Steel Processing Market by Type (Carbon Steel, Alloy Steel), Shape of Steel (Long, Flat and Tubular), End User Industry (Construction, Shipping, Energy, Packaging, Consumer Appliances, Housing, Automotive), & by Region - Trends & Forecast to 2020

[256 Pages Report] The growth in the construction, automotive, and consumer appliances industry has played a huge part in providing the necessary boost to the global steel processing industry. The global steel processing industry is projected to grow at a CAGR of 2.16% during 2015 to 2020. Alloy steel is the fastest growing segment within the steel processing market across the globe and is suitable for all application areas.

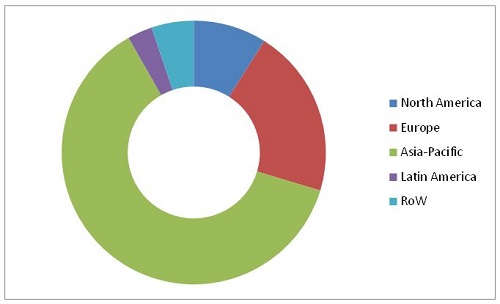

The market has been segmented on the basis of the shape of steel products, steel type, end users, and regions in terms of value and volume. The market segment on the basis of shape of steel products includes flat steel, long steel, and tubular steel. The segment on the basis of type of steel includes alloy steel and carbon steel. The applications segment includes construction, shipping, energy, packaging, consumer appliances industry, housing, automotive and others. The regions segment includes market size and share of North America, Europe, Asia-Pacific, Latin America, and RoW.

This report provides a full analysis of key companies and competitive analysis of developments recorded in the industry during the past five years. In the report, market drivers, restraints, opportunities, and challenges have been discussed in detail. The leading players of the market such as ArcelorMittal (Luxembourg), Baosteel Group Corporation (China), POSCO (South Korea), Nippon Steel & Sumitomo Metal Corporation (Japan), JFE Holdings, Inc. (Japan) have been profiled to provide an insight of the competitive scenario in the steel processing market. Mergers & acquisitions have been the key strategies adopted by leading companies to accommodate the fast changing technologies in the application areas and to increase their market share. Companies have also adopted strategic expansions and investments to bridge the existing gaps in their product offerings, end market requirements, and geographical constraints. These strategies have been adopted by leading companies to ensure retention of considerable market share within the highly fragmented steel processing market.

Steel Processing Market Share, by Region, 2014 ($Billion)

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Scope of the report

This research study categorizes the global steel processing market based on steel type, shape, end users, and region:

On the basis of steel type

- Alloy steel

- Carbon steel

On the basis of shape of steel products

- Flat steel

- Long steel

- Tubular steel

On the basis of end users

- Construction

- Shipping

- Energy

- Packaging

- Consumer appliances industry

- Housing

- Automotive

- Others

On the basis of region

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest of the World (RoW)

The market demand for steel processing is projected to grow at $642.43 Billion by 2020 and CAGR of 2.16% from 2015 to 2020. The growth in the construction, consumer appliances, and automotive industries throughout the world has played a huge part in providing the necessary momentum to the global steel processing industry, after the economic slowdown between 2007 and 2009. Also, the fact that there are less substitutes of steel has made steel indispensable from customers lives. The recovery of global economy would also boost the demand for the steel processing market.

The steel processing market is dominated by large firms such as ArcelorMittal (Luxembourg), Baosteel Group Corporation (China), POSCO (South Korea), Nippon Steel & Sumitomo Metal Corporation (Japan), JFE Holdings, Inc. (Japan), TATA Steel Ltd.(India), United States Steel (U.S.), Angang Steel Company Limited (China), Gerdau SA (Brazil), and Maanshan Iron and Steel Company Limited (China). They provide advanced steel processing products, and by gaining considerable expertise and experience over the years, have optimized their processes and practises to become even more efficient.

The segments considered for this report are based on the shape of steel, type of steel, end user applications and regions that constitute the steel market. The first segmentation, shape of steel, includes flat steel, long steel, and tubular steel. The second segment, type of steel, consists of alloy steel and carbon steel. Carbon steel is further segmented, on the basis of amount of carbon present, as low-carbon steel, medium-carbon steel and high-carbon steel. The applications of steel covered in this report include construction, automotive industry, shipping, energy, packaging, housing, consumer appliances, and others. On the basis of key regions, the global steel processing market has been segmented into North America, Europe, Asia-Pacific, Latin America, and the Rest of the World (RoW).

