Global Video Surveillance Market Applications and Management Services Forecasts (2010-2015)

Please click here to get the updated version of Video Surveillance As A Service (VSaaS) Market [By Service (Hosted, Managed, Hybrid) & Components (Camera, Storage, Server, Video Analytics), Application & Geography] - Global Forecast & Analysis (2012-2017)

Security is currently the number one priority for everyone and the use of video surveillance is not restricted only to protecting people and assets.

Escalating security concerns and the recent spate in terrorist activities have forced governments around the world to invest in video surveillance technologies for homeland security. This has significantly boosted the growth of the global video surveillance market. However, applications of video surveillance are not restricted to homeland security alone and include the domains of banking, transportation, education, retail, and healthcare as well.

There have been significant advances in the field of video surveillance systems over the last decade. The advent of digital systems has made it easier and systematic to store and retrieve of data as opposed to watching hours of video tapes. The video surveillance industry is growing rapidly not only in terms of technological advances, but also adoption in new applications sectors. Video surveillance systems have made beeline into a variety of application sectors such as education, banking, retail, transportation. With the advent of globalization, businesses have expanded and also spread to overseas locations. As a result, surveillance systems are now also being used for real-time and remote supervision.

Asia-Pacific offers a lucrative market to video surveillance players. This can be attributed to the developing countries such as India, China. The video surveillance market is experiencing a shift from analog to IP and the players of this market are focusing on developing new products. An IP video surveillance system enables real time monitoring of the desired location remotely. The monitoring from several different cameras can be done through a single location. The picture quality offered by IP video surveillance system is superior than the one offered by analog system. The use of IP surveillance systems also helps in saving the operational and infrastructural cost incurred in installation of a video surveillance system. Traditional analog cameras are expensive to install, owing to the requirement of coaxial cables, power source. On the other hand, digital cameras can be powered using Power over Ethernet (PoE) that supplies power to a camera by means of the same cable that is used for network connectivity; thereby eliminating the need for power outlets at the camera locations.

Some of the key players in this market include Axis Communications (Sweden), Pelco (U.S.), Mobotix (Germany), Sony (Japan), Bosch Security Systems (Germany), Cisco (U.S.), Milestone (Denmark) and ONSSI (U.S.), among the others.

Mobile video surveillance is another fast growing segment of the video surveillance market. The mobile video surveillance system can be both analog and IP. This market comprises surveillance equipment being installed in vehicles, and trains. The mobile video surveillance market is being driven by the increasing cases of crimes in school buses, trains, and public buses, which amount to a loss of millions of dollars. Some of the major players in the mobile video surveillance market include March Networks (Canada), Safety Vision LLC (U.S.), and Iveda Solutions, (U.S.).

This report provides a detailed analysis of the markets for all the components of a video surveillance system, such as video cameras, video analytics, storage, and servers. The reports strategic section sketches the competitive scenario in the video surveillance market.

Scope of the report

This research report categorizes the global market for video surveillance on the basis of components, applications, and geography; forecasting revenues, and analyzing trends in each of the following submarkets:

On the basis of components:

- Cameras, storage, servers and encoders, and software

On the basis of applications:

- Retail, government, education, banking, transportation, and others

On the basis of geography:

- North America, Europe, Asia Pacific, and ROW (Rest of the World)

Customer Interested in this report also can view

-

Video Surveillance Market - Global Forecast & Analysis (2011 2016): By Products (IP, Analog, Remote, Mobile); Components (Cameras, Storage Devices, Software, System Management); Applications (Infrastructure, Commercial, Institution, Industrial, Residential); System Services

Video Surveillance Market, Applications and Management Services Global Forecasts (2010-2015)

