Silk Market by Type (Mulberry Silk, Tussar Silk, and Eri Silk), Application (Textile, and Cosmetics & Medical), and Region (Asia-Pacific, North America, Europe, Middle East & Africa, and South America) - Global Forecast to 2021

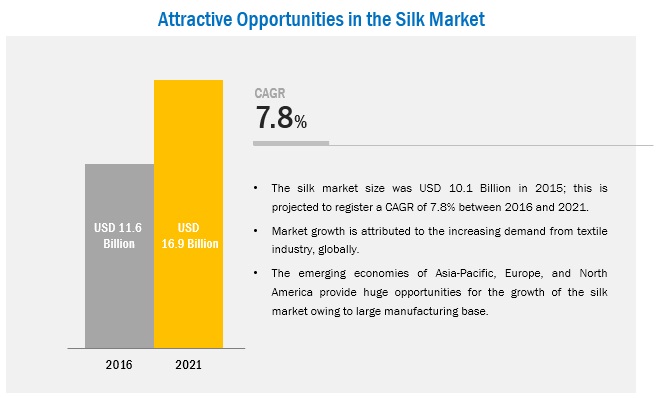

The global silk market is projected to be valued at USD 16.94 billion by 2021, at a cagr 7.8% from 2016 to 2021. In this study, 2015 has been considered the base year and 2016 to 2021, the forecast period, to estimate the global market of silk. The growing demand in the Asia-Pacific, coupled with the growing demand for textile goods is expected to drive the global silk market during the forecast period.

Market Dynamics

Drivers

- Technological advancement in sericulture

- Low capital intensive industry

Restraints

- Higher dependency on china for raw material

Opportunities

- High demand from Indian textile industry

- Emerging spider silk

Challenges

- High Cost of Material

- Labor Intensive Industry

Textile application is driving the demand in silk market

Textile is the fastest-growing application of silk. Silk is an important contributor to the textile industry which is continuously growing and evolving in terms of demand and supply. Silk is used in textiles for its lustrous appearance, luxurious feel, lightweight, resilient, and strength. It is used in many types of apparel such as wedding dresses, gowns, blouses, scarves, neckties as well as in many household products such as pillows, wall hangings, draperies, upholstery.

Further, Silk's absorbency makes it quite comfortable to wear, especially, in warm weather. Its low conductivity keeps warm air close to the skin during cold weather. This increases the uses of silk for clothing such as shirts, ties, formal dresses, high fashion clothes, lingerie, pajamas, robes, dress suits, sun dresses, and kimonos. In India, silk is also used for making sarees, which is traditional outfit in the country.

The following are the major objectives of the study:

- To define and segment the global silk market by type, application and region

- To estimate and forecast the global silk market in terms of value & volume

- To analyze significant region-specific trends of the market in Asia-Pacific, North America, Europe, South America, and Middle east & Africa regions

- To estimate and forecast the global silk market by type at the country level in each of the regions

- To estimate and forecast the global silk market by application at the region level

- To identify and analyze the key drivers, restraints, and opportunities, and challenges influencing the silk market

- To strategically identify and profile the key market players and analyze their core competencies in each type of the global silk market

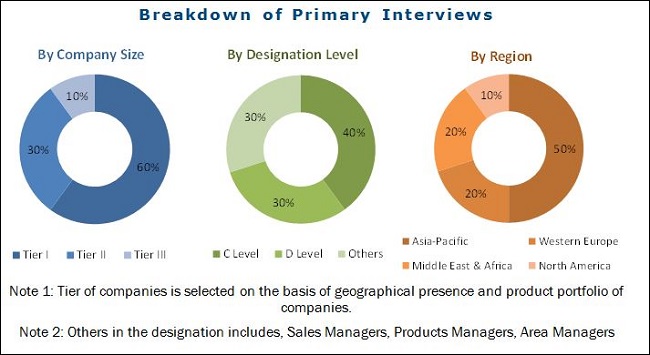

During this research study, major players operating in the silk market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights pertaining to the market. The figure below shows the breakdown of the primary interviews on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Silk is a consolidated market with Asia-Pacific countries catering to the major share of demand and supply. Globally, China and India are the first and second largest producers of silk respectively. The sericulture industry has a history of over 6,000 years in China. China is also a major exporter of silk in the world. The major type of silk produced in China are mulberry silk and Tussar silk.