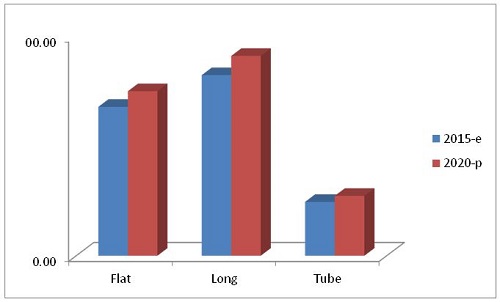

Steel Processing Market Size, by Shape of Steel, 2015 & 2020 ($Billion)

E - Expected, P - Projected

Source: Expert Interviews and MarketsandMarkets Analysis

The Asia-Pacific region is projected to be the fastest growing from 2015 to 2020 for steel processing market. The key players of steel processing prefer agreements, contracts, joint ventures, and partnership strategies and expansions & investments to garner a larger share in the market. The leading steel processing products and service providers are focusing on emerging countries that are estimated to show potential for industrial development in the near future.

The steel processing market is a highly fragmented one owing to the huge demand for eco-friendly products and changing technologies. Major companies rely on regional and local distributors to increase their share as well as geographical presence in the market. Companies are adopting inorganic growth strategies such as acquisitions to cope with the increasing demand for steel processing in key emerging markets. These strategies have aided companies to create a larger customer and partner base in key markets. The application requirements for steel processing are continuously changing, making it essential for manufacturers to continually invest in R&D and come up with innovative solutions.

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Population

2.2.2.1.1 Increase in Middle-Class Population, 20092030

2.2.2.2 Developing Economies, GDP (PPP), 2013

2.2.3 Supply-Side Analysis

2.2.3.1 Regulations

2.2.3.2 Research & Development

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumption & Limitation

2.6.1 Assumptions Made for This Study

2.6.2 Limitations for the Research Study

3 Executive Summary (Page No. - 40)

3.1 Evolution of Steel Processing Market

3.2 Steel Processing & Processed Steel Market Driving Factors

3.3 Long Steel is Projected to Cover Major Market in the Overall Processed Steel Market in 2020

3.4 Asia-Pacific Market is Projected to Dominate the Global Steel Processing & Processed Steel Market By 2020

3.5 Leading Market Players Adopted Acquisition as the Key Strategy From 2011 to 2015

4 Premium Insights (Page No. - 45)

4.1 Emerging Economies to Have Greater Demand for Finished Steel

4.2 Long Steel Accounts for the Maximum Market Share Among All Shapes of Steel

4.3 Long Steel and Flat Steel Occupied the Majority Share in the Emerging Asia-Pacific Region in 2014

4.4 China is Projected to Be the Fastest-Growing Market for Steel Processing & Processed Steel, 2015-2020

4.5 Developing Markets Such as China and India are Expected to Grow at A Higher CAGR Than Developed Markets, 2015-2020

4.6 Carbon Steel Market Was the Largest Market Among All Types of Steel in All the Regions in 2014

4.7 Among All the Applications of Steel, the Construction Sector Accounted for the Majority of the Share

5 Market Overview (Page No. - 52)

5.1 Introduction

5.2 Evolution of the Steel Processing Market

5.3 Steel Processing & Processed Steel Industry: Life-Cycle Analysis, By Region Asia-Pacific Region is Witnessing High Growth

5.4 Steel Processing & Processed Steel Market Segmentation

5.4.1 Processed Steel Market, By Type of Steel

5.4.1.1 Carbon Steel

5.4.1.1.1 Low-Carbon Steel

5.4.1.1.2 Medium-Carbon Steel

5.4.1.1.3 High-Carbon Steel

5.4.1.2 Alloy Steel

5.4.1.2.1 Stainless Steel

5.4.1.2.2 Tool Steel

5.4.2 Processed Steel Market, By Shape of Steel

5.4.2.1 Long Steel

5.4.2.2 Flat Steel

5.4.2.3 Tube Steel

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Increasing Urban Population Requires A Huge Amount of New Steel Products

5.5.1.2 Increasing Industrialization Stimulates the Production of More Steel

5.5.1.3 Growing Infrastructure Investment Will Drive Demand for Steel

5.5.2 Restraints

5.5.2.1 Economic Downturn in Some Regions May Impact Steel Processing & Processed Steel Market Negatively

5.5.2.2 Saturated Markets Have Low Demand for Finished Steel

5.5.3 Opportunities for Growth of Steel Processing & Processed Steel Market

5.5.3.1 Growing Market for Construction and Automotive Needs Significant Amount of Steel

5.5.3.2 Increased Spending on Infrastructure in Emerging Economies has Increased the Consumption of Steel

5.5.3.3 Less Number of Substitutes

5.5.3.4 Optimum Utilization of Steel Scrap Helps the Industry Protect the Environment By Saving Natural Resources

5.5.3.5 Relaxed Credit Policy Encourages More Investment in Steel Industry

5.5.4 Challenges

5.5.4.1 Eliminating Excess Capacity Remains A Huge Challenge

5.5.4.2 Volatility in Raw Material Prices Creates an Unpredictable Business Environment

5.5.4.3 Curtailing Environmental Hazards is A Major Challenge Faced By Steel Processing Companies

6 Industry Trends (Page No. - 65)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Steel Processing Market, By Region (Page No. - 70)

