Threat Detection Systems Market by Detection Type (Explosive, Radiological & Nuclear, Chemical & Biological, Narcotics, Intrusion), Product (Dosimeter, Laser, Radar, Video Surveillance, Biometric), Application, and Geography - Global Forecast to 2022

[192 Pages Report] The threat detection systems market was valued at USD 48.38 billion in 2015 and is estimated to reach USD 119.17 billion by 2022, at a CAGR of 13.11% during the forecast period. The growth of this market is propelled by the increasing acts of terrorism across the globe in the past few years. Due to which governments in terror-affected nations to introduce new regulations making it mandatory to install advanced security systems across airports, commercial centers, and tourist destinations.

The objectives of the study are as follows:

- To define, describe, and forecast the threat detection systems market segmented on the basis of detection type, product/system, application, and geography

- To forecast the market size, in terms of value, for various segments with regard to four main regions—North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the market dynamics influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies2 along with detailing the competitive landscape for the market leaders

- To study the complete value chain and allied industry segments and perform a value chain analysis of the global threat detection systems landscape

- To provide a detailed Porter’s analysis for the threat detection systems market

- To analyze strategic developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the global threat detection systems market

Increasing act of terrorism across the globe and growing need for large scale surveillance at public gathering to drive the global threat detection market demand close to USD 119.17 billion by 2022

The growth of the threat detection market is majorly driven by Increasing act of terrorism across the globe and growing need for large scale surveillance at public gathering and increasing government regulation for security devices

Threat detection systems are used in various end use application like Defense, Public Infrastructure, Commercial, Industrial, Institutional and Residential. Public infrastructure is the largest application area of threat detection market these sysetms are deployed in places like airports, railway station, sport stadiums, shopping malls, pilgrimages and others .

With the continuous development of technology and increasing government regulation for security devices, there is a rise in adoption of threat detection products such as explosive and narcotics detectors, personal radiation detectors, dosimeters, survey meters, identifiers, photo-ionization detectors (pid), air samplers,chemical agent detectors, biological agent detectors, radar systems, video surveillance systems, perimeter intrusion detectors, wide-band wireless communication systems, biometric systems and others.

Market Dynamics

Market Drivers

- Increase in acts of terrorism across the globe

- Rising territorial conflicts and geopolitical instabilities

- Growing need for large-scale surveillance at public gatherings

- Government regulations for security devices

Restraints

- Concerns over intrusion of privacy

Opportunities

- Increasing demand for robotics as a services application

- Upgrading existing infrastructure with advanced systems

- Growing demand for biometric systems from consumer electronic devices and commercial establishments

Challenges

- Negative publicity in case of a product failure

- Technological limitations associated with threat detection systems

- Complexities and high purchasing costs for threat detection systems

Critical questions would be;

- The Threat detection ecosystem witness concern of technological limitation associated with threat detection systems, when will this scenario ease out?

- How are the industry players addressing this challenge?

The threat detection systems market is expected to reach USD 119.17 billion in 2023 from USD 56.91 billion by 2016 at a CAGR of 13.11% during the forecast period. The growth of this market is driven by the increase in the terrorist activities and rising territorial conflicts and geopolitical instabilities. Government regulations also play an important role in the increasing demand for the threat detections systems.

Based on product/systems the threat detection systems market has been segmented into, Explosive and Narcotics Detectors, Personal Radiation Detectors, Dosimeters, Survey Meters, Identifiers, Photo Ionization Detectors, Air Samplers, Chemical Agent Detectors, Biological Agent Detectors, Laser Systems, Radar Systems, Video Surveillance Systems, Perimeter Intrusion Detection Systems, Wideband Wireless Communication Systems and Biometric Systems. The Video surveillance systems accounted for the largest share of the overall market and is expected to grow at a high rate between 2016 and 2022. Increasing need for reconnaissance at commercial places, industry premises, and public avenues is one of the prime factors which are leading the demand for video surveillance systems. Video surveillance recordings are also used for investigation purpose in many crime scenarios which is also driving the market for video surveillance systems; this factor is also driving the growth of the threat detection systems market for video surveillance systems.

