Turbocompressor Market by Type (Centrifugal & Axial), Application (Oil & Gas, Chemical, and Power Generation), Stage (Single & Multi), Output Pressure (020, 21100, Above 100 Bar), and by Region - Global Trends & Forecasts to 2021

[144 Pages Report] The global turbocompressor market is estimated to be USD 12.15 Billion in 2016, and is expected to grow at a CAGR of 5.4% from 2016 to 2021.

Objectives of the report:

- To define, describe, and forecast the global turbocompressor market on the basis of application, output pressure, stage, type, and region

- To provide detailed information regarding major factors influencing the growth of the market, including drivers, restraints, opportunities, industry-specific challenges, winning imperatives, and burning issues

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze market opportunities for stakeholders and provide details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, mergers & acquisitions, and expansions in the turbocompressors market

The years considered for the study are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

2015 has been considered the base year for company profiles in the report. Whenever information is unavailable for the base year, the prior year has been considered.

Research Methodology

This research study has involved extensive usage of secondary sources, directories, and databases to identify and collect information for a technical, market-oriented, and commercial study of the turbocompressor market. The below-mentioned points explain the research methodology applied in making the report.

- Analysis of all the operational and upcoming projects across the globe

- Analysis of country-wise GDP from manufacturing for the past 3 years

- Analysis of LNG and refinery projects across various regions

- Estimation of installation cost of turbocompressors in various regions using the cost variance models

- Estimation of the total market size of the turbocompressors market using the market engineering process

- Analysis of market trends in various regions/countries, supported by ongoing investments in respective regions/countries

- Overall market size has been finalized by triangulation of the supply-side data, which includes product developments, the supply chain, and annual global sales of turbocompressors

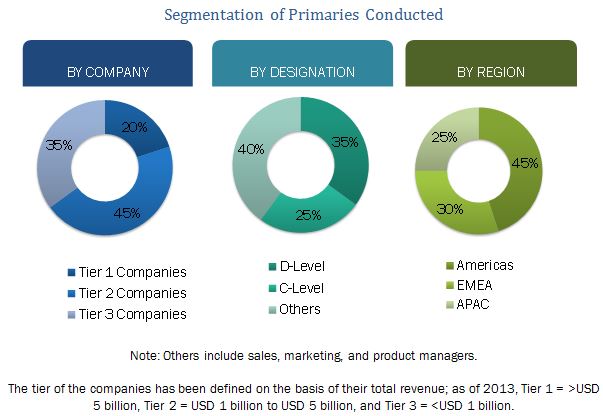

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below includes a breakdown of the primaries conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The ecosystem of the turbocompressors market is divided into in-house and outsourced tasks. In-house activities mainly focus on the critical aspects and components of a product, while the required auxiliary parts are often outsourced. These components are then assembled according to the required specifications in the assembly stage. All parts are configured before the final packaging of the product. The product is then introduced in the market through the process of distribution, marketing, and sales.

Original equipment manufacturers of turbocompressor include Siemens AG (Germany), General Electric (U.S.), Howden (U.K.), and Mitsubishi Electric Corporation (Japan). The end-users, on the other hand, include Duke Energy (U.S.), National Grid (U.K.), Ruwais Refinery (Abu Dhabi Oil Refining Company) (UAE), Exxon Mobil (U.S.), and Reliance Industries (India).

