Wireless Power Transmission Market by Technology (Induction, Magnetic Resonance), Implementation, Transmitter, and Receiver Application (Smartphones, Electric Vehicles, Wearable Electronics, and Furniture) and Geography - Global Forecast to 2022

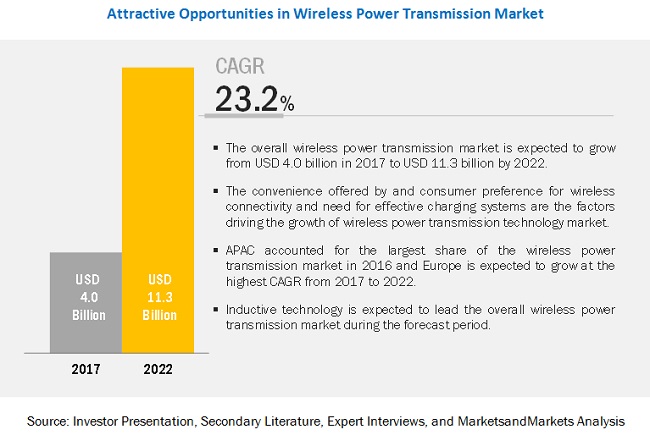

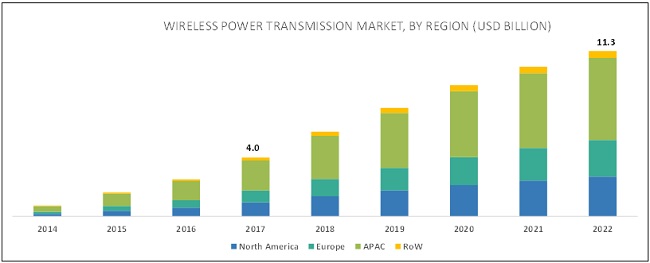

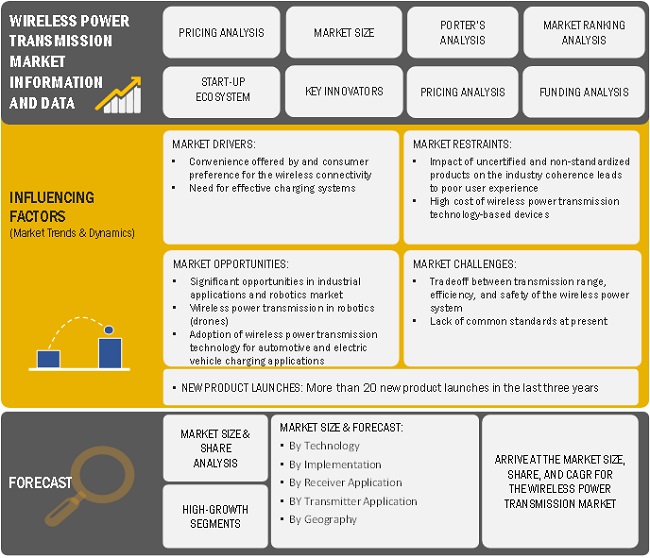

[163 Pages Report] MarketsandMarkets forecasts the wireless power transmission market to grow from USD 2.5 billion in 2016 to USD 11.3 billion by 2022, at a CAGR of 23.2% between 2017 and 2022. The key factors driving the growth of the market include the convenience offered by and consumer preference for wireless connectivity and need for effective charging systems. However, the impact of uncertified and non-standardized products on the industry coherence leads to poor user experience and high cost of wireless power transmission technology-based devices are the key restraining factors for market growth.

Wireless power transmission market for inductive technology to hold largest share of the market during forecast period

Currently, wireless power transmission is based on the two technologies; inductive and magnetic resonance. Inductive technology has almost commoditized in the wireless power transmission market, especially for the consumer electronics applications; therefore, held the largest market share in 2016. Smartphones, tablets, wearable devices are some key applications of the inductive wireless power transmission. On the other hand, magnetic resonance technology is yet to mainstream.

