Virtual Customer Premises Equipment (vCPE) Market by Component, Solutions/Tools (Virtual Switches, Virtual Routers), Service, Deployment Mode, Organization Size, Application (Data Center and Enterprises) and Region - Global Forecast to 2027

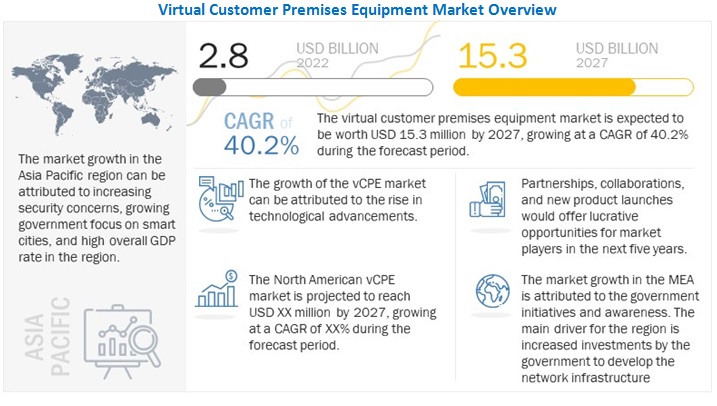

[261 Pages Report] MarketsandMarkets forecasts the global virtual customer premises equipment Market size is expected to grow USD 2.8 billion in 2022 to USD 15.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 40.2% during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global virtual customer premises equipment market

The outbreak of COVID-19 has significantly impacted operations in a few key verticals, such as BFSI, IT, Healthcare, Government & Public Sector, Manufacturing, and Others. Hence, the impact of this factor on the market is expected to be moderate across global sectors.

Virtual Customer Premises Equipment Market Dynamics

Driver: Adoption of network virtualization among enterprises

Technology is growing rapidly, and virtualization is no exception. Virtualization is one of the most broadly employed computing technologies. 75% of organizations use virtual servers. According to the 2020 State of Virtualization Technology, virtualization implementation is expanding beyond servers. By 2021, desktops, applications, networks, storage, and data virtualization are expected to experience robust double-digit growth. According to Spiceworks, more than half of businesses worldwide will use storage virtualization and application virtualization by 2021. Application virtualization is predicted to jump from 39% to 56% in the coming years. A double-digit increase is also anticipated in the use of desktop and data & network virtualization by 2021. According to a survey prepared by a group of Cisco partner firms and conducted by The Blackstone Group, small to medium-size businesses (SMBs) are increasingly aware of virtualization technology's benefits, and a majority are already using some form of it. The report found nearly 70% of small firms that reported having virtualization technologies were utilizing them to move servers from hardware to software, which is expected to help cut down server sprawl and maintenance costs. Virtual desktop infrastructure, or VDI, appeared to be the biggest luxury application as 60 percent of medium-sized companies employed VDIs compared to just 42 percent of small companies. Storage virtualization, another application that helps condense necessary infrastructure, was another popular application among small businesses, with 53 percent implementing it compared to just 42 percent of larger companies.

Restraint: Security concerns in network virtualization

Network virtualization has become increasingly prominent in recent years. It enables the creation of network infrastructures tailored to the needs of distinct network applications. It supports instantiating favorable environments for developing and evaluating new architectures and protocols. Despite the wide applicability of network virtualization, the shared use of routing devices and communication channels leads to a series of security-related concerns. It is necessary to protect virtual network infrastructures to enable their use in real, large-scale environments. The benefits of network virtualization and the shared use of routing devices & communication channels introduce a series of security-related concerns. Without adequate protection, users from a virtual network might be able to access or even interfere with traffic that belongs to other virtual networks, violating security properties such as confidentiality and integrity. Additionally, the infrastructure could be a target for denial of service attacks, causing availability issues for virtual networks instantiated on top of it. Therefore, it is of great importance that network virtualization architectures offer protection against these and other types of threats that might compromise security.

Opportunity: Reduction of hardware dependency

Most people all over the world are dependent on digital devices and need a constant connection to the internet. According to a survey released by the World Economic Forum (WEF), rowing reliance on digital processes in the last two years of the Coronavirus pandemic has increased. Using software and virtualization has reduced hardware dependencies, due to which hardware virtualization has become a trend. Hardware virtualization is the method used to create virtual versions of physical desktops and operating systems. It uses a virtual machine manager (VMM) hypervisor to provide abstracted hardware to multiple guest operating systems, sharing the physical hardware resources more efficiently. Hardware virtualization offers many benefits, such as better performance and lower costs.