Target Audience:

- Turbocompressor manufacturers, dealers, and suppliers

- Power generation companies

- Oil & gas refineries

- LNG transport companies

- Consulting companies and associations in the energy & power sector

- Government and research organizations

The study answers several questions for stakeholders, primarily which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report:

- By Type

- Centrifugal Turbocompressors

- Axial Turbocompressors

- By Application

- Oil & Gas

- Power Generation

- Chemical

- Others

- By Stage

- Single Stage

- Multi-Stage

- By Output Pressure

- 0 bar20 bar

- 21 bar100 bar

- Above 100 bar

- By Region

- North America

- South America

- Europe

- Asia-Pacific

- Middle East

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Product Analysis

- A product matrix, which provides a detailed comparison of the product portfolios of each company

Regional Analysis

- Further breakdown of the Rest of Asia-Pacific turbocompressors market into South Korea, Malaysia, and Indonesia, among others

- Further breakdown of the Middle East & African turbocompressors market into Iraq, Qatar, Nigeria, and Algeria, among others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global turbocompressor market is projected to grow at a CAGR of 5.4% during the forecast period, to reach USD 15.81 Billion by 2021. This growth can be attributed to the rising investments in the manufacturing sector and the increasing LNG trade between countries.

The turbocompressor market has been segmented on the basis of output pressure into 0 bar20 bar, 21 bar100 bar, and above 100 bar. The 0 bar20 bar segment is estimated to hold the largest market share, as turbocompressors within this range are used for multiple applications, including ethylene and fertilizer plants, refineries, liquid nitrogen freezers (LNF) for refrigeration, and air compression.

On the basis of stage, the market has been classified into single stage and multi-stage. Single stage turbocompressors hold a larger market share than multi-stage turbocompressors, owing to their widespread adoption in various industries.

In terms of type, centrifugal turbocompressors are estimated to account for the largest market share; however, the market for axial turbocompressors is set to grow at a faster rate, due to their extensive use in LNG transport and crude oil refineries. Centrifugal turbocompressors are widely used in chemical and pharmaceutical-manufacturing companies.

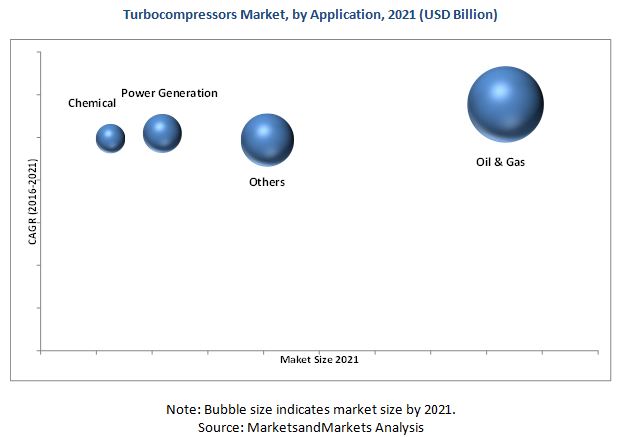

With regard to application, the oil & gas sector is the largest end-user of turbocompressors, as turbocompressors are used in almost all the stages of the oil & gas industry, from the extraction of oil & gas to its transport and storage.

The market has been segmented on the basis of region into North America, Europe, Asia-Pacific, South America, the Middle East, and Africa. Each region has been further divided on the basis of key countries. North America held the largest market share in 2015, followed by Asia-Pacific and Europe. In terms of individual countries, the market is dominated by the U.S., on account of the large number of ongoing shale gas and LNG projects and the increasing focus on the manufacturing sector in the country. Turbocompressors are expected to be extensively used in gas transportation and storage and manufacturing applications in industries such as chemical, food processing, and pharmaceutical.

The maturing European manufacturing industry and the development of rotatory screw compressors are major restraints of the turbocompressors market. Most turbocompressor-manufacturing companies are based in Europe, where market growth is slow. To counter the economic slump in European countries, turbocompressor manufacturers are trying to increase their geographic presence and market penetration in other regions by launching new and advanced products and technologies.