Wireless power transmission market for smartphones receiver application to hold largest size of wireless power transmission technology from 2017 to 2022

Smartphones is the largest receiver application for wireless power transmission technology owing to the adoption of inductive wireless power transmission in various smartphones in the past years. Samsung Galaxy Series, Motorola Droid phones, and Google Nexus phones are some notable smartphones, which have wireless charging capabilities. Samsung Electronics Co., Ltd. (South Korea) has a major product portfolio of smartphones integrated with wireless charging receiver capabilities.

Wireless power transmission market in APAC to hold the largest share of the market during forecast period

APAC is considered as the manufacturing hub for consumer electronic products such as smartphones, tablets, laptops, and wearable devices. Its huge population and rapid urbanization in the past has led to the significant demand for devices. Thus, the presence of large consumer electronics industries in the counties such as China, Japan, India, and South Korea has attributed to the huge market size of the APAC region in the global wireless power transmission technology market.

Market Dynamics

Driver: Convenience offered by and consumer preference for the wireless connectivity

Currently, wireless connectivity technologies are being adopted at a high rate. The user wants to get rid of the wired connectivity because of its complexity. Nowadays, consumers expect robust wireless services everywhere including smartphones, notebooks, MP3 players, and digital cameras. Wireless connectivity offers users the freedom of mobility, quick and easy accordance, and handy operations which is why the wireless charging technology is highly deployed in consumer electronics such as smartphones, tablets, and wearable devices. This increasing go-wireless tendency of consumers is driving the market for the wireless power transmission technology. Many companies are providing wireless charging-enabled devices that are user friendly, cost effective, and has lifespan of 10 to 15 years. This results into the increasing demand for these devices in the market.

Restraint: Impact of uncertified and non-standardized products on the industry coherence leads to poor user experience

The wireless power transmission technology has become crucially important nowadays due to its successful implementation into consumer electronic products. Thus, to fulfil the increasing demand, various players, including start-up companies along with their innovative ideas, are entering the market to offer the wireless power transmission technology. This increases competitive pressures among the suppliers of wireless power transmission technology-based products. It is challenging for the Wireless Power Consortium (WPC) and Airfuel Alliance to bring small- and mid-sized suppliers of wireless charging products under their umbrella. Asto gain the competitive advantage, some manufacturers are launching the non-standardized and uncertified products (Qi/Rezence), at a lower cost compared to the standardized and certified products. However, the quality of these non-standardized and non-certified products is not guaranteed, and safety issue is also the main concern in these products Thus, the introduction of such uncertified products hinders the growth of the market for wireless power transmission technology.

Opportunity: Wireless power transmission in robotics (drones)

The wireless power transmission technology has been used for the research and development of mini and micro robots for wireless power transfer. Several research programs pertaining to wireless powered-drones are taking place. A transmitting coil is expected to transmit power at a higher frequency, which would be received by the receiver in robots. Imperial College of London has successfully demonstrated the wireless-powered drone which is likely to operate above five inch of wireless power transmitter. ZiiEnergy, Inc. (U.S.) developing the wireless drone receiver which works on Open Dots Alliance (ODA) standards and can deliver 45 watts of power to drones.

Challenge: Tradeoff between transmission range, efficiency, and safety of the wireless power system

The wireless power transmission technology is witnessing high growth in consumer electronics applications. It can charge various devices such as smartphones, tablets, and smartwatches. However, the wireless power transmission technology currently faces some limitations. The transmission range of wireless power transmission through electromagnetic induction and or by magnetic resonance technique is limited. This limitation of the range poses a serious challenge for the manufacturers. The efficiency of the power is inversely proportional to the distance between the transmitter and receiver. Safety issue is also the main concern for the wireless transmission market as strong electromagnetic fields may harm the biological environment. Every year, many start-ups companies enter this market, do their research activities, develop product prototypes, make the announcement of their products, and at the end, they fail to launch these products. Safety and efficiency issues make them impossible to go ahead in this market.