Challenge: Limited knowledge and shortage of skilled workforce

In the traditional CPE market space, the involvement of software developers is very limited as most of the work is performed through hardware. However, with the vCPE, developers will control the CPE environment virtually. The maintenance of vCPE solutions needs skilled programmers with experience managing customer premises equipment solutions virtually. Deployment of vCPE on customer premises infrastructure also needs a skilled workforce who can deploy a new vCPE infrastructure or transform a traditional CPE into a virtual one. Since the concept is newly evolved and the market is still developing, the end users' knowledge about the vCPE is low. It needs a lot of awareness and pro-activeness among end users to know about the advantages of vCPE over traditional CPE. The vEPC architecture involves several network functions, such as MME, SGW, PGW, and HSS, with multiple VMs hosted on general-purpose servers. The major concerns mobile operators face include dealing with several VMs, NFV infrastructure, and upgrading the existing network infrastructure while deploying VNFs on the network. NFV creates additional network complexity with interoperability issues.

By Component, the service segment to have a higher growth during the forecast period

The services in the vCPE market play a vital role in the efficient and effective functioning of the network infrastructure and comprise professional and managed services . While professional services include consulting & integration, support & maintenance, and network security services & analytics, the managed services consist of outsourced services such as infrastructure management and other support services. As the market grows, the demand for services is also likely to increase, specifically for consulting & integration and support & maintenance services.

By deployment mode, the cloud segment to dominate the market during the forecast period

The virtualized network architecture used in the vCPE market is native to the cloud. With the help of cloud-based technologies, customers can effectively move their businesses to the cloud or maintain them in the cloud for effective & continuous service capabilities. Adopting various cloud-based and 5G on-demand slicing solutions will undoubtedly hasten the digital transformation of the entire communications sector. These solutions will be implemented using native cloud models. Organizations can create and deploy scalable applications in contemporary and dynamic environments, including public, private, and hybrid clouds , via native cloud technology.

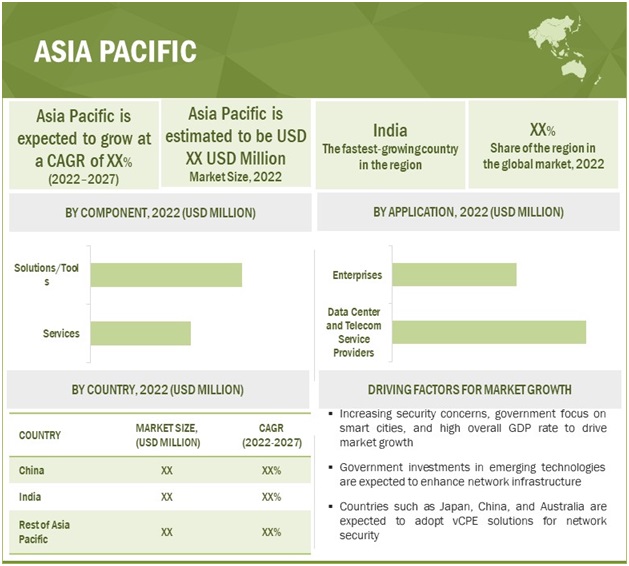

APAC to grow at the highest CAGR during the forecast period

The Asia Pacific or APAC is expected to be the fastest-growing region during the forecast period in the vCPE market owing to heavy investments in infrastructure and smart city projects. The region demonstrates a combination of a high-growth population, developing economies, and the increasing adoption of mobile and the internet. The enormous population in the region has led to an extensive pool of subscriber base for companies. The vast and diverse geographies and the wide adoption of smart devices and the internet mandate the need for reliable and secure internet connectivity, driving the market for vCPE. vCPE is a significant paradigm shift in networking technology, and several global players are looking to invest in the Asia Pacific owing to the region being lucrative for growth opportunities. The volume of enterprise traffic is growing rapidly as data is expanding worldwide. There is also an immense demand for efficient data center resources. To address these issues, vCPE has been gaining momentum within the enterprise ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players virtual customer premises equipment market. It profiles major vendors in the market. The major vendors in the market include Cisco (US), HPE (US), Juniper Networks (US), Broadcom (US), IBM (US), Arista Networks (US), Dell Corporation (US), Ericsson (Sweden), NEC Corporation (Japan), Intel (US), Wind River (US), RAD Data Communication (Israel), Huawei Technologies (China), Verizon (US), ADVA Optical Networking (Germany), Advantech (Taipei), Spirent Technologies (UK), Versa Networks (US), Anuta Networks (US), Parallel Wireless (US), Altiostar (US), NoviFlow (Canada), Cumucore (Finland), NFWare (US), netElastic Systems (US), VoerEirAB (Sweden), and Brian4net (Russia). These players have adopted various strategies to grow in the global offering virtual customer premises equipment market. The study includes an in-depth competitive analysis of these key players in the offering market with their company profiles, recent developments, and key market strategies.

