Smart Greenhouse Market by Type (Hydroponics and Non-Hydroponics), Covering Material Type (Polyethylene, Polycarbonate, and Others), Offering (Hardware and Software & Services), Component, Cultivation, End User, Region - Global Forecast to 2025

Smart Greenhouse Market

Smart Greenhouse Market and Top Companies

Key market players profiled in smart greenhouse market include

- Nexus Corporation (US)

- Argus Control Systems Limited (Canada)

- Certhon (Netherlands)

- Rough Brothers, Inc. (US)

- GreenTech Agro LLC (US)

- Netafim (Israel)

- Sensphone (US)

- Cultivar Ltd. (UK)

- Heliospectra AB (Sweden)

- LumiGrow (US)

- Nexus Corporation (US): Nexus Corporation is one of the leading designers and developers of greenhouses. It operates as a subsidiary of Gibraltar Industries, a manufacturer and distributor of building products for the industrial, transportation, infrastructure, residential housing, renewable energy, and resource conservation markets. The company designs and manufactures greenhouse systems and display fixtures for commercial growers, retail garden centers, research and educational greenhouses, design professionals, conservatories and botanical greenhouses, residential applications, controlled-environment agriculture (CEA), and biotech greenhouses.

- Argus Control Systems (Canada): Argus Controls is a part of the Conviron Group of companies. It provides automated control systems for horticulture, aquaculture, and related biotechnology industries. The company is a leading provider of control systems and uses computers for integrating controls of greenhouse environments with irrigation systems. The company is known for its products used for facility automation, specialty monitoring, and control applications. Argus offers complete monitoring and controlling solutions, including all necessary hardware and software required to cater to the requirements of its customers.

- Certhon (Netherlands): Certhon is a combination of 2 sister companies—Wilk van der Sande (technical installations) and Bosch Inveka (greenhouse construction)—that work together to provide greenhouse solutions and products. Certhon offers products and technical services for the installation of greenhouses as a complete package for the horticulture sector. It also provides end-to-end solutions to carry out greenhouse projects, right from their design to their execution based on the requirements of clients.

- Rough Brothers (US): Rough Brothers is one of the leading companies in North America that is engaged in the designing, engineering, and manufacturing of greenhouses. It provides a single solution for greenhouse operations. The company designs customized solutions for commercial growers, retail garden centers, research facilities, universities, and schools. It also helps to construct, manage, and maintain optimal greenhouse structures and offer integrated environment control systems.

- GreenTech Agro (US): GreenTech Agro is a provider of specialized growing containers, Growtainer that are used for cultivating plants in transit. These containers are designed to meet the requirements of customers and can be used for indoor farming, vertical farming, controlled-environment agricultural practices, and alternative agriculture production. The company offers Growtainers and insulated shipping containers in different sizes, such as 20-, 40-, 45-, and 53-inches. Growtainers are designed to provide a controlled vertical environment for growing a wide range of horticultural and agricultural crops in all environments.

- Netafim (Israel): Netafim is a part of Orbia, a community of companies working together to tackle some of the world's most complex challenges. In February 2018, ~80% share of Netafim was acquired by Mexico-based petrochemical firm, Mexichem. Netafim provides irrigation equipment such as drippers, driplines, sprinklers, and micro-emitters. It also offers irrigation services and solutions. Netafim develops and offers crop management technologies, including monitoring and controlling systems, dosing systems, and crop management software.

- Sensaphone (US): Sensaphone designs innovative, remote environmental monitoring systems, which safeguard assets of greenhouses while sharing data related to temperature, humidity, and power failure in greenhouses. These systems help growers to witness crop growth remotely. More than 500,000 Sensaphone systems have been installed by the company globally, and several patents have been filed by it for its products. Sensaphone provides remote monitoring devices, auto-dialers, and sensors for industrial greenhouses.

- CultiVar (UK): Cultivar designs greenhouses based on the requirements of customers. It has introduced a number of innovative greenhouses made of glass, polyester powder coatings, and aluminum frames. The company serves a large customer base. It offers greenhouses made of accoya and aluminum.

- Heliospectra AB (Sweden): Heliospectra AB offers intelligent lighting solutions for greenhouses and controlled plant growth environments. It manufactures LED grow lights and solutions for commercial greenhouse growers and horticulturists. The lighting systems manufactured by the company use LED, optics, remote sensing technologies, and heat dissipation mechanisms to create an ideal environment for the crop cultivation. All these lights are energy-efficient. The company offers Mitra, Elixia, Siera, Dyna, and EOS for commercial greenhouses, indoor farming facilities, and research facilities.

- Lumigrow (US): LumiGrow is a manufacturer of advanced LED lighting solutions for horticultural and agricultural applications. It offers LED grow lights installed in various fixture designs for commercial greenhouses, indoor farming facilities, and plant research institutions. It also offers lights for use in entomology applications. The company also provides light management software to help growers in customizing their lighting systems, depending on the kind of crop being cultivated and the nature of the climate required for crop growth.