Scope of Report:

|

Report Metric |

Details |

|

Report Name |

Wireless Power Transmission Market |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Value (USD) in million/billion |

|

Segments covered |

Technology, implementation, receiver application, and transmitter application |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Samsung Electronics Co., Ltd. (South Korea), Qualcomm Inc. (U.S.), Texas Instruments Inc. (U.S.), TDK Corporation (Japan), WiTricity Corporation (U.S.), Integrated Device Technology, Inc. (U.S.), NuCurrent Inc. (U.S.), PowerbyProxi Ltd. (New Zealand), ConvenientPower HK Ltd. (Hong Kong), Salcomp Plc. (Finland), and Powermat Technologies Ltd. (Israel) |

This research report categorizes the global wireless power transmission market on the basis of technology, implementation, receiver application, transmitter application, and geography.

Wireless Power Transmission Market By Technology:

- Near-Field Technology

- Inductive

- Magnetic Resonance

- Capacitive Coupling/Conductive

- Far-Field Technology

- Microwave/RF

- Laser/Infrared

Wireless Power Transmission Market By Implementation:

- Integrated

- Aftermarket

Wireless Power Transmission Market By Receiver Application:

- Smartphones

- Tablets

- Wearable Electronics

- Notebooks

- Other Consumer Electronics

- Electric Vehicle Charging

- Industrial

Wireless Power Transmission Market By Transmitter Application:

- Standalone Chargers

- Automotive (In Vehicle)

- Electric Vehicle Charging

- Furniture

- Industrial

Wireless Power Transmission Market By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Key Market Players

As of 2016, Texas Instruments, Inc. (US), Qualcomm, Inc. (US), Integrated Device Technology, Inc. (US), Semtech Corp. (US), Toshiba Corp. (Japan), Panasonic Corp. (Japan), and Rohm Co., Ltd. (Japan) were the major players in the wireless power transmission market.

Texas Instruments, Inc. (U.S.) is one of the most prominent semiconductor companies and, thus, it ranked first in the component supplier list for wireless power transmission technology. The company has a broad product portfolio of wireless power transmitter and receiver ICs and modules, ranging from low to high power requirements. The company is focusing on the different applications such as wearables, smart phones, automotive, industrial, and medical. Thus, with the robust R7D activities and large geographical coverage, Texas Instruments, Inc. (U.S.) is expected to remain a key ICs supplier in the wireless power transmission technology market.

Key Developments

- In February 2017, WiTricity Corp. announced a collaboration with Nissan Motor Company, Ltd. (Japan) for the wireless charging of electrical vehicles. This will help the company focus on the integrating their wireless charging technology into electric vehicles.

- In January 2017, Dell, Inc. (U.S.) launched the magnetic resonance technology based wireless charging notebook. The company has integrated the WiTricity wireless charging technology in the notebook.

- In November 2016, PowerbyProxi Ltd. launched the Proxi-Module 100W modular wireless power system. It is specially designed for industrial applications such as transferring power across rotating or vibrating joints, in between hot swap connectors to transfer power, and to transfer power in hazardous and dusty environments.

Key Questions Answered:

- Which type of technology is expected to have the highest demand in the future?

- Which is the most dominated application for wireless power transmission in the market?

- Which are the key geographies for wireless power transmission in the market?