Scope of the Repor

|

Report Metrics |

Details |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By component, solutions/tools, service, deployment mode, organization size, application, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle east and Africa, and Latin America |

|

Companies covered |

Cisco (US), HPE (US), Juniper Networks (US), Broadcom (US), IBM (US), Arista Networks (US), Dell Corporation (US), Ericsson (Sweden), NEC Corporation (Japan), Intel (US), Wind River (US), RAD Data Communication (Israel), Huawei Technologies (China), Verizon (US), ADVA Optical Networking (Germany), Advantech (Taipei), Spirent Technologies (UK), Versa Networks (US), Anuta Networks (US), Parallel Wireless (US), Altiostar (US), NoviFlow (Canada), Cumucore (Finland), NFWare (US), netElastic Systems (US), VoerEirAB (Sweden), and Brian4net (Russia). |

This research report categorizes the virtual customer premises equipment market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Solutions/tools

- Service

By Solutions/tools:

- Virtual Switches

- Virtual Routers

- Application and Controller Platform

- Security and Compliance

- Infrastructure Mnagament and Orchestration

By Service:

- Professional Services

- Managed Services

By Deployment Type:

- On-Premises

- Cloud

By Organization Size:

- Large enterprises

- SMEs

By Application:

- Data Centers and Telecom Service Providers

- Enterprises

- BFSI

- IT

- Healthcare

- Government and Public Sector

- Manufacturing

- Others

By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- Asia Pacific

- China

- India

- Rest of Asia Pacific

- Middle East and Africa

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Latin America

- Mexico

- Brazil

- Rest of Latin America

Recent Developments:

- In December 2021, Broadcom acquired AppNeta, a service provider offering SaaS-based network performance monitoring solutions for the distributed enterprise. This acquisition will enable Broadcom to strengthen network performance monitoring across the internet and hybrid cloud-based applications.

- In November 2021, Arista Networks launched the next generation of 7050X and 7060X Series, which provides performance and cost-effectiveness as the company transitions to 400G networks.

- In October 2021, IBM and Cisco collaborated to help orchestrate and manage 5G networks. This helps service providers join their customers cloud services with a network slice that provides an end-to-end SLA under a single cross-managed network.

- In September 2021, HPE announced its acquisition of Zerto, an industry leader in cloud data management and protection headquartered in Boston, Massachusetts. The deal was closed at USD 374 million. This acquisition has strengthened HPEs position in the network security, cloud-native, and software-defined data services business.

- In June 2021, HPE announced innovations to its GreenLake Cloud Platform. These innovations will help HPE extend its leadership in the hybrid cloud. Innovations will help customers transform and modernize their workloads to a cloud operating model by optimizing and securing applications from edge to cloud.

Frequently Asked Questions (FAQ):

How is the virtual customer premises equipment market expected to grow in the next five years?

According to MarketsandMarkets, the virtual customer premises equipment market size is expected to grow USD 2.8 billion in 2022 to USD 15.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 40.2% during the forecast period.

Which region has the largest market share in the virtual customer premises equipment market?

North America is estimated to hold the largest market share in virtual customer premises equipment market in 2022. North America is one of the technologically advanced markets in the world.

What are the major factors driving virtual customer premises equipment market?

The major drivers virtual customer premises equipment market are efficient deployment of managed services and simplified data transfer.

Who are the major vendors in virtual customer premises equipment market?

Major vendors in virtual customer premises equipment market include Cisco (US), HPE (US), Juniper Networks (US), Broadcom (US), IBM (US), Arista Networks (US), Dell Corporation (US), Ericsson (Sweden), NEC Corporation (Japan), Intel (US), Wind River (US), RAD Data Communication (Israel), Huawei Technologies (China), Verizon (US), ADVA Optical Networking (Germany), Advantech (Taipei), Spirent Technologies (UK), Versa Networks (US), Anuta Networks (US), Parallel Wireless (US), Altiostar (US), NoviFlow (Canada), Cumucore (Finland), NFWare (US), netElastic Systems (US), VoerEirAB (Sweden), and Brian4net (Russia). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 20182021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

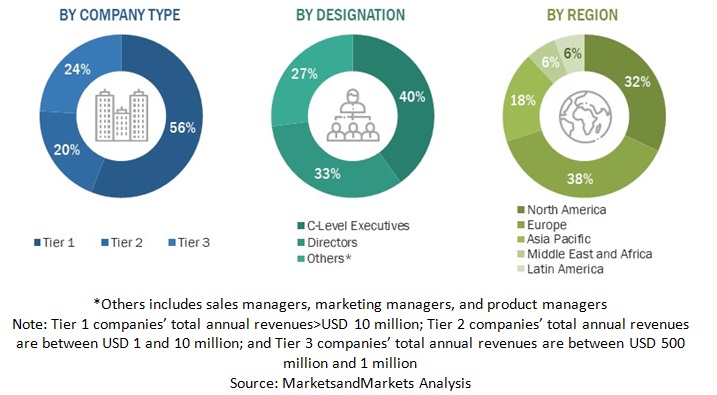

FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, SUPPLY-SIDE ANALYSIS (1/2)

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, SUPPLY-SIDE ANALYSIS (2/2)

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR STUDY

TABLE 3 ASSUMPTIONS FOR STUDY

2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, 20202027

FIGURE 8 LEADING SEGMENTS IN MARKET FOR 2022

FIGURE 9 MARKET, REGIONAL AND COUNTRY-WISE SHARES (2022)