Major Market Developments:

- In March 2017, Bolt Threads Inc. started its first product made of spider silk. It introduced tie made of spider silk.

- In September 2016 AMSilk GmbH entered into distribution agreements with Korean-based company Hanjoo C&C for the distribution of its product in the Asian market. It distributes AMSilk products, Silkbeads (microparticles), and Silkgel (hydrogel) in Korea.

- In June 2016, AMSilk GmbH entered into an agreement with Zurich based company, RAHN AG, to distribute two ingredients made from AMSilk, Silkgel, and Silkbeads.

Key Target Audience:

- Silk manufacturers

- Silk traders, distributors, and suppliers

- End-use market participants of different segments of Silk

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Report Scope:

On the Basis of Type:

- Mulberry Silk

- Tussar Silk

- Eri Silk

On the Basis of Application:

- Textile

- Cosmetics & Medical

On the Basis of Region:

- Asia-Pacific

- North America

- Europe

- Middle East & Africa

- South America

Critical questions which the report answers

- What is emerging type of silk being developed?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market of regions based on applications

Company Information

- Detailed analysis and profiling of additional market players (Up to 3)

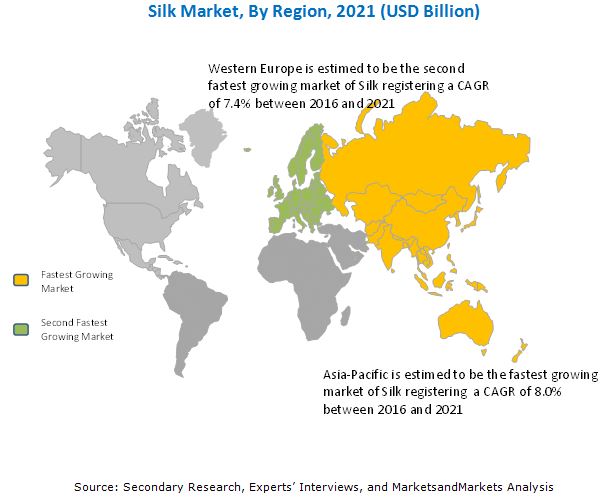

The global silk market is projected to reach USD 16.94 billion by 2021, at a CAGR of 7.8% from 2016 to 2021. Silk is experiencing a high demand from the Asia-Pacific region mainly from China. Asia-Pacific is the largest producer of raw silk which makes it the region with easy availability of raw material. Silk find application majorly in textile industry. Increasing demand from textile industry promoted the usage of silk. Technological development in the sericulture industry is expected to further drive the silk market.

The mulberry silk is projected to be the largest type in the silk market from 2016 to 2021. Mulberry silk is majorly used in the textile industry. Mulberry silk is also used in the blends made with other natural fibers such as cotton to enhance the properties of base fiber. Improving quality of silk is expected to increase the demand of mulberry silk and drive the silk market in the future. The tussar silk is the second largest type of silk used after mulberry silk.

The Asia-Pacific is projected to be the fastest-growing market for silk, in terms of value and volume, during the forecast period. China, India, Uzbekistan, and Thailand are the markets of silk in the Asia-Pacific region. The demand for silk is primarily driven by the increasing population & export of the textile goods made in these countries. Also, the domestic demand of silk in China and India is significantly influencing the demand of silk in the region.

Increasing demand from textile and cosmetics & medicine applications is driving the growth of silk market

Textile

Textile is the largest as well as fastest-growing application of silk market. Silk is used in textiles for its lustrous appearance, luxurious feel, lightweight, resilient, and strength. Silk material is used for wedding dresses, gowns, blouses, scarves, neckties as well as in many household products such as pillows, wall hangings, draperies, upholstery. Silk's absorbency makes it quite comfortable to wear, especially, in warm weather. Its low conductivity keeps warm air close to the skin during cold weather. This increases the uses of silk for clothing such as shirts, ties, formal dresses, high fashion clothes, lingerie, pajamas, robes, dress suits, sun dresses, and kimonos.

Cosmetics & Medicine

Cosmetics & medicine is the another major application cluster of silk material. This application of silk is still in nascent stage and cater to a very small share of silk market. Silk fibroin is a natural protein which is used as a raw material for various cosmetic products. Silk is used in cosmetic cream, lotion, liquid soap, cleansing foam, shampoo, conditioner, and nail enamel. Silk polypeptide is used in shampoo, skin lotion, skin cream, cleansing cream, and soap owing to its excellent film making function. In medicine application silk-based biomaterials (SBBs) have been used clinically, viz. sutures for centuries.

