Self-Cleaning Filters Market by Material (Stainless Steel, Carbon), End-Use Industry (Food & Beverage, Automotive, Chemical & Power, Oil & Gas, Wastewater Treatment, Marine, Agriculture Irrigation & Domestic Water), and Region - Global Forecast to 2022

[143 Pages Report] on Self-Cleaning Filters Market is estimated to be USD 5.03 Billion in 2017, and is projected to reach USD 7.18 Billion by 2022, at a CAGR of 7.4% from 2017 to 2022.

The objectives of this study are:

- To define and segment the self-cleaning filters market based on material, end-use industry, and region

- To identify key market dynamics such as drivers, opportunities, and challenges impacting the growth of the self-cleaning filters market

- To analyze and forecast the demand for self-cleaning filters, in terms of value

- To estimate, analyze, and forecast the self-cleaning filters market with respect to key countries across various regions, such as North America, Asia-Pacific, Europe, South America, and the Middle East & Africa

- To analyze the recent developments such as expansions, partnerships & collaborations, agreements & contracts, and new product launches

- To analyze the opportunities in this market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically identify and profile key players in the self-cleaning filters market

Years considered for the study are:

- Base Year – 2016

- Estimated Year – 2017

- Projected Year –2022

- Forecast Period – 2017 to 2022

For company profiles, 2016 has been considered as the base year. In the cases, wherein information was unavailable for the base year, the years prior to it have been considered.

Research Methodology

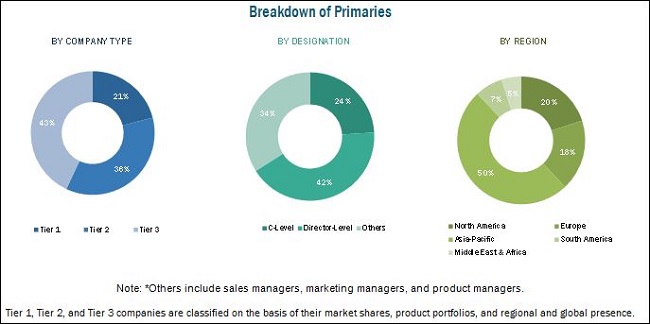

This study estimates the size of the self-cleaning filters market for 2017 and projects its demand till 2022. It also provides a detailed qualitative and quantitative analysis of the self-cleaning filters market. Various secondary sources, including directories, industry journals, and databases (such as D&B Hoovers, Bloomberg, Chemical Weekly, Factiva, government and private websites, and associations), have been used to identify and collect information useful for this extensive commercial study of the self-cleaning filters market. Primary sources, such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as assess future prospects of the self-cleaning filters market. The breakdown of the profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the self-cleaning filters includes raw material suppliers and manufacturers of self-cleaning filters. Eaton Corporation plc (Ireland), Parker Hannifin Corporation (U.S.), Alfa Laval AG (Sweden), Amiad Water Systems Ltd. (Israel), 3M Company (U.S.), Baleen Filters Pty. Ltd. (Australia), The Dow Chemical Company (U.S.), Oxford Filtration Limited (U.K.), Pall Corporation (U.S.), Cummins, Inc. (U.S.), HYDAC Filter System GmbH (Germany), among others, are the key players operating in the self-cleaning filters market The products manufactured by these companies are used in various end-use industries such as the food & beverage, steel, pharmaceutical, automotive, chemical & power, oil & gas, wastewater treatment, marine, agricultural irrigation & domestic water.

Key Target Audience

- Manufacturers of Self-Cleaning Filters

- Traders, Distributors, and Suppliers of Self-Cleaning Filters

- End-Use Industries Operating in the Self-Cleaning Filters Supply Chain

- Government and Research Organizations

- Filter Associations

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Scope of the Report: This research report categorizes the self-cleaning filters market on the basis of material type, end-use industry, and region. The report forecasts revenues as well as analyzes the trends in each of these submarkets.

Self-Cleaning Filters Market, by Material:

- Stainless Steel

- Carbon

- Others

Self-Cleaning Filters Market, by End-use Industry:

- Food & Beverage

- Steel

- Pharmaceutical

- Automotive

- Chemical & Power

- Oil & Gas

- Wastewater Treatment

- Marine

- Agricultural Irrigation & Domestic Water

- Others

Self-Cleaning Filters Market, by Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to specific needs of the companies. The following customization options are available for the report:

- New Product Analysis

Product matrix, which gives a detailed comparison of new products and market trends in each industry

- Regional Analysis

Further breakdown of a region on the basis of country and end-use industry

- Company Information

Detailed analysis and profiling of additional market players (up to five)

The self-cleaning filters market is estimated to be USD 5.03 Billion in 2017, and is projected to reach USD 7.18 Billion by 2022, at a CAGR of 7.4% from 2017 to 2022. Research & development activities are being carried out across the globe to make further additions and advancements to the features of self-cleaning filters. For instance, research & development activities are being carried out for the production of advanced technologies that can address specific worldwide environmental challenges. The growing demand for fully automatic filters in developed economies is contributing to the high demand for self-cleaning filters.

Among material types, the stainless steel segment of the self-cleaning filters market is projected to grow at the highest CAGR from 2016 to 2021. The growth of this segment can be attributed to the various advantages of stainless steel such as excellent corrosion resistance in an aerated water environment, durability, reliability, and chemical and high-pressure resistibility.

Among end-use industries, the wastewater treatment segment is projected to lead the self-cleaning filters market during the forecast period. The growth of the wastewater treatment segment of the self-cleaning filters market can be attributed to use of self-cleaning filters in the wastewater treatment help in reduction of Biochemical Oxygen Demand (BOD) and Total Suspended Solids (TSS). Self-cleaning filters are preferred for filtration of sewage treatment plants.

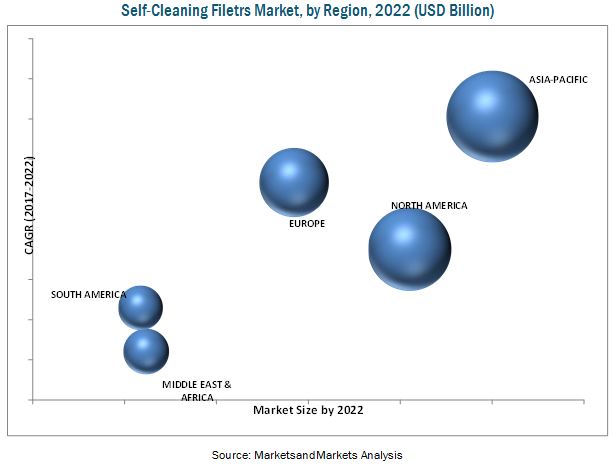

The Asia-Pacific self-cleaning filters market is projected to grow at the highest CAGR during the forecast period. Increasing industrialization and infrastructural developments in the region offers growth opportunities to the self-cleaning filters market. Asia-Pacific is the largest consumer of self-cleaning filters in the world. In order to meet this growing demand for self-cleaning filters, top manufacturers of filters