Smart Greenhouse Market and Top End Users

- Commercial Growers: Commercial greenhouses are high-tech structures, which provide stable, highly-controlled environments for the cultivation of plants, such as flowers, vegetables, and fruits by commercial growers. Environmental properties such as temperature, light exposure, irrigation, fertilization, humidity, and ventilation can be precisely controlled by growers in smart greenhouses for the optimal growth of crops. Commercial smart greenhouses enable the cultivation of plants in large volumes for commercial growers. Companies such as Rough Brothers and Nexus Corporation offer different structures of commercial smart greenhouses to commercial growers.

- Research & Educational Institutes: Companies are providing smart greenhouses to research & educational institutes for public or private research. They are providing fully functional smart greenhouse facilities by integrating different plant systems and plant research equipment in their designs for the optimal performance of these research facilities. Research greenhouses can be small or large, depending on the requirements of research activities to be carried out. Research and educational institutes are the key end users of smart greenhouses as they carry out research activities related to different flowers, fruits, and vegetables, as well as provide hands-on experience to the concerned in campuses and schools.

- Retail Gardens: Retail gardens are customized smart greenhouses that are designed according to the requirements and expectations of users. Companies offer their in-house engineering staff to end users to help them in the establishment of retail gardens by addressing code issues related to the garden performance, permitting licenses to users of retail gardens, and designing different phases of these gardens.

Smart Greenhouse Market and Top Covering Material Types

- Polyethylene: Polyethylene is the most commonly used greenhouse film or covering material used in smart greenhouses. It is a smooth plastic, which is placed on the roof of greenhouses to protect plants from external factors. Polyethylene films are manufactured by coextruding three layers of films with different polymers and additives. Each layer contributes to the quality of films and enhances their performance. Moreover, polyethylene is a low-cost and easily accessible material, which also contributes to its increased adoption in smart greenhouses.

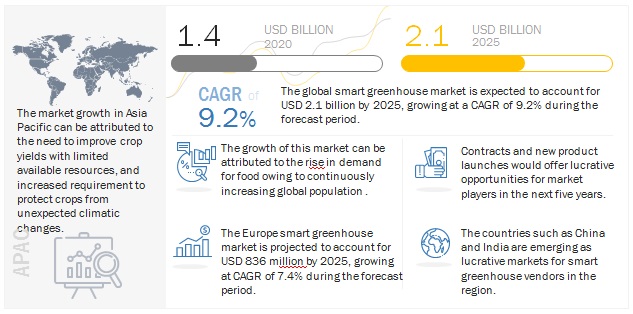

[120 Pages Report] The smart greenhouse market is projected to reach USD 2.1 billion by 2025 from USD 1.4 billion in 2020; it is expected to grow at a CAGR of 9.2% from 2020 to 2025. Major drivers for the growth of the market are increasing adoption of Internet of Things (IoT) and artificial intelligence (AI) by farmers and agriculturists; growing demand for food owing to continuously increasing global population; surging adoption of indoor farming in urban areas; and rising number of government initiatives to promote the adoption of smart agricultural practices.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growing demand for food owing to continuously increasing global population

As the global population is increasing at a significant rate, the food production worldwide requires to be doubled from 2014 to 2050 (Source: the Food and Agriculture Organization (FAO)). According to the United Nations, the world population is expected to reach 9.6 billion by 2050. Therefore, farmers are likely to witness immense pressure for increasing their crop production either by making the land arable to grow crops or adopting emerging techniques such as smart greenhouses and vertical farming. According to the World Health Organization (WHO), ~80% of the global population resides in urban areas. The prevailing scarcity of arable land in urban areas has led farmers to adopt new solutions such as smart greenhouses and vertical farming for developing fresh produce.

Restraint: High investment costs owing to deployment of expensive systems in smart greenhouses

Smart greenhouses are highly expensive owing to the deployment of a number of high-cost systems, such as HVAC systems, control systems, LED grow lights, and sensors in them. LED grow lights are an important and expensive component used in smart greenhouses. Each LED grow light unit contains an array of LED, specially designed for greenhouse applications, which increases their overall costs. These units contain different types of LED lights having variations in terms of wattage and wavelengths to provide the required light spectrum for the optimal growth of specific plant species. High-powered LED grow lights are available in the market, with prices ranging from USD 500 to USD 2,000. However, high-quality full-spectrum LED grow lights suitable for indoor farming can cost around USD 2,000 or more, depending on their power output and other features. Thus, the high costs of LED lighting systems are an important aspect delaying the incorporation of LED technology in the lighting of greenhouses.

Opportunity: Emerging trend of rooftop farming in urban areas

Rooftop gardens have become a prevailing trend across the world. The practice of cultivating food on rooftops of buildings is referred to as rooftop farming. It usually uses green roofs, hydroponics, aeroponics, or air-dynaponics systems or container gardens. Rooftop farming is being adopted in urban areas owing to the scarcity of the arable land. Rooftops of high-rise buildings are used to develop rooftop farms. These farms retain rainwater, decrease the likelihood of pests and human interference in crop cultivation, and reduce air pollution. Thus, the increasing adoption of rooftop farming in urban areas is expected to act as a growth opportunity for the smart greenhouse market.