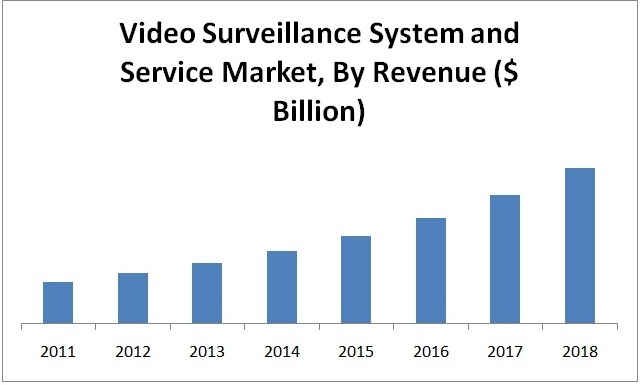

The video surveillance market is in the growth phase and is expected to grow from $11.5 billion in 2008 to $37.7 billion in 2015 at a CAGR of 20.4% from 2010 to 2015. Cameras, storage, servers, and software are the main components of the video surveillance systems.

Source: MarketsandMarkets

There has been a significant beef up in security around the globe post 9/11. Governments across the globe have been investing loads of funds for the development of reliable and robust security systems to counter the advanced systems being used by various terrorist outfits. Video surveillance is one of the solutions to monitor and deter dangerous and nefarious activities.

The fast growing video surveillance market is being driven not only by the heightened need for public security, but also due to private security concerns; in addition to a technology shift. The security industry is converging with information technology, marked by a gradual transition to IP-based video surveillance systems. IP video surveillance enables cost effective monitoring with both-local and remote locations being checked with a large number of cameras being managed on a single network. The emergence of video analytics has further enhanced the monitoring capabilities of such systems by adding intelligence to the devices and the network. Wireless systems can also help reduce the cost and complexity of deploying such systems in harsh and remote environments.

The video surveillance market is experiencing a transition from analog to IP and it is expected that by 2015 IP surveillance systems will take over the conventional analog surveillance systems. In terms of applications, education sector is expected to be the fastest growing amongst all the other applications.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 EVOLUTION OF VIDEO SURVEILLANCE