Based on application the threat detection systems market has been segmented into, Defense, Public Infrastructure, Commercial, Industrial, Institutional, and Residential. Public infrastructure is expected to hold the largest market share of threat detection systems. The commercial sector is expected to be the fastest-growing market by 2022. Intrusion detection systems are used on a large scale in office spaces, banks, lodging, and warehouses. Video surveillance systems and biometric systems are used on a large scale in the commercial sector to restrict the unauthorized access. Increasing threat of terrorism in public places is the key reason in increasing the demand for threat detection systems such video surveillance systems and explosive detectors, among other detection technologies in public infrastructure application during the forecast period.

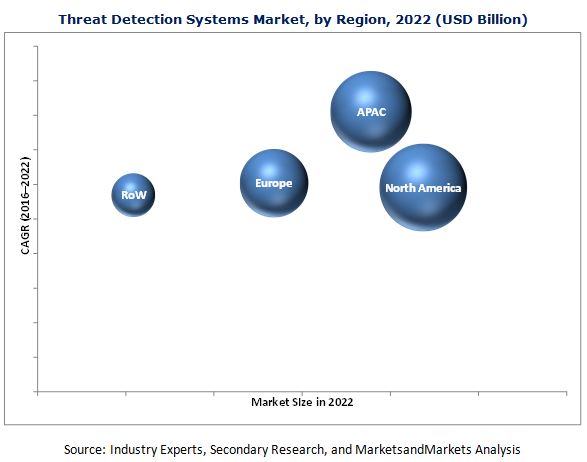

North America is expected to dominate the threat detection systems market during the forecast period. The region contains several manufacturers and component suppliers of threat detection and border security systems. North America is witnessing a continuous increase in the research & development activities, particularly in the high-energy laser system technologies.

The key restraining factor for the growth of the threat detection systems market is the concerns over intrusion of privacy. Companies have adopted the new product developments and partnerships, contracts, agreements, & joint-venture strategies, to expand their market presence and distribution networks in the threat detection market for the forecast period.

Some of the major players in the threat detection systems market are Smiths Group PLC (U.K.), Safran S.A. (France), FLIR Systems Inc. (U.S.), and Thales S.A. (France). The initial capital investment on product development and setting up an efficient manufacturing process to build reliable products is quite high. Moreover, the companies also need to earn the trust of the market to gain new contracts; hence, the impact of new entrants is considerably low.

Increase in the terrorist activities and rising territorial conflicts and geopolitical instabilities

Public Infrastructure

Infrastructure is one of the key application segments for threat detection systems. Infrastructure consists of applications wherein large areas such as airports, railway stations, and other areas need to be covered for surveillance. Also, the transportation is a part of infrastructure sector which includes railway stations, airports, bus stations, and vehicles. Such video surveillance reduces the need for security guards as they can only conduct periodic check of each location. This is increasing the demand for video surveillance system in this segment.

Infrastructure applications are the part of public surveillance which has government regulations such as law enforcement must obtain a warrant prior to using a stored data to automatically identify individuals, provide safety guards, and also for personnel with access to a public video surveillance system, and so on. Following are the key places wherein threat detection systems are deployed on a large scale:

- Airports

- Railway stations

- Sports stadiums

- Shopping malls

- Pilgrimages

- Others (amusement and theme parks and gardens)

Commercial Spaces

In this segment, various commercial areas such as corporate offices, banks, lodging, retail shops, and healthcare clinics are considered. In addition, non-manufacturing buildings such as warehouses are also considered under this segment. Threat detections systems are being used in private sectors on a large scale. Biometric systems are used in IT companies for the identification and access purpose. This helps in maintaining security by disallowing unauthorized persons from entering private offices. Handheld and walk-through metal detectors are used at the entry point of corporate buildings to detect any unwanted metal objects. X-ray screening systems are installed in private companies to detect any illegal objects carried by employees in their baggage. Video surveillance systems are also used to keep watch in office surroundings and enhance the safety of the office environment. It is very important to maintain security at workplaces to ensure the smooth functioning of the private sector companies. Due to such advantages of the threat detection devices, their demand is expected to rise soon.