7.1 Introduction

7.2 Steel Processing Market Size, By Country

7.2.1 North America: Steel Processing Market, By Country

7.2.2 Europe: Steel Processing Market Size, By Country

7.2.2.1 Russia Accounted for the Maximum Share in the European Steel Processing Market in 2014

7.2.3 Asia-Pacific: Steel Processing Market, By Country

7.2.3.1 the Asia-Pacific Region Accounted for the Majority Share in Global Steel Processing Market

7.2.4 Latin America: Steel Processing Market Size, By Country

7.2.5 RoW: Steel Processing Market Size, By Country

7.2.5.1 Iran Accounted for the Maximum Market Share in RoW in Terms of Value in 2014

8 Processed Steel Market, By Type of Steel (Page No. - 78)

8.1 Introduction

8.2 Carbon Steel

8.2.1 Carbon Steel Market Size, By Region

8.2.2 Carbon Steel Market Size, By Country

8.3 Alloy Steel

8.3.1 Alloy Steel Market Size, By Region

8.3.2 Alloy Steel Market Size, By Country

9 Processed Steel Market,By Shape of Steel (Page No. - 89)

9.1 Introduction

9.2 Flat Steel

9.2.1 Flat Steel Market, By Region, 20132020

9.2.2 Flat Steel Market Size, By Country

9.3 Long Steel

9.3.1 Long Steel Market Size, By Country

9.4 Tube Steel

9.4.1 Tube Steel Market Size, By Country

9.4.2 Tube Steel Size, By Country

10 Processed Steel Market, By End User (Page No. - 109)

10.1 Introduction

10.1.1 the Growth in the Consumer Appliances Market to Drive the Processed Steel Demand

10.2 Processed Steel Market, By End User & Region

10.2.1 Construction

10.2.2 Shipping

10.2.3 Energy

10.2.4 Consumer Appliances

10.2.5 Packaging

10.2.6 Housing

10.2.7 Automotive

10.2.8 Others

11 Processed Steel Market, By Region (Page No. - 122)

11.1 Introduction

11.2 North America

11.2.1 North America: Processed Steel Market Size, By Country

11.2.2 North America: Processed Steel Market, By Type of Steel

11.2.3 North America: Processed Steel Market Size, By Shape of Steel

11.2.4 North America: Processed Steel Market Size, By End User

11.2.5 the U.S.

