Global & China Wind Turbine Market – by Offshore/Onshore type, Geography, Installed Capacity, Price Trends and Forecast (2010 - 2015)

| Global & China Wind Turbine Market (2010 – 2015) |

|

The global wind turbine market, a rapidly growing segment of global energy market, has recorded double digit annual growth in past five years and is expected to maintain this growth till 2015 by reinstallation and addition of new generation turbines as well as increase in their size and efficiency. Factors responsible for the growth of the global wind turbine market include rising prices of non-renewable energy sources, supportive regulatory environment, growing energy consumption, and utility scale generation. Ever growing consumption of electricity, especially in developing countries such as China, India, Russia, and Brazil has boosted the market for alternative domestic sources of electricity. Wind is absolutely free. It offers low maintenance cost and electricity generated from it can also be cheap, once the turbine installation cost is recovered. Many countries are utilizing electricity from wind power plants. The U.S., Germany, Spain, India, and China are the major countries involved in generation of wind energy.

The major problem with wind power is that it is capital intensive as compared to traditional non-renewable energy. In case of wind energy, more than 70% cost is associated with the plant setup. Installation of wind turbine alone costs around 75% of the total installation cost and more than 50% of the overall cost. However, with continuous technological innovations, their costs are coming down.

Turbine cost per megawatt has reduced significantly in the past few years. The reduction became possible due to turbine design stability, which improved the efficiency of production lines at turbine manufacturing facilities. Another reason for per megawatt price reduction is cheap resources in the Asia-Pacific region. Companies such as Vestas Wind Systems A/S, Siemens Wind Power A/S, and Gamesa Corporacion Tecnologica have moved their manufacturing towards countries such as India or China to take advantage of low resource costs.

Prices have reduced at greater pace than costs and thus wind turbine industry is facing reductions in profit margins. In 2010, estimated average profit margin was around 10%, which used to be about 27% in 2004. The main reason for the reduced margin is decreasing turbine prices, which is due to oversupply and possibility of per megawatt price reduction.

Offshore wind has tremendous potential and is still unutilized. In 2009, only 1.2% was contributed by offshore wind installations globally. Despite more potential, offshore installations stand at around 27 GW as compared to 132 GW onshore installations. The main reasons behind the slow growth of the offshore wind installations are transportation and installation of heavy machineries, supplying generated power to onshore grids, and possibility of the loss of excess power due to integration issues. Now, these challenges are being taken care of by technological innovations, improvements in grid infrastructure, support from various governments, and co-operation in the field of offshore wind power. In December 2010, Sweden, Denmark, Germany, The Netherlands, Luxembourg, France, UK, Ireland, Norway, and Belgium signed a memorandum of understanding (MoU) for joint development of an offshore electricity grid, which held the responsibility for integration of offshore wind power at North Sea. The grid is expected to maintain 150 GW offshore wind power by 2030. It will contribute 16% of the Europe’s electricity consumption by 2030 and 46% by 2050.

China is the fastest growing wind turbine market worldwide. In 2009, China was the largest wind turbine market with 13.8 Gigawatts (GW) of new installations alone in the region out of a 38.3 GW installed globally. China is also the second largest wind power market after the U.S. in terms of cumulative installed capacity. The major factors encouraging the growth of China’s wind turbine market are enormous wind resources such as large land mass and long coastline, and strong government support.

Markets covered

This report analyzes the global wind turbine market in terms of cumulative and new installed capacities (MW) in North America, Europe, Asia-Pacific, and Rest of the World (ROW) and in China. The report covers types and sizes of wind turbines and technologies. Recent updates and developments in global and China wind turbine markets are also included in the report.

Stakeholders

The intended audience of this report includes:

- Wind turbine component suppliers

- Wind farm developers and investors

- Raw material suppliers

- Government agencies and industry associations

Research methodology

Global & China Wind Turbine Market research report is analyzed and forecasted from 2010 to 2015. The market forecasts are based on primary and secondary research data. The secondary research was based on paid sources such as Factiva and industry associations such as Global Wind Energy Council (GWEC), International Energy Association (IEA), World Wind Energy Association (WWEA), Information Energy Agency (EIA) (U.S.), European Wind Energy Association (EWEA), National Energy Administration (NEA) (China), National Development and Reform Commission (NDRC) (China), Renewable Energy & Energy Efficiency Partnership (REEEP) (Austria), company websites, and news articles.