FIGURE 10 ASIA PACIFIC MARKET TO PRESENT LUCRATIVE INVESTMENT OPPORTUNITIES DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES FOR GROWTH IN MARKET

FIGURE 11 RISING TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET GROWTH

4.2 MARKET, BY DEPLOYMENT MODE

FIGURE 12 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4.3 MARKET FOR NORTH AMERICA, 2022

FIGURE 13 SOLUTIONS/TOOLS SEGMENT AND UNITED STATES TO ACCOUNT FOR A HIGHER MARKET SHARE

4.4 ASIA PACIFIC UIPMENT MARKET, 2022

FIGURE 14 SOLUTIONS/TOOLS AND REST OF ASIA PACIFIC TO ACCOUNT FOR HIGH MARKET SHARES IN 2022

4.5 MARKET, BY COUNTRY

FIGURE 15 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Adoption of network virtualization among enterprises

5.2.1.2 Efficient deployment of managed services

5.2.1.3 Simplified data transfer

5.2.2 RESTRAINTS

5.2.2.1 Security concerns in network virtualization

5.2.2.2 Transition to virtualized infrastructure from legacy infrastructure

5.2.3 OPPORTUNITIES

5.2.3.1 Reduction of hardware dependency

5.2.3.2 Value-added services

5.2.4 CHALLENGES

5.2.4.1 Limited knowledge and shortage of skilled workforce

5.2.4.2 Monitoring complex multi-technology virtual networks across infrastructures

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN

FIGURE 17 VIRTUAL CUSTOMER PREMISES EQUIPMENT VALUE CHAIN

5.3.2 ECOSYSTEM

5.3.2.1 Virtual customer premises equipment market: Ecosystem

TABLE 4 MARKET: ECOSYSTEM

5.3.3 PORTERS FIVE FORCES MODEL

TABLE 5 MARKET: PORTERS FIVE FORCES MODEL

FIGURE 18 MARKET: PORTERS FIVE FORCES MODEL

5.3.3.1 Threat of new entrants

5.3.3.2 Threat of substitutes

5.3.3.3 Bargaining power of buyers

5.3.3.4 Bargaining power of suppliers

5.3.3.5 Competition rivalry

5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.4.1 Key stakeholders in buying process

FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS (%)

5.3.4.2 Buying Criteria

FIGURE 20 KEY BUYING CRITERIA FOR TOP 3 END USERS

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.3.5 TECHNOLOGY ANALYSIS

5.3.5.1 Software-defined networking

5.3.5.2 Cloud Computing

5.3.5.3 Edge computing

5.3.5.4 Network function virtualization

5.3.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 21 REVENUE SHIFT FOR VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET

5.3.7 PATENT ANALYSIS

FIGURE 22 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 8 TOP TWENTY PATENT OWNERS

FIGURE 23 NUMBER OF PATENTS GRANTED IN A YEAR (2012─2021)

5.3.8 PRICING ANALYSIS

TABLE 9 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED VCPE

5.3.9 USE CASES

5.3.9.1 Case study 1: Verizon provides wireless router solutions

5.3.9.2 Case study 2: Virtualization of customer premises equipment

5.3.10 KEY CONFERENCES & EVENTS IN 2022

TABLE 10 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.3.11 TARIFF AND REGULATORY IMPACT

5.3.11.1 SOC2

5.3.11.2 Digital Millennium Copyright Act

5.3.11.3 Anti-cybersquatting Consumer Protection Act

5.3.11.4 North America

5.3.11.5 Europe

5.3.11.6 Asia Pacific

5.3.11.7 Middle East and Africa

5.3.11.8 Latin America

6 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT (Page No. - 72)

6.1 INTRODUCTION

FIGURE 24 SERVICES SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 20222027 (USD MILLION)

6.1.1 COMPONENT: VCPE MARKET DRIVERS

6.2 SOLUTIONS/TOOLS

TABLE 13 SOLUTIONS/TOOLS: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 14 SOLUTIONS/TOOLS: MARKET, BY REGION, 20222027 (USD MILLION)

6.3 SERVICE

TABLE 15 SERVICE: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 16 SERVICE: MARKET, BY REGION, 20222027 (USD MILLION)

7 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY SOLUTIONS/TOOLS (Page No. - 77)

7.1 INTRODUCTION

FIGURE 25 VIRTUAL ROUTERS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 18 MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

7.1.1 SOLUTIONS/TOOLS: VCPE MARKET DRIVERS

7.2 VIRTUAL SWITCHES

TABLE 19 VIRTUAL SWITCHES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 20 VIRTUAL SWITCHES: MARKET, BY REGION, 20222027 (USD MILLION)

7.3 VIRTUAL ROUTERS

TABLE 21 VIRTUAL ROUTERS: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 22 VIRTUAL ROUTERS: MARKET, BY REGION, 20222027 (USD MILLION)