- What are the key trends in the wireless power transmission market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objective of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographical Scope

1.3.3 Years Consider for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 List of Major Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Primary Interviews With Experts

2.3.2 Breakdown of Primaries

2.3.3 Key Data From Primary Sources

2.3.4 Secondary and Primary Research

2.3.5 Key Industry Insights

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.4.2 Top Down Approach

2.4.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumption

3 Executive Summary

4 Premium Insights

4.1 Wireless Power Transmission Market Opportunities

4.2 Inductive WPT Market, By Component

4.3 Market for Inductive Technology, By Implementation

4.4 Market for Inductive Technology, By Receiver Application and Region

4.5 Market for Magnetic Resonance Technology, By Transmitter Application

4.6 Market for Inductive Technology, By Geography

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Technology

5.2.2 By Implementation

5.2.3 By Receiver Application

5.2.4 By Transmitter Application

5.2.5 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Convenience Offered By and Consumer Preference for Wireless Connectivity

5.3.1.2 Need for Effective Charging Systems

5.3.2 Restraints

5.3.2.1 Impact of Uncertified and NonStandardized Products on the Industry Coherence Leads to Poor User Experience

5.3.2.2 High Cost of Wireless Power Transmission Technology-Based Devices

5.3.3 Opportunities

5.3.3.1 Significant Opportunities in Industrial Applications and Robotics Market

5.3.3.1.1 Wireless Power Transmission in Robotics (Drones)

5.3.3.2 Adoption of Wireless Power Transmission Technology for Automotive and Electric Vehicle Charging Applications

5.3.3.2.1 Development of the Wireless Charging System By Korea Advanced Institute of Science and Technology

5.3.4 Challenges

5.3.4.1 Tradeoff Between Transmission Range, Efficiency, and Safety of the Wireless Power System

5.3.4.2 Lack of Common Standards at Present

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Analysis of Future Applications

6.4 Wireless Power Standards Developing Alliances

6.4.1 Wireless Power Consortium

6.4.2 Airfuel Alliance

6.4.3 Open Dots Alliance

6.4.4 Adoption of Standards

6.5 Porters Five Forces Model

6.5.1 Bargaining Power of Suppliers

6.5.2 Bargaining Power of Buyers

6.5.3 Intensity of Competitive Rivalry

6.5.4 Threat of Substitutes

6.5.5 Threat of New Entrants

6.6 Pricing Analysis for Wireless Power Transmitter and Receiver

6.7 Key Funding and Investments in the Wireless Power Transmission Technology Market

7 Wireless Power Transmission Market, By Technology

7.1 Introduction

7.2 Near-Field Technologies

7.2.1 Inductive Technology

7.2.2 Magnetic Resonance Technologies

7.2.3 Capacitive Coupling/Conductive

7.3 Far-Field Technologies

7.3.1 Microwave/Rf

7.3.2 Laser/Infrared

8 Wireless Power Transmission Market, By Implementation

8.1 Introduction

8.2 Aftermarket

8.3 Integrated

9 Wireless Power Transmission Market, By Receiver Application

9.1 Introduction

9.2 Smartphones

9.3 Tablets

9.4 Wearable Electronics

9.5 Notebooks

9.6 Other Consumer Electronics

9.7 Electrical Vehicle Charging

9.8 Industrial

10 Wireless Power Transmission Market, By Transmitter Application

10.1 Introduction

10.2 Standalone Chargers

10.3 Automotive (In-Vehicle Charging System)

10.4 Electric Vehicle Charging

10.5 Furniture

10.6 Industrial

11 Wireless Power Transmission Market, By Geography

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Rest of North America

11.3 Europe

11.3.1 UK

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia Pacific (APAC)

11.4.1 China

11.4.2 Japan

11.4.3 South Korea

11.4.4 India

11.4.5 Rest of APAC

11.5 Rest of the World

11.5.1 Middle East & Africa

11.5.2 South America

12 Competitive Landscape

12.1 Overview

12.2 Market Ranking Analysis: Wireless Power Transmission Technology Market

12.3 Competitive Situations and Trends

12.3.1 New Product Launches

12.3.2 Partnerships, Agreements, Collaborations, and Contracts

13 Company Profiles

13.1 Integrated Device Technology, Inc.

13.1.1 Business Overview

13.1.2 Products Offered

13.1.3 Recent Developments

13.1.4 SWOT Analysis

13.1.5 MnM View

13.2 Qualcomm, Inc.

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 SWOT Analysis

13.2.5 MnM View

13.3 Samsung Electronics Co., LTD.

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 SWOT Analysis

13.3.5 MnM View

13.4 TDK Corporation

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.4.4 SWOT Analysis

13.4.5 MnM View

13.5 Texas Instruments, Inc.

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.5.4 SWOT Analysis

13.5.5 MnM View

13.6 Nucurrent, Inc.

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.7 Powermat Technologies, LTD.