Critical questions the report answers:

- What is spider silk, the emerging type in silk market?

- Where will all the developments take the industry in the mid to long term?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The global silk market is witnessing a high growth rate. Factors restraining and challenging the growth of silk market are higher dependency on china for raw material and high cost of material. China is the largest producer and exporter of silk globally, giving them leverage over price setting and product quality. This lowers the switching power of buyers, restraining the market growth in terms of demands.

Companies such Anhui silk Co. Ltd. (China), Kraig Biocraft Laboratories, Inc. (U.S.), Wujiang First Textile Co.,Ltd. (China), Wujiang Wanshiyi silk Co., Ltd. (China), and Zhejiang Jiaxin silk Corp., Ltd. (China) are the leading market participants in the global silk market.

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Attractive Opportunities in the Silk Market

4.2 Silk Market Growth, By Type

4.3 Silk Market Share, By Region and Application, 2015

4.4 Silk Market Attractiveness

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancement in Sericulture

5.2.1.2 Low Capital Intensive Industry

5.2.2 Restraints

5.2.2.1 Higher Dependency on China for Raw Material

5.2.3 Opportunities

5.2.3.1 High Demand From Indian Textile Industry

5.2.3.2 Emerging Spider Silk

5.2.4 Challenges

5.2.4.1 High Cost of Material

5.2.4.2 Labor Intensive Industry

6 Industry Trends (Page No. - 34)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Cocoon Production

6.2.2 Reeling

6.2.3 Throwing

6.2.4 Weaving

6.2.5 Dyeing

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Bargaining Power of Suppliers

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Silk Market, By Type (Page No. - 39)

7.1 Introduction

7.2 Mulberry Silk

7.3 Tussar Silk

7.4 Eri Silk

7.5 Spider Silk

8 Silk Market, By Application (Page No. - 47)

8.1 Introduction

8.2 Textile

8.3 Cosmetics & Medicine

9 Silk Market, By Region (Page No. - 53)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Uzbekistan

9.2.4 Thailand

9.2.5 Japan

9.2.6 Rest of Asia-Pacific

9.3 Europe

9.3.1 Italy

9.3.2 Romania

9.3.3 U.K.

9.3.4 France

9.3.5 Turkey

9.3.6 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 South America

9.5.1 Brazil

9.5.2 Peru

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Iran

9.6.2 Egypt

9.6.3 Rest of Middle East & Africa

10 Company Profiles (Page No. - 86)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Anhui Silk Co. Ltd.

10.2 Wujiang First Textile Co., Ltd.

10.3 Wujiang Wanshiyi Silk Co. Ltd.

10.4 Zhejiang Jiaxin Silk Co., Ltd.

10.5 Sichuan Nanchong Liuhe (Group) Corp.

10.6 Shengkun Silk Manufacturing Co., Ltd.

10.7 Jiangsu Sutong Cocoon & Silk Co.

10.8 Jinchengjiang Xinxing Cocoon Silk Co., Ltd.

10.9 Wensli Group Co. Ltd.

10.10 China Silk Corporation

10.11 Entogenetics, Inc.

10.12 Bolt Threads Inc.

10.13 Spiber Technologies

10.14 Amsilk GmbH

10.15 Kraig Biocraft Laboratories, Inc.

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 101)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (88 Tables)

Table 1 Silk Market Size, By Type, 2014–2021 (USD Million)

Table 2 Market Size, By Type, 2014–2021 (Thousand Ton)

Table 3 Mulberry Silk Market Size, By Region, 2014–2021 (USD Million)

Table 4 Mulberry Market Size, By Region, 2014–2021 (Thousand Ton)

Table 5 Tussar Silk Market Size, By Region, 2014–2021 (USD Million)

Table 6 Tussar Market Size, By Region, 2014–2021 (Thousand Ton)

Table 7 Eri Silk Market Size, By Region, 2014–2021 (USD Million)

Table 8 Eri Market Size, By Region, 2014–2021 (Thousand Ton)

Table 9 Silk Market Size, By Application, 2014–2021 (USD Million)

Table 10 Market Size, By Application, 2014–2021 (Thousand Ton)

Table 11 Silk Market Size in Textile Application, By Region, 2014–2021 (USD Million)

Table 12 Market Size in Textile Application, By Region, 2014–2021 (Thousand Ton)