11.2.5.1 U.S.: Country Economic Indicators

11.2.5.2 U.S.: Processed Steel Market, By Type of Steel

11.2.5.3 U.S.: Processed Steel Market, By Shape of Steel

11.2.5.4 U.S.: Processed Steel Market, By End User

11.2.6 Canada

11.2.6.1 Canada: Country Economic Indicator

11.2.6.2 Canada: Processed Steel Market, By Type of Steel

11.2.6.3 Canada: Processed Steel Market, By Shape of Steel

11.2.6.4 Canada: Processed Steel Market, By End-User

11.2.7 Mexico

11.2.7.1 Mexico: Country Economic Indicators

11.2.7.2 Mexico: Processed Steel Market, By Type of Steel

11.2.7.3 Mexico: Processed Steel Market, By Shape of Steel

11.2.7.4 Mexico: Processed Steel Market, By End-User

11.3 Europe

11.3.1 Europe: Processed Steel Market Size, By Country

11.3.2 Europe: Processed Steel Market, By Type of Steel

11.3.3 Europe: Processed Steel Market Size, By Shape of Steel

11.3.4 Europe: Processed Steel Market Size, By End User

11.3.5 Russia

11.3.5.1 Russia: Country Economic Indicators

11.3.5.2 Russia: Processed Steel Market, By Type of Steel

11.3.5.3 Russia: Processed Steel Market, By Shape of Steel

11.3.5.4 Russia: Processed Steel Market, By End Users

11.3.6 Germany

11.3.6.1 Germany: Country Economic Indicators

11.3.6.2 Germany: Processed Steel Market, By Type of Steel

11.3.6.3 Germany: Processed Steel Market, By Shape of Steel

11.3.6.4 Germany: Processed Steel Market, By End User

11.3.7 France

11.3.7.1 France: Country Economic Indicators

11.3.7.2 France: Processed Steel Market, By Type of Steel

11.3.7.3 France: Processed Steel Market, By Shape of Steel

11.3.7.4 France: Processed Steel Market, By End User

11.3.8 Italy

11.3.8.1 Italy: Country Economic Indicators

11.3.8.2 Italy: Processed Steel Market, By Type of Steel

11.3.8.3 Italy: Processed Steel Market, By Shape of Steel

11.3.8.4 Italy: Processed Steel Market, By End User

11.3.9 Rest of Europe

11.3.9.1 Rest of Europe: Processed Steel Market, By Type of Steel

11.3.9.2 Rest of Europe: Processed Steel Market, By Shape of Steel

11.3.9.3 Rest of Europe: Processed Steel Market, By End User

11.4 Asia-Pacific

11.4.1 Asia-Pacific: Processed Steel Market Size, By Country

11.4.2 Asia-Pacific: Processed Steel Market, By Type of Steel

11.4.3 Asia-Pacific: Processed Steel Market Size, By Shape of Steel

11.4.4 Asia-Pacific: Processed Steel Market Size, By Shape of Steel

11.4.5 China

11.4.5.1 China: Country Economic Indicators

11.4.5.2 China: Processed Steel Market Size, By Type of Steel

11.4.5.3 China: Processed Steel Market, By Shape of Steel

11.4.5.4 China: Processed Steel Market, By End User

11.4.6 India

11.4.6.1 India: Country Economic Indicators

11.4.6.2 India: Processed Steel Market Size, By Type of Steel

11.4.6.3 India: Processed Steel Market, By Shape of Steel

11.4.6.4 India: Processed Steel Market, By End User

11.4.7 Japan

11.4.7.1 Japan: Country Economic Indicators

11.4.7.2 Japan: Processed Steel Market Size, By Type of Steel

11.4.7.3 Japan: Processed Steel Market, By Shape of Steel

11.4.7.4 Japan: Processed Steel Market, By End User

11.4.8 South Korea

11.4.8.1 South Korea: Country Economic Indicators

11.4.8.2 South Korea: Processed Steel Market Size, By Type of Steel

11.4.8.3 South Korea: Processed Steel Market, By Shape of Steel

11.4.8.4 South Korea: Processed Steel Market, By End User

11.4.9 Rest of Asia-Pacific

11.4.9.1 Rest of Asia-Pacific: Processed Steel Market Size, By Type of Steel

11.4.9.2 Rest of Asia-Pacific: Processed Steel Market, By Shape of Steel

11.4.9.3 Rest of Asia-Pacific: Processed Steel Market, By End User

11.5 Latin America

11.5.1 Latin America: Processed Steel Market Size, By Country

11.5.2 Latin America: Processed Steel Market, By Type of Steel

11.5.3 Latin America: Processed Steel Market Size, By Shape of Steel

11.5.4 Latin America: Processed Steel Market Size, By Shape of Steel

11.5.5 Brazil

11.5.5.1 Brazil: Country Economic Indicators

11.5.5.2 Brazil: Processed Steel Market Size, By Type of Steel

11.5.5.3 Brazil: Processed Steel Market, By Shape of Steel

11.5.5.4 Brazil: Processed Steel Market, By End User

11.5.6 Argentina

11.5.6.1 Argentina: Country Economic Indicators

11.5.6.2 Argentina: Processed Steel Market Size, By Type of Steel

11.5.6.3 Argentina: Processed Steel Market, By Shape of Steel

11.5.6.4 Argentina: Processed Steel Market, By End User

11.5.7 Rest of Latin America

11.5.7.1 Rest of Latin America: Processed Steel Market Size, By Type of Steel

11.5.7.2 Rest of Latin America: Processed Steel Market, By Shape of Steel

11.5.7.3 Rest of Latin America: Processed Steel Market, By End User

11.6 Rest of the World

11.6.1 RoW: Processed Steel Market Size, By Country

11.6.2 RoW: Processed Steel Market, By Type of Steel

11.6.3 RoW: Processed Steel Market Size, By Shape of Steel

11.6.4 RoW: Processed Steel Market Size, By End User

11.6.5 Iran

11.6.5.1 Iran: Country Economic Overview

11.6.5.2 Iran: Processed Steel Market Size, By Type of Steel

11.6.5.3 Iran: Processed Steel Market, By Shape of Steel

11.6.5.4 Iran: Processed Steel Market, By End User

11.6.6 Others in RoW

11.6.6.1 Others in RoW: Processed Steel Market Size, By Type of Steel

11.6.6.2 Others in RoW: Processed Steel Market, By Shape of Steel

11.6.6.3 Others in RoW: Processed Steel Market, By End-User

12 Competitive Landscape (Page No. - 216)

12.1 Overview

12.1.1 Mergers & Acquisitions

12.1.2 Partnerships, Agreements & Joint Ventures

12.1.3 Expansion

12.1.4 New Product Launches

13 Company Profiles (Page No. - 222)

(Company at A Glance, Business Overview, Product Offerings, Key Strategy, Recent Developments, SWOT Analysis & Mnm View)*

