Forecast Period

Figure 17 Patient-Specific Application is the Largest Application Segment in the Wireless Health Market in 2015

Figure 18 Global Market Size, By End User, 2015–2020 (USD Million)

Figure 19 Global Market: Regional Snapshot

Figure 20 North America Wireless Health Market Snapshot

Figure 21 VC Funding for HCIT in the U.S. (USD Million), 2010-2014

Figure 22 European Market Snapshot

Figure 23 Asia Pacific Market Snapshot

Figure 24 RoW Market Snapshot

Figure 25 Top 5 Strategies Adopted By Key Players From 2013-2015

Figure 26 Battle for Market Share: Agreements, Collaborations, and Partnerships Was the Key Strategy Adopted By Market Players (2013–2015)

Figure 27 Geographic Revenue Mix of Key Players in the Wireless Health Market

Figure 28 AT&T, Inc.: Company Snapshot

Figure 29 Royal Philips Electronics: Company Snapshot

Figure 30 Qualcomm, Inc.: Company Snapshot

Figure 31 Aerohive Networks, Inc.: Company Snapshot

Figure 32 Vocera Communications, Inc.: Company Snapshot

Figure 33 Allscripts Healthcare Solutions, Inc.: Company Snapshot

Figure 34 Alcatel-Lucent: Company Snapshot

Figure 35 Cerner Corporation: Company Snapshot

Figure 36 Omron Corporation: Company Snapshot

Figure 37 Verizon Communications, Inc.: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wireless Health Market