The increasing competition in emerging markets and prevailing laws in countries such as China, India, and Brazil have compelled companies to adopt strategies such as partnerships, agreements, and collaborations to increase their market share. The top five companies in the turbocompressors industry are Ingersoll Rand PLC (Ireland), Atlas Copco (Sweden), Mitsubishi Heavy Industries, Ltd. (Japan), General Electric (U.S.), Siemens AG (Germany), and Howden Group Ltd. (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.2 Key Industry Insights

2.3.3 Breakdown of Primaries

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown & Data Triangulation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 27)

3.1 Historical Backdrop, Evolution, & Current Scenario

3.2 Future Outlook

3.3 Conclusion

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Turbocompressor Market, 20162021

4.2 North America is the Largest Market for Turbocompressors

4.3 Turbocompressor Market, By Application

4.4 North American Turbocompressor Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Turbocompressors: Market Segmentation

5.2.1 By Stage

5.2.2 By Output Pressure

5.2.3 By Type

5.2.4 By Application

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Lng Trade Between Nations is Expected to Drive the Demand for Turbocompressors

5.3.1.2 Increasing Demand for Energy Would Compel the Governments to Increase Power Generation

5.3.1.3 Growing Industrialization Would Increase the Demand for Turbocompressors

5.3.1.4 Investments in Sectors Other Than Oil & Gas in Mena

5.3.1.5 Growing Number of Wastewater Treatment Plants Would Trigger the Demand for Turbocompressors

5.3.2 Restraints

5.3.2.1 Substitute Products Such as Rotatory Screw Compressors

5.3.2.2 Declining Lng Import in Japan and South Korea

5.3.3 Opportunities

5.3.3.1 Co2 Transport Network

5.3.3.2 Step Change Turbocompressor Technology

5.3.4 Challenges

5.3.4.1 High Technical and Operating Standards

5.3.4.2 Market Fragmentation Leading to Declining Profits

5.4 Value Chain Analysis

5.5 Porters Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Turbocompressors Market, By Type (Page No. - 47)

6.1 Introduction

6.1.1 Centrifugal Turbocompressors

6.1.2 Axial Turbocompressors

7 Turbocompressors Market, By Application (Page No. - 51)

7.1 Introduction

7.1.1 Oil & Gas

7.1.2 Chemical

7.1.3 Power Generation

7.1.4 Others

8 Turbocompressors Market, By Stage (Page No. - 58)

8.1 Introduction

8.2 Single Stage Turbocompressors

8.3 Multi-Stage Turbocompressors

9 Turbocompressors Market, By Output Pressure (Page No. - 62)

9.1 Introduction

9.2 020 Bar

9.3 21100 Bar

9.4 Above 100 Bar

10 Turbocompressors Market, By Region (Page No. - 67)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Asia-Pacific

10.3.1 China

10.3.2 India

10.3.3 Japan

10.3.4 Rest of Asia-Pacific

10.4 Europe

10.4.1 Germany

10.4.2 Russia

10.4.3 U.K.

10.4.4 Rest of Europe

10.5 Middle East

10.5.1 Saudi Arabia

10.5.2 Iran

10.5.3 UAE

10.5.4 Rest of the Middle East

10.6 Africa

10.6.1 South Africa

10.6.2 Egypt

10.6.3 Rest of Africa

10.7 South America

10.7.1 Brazil

10.7.2 Argentina

10.7.3 Rest of South America

11 Competitive Landscape (Page No. - 95)

11.1 Overview

11.2 Development Share Analysis, 2015

11.3 Competitive Situation & Trends

11.4 Contracts & Agreements

11.5 Expansions

11.6 New Product Developments

11.7 Mergers & Acquisitions

12 Company Profiles (Page No. - 103)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

12.1 Introduction

12.2 Siemens AG

12.3 GE Oil & Gas

12.4 Mitsubishi Heavy Industries, Ltd.

12.5 Ingersoll Rand PLC.

12.6 Man Diesel & Turbo

12.7 Kobe Steel Ltd.

12.8 Atlas Copco AB

12.9 Elliott Group Ltd.

12.10 Howden Group Ltd.

12.11 SKF

12.12 Sulzer Ltd.

12.13 Kawasaki Heavy Industries Ltd.

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 137)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (66 Tables)

