Wiper Motor Aftermarket by Vehicle Type (Passenger Cars, & Commercial Vehicles), and Region (Europe, North America, Asia-Pacific & RoW) - Global Forecast to 2021

[98 Pages Report] The market is projected to grow from USD 2.31 Billion in 2016 to USD 2.65 Billion by 2021, at a CAGR of 2.78%. The wiper motor is a critical component that drives the wiper system. Wiper systems are used on a regular basis in case the vehicle is subjected to adverse conditions such as rainfall or snowfall. Continuous use of a wiper system will result in wear and tear of the motor, which would then have to be replaced. Thus the need of replacement of the wiper motor when subjected to adverse conditions will drive the wiper motor aftermarket.

The objective of the study is to define and segment the wiper motor aftermarket for the passenger car and commercial vehicle segments. The primary aim of the research study is to strategically analyze the market with respect to individual growth trends and future prospects. The report includes a competitive study of various market leaders and an opportunity assessment for various stakeholders.

Years considered for the study:

2015-base year

2016-estimated year

2021-projected year

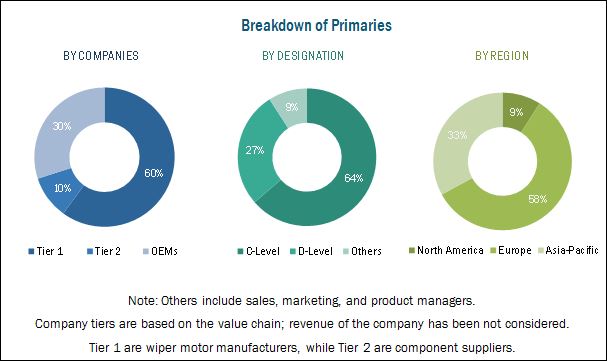

The research methodology used in the report involves primary and secondary sources. Secondary sources include Organisation Internationale des Constructeurs d’Automobiles (OICA), European Commission, Japan Automobile Manufacturers Association, various paid databases and directories among others. In the primary research process, experts from related industries and suppliers have been interviewed to understand the future trends of the wiper motor aftermarket. The global wiper motor aftermarket, in terms of volume (thousand units) and value (USD million), for various regions and vehicle types has been derived using forecasting techniques based on automobile demand and production trends. The aftermarket prices of wiper motors have been verified through primary sources. In order to derive the market size, the bottom-up approach has been followed.

The figure below indicates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The wiper motor aftermarket eco-system comprises established global wiper motor manufacturers. Major manufacturers include Valeo S.A. (France), Robert Bosch GmbH (Germany), Magneti Marelli (Italy), DOGA Automotive (Spain) and WAI Global (U.S.A.). The eco-system also includes regional automotive associations such as Society of Indian Automotive Manufacturers (SIAM), Japan Automotive Manufacturers Association (JAMA), European Automobile Manufacturers Association (ECEA) and the Independent Automotive Aftermarket Federation.

Target Audience

- Automobile original equipment manufacturers (OEMs)

- Manufacturers of wiper system and their components.

- Independent aftermarket suppliers.

- Research institutes

- Traders, distributors, and suppliers of wiper motor.

- Market research and consulting firms

Scope of the Report

The scope of the wiper motor aftermarket is as follows:

-

Market By Region

- Asia-Pacific

- North America

- Europe

-

Rest of the World

-

Market By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with companies’ specific needs.

- Profiling of additional market players (Up to 3).

-

Automotive Wiper Motor OE Market, By Region

- Asia-Pacific

- North America

- Europe

- Rest of the World

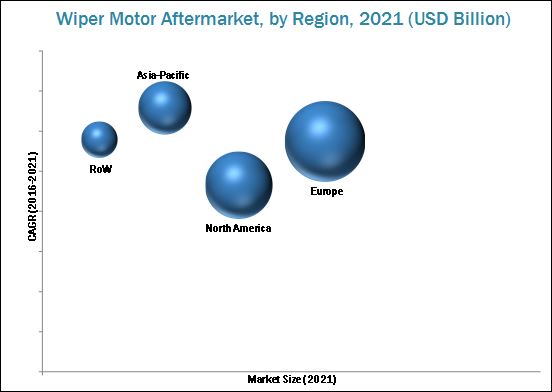

The wiper motor aftermarket is projected to grow from USD 2.31 billion in 2016 to USD 2.65 billion by 2021, at a CAGR of 2.78% during the forecast period. The wiper motor aftermarket is primarily driven by two important factors, one is the usage of wiper system, and the other is the increasing number of vehicles on road. The wiper motor is a critical component that drives the wiper system. The vehicles would use wiper system on a regular basis if subjected to adverse conditions such as rainfall or snowfall. The weather conditions in a country will determine the usage pattern for the wiper system. Thus wiper system usage will drive the wiper motor aftermarket.