7.4 APPLICATION AND CONTROLLER PLATFORM

TABLE 23 APPLICATION AND CONTROLLER PLATFORM: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 24 APPLICATION AND CONTROLLER PLATFORM: MARKET, BY REGION, 20222027 (USD MILLION)

7.5 SECURITY AND COMPLIANCE

TABLE 25 SECURITY AND COMPLIANCE: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 26 SECURITY AND COMPLIANCE: MARKET, BY REGION, 20222027 (USD MILLION)

7.6 INFRASTRUCTURE MANAGEMENT AND ORCHESTRATION

TABLE 27 INFRASTRUCTURE MANAGEMENT AND ORCHESTRATION: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 28 INFRASTRUCTURE MANAGEMENT AND ORCHESTRATION: MARKET, BY REGION, 20222027 (USD MILLION)

8 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY SERVICE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 26 MANAGED SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 30 MARKET, BY SERVICE, 20222027 (USD MILLION)

8.1.1 SERVICE: VCPE MARKET DRIVERS

8.2 PROFESSIONAL SERVICES

TABLE 31 PROFESSIONAL SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 32 PROFESSIONAL SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

8.3 MANAGED SERVICES

TABLE 33 MANAGED SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 34 MANAGED SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

9 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY DEPLOYMENT MODE (Page No. - 89)

9.1 INTRODUCTION

FIGURE 27 CLOUD-BASED DEPLOYMENT MODE IS EXPECTED TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

9.1.1 DEPLOYMENT MODE: VCPE MARKET DRIVERS

TABLE 35 MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 36 MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

9.2 CLOUD

TABLE 37 CLOUD: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY REGION, 20162021 (USD MILLION)

TABLE 38 CLOUD: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY REGION, 20222027 (USD MILLION)

9.3 ON-PREMISES

TABLE 39 ON-PREMISES: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY REGION, 20162021 (USD MILLION)

TABLE 40 ON-PREMISES: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY REGION, 20222027 (USD MILLION)

10 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY ORGANIZATION SIZE (Page No. - 93)

10.1 INTRODUCTION

FIGURE 28 SMALL AND MEDIUM-SIZED ENTERPRISES ARE EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

10.1.1 ORGANIZATION SIZE: VCPE MARKET DRIVERS

TABLE 41 MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 42 MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

10.2 LARGE ENTERPRISES

TABLE 43 LARGE ENTERPRISES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 44 LARGE ENTERPRISES: MARKET, BY REGION, 20222027 (USD MILLION)

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

TABLE 45 SMALL AND MEDIUM-SIZED ENTERPRISE: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 46 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 20222027 (USD MILLION)

11 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY APPLICATION (Page No. - 97)

11.1 INTRODUCTION

11.1.1 APPLICATION: VCPE MARKET DRIVERS

FIGURE 29 ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 47 MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 48 MARKET, BY APPLICATION, 20222027 (USD MILLION)

11.2 DATA CENTERS AND TELECOM SERVICE PROVIDERS

TABLE 49 DATA CENTERS AND TELECOM SERVICE PROVIDERS: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 50 DATA CENTERS AND TELECOM SERVICE PROVIDERS: MARKET, BY REGION, 20222027 (USD MILLION)

11.3 ENTERPRISES

TABLE 51 ENTERPRISES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 52 ENTERPRISES: MARKET, BY REGION, 20222027 (USD MILLION)

FIGURE 30 HEALTHCARE, BY ENTERPRISE, IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 53 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 54 MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

11.3.1 BFSI

TABLE 55 BFSI: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 56 BFSI: MARKET, BY REGION, 20222027 (USD MILLION)

11.3.2 INFORMATION TECHNOLOGY

TABLE 57 INFORMATION TECHNOLOGY: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 58 INFORMATION TECHNOLOGY: MARKET, BY REGION, 20222027 (USD MILLION)

11.3.3 HEALTHCARE

TABLE 59 HEALTHCARE: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 60 HEALTHCARE: MARKET, BY REGION, 20222027 (USD MILLION)

11.3.4 GOVERNMENT AND PUBLIC SECTOR

TABLE 61 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 62 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 20222027 (USD MILLION)

11.3.5 MANUFACTURING

TABLE 63 MANUFACTURING: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 64 MANUFACTURING: MARKET, BY REGION, 20222027 (USD MILLION)

11.3.6 OTHERS

TABLE 65 OTHERS: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 66 OTHERS: MARKET, BY REGION 20222027 (USD MILLION)

12 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY REGION (Page No. - 109)

12.1 INTRODUCTION

FIGURE 31 ASIA PACIFIC IS EXPECTED TO GROW AT HIGHEST CAGR FROM 2022-2027

TABLE 67 MENT MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 68 MARKET, BY REGION, 20222027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