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 Recent Developments

13.8 Powerbyproxi, LTD.

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.9 Witricity Corporation

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 Recent Developments

13.10 Convenientpower Hk, LTD.

13.10.1 Business Overview

13.10.2 Products Offered

13.11 Salcomp PLC

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 Recent Developments

14 Other Players

14.1 Bae Systems PLC

14.2 Ossia Inc.

14.3 Energous Corporation

14.4 Fulton Innovation LLC

14.5 Humavox LTD.

14.6 Wi Charge LTD.

14.7 Energysquare

14.8 Everpurse

14.9 Put2Go

14.10 Fulton Innovation

15 Appendix

15.1 Insights of Industry Experts

15.2 Discussion Guide for the Wireless Power Transmission (WPT) Market

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (105 Tables)

Table 1 Wireless Power Transmission Market Segmentation, By Technology

Table 2 Wireless Power Transmission Market Segmentation, By Implementation

Table 3 WPT Market Segmentation, By Receiver Application

Table 4 WPT Market Segmentation, By Transmitter Application

Table 5 Future Applications in Wireless Power Transmission Technology

Table 6 List of WPC Members

Table 7 List of Board Member Companies

Table 8 Prices of Different Products Based on Wireless Power Transmission Technology

Table 9 Funding and Investments Into the Wireless Charging Market

Table 10 Wireless Power Transmission Market, By Technology, 20172025(USD Million)

Table 11 Market for Inductive Technology, By Component, 20172025(USD Million)

Table 12 Market for Inductive Technology, By Component, 20172025(Million Units)

Table 13 Market for Inductive Technology, By Receiver Application, 20172025(USD Million)

Table 14 Market for Inductive Technology, By Transmitter Application, 20172025(USD Million)

Table 15 Market for Inductive Technology, By Region, 20172025(USD Million)

Table 16 Market for Magnetic Resonance Technology, By Component, 20172025(USD Million)

Table 17 Magnetic Resonance Technology Market, By Receiver Application, 20172025(USD Million)

Table 18 Magnetic Resonance Technology Market, By Transmitter Application, 20172025(USD Million)

Table 19 Magnetic Resonance Technology Market, By Region, 20172025(USD Million)

Table 20 Market for Inductive Technology, By Implementation, 20172025(USD Million)

Table 21 Inductive WPT Market for Aftermarket Solutions, By Receiver Application, 20172025(USD Million)

Table 22 Induction WPT Market for Integrated Implementation, By Receiver Application, 20172025(USD Million)

Table 23 Market for Receiver Applications, By Technology, 20172025(USD Million)

Table 24 Global Market, By Receiver Application, 20172025(USD Million)

Table 25 Inductive WPT Market for Receiver Application, By Region, 20172025(USD Million)

Table 26 Market for Smartphone Receivers, By Technology, 20172025(USD Million)

Table 27 Market for Smartphone Receivers, By Implementation, 20172025 (USD Million)

Table 28 Inductive WPT Market for Smartphones Receivers, By Region, 20172025(USD Million)

Table 29 Market for Tablet Receivers, By Technology, 20172025(USD Million)

Table 30 Market for Tablet Receivers, By Implementation, 20172025(USD Million)

Table 31 Inductive WPT Market for Tablet Receivers, By Region, 20172025(USD Million)