For future forecast, the global market is divided into four regions: Europe, America, Asia-Pacific, and Rest of the World (ROW). List of countries - region wise is provided in Appendix. Megawatt installations forecasts consider different countries’ renewable energy targets, plans, wind potentials, and investments. For value analysis (dollar billion market), the report assumes three things: No major change in steel prices during 2010 to 2015. There is no inflation or value of U.S. dollar is constant during the period and no major change in wind turbine technology that may lead to change in production lines at manufacturing. Also, the cost breakdown by turbine components and by raw material is assumed to be fixed from 2008 to 2015.

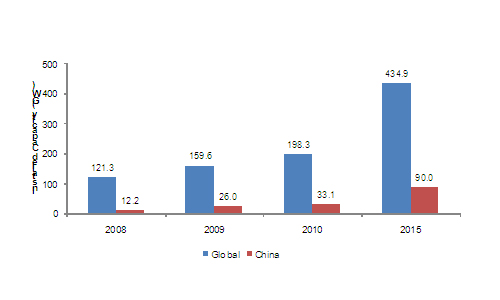

The demand for energy from renewable sources has been rising since the last decade. Global wind turbine cumulative installed capacity reached to 159 GW in 2009 from 292.9 GW in 2003, which is an increase of whopping 310%. The growth potential of wind in future also looks very promising. According to our research, installed capacity is expected to increase by 173% and reach 434.5 GW by 2015. The industry growth is supported by market drivers such as increasing price of non-renewable energy like crude oil and natural gas, growing energy consumption particularly from emerging countries, pro-wind regulatory environment for wind projects & wind farms, and increase in utility scale wind energy generation plants.

China Wind Turbine Market as compared to Global (2008 – 2015)

Source: MarketsandMarkets

China is the largest and fastest growing market that has recorded whopping 449% growth over the last six years and reached 26 GW installed capacity in 2009 from mere 567 MW in 2003. The market of China is expected to show similar growth of increase by 282% with new addition of 73.3 GW installations between 2009 and 2015.

Benefited by the market growth in China, Asia-Pacific became the fastest growing region. In 2009, Asia-Pacific led the growth with addition of 16 GW of wind turbines, followed by Americas with 11.6 GW, and Europe with 10.5 GW. The other parts of the world could manage 168 MW new installations in 2009. China, alone added 13.8 GW, 86% of Asia-Pacific and 36% of global installations. China’s turbine market growth is supported by the internal market drivers such as government support through various subsidies, increasing demand for turbines from existing and proposed wind farms, and inexpensive raw material availability. China has also become the best place for turbine and component manufacturing due to cheaper resources availability. Recently, the government of China removed ‘70% domestic content’ policy to maintain larger market shares till now. The removal of this rule has eased MNC’s to set up new manufacturing facilities in China. Entry of foreign players will put the pressure on domestic players in terms of delivering technically superior products.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKET COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