13.1 Introduction

13.2 Arcelormittal

13.3 POSCO

13.4 Nippon Steel & Sumitomo Metal Corporation.

13.5 JFE Holdings, Inc.

13.6 Baosteel Group Corporation

13.7 Tata Steel Limited.

13.8 United States Steel Corporation

13.9 Gerdau S.A.

13.10 Angang Steel Company Limited

13.11 Maanshan Iron & Steel Company Limited

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 249)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (235 Tables)

Table 1 Impact of Key Drivers on Steel Processing & Processed Steel Market

Table 2 Economic Downturn May Restrain Market Growth

Table 3 The Biggest Challenge to the Steel Processing Industry is Eliminating Excess Capacity

Table 4 Steel Processing Market Size, By Region, 20132020 ($Billion)

Table 5 Steel Processing Market Size, By Region, 20132020 (MT)

Table 6 North America: Steel Processing Market Size, By Country,20132020 ($Billion)

Table 7 North America: Steel Processing Market Size, By Country,20132020 (MT)

Table 8 Europe: Steel Processing Market Size, By Country, 20132020 ($Billion)

Table 9 Europe: Steel Processing Market Size, By Country, 20132020 (MT)

Table 10 Asia-Pacific: Steel Processing Market Size, By Country,20132020 ($Billion)

Table 11 Asia-Pacific: Steel Processing Market Size, By Country, 20132020 (MT)

Table 12 Latin America: Steel Processing Market Size, By Country,20132020 ($Billion)

Table 13 Latin America: Steel Processing Market Size, By Country, 20132020 (MT)

Table 14 RoW: Steel Processing Market Size, By Country, 20132020 ($Billion)

Table 15 RoW: Steel Processing Market Size, By Country, 20132020 (MT)

Table 16 Processed Steel Market Size, By Type of Steel, 20132020 ($Billion)

Table 17 Processed Steel Market Size, By Type of Steel, 20132020 (MT)

Table 18 Carbon Steel Market Size, By Region, 20132020 ($Billion)

Table 19 Carbon Steel Market Size, By Region, 20132020 (MT)

Table 20 Carbon Steel Market Size, By Country, 20132020 ($Billion)

Table 21 Carbon Steel Market Size, By Country, 20132020 (MT)

Table 22 Alloy Steel Market Size, By Region, 20132020 ($Billion)

Table 23 Alloy Steel Market Size, By Region, 20132020 (MT)

Table 24 Alloy Steel Market Size, By Country, 20132020 ($Billion)

Table 25 Alloy Steel Market Size, By Country, 20132020 (MT)

Table 26 Processed Steel Market Size, By Shape of Steel, 20132020 ($Billion)

Table 27 Processed Steel Market Size, By Shape of Steel, 20132020 (MT)

Table 28 Flat Steel Market Size, By Region, 20132020 ($Billion)

Table 29 Flat Steel Market Size, By Region, 20132020 (MT)

Table 30 North America: Flat Steel Market Size, By Country, 20132020 ($Billion)

Table 31 North America: Flat Steel Market Size, By Country, 20132020 (MT)

Table 32 Europe: Flat Steel Market Size, By Country, 20132020 ($Billion)

Table 33 Europe: Flat Steel Market Size, By Country, 20132020 (MT)

Table 34 Asia-Pacific: Flat Steel Market Size, By Country, 20132020 ($Billion)

Table 35 Asia-Pacific: Flat Steel Market Size, By Country, 20132020 (MT)

Table 36 Latin America: Flat Steel Market Size, By Country, 20132020 ($Billion)

Table 37 Latin America: Flat Steel Market Size, By Country, 20132020 (MT)

Table 38 RoW: Flat Steel Market Size, By Country, 20132020 ($Billion)

Table 39 RoW: Flat Steel Market Size, By Country, 20132020 (MT)

Table 40 Long Steel Market Size, By Region, 20132020 ($Billion)

Table 41 Long Steel Market Size, By Region, 20132020 (MT)

Table 42 North America: Long Steel Market Size, By Country, 2013-2020 ($Billion)

Table 43 North America: Long Steel Market Size, By Country, 2013-2020 (MT)

Table 44 Europe: Long Steel Market Size, By Country, 2013-2020 ($Billion)

Table 45 Europe: Long Steel Market Size, By Country, 2013-2020 (MT)

Table 46 Asia-Pacific: Long Steel Market Size, By Country, 2013-2020 ($Billion)

Table 47 Asia-Pacific: Long Steel Market Size, By Country, 2013-2020 (MT)

Table 48 Latin America: Long Steel Market Size, By Country, 2013-2020 ($Billion)

Table 49 Latin America: Long Steel Market Size, By Country, 2013-2020 (MT)

Table 50 RoW: Long Steel Market Size, By Country, 2013-2020 ($Billion)

Table 51 RoW: Long Steel Market Size, By Country, 2013-2020 ($Billion)

Table 52 Tube Steel Market, By Region, 20132020 ($Billion)

Table 53 Tube Steel Market, By Region, 20132020 (MT)