12.2.2 UNITED STATES

12.2.2.1 Enterprises demanding high-performance networks to support adoption of vCPE solutions

TABLE 85 UNITED STATES: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 86 UNITED STATES: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 87 UNITED STATES: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 88 UNITED STATES: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 89 UNITED STATES: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 90 UNITED STATES: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 91 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 92 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 93 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 94 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 95 UNITED STATES: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 96 UNITED STATES: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 97 UNITED STATES: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 98 UNITED STATES: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Adoption of vCPE in Canada to rise to overcome complex network issues and hardware costs

TABLE 99 CANADA: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 100 CANADA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 101 CANADA: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 102 CANADA: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 103 CANADA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 104 CANADA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 105 CANADA: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 106 CANADA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 107 CANADA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 108 CANADA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 109 CANADA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 110 CANADA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 111 CANADA: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 112 CANADA: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

TABLE 113 EUROPE: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 121 EUROPE: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY COUNTRY, 20222027 (USD MILLION)

12.3.2 UNITED KINGDOM

12.3.2.1 Adoption of vCPE for cost reduction across various verticals to drive market

TABLE 129 UNITED KINGDOM: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 135 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 137 UNITED KINGDOM: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 141 UNITED KINGDOM: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 142 UNITED KINGDOM: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 Rising initiatives to develop network infrastructure supports market growth

12.3.4 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 143 ASIA PACIFIC: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 151 ASIA PACIFIC: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY COUNTRY, 20222027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Rising government investments in infrastructure & public security projects to drive market

TABLE 159 CHINA: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 160 CHINA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 161 CHINA: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 162 CHINA: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 163 CHINA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 164 CHINA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 165 CHINA: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 166 CHINA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 167 CHINA: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 168 CHINA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 169 CHINA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 170 CHINA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 171 CHINA: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 172 CHINA: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 End-user spending on IT services in India to support market growth

12.4.4 REST OF ASIA PACIFIC

12.5 MIDDLE EAST & AFRICA

12.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 173 MIDDLE EAST & AFRICA: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

12.5.2 KINGDOM OF SAUDI ARABIA (KSA)

12.5.2.1 Growing government awareness of advanced technologies to support market growth

12.5.3 SOUTH AFRICA

12.5.3.1 Gradual shift to cloud-based technologies expected to support market growth

12.5.4 REST OF MIDDLE EAST & AFRICA

12.6 LATIN AMERICA

12.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 189 LATIN AMERICA: VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY SOLUTIONS/TOOLS, 20162021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY SOLUTIONS/TOOLS, 20222027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 197 LATIN AMERICA: VIRTUAL CUSTOMER PREMISES EQUIPMENT, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY ENTERPRISES, 20162021 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY ENTERPRISES, 20222027 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

12.6.2 MEXICO

12.6.2.1 Government investments in developing existing network infrastructure support market growth

12.6.3 BRAZIL

12.6.3.1 Growing public-private investments toward core networks to support market growth

12.6.4 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 163)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 34 MARKET EVALUATION FRAMEWORK, 20192021

13.3 COMPETITIVE SCENARIO AND TRENDS

13.3.1 PRODUCT LAUNCHES

TABLE 205 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET: PRODUCT LAUNCHES, 2019-2021

13.3.2 DEALS

TABLE 206 DEALS, 2019─2021

13.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 207 MARKET: DEGREE OF COMPETITION

FIGURE 35 MARKET SHARE ANALYSIS OF COMPANIES

13.5 HISTORICAL REVENUE ANALYSIS

FIGURE 36 HISTORICAL REVENUE ANALYSIS, 2017─2021

13.6 COMPANY EVALUATION MATRIX OVERVIEW

13.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 208 PRODUCT FOOTPRINT WEIGHTAGE

13.7.1 STAR

13.7.2 EMERGING LEADERS

13.7.3 PERVASIVE

13.7.4 PARTICIPANTS

FIGURE 37 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (2022)

13.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 209 COMPANY PRODUCT FOOTPRINT

TABLE 210 COMPANY COMPONENT FOOTPRINT

TABLE 211 VERTICAL FOOTPRINT

TABLE 212 COMPANY REGION FOOTPRINT

13.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 38 RANKING OF KEY PLAYERS IN VCPE MARKET (2022)

13.10 START-UP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 39 START-UPS/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 213 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

13.10.1 PROGRESSIVE COMPANIES

13.10.2 RESPONSIVE COMPANIES

13.10.3 DYNAMIC COMPANIES

13.10.4 STARTING BLOCKS

FIGURE 40 VIRTUAL CUSTOMER PREMISES EQUIPMENT MARKET, START-UP/SME EVALUATION MATRIX, 2022

13.11 COMPETITIVE BENCHMARKING FOR SME/START-UPS

TABLE 214 MARKET: DETAILED LIST OF KEY START-UP/SMES

TABLE 215 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

TABLE 216 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES), BY REGION

14 COMPANY PROFILES (Page No. - 185)

14.1 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

14.1.1 CISCO

TABLE 217 CISCO: BUSINESS OVERVIEW

FIGURE 41 CISCO: COMPANY SNAPSHOT

TABLE 218 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 219 CISCO: PRODUCT LAUNCHES