3.2 MARKET VALUE CHAIN

3.3 DRIVERS

3.3.1 INCREASED SECURITY NEEDS

3.3.2 DECREASING COST OF EQUIPMENT

3.3.3 NEW MEGAPIXEL SOLUTIONS

3.3.4 INCREASED INVESTMENTS BY THE CENTRAL & STATE GOVERNMENTS

3.4 RESTRAINTS

3.4.1 DATA PROTECTION/PRIVACY

3.4.2 LACK OF STANDARDIZATION

3.4.3 DAMAGE TO HARDWARE AND CAMERAS

3.5 OPPORTUNITIES

3.5.1 INTELLIGENT VIDEO SURVEILLANCE

3.5.2 THERMAL IP CAMERAS

3.5.3 HOSPITALITY AND CASINOS

3.6 BURNING ISSUES

3.6.1 GOVERNMENT & PUBLIC SAFETY

3.6.2 INCREASING NEED FOR STORAGE

3.7 WINNING IMPERATIVES

3.7.1 TECHNOLOGY INNOVATION

3.7.2 CLOUD VIDEO SURVEILLANCE

3.7.3 INTEGRATED SOLUTIONS

3.8 MARKET SHARE ANALYSIS

3.9 PORTERS FIVE FORCES MODEL

3.9.1 THREAT FROM SUBSTITUTES

3.9.2 BARGAINING POWER OF CUSTOMERS

3.9.3 BARGAINING POWER OF SUPPLIERS

3.9.4 THREAT FROM NEW ENTRANTS

3.9.5 INTENSITY OF RIVALRY

4 VIDEO SURVEILLANCE MARKET, BY PRODUCTS

4.1 INTRODUCTION

4.2 TYPES OF VIDEO SURVEILLANCE SYSTEMS

4.2.1 ANALOG VIDEO SURVEILLANCE SYSTEM

4.2.2 IP VIDEO SURVEILLANCE SYSTEM

4.2.3 MOBILE VIDEO SURVEILLANCE

4.2.4 REMOTE VIDEO SURVEILLANCE (RVS)

5 VIDEO SURVEILLANCE MARKET, BY COMPONENTS

5.1 INTRODUCTION

5.2 CAMERAS

5.2.1 TYPES OF IP CAMERAS

5.3 STORAGE

5.3.1 DIGITAL VIDEO RECORDER (DVR)

5.3.2 NETWORK VIDEO RECORDER (NVR)

5.3.3 IP SAN

5.3.4 OTHERS

5.4 SOFTWARE

5.4.1 VIDEO MANAGEMENT SOFTWARE

5.4.2 VIDEO ANALYTICS

5.5 MONITORS

5.6 SERVERS

5.7 SYSTEM MANAGEMENT

6 VIDEO SURVEILLANCE MARKET, BY APPLICATIONS

6.1 INTRODUCTION

6.2 INFRASTRUCTURE

6.2.1 HIGHWAYS, STREETS AND BRIDGES

6.2.2 ENERGY

6.2.3 TRANSPORTATION

6.2.4 STADIUMS, PARKS AND PLAYGROUND

6.3 COMMERCIAL

6.3.1 OFFICE

6.3.2 LODGING

6.3.3 RETAIL

6.3.4 HEALTHCARE

6.3.5 WAREHOUSE NON-MANUFACTURING

6.4 INSTITUTIONS

6.4.1 EDUCATIONAL BUILDING

6.4.2 RELIGIOUS BUILDING

6.4.3 GOVERNMENT BUILDING

6.4.4 AMUSEMENT PARK

6.4.5 PUBLIC RECREATION

6.5 INDUSTRIAL (BUILDINGS)

6.6 RESIDENTIAL

7 VIDEO SURVEILLANCE MARKET, BY GEOGRAPHY

7.1 INTROUDCTION

7.2 NORTH AMERICA

7.3 EUROPE

7.4 ASIA-PACIFIC

7.5 REST OF THE WORLD (ROW)

8 COMPETATIVE LANDSCAPE

8.1 MARKET SHARE ANALYSIS

8.2 MERGERS & ACQUISITIONS

8.3 COLLABORATIONS/PARTNERSHIPS/ AGREEMENTS/JOINT VENTURES

8.4 NEW PRODUCTS LAUNCHES

8.5 OTHERS

9 COMPANY PROFILES

9.1 ADT SECURITY SERVICES

9.1.1 OVERVIEW

9.1.2 PRIMARY BUSINESS

9.1.3 FINANCIALS

9.1.4 STRATEGY

9.1.5 DEVELOPMENTS

9.2 AGENT VIDEO INTELLIGENCE INC.

9.2.1 OVERVIEW

9.2.2 STRATEGY

9.2.3 DEVELOPMENTS

9.3 ARECONT VISION LLC

9.3.1 OVERVIEW

9.3.2 PRIMARY BUSINESS

9.3.3 FINANCIALS

9.3.4 STRATEGY

9.3.5 DEVELOPMENTS

9.4 AXIS COMMUNICATIONS AB

9.4.1 OVERVIEW

9.4.2 PRIMARY BUSINESS

9.4.3 FINANCIALS