The report covers two major vehicle categories for the wiper motor aftermarket, passenger cars, and commercial vehicles. The wiper motor aftermarket for the passenger car segment is expected to hold the largest share owing to the large number of passenger cars in use. The demand for passenger cars is influenced by economic conditions, changing government policies, and inflation levels. The increasing number of vehicles and their need for regular replacement of parts, owing to consistent use, would fuel the growth of wiper motor aftermarket. The commercial vehicle segment is expected to offer promising growth opportunities. As the distance travelled by commercial vehicles is more than the passenger cars. They are subjected to adverse conditions for longer duration which leads to replacement of components on regular basis.

The Asia-Oceania market for wiper motor aftermarket is expected to grow at a promising CAGR during the forecast period. The region comprises countries such as China, India, Japan, and South Korea, which have been considered for the study. China and India are among the fastest developing economies in the world. Growing awareness about vehicle safety will likely boost the wiper motor aftermarket. Clear visibility is a critical aspect while driving. The effective functioning of a wiper motor is very essential while driving in adverse conditions as it will ensure clear visibility and a safe journey.

Increased consumer concern for safety while driving in adverse conditions would drive the wiper motor aftermarket. Currently OEMs equip their vehicles with quality components which has reduced the potential of parts being replaced and is adversely affecting the aftermarket.

The wiper motor aftermarket market is dominated by key manufacturers such as Valeo S.A. (France), Robert Bosch GmbH (Germany), Magneti Marelli (Italy), DOGA Automotive (Spain) and WAI Global (U.S.A.). Valeo S.A. is a strong competitor, and has a wide geographical presence. It has a broad product portfolio for the aftermarket. The company is expanding its global footprint and customer base through various applications. They are increasing their market share in high growth markets such as Japan, India, South America, and Russia. The above-mentioned companies have been focusing on developing new products and forming partnerships and collaborations with key organizations to expand their presence in the global wiper motor aftermarket.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand-Side Analysis

2.5.2.1 Impact of Disposable Income on Total Vehicle Sales

2.5.2.2 Adverse Climatic Conditions Such as Heavy Rainfall and Snowfall

2.5.3 Supply-Side Analysis

2.5.3.1 Strong Distribution Channel

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Opportunities in the Wiper Motor Aftermarket

4.2 Regional Analysis for the Wiper Motor Aftermarket, 2016–2021

4.3 Wiper Motor Aftermarket, By Vehicle Type, 2016–2021

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Wiper Motor Aftermarket

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Steady Rise in Vehicle Sales

5.3.1.2 Increasing Average Age of Vehicles

5.3.2 Restraints

5.3.2.1 Vehicles Being Equipped With Better Electrical Equipment

5.3.3 Opportunities

5.3.3.1 Increasing Adoption of Rear Wiper Systems & Opportunities in the Commercial Vehicle Segment

5.3.4 Challenges

5.3.4.1 Independent Market Players Have to Provide Oe-Quality Products at Lower Costs

5.4 Porter’s Five Forces Analysis

5.4.1 Intensity of Competitive Rivalry

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Threat of New Entrants

6 Wiper Motor Aftermarket, By Vehicle Type (Page No. - 41)

6.1 Introduction

6.1.1 Europe

6.1.2 North America

6.1.3 Asia-Pacific

6.1.4 Rest of the World

7 Wiper Motor Aftermarket, By Region (Page No. - 54)

7.1 Introduction

7.2 North America

7.2.1 U.S.

7.2.2 Canada

7.2.3 Mexico

7.3 Europe

7.3.1 Germany

7.3.2 France

7.3.3 Italy

7.3.4 U.K.

7.3.5 Spain

7.4 Asia-Pacific

7.4.1 China

7.4.2 Japan

7.4.3 South Korea

7.4.4 India

7.5 Rest of the World

7.5.1 Brazil

7.5.2 Russia

8 Competitive Landscape (Page No. - 73)

8.1 Market Share: Wiper Motor Aftermarket (Europe)

8.2 Partnerships/Agreements/Joint Ventures/Supply Contracts

8.3 New Product Development/Launch

8.4 Expansion

9 Company Profiles (Page No. - 78)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

9.1 Introduction

9.2 Valeo S.A.

9.3 Robert Bosch GmbH

9.4 Magneti Marelli S.P.A.

9.5 Doga S.A.

9.6 WAI Global

9.7 Febi Bilstein

9.8 Trico Products

9.9 PSV Wipers Ltd.

9.10 Wexco Industries Inc.

9.11 Lucas TVs Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 92)

10.1 Insights of Industry Experts

10.2 Additional Customization

10.3 Discussion Guide

10.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.5 Related Reports

List of Tables (68 Tables)