TABLE 220 CISCO: DEALS

14.1.2 HPE

TABLE 221 HPE: COMPANY OVERVIEW

FIGURE 42 HPE: COMPANY SNAPSHOT

TABLE 222 HPE: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 223 HPE: PRODUCT LAUNCHES

TABLE 224 HPE: DEALS

14.1.3 JUNIPER NETWORKS

TABLE 225 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 43 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 226 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 227 JUNIPER NETWORKS: PRODUCT LAUNCHES

TABLE 228 JUNIPER NETWORKS: DEALS

14.1.4 BROADCOM

TABLE 229 BROADCOM: COMPANY OVERVIEW

FIGURE 44 BROADCOM: COMPANY SNAPSHOT

TABLE 230 BROADCOM: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 231 BROADCOM: DEALS

14.1.5 IBM

TABLE 232 IBM: BUSINESS OVERVIEW

FIGURE 45 IBM: COMPANY SNAPSHOT

TABLE 233 IBM: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 234 IBM: PRODUCT LAUNCHES

TABLE 235 IBM: DEALS

14.1.6 ARISTA NETWORKS

TABLE 236 ARISTA NETWORKS: COMPANY OVERVIEW

FIGURE 46 ARISTA NETWORKS: COMPANY SNAPSHOT

TABLE 237 ARISTA NETWORKS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 238 ARISTA NETWORKS: PRODUCT LAUNCHES

TABLE 239 ARISTA NETWORKS: DEALS

14.1.7 DELL CORPORATION

TABLE 240 DELL CORPORATION: COMPANY OVERVIEW

FIGURE 47 DELL CORPORATION: COMPANY SNAPSHOT

TABLE 241 DELL CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 242 DELL CORPORATION: DEALS

14.1.8 ERICSSON

TABLE 243 ERICSSON: BUSINESS OVERVIEW

FIGURE 48 ERICSSON: COMPANY SNAPSHOT

TABLE 244 ERICSSON: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 245 ERICSSON: PRODUCT LAUNCHES

TABLE 246 ERICSSON: DEALS

14.1.9 NEC CORPORATION

TABLE 247 NEC CORPORATION: COMPANY OVERVIEW

FIGURE 49 NEC CORPORATION: COMPANY SNAPSHOT

TABLE 248 NEC CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 249 NEC CORPORATION: DEALS

14.1.10 INTEL

TABLE 250 INTEL: COMPANY OVERVIEW

FIGURE 50 INTEL: COMPANY SNAPSHOT

TABLE 251 INTEL: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 252 INTEL: PRODUCT LAUNCHES

TABLE 253 INTEL: DEALS

14.1.11 WIND RIVER

14.1.12 RAD DATA COMMUNICATION

14.1.13 HUAWEI TECHNOLOGIES

14.1.14 VERIZON

14.1.15 ADVA OPTICAL NETWORKING

14.1.16 ADVANTECH

14.1.17 SPIRENT COMMUNICATIONS

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.2 START-UPS AND SMES

14.2.1 VERSA NETWORKS

14.2.2 ANUTA NETWORKS

14.2.3 PARALLEL WIRELESS

14.2.4 ALTIOSTAR

14.2.5 NOVIFLOW INC.

14.2.6 CUMUCORE

14.2.7 NFWARE

14.2.8 NETELASTIC SYSTEMS

14.2.9 VOEREIR AB

14.2.10 BRAIN4NET

15 ADJACENT/RELATED MARKETS (Page No. - 237)

15.1 INTRODUCTION

15.1.1 LIMITATIONS

15.2 MANAGED NETWORK SERVICES MARKET GLOBAL FORECAST TO 2026

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.2.1 Managed Network Services Market, By Type

TABLE 254 MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 255 MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

15.2.2.2 Managed Network Services Market, By Organization Size

TABLE 256 MANAGED NETWORK SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 20172020 (USD MILLION)

TABLE 257 MANAGED NETWORK SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 20212026 (USD MILLION)

15.2.2.3 Managed Network Services Market, By Deployment Mode

TABLE 258 MANAGED NETWORK SERVICES MARKET SIZE, BY DEPLOYMENT MODE, 20172020 (USD MILLION)

TABLE 259 MANAGED NETWORK SERVICES MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

15.2.2.4 Managed Network Services Market, By Vertical

TABLE 260 MANAGED NETWORK SERVICES MARKET SIZE, BY VERTICAL, 20172020 (USD MILLION)

TABLE 261 MANAGED NETWORK SERVICES MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

15.2.2.5 Managed Network Services Market, By Region

TABLE 262 MANAGED NETWORK SERVICES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 263 MANAGED NETWORK SERVICES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.3 VIRTUALIZED EVOLVED PACKET CORE (VEPC) MARKET─ GLOBAL FORECAST TO 2026

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.2.1 Virtualized Evolved Packet Core (vEPC) Market, By Component