9.4.4 STRATEGY

9.4.5 DEVELOPMENTS

9.5 BOSCH SECURITY SYSTEMS

9.5.1 OVERVIEW

9.5.2 PRIMARY BUSINESS

9.5.3 FINANCIALS

9.5.4 STRATEGY

9.5.5 DEVELOPMENTS

9.6 CANON, INC.

9.6.1 OVERVIEW

9.6.2 PRIMARY BUSINESS

9.6.3 FINANCIALS

9.6.4 STRATEGY

9.6.5 DEVELOPMENTS

9.7 CERNIUM CORP.

9.7.1 OVERVIEW

9.7.2 PRIMARY BUSINESS

9.7.3 FINANCIALS

9.7.4 STRATEGY

9.7.5 DEVELOPMENTS

9.8 CISCO SYSTEM INC.

9.8.1 OVERVIEW

9.8.2 PRIMARY BUSINESS

9.8.3 FINANCIALS

9.8.4 STRATEGY

9.8.5 DEVELOPMENTS

9.9 DEDICATED MICROS INC.

9.9.1 OVERVIEW

9.9.2 PRIMARY BUSINESS

9.9.3 FINANCIALS

9.9.4 STRATEGY

9.9.5 DEVELOPMENTS

9.10 ENVYSION, INC.

9.10.1 OVERVIEW

9.10.2 PRIMARY BUSINESS

9.10.3 FINANCIALS

9.10.4 STRATEGY

9.10.5 DEVELOPMENTS

9.11 FIRETIDE, INC.

9.11.1 OVERVIEW

9.11.2 PRIMARY BUSINESS

9.11.3 FINANCIALS

9.11.4 STRATEGY

9.11.5 DEVELOPMENTS

9.12 GENETEC INC.

9.12.1 OVERVIEW

9.12.2 PRIMARY BUSINESS

9.12.3 FINANCIALS

9.12.4 STRATEGY

9.12.5 DEVELOPMENTS

9.13 HONEYWELL INTERNATIONAL INC.

9.13.1 OVERVIEW

9.13.2 PRIMARY BUSINESS

9.13.3 FINANCIALS

9.13.4 STRATEGY

9.13.5 DEVELOPMENTS

9.14 INDIGOVISION GROUP PLC

9.14.1 OVERVIEW

9.14.2 PRIMARY BUSINESS

9.14.3 FINANCIALS

9.14.4 STRATEGY

9.14.5 DEVELOPMENTS

9.15 MARCH NETWORKS CORP

9.15.1 OVERVIEW

9.15.2 PRIMARY BUSINESS

9.15.3 FINANCIALS

9.15.4 STRATEGY

9.15.5 DEVELOPMENTS

9.16 MILESTONE SYSTEMS A/S

9.16.1 OVERVIEW

9.16.2 PRIMARY BUSINESS

9.16.3 FINANCIALS

9.16.4 STRATEGY

9.16.5 DEVELOPMENTS

9.17 MIRASYS LTD

9.17.1 OVERVIEW

9.17.2 PRIMARY BUSINESS

9.17.3 FINANCIALS

9.17.4 STRATEGY

9.17.5 DEVELOPMENTS

9.18 MOBOTIX AG

9.18.1 OVERVIEW

9.18.2 PRIMARY BUSINESS

9.18.3 FINANCIALS

9.18.4 STRATEGY

9.18.5 DEVELOPMENTS

9.19 OBJECTVIDEO, INC.

9.19.1 OVERVIEW

9.19.2 PRIMARY BUSINESS

9.19.3 FINANCIALS

9.19.4 STRATEGY

9.19.5 DEVELOPMENTS

9.20 PANASONIC CORP.

9.20.1 OVERVIEW

9.20.2 PRIMARY BUSINESS

9.20.3 FINANCIALS

9.20.4 STRATEGY

9.20.5 DEVELOPMENTS

9.21 PELCO INC.

9.21.1 OVERVIEW

9.21.2 PRIMARY BUSINESS

9.21.3 FINANCIALS

9.21.4 STRATEGY

9.21.5 DEVELOPMENTS

9.22 PIVOT3 INC.

9.22.1 OVERVIEW

9.22.2 PRIMARY BUSINESS

9.22.3 FINANCIALS

9.22.4 STRATEGY

9.22.5 DEVELOPMENTS

9.23 SMARTVUE CORP.

9.23.1 OVERVIEW

9.23.2 PRIMARY BUSINESS

9.23.3 FINANCIALS

9.23.4 STRATEGY

9.23.5 DEVELOPMENTS

9.24 SURVEON TECHNOLOGY INC.

9.24.1 OVERVIEW

9.24.2 PRIMARY BUSINESS

9.24.3 FINANCIALS

9.24.4 STRATEGY

9.24.5 DEVELOPMENTS

9.25 UNITED TECHNOLOGIES CORP.

9.25.1 OVERVIEW

9.25.2 PRIMARY BUSINESS

9.25.3 FINANCIALS

9.25.4 STRATEGY

9.25.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 VIDEO SURVEILLANCE MARKET REVENUE, BY COMPONENT, 2011 2016 ($BILLION)