Table 13 Silk Market Size in Cosmetics & Medicine Application, By Region, 2014–2021 (USD Million)

Table 14 Market Size in Cosmetics & Medicine Application, By Region, 2014–2021 (Thousand Ton)

Table 15 Silk Market Size, By Region, 2014–2021 (USD Million)

Table 16 Market Size, By Region, 2014–2021 (Thousand Ton)

Table 17 Asia-Pacific: By Market Size, By Country, 2014–2021 (USD Million)

Table 18 Asia-Pacific: By Market Size, By Country, 2014–2021 (Thousand Ton)

Table 19 Asia-Pacific: By Market Size, By Type, 2014–2021 (USD Million)

Table 20 Asia-Pacific: By Market Size, By Type, 2014–2021 (Thousand Ton)

Table 21 Asia-Pacific: By Market Size, By Application, 2014–2021 (USD Million)

Table 22 Asia-Pacific: By Market Size, By Application, 2014–2021 (Thousand Ton)

Table 23 China: By Market Size, By Type, 2014–2021 (USD Million)

Table 24 China: By Market Size, By Type, 2014–2021 (Thousand Ton)

Table 25 India: By Market Size, By Type, 2014–2021 (USD Million)

Table 26 India: By Market Size, By Type, 2014–2021 (Thousand Ton)

Table 27 Uzbekistan: By Market Size, By Type, 2014–2021 (USD Million)

Table 28 Uzbekistan: By Market Size, By Type, 2014–2021 (Thousand Ton)

Table 29 Thailand: By Market Size, By Type, 2014–2021 (USD Million)

Table 30 Thailand: By Market Size, By Type, 2014–2021 (Thousand Ton)

Table 31 Japan: By Market Size, By Type, 2014–2021 (USD Million)

Table 32 Japan: By Market Size, By Type, 2014–2021 (Thousand Ton)

Table 33 Rest of Asia-Pacific: By Market Size, By Type, 2014–2021 (USD Million)

Table 34 Rest of Asia-Pacific: By Market Size, By Type, 2014–2021 (Thousand Ton)

Table 35 Europe: By Market Size, By Country, 2014–2021 (USD Million)

Table 36 Europe: By Market Size, By Country, 2014–2021 (Ton)

Table 37 Europe: By Market Size, By Type, 2014–2021 (USD Million)

Table 38 Europe: By Market Size, By Type, 2014–2021 (Ton)

Table 39 Europe: By Market Size, By Application, 2014–2021 (USD Million)

Table 40 Europe: By Market Size, By Application, 2014–2021 (Ton)

Table 41 Italy: By Market Size, By Type, 2014–2021 (USD Million)

Table 42 Italy: By Market Size, By Type, 2014–2021 (Ton)

Table 43 Romania: By Market Size, By Type, 2014–2021 (USD Million)

Table 44 Romania: By Market Size, By Type, 2014–2021 (Ton)

Table 45 U.K.: By Market Size, By Type, 2014–2021 (USD Million)

Table 46 U.K.: By Market Size, By Type, 2014–2021 (Ton)

Table 47 France: By Market Size, By Type, 2014–2021 (USD Million)

Table 48 France: By Market Size, By Type, 2014–2021 (Ton)

Table 49 Turkey: By Market Size, By Type, 2014–2021 (USD Million)

Table 50 Turkey: By Market Size, By Type, 2014–2021 (Ton)

Table 51 Rest of Europe: By Market Size, By Type, 2014–2021 (USD Million)

Table 52 Rest of Europe: By Market Size, By Type, 2014–2021 (Ton)

Table 53 North America: By Market Size, By Country, 2014–2021 (USD Million)

Table 54 North America: By Market Size, By Country, 2014–2021 (Ton)

Table 55 North America: By Market Size, By Type, 2014–2021 (USD Million)

Table 56 North America: By Market Size, By Type, 2014–2021 (Ton)

Table 57 North America: By Market Size, By Application, 2014–2021 (USD Million)

Table 58 North America: By Market Size, By Application, 2014–2021 (Ton)

Table 59 U.S.: By Market Size, By Type, 2014–2021 (USD Million)

Table 60 U.S.: By Market Size, By Type, 2014–2021 (Ton)

Table 61 Canada: By Market Size, By Type, 2014–2021 (USD Million)

Table 62 Canada: By Market Size, By Type, 2014–2021 (Ton)

