Space On-board Computing Platform Market by Platform, Application (Earth Observation, Navigation, Communication, Military & Scientific), Orbit, Communication Frequency, Technology, and Region (North America, Europe, APAC and RoW) - Forecast to 2027

Update:: 22.10.24

The Space On-board Computing Platform market is experiencing growing demand driven by the increasing need for advanced computing capabilities in space missions. Technological advancements in miniaturization, processing power, and energy efficiency are enabling more sophisticated on-board systems for satellite operations, deep space exploration, and defense applications. These platforms are essential for handling large volumes of data, real-time processing, and autonomous decision-making in space. With the rise of commercial space ventures and government investments in space exploration, the market is expected to expand, benefiting from innovations like AI, edge computing, and enhanced communication technologies.

Space On-Board Computing Platform Market Size & Growth

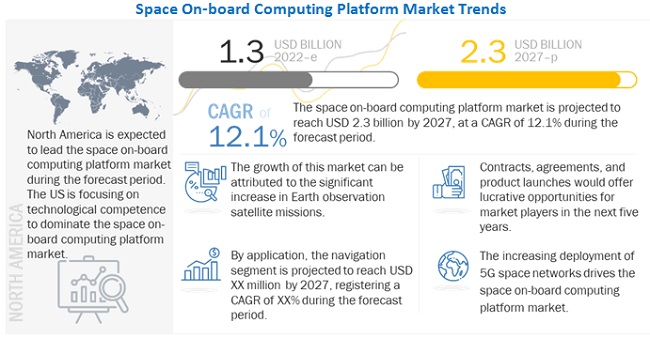

The Space on-board computing platform market is estimated to be USD 1.3 billion in 2022 and is projected to reach USD 2.3 billion by 2027, at a CAGR of 12.1% from 2022 to 2027. The market is driven by factors such as innovations in Space on-board computing platform used in navigation and communication satellites across the world.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has led to several challenges for many industries. The Aerospace & defense industry is no exception to that. The budget allotted to the defense sector has been reduced by several countries due to the COVID-19 pandemic. This puts most research projects on hold. The export of Space on-board computing platform to several countries in the Middle East, Africa, and Latin America has also been reduced. All these scenarios affect the development of Space on-board computing platform.

Space On-board Computing Platform Market Dymanic

Software-defined payloads for communication satellites

Software-defined payload is considered the central unit of a software-defined satellite. It is responsible for providing core functionality and purpose for a particular application. Various end users, basically commercial industries, such as oil and gas, mining, and agriculture, utilize software-defined satellites for their product mapping, earth exploration, and communication.

Conventional satellites were earlier tailored to comply with single mission requirements. Satellite developers are gradually adopting the vision of software-defined satellites that can be reprogrammed and reconfigured to allow a satellite to take up new applications and expand its performance. Different technologies such as reconfigurable payload, AI, cloud computing, and software-defined radio are embedded in the satellites, which allow them to be reconfigurable and flexible. Thus, increased demand for software-defined payloads has driven the space on-board computing platforms market.

Opportunity : Use of software-defined technology for flexibility to alter space missions

Flexibility and the ability to reconfigure a satellite that is already in orbit are some applications demanded by operators. The ability to adjust the spacecraft to the changing needs of the market is essential for operators of Geostationary Orbit (GEO) satellites that usually have lifespans of 15 years or more. That might include moving a satellite into a different position or switching its functionality from TV broadcasting to internet connectivity—something that would be impossible with the traditional hardware-defined satellites.

In 2021, American satellite manufacturer Lockheed Martin launched a bunch of CubeSats into the LEO. These CubeSats were different from regular CubeSats. They were launched in formations, act as a space-based cloud computing platform, process data onboard, and have their functionality changed through software updates beamed from the ground during the mission. This demonstrated the entry of the company into software-defined satellites that rely on generic hardware, flexible software, and an advanced and distributed space on-board computing platform to define their missions.

With its hi-tech on-board computing platform, software-defined technology provides the flexibility they need and could also reduce costs in the future. However, manufacturers and operators have already introduced partially software-defined satellites for LEO and MEO constellations. Thus, software-defined technology has created growth opportunities for the space on-board computing platform market.

