Telecom Analytics Market by Application (Customer Management, Sales and Marketing Management, Risk and Compliance Management, Workforce management, and Network Management), Component, Deployment, Organization Size, and Region - Global Forecast to 2023

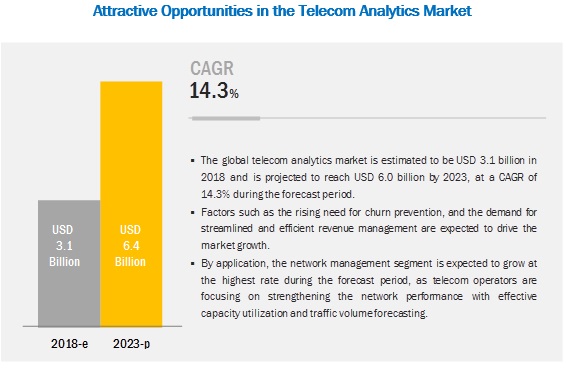

[136 Pages Report] The telecom analytics market size is expected to grow from USD 3.1 billion in 2018 to USD 6.0 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.3% during the forecast period. The factors such as the growing need for churn prevention, increasing demand for effective revenue management, and rising attacks and suspicious activities are expected to fuel the market growth. However, the lack of awareness of telecom analytics among telecom operators is expected to restrain the market growth. Moreover, the significance of Private Branch Exchange (PBX) in internal operations, vulnerability of mobile devices, and use of customer and network data analytics to devise the targeted upselling strategy for effective subscriber engagement are expected to create opportunities.

To know about the assumptions considered for the study, download the pdf brochure

The software segment to hold a larger market size during the forecast period

The telecom analytics market by component covers software and services. The software segment outperforms the services segment and would see maturation in the future, due to a higher adoption of software. Telecom analytics software are currently being deployed to cater to complex Business Intelligence (BI) requirements of the telecom industry vertical. These requirements include churn reduction; fraud detection; risk management; cross-sell and upsell product and services plans; customer segmentation and analysis; revenue management; and security and compliance.

The consulting segment to grow at the highest CAGR during the forecast period

Consulting services mainly steer around the critical issues and opportunities related to strategies, marketing, operations, technologies, mergers and acquisitions, and finance, leading to increased effectiveness, boosted performance, reduced costs, and enhanced resilience. Consulting in the telecom analytics market is poised to grow at a steady speed, as companies in the telecom industry vertical are realizing the significance of analytics in their value chain and are selecting appropriate technologies and vendors based on their requirements and budgets.

The cloud deployment model to grow at a higher CAGR during the forecast period

The cloud deployment model is expected to grow at a higher CAGR during the forecast period. Cloud-based solutions are gaining a firm hold in the market due to various benefits, such as cost control, resource pooling, and less implementation time.

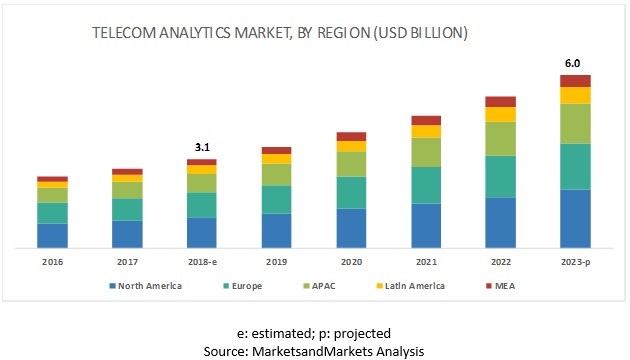

North America to account for the largest market size during the forecast period

The global telecom analytics market by region covers 5 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. It is expected to hold the highest market share and dominate the market from 2018 to 2023, due to the presence of a large number of solution vendors in the US. The APAC region is witnessing significant growth opportunities, owing to growing technology expenditure in major countries, such as Japan, China, and India and rising demand for cost-effective analytical software and services by Small and Medium-sized Enterprises (SMEs).

Key Market Players

The telecom analytics market comprises major solution providers, such as SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Adobe (US), Cisco (US), Teradata (US), Micro Focus (UK), TIBCO (US), MicroStrategy (US), Tableau (US), Panorama Software (Canada), Qlik (US), OpenText (Canada), Alteryx (US), and Sisense (US).