Following are the major places wherein threat detection systems are deployed for the safety purpose:

- Business offices

- Banks and financial buildings

- Lodging

- Retail shops

- Healthcare clinics

- Warehouses (non-manufacturing)

Critical questions would be;

- Where will all these developments take the industry in the mid to long term?

- Which industry will hold the major market potential in threat detection systems ecosystem?

- Which will be the major market expansion strategy adopted by the players in the studied market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Lucrative Opportunities in the Threat Detection Systems Market

4.2 Threat Detection Systems Market – Comparison of Growth Pattern of Threat Detection Applications

4.3 Threat Detection Systems Market in APAC in 2015

4.4 Market Share of Major Countries and Regions, 2015

4.5 Threat Detection Systems Market, By Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Threat Detection Systems Market, By Detection Type

5.2.2 Threat Detection Systems Market, By Product

5.2.3 Market, By Application

5.2.4 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Acts of Terrorism Across the Globe

5.3.1.2 Rising Territorial Conflicts and Geopolitical Instabilities

5.3.1.3 Growing Need for Large-Scale Surveillance at Public Gatherings

5.3.1.4 Government Regulations for Security Devices

5.3.2 Restraints

5.3.2.1 Concerns Over Intrusion of Privacy

5.3.3 Opportunities

5.3.3.1 Upgrading Existing Infrastructure With Advanced Systems

5.3.3.2 Growing Demand for Biometric Systems From Consumer Electronic Devices and Commercial Establishments

5.3.4 Challenges

5.3.4.1 Technological Limitations Associated With Threat Detection Systems

5.3.4.2 Complexities and High Purchasing Costs for Threat Detection Systems

5.3.4.3 Negative Publicity in Case of Product Failure

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Threat Detection Systems Market, By Detection Type (Page No. - 55)