Challenge: Absence of industry standards for managing farm data

The management of farm data is a major challenge for the growth of the smart greenhouse market. The data obtained from different systems deployed in smart greenhouses is of high importance as it helps in making productive decisions. High volumes of important data pertaining to mapping, variable rate seeding, soil testing, and yield monitoring, as well as historical crop rotation, are generated from smart greenhouses on a regular basis. This data must be stored and managed properly as successful smart farming relies entirely on it for assessing the condition of farms. Data management is key for making smart farm management decisions and improving farm operations. There are no industry standards for managing this agricultural data and enabling uniformity of farm operations. Many agriculturists or farmers are unaware of the effective use of farm data for decision-making. Hence, it is important to provide farmers and agriculturists with proper data management tools and techniques to acquire, manage, process, and use farm data effectively.

Based on end user, the research & educational institutes segment held the largest share of the smart greenhouse market in 2019.

Companies are providing smart greenhouses to research & educational institutes for public or private research. They are providing fully functional smart greenhouse facilities by integrating different plant systems and plant research equipment in their designs for the optimal performance of these research facilities. Research greenhouses can be small or large, depending on the requirements of research activities to be carried out. For instance, Nexus Corporation designs 15,000-square feet state-of-the-art research facilities, as well as 500-square feet smart greenhouses for high school programs. Research & educational institutes are the key end users of smart greenhouses as they carry out research activities related to different flowers, fruits, and vegetables, as well as provide hands-on experience to the concerned in campuses and schools.

The hydroponics segment projected to account for larger size of the smart greenhouse market during the forecast period.

Hydroponics is a production method wherein plants are grown in a nutrient solution rather than in soil. This technique makes use of containers or specially designed benches with troughs to enable the suspension of plants in water. Smart greenhouses based on hydroponics use sand, pebbles, or sawdust as substrates as they have a high water-holding capacity. The roots grow within these substrates to secure plants in troughs or containers. Hydroponics-based smart greenhouses enable soilless agricultural practices to reduce the consumption of resources, thereby enabling this farming technique to be adopted by a large number of stakeholders, ranging from home gardeners to professional growers and supermarkets to restaurants.

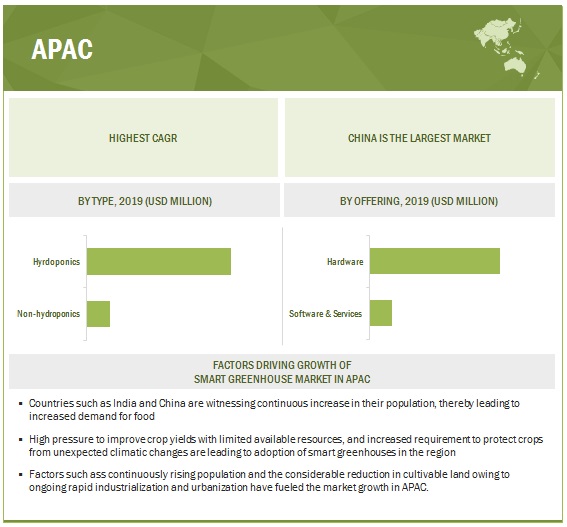

APAC to witness the highest CAGR in smart greenhouse market during the forecast period.

The market in APAC has been studied for Australia, China, Japan, and the Rest of APAC. The smart greenhouse market in APAC is projected to grow at a fastest CAGR during the forecast period. The growth of the market in APAC can be attributed to its continuously increasing population, thereby leading to a rising demand for food from the region. This has led to an increase in the adoption of advanced technologies such as smart greenhouses to enable the supply of fresh fruits and vegetables throughout the year. The growers in China have also introduced advanced growing techniques such as CEA and hydroponics to increase their yields

Key Market Players

Nexus Corporation (Nexus, US), Argus Control Systems Limited (Argus Controls, Canada), Certhon (Certhon, Netherlands), Rough Brothers, Inc. (Rough Brothers, US), GreenTech Agro LLC (GreenTech Agro, US), Netafim (Netafim, Israel), Sensaphone (Sensaphone, US), Cultivar Ltd. (Cultivar, UK), Heliospectra AB (Heliospectra, Sweden), and LumiGrow (LumiGrow, US) are a few major players in the smart greenhouse market.

Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) Million/thousand |

|

Segments covered |

Type, covering material type, offering, component, cultivation, and end user |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Nexus Corporation (Nexus, US), Argus Control Systems Limited (Argus Controls, Canada), Certhon (Certhon, Netherlands), Rough Brothers, Inc. (Rough Brothers, US), GreenTech Agro LLC (GreenTech Agro, US), Netafim (Netafim, Israel), Sensaphone (Sensaphone, US), Cultivar Ltd. (Cultivar, UK), Heliospectra AB (Heliospectra, Sweden), and LumiGrow (LumiGrow, US) are a few major players in the smart greenhouse market. |

Smart Greenhouse Market Segmentation:

In this report, the smart greenhouse market has been segmented into the following categories:

By Type:

- Hydroponics

- Non-hydroponics

By Covering Material Type:

- Polyethylene

- Polycarbonate

- Others

By Offering:

- Hardware

- Software & Services

By Component:

- HVAC Systems

- LED Grow Lights

- Control Systems & Sensors

By End User:

- Commercial Growers

- Research & Educational Institutes

- Retail Gardens

- Others

By Region

- North America

- Europe

- APAC

- RoW

Following crops cultivated in smart greenhouses have also been considered in the report

- Vegetables

- Flowers

- Food

Recent Developments

- In December 2019, Argus and urban-gro, Inc. entered into a multiyear strategic agreement to provide cannabis cultivators in North America with industry-leading, plant-centric solutions for ensuring environmental control, greenhouse automation, and nutrient management.

- In November 2019, Argus launched 3 new subscription-based products available on Argus Hub. These 3 add-ons enable Argus software to provide the right tools to users to easily access and retrieve information from the Argus system.

- In October 2019, Heliospectra partnered with Nectar Farms to provide MITRA LED lighting solutions for large-scale glasshouse installations in Australia.

- In April 2019, Sensaphone launched the Express II monitoring system to cater to the operational requirements of greenhouses. The Express II monitoring system allows users to remotely monitor changes in the environmental conditions of greenhouses and evaluate the performance of equipment installed in them round-the-clock.

- In December 2018, Certhon opened an additional research facility at Delphy (Netherlands). The facility has been extended with the addition of 2 climate cells. This expansion helped the company gain increased knowledge about daylight-free cultivation.

Frequently Asked Questions (FAQ):

Where will all these developments take the industry in the mid- to long-term?

With the rapid rise in self-service technologies in the last five years, kiosks are gaining a significant amount of market traction in various industry applications. One of the perks of this technology is its cost-effectiveness. Also, the factors such as enhanced shopping experience for customers, lower investment costs than traditional outlets, enhanced applications other than conventional ones, and innovations in touch screen display and glass technology drive the demand for interactive kiosks in many application areas.

Who are the important players in the interactive kiosk market?

The major players in the market include KIOSK Information Systems (US), Olea Kiosks Inc. (US), Frank Mayer and Associates, Inc. (US), Source Technologies (US), NCR Corporation (US), Diebold Nixdorf (US), Embross (Canada), Meridian Kiosks (US), REDYREF Interactive Kiosks (US), lilitab, LLC (US), KAL (UK), Acante Solutions Limited (UK), SlabbKiosks (US), Advantech Co., Ltd. (Taiwan), Intuiface (France), ZIVELO (US), Aila Technologies, Inc. (US), ADVANCED KIOSKS (US), DynaTouch (US), and Peerless-AV (UK).

Which segment provides the most opportunity for growth?

In terms of vertical, the demand for interactive kiosks in retail sector is increasing as they provide information and advertise the offerings to shoppers without the need for actual entry of the shoppers in the retail stores. It also enables in-store product information and promotional displays of the products and services to attract the attention of customers. These activities also help improve brand loyalty as the products are easily available with complete information.

What are the trends prevalent in the market?

There are many advanced features which are being incorporated in the interactive kiosks, hence it is getting popular in many unconventional applications as well. Few trends which are prevalent in recent times are, inceasing use of customized kiosks, increasing use of high-resolution displays, usage in real-estate marketing, kiosks with video chat services, and so on.

Which are the major application verticals of interactive kiosks? How huge is the opportunity for their growth in the next five years?

The major application verticals of interactive kiosk are retail, healthcare, banking and financial services, government, transportation, hospitality, entertainment, and others. Currently, the retail and transportation verticals are dominating the market whereas the banking and financial services application is growing at a high pace. This trend is expected to continue in the next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach used to arrive at market size using bottom-up analysis (demand side)

2.2.1.2 Approach for obtaining company-specific information in smart greenhouse value chain

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach used to arrive at market size using top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SMART GREENHOUSE MARKET

4.2 SMART GREENHOUSE MARKET, BY TYPE

4.3 SMART GREENHOUSE MARKET IN APAC, BY END USER AND COUNTRY

4.4 SMART GREENHOUSE MARKET IN NORTH AMERICA, BY COVERING MATERIAL TYPE

4.5 SMART GREENHOUSE MARKET, BY REGION

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of IoT and AI by farmers and agriculturists