Table 32 Market for Wearable Electronic Receivers, By Technology, 20172025(USD Million)

Table 33 Market for Wearable Electronics Receivers, By Implementation, 20172025 (USD Million)

Table 34 Inductive WPT Market for Wearable Electronics Receivers, By Region, 20172025 (USD Million)

Table 35 Market for Notebook Receivers, By Technology, 20172025(USD Million)

Table 36 Market for Notebook Receivers, By Implementation, 20172025(USD Million)

Table 37 Inductive WPT Market for Notebooks Receivers, By Region, 20172025(USD Million)

Table 38 Market for Other Consumer Electronics Receivers, By Technology, 20172025(USD Million)

Table 39 Market for Other Consumer Electronics Receivers, By Implementation, 20172025(USD Million)

Table 40 Inductive WPT Market for Other Consumer Electronics Receivers, By Region, 20172025(USD Million)

Table 41 Market for Electric Vehicle Receivers, By Technology, 20172025(USD Million)

Table 42 Market for Electric Vehicle Receivers, By Implementation, 20172025(USD Million)

Table 43 Inductive WPT Market By Electric Vehicle Receivers, By Region, 20172025(USD Million)

Table 44 Market for Industrial Receivers, By Technology, 20172025(USD Million)

Table 45 Market for Industrial Receivers, By Implementation, 20172025(USD Million)

Table 46 Inductive WPT Market for Industrial Receivers, By Region, 20172025(USD Million)

Table 47 Market for Transmitter Application, By Technology, 20172025(USD Million)

Table 48 Market, By Transmitter Application, 20172025(USD Million)

Table 49 Inductive WPT Market for Transmitter Applications, By Region, 20172025(USD Million)

Table 50 Market for Standalone Chargers, By Technology, 20172025(USD Million)

Table 51 Inductive WPT Market for Standalone Chargers, By Region, 20172025(USD Million)

Table 52 Market for Automotive Transmitters, By Technology, 20172025(USD Million)

Table 53 Inductive WPT Market for Automotive Transmitters, By Region, 20172025(USD Million)

Table 54 Market for Electric Vehicle Charging Transmitters, By Technology, 20172025(USD Million)

Table 55 Inductive WPT Market for Electric Vehicle Charging Transmitters, By Region, 20172025(USD Million)

Table 56 Market for Furniture Transmitters, By Technology, 20172025(USD Million)

Table 57 Inductive WPT Market, for Furniture Transmitters, By Region, 20172025(USD Million)

Table 58 Market for Industrial Transmitters, By Technology, 20172025(USD Million)

Table 59 Inductive WPT Market for Industrial Transmitters, By Region, 20172025(USD Million)

Table 60 Inductive WPT Market, By Region, 20172025(USD Million)

Table 61 Inductive WPT Market in North America, By Country, 20172025(USD Million)

Table 62 Inductive WPT Market in North America, By Technology, 20172025(USD Million)

Table 63 Inductive Market in North America, By Receiver Application, 20172025(USD Million)

Table 64 Inductive Market in US, By Receiver Application, 20172025(USD Million)

Table 65 Inductive Market in Rest of North America, By Receiver Application, 20172025(USD Million)

Table 66 Inductive WPT Market in North America, By Transmitter Application, 20172025(USD Million)

Table 67 Inductive WPT Market in US, By Transmitter Application, 20172025(USD Million)

Table 68 Inductive WPT Market in Rest of North America, By Transmitter Application, 20172025(USD Million)

Table 69 Inductive Market in Europe, By Country, 20172025(USD Million)

Table 70 Inductive Market in Europe, By Technology, 20172025(USD Million)

Table 71 Inductive WPT Market in Europe, By Receiver Application, 20172025(USD Million)

Table 72 Inductive WPT Market in UK, By Receiver Application, 20172025(USD Million)

Table 73 Inductive WPT Market in Germany, By Receiver Application, 20172025(USD Million)

