Transfer Switch Market by Type (Automatic & Manual), Transition Mode (Open, Closed, Delayed, & Soft Load), Ampere Rating (0-300A, 301A-1.6kA, 1.6kA-4kA), Applications (Industrial, Commercial, & Residential) and Region - Global Trends and Forecasts to 2020

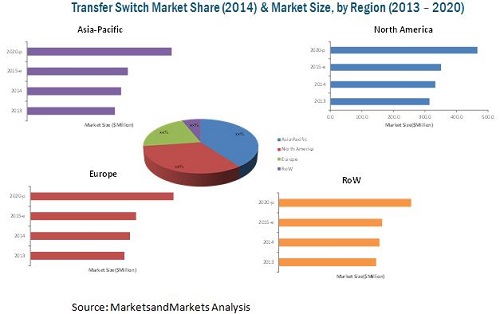

[214 Pages Report] The transfer switch market is expected to reach $1,470.9 Million by 2020, at a CAGR of 6.6% from 2015 to 2020. There is an increasing demand for electricity is the large markets such as China, India, and Brazil, globally. Transfer switch are used for providing back-up power solutions for various critical industries such as healthcare, telecommunication, IT, datacenters, and among others. Factors including fluctuating whether conditions, industry applications, infrastructural developments, need for uninterrupted and reliable power are expected to drive the global transfer switch market. Asia-Pacific is the most attracting market for transfer switch due to the rise of industrial and commercial sectors in the region, especially in countries such as China and India. The global market is expected to witness decent growth in the coming years, supported by huge investments in the power sector.

Scope of the report: This report covers the global transfer switch market in terms of value. It highlights some of the key industrial issues and market impulse factors. It also describes some of the important dynamics such as driver, restraints, and opportunities and challenges for the market.

On the type:

- Automatic

- Contactor Based

- Circuit Based

- Static Transfer switch

- Manual

On the basis of Applications:

- Industrial

- Power Utilities

- Transportation

- Telecom & IT

- Others

- Commercial

- Residential

On the basis of Transition Mode: Open, Closed, Delayed, Soft load transition

On the basis of Ampere Rating: 0-300A, 301-1600A, and 1600A-4000A

On the basis of Region: North America, Asia-Pacific, Europe, and RoW

To provide an in-depth understanding of the competitive landscape, the report includes profiles of some of the major transfer switch manufacturers, which includes ABB Ltd. (Switzerland), General Electric (U.S.), Cummins Inc. (U.S.), Emerson Electric Company (U.S.), Eaton Corporation PLC. (Ireland), Kohler Power (U.S.), Marathon Thomson Power System (Canada), and Generac Power Systems (U.S.), and among others.

Market share analysis, by revenue, of the top companies is also included in the report. The scope accordingly aids market participants to identify high growth markets and help managing key investment decisions. For this report, major players in the transfer switch market have been identified using various primary and secondary sources, which include annual reports of top market players, interviews with key opinion leaders such as CEOs, directors, and marketing people. Based on this research, the market shares have been evaluated and validated.

The global transfer switch market is estimated to reach $1,470.9 Million by 2020 at a projected CAGR of 6.6% during the forecast period. The growth is attributed to the increasing demand in the industrial and commercial applications.

Transfer switch is an electromechanical device which facilitates switching between two or more power sources mainly backup generators. It assures convenient and hassle free switching and continuous power supply in industrial, commercial and residential operations. The market drivers of the transfer switch market are entirely influenced by power distribution & transmission industry. Growth in the related as well as complementary markets, of generators and alternate energy sources, also contribute towards the growth of transfer switch market.

Sudden brownouts and voltage fluctuation, outages, blackouts, and uncertain weather conditions have led to the increase in demand for transfer switch in the market. The growing dependence on power and critical application in industries, commercial institutions, healthcare, transportation, and households is the driving factor for transfer switch market. The figure below shows the global transfer switch market by region in the year 2014.

The Asia-Pacific transfer switch market held the largest market share in 2014. The market in China accounts the largest share in this region. Rapid industrialization is driving the market growth in this country. Also, some of the worlds largest transfer switch manufacturers are present in China.

The need for the installation of transfer switch is more seen in the industrial sector as most of the industrial end users rely on continuous power. The sector comprises mainly power rental companies, utilities, telecom & IT (datacenters) and construction & manufacturing, mining industries, oil & gas, automotive, & pharmaceuticals industries. In terms of value, the industrial segment accounted for the largest share in the global transfer switch market, followed by commercial and residential.