5.2.1.2 Growing demand for food owing to continuously increasing global population

5.2.1.3 Rising number of government initiatives to promote adoption of smart agricultural practices

5.2.1.4 Increasing adoption of indoor farming in urban areas

5.2.2 RESTRAINTS

5.2.2.1 High investment costs owing to deployment of expensive systems in smart greenhouses

5.2.3 OPPORTUNITIES

5.2.3.1 Rising global adoption of vertical farming technology

5.2.3.2 Emerging trend of rooftop farming in urban areas

5.2.4 CHALLENGES

5.2.4.1 Absence of industry standards for managing farm data

5.2.4.2 Integration of different components and technologies used in smart greenhouses

5.3 VALUE CHAIN ANALYSIS

5.4 IMPACT OF COVID-19 ON SMART GREENHOUSE MARKET

6 SMART GREENHOUSE MARKET, BY TYPE (Page No. - 46)

6.1 INTRODUCTION

6.2 HYDROPONICS

6.2.1 HYDROPONICS SEGMENT TO ACCOUNT FOR LARGE SIZE OF SMART GREENHOUSE MARKET FROM 2020 TO 2025

6.3 NON-HYDROPONICS

6.3.1 EUROPE TO HOLD LARGE SIZE OF NON-HYDROPONICS SMART GREENHOUSE MARKET FROM 2020 TO 2025

7 SMART GREENHOUSE MARKET, BY COVERING MATERIAL TYPE (Page No. - 49)

7.1 INTRODUCTION

7.2 POLYETHYLENE

7.2.1 POLYETHYLENE SEGMENT OF SMART GREENHOUSE MARKET EXPECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

7.3 POLYCARBONATE

7.3.1 USE OF POLYCARBONATE OFFERS EXCELLENT INSULATION, DURABILITY, AND FLEXIBILITY TO SMART GREENHOUSES

7.4 OTHERS

7.4.1 EUROPE TO ACCOUNT FOR LARGEST SIZE OF SMART GREENHOUSE MARKET FROM 2020 TO 2025

8 SMART GREENHOUSE MARKET, BY OFFERING (Page No. - 52)

8.1 INTRODUCTION

8.2 HARDWARE

8.2.1 HARDWARE SEGMENT ACCOUNTED FOR LARGE SIZE OF SMART GREENHOUSE MARKET IN 2019

8.3 SOFTWARE & SERVICES

8.3.1 SOFTWARE & SERVICES SEGMENT OF SMART GREENHOUSE MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

9 SMART GREENHOUSE MARKET, BY COMPONENT (Page No. - 56)

9.1 INTRODUCTION

9.2 HVAC SYSTEMS

9.2.1 HVAC SYSTEMS PROVIDE AN IMPROVED INDOOR ENVIRONMENT IN SMART GREENHOUSES

9.3 LED GROW LIGHTS

9.3.1 INCREASED ADOPTION OF LED GROW LIGHTS IN SMART GREENHOUSES FOR ENHANCED OPERATIONAL EFFICIENCY AND REDUCED ENERGY CONSUMPTION

9.4 CONTROL SYSTEMS & SENSORS

9.4.1 SENSORS PROVIDE QUANTITATIVE INFORMATION TO GUIDE CULTIVATORS AND ENABLE AUTOMATED DECISION-MAKING RELATED TO CROP CULTIVATION

10 CROPS CULTIVATED IN SMART GREENHOUSES (Page No. - 60)

10.1 INTRODUCTION

10.2 VEGETABLES

10.2.1 VEGETABLES GROWN USING HYDROPONICS TECHNIQUE WITNESS FAST GROWTH THAN VEGETABLES GROWN THROUGH TRADITIONAL FARMING

10.3 FRUITS

10.3.1 FRUITS CAN BE HARVESTED THROUGHOUT YEAR IN SMART GREENHOUSES

10.4 FLOWERS

10.4.1 SMART GREENHOUSES ENABLE FLOWER GROWERS TO HAVE COMPLETE CONTROL OVER NUTRIENT FLOW TO PLANTS

11 SMART GREENHOUSE MARKET, BY END USER (Page No. - 62)

11.1 INTRODUCTION

11.2 COMMERCIAL GROWERS

11.2.1 COMMERCIAL GROWERS SEGMENT OF SMART GREENHOUSE MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

11.3 RESEARCH & EDUCATIONAL INSTITUTES

11.3.1 RESEARCH & EDUCATIONAL INSTITUTES SEGMENT ACCOUNTED FOR LARGEST SIZE OF SMART GREENHOUSE MARKET IN 2019

11.4 RETAIL GARDENS

11.4.1 EUROPE ACCOUNTED FOR LARGEST SIZE OF SMART GREENHOUSE MARKET FOR RETAIL GARDENS IN 2019

11.5 OTHERS

11.5.1 SMART GREENHOUSES ENABLE GROWTH OF DIFFERENT ALGAE STRAINS USED IN BIOTECHNOLOGY INDUSTRY

12 GEOGRAPHIC ANALYSIS (Page No. - 66)

12.1 INTRODUCTION

12.2 NORTH AMERICA

12.2.1 US

12.2.1.1 US to account for largest size of smart greenhouse market in North America from 2020 to 2025

12.2.2 CANADA

12.2.2.1 Increase in government initiatives and support for automation of greenhouses to fuel growth of greenhouse market in Canada