Table 74 Inductive WPT Market in France, By Receiver Application, 20172025(USD Million)

Table 75 Inductive WPT Market in Rest of Europe, By Receiver Application, 20172025(USD Million)

Table 76 Inductive market in Europe, By Transmitter Application, 20172025(USD Million)

Table 77 Inductive WPT Market in UK, By Transmitter Application, 20172025(USD Million)

Table 78 Inductive WPT Market in Germany, By Transmitter Application, 20172025(USD Million)

Table 79 Inductive WPT Market in France, By Transmitter Application, 20172025(USD Million)

Table 80 Inductive Market in Rest of Europe, By Transmitter Application, 20172025(USD Million)

Table 81 Inductive WPT Market in APAC, By Country, 20172025(USD Million)

Table 82 Inductive WPT Market in APAC, By Technology, 20172025(USD Million)

Table 83 Inductive WPT Market in APAC, By Receiver Application, 20172025(USD Million)

Table 84 Inductive Market in China, By Receiver Application, 20172025(USD Million)

Table 85 Inductive WPT Market in India, By Receiver Application, 20172025(USD Million)

Table 86 Inductive WPT Market in Japan, By Receiver Application, 20172025(USD Million)

Table 87 Inductive WPT Market in South Korea, By Receiver Application, 20172025(USD Million)

Table 88 Inductive WPT Market in Rest of APAC, By Receiver Application, 20172025(USD Million)

Table 89 Inductive Market in APAC, By Transmitter Application, 20172025(USD Million)

Table 90 Inductive Market in China, By Transmitter Application, 20172025(USD Million)

Table 91 Inductive Market in India, By Transmitter Application, 20172025(USD Million)

Table 92 Inductive Market in Japan, By Transmitter Application, 20172025(USD Million)

Table 93 Inductive WPT Market in South Korea, By Transmitter Application, 20172025(USD Million)

Table 94 Inductive WPT Market in Rest of APAC, By Transmitter Application, 20172025(USD Million)

Table 95 Inductive Market in RoW, By Region, 20172025(USD Million)

Table 96 Inductive Market in RoW, By Technology, 20172025(USD Million)

Table 97 Inductive WPT Market in RoW, By Receiver Application, 20172025(USD Million)

Table 98 Inductive WPT Market in Middle East & Africa, By Receiver Application, 20172025(USD Million)

Table 99 Inductive Market in South America, By Receiver Application, 20172025(USD Million)

Table 100 Inductive Market in RoW, By Transmitter Application, 20172025(USD Million)

Table 101 Inductive Market in Middle East & Africa, By Transmitter Application, 20172025(USD Million)

Table 102 Inductive Market in South America, By Transmitter Application, 20172025(USD Million)

Table 103 Wireless Power Transmission Market Ranking Analysis, By Key Ic Supplier, 2019

Table 104 New Product Launches, 20172019

Table 105 Partnerships, Agreements, Collaborations, and Contracts 20172019

List of Figures (62 Figures)

Figure 1 Wireless Power Transmission Markets Segmentation

Figure 2 Wireless Power Transmission Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumption of the Research Study

Figure 7 Wireless Power Transmission Technology Market Segmentation

Figure 8 Market for Inductive Technology, By Component (Million Units)

Figure 9 Integrated Wireless Power Charging Solutions Exhibited the Largest Market Size in 2019

Figure 10 Standalone Chargers Held the Largest Size in the Market Through 2025

Figure 11 APAC Held the Largest Share of the Market in 2019

Figure 12 Attractive Growth Opportunities in WPT Market Between 2020 and 2025

Figure 13 Transmitter Market Expected to Hold A Larger Market Size By 2025

Figure 14 Integrated Implementation of Inductive Wireless Power Transmission Technology Expected to Capture the Largest Market Share in 2020

Figure 15 Smartphones Expected to Hold the Largest Share of the Global WPT Market in 2020