Table 54 North America: Tube Steel Market Size, By Country, 20132020 ($Billion)

Table 55 North America: Tube Steel Market Size, By Country, 20132020 (MT)

Table 56 Europe: Tube Steel Market Size, By Country, 20132020 ($Billion)

Table 57 Europe: Tube Steel Market Size, By Country, 20132020 (MT)

Table 58 Asia-Pacific: Tube Steel Market Size, By Country, 20132020 ($Billion)

Table 59 Asia-Pacific: Tube Steel Market Size, By Country, 20132020 (MT)

Table 60 Latin America: Tube Steel Market Size, By Country, 20132020 ($Billion)

Table 61 Latin America: Tube Steel Market Size, By Country, 20132020 (MT)

Table 62 RoW: Tube Steel Market Size, By Country, 20132020 ($Billion)

Table 63 RoW: Tube Steel Market Size, By Country, 20132020 (MT)

Table 64 Processed Steel Market Size, By End User, 20132020 ($Billion)

Table 65 Processed Steel Market, By End User, 20132020 (MT)

Table 66 Construction in Processed Steel Market Size, By Region,20132020 ($Billion)

Table 67 Construction in Processed Steel Market Size, By Region, 20132020 (MT)

Table 68 Shipping in Processed Steel Market Size, By Region, 20132020 ($Billion)

Table 69 Shipping in Processed Steel Market Size, By Region, 20132020 (MT)

Table 70 Energy in Processed Steel Market Size, By Region, 20132020 ($Billion)

Table 71 Energy in Processed Steel Market Size, By Region, 20132020 (MT)

Table 72 Consumer Appliances in Processed Steel Market Size, By Region,20132020 ($Billion)

Table 73 Consumer Appliances in Processed Steel Market Size, By Region,20132020 (MT)

Table 74 Packaging in Processed Steel Market Size, By Region,20132020 ($Billion)

Table 75 Packaging in Processed Steel Market Size, By Region, 20132020 (MT)

Table 76 Housing in Processed Steel Market Size, By Region, 20132020 ($Billion)

Table 77 Housing in Processed Steel Market Size, By Region, 20132020 (MT)

Table 78 Automotive in Processed Steel Market Size, By Region,20132020 ($Billion)

Table 79 Automotive in Processed Steel Market Size, By Region, 20132020 (MT)

Table 80 Others in Processed Steel Market Size, By Region, 20132020 ($Billion)

Table 81 Others in Processed Steel Market Size, By Region, 20132020 (MT)

Table 82 Processed Steel Market Size, By Region, 2013-2020 ($Billion)

Table 83 Processed Steel Market Size, By Region, 2013-2020 (MT)

Table 84 North America: Processed Steel Market Size, By Country,2013-2020 ($Billion)

Table 85 North America: Processed Steel Market Size, By Country, 2013-2020 (MT)

Table 86 North America: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 87 North America: Processed Steel Market Size, By Type of Steel,2014-2020 (MT)

Table 88 North America: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 89 North America: Processed Steel Market Size, By Shape of Steel,2013-2020 (MT)

Table 90 North America: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 91 North America: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 92 U.S.: Processed Steel Market Size, By Type of Steel, 2013-2020 ($Billion)

Table 93 U.S.: Processed Steel Market Size, By Type of Steel, 2013-2020 (MT)

Table 94 U.S.: Processed Steel Market Size, By Shape of Steel, 2013-2020 ($Billion)

Table 95 U.S.: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 96 U.S.: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 97 U.S.: Processed Steel Market Size, By End-User, 2013-2020 (MT)

Table 98 Canada: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 99 Canada: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 100 Canada: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 101 Canada: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 102 Canada: Processed Steel Market Size, By End-User, 2013-2020 ($Billion)

Table 103 Canada: Processed Steel Market Size, By End-User, 2013-2020 (MT)

Table 104 Mexico: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 105 Mexico: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 106 Mexico: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 107 Mexico: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 108 Mexico: Processed Steel Market Size, By End-User, 2013-2020 ($Billion)

Table 109 Mexico: Processed Steel Market Size, By End-User, 2013-2020 (MT)

Table 110 Europe: Processed Steel Market Size, By Country, 2013-2020 ($Billion)

Table 111 Europe: Processed Steel Market Size, By Country, 2013-2020 (MT)

Table 112 Europe: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 113 Europe: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 114 Europe: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 115 Europe: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 116 Europe: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 117 Europe: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 118 Russia: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 119 Russia: Processed Steel Market Size, By Type of Steel, 2013-2020 (MT)

Table 120 Russia: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 121 Russia: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 122 Russia: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 123 Russia: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 124 Germany: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 125 Germany: Processed Steel Market Size, By Type of Steel, 2013-2020 (MT)