The study includes an in-depth competitive analysi

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Software, Services, Deployment Models, Organization Size, and Regions |

|

Geographies covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Adobe (US), Cisco (US), Teradata (US), Micro Focus (UK), TIBCO (US), MicroStrategy (US), Tableau (US), Panorama Software (Canada), Qlik (US), OpenText (Canada), Alteryx (US), and Sisense (US) |

This research report categorizes the market based on software, services, deployment models, organization size, and regions.

Based on Components, the telecom analytics market has been segmented as follows:

- Software

- Services

- Managed Services

- Professional Services

- Consulting

- Support and Maintenance

- Deployment and Integration

Based on Applications, the telecom analytics market has been segmented as follows:

- Customer Management

- Sales and Marketing Management

- Risk and Compliance Management

- Network Management

- Workforce Management

- Others (quality management, and BI and reporting)

Based on Deployment Models, the telecom analytics market has been segmented as follows:

- On-premises

- Cloud

Based on Organization Size, the market has been segmented as follows:

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Based on Regions, the telecom analytics market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- India

- Japan

- China

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- Middle East

- Africa

Recent Developments:

- In January 2019, IBM collaborated with Vodafone to enable businesses to integrate their cloud computing systems with 5G network and support new technologies, such as machine learning. Under this collaboration, Vodafone would pay USD 550 million to IBM and provide IBM’s AI and automation technologies to networked businesses.

Frequently Asked Questions (FAQ):

What is Telecom Analytics?

What are the top companies providing Telecom Analytics software and services?

What are the driving factors for the telecom analytics in the telecommunication Industry?

What are various technologies driving telecom analytics market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Market Segmentation

1.5 Regions Covered

1.6 Years Considered for the Study

1.7 Currency Considered

1.8 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

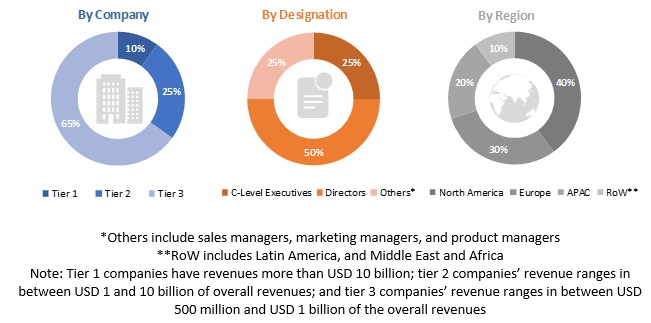

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

2.5 Microquadrant Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Research Assumptions

2.7 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Telecom Analytics Market

4.2 Market, By Application (2018-2023)

4.3 Market, By Organization Size

4.4 Market: Market Share Across Regions

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need to Reduce Churn and Retain Customers

5.2.1.2 Demand for Streamlined and Efficient Revenue Management

5.2.1.3 Rise in Network Attacks and Online Data Security Threats

5.2.2 Restraints

5.2.2.1 Lack of Awareness of Telecom Analytics Among Telecom Operators

5.2.3 Opportunities

5.2.3.1 Significance of Private Branch Exchange in Internal Operations

5.2.3.2 Use of Customer and Network Data Analytics to Devise Targeted Upselling Strategy for Effective Subscriber Engagement

5.2.4 Challenges

5.2.4.1 Lack of Availability of Mature Solutions

5.2.4.2 Identifying Fraudulent Activities

5.3 Industry Trends

5.3.1 Key Trends in the Telecom Analytics Market

5.3.1.1 AI and Machine Learning Set to Disrupt Traditional Business Processes in the Telecom Sector

5.3.1.2 Convergence of Telecom and Iot

5.3.2 Market: Use Cases

5.3.2.1 to Gain Real-Time Insights Into Network Health and Ensure Reliability

5.3.2.2 Improving Customer Experience and Minimizing Turn-Around Time for Customer Issues With Guavus Analytics Platform

5.3.2.3 to Track and Analyze Sales Performance On-Demand

5.3.2.4 to Identify and Prevent Churn and Generate New Revenue Streams With Micro Segmentation of the Customer Base