7.1 Introduction

7.2 Explosive Detection

7.2.1 Trace Detectors

7.2.1.1 Ion-Mobility Spectrometry (IMS)

7.2.1.2 Thermo-Redox

7.2.1.3 Chemiluminescence

7.2.1.4 Colorimetric

7.2.1.5 Mass Spectrometry

7.2.2 Bulk Detectors

7.2.2.1 X-Ray Systems

7.2.2.2 Neutron Method-Based Systems

7.2.2.3 Optical Detectors

7.3 Radiological & Nuclear Detection

7.4 Chemical & Biological Detection

7.4.1 Chemical Agents

7.4.1.1 Nerve Agents

7.4.1.2 Blister Agents

7.4.1.3 Choking Agents

7.4.1.4 Blood Agents

7.4.2 Biological Agents

7.5 Narcotics Detection

7.6 Intrusion Detection

8 Threat Detection Systems Market, By Product (Page No. - 78)

8.1 Introduction

8.2 Explosive and Narcotics Detectors

8.2.1 Trace Detectors

8.2.2 Bulk Detectors

8.3 Personal Radiation Detectors (PRD)

8.4 Dosimeters

8.4.1 Electronic Personal Dosimeters (EPD)

8.4.2 Film Bandage Dosimeters

8.4.3 Mosfet Dosimeters

8.4.4 Thermoluminescent Dosimeters (TLD)

8.4.5 Quartz Fiber Dosimeters

8.5 Survey Meters

8.6 Identifiers

8.7 Photo-Ionization Detectors (PID)

8.8 Air Samplers

8.9 Chemical Agent Detectors

8.10 Biological Agent Detectors

8.11 Laser Systems

8.12 Radar Systems

8.12.1 Ground Surveillance Radar (GSR) Systems

8.12.2 Air Surveillance Radar (ASR) Systems

8.12.3 Costal Surveillance Radar (CSR) Systems

8.13 Video Surveillance Systems

8.14 Perimeter Intrusion Detectors

8.14.1 Electric Fencing Systems

8.14.2 Laser Fencing Systems

8.15 Wide-Band Wireless Communication Systems

8.16 Biometric Systems

8.17 Others

9 Threat Detection Systems Market, By Applicaiton (Page No. - 101)

9.1 Introduction

9.2 Defense

9.3 Public Infrastructure

9.3.1 Airports

9.3.2 Railway Stations

9.3.3 Sports Stadiums

9.3.4 Shopping Malls

9.3.5 Pilgrimages

9.3.6 Others

9.4 Commercial Places

9.4.1 Business Offices

9.4.2 Banks and Financial Institutions

9.4.3 Lodging

9.4.4 Retail Shops

9.4.5 Healthcare Clinics

9.4.6 Warehouses

9.5 Industrial

9.6 Institutional

9.6.1 Educational Buildings

9.6.2 Government Buildings

9.7 Residential (Home Surveillance)

10 Geographic Analysis (Page No. - 115)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of APAC

10.5 Rest of the World

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 140)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Situations and Trends

11.3.1 New Product Launches

11.3.2 Agreements, Partnerships, and Contracts

11.3.3 Mergers & Acquisitions

12 Company Profiles (Page No. - 147)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Safran S.A.

12.3 Smiths Group PLC

12.4 Flir Systems, Inc.

12.5 Chemring Group PLC

12.6 Thales S.A.

12.7 AXIS Communications AB

12.8 Rapiscan Systems, Inc.

12.9 RAE Systems, Inc.

12.10 Chemimage Corporation

12.11 Mirion Technologies, Inc.

12.12 Lockheed Martin Corporation

12.13 Blighter Surveillance Systems

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 185)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (69 Tables)

Table 1 Market, By Detection Type, 2013–2022 (USD Billion)

Table 2 Threat Detection Market for Explosive Detection, By Application, 2013–2022 (USD Billion)

Table 3 Market for Explosive Detection, By Region, 2013–2022 (USD Billion)

Table 4 Market for Explosive Detection, By Product, 2013–2022 (USD Billion)

Table 5 Market for Explosive Detection, By Product, 2013–2022 (Thousand Units)

Table 6 Explosive Detection Market for Trace Detectors, By Technology, 2013–2022 (USD Billion)

Table 7 Explosive Detection Market for Bulk Detectors, By Technology, 2013–2022 (USD Billion)

Table 8 Threat Detection Systems Market for Radiological & Nuclear Detection, By Application, 2013–2022 (USD Billion)

Table 9 Threat Detection Systems Market for Radiological & Nuclear Detection, By Region, 2013–2022 (USD Billion)

Table 10 Threat Detection Market for Radiological & Nuclear Detection, By Product, 2013–2022 (USD Billion)

Table 11 Threat Detection Systems Market for Radiological & Nuclear Detection, By Product, 2013–2022 (Thousand Units)

Table 12 Market for Chemical & Biological Detection, By Application, 2013–2022 (USD Billion)

Table 13 Market for Chemical & Biological Detection, By Region, 2013–2022 (USD Billion)

Table 14 Market for Chemical & Biological Detection, By Product, 2013–2022 (USD Billion)

Table 15 Market for Narcotics Detection, By Application, 2013–2022 (USD Billion)

Table 16 Market for Narcotics Detection , By Region, 2013–2022 (USD Billion)

Table 17 Market for Narcotics Detection, By Product, 2013–2022 (USD Billion)

Table 18 Market for Intrusion Detection, By Application, 2013–2022 (USD Billion)

Table 19 Market for Intrusion Detection, By Region, 2013–2022 (USD Billion)

Table 20 Market for Intrusion Detection, By Product, 2013–2022 (USD Billion)

Table 21 Market for Intrusion Detection, By Product, 2013–2022 (Thousand Units)

Table 22 Market in North America, By Product, 2013–2022 (USD Billion)

Table 23 Market for Trace Detectors, By Region, 2013–2022 (USD Billion)

Table 24 Threat Detection Systems Market for Bulk Detectors, By Region, 2013–2022 (USD Billion)