Further, new product/service/technology launch is one of the key strategies adopted by the key market players to strengthen their market position and expand their market size. Some of the major players operating in this market are ABB Ltd. (Switzerland), General Electric (U.S.), Cummins Inc. (U.S.), Emerson Electric Co. (U.S.), Eaton Co. Plc. (Ireland), Marathon Thomson Power System (Canada), and Generac Power Systems (U.S).

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objective of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered for Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Data Industry Insights

2.1.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

3.1 History & Evolution

3.2 Requirement for Uninterrupted & Steady Power Supply From the Industrial & Commercial Sectors Drives the Global Market for Transfer Switch

3.3 Top Companies Adopted the New Product Launch Strategy to Grow in the Transfer Switch Market

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Transfer Switch Market

4.2 Transfer Switch Market: Top Three Application Segments

4.3 Transfer Switch Market in North America

4.4 Automatic Transfer Switch to Dominate the Global Transfer Switch Market During the Forecast Period

4.5 Transfer Switch Market: By Transition Mode

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Global Transfer Switch Market Segmentation

5.2.1 By Type

5.2.2 By Transition Mode

5.2.3 By Ampere Ratings

5.2.4 By Application

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Demand for Uninterrupted Power

5.3.1.2 Power for Critical Applications

5.3.1.3 Supply-Demand Gap in Utility Power

5.3.1.4 Adoption of Smart Grid Technology

5.3.2 Restraints

5.3.2.1 Lack of Awareness of the Application of Transfer Switch in Developing Countries

5.3.2.2 Requires Regular Maintenance

5.3.3 Opportunities

5.3.3.1 Increasing Rate of Urbanization & Industrialization

5.3.3.2 Old Power Grid & Transmission System

5.3.4 Challenges

5.3.4.1 Seismic Test & NFPA Approval

5.3.4.2 Generator Interlock Kit

5.4 Impact of Market Dynamics

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of Substitute

6.3.2 Threat of New Entrants

6.3.3 Bargaining Power of the Buyer

6.3.4 Bargaining Power of the Supplier

6.3.5 Intensity of Competitive Rivalry

7 Transfer Switch Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Automatic Transfer Switch Market

7.2.1 Static Transfer Switch Market

7.2.2 Contactor Based Transfer Switch Market

7.2.3 Circuit Based Transfer Switch Market

7.3 Manual Transfer Switch Market

8 Transfer Switch Market, By Ampere Rating (Page No. - 59)

8.1 Introduction

8.2 0-300a Ratings

8.3 301-1600a Ratings

8.4 1601-4000a Ratings

9 Transfer Switch Market, By Transition Mode (Page No. - 65)

9.1 Introduction

9.2 Soft Load Transition Mode

9.3 Closed Transition Mode

9.4 Delayed Transition Mode

9.5 Open Transition Mode

10 Transfer Switch Market, By Application (Page No. - 72)

10.1 Introduction

10.2 Industrial

10.2.1 Industrial Transfer Switch Market, By End-Users

10.2.1.1 Power Utilities

10.2.1.2 Telecom & IT

10.2.1.3 Transportation

10.2.1.4 Others

10.3 Commercial

10.4 Residential

11 Transfer Switch Market, By Region (Page No. - 81)

11.1 Introduction

11.2 North America

11.2.1 By Country

11.2.1.1 U.S.

11.2.1.2 Canada

11.2.1.3 Mexico

11.2.2 By Type

11.2.2.1 By Automatic Transfer Switch Type

11.2.3 By Application

11.3 Europe

11.3.1 By Country

11.3.1.1 France

11.3.1.2 Germany

11.3.1.3 U.K.

11.3.1.4 Russia

11.3.1.5 Others

11.3.2 By Type

11.3.2.1 By Automatic Transfer Switch Type

11.3.3 By Application

11.4 Asia-Pacific

11.4.1 By Country

11.4.1.1 China

11.4.1.2 Australia

11.4.1.3 India

11.4.1.4 Japan

11.4.1.5 Others

11.4.2 By Type

11.4.2.1 By Automatic Transfer Switch Type

11.4.3 By Application

11.5 Rest of the World

11.5.1 By Country

11.5.1.1 Brazil

11.5.1.2 Argentina

11.5.1.3 UAE

11.5.1.4 South Africa

11.5.1.5 Kuwait

11.5.1.6 Others

11.5.2 By Type

11.5.2.1 By Automatic Transfer Switch Type

11.5.3 By Application

12 Competitive Landscape (Page No. - 109)

12.1 Overview

12.2 Market Share Analysis

12.3 Competitive Situation & Trends

12.3.1 Contracts & Agreements

12.3.2 New Product/Service/Technology Development

12.3.3 Mergers & Acquisitions

12.3.4 Expansion

12.3.5 Other Developments

13 Company Profiles (Page No. - 127)

13.1 ABB Ltd.

13.1.1 Business Overview

13.1.2 Products & Services: ABB Ltd.

13.1.3 Products & Services: Thomas & Betts Co.

13.1.4 Developments, 20122015

13.1.5 ABB Ltd.: SWOT Analysis

13.1.6 MnM View

13.2 General Electric

13.2.1 Business Overview