2 EXECUTIVE SUMMARY

3 GLOBAL WIND TURBINE MARKET OVERVIEW

3.1 INTRODUCTION

3.2 BURNING ISSUES

3.2.1 TRANSMISSION SYSTEMS

3.2.2 DECLINING PER MEGAWATT PRICES

3.3 MARKET METRICS

3.3.1 DRIVERS

3.3.1.1 Increasing price of non-renewable energy

3.3.1.2 Supportive regulatory environment

3.3.1.3 Growing energy consumption

3.3.1.4 Utility scale generation

3.3.2 RESTRAINTS

3.3.2.1 High capital intensive

3.3.2.2 Variability in wind speed

3.3.3 OPPORTUNITIES

3.3.3.1 Growing investments in wind energy

3.3.3.2 Technological improvement

3.3.3.3 Offshore potential

3.4 MARKET SEGMENTATION

3.4.1 BY GEOGRAPHY

3.4.1.1 Europe

3.4.1.2 Americas

3.4.1.3 Asia Pacific

3.4.1.4 Rest of the World (ROW)

3.4.2 BY TYPE OF WIND FARM

3.4.2.1 Onshore wind turbine market

3.4.2.2 Offshore wind turbine market

3.4.3 BY TURBINE MW CAPACITIES

3.4.4 BY TURBINE COMPONENTS

3.4.5 BY TURBINE MATERIALS

3.5 MARKET SHARE ANALYSIS

3.5.1 DECLINING CONSOLIDATION IN WIND TURBINE INDUSTRY

3.5.2 WIND FARM DEVELOPER

3.6 COST STRUCTURE ANALYSIS

3.6.1 TURBINE COMPONENTS & RAW MATERIALS

3.6.2 ONSHORE VS OFFSHORE WIND FARM

3.7 POLICIES & REGULATIONS

3.7.1 U.S.

3.7.1.1 Renewable Energy Tribal Land S GRANT

3.7.1.2 Energy Improvement And Extension Act 2008 - Tax Incentives

3.7.2 GERMANY

3.7.2.1 Amendment of the Renewable Energy Sources Act 2009

3.7.3 SPAIN

3.7.3.1 Offshore wind power regulations

3.7.3.2 Feed-in tariffs

3.7.4 INDIA

3.7.4.1 Generation based incentives

3.7.4.2 Feed-in Tariffs

3.7.5 ITALY

3.7.6 FRANCE

3.7.7 U.K.

3.8 PATENT ANALYSIS

4 COMPETITIVE LANDSCAPE

5 COMPANY PROFILES – GLOBAL PLAYERS

5.1 ACCIONA S.A.

5.1.1 OVERVIEW

5.1.2 PRIMARY BUSINESS

5.1.3 STRATEGY

5.1.4 DEVELOPMENTS

5.2 AEOLOS WIND ENERGY LTD.

5.2.1 OVERVIEW

5.2.2 PRIMARY BUSINESS

5.2.3 STRATEGY

5.2.4 DEVELOPMENTS

5.3 AERONAUTICA WINDPOW

5.3.1 OVERVIEW

5.3.2 PRIMARY BUSINESS

5.3.3 STRATEGY

5.3.4 DEVELOPMENTS

5.4 ALSTOM S.A.

5.4.1 OVERVIEW

5.4.2 PRIMARY BUSINESS

5.4.3 STRATEGY

5.4.4 DEVELOPMENTS

5.5 BERGEY WINDPOWER CO. (BWC)

5.5.1 OVERVIEW

5.5.2 PRIMARY BUSINESS

5.5.3 STRATEGY

5.6 CLIPPER WINDPOWER PLC

5.6.1 OVERVIEW

5.6.2 PRIMARY BUSINESS

5.6.3 STRATEGY

5.6.4 DEVELOPMENTS

5.7 DEWIND CO.

5.7.1 OVERVIEW

5.7.2 PRIMARY BUSINESS

5.7.3 STRATEGY

5.7.4 DEVELOPMENTS

5.8 ENERCON GMBH

5.8.1 OVERVIEW

5.8.2 PRIMARY BUSINESS

5.8.3 STRATEGY

5.8.4 DEVELOPMENTS

5.9 FUHRLANDER AG

5.9.1 OVERVIEW

5.9.2 PRIMARY BUSINESS

5.9.3 STRATEGY

5.9.4 DEVELOPMENTS

5.10 GAMESA CORPORACION TECNOLOGICA

5.10.1 OVERVIEW