Table 25 Market for Personal Radiation Detector, By Region, 2013–2022 (USD Billion)

Table 26 Market for Dosimeters, By Region, 2013–2022 (USD Billion)

Table 27 Market for Survey Meters, By Region, 2013–2022 (USD Billion)

Table 28 Market for Identifiers, By Region, 2013–2022 (USD Billion)

Table 29 Market for PIDs, By Region, 2013–2022 (USD Billion)

Table 30 Market for Air Samplers, By Region, 2013–2022 (USD Billion)

Table 31 Threat Detection Systems Market for Chemical Agent Detectors, By Region, 2013–2022 (USD Billion)

Table 32 Market for Biological Agent Detectors, By Region, 2013–2022 (USD Billion)

Table 33 Market for Laser Systems, By Region, 2013–2022 (USD Billion)

Table 34 Market for Radar Systems, By Region, 2013–2022 (USD Billion)

Table 35 Market for Video Surveillance Systems, By Offering, 2013–2022 (USD Billion)

Table 36 Market for Video Surveillance Systems, By Type, 2013–2022 (USD Billion)

Table 37 Market for Video Surveillance Systems, By Region, 2013–2022 (USD Billion)

Table 38 Market for Perimeter Intrusion Detectors, By Region, 2013–2022 (USD Billion)

Table 39 Threat Detection Systems Market for Wide-Band Wireless Communication Systems, By Region, 2013–2022 (USD Billion)

Table 40 Market for Biometric Systems, By Region, 2013–2022 (USD Billion)

Table 41 Market for Others, By Geography, 2013–2022 (USD Billion)

Table 42 Market, By Application, 2013–2022 (USD Billion)

Table 43 Market for Defense Application, By Region, 2013–2022 (USD Billion)

Table 44 Market for Public Infrastructure Application, By Region, 2013–2022 (USD Billion)

Table 45 Market for Commercial Application, By Region, 2013–2022 (USD Billion)

Table 46 Market for Industrial Application, By Region, 2013–2022 (USD Billion)

Table 47 Market for Institutional Application, By Region, 2013–2022 (USD Billion)

Table 48 Market for Residential Application, By Region, 2013–2022 (USD Billion)

Table 49 Market, By Region, 2013–2022 (USD Billion)

Table 50 Market in North America, By Detection Type, 2013–2022 (USD Billion)

Table 51 Threat Detection Systems Market in North America, By Product/System, 2013–2022 (USD Billion)

Table 52 Market in North America, By Application, 2013–2022 (USD Billion)

Table 53 Market in North America, By Country, 2013–2022 (USD Billion)

Table 54 Market in Europe, By Detection Type, 2013–2022 (USD Billion)

Table 55 Market in Europe, By Product/System, 2013–2022 (USD Billion)

Table 56 Market in Europe, By Application, 2013–2022 (USD Billion)

Table 57 Threat Detection Systems Market in Europe, By Country, 2013–2022 (USD Billion)

Table 58 Market in APAC, By Detection Type, 2013–2022 (USD Billion)

Table 59 Market in APAC, By Product/System, 2013–2022 (USD Billion)

Table 60 Market in APAC, By Application, 2013–2022 (USD Billion)

Table 61 Market in APAC, By Country, 2013–2022 (USD Billion)

Table 62 Market in RoW, By Detection Type, 2013–2022 (USD Billion)

Table 63 Market in RoW, By Product/System, 2013–2022 (USD Billion)

Table 64 Market in RoW, By Application, 2013–2022 (USD Billion)

Table 65 Market in RoW, By Country, 2013–2022 (USD Billion)

Table 66 Market Ranking, 2015

Table 67 New Product Launches, 2014–2016

Table 68 Agreements, Contracts, Partnerships, and Collaborations, 2014–2016

Table 69 Mergers & Acquisitions, 2015–2016

List of Figures (61 Figures)