13.2.2 Products & Services

13.2.3 GE: SWOT Analysis

13.2.4 Developments, 20122014

13.2.5 MnM View

13.3 Emerson Electric Co.

13.3.1 Business Overview

13.3.2 Products & Services

13.3.3 Strategy & Insights

13.3.4 Developments, 20122015

13.4 Socomec

13.4.1 Business Overview

13.4.2 Products & Services

13.4.3 Strategy & Insights

13.4.4 Developments, 20122015

13.5 Cummins

13.5.1 Business Overview

13.5.2 Products & Services

13.5.3 Cummins: SWOT Analysis

13.5.4 Developments, 2014

13.5.5 MnM View

13.6 Schneider Electric SE

13.6.1 Business Overview

13.6.2 Products & Services

13.6.3 Schneider Electric: SWOT Analysis

13.6.4 Developments, 20122015

13.6.5 MnM View

13.7 Eaton

13.7.1 Business Overview

13.7.2 Products & Services

13.7.3 Strategy & Insights

13.7.4 Developments, 20122015

13.8 Siemens AG.

13.8.1 Business Overview

13.8.2 Products & Services

13.8.3 Siemens AG.: SWOT Analysis

13.8.4 Developments, 2014

13.8.5 MnM View

13.9 Eltek Power Systems as

13.9.1 Business Overview

13.9.2 Products & Services

13.9.3 Strategy & Insights

13.9.4 Developments, 20122015

13.10 Generac Power Systems

13.10.1 Business Overview

13.10.2 Products & Services

13.10.3 Strategy & Insights

13.10.4 Developments, 2012-2015

13.11 Russelectric

13.11.1 Business Overview

13.11.2 Products & Services

13.11.3 Strategy & Insights

13.11.4 Developments

13.12 Caterpillar Inc.

13.12.1 Business Overview

13.12.2 Products & Services

13.12.3 Strategy & Insights

13.12.4 Developments, 2014

13.13 Kohler Co.

13.13.1 Business Overview

13.13.2 Products & Services

13.13.3 Strategy & Insights

13.13.4 Developments, 20142015

13.14 Camsco Electric Co.

13.14.1 Business Overview

13.14.2 Products & Services

13.14.3 Strategy & Insights

13.14.4 Developments

13.15 Marathon Thomson Power System

13.15.1 Business Overview

13.15.2 Products & Services

13.15.3 Strategy & Insights

13.15.4 Developments, 20122015

14 Appendix (Page No. - 199)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Realtime Market Intelligence

14.4 Available Customization

14.5 Related Reports

List of Tables (67 Tables)

Table 1 Impact of Market Dynamics

Table 2 Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 3 Automatic Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 4 Automatic Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 5 Static Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 6 Contactor Based Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 7 Circuit Based Transfer Switch Market, By Region, 20132020 (USD Million)

Table 8 Manual Transfer Switch Market, By Region, 20132020 (USD Million)

Table 9 Transfer Switch Market Size, By Ampere Ratings, 20132020 (USD Million)

Table 10 0-300a Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 11 Transfer Switches With 301-1600a Ratings Market Size, By Region, 20132020 (USD Million)

Table 12 Transfer Switches With 1601-4000a Ratings Market Size, By Region, 20132020 (USD Million)

Table 13 Transfer Switch Market Size, By Transition Mode, 20132020 (USD Million)

Table 14 Soft Load Transition Mode Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 15 Closed Transition Mode Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 16 Delayed Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 17 Open Transition Mode Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 18 Transfer Switch Market Size, By Application, 20152020 (USD Million)

Table 19 Industrial Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 20 Industrial Transfer Switch Market, By End Users, 20132020 (USD Million)

Table 21 Power Utilities: Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 22 Telecom & It: Transfer Switch Market Size, By Region, 20152020 (USD Million)

Table 23 Transportation: Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 24 Others: Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 25 Commercial Transfer Switch Market, By Region, 20132020 (USD Million)

Table 26 Residential Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 27 Transfer Switch Market Size, By Region, 20132020 (USD Million)

Table 28 North America: Transfer Switch Market Size, By Country, 20132020 (USD Million)

Table 29 U.S.: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 30 Canada: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 31 Mexico: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 32 North America: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 33 North America: Automatic Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 34 North America: Transfer Switch Market Size, By Application, 20132020 (USD Million)