TABLE 2 REVENUES OF TOP COMPANIES IN VIDEO SURVEILLANCE, 2011 ($MILLION)

TABLE 3 VIDEO SURVEILLANCE MARKET REVENUE, BY TYPES, 2011 2016 ($BILLION)

TABLE 4 ANALOG VIDEO SURVEILLANCE MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 5 IP VIDEO SURVEILLANCE SYSTEM MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 6 COMPARISON BETWEEN WIRED & WIRELESS VIDEO SURVEILLANCE SYSTEM

TABLE 7 CAMERA MARKET REVENUE, BY TYPES, 2011 2016 ($BILLION)

TABLE 8 CAMERA MARKET REVENUE, BY FORMS, 2011 2016 ($BILLION)

TABLE 9 CAMERA MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 10 CAMERA MARKET REVENUE, BY ENVIRONMENT, 2011 2016 ($BILLION)

TABLE 11 CAMERA MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 12 CAMERAS MARKET REVENUE IN INFRASTRUCTURE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 13 CAMERAS MARKET REVENUE IN COMMERCIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 14 CAMERAS MARKET REVENUE IN INSTITUTIONS, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 15 CAMERAS MARKET REVENUE IN INDUSTRIAL (BUILDINGS), BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 16 CAMERAS MARKET REVENUE IN RESIDENTIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 17 IP CAMERA MARKET REVENUE, BY TYPES, 2011 2016 ($BILLION)

TABLE 18 STORAGE MARKET REVENUE, BY TYPES, 2011 2016 ($BILLION)

TABLE 19 STORAGE MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 20 STORAGE MARKET REVENUE IN INFRASTRUCTURE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 21 STORAGE MARKET REVENUE IN COMMERCIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 22 STORAGE MARKET REVENUE IN INSTITUTION, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 23 STORAGE MARKET REVENUE IN INDUSTRIAL (BUILDINGS), BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 24 STORAGE MARKET REVENUE IN RESIDENTIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 25 DIGITAL VIDEO RECORDER MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 26 NETWORK VIDEO RECORDER MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 27 IP SAN MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 28 SOFTWARE MARKET REVENUE, BY TYPES, 2011 2016 ($BILLION)

TABLE 29 SOFTWARE MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 30 SOFTWARE MARKET REVENUE IN INFRASTRUCTURE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 31 SOFTWARE MARKET REVENUE IN COMMERCIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 32 SOFTWARE MARKET REVENUE ININSTITUTIONS, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 33 SOFTWARE MARKET REVENUE IN INDUSTRIAL (BUILDINGS), BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 34 SOFTWARE MARKET REVENUE IN RESIDENTIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 35 VIDEO MANAGEMENT SOFTWARE MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 36 VIDEO ANALYTICS MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 37 MONITORS MARKET REVENUE, BY GEOGRAPHY, 2011 2016, ($BILLION)

TABLE 38 MONITORS MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 39 MONITORS MARKET REVENUE IN INFRASTRUCTURE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 40 MONITORS MARKET REVENUE IN COMMERCIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 41 MONITORS MARKET REVENUE IN INSTITUTIONS, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 42 MONITORS MARKET REVENUE IN INDUSTRIAL (BUILDINGS), BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 43 MONITORS MARKET REVENUE IN RESIDENTIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 44 SERVERS MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 45 SERVERS MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 46 SERVERS MARKET REVENUE IN INFRASTRUCTURE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 47 SERVERS MARKET REVENUE IN COMMERCIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 48 SERVERS MARKET REVENUE IN INSTITUTIONS, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 49 SERVERS MARKET REVENUE IN INDUSTRIAL (BUILDINGS), BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 50 SERVERS MARKET REVENUE IN RESIDENTIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 51 SYSTEM MANAGEMENT MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 52 SYSTEM MANAGEMENT MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 53 SYSTEM MANAGEMENT MARKET REVENUE IN INFRASTRUCTURE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 54 SYSTEM MANAGEMENT MARKET REVENUE IN COMMERCIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 55 SYSTEM MANAGEMENT MARKET REVENUE IN INSTITUTIONS, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 56 SYSTEM MANAGEMENT MARKET REVENUE IN INDUSTRIAL (BUILDINGS), BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 57 SYSTEM MANAGEMENT MARKET REVENUE IN RESIDENTIAL, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 58 VIDEO SURVEILLANCE MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 59 VIDEO SURVEILLANCE MARKET REVENUE, BY BUILDING TYPES, 2011 2016 ($BILLION)