Table 126 Germany: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 127 Germany: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 128 Germany: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 129 Germany: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 130 France: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 131 France: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 132 France: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 133 France: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 134 France: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 135 France: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 136 Italy: Processed Steel Market Size, By Type of Steel, 2013-2020 ($Billion)

Table 137 Italy: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 138 Italy: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 139 Italy: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 140 Italy: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 141 Italy: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 142 Rest of Europe: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 143 Rest of Europe: Processed Steel Market Size, By Type of Steel,2014-2020 (MT)

Table 144 Rest of Europe: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 145 Rest of Europe: Processed Steel Market Size, By Shape of Steel,2013-2020 (MT)

Table 146 Rest of Europe: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 147 Rest of Europe: Processed Steel Market Size, By End User,2013-2020 (MT)

Table 148 Asia-Pacific: Processed Steel Market Size, By Country,2013-2020 ($Billion)

Table 149 Asia-Pacific: Processed Steel Market Size, By Country, 2013-2020 (MT)

Table 150 Asia-Pacific: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 151 Asia-Pacific: Processed Steel Market Size, By Type of Steel,2014-2020 (MT)

Table 152 Asia-Pacific: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 153 Asia-Pacific: Processed Steel Market Size, By Shape of Steel,2013-2020 (MT)

Table 154 Asia-Pacific: Processed Steel Market Size, By End-User,2013-2020 ($Billion)

Table 155 Asia-Pacific: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 156 China: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 157 China: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 158 China: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 159 China: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 160 China: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 161 China: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 162 India: Processed Steel Market Size, By Type of Steel, 2013-2020 ($Billion)

Table 163 India: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 164 India: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 165 India: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 166 India: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 167 India: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 168 Japan: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 169 Japan: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 170 Japan: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 171 Japan: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 172 Japan: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 173 Japan: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 174 South Korea: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 175 South Korea: Processed Steel Market Size, By Type of Steel,2014-2020 (MT)

Table 176 South Korea: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 177 South Korea: Processed Steel Market Size, By Shape of Steel,2013-2020 (MT)

Table 178 South Korea: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 179 South Korea: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 180 Rest of Asia-Pacific: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 181 Rest of Asia-Pacific: Processed Steel Market Size, By Type of Steel,2014-2020 (MT)

Table 182 Rest of Asia-Pacific: Processed Steel Market Size, By Shape of Steel, 2013-2020 ($Billion)

Table 183 Rest of Asia-Pacific: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 184 Rest of Asia-Pacific: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 185 Rest of Asia-Pacific: Processed Steel Market Size, By End User,2013-2020 (MT)

Table 186 Latin America: Processed Steel Market Size, By Country,2013-2020 ($Billion)

Table 187 Latin America: Processed Steel Market Size, By Country, 2013-2020 (MT)

Table 188 Latin America: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 189 Latin America: Processed Steel Market Size, By Type of Steel,2014-2020 (MT)

Table 190 Latin America: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 191 Latin America: Processed Steel Market Size, By Shape of Steel,2013-2020 (MT)

Table 192 Latin America: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 193 Latin America: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 194 Brazil: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 195 Brazil: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 196 Brazil: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 197 Brazil: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 198 Brazil: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 199 Brazil: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 200 Argentina: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 201 Argentina: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 202 Argentina: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 203 Argentina: Processed Steel Market Size, By Shape of Steel,2013-2020 (MT)

Table 204 Argentina: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 205 Argentina: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 206 Rest of Latin America: Processed Steel Market Size, By Type of Steel, 2013-2020 ($Billion)

Table 207 Rest of Latin America: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 208 Rest of Latin America: Processed Steel Market Size, By Shape of Steel, 2013-2020 ($Billion)

Table 209 Rest of Latin America: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 210 Rest of Latin America: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 211 Rest of Latin America: Processed Steel Market Size, By End User,2013-2020 (MT)

Table 212 RoW: Processed Steel Market Size, By Country, 2013-2020 ($Billion)

Table 213 RoW: Processed Steel Market Size, By Country, 2013-2020 (MT)

Table 214 RoW: Processed Steel Market Size, By Type of Steel, 2013-2020 ($Billion)

Table 215 RoW: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 216 RoW: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 217 RoW: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 218 RoW: Processed Steel Market Size, By End -User, 2013-2020 ($Billion)

Table 219 RoW: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 220 Iran: Processed Steel Market Size, By Type of Steel, 2013-2020 ($Billion)

Table 221 Iran: Processed Steel Market Size, By Type of Steel, 2014-2020 (MT)

Table 222 Iran: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 223 Iran: Processed Steel Market Size, By Shape of Steel, 2013-2020 (MT)

Table 224 Iran: Processed Steel Market Size, By End User, 2013-2020 ($Billion)

Table 225 Iran: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 226 Others in RoW: Processed Steel Market Size, By Type of Steel,2013-2020 ($Billion)

Table 227 Others in RoW: Processed Steel Market Size, By Type of Steel,2014-2020 (MT)