Table 35 Europe: Transfer Switch Market Size, By Country, 20132020 (USD Million)

Table 36 France: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 37 Germany: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 38 U.K.: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 39 Russia: Transfer Switch Market Size, By Type 20132020 (USD Million)

Table 40 Others: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 41 Europe: Transfer Switch Market, By Type, 20132020 (USD Million)

Table 42 Europe: Automatic Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 43 Europe: Transfer Switch Market Size, By Application, 20132020 (USD Million)

Table 44 Asia-Pacific: Transfer Switch Market Size, By Country, 20132020 (USD Million)

Table 45 China: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 46 Australia: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 47 India: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 48 Japan: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 49 Others: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 50 Asia-Pacific: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 51 Asia-Pacific: Automatic Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 52 Asia-Pacific: Transfer Switch Market Size, By Application, 20132020 (USD Million)

Table 53 RoW: Transfer Switch Market Size, By Country, 20132020 (USD Million)

Table 54 Brazil: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 55 Argentina: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 56 Uae: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 57 South Africa: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 58 Kuwait: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 59 Others: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 60 RoW: Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 61 RoW: Automatic Transfer Switch Market Size, By Type, 20132020 (USD Million)

Table 62 RoW: Transfer Switch Market Size, By Application, 20132020 (USD Million)

Table 63 Contracts & Agreements, 20122015

Table 64 New Product Development, 20122015

Table 65 Mergers & Acquisitions, 20122015

Table 66 Expansions, 20122015

Table 67 Other Developments, 20142015

List of Figures (45 Figures)

Figure 1 Markets Covered: Global Transfer Switch

Figure 2 Transfer Switch Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Asia-Pacific is Expected to Be the Highest Growing Region During the Forecast Period

Figure 8 Asia-Pacific Dominated the Market in 2014 & is Expected to Lead the Market During the Forecast Period

Figure 9 Asia-Pacific & North America to Capture the Lions Share in the Global Transfer Switch Market

Figure 10 Transfer Switch Market Size, 20152020 (USD Million)

Figure 11 Need for Reliable & Continuous Power in Critical Applications Would Increase the Demand for Transfer Switch

Figure 12 Industrial Market Accounts for the Largest Share of Transfer Switch Application Market in 2014

Figure 13 North America to Be the Second Largest Region in the Transfer Switch Market

Figure 14 Automatic Transfer Switch Holds the Lions Share in Transfer Switch Market

Figure 15 Soft Load & Closed Transition Mode Segments Dominated the Global Transfer Switch Market in 2014

Figure 16 Global Transfer Switch Market Segmentation By Voltage Level, Application, Equipment, Type, & Region

Figure 17 Need for Uninterrupted Power Drives the Transfer Switch Market

Figure 18 Transfer Switch: Value Chain Analysis

Figure 19 Transfer Switch: Porters Five Force Analysis

Figure 20 Transfer Switch Market Share (USD Million), By Type, 2014

Figure 21 Transfer Switch Market Share (Value), By Ampere Rating, 2014

Figure 22 Global Transfer Switch Market Size, By Ampere Rating, 2014

Figure 23 Transfer Switch Market Share (Value), By Transition Mode, 2014

Figure 24 Global Transfer Switch Market Size, By Transition Mode, 2014

Figure 25 Transfer Switch Market Share (USD Million), By Application, 2014

Figure 26 Transfer Switch Market Share (Value), By Region, 2014

Figure 27 Companies Adopted Contracts & Agreements and New Product/Service/Technology Development as Key Growth Strategies

Figure 28 Transfer Switch Market Share (Value) Analysis, 2014

Figure 29 Market Evaluation Framework: New Product Launches, Contracts & Agreements, & Mergers & Acquisitions Fuelled the Growth of Companies From 2012 to 2015

Figure 30 Region-Wise Revenue Mix of Top Five Players

Figure 31 ABB Ltd.: Company Snapshot

Figure 32 GE: Company Snapshot

Figure 33 Emerson: Company Snapshot

Figure 34 Socomec: Company Snapshot

Figure 35 Cummins: Company Snapshot

Figure 36 Schneider Electric: Business Overview

Figure 37 Eaton: Business Overview

Figure 38 Siemens: Business Overview

Figure 39 Eltek: Business Overview

Figure 40 Generac: Business Overview

Figure 41 Russelectric: Business Overview

Figure 42 Caterpillar Inc.: Business Overview

Figure 43 Kohler Co.: Business Overview

Figure 44 Camsco Electric Co.: Business Overview

Figure 45 Marathon Thomson Power System: Business Overview

Growth opportunities and latent adjacency in Transfer Switch Market