TABLE 60 INFRASTRUCTURE MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 61 INFRASTRUCTURE APPLICATION MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 62 COMMERCIAL MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 63 COMMERCIAL APPLICATION MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 64 INSTITUTIONAL MARKET REVENUE, BY APPLICATIONS, 2011 2016 ($BILLION)

TABLE 65 INSTITUTIONAL MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 66 INDUSTRIAL (BUILDINGS) APPLICATION MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 67 RESIDENTIAL APPLICATION MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 68 VIDEO SURVEILLANCE MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 69 VIDEO SURVEILLANCE MARKET RANKING, 2010

TABLE 70 RANKING OF THE LEADING PLAYERS, BY COMPONENTS

TABLE 71 AXIS COMMUNICATIONS: MARKET REVENUE, BY PRODUCTS, 2009 2010 ($MILLION)

TABLE 72 CANON: MARKET REVENUE, BY SEGMENT, 2009 2010 ($MILLION)

TABLE 73 CISCO: MARKET REVENUES, BY SEGMENT, 2010 2011 ($MILLION)

TABLE 74 HONEYWELL INTERNATIONAL: MARKET REVENUE, BY PRODUCTS & SERVICES, 2009 2010 ($MILLION)

TABLE 75 INDIGOVISION GROUP: MARKET REVENUE, BY PRODUCTS & SERVICES, 2010 2011 ($MILLION)

TABLE 76 MARCH NETWORKS: MARKET REVENUE, BY PRODUCTS & SERVICES, 2010 2011 ($MILLION)

TABLE 77 MOBOTIX: MARKET REVENUE, BY PRODUCT, 2010- 2011 ($MILLION)

TABLE 78 PANASONIC: TOTAL REVENUE, 2010 2011 ($MILLION)

TABLE 79 UNITED TECHNOLOGIES CORP: MARKET REVENUE, BY SEGMENT, 2009 2010 ($MILLION)

LIST OF FIGURES

FIGURE 1 EVOLUTION OF VIDEO SURVEILLANCE

FIGURE 2 VIDEO SURVEILLANCE MARKET SEGMENTATION

FIGURE 3 IMPACT OF MAJOR DRIVERS ON VIDEO SURVEILLANCE MARKET

FIGURE 4 IMPACT OF MAJOR RESTRAINTS ON VIDEO SURVEILLANCE MARKET

FIGURE 5 MARKET SHARE OF TOP COMPANIES, 2011

FIGURE 6 PORTERS FIVE FORCES

FIGURE 7 VIDEO SURVEILLANCE MARKET TRENDS

FIGURE 8 ADVANTAGES OF IP VIDEO SURVEILLANCE SYSTEM

FIGURE 9 NORTH AMERICA: MARKET GROWTH RATE, 2011 2016 ($BILLION)

FIGURE 10 EUROPE: MARKET GROWTH RATE, 2011 2016 ($BILLION)

FIGURE 11 ASIA-PACIFIC: MARKET GROWTH RATE, 2011 2016 ($BILLION)

FIGURE 12 ROW: MARKET GROWTH RATE, 2011 2016 ($BILLION)

Growth opportunities and latent adjacency in Global Video Surveillance Market

We are planning to manufacture DVR hence please provide the market requirement and the major players share.

Need information on video communications, digital signage, cloud services, video surveillance, unified communications and collaboration, and call center services markets.

I am interested in your detailed report on the surveillance sector and have noticed that you have possibly completed such a report. My main interest would be for the commercial governmental aspect of this industry. Please call me to further discuss the details of your report.