Challenges : Use of COTS components and systems in satellites

Increasing use of Commercial-off-the-shelf (COTS) based components and systems in satellite payloads is expected to pose a challenge for the space on-board computing platform. The Commercial-off-the-shelf (COTS) components and systems have different specifications than the MIL-STD components, and their specifications are the sole responsibility of the manufacturer. It is required to study the component and system well and decide whether it is compatible with the satellite. Hence, it poses a challenge for space on-board computing platform manufacturers to develop suitable products as per COTS standards.

Space on-board computing platform used in navigation satellites to lead the market by application, during the forecast period

Space on-board computing platforms are useful for mapping of the Earth and navigation across regions. The data collected through these applications is processed through the web of satellites by their on-board computing platforms, which enables the development of exact maps of the Earth’s surface. These platforms improve the performance of GPS-based navigation due to their enhanced processing capabilities. The satellite, with the help of enhanced space on-board computing platforms, uses GNSS to generate signals for effective navigation, which was previously possible only with traditional and larger satellites. Many transportation and marine companies are investing more in small satellite and medium satellites to develop better navigation and tracking systems. All these factors have resulted in increased growth of this market.

S-band segment to command the Space on-board computing platform market by communication frequency, during the forecast period

S-band frequencies are used in most mobile satellite services in the US. In satellite communication, the frequency band range from 1.98–2.01 GHz is used for Earth to space communication, whereas the frequency band range from 2.17 GHz to 2.20 GHz is used for space to Earth communication. The on-board computing platform for managing such satellites is designed to handle antennas that operate on the above-mentioned frequency ranges.

Space On-board Computing Platform Market Regional Analysis

The North America market is projected to contribute the largest share from 2022 to 2027

In 2021, North America dominated the space on-board computing platform market, with the United States holding the largest share in the region. The market's growth in North America is primarily driven by the increasing demand for space on-board computing platforms in the U.S. and Canada, as well as their widespread use in various commercial and military satellite applications.

To know about the assumptions considered for the study, download the pdf brochure

Emerging IndustryTrends

Use of small satellites to provide communication services

OneWeb and SpaceX are expected to introduce networks to bring a change in terms of communication-related services provided by small satellites. These companies plan to use small satellites for low-priced applications that were previously not feasible using traditional systems. The constellations proposed by the abovementioned companies aim to offer high-throughput bandwidth in real time. The proposed launch of massive smallsat communication constellations is also expected to deliver substantial economies of scale in terms of manufacturing. Low manufacturing cost is expected to enable companies to offer broadband services at prices that rival terrestrial alternatives. Space on-board computing platforms play a vital role in managing communication from a satellite. The involvement of satellite communication in rapidly evolving 5G technology would benefit the growth of this platforms.

Top Space On-board Computing Platform Companies - Key Market Players

Major players in the Space on-board computing platform market include BAE Systems (UK), L3harris Technologies (US), Lockheed Martin Corporation (US), Thales Group (France), Northrop Grumman Corp. (US), Honeywell International Inc. (US), and Lockheed Martin (US). The report covers various industry trends and new technological innovations in the Space on-board computing platform market for the period, 2018-2027.

Scope of the Space On-board Computing Platform Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.3 Billion |

|

Projected Market Size |

USD 2.3 Billion |

|

CAGR |

12.1% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Application, By Platform, By Communication Frequency, By Orbit, By Technology |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

SAAB AB (Sweden), Raytheon Technologies (US), Honeywell International Inc (US), Thales Group (France), and BAE Systems (UK) |

The study categorizes the Space on-board computing platform market based on Application, Platform, Orbit, Communication Frequency, and Region.

Based on Application, the space based computing platforms market has been segmented as follows:

- Communication

- Earth Observation

- Navigation

- Meteorology

- Other

Based on Platform, the space based computing platforms market has been segmented as follows:

- Nano Satellite

- Micro satellite

- Small satellite

- Medium satellite

- Large satellite

- Spacecraft

Based on the Communication Frequency, the space based computing platforms market has been segmented as follows:

- X-band

- S-band

- K-band

- UHF/VHF Band

Based on the Orbit, space based computing platforms market has been segmented as follows:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Earth Orbit (GEO)

Based on the region, space based computing platforms market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Rest of the World includes Latin America, Middle East, and Africa

Recent Developments

- In March 2022, Ramon Space unveiled a storage system that can withstand the harsh environment of space. NuStream is the latest computing infrastructure platform for data-driven space missions. It has high-density storage and advanced modular architecture.