5.10.2 PRIMARY BUSINESS

5.10.3 STRATEGY

5.10.4 DEVELOPMENTS

5.11 GE ENERGY

5.11.1 OVERVIEW

5.11.2 PRIMARY BUSINESS

5.11.3 STRATEGY

5.11.4 DEVELOPMENTS

5.12 MITSUBISHI HEAVY INDUSTRIES LTD.

5.12.1 OVERVIEW

5.12.2 PRIMARY BUSINESS

5.12.3 STRATEGY

5.12.4 DEVELOPMENTS

5.13 NORDEX SE

5.13.1 OVERVIEW

5.13.2 PRIMARY BUSINESS

5.13.3 STRATEGY

5.13.4 DEVELOPMENTS

5.14 NORDIC WINDPOWER LTD.

5.14.1 OVERVIEW

5.14.2 PRIMARY BUSINESS

5.14.3 STRATEGY

5.14.4 DEVELOPMENTS

5.15 REPOWER SYSTEMS AG

5.15.1 OVERVIEW

5.15.2 PRIMARY BUSINESS

5.15.3 STRATEGY

5.15.4 DEVELOPMENTS

5.16 SIEMENS WIND POWER A/S

5.16.1 OVERVIEW

5.16.2 PRIMARY BUSINESS

5.16.3 STRATEGY

5.16.4 DEVELOPMENTS

5.17 SUZLON ENERGY LTD.

5.17.1 OVERVIEW

5.17.2 PRIMARY BUSINESS

5.17.3 STRATEGY

5.17.4 DEVELOPMENTS

5.18 VERGNET SA

5.18.1 OVERVIEW

5.18.2 PRIMARY BUSINESS

5.18.3 STRATEGY

5.18.4 DEVELOPMENTS

5.19 VESTAS WIND SYSTEMS A/S

5.19.1 OVERVIEW

5.19.2 PRIMARY BUSINESS

5.19.3 STRATEGY

5.19.4 DEVELOPMENTS

5.20 WINDFLOW TECHNOLOGY LTD

5.20.1 OVERVIEW

5.20.2 PRIMARY BUSINESS

5.20.3 STRATEGY

5.20.4 DEVELOPMENTS

6 CHINA WIND TURBINES MARKET OVERVIEW

6.1 INTRODUCTION

6.2 BURNING ISSUES

6.2.1 WEEK GRID INFRASTRUCTURE

6.3 WINNING IMPERATIVES

6.3.1 RESEARCH AND DEVELOPMENT CENTER

6.3.2 JOINT DEVELOPMENT OF NEW PRODUCTS

6.3.3 LEVERAGING LOW COST CAPITAL

6.3.4 CUSTOMIZED PRODUCTS

6.3.5 MERGERS & ACQUISITIONS

6.4 MARKETS METRICS

6.4.1 DRIVERS

6.4.1.1 Increasing demand from existing and proposed wind energy power plants

6.4.1.2 Availability of inexpensive raw material

6.4.1.3 Investments in wind energy

6.4.1.4 Government support

6.4.2 RESTRAINTS

6.4.2.1 Intense competition

6.4.2.2 Supply constraints of key components

6.4.3 OPPORTUNITIES

6.4.3.1 Future renewable energy goals

6.4.3.2 Abundant wind resources

6.5 WIND TURBINE MARKET IN CHINA

6.5.1 OFFSHORE, AN UPCOMING OPPORTUNITY

6.6 MARKET SHARE ANALYSIS

6.7 POLICIES & REGULATIONS

6.7.1 WIND POWER CONCESSION POLICY

6.7.2 WIND TURBINE: 70% DOMESTIC CONTENTS

6.7.3 RENEWABLE ENERGY LAW 2005

6.7.4 MEDIUM & LONG TERM DEVELOPMENT PLAN

6.7.5 RENEWABLE ENERGY PREMIUM

6.7.6 VALUE ADDED TAX (VAT)

6.7.7 RENEWABLE ENERGY LAW AMENDMENT 2009

7 COMPANY PROFILES – CHINESE PLAYERS

7.1 A-POWER ENERGY GENERATION SYSTEMS LTD.

7.1.1 OVERVIEW

7.1.2 PRIMARY BUSINESS

7.1.3 STRATEGY

7.1.4 DEVELOPMENTS

7.2 CHINA MINGYANG WIND POWER GROUP LTD.

7.2.1 OVERVIEW

7.2.2 PRIMARY BUSINESS

7.2.3 STRATEGY

7.2.4 DEVELOPMENTS

7.3 CSIC HAIZHUANG WINDPOWER EQUIPMENT CO., LTD.