5.3.2.5 to Improve Customer Care Services and Deliver the QOS

6 Telecom Analytics Market, By Component (Page No. - 45)

6.1 Introduction

6.2 Software

6.2.1 Need for Sustaining in the Highly Competitive Telecom Industry to Drive the Adoption of Telecom Analytics Solutions

6.3 Services

6.3.1 Professional Services

6.3.1.1 Consulting

6.3.1.1.1 Need for Enhanced Strategic Outlook, Improved Performance Efficiencies, and Business Transformation to Drive the Consulting Services

6.3.1.2 Support and Maintenance

6.3.1.2.1 Complexity of Operations and the Need for Regular Assistance During the Solution Life Cycle to Foster the Growth of Support and Maintenance Services

6.3.1.3 Deployment and Integration

6.3.1.3.1 Rise in the Adoption of Telecom Analytics Solutions With Inherent Need to Align Solution to the Client Environment to Drive the Deployment and Integration Services

6.3.2 Managed Services

7 Telecom Analytics Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Customer Management

7.2.1 Need to Understand Customer Requirements and Deliver Personalized Targeted Services to Drive the Customer Management Segment

7.2.2 Key Use-Cases

7.2.2.1 Customer Experience Analytics

7.2.2.2 Customer Churn Prediction

7.2.2.3 Customer Service Optimization

7.3 Sales and Marketing Management

7.3.1 Need to Retain Existing Customer Base and Increase Market Share to Drive the Sales and Marketing Management Segment

7.3.2 Key Use-Cases

7.3.2.1 Customer Segmentation and Targeting

7.3.2.2 Customer Acquisition

7.3.2.3 Revenue Management

7.4 Risk and Compliance Management

7.4.1 Need to Mitigate Risk and Reduce Cost Associated to Drive the Growth of the Risk and Compliance Segment

7.4.2 Key Use-Cases

7.4.2.1 Compliance Management

7.4.2.2 Fraud Detection

7.4.2.3 Retention Risk and Impact Analysis

7.5 Network Management

7.5.1 Need to Optimize Network Operations to Meet QOS and Qoe Levels to Drive the Network Management Segment

7.5.2 Key Use-Cases

7.5.2.1 Proactive Network Diagnosis

7.5.2.2 Capacity Management

7.5.2.3 Route Optimization

7.6 Workforce Management

7.6.1 Need to Optimize Workforce and Maximize Productivity to Drive the Workforce Management Segment

7.6.2 Key Use-Cases

7.6.2.1 Field Service Planning and Optimization

7.6.2.2 Predicting Future Hiring Needs

7.6.2.3 Employee Attrition Analysis

7.7 Others

7.7.1 Key Use-Cases

7.7.1.1 Quality Management

7.7.1.2 BI and Reporting

8 Telecom Analytics Market, By Organization Size (Page No. - 63)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.2.1 Need for Viable Cloud-Based Data and Analytics Solutions to Drive the Adoption of Telecom Analytics in SMEs

8.3 Large Enterprises

8.3.1 Increasing Adoption of Advanced Technologies to Drive the Adoption of Telecom Analytics in Large Enterprises

9 Market, By Deployment Model (Page No. - 67)

9.1 Introduction

9.2 Cloud

9.2.1 Rapid Implementation, Reduced Operational Cost, 24×7 Data Accessibility, Scalability, and Ease of Use to Drive the Adoption of Cloud-Based Telecom Analytics Solutions

9.3 On-Premises

9.3.1 Flexibility to Customize Solutions, and Data Security and Privacy in the Heavily Regulated Telecom Industry to Be the Key Factor Driving the On-Premises Telecom Analytics Solutions

10 Telecom Analytics Market, By Region (Page No. - 71)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 The US Leads the Region With Significant Analytics Penetration and Investment By Telecom Companies

10.2.2 Canada

10.2.2.1 Canada is Expected to Grow at A Higher CAGR During the Forecast Period With Increasing Need to Retain the Customer Base

10.3 Europe

10.3.1 UK

10.3.1.1 Demand for High QOS Driven By A Large Consumer Base and High Competition to Drive the Market Growth in the UK

10.3.2 Germany

10.3.2.1 Adoption of Advanced Technologies By Local Service Providers and Continued Investments Into the Sector is Fueling the Market Growth in Germany