Table 1 Turbocompressor Market Size, By Type, 20142021, (USD Million)

Table 2 Centrifugal: Turbocompressors Market Size, By Region, 20142021 (USD Million)

Table 3 Axial: Turbocompressors Market Size, By Region, 20142021 (USD Million)

Table 4 Turbocompressor Market Size, By Application, 20142021 (USD Million)

Table 5 Oil & Gas: Turbocompressors Market Size, By Region, 20142021 (USD Million)

Table 6 Oil & Gas: Turbocompressors Market Size, By Output Pressure, 20142021 (USD Million)

Table 7 Chemical: Turbocompressors Market Size, By Region, 20142021 (USD Million)

Table 8 Chemical: Turbocompressors Market Size, By Output Pressure, 20142021 (USD Million)

Table 9 Power Generation: Turbocompressors Market Size, By Region, 20142021 (USD Million)

Table 10 Power Generation: Turbocompressors Market Size, By Output Pressure, 20142021 (USD Million)

Table 11 Others: Tubocompressors Market Size, By Region, 20142021 (USD Million)

Table 12 Others: Tubocompressors Market Size, By Output Pressure, 20142021 (USD Million)

Table 13 Turbocompressors Market Size, By Stage, 20142021 (USD Million)

Table 14 Single Stage: Turbocompressors Market Size, By Output Pressure, 20142021 (USD Million)

Table 15 Multi-Stage: Turbocompressors Market Size, By Output Pressure, 20142021 (USD Million)

Table 16 Turbocompressor Market Size, By Output Pressure, 20142021 (USD Million)

Table 17 020 Bar: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 18 020 Bar: Turbocompressors Market Size, By Stage, 20142021 (USD Million)

Table 19 21100 Bar: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 20 21100 Bar: Turbocompressors Market Size, By Stage, 20142021 (USD Million)

Table 21 Above 100 Bar: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 22 Above 100 Bar: Turbocompressors Market Size, By Stage, 20142021 (USD Million)

Table 23 Turbocompressor Market Size, By Region, 20142021 (USD Million)

Table 24 North America: Turbocompressors Market Size, By Country, 20142021 (USD Million)

Table 25 North America: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 26 North America: Turbocompressors Market Size, By Type, 20142021 (USD Million)

Table 27 U.S.: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 28 Canada: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 29 Mexico: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 30 Asia-Pacific: Turbocompressors Market Size, By Country, 20142021 (USD Million)

Table 31 Asia-Pacific: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 32 Asia-Pacific: Turbocompressors Market Size, By Type, 20142021 (USD Million)

Table 33 China: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 34 India: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 35 Japan: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 36 Rest of Asia-Pacific: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 37 Europe: Turbocompressors Market Size, By Country, 20142021 (USD Million)

Table 38 Europe: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 39 Europe: Turbocompressors Market Size, By Type, 20142021 (USD Million)

Table 40 Germany: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 41 Russia: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 42 U.K.: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 43 Rest of Europe: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 44 Middle East : Turbocompressors Market Size, By Country, 20142021 (USD Million)

Table 45 Middle East: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 46 Middle East : Turbocompressors Market Size, By Type, 20142021 (USD Million)

Table 47 Saudi Arabia: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 48 Iran: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 49 UAE: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 50 Rest of the Middle East: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 51 Africa : Turbocompressors Market Size, By Country, 20142021 (USD Million)

Table 52 Africa: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 53 Africa : Turbocompressors Market Size, By Type, 20142021 (USD Million)

Table 54 South Africa: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 55 Egypt: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 56 Rest of Africa: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 57 South America: Turbocompressors Market Size, By Country, 20142021 (USD Million)

Table 58 South America: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 59 South America: Turbocompressors Market Size, By Type, 20142021 (USD Million)

Table 60 Brazil: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 61 Argentina: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 62 Rest of South America: Turbocompressors Market Size, By Application, 20142021 (USD Million)