Figure 1 Threat Detection Systems Market: Research Design

Figure 2 Market Size Estimation Meth0dology: Bottom-Up Approach

Figure 3 Market Size Estimation Meth0dology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Threat Detection Systems Market Snapshot (2016 vs 2022): Intrusion Detection to Be the Largest Market During the Forecast Period

Figure 7 Commercial Application to Exhibit High Growth Between 2016 and 2022

Figure 8 Video Surveillance Systems to Hold the Largest Share of the Market Between 2016 and 2022

Figure 9 North America Held the Largest Share of the Market in 2015

Figure 10 Increasing Demand From Commercial and Public Infrastructure Sectors Would Create Opportunities for Threat Detection Systems Market Between 2016 and 2022

Figure 11 Commercial Application to Grow at the Highest Rate During the Forecast Period

Figure 12 China Held the Largest Share of the Market in APAC in 2015

Figure 13 U.S. Accounted for the Largest Market Share in 2015

Figure 14 Intrusion Threat Detection to Hold the Largest Size of the Market Between 2016 and 2022

Figure 15 Major Markets for Threat Detection Systems Across Different Regions

Figure 16 Increase in Acts of Terrorism Across the Globe Drive the Market

Figure 17 Value Chain Analysis: Threat Detection Systems Market

Figure 18 Porter’s Five Forces Analysis: Threat Detection Systems Market (2015)

Figure 19 Porter’s Five Forces: Impact Analysis

Figure 20 Market: Threat of New Entrants

Figure 21 Threat Detection Systems Market: Threat of Substitutes

Figure 22 Market: Bargaining Power of Suppliers

Figure 23 Threat Detection Systems Market: Bargaining Power of Buyers

Figure 24 Market: Intensity of Competitive Rivalry

Figure 25 Intrusion Detection Expected to Hold A Large Size of the Threat Detection Market During the Forecast Period

Figure 26 IMS Detection Technique Held the Largest Size of the Explosive Detection Market in 2015

Figure 27 Survey Meters Expected to Hold the Largest Size of the Threat Detection Market for Radiological and Nuclear Detection Between 2015 and 2022

Figure 28 Chemical Agent Detectors to Account for the Largest Size of Market By 2022

Figure 29 Threat Detection Systems Market for Narcotics Detection, By Region, 2015–2022 (USD Billion)

Figure 30 Video Surveillance Systems Expected to Hold the Largest Size of the Market for Intrusion Detection By 2022

Figure 31 Video Surveillance Systems to Lead the Threat Detection Market By Holding the Largest Market Size By 2022

Figure 32 Trace Selection Systems Market, By Region (2015–2022)

Figure 33 North America Expected to Hold the Largest Market Size By 2022

Figure 34 North America to Be the Leading Market for Chemical Agent Detectors During the Forecast Period

Figure 35 IP System Held the Largest Market Size for Video Surveillance Systems (2015-2022)

Figure 36 Biometric System Market, By Region (2015 & 2022)

Figure 37 Public Infrastructure to Hold the Largest Market Size for Threat Detection Systems By 2022

Figure 38 Threat Detection Systems Market for Pubclic Infrastructure Application, By Region (2015 vs 2022)

Figure 39 Market in Commercial Application, By Region (2015 vs 2022)

Figure 40 Market in India Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 41 Attractive Growth Opportunities in the Commercial Application During the Forecast Period

Figure 42 North America: Market Snapshot, 2015

Figure 43 Europe: Market Snapshot, 2015

Figure 44 APAC: Market Snapshot, 2015

Figure 45 RoW: Market Snapshot, 2015

Figure 46 Organic and Inorganic Strategies Adopted By Companies Operating in the Market

Figure 47 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 48 Geographic Revenue Mix of Top 6 Players

Figure 49 Safran S.A.: Company Snapshot

Figure 50 Safran S.A.: SWOT Analysis

Figure 51 Smiths Group PLC: Company Snapshot

Figure 52 Smiths Group PLC: SWOT Analysis

Figure 53 Flir Systems, Inc.: Company Snapshot

Figure 54 Flir Systems, Inc.: SWOT Analysis

Figure 55 Chemring Group PLC: Company Snapshot

Figure 56 Chemring Group PLC: SWOT Analysis

Figure 57 Thales S.A.: Company Snapshot

Figure 58 Thales S.A.: SWOT Analysis

Figure 59 AXIS Communications AB: Company Snapshot

Figure 60 AXIS Communications AB: SWOT Analysis

Figure 61 Lockheed Martin Corporation: Company Snapshot

The base year considered for the study is 2015, and the market size forecast is provided for the period between 2016 and 2022.