10.3.3 France

10.3.3.1 Supportive Government Policies and Capital Flow Into the Telecom Sector to Fuel the Market Growth in France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Growing Investment in Advanced Technologies Such as Big Data and IoT Expected to Spur the Growth of Telecom Analytics

10.4.2 India

10.4.2.1 India is Expected to Grow at the Highest CAGR During the Forecast Period

10.4.3 Japan

10.4.3.1 Established Infrastructure and Large Mobile Penetration is Expected to Drive the Market

10.4.4 Rest of APAC

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Need to Diversify and Offer Services at Competitive Pricing to Drive the Market in Brazil

10.5.2 Mexico

10.5.2.1 Need to Effectively Target the Large Subscriber Base and Government Initiatives to Strengthen the Local Telecom Infrastructure to Drive the Market in Mexico

10.5.3 Rest of Latin America

10.6 Middle East and Africa

10.6.1 Middle East

10.6.1.1 Need to Differentiate in the Saturated Telecom Sector for the Csps and Increase Their Market Share to Drive the Market in the Middle Eastern Region

10.6.2 Africa

10.6.2.1 Rapidly Evolving Telecom Sector and Favorable Government Policies to Drive the Market in the African Region

11 Competitive Landscape (Page No. - 91)

11.1 Microquadrant Overview

11.1.1 Visionaries

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Benchmarking

11.2.1 Business Strategy Excellence of Major Players in the Telecom Analytics Market

11.2.1 Strength of Product Offerings of Major Players in the Market

12 Company Profiles (Page No. - 96)

(Business Overview, Software and Services Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 IBM

12.2 Oracle

12.3 SAP

12.4 SAS Institute

12.5 Adobe

12.6 Cisco

12.7 Teradata

12.8 Micro Focus

12.9 Tibco

12.10 Tableau

12.11 Panorama

12.12 Opentext

12.13 Alteryx

12.14 Microstrategy

12.15 Sisense

*Business Overview, Software and Services Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 130)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customization

13.4 Related Reports

13.5 Author Details

List of Tables (57 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Evaluation Criteria

Table 3 Telecom Analytics Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 4 Market Size, By Component, 2016–2023 (USD Million)

Table 5 Software: Market Size, By Region, 2016–2023 (USD Million)

Table 6 Market Size, By Service, 2016–2023 (USD Million)

Table 7 Services: Market Size, By Region, 2016–2023 (USD Million)

Table 8 Market Size, By Professional Service, 2016–2023 (USD Million)

Table 9 Professional Services: Market Size, By Region, 2016–2023 (USD Million)

Table 10 Consulting: Market Size, By Region, 2016–2023 (USD Million)

Table 11 Support and Maintenance: Telecom Analytics Market Size, By Region, 2016–2023 (USD Million)

Table 12 Deployment and Integration: Market Size, By Region, 2016–2023 (USD Million)

Table 13 Managed Services: Market Size, By Region, 2016–2023 (USD Million)

Table 14 Market Size, By Application, 2016–2023 (USD Million)

Table 15 Customer Management: Market Size, By Region, 2016–2023 (USD Million)

Table 16 Sales and Marketing Management: Market Size, By Region, 2016–2023 (USD Million)

Table 17 Risk and Compliance Management: Market Size, By Region, 2016–2023 (USD Million)

Table 18 Network Management: Market Size, By Region, 2016–2023 (USD Million)

Table 19 Workforce Management: Market Size, By Region, 2016–2023 (USD Million)

Table 20 Other: Market Size, By Region, 2016–2023 (USD Million)

Table 21 Telecom Analytics Market Size, By Organization Size, 2016–2023 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 23 Large Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 24 Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 25 Cloud: Market Size, By Region, 2016–2023 (USD Million)

Table 26 On-Premises: Market Size, By Region, 2016–2023 (USD Million)

Table 27 Market Size, By Region, 2016–2023 (USD Million)

Table 28 North America: Telecom Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 29 North America: Market Size, By Service, 2016–2023 (USD Million)