12.2.3 MEXICO

12.2.3.1 Favorable climate of Mexico promoting adoption of smart greenhouses in country

12.3 EUROPE

12.3.1 NETHERLANDS

12.3.1.1 Netherlands to lead smart greenhouse market in Europe from 2020 to 2025

12.3.2 SPAIN

12.3.2.1 Poor quality of soil to lead to increased establishment of smart greenhouses in Spain

12.3.3 ITALY

12.3.3.1 Increased adoption of smart greenhouses in Italy post-2014–15 drought

12.3.4 GERMANY

12.3.4.1 Cold winters and strong R&D base expected to drive adoption of smart greenhouses in Germany

12.3.5 UK

12.3.5.1 Transformation in smart agriculture landscape of UK to lead to growth of smart greenhouse market in country

12.3.6 REST OF EUROPE

12.4 APAC

12.4.1 CHINA

12.4.1.1 Continuously increasing population in China leading to rise in adoption of smart greenhouses in country

12.4.2 JAPAN

12.4.2.1 Rise in urban farming practices to increase growth of smart greenhouse market in Japan

12.4.3 AUSTRALIA

12.4.3.1 less rainfall and legalization of cannabis to fuel growth of smart greenhouse market in Australia

12.4.4 REST OF APAC

12.5 ROW

12.6 MIDDLE EAST AND AFRICA

12.6.1 MIDDLE EAST AND AFRICA TO LEAD SMART GREENHOUSE MARKET FROM 2020 TO 2025

12.7 SOUTH AMERICA

12.7.1 EXTREME WEATHER CONDITIONS TO DRIVE DEMAND FOR SMART GREENHOUSES IN SOUTH AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 84)

13.1 OVERVIEW

13.2 RANKING ANALYSIS OF KEY PLAYERS IN SMART GREENHOUSE MARKET

13.3 COMPETITIVE SITUATIONS AND TRENDS

13.3.1 PRODUCT LAUNCHES/DEVELOPMENTS

13.3.2 AGREEMENTS

13.3.3 CONTRACTS

13.3.4 EXPANSIONS

13.3.5 PARTNERSHIPS

13.4 COMPETITIVE LEADERSHIP MAPPING, 2019

13.4.1 VISIONARY LEADERS

13.4.2 DYNAMIC DIFFERENTIATORS

13.4.3 INNOVATORS

13.4.4 EMERGING COMPANIES

14 COMPANY PROFILES (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 KEY PLAYERS

14.1.2 ARGUS CONTROLS

14.1.3 CERTHON

14.1.4 ROUGH BROTHERS

14.1.5 GREENTECH AGRO

14.1.6 NETAFIM

14.1.7 SENSAPHONE

14.1.8 CULTIVAR

14.1.9 HELIOSPECTRA AB

14.1.10 LUMIGROW, INC.

14.2 RIGHT TO WIN

14.3 OTHER IMPORTANT PLAYERS

14.3.1 DESERT GROWING

14.3.2 GREENTECH INDIA

14.3.3 PROSPERA TECHNOLOGIES

14.3.4 PURE HARVEST

14.3.5 GROWLINK

14.3.6 MOTORLEAF

14.3.7 KHEYTI

14.3.8 HORT AMERICAS

14.3.9 DELTA T SOLUTIONS

14.3.10 GROWFLUX

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 113)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

LIST OF TABLES (60 Tables)

TABLE 1 SMART GREENHOUSE MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 2 HYDROPONICS SMART GREENHOUSE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 3 NON-HYDROPONICS SMART GREENHOUSE MARKET, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 4 SMART GREENHOUSE MARKET, BY COVERING MATERIAL TYPE, 2017–2025 (USD MILLION)

TABLE 5 POLYETHYLENE SMART GREENHOUSE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 6 POLYCARBONATE SMART GREENHOUSE MARKET, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 7 OTHER COVERING MATERIALS SMART GREENHOUSE MARKET, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 8 SMART GREENHOUSE MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 9 PRECISION FARMING MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 10 SMART GREENHOUSE HARDWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 11 PRECISION FARMING HARDWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 12 SMART GREENHOUSE SOFTWARE & SERVICES MARKET, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 13 PRECISION FARMING SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 14 PRECISION FARMING SERVICES MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 15 SMART GREENHOUSE MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 16 SMART GREENHOUSE HVAC SYSTEMS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 17 SMART GREENHOUSE LED GROW LIGHTS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 18 SMART GREENHOUSE CONTROL SYSTEMS & SENSORS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 19 SMART GREENHOUSE MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 20 SMART GREENHOUSE MARKET FOR COMMERCIAL GROWERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 21 SMART GREENHOUSE MARKET FOR RESEARCH & EDUCATIONAL INSTITUTES, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 SMART GREENHOUSE MARKET FOR RETAIL GARDENS, BY REGION, 2017–2025 (USD MILLION)

TABLE 23 SMART GREENHOUSE MARKET FOR OTHER END USERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 24 SMART GREENHOUSE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 25 PRECISION FARMING MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 26 PRECISION FARMING MARKET, BY AMERICAS, 2017–2025 (USD MILLION)