Table 63 Contracts & Agreements, 20132016

Table 64 Expansions, 2015

Table 65 New Product Developments, 20132015

Table 66 Mergers & Acquisitions, 20152016

List of Figures (51 Figures)

Figure 1 Turbocompressor Market Segmentation

Figure 2 Turbocompressor Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 North America Accounted for the Largest Share (By Value) in the Turbocompressor Market in 2015

Figure 8 Axial Turbocompressors Expected to Witness the Highest Demand During the Forecast Period

Figure 9 North America Estimated to Dominate the Turbocompressor Market, 20162021

Figure 10 Oil & Gas Application to Grow at the Fastest Rate During the Forecast Period

Figure 11 Top Market Developments (20142015)

Figure 12 Growth of Manufacturing Sector in Asia-Pacific is Expected to Drive the Turbocompressor Market, 20162021

Figure 13 The North American Market is Estimated to Grow at A High CAGR From 2016 to 2021

Figure 14 Oil & Gas Sector Expected to Dominate the Turbocompressor Market By 2021

Figure 15 U.S. Accounted for the Largest Share in the North American Turbocompressors Market in 2015

Figure 16 Turbocompressors: Market Segmentation, By Stage, Output Pressure, Type, Application, & Region

Figure 17 Market Dynamics: Turbocompressor Market

Figure 18 Top Ten Energy-Consuming Nations, 2015

Figure 19 Historic Crude Oil Prices (USD/Barrel), 2010-2015

Figure 20 Turbocompressor Market: Value Chain Analysis

Figure 21 Porters Five Forces Analysis: Turbocompressor Market

Figure 22 Axial Turbocompressors Segment is Expected to Dominate the Market During the Forecast Period

Figure 23 Oil & Gas is the Largest Market for Turbocompressors, 20162021

Figure 24 Chemical Sector: Market Share (Value), By Region, 2016 & 2021

Figure 25 Turbocompressor Market Size, By Output Pressure, 2016 & 2021 (USD Million)

Figure 26 Regional Snapshot (2015): Growing Markets Emerging as New Hot Spots

Figure 27 Turbocompressor Market Size, By Region, 20162021 (USD Million)

Figure 28 North America: Turbocompressor Market Overview

Figure 29 Asia-Pacific: Turbocompressor Market Overview

Figure 30 Companies Adopted Contracts & Agreements as the Key Growth Strategy, 20132016

Figure 31 Atlas Copco AB Accounted for the Largest Development Share in the Turbocompressor Market in 2015

Figure 32 Market Evaluation Framework

Figure 33 Battle for Market Share: Contracts & Agreements Was the Key Strategy, 20132016

Figure 34 Regional Revenue Mix of the Top 5 Market Players

Figure 35 SiemensAG: Company Snapshot

Figure 36 SiemensAG: SWOT Analysis

Figure 37 GE Oil & Gas: Company Snapshot

Figure 38 GE Oil & Gas: SWOT Analysis

Figure 39 Mitsubishi Heavy Industries, Ltd.: Company Snapshot

Figure 40 Mitsubishi Heavy Industries, Ltd.: SWOT Analysis

Figure 41 Ingersoll Rand PLC.: Company Snapshot

Figure 42 Ingersoll Rand PLC.: SWOT Analysis

Figure 43 Man Diesel & Turbo: Company Snapshot

Figure 44 Man Diesel & Turbo: SWOT Analysis

Figure 45 Kobe Steel Ltd.: Company Snapshot

Figure 46 Atlas Copco AB: Company Snapshot

Figure 47 Elliott Group Ltd.: Company Snapshot

Figure 48 Howden Group Ltd.: Company Snapshot

Figure 49 SKF: Company Snapshot

Figure 50 Sulzer Ltd.: Company Snapshot

Figure 51 Kawasaki Heavy Industries Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Turbocompressor Market