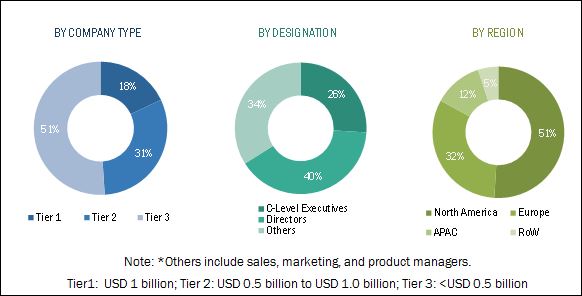

The research methodology used to estimate and forecast the threat detection systems market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as IEEE journals, Factiva, Hoover’s, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global threat detection systems market from the revenues of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and sub segments, which have then been verified through primary research by conducting extensive interviews of people holding key positions in the industry such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments. The breakdown of the profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain analysis of the threat detection systems market shows the industry insights through raw material suppliers, component suppliers, system designers and manufacturers, system integrators, distributors, and providers of post-sales services. The major value to threat detection systems is added during the system designers and manufacturers, system integrators phases. The market ecosystem includes threat detection equipment manufacturers such as Smiths Group PLC (U.K.), Safran S.A. (France), FLIR Systems Inc. (U.S.), Thales S.A. (France), Rapiscan Systems Inc. (U.S.), RAE Systems Inc. (U.S.), Chemring Group plc (U.K.), ChemImage Sensor Systems (U.S.), Mirion Technologies Inc. (U.S.), and Axis Communication AB (Sweden), among others who offer threat detection devices to end users.

Key Target Audience:

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users who want to know more about the technology and the latest technological developments in the industry

Scope of the Report

The threat detection market has been covered in detail in this report, segmented on the basis of type, product/system, application and geography. To provide a holistic picture, the current market demand and forecasts have also been included in the report. The threat detection market has been segmented as follows:

Threat Detection Systems Market, by Type:

- Explosive Detection

- Radiological and Nuclear Detection

- Chemical and Biological Detection

- Narcotics Detection

- Intrusion Detection

Threat Detection Systems Market, by Product/System:

- Explosive and Narcotics Detectors

- Personal Radiation Detectors

- Dosimeters

- Survey Meters

- Identifiers

- Photo Ionization Detectors

- Air Samplers

- Chemical Agent Detectors

- Biological Agent Detectors

- Laser Systems

- Radar Systems

- Video Surveillance Systems

- Perimeter Intrusion Detection Systems

- Wideband Wireless Communication Systems

- Biometric Systems

Threat Detection Systems Market, by Application:

- Defense

- Public Infrastructure

- Commercial

- Industrial

- Institutional

- Residential

Threat Detection Systems Market, by Geography:

- North America

- Europe

- APAC

- RoW (South America, Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Market size for 2019 and 2021 for segments such as by type, and product/systems, application and geography.

- Company information: detailed analysis and profiling of additional (5) market players.

Growth opportunities and latent adjacency in Threat Detection Systems Market

Preparing a research project on UTC Aerospace and would like to gain further knowledge of the industry.

I would like a brief interview with the author of the following report: Threat Detection Systems Market by Detection Type (Explosive, Radiological & Nuclear, Chemical & Biological, Narcotics, Intrusion), Product (Dosimeter, Laser, Radar, Video Surveillance, Biometric), Application, and Geography - Global Forecast to 2022.

Please send me the PDF brochure of this report. If I am interested in the main report, then I will contact you.