TABLE 27 SMART GREENHOUSE MARKET IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 28 SMART GREENHOUSE MARKET IN NORTH AMERICA, BY COVERING MATERIAL TYPE, 2017–2025 (USD MILLION)

TABLE 29 SMART GREENHOUSE HARDWARE MARKET IN NORTH AMERICA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 30 SMART GREENHOUSE MARKET IN NORTH AMERICA, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 31 SMART GREENHOUSE MARKET IN NORTH AMERICA, BY END USER, 2017–2025 (USD MILLION)

TABLE 32 SMART GREENHOUSE MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 33 PRECISION FARMING MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 34 SMART GREENHOUSE MARKET IN EUROPE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 35 SMART GREENHOUSE MARKET IN EUROPE, BY COVERING MATERIAL TYPE, 2017–2025 (USD MILLION)

TABLE 36 SMART GREENHOUSE MARKET IN EUROPE, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 37 SMART GREENHOUSE MARKET IN EUROPE, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 38 SMART GREENHOUSE MARKET IN EUROPE, BY END USER, 2017–2025 (USD MILLION)

TABLE 39 SMART GREENHOUSE MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 40 PRECISION FARMING MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 41 SMART GREENHOUSE MARKET IN APAC, BY TYPE, 2017–2025 (USD MILLION)

TABLE 42 SMART GREENHOUSE MARKET IN APAC, BY COVERING MATERIAL TYPE, 2017–2025 (USD MILLION)

TABLE 43 SMART GREENHOUSE MARKET IN APAC, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 44 SMART GREENHOUSE MARKET IN APAC, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 45 SMART GREENHOUSE MARKET IN APAC, BY END USER, 2017–2025 (USD MILLION)

TABLE 46 SMART GREENHOUSE MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 47 PRECISION FARMING MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 48 SMART GREENHOUSE MARKET IN ROW, BY TYPE, 2017–2025 (USD THOUSAND)

TABLE 49 SMART GREENHOUSE MARKET IN ROW, BY COVERING MATERIAL TYPE, 2017–2025 (USD THOUSAND)

TABLE 50 SMART GREENHOUSE MARKET IN ROW, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 51 SMART GREENHOUSE MARKET IN ROW, BY COMPONENT, 2017–2025 (USD THOUSAND)

TABLE 52 SMART GREENHOUSE MARKET IN ROW, BY END USER, 2017–2025 (USD THOUSAND)

TABLE 53 SMART GREENHOUSE MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 54 PRECISION FARMING MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 55 PRECISION FARMING MARKET IN SOUTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 56 PRODUCT LAUNCHES/DEVELOPMENTS, 2017–2019

TABLE 57 AGREEMENTS, 2017–2019

TABLE 58 CONTRACTS, 2017–2019

TABLE 59 EXPANSIONS, 2017–2019

TABLE 60 PARTNERSHIPS, 2017–2019

LIST OF FIGURES (34 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 SMART GREENHOUSE MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF HARDWARE OF SMART GREENHOUSES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF HARDWARE/SOFTWARE & SERVICES OF SMART GREENHOUSES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIZE) – BOTTOM-UP APPROACH FOR ESTIMATION OF SIZE OF SMART GREENHOUSE MARKET BASED ON REGION

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 8 DATA TRIANGULATION METHODOLOGY

FIGURE 9 HYDROPONICS SEGMENT TO LEAD SMART GREENHOUSE MARKET FROM 2020 TO 2025

FIGURE 10 HARDWARE SEGMENT TO ACCOUNT FOR LARGE SIZE OF SMART GREENHOUSE MARKET FROM 2020 TO 2025

FIGURE 11 POLYETHYLENE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF SMART GREENHOUSE MARKET FROM 2020 TO 2025

FIGURE 12 RESEARCH & EDUCATIONAL INSTITUTES SEGMENT HELD LARGEST SHARE OF SMART GREENHOUSE MARKET IN 2019

FIGURE 13 EUROPE ACCOUNTED FOR LARGEST SHARE OF SMART GREENHOUSE MARKET IN 2019

FIGURE 14 INCREASING GLOBAL DEMAND FOR FOOD DRIVING GROWTH OF SMART GREENHOUSE MARKET

FIGURE 15 HYDROPONICS SEGMENT TO ACCOUNT FOR LARGE SIZE OF SMART GREENHOUSE MARKET FROM 2020 TO 2025

FIGURE 16 RESEARCH & EDUCATIONAL INSTITUTES SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF SMART GREENHOUSE MARKET IN APAC IN 2019

FIGURE 17 POLYETHYLENE SEGMENT TO LEAD SMART GREENHOUSE MARKET IN NORTH AMERICA FROM 2020 TO 2025

FIGURE 18 SMART GREENHOUSE MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 19 SMART GREENHOUSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 20 GLOBAL FOOD CONSUMPTION IN KCAL/PERSON/DAY BY 2030

FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON SMART GREENHOUSE MARKET

FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS ON SMART GREENHOUSE MARKET

FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES ON SMART GREENHOUSE MARKET

FIGURE 24 IMPACT ANALYSIS OF CHALLENGES ON SMART GREENHOUSE MARKET

FIGURE 25 VALUE CHAIN ANAYSIS: SMART GREENHOUSE MARKET

FIGURE 26 SMART GREENHOUSE MARKET IN CANADA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 27 NORTH AMERICA: SMART GREENHOUSE MARKET SNAPSHOT

FIGURE 28 EUROPE: SMART GREENHOUSE MARKET SNAPSHOT

FIGURE 29 APAC: SMART GREENHOUSE MARKET SNAPSHOT

FIGURE 30 PRODUCT LAUNCHES/DEVELOPMENTS ADOPTED AS KEY GROWTH STRATEGY FROM 2017 TO 2019

FIGURE 31 SMART GREENHOUSE MARKET: RANKING OF KEY COMPANIES IN 2019

FIGURE 32 COMPETITIVE LEADERSHIP MAPPING FOR SMART GREENHOUSE SOLUTION PROVIDERS, 2019

FIGURE 33 COMPETITIVE LEADERSHIP MAPPING FOR SMART GREENHOUSE HARDWARE PROVIDERS, 2019

FIGURE 34 HELIOSPECTRA AB: COMPANY SNAPSHOT

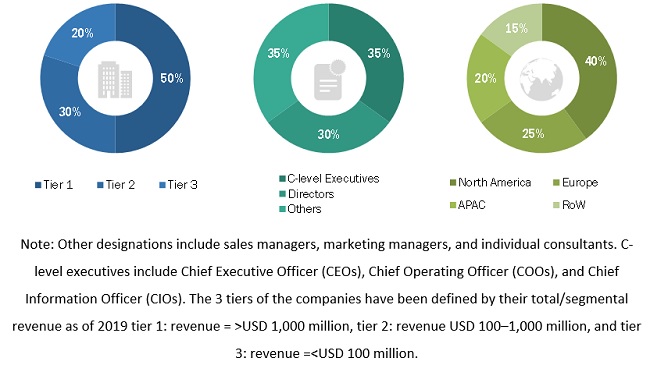

The study involved 4 major activities for estimating the current size of the smart greenhouse market. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, smart greenhouse-related journals, The Institute of Environmental Sciences and Technology (IEST) publications; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size estimations, which was further validated through the primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Extensive primary research was conducted after understanding and analyzing the smart greenhouse market through secondary research. Several primary interviews were conducted with the key opinion leaders from both demand and supply side across 4 regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). RoW comprises the Middle East and Africa and South America. Approximately 25% of the primary interviews were conducted with the demand side, while approximately 75% with the supply side. This primary data was collected mainly through telephonic interviews, which accounted for approximately 80% of the total primary interviews. Besides, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the smart greenhouse market. These methods were also used extensively to estimate the size of the markets based on various segments. The research methodology used to estimate the market size included the following steps:

- The key players in the industry and markets were identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment. The data was triangulated by studying various factors and trends from demand and supply sides across different end users.

Study Objectives

- To describe and forecast the smart greenhouse market, in terms of value, based on type, covering material type, end user, offering, and component

- To describe and forecast the market for 4 major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To describe the types of crops cultivated in smart greenhouses

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for the stakeholders and provide a detailed competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

- To analyze competitive developments such as contracts, partnerships, product launches/developments, expansions, acquisitions, agreements, and research and development (R&D) activities carried out by players in the smart greenhouse market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown of the smart greenhouse market for North America, Europe, APAC, and RoW

Company Informations

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Smart Greenhouse Market

Hello, I am a researcher and I am interested to put up a smart greenhouse in a school. How much do I need to put up such a project. Thank you.

Yes, we do track such type of data for different type of crops. I would request you to go through this linkhttps://www.marketsandmarkets.com/Market-Reports/commercial-greenhouse-market-221045451.htmlIn case of any concern, feel free to mail us at sales@marketsandmarkets.com

I am seeking marekt data which tells protected horticulture crop area country by countriy especially that of China and EU member states. Do your market data include such data ?

I am interested in understanding the market for smart greenhouse in APAC. Also, I would like to know more about the smart green house market for specific countries in APAC and technologies of smart green house in same region. Could you please explain me the scope of your report ?

In smart greenhouse factors such as air, light, temperature, soil, etc. are controlled for plant growth. I am trying to understand the different types of smart green houses. Does your report cover this specific interest of mine?

I am looking for in-depth analysis of the snart green house market. I would like to know more about the segments covered in the report. I would also like to understand the research methodology used to arrive at the market size. Can you help me with the scope of the Smart green house Market?

Hi, I am a post-doctoral researcher in US This market report appears to be very interesting. Can I get a sample of this report?

I am a student doing a research paper on the viability of the residential hydroponic systems in the US. Does your report cover this information?