7.3.1 OVERVIEW

7.3.2 PRIMARY BUSINESS

7.3.3 STRATEGY

7.3.4 DEVELOPMENTS

7.4 DONGFANG ELECTRIC CORPORATION (DEC)

7.4.1 OVERVIEW

7.4.2 PRIMARY BUSINESS

7.4.3 STRATEGY

7.4.4 DEVELOPMENTS

7.5 ENVISION ENERGY

7.5.1 OVERVIEW

7.5.2 PRIMARY BUSINESS

7.5.3 STRATEGY

7.5.4 DEVELOPMENTS

7.6 GUODIAN UNITED POWER TECHNOLOGY CO., LTD.

7.6.1 OVERVIEW

7.6.2 PRIMARY BUSINESS

7.6.3 STRATEGY

7.6.4 DEVELOPMENTS

7.7 SHANGHAI ELECTRIC GROUP COMPANY LTD.

7.7.1 OVERVIEW

7.7.2 PRIMARY BUSINESS

7.7.3 STRATEGY

7.7.4 DEVELOPMENTS

7.8 SINOVEL WIND CO. LTD.

7.8.1 OVERVIEW

7.8.2 PRIMARY BUSINESS

7.8.3 STRATEGY

7.8.4 DEVELOPMENTS

7.9 XEMC WINDPOWER CO. LTD

7.9.1 OVERVIEW

7.9.2 PRIMARY BUSINESS

7.10 XINJIANG GOLDWIND SCIENCE & TECH CO. LTD.

7.10.1 OVERVIEW

7.10.2 PRIMARY BUSINESS

7.10.3 STRATEGY

7.10.4 DEVELOPMENTS

APPENDIX

WIND TURBINE INSTALLATIONS BY GEOGRAPHY

DEFINITIONS

FEED-IN TARIFF

LIST OF TABLES

1 GLOBAL WIND TURBINE MARKET, BY REGION 2008 – 2015 (INSTALLED CAPACITY, GW)

2 GROWING ELECTRICITY CONSUMPTION, BY COUNTRY (2005 – 2008)

3 WIND ENERGY CONSUMPTION, BY COUNTRY (2005 – 2009)

4 INSTALLED WIND TURBINE CAPACITY, BY REGION 2006 – 2009 (MW)

5 OVERSUPPLY OF WIND TURBINES, 2005 – 2011 (MW)

6 AVERAGE WIND TURBINE PRICES, BY REGION 2008 – 2015 (MW)

7 DEVELOPMENTS IN BATTERY STORAGE SYSTEM

8 DETAILS OF INVESTMENTS MADE IN OCTOBER & NOVEMBER 2010, BY INVESTOR, REGION & APPLICATION

9 DIRECT DRIVE WIND TURBINE BY MANUFACTURER

10 POTENTIAL TECHNICAL IMPROVEMENT AREA, IMPACT OF PERFORMANCE & COST

11 GLOBAL WIND TURBINE MARKET (2008 – 2015)

12 WIND TURBINE INSTALLED CAPACITY GROWTH, BY GEOGRAPHY 2006 – 2010 (MW)

13 TOP 10 COUNTRIES IN EUROPE, BY INSTALLED CAPACITY (2009)

14 TOP COUNTRIES IN EUROPE, BY WIND ENERGY PRODUCTION (2005 – 2009)

15 ELECTRICITY STATS OF TOP EUROPEAN COUNTRIES, 2009 (GWH)

16 BREAK-UP OF OTHER ENERGY SOURCES IN EUROPE

17 EUROPE WIND TURBINE MARKET (2008 – 2015)

18 TOP 10 COUNTRIES IN AMERICAS, BY INSTALLED CAPACITY (2009)

19 LATIN AMERICAN COUNTRIES YET TO REALIZE THEIR POTENTIAL

20 TOP COUNTRIES IN THE AMERICAS, BY WIND ENERGY PRODUCTION 2005 – 2009 (MW)

21 ELECTRICITY STATS OF TOP COUNTRIES IN THE AMERICAS, 2009 (GWH)

22 AMERICAS WIND TURBINE MARKET (2008 – 2015)

23 TOP 10 COUNTRIES IN ASIA PACIFIC, BY INSTALLED CAPACITY (2009)

24 ASIAN COUNTRIES YET TO REALIZE THEIR WIND POTENTIAL (MW)

25 TOP ASIA PACIFIC COUNTRIES, BY WIND ENERGY PRODUCTION 2005 – 2009 (MW)

26 ELECTRICITY STATS OF ASIA PACIFIC TOP COUNTRIES, 2009 (GWH)