Table 228 Others in RoW: Processed Steel Market Size, By Shape of Steel,2013-2020 ($Billion)

Table 229 Others in RoW: Processed Steel Market Size, By Shape of Steel,2013-2020 (MT)

Table 230 Others in RoW: Processed Steel Market Size, By End User,2013-2020 ($Billion)

Table 231 Others in RoW: Processed Steel Market Size, By End User, 2013-2020 (MT)

Table 232 Mergers & Acquisitions, 20122015

Table 233 Partnerships, Agreements & Joint Ventures, 20112015

Table 234 Expansions, 20112015

Table 235 New Product Launches, 20132015

List of Figures (53 Figures)

Figure 1 Research Design

Figure 2 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 3 Middle Class Population, Growth Trend, 20092030

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Evolution of Steel Processing Market

Figure 8 The Steel Processing Market is Projected to Be Dominated By the Long Steel Segment By 2020

Figure 9 Asia-Pacific Market is Projected to Dominate the Global Steel Processing & Processed Steel Market By 2020

Figure 10 Key Strategies Adopted By Market Players

Figure 11 Emerging Economies Offer Attractive Opportunities in the Steel Processing & Processed Steel Market

Figure 12 Long Steel Accounts for the Largest Market Share Among All ShapesOf Steel

Figure 13 Long Steel and Flat Steel Occupied the Majority Share in the Emerging Asia-Pacific Region in 2014

Figure 14 China is Projected to Be the Fastest-Growing Market for Steel Processing, 2015-2020

Figure 15 Developing Markets Such as China and India are Expected ToGrow at A Higher CAGR Than Developed Markets, 2015-2020

Figure 16 Carbon Steel Market Was the Largest Market Among All Types of Steel in All the Regions in 2014

Figure 17 Among All the Applications of Steel, the Construction Sector Accounted for the Majority of the Share

Figure 18 Evolution of Steel Processing Market

Figure 19 Steel Processing & Processed Steel Industry Life Cycle, By Region

Figure 20 Steel Processing & Processed Steel Market Segmentation

Figure 21 Increasing Urbanized Population is the Key Driver for Steel Processing & Processed Steel Market

Figure 22 Supply Chain Analysis

Figure 23 Porters Five Forces Analysis

Figure 24 Processed Steel Market, By Type of Steel, 2015 & 2020 ($ Billion)

Figure 25 Asia-Pacific Led the Global Processed Steel Market in 2014

Figure 26 Carbon Steel Market, By Region, 2015 & 2020 ($Billion)

Figure 27 Alloy Steel Market, By Region, 2015 & 2020 ($Billion)

Figure 28 Flat Steel Market, By Country,2015 & 2020 ($Billion)

Figure 29 Long Steel Market Size, By Country, 2015 & 2020 ($Billion)

Figure 30 The Consumer Appliances Segment is Projected to Grow at the Highest CAGR, Between 2015 and 2020

Figure 31 Geographic Snapshot (2015-2020): the Market in Asia-Pacific is Projected to Grow at the Highest Rate, By Value

Figure 32 North America- Processed Steel Market Snapshot: U.S. Projected to Be the Fastest Growing Country Market During the ForecastPeriod (2015-2020)

Figure 33 Asia-Pacific Processed Steel Market Snapshot: China is the Most Lucrative Market, (20152020)

Figure 34 Companies Adopted Mergers and Acquisitions as the Key Growth Strategy, 2011-2015

Figure 35 Battle for Market Share: Mergers & Acquisitions Were the Key Strategies,2011-2015

Figure 36 Annual Developments in the Steel Processing Market, 2011-2015

Figure 37 Geographic Revenue Mix of Top Five Market Players

Figure 38 Arcelormittal: Company Snapshot

Figure 39 SWOT Analysis: Arcelormittal

Figure 40 POSCO: Company Snapshot

Figure 41 SWOT Analysis: POSCO

Figure 42 Nippon Steel & Sumitomo Metal Corporation: Company Snapshot

Figure 43 SWOT Analysis: Nippon Steel and Sumitomo Metal Corporation

Figure 44 JFE Holdings, Inc.: Company Snapshot

Figure 45 SWOT Analysis: JFE Holdings, Inc.

Figure 46 Baosteel Group Corporation: Company Snapshot

Figure 47 SWOT Analysis: Baosteel Group Corporation

Figure 48 Tata Steel Limited.: Company Snapshot

Figure 49 SWOT Analysis: Tata Steel Limited

Figure 50 United States Steel Corporation: Company Snapshot

Figure 51 Gerdau S.A.: Company Snapshot

Figure 52 Angang Steel Company Limited: Company Snapshot

Figure 53 Maanshan Iron and Steel Company Limited: Company Snapshot

Growth opportunities and latent adjacency in Steel Processing Market