TABLE 264 VEPC MARKET SIZE, BY COMPONENT, 20152019 (USD MILLION)

TABLE 265 VEPC MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

15.3.2.2 Virtualized Evolved Packet Core (vEPC) Market, By Solution

15.3.2.3 Virtualized Evolved Packet Core (vEPC) Market, By Service

TABLE 266 VEPC MARKET SIZE, BY SERVICE, 20152019 (USD MILLION)

TABLE 267 VEPC MARKET SIZE, BY SERVICE, 20202026 (USD MILLION)

TABLE 268 VEPC MARKET SIZE, BY PROFESSIONAL SERVICE, 20152019 (USD MILLION)

TABLE 269 VEPC MARKET SIZE, BY PROFESSIONAL SERVICE, 20202026 (USD MILLION)

15.3.2.4 Virtualized Evolved Packet Core (vEPC) Market, By Deployment Mode

TABLE 270 VEPC MARKET SIZE, BY DEPLOYMENT MODEL, 20152019 (USD MILLION)

TABLE 271 VEPC MARKET SIZE, BY DEPLOYMENT MODEL, 20202026 (USD MILLION)

15.3.2.5 Virtualized Evolved Packet Core (vEPC) Market, By End User

TABLE 272 VEPC MARKET SIZE, BY END USER, 20152019 (USD MILLION)

TABLE 273 VEPC MARKET SIZE, BY END USER, 20202026 (USD MILLION)

15.3.2.6 Virtualized Evolved Packet Core (vEPC) Market, By Application

15.3.2.7 Virtualized Evolved Packet Core (vEPC) Market, By Region

TABLE 274 NORTH AMERICA: VEPC MARKET SIZE, BY COMPONENT, 20152019 (USD MILLION)

TABLE 275 NORTH AMERICA: VEPC MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

TABLE 276 EUROPE: VEPC MARKET SIZE, BY COMPONENT, 20152019 (USD MILLION)

TABLE 277 EUROPE: VEPC MARKET SIZE, BY COMPONENT, 20202026 (USD MILLION)

15.4 SOFTWARE DEFINED WIDE AREA NETWORK (SD-WAN) MARKET─GLOBAL FORECAST TO 2025

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

15.4.2.1 Software Defined Wide Area Network (SD-WAN) Market, By Network Type

15.4.2.2 Software Defined Wide Area Network (SD-WAN) Market, By Component

TABLE 278 D-WAN MARKET SIZE, BY COMPONENT, 20162019 (USD MILLION)

TABLE 279 SD-WAN MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

15.4.2.3 Software Defined Wide Area Network (SD-WAN) Market, By Organization Size

TABLE 280 SD-WAN MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 281 SD-WAN MARKET SIZE, BY ORGANIZATION SIZE, 20192025 (USD MILLION)

15.4.2.4 Software Defined Wide Area Network (SD-WAN) Market, By End User

TABLE 282 SD-WAN MARKET SIZE, BY END USER, 20162019 (USD MILLION)

TABLE 283 SD-WAN MARKET SIZE, BY END USER, 20192025 (USD MILLION)

TABLE 284 SD-WAN MARKET SIZE, BY VERTICAL, 20162019 (USD MILLION)

TABLE 285 SD-WAN MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

15.4.2.5 Software Defined Wide Area Network (SD-WAN) Market, By Region

TABLE 286 SD-WAN MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 287 SD-WAN MARKET SIZE, BY REGION, 20192025 (USD MILLION)

16 APPENDIX (Page No. - 254)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the virtual customer premises equipment market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources; journals and various associations have also been referred to for consolidating the report.

Secondary research was mainly used to obtain key information about industry insights, the markets monetary chain, the overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the virtual Customer Premises Equipment market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing virtual Customer Premises Equipment software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the virtual customer premises equipment market. The first approach involves the estimation of the market size by summation of companies revenue generated through the virtual customer premises equipment solutions and services. This entire procedure has studied the annual and financial reports of top market players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives of leading companies, for key insights. All percentage splits and breakups have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

The bottom-up procedure was employed to arrive at the overall size of the virtual Customer premises equipment market from the revenues of key players (companies) and their market shares. The calculation was done based on estimations and by verifying key companies revenue through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of other individual segments (component, deployment mode, organization size, application, and region) via the percentage splits of the markets segments from secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained. Market shares were then estimated for each company to verify revenue shares used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primary interviews, the exact values of the overall parent market size and its segments market size were determined and confirmed using this study.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To determine and forecast the global virtual customer premises equipment (vCPE) market based on component, solutions/tools, service, organization size, deployment mode, application, and region from 2016 to 2027, and analyze various macro and microeconomic factors that affect the market growth

- To forecast the size of the markets segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America (LATAM)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the vCPE market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total virtual Customer Premises Equipment market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key market players (such as top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the markets competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions (M&As), product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Virtual Customer Premises Equipment (vCPE) Market