- In August 2021, The radiation-hardened RAD510 System on Chip (SoC) is designed by BAE Systems and manufactured by GlobalFoundries (GF) and forms the core of a single board computer (SBC) with twice the performance capability of the industry-standard RAD750 microprocessor. The SBC provides Power Architecture software-compatible processing that is more advanced than the RAD750 radiation-hardened general-purpose processor.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Space on-board computing platform market?

The Space on-board computing platform market is expected to grow substantially owing to the technological development in designing of the Space on-board computing platform based systems for several military & commercial applications.

What are the key sustainability strategies adopted by leading players operating in the Space on-board computing platform market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Space on-board computing platform market. Major players including BAE Systems (UK), L3harris Technologies (US), Lockheed Martin Corporation (US), Honeywell International Inc. (US), Northrop Grumman Corp. (US), Thales Group (France), and Lockheed Martin (US). have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Space on-board computing platform market?

Some of the major emerging technologies and use cases disrupting the market include the use of COTS components in satellite manufacturing.

Who are the key players and innovators in the ecosystem of the Space on-board computing platform market?

Major players in the Space on-board computing platform market include BAE Systems (UK), L3harris Technologies (US), Lockheed Martin Corporation (US), Honeywell International Inc. (US), Northrop Grumman Corp. (US), Thales Group (France), and Lockheed Martin (US).

Which region is expected to hold the highest market share in the Space on-board computing platform market?

Space on-board computing platform market in The North America region is estimated to account for the largest share of 62.5% of the market in 2022 and is expected to grow at the highest CAGR of 13.5% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

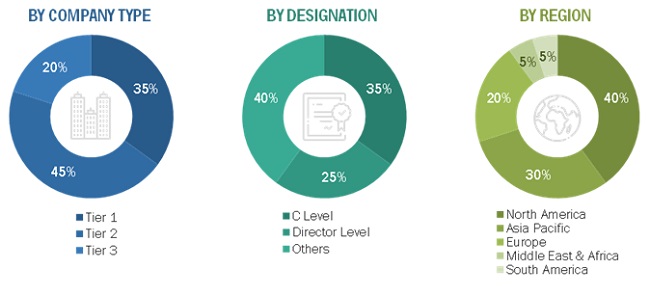

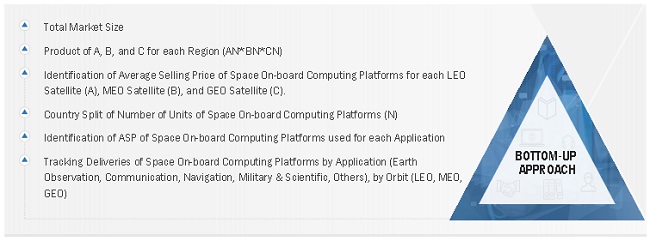

The study involved four major activities in estimating the current size of the Space on-board computing platform market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from space on-board computing platform vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using space on-board computing platform were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of space on-board computing platform and future outlook of their business which will affect the overall market.

|

Space on-board computing platform OEMS |

Others |

|

Honeywell International Inc. |

MDA |

|

Thales Group |

Teledyne |

|

Raytheon Technologies |

Ball Corp. |

|

Lockheed Martin |

SAAB AB |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Space on-board computing platform market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Space On-board Computing Platform Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Space on-board computing platform market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the Space on-board computing platform market.

Report Objectives

- To define, describe, and forecast the space on-board computing platform market by Platform, Application, Communication Frequency, Orbit, Technology, and region

- To analyze the demand- and supply-side indicators influencing the growth of the space on-board computing platform market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and industry-specific challenges, which influence the growth of the space on-board computing platform market

- To forecast the size of various segments of the space on-board computing platform market across four main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze micromarkets 1 with respect to individual growth trends, prospects, and their contribution to the space on-board computing platform market

- To analyze technological advancements and new product launches in the space on-board computing platform market

- To strategically profile key players in the space on-board computing platform market and comprehensively analyze their core competencies 2

- To identify products and key developments of leading companies operating in the space on-board computing platform market

- To provide a comprehensive analysis of business and corporate strategies adopted by key players operating in the space on-board computing platform market

- To provide a detailed competitive landscape of the space on-board computing platform market, along with market share ranking of leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Space On-board Computing Platform Market