27 ASIA PACIFIC WIND TURBINE MARKET (2008 – 2015)

28 TOP 10 COUNTRIES IN ROW, BY INSTALLED CAPACITY (2009)

29 AFRICAN COUNTRIES YET TO REALIZE THEIR WIND POTENTIAL (MW)

30 UPCOMING PROJECTS IN AFRICA

31 TOP ROW COUNTRIES, BY WIND ENERGY PRODUCTION (2005 – 2009)

32 ROW ELECTRICITY STATS OF TOP COUNTRIES, 2009 (GWH)

33 ROW WIND TURBINE MARKET (2008 – 2015)

34 GLOBAL ONSHORE VS. OFFSHORE INSTALLED CAPACITY, BY REGION (2008 – 2009)

35 TOP 10 COUNTRIES IN OFFSHORE WIND TURBINE INSTALLATIONS (2008 – 2009)

36 U.S. OFFSHORE WIND ENERGY POTENTIAL, BY REGION

37 U.S. OFFSHORE WIND POTENTIAL, BY WIND SPEED

38 AVERAGE WIND TURBINE CAPACITY, BY TYPE OF WIND FARM 2008 – 1015 (KW)

39 GLOBAL WIND TURBINE MARKET, BY MW CAPACITY 2008 – 2015 (MW)

40 WIND TURBINE COMPONENT MARKET, 2008 - 2015 ($BILLION)

41 GLOBAL WIND TURBINE CUMULATIVE INSTALLATIONS, BY TURBINE TECHNOLOGY 2003 -2009 (MW)

42 HOT ROLLED STEEL PLATE PRICES IN U.S. & EUROPE (2010)

43 WIND TURBINE MATERIAL MARKET, 2008 – 2015 ($BILLION)

44 INCREASING MARKET SHARE OF CHINESE & INDIAN DOMESTIC PLAYERS (2005 – 2009)

45 CUMULATIVE TURBINE INSTALLATIONS, BY MANUFACTURERS 2009 (MW)

46 NEW TURBINE INSTALLATIONS, BY MANUFACTURER 2008 – 2009 (MW)

47 COST BREAK UP BY COMPONENTS

48 COST BREAK UP BY MATERIALS

49 ONSHORE & OFFSHORE WIND COSTS

50 FEED-IN TARIFF FOR EXISTING WIND PLANTS IN GERMANY

51 ELIGIBILITY FOR FEED-IN TARIFFS IN INDIA

52 ELIGIBILITY FOR FINANCIAL INCENTIVES IN ITALY

53 PATENTS IN THE FIELD OF WIND TURBINE, BY REGION (2009 – 2010)

54 AGREEMENTS/PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES (JANUARY 2008 – NOVEMBER 2010)

55 NEW PRODUCT DEVELOPMENTS (FEBURARY 2008 – OCTOBER 2010)

56 MERGERS & ACQUISITIONS (JUNE 2008 – OCTOBER 2010)

57 CHINA RENEWABLE ENERGY SCENARIO (2009)

58 CHINA ELECTRICITY PRODUCTION, BY RESOURCE (2009)

59 HOT ROLLED COIL STEEL AVERAGE PRICE, FOURTH QUARTER (2009)

60 CHINA VS. GLOBAL WIND TURBINE PRICES ($MILLION/MW)

61 FEED-IN TARIFFS AND VAT IN CHINA, BY REGION ($PER MWH)

62 NEW PROJECTS APPROVED AS OF OCTOBER 2010 IN CHINA, BY GHG REDUCTION

63 CHINA WIND POWER POTENTIAL VS. INSTALLED CAPACITY, BY TYPE OF WIND FARM (2009)

64 CHINA WIND TURBINE MARKET (2008 – 2015)

65 HIGH ELECTRICITY DEMAND IN THE CHINESE COASTAL REGION

66 OFFSHORE TURBINES BEING DEVELOPED, BY THE CHINESE PLAYERS

67 TURBINE INSTALLATIONS IN CHINA, BY MANUFACTURERS 2009 (MW)

68 EUROPE WIND TURBINE INSTALLED CAPACITY, BY COUNTRIES 2006 – 2009 (MW)

69 AMERICA WIND TURBINE INSTALLED CAPACITY, BY COUNTRIES 2006 – 2009 (MW)