Table 1 Key Countries Considered for the Study

Table 2 Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 3 Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 4 Europe: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 5 Europe: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 6 Europe: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 7 Europe: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 8 Europe: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 9 Europe: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 10 North America: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 11 North America: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 12 North America: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 13 North America: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 14 North America: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 15 North America: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 16 Asia-Pacific: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 17 Asia-Pacific: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 18 Asia-Pacific: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 19 Asia-Pacific: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 20 Asia-Pacific: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 21 Asia-Pacific: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 22 Rest of the World: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 23 Rest of the World: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 24 Rest of the World: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 25 Rest of the World: Passenger Car Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 26 Rest of the World: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 27 Rest of the World: Commercial Vehicle Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 28 Wiper Motor Aftermarket Size, By Region, 2014–2021 ('000 Units)

Table 29 Wiper Motor Aftermarket Size, By Region, 2014–2021 (USD Million)

Table 30 North America: Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 31 North America: Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 32 U.S.: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 33 U.S.: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 34 Canada: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 35 Canada: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 36 Mexico: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 37 Mexico: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 38 Europe: Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 39 Europe: Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 40 Germany: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 41 Germany: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 42 France: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 43 France: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 44 Italy: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 45 Italy: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 46 U.K.: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 47 U.K.: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 48 Spain: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 49 Spain: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 50 Asia-Pacific: Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 51 Asia-Pacific: Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 52 China: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 53 China: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 54 Japan: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 55 Japan: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 56 South Korea: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 57 South Korea: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 58 India: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 59 India: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 60 Rest of the World: Wiper Motor Aftermarket Size, By Country, 2014–2021 ('000 Units)

Table 61 Rest of the World: Wiper Motor Aftermarket Size, By Country, 2014–2021 (USD Million)

Table 62 Brazil: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 63 Brazil: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 64 Russia: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 ('000 Units)

Table 65 Russia: Wiper Motor Aftermarket Size, By Vehicle Type, 2014–2021 (USD Million)

Table 66 Partnerships/Agreements/Joint Ventures/Supply Contracts, 2011–2015

Table 67 New Product Developments/Launches, 2015–2016

Table 68 Expansions, 2014–2015

List of Figures (34 Figures)

Figure 1 Wiper Motor Aftermarket Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company, Designation, & Region

Figure 5 Impact of Disposable Income on Vehicle Sales, 2014

Figure 6 Surface Area vs Average Precipitation, 2014

Figure 7 Wiper Motor Aftermarket: Bottom-Up Approach

Figure 8 Europe to Dominate the Wiper Motor Aftermarket During the Forecast Period

Figure 9 Potential Growth From 2016 to 2021, By Region

Figure 10 Passenger Cars Expected to Constitute the Largest Segment of the Wiper Motor Aftermarket, By Vehicle Type, in 2016

Figure 11 Increasing Average Age of Vehicles is Expected to Drive the Wiper Motor Aftermarket

Figure 12 European Vehicle Sales, By Country, 2013–2015

Figure 13 European Passenger Car Average Age (Years)

Figure 14 Porter’s Five Forces Analysis: Wiper Motor Aftermarket

Figure 15 Numerous Market Players Increase the Intensity of Competitive Rivalry

Figure 16 Lack of Direct Substitutes Lowers the Threat of the Same

Figure 17 Low Switching Cost Would Increase the Bargaining Power of Buyers

Figure 18 Competitive Environment & Low Switching Cost Make the Bargaining Power of Suppliers Medium

Figure 19 Presence of Well-Established Players to Have the Highest Impact on New Entrants

Figure 20 Passenger Car Wiper Motor Aftermarket Projected to Grow at A Higher CAGR From 2016 to 2021

Figure 21 Asia-Pacific Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 22 North America: Wiper Motor Aftermarket Snapshot

Figure 23 Europe: Wiper Motor Aftermarket Snapshot

Figure 24 Japan to Account for the Largest Market Share in 2016

Figure 25 Companies Adopted New Product Development as the Key Growth Strategy From 2011 to 2016

Figure 26 European Wiper Motor Aftermarket, 2015

Figure 27 European Wiper Motor Aftermarket Supplier Share, By Vehicle Type

Figure 28 Battle for Market Share: New Product Development & Partnerships/Agreements/Joint Ventures/Supply Contracts are the Key Strategies

Figure 29 Valeo S.A.: Company Snapshot

Figure 30 SWOT Analysis: Valeo S.A.

Figure 31 Robert Bosch GmbH: Company Snapshot

Figure 32 SWOT Analysis: Robert Bosch GmbH

Figure 33 Magneti Marelli S.P.A.: Company Snapshot

Figure 34 SWOT Analysis: Magneti Marelli S.P.A.

Growth opportunities and latent adjacency in Wiper Motor Aftermarket