Table 63 Mexico: By Market Size, By Type, 2014–2021 (USD Million)

Table 64 Mexico: By Market Size, By Type, 2014–2021 (Ton)

Table 65 South America: By Market Size, By Country, 2014–2021 (USD Million)

Table 66 South America: By Market Size, By Country, 2014–2021 (Ton)

Table 67 South America: By Market Size, By Type, 2014–2021 (USD Million)

Table 68 South America: By Market Size, By Type, 2014–2021 (Ton)

Table 69 South America: By Market Size, By Application, 2014–2021 (USD Million)

Table 70 South America: By Market Size, By Application, 2014–2021 (Thousand Ton)

Table 71 Brazil: By Market Size, By Type, 2014–2021 (USD Million)

Table 72 Brazil: By Market Size, By Type, 2014–2021 (Ton)

Table 73 Peru: By Market Size, By Type, 2014–2021 (USD Million)

Table 74 Peru: By Market Size, By Type, 2014–2021 (Ton)

Table 75 Rest of South America: By Market Size, By Type, 2014–2021 (USD Million)

Table 76 Rest of South America: By Market Size, By Type, 2014–2021 (Ton)

Table 77 Middle East & Africa: By Market Size, By Country, 2014–2021 (USD Million)

Table 78 Middle East & Africa: By Market Size, By Country, 2014–2021 (Ton)

Table 79 Middle East & Africa: Silk Market Size, By Type, 2014–2021 (USD Million)

Table 80 Middle East & Africa: By Market Size, By Type, 2014–2021 (Ton)

Table 81 Middle East & Africa: By Market Size, By Application, 2014–2021 (USD Million)

Table 82 Middle East & Africa: By Market Size, By Application, 2014–2021 (Ton)

Table 83 Iran: By Market Size, By Type, 2014–2021 (USD Million)

Table 84 Iran: By Market Size, By Type, 2014–2021 (Ton)

Table 85 Egypt: By Market Size, By Type, 2014–2021 (USD Million)

Table 86 Egypt: By Market Size, By Type, 2014–2021 (Ton)

Table 87 Rest of Middle East & Africa: By Market Size, By Type, 2014–2021 (USD Million)

Table 88 Rest of Middle East & Africa: By Market Size, By Type, 2014–2021 (Ton)

List of Figures (29 Figures)

Figure 1 Silk: Market Segmentation

Figure 2 Silk Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Research Assumptions

Figure 7 Mulberry Silk Dominates the Silk Market, 2016–2021

Figure 8 Textile Industry Dominates the Silk Market, 2016–2021

Figure 9 Asia-Pacific Dominated the Silk Market in 2015

Figure 10 Silk Market to Witness High Growth Between 2016 and 2021

Figure 11 Mulberry Silk to Be the Fastest-Growing Segment Between 2016 and 2021

Figure 12 Textile Application Accounted for Largest Share of Silk Market in 2015

Figure 13 Silk Market to Register High Growth in India Between 2016 and 2021

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Silk Market

Figure 15 Supply Chain Analysis of the Silk Market

Figure 16 Porter’s Five Forces Analysis

Figure 17 Mulberry Silk Dominates the Silk Market, 2016–2021

Figure 18 Asia-Pacific Projected to Be the Fastest-Growing Market for Mulberry Silk Between 2016 and 2021

Figure 19 Tussar Silk Projected to Witness High Growth in Asia-Pacific During Forecast Period (2016–2021)

Figure 20 High Growth Projected in Asia-Pacific During Forecast Period (2016–2021)

Figure 21 Spider Silk: an Emerging Type of Silk

Figure 22 Textile Application to Drive the Silk Market Between 2016 and 2021

Figure 23 Asia-Pacific is the Largest Market for Silk in Textile Application

Figure 24 Asia-Pacific Projected to Be the Largest Market for Silk in Cosmetics & Medicine Application Between 2016 and 2021

Figure 25 Asia-Pacific Market Snapshot: China is the Fastest-Growing Market, 2016–2021

Figure 26 Europe Market Snapshot: Italy is the Largest and Fastest Growing Market, 2016–2021

Figure 27 North America Silk Market Snapshot: U.S. Estimated to Be the Largest Market, 2016–2021

Figure 28 South America Silk Market Snapshot: Brazil is the Largest Market, 2016–2021

Figure 29 Middle East & Africa Silk Market Snapshot: Iran is the Largest Market

Growth opportunities and latent adjacency in Silk Market