Table 30 North America: Market Size, By Application, 2016–2023 (USD Million)

Table 31 North America: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 32 North America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 33 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 34 Europe: Telecom Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 35 Europe: Market Size, By Service, 2016–2023 (USD Million)

Table 36 Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 37 Europe: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 38 Europe: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 39 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 40 Asia Pacific: Telecom Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market Size, By Service, 2016–2023 (USD Million)

Table 42 Asia Pacific: Market Size, By Application, 2016–2023 (USD Million)

Table 43 Asia Pacific: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 44 Asia Pacific: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 45 Asia Pacific: Market Size, By Country, 2016–2023 (USD Million)

Table 46 Latin America: Telecom Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 47 Latin America: Market Size, By Service, 2016–2023 (USD Million)

Table 48 Latin America: Market Size, By Application, 2016–2023 (USD Million)

Table 49 Latin America: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 50 Latin America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 51 Latin America: Market Size, By Country, 2016–2023 (USD Million)

Table 52 Middle East and Africa: Telecom Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 53 Middle East and Africa: Market Size, By Service, 2016–2023 (USD Million)

Table 54 Middle East and Africa: Market Size, By Application, 2016–2023 (USD Million)

Table 55 Middle East and Africa: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 56 Middle East and Africa: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 57 Middle East and Africa: Market Size, By Sub-Region, 2016–2023 (USD Million)

List of Figures (37 Figures)

Figure 1 Global Market: Research Design

Figure 2 Telecom Analytics Market: Market Estimation and Forecast Methodology

Figure 3 Factor Analysis

Figure 4 Market Overview

Figure 5 Market to Witness High Growth During the Forecast Period

Figure 6 Market, By Component (2018 vs 2023)

Figure 7 Telecom Analytics Market, By Deployment Model (2018–2023)

Figure 8 Increasing Need to Analyze the Real-Time Consumer Data for Informed Decision-Making to Drive the Market

Figure 9 Network Management Application to Grow at the Highest CAGR During the Forecast Period

Figure 10 Market, By Organization Size (2018–2023)

Figure 11 North America to Account for the Highest Market Share in 2018

Figure 12 Drivers, Restraints, Opportunities, and Challenges: Telecom Analytics Market

Figure 13 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 14 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 15 Consulting Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Network Management Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 SMEs Segment to Grow at A Higher CAGR During the Forecast Period

Figure 18 Cloud Deployment Model to Grow at A Higher CAGR During the Forecast Period

Figure 19 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Telecom Analytics (Global), Competitive Leadership Mapping, 2018

Figure 23 Ranking of Key Players in the Telecom Analytics Market, 2018

Figure 24 IBM: Company Snapshot

Figure 25 SWOT Analysis: IBM

Figure 26 Oracle: Company Snapshot

Figure 27 SWOT Analysis: Oracle

Figure 28 SAP: Company Snapshot

Figure 29 SWOT Analysis: SAP

Figure 30 SAS Institute: Company Snapshot

Figure 31 SWOT Analysis: SAS Institute

Figure 32 Adobe: Company Snapshot

Figure 33 SWOT Analysis: Adobe

Figure 34 Cisco: Company Snapshot

Figure 35 Teradata: Company Snapshot

Figure 36 Micro Focus: Company Snapshot

Figure 37 Tableau: Company Snapshot

The study involves 4 major activities to estimate the current market size of the telecom analytics by component that include software and services. Exhaustive secondary research was done to collect information about the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, and articles by recognized authors; gold standard and silver standard websites; business analytics technology, Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both the supply and demand sides of the telecom analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, related key executives from various vendors who provide telecom analytics software; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

Market Size Estimation

For making market estimates and forecasting the telecom analytics market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the telecom analytics market based on components, deployment models, organization size, applications, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze recent developments and their positioning related to the market

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the market

Key Questions addressed by the report:

- What are the opportunities in the telecom analytics market?

- What is the competitive landscape in the market?

- What are the emerging technologies impacting the overall market?

- What are the key use cases existing in the market?

- What are the key trends and dynamics existing in the market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Telecom Analytics Market

Understanding the network analytics market based on categories and regions

Intered in market share of vendors such as Ericsson, Huawei, Cisco.