Figure 16 Standalone Chargers to Hold the Largest Market Size in 2020

Figure 17 U.S. Held the Largest Share of the Market for Inductive Technology in 2019

Figure 18 WPT Market Segmentation, By Geography

Figure 19 DROC: Wireless Power Transmission Technology Market

Figure 20 WPT Market: Value Chain Analysis

Figure 21 Key Innovations in Wireless Power Technology

Figure 22 Companies Adopting Both Standards

Figure 23 WPT Market: Porters Five Forces Analysis, 2019

Figure 24 Porters Five Forces Analysis for Wireless Power Transmission Market

Figure 25 Bargaining Power of Suppliers

Figure 26 Bargaining Power of Buyers Analysed to have A Medium Impact on the WPT Market

Figure 27 Several New Product Launches Had High Impact on the WPT Market

Figure 28 Threat of Substitutes Analysed to have A Medium Impact on WPT Market

Figure 29 Threat of New Entrants Regarded as High Owing to Low Capital Requirements

Figure 30 Wireless Power Transmission Market, By Technology

Figure 31 Market for Inductive Receivers Expected to Grow at A Higher Rate Between 2020 and 2025

Figure 32 Standalone Chargers is Estimated to Hold the Largest Share for Magnetic Resonance Technology Market

Figure 33 WPT Market, By Implementation

Figure 34 Market for Integrated Power Charging Solutions Held A Larger Size in 2019

Figure 35 WPT Market, By Receiver Application

Figure 36 Electric Vehicle Market Expected to Grow at the Highest Rate During the Forecast Period

Figure 37 APAC Expected to Dominate the Market for Inductive Technology-Based Smartphone Receivers

Figure 38 North America Expected to Hold the Largest Share of Inductive Based-Wireless Wearable Electronics Receiver Market By 2025

Figure 39 Market for Integrated Solutions Expected to Grow Rapidly in the Industrial Application During the Forecast Period

Figure 40 WPT Market, By Transmitter Application

Figure 41 Standalone Chargers Estimated to Hold the Largest Size of the Wireless Transmitter Market Between 2020 and 2025

Figure 42 North American Market for In-Vehicle Wireless Charging Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 43 European Furniture Transmitter Market Expected to Grow at the Highest Rate During the Forecast Period

Figure 44 Inductive WPT Market, Geographic Snapshot (20202025)

Figure 45 APAC to Dominate the Inductive Market During the Forecast Period

Figure 46 Inductive Wireless Power Transmission Market Snapshot in North America

Figure 47 Market for Electric Vehicles Expected to Grow at the Highest Rate During the Forecast Period

Figure 48 Inductive Wireless Power Transmission Market Snapshot in APAC

Figure 49 South America Expected to Dominate the Inductive Wireless Power Transmission Between 2020 and 2025

Figure 50 Market Evolution Framework: Strategic Alliance has Been the Key Strategy Between 2017 and 2019

Figure 51 Companies Adopted New Product Launches as the Key Growth Strategy Between 2017 and 2019

Figure 52 Battle for Market Share: New Product Launches is the Key Strategy Adopted Between 2017 and 2019

Figure 53 Integrated Device Technology, Inc.: Company Snapshot

Figure 54 Integrated Device Technology, Inc.: SWOT Analysis

Figure 55 Qualcomm, Inc.: Company Snapshot

Figure 56 Qualcomm, Inc.: SWOT Analysis

Figure 57 Samsung Electronics Co., LTD: Company Snapshot

Figure 58 Samsung Electronics Co., LTD.: SWOT Analysis

Figure 59 TDK Corporation: Company Snapshot

Figure 60 TDK Corporation: SWOT Analysis

Figure 61 Texas Instruments, Inc.: Company Snapshot

Figure 62 Texas Instruments, Inc.: SWOT Analysis

Growth opportunities and latent adjacency in Wireless Power Transmission Market