70 ASIA PACIFIC WIND TURBINE INSTALLED CAPACITY, BY COUNTRIES 2006 – 2009 (MW)

71 ROW WIND TURBINE INSTALLED CAPACITY, BY COUNTRIES 2006 - 2009 (MW)

LIST OF FIGURES

1 CHINA WIND TURBINE MARKET AS COMPARED WITH GLOBAL (2008 – 2015)

2 GLOBAL TREND OF WIND TURBINE PRICES (2008 – 2010)

3 WORLDWIDE ENERGY CONSUMPTION (2003 – 2015)

4 INVESTMENT ANNOUNCEMENTS IN WIND ENERGY (2010)

5 GLOBAL WIND TURBINE MARKET, BY INSTALLED CAPACITY (2008 – 2015)

6 GLOBAL WIND TURBINE MARKET, 2008 – 2015 ($BILLION)

7 CHANGE IN INSTALLED CAPACITY SHARE, BY COUNTRIES (2006 – 2009)

8 EUROPE: WIND TURBINE MARKET, BY INSTALLED CAPACITY (2008 – 2015)

9 EUROPE: WIND TURBINE MARKET, BY $BILLION (2008 – 2015)

10 AMERICAS: WIND TURBINE MARKET, BY INSTALLED CAPACITY (2008 – 2015)

11 AMERICAS: WIND TURBINE MARKET, 2008 – 1015 ($BILLION)

12 ASIA PACIFIC: WIND TURBINE MARKET, BY INSTALLED CAPACITY (2008 – 2015)

13 ASIA PACIFIC: WIND TURBINE MARKET, 2008 – 2015 ($BILLION)

14 ROW: WIND TURBINE MARKET, BY INSTALLED CAPACITY (2008 – 2015)

15 ROW: WIND TURBINE MARKET, 2008 – 2015 ($BILLION)

16 OFFSHORE INSTALLED CAPACITY VS ONSHORE (2009)

17 ONSHORE WIND TURBINE MARKET BY INSTALLED CAPACITY, (2008 – 2015)

18 OFFSHORE WIND TURBINE MARKET BY INSTALLED CAPACITY, (2008 – 2015)

19 GLOBAL WIND TURBINE MARKET, BY MW CAPACITY 2008 – 2009 (MW)

20 GLOBAL WIND TURBINE MARKET SHARE, BY MW CAPACITY 2008 – 2015 (%)

21 MARKET GROWTH WITH MORE THAN 2.5 MW (2008 – 2015)

22 DIRECT DRIVE TURBINES ANNUAL INSTALLATIONS, COMPARED WITH GEARED TURBINES, 2003 – 2009 (MW)

23 MARKET SHARE OF TOP TEN MANUFACTURER, BY MW INSTALLED (2009)

24 MARKET SHARE OF TOP 10 PLAYERS BY TOTAL MW INSTALLED (2009)

25 WIND FARM DEVELOPERS MARKET SHARE (2009)

26 KEY MATERIALS IN KEY TURBINE COMPONENTS

27 TYPES OF REPAIR IN WIND TURBINES (%)

28 COST BREAKDOWN FOR AN OFFSHORE WIND FARM

29 PATENT ANALYSIS BY GEOGRAPHY (2009–2010)

30 WIND POWER IN CHINA W.R.T. OTHER COUNTRIES (2006 – 2012)

31 CHINA WIND TURBINE INSTALLATIONS (2002 – 2009)

32 CHINA WIND TURBINE MARKET, BY PRODUCT SIZE (2009)

33 WIND TURBINE PRICES TREND IN CHINA VS GLOBAL

34 INVESTMENTS IN WIND POWER, CHINA V/S WORLD

35 WIND POWER POTENTIAL VS. INSTALLED CAPACITY

36 CHINA WIND TURBINE MARKET, BY INSTALLATION (2008 – 2015)

37 CHINA WIND TURBINE MARKET, 2008 – 2015 ($BILLION)

38 CHINA WIND TURBINE MARKET SHARE BY MW INSTALLED (2009)

39 CHINA POLICIES TO SUPPORT WIND POWER – TIMELINE (2001 – 2010)

Growth opportunities and latent adjacency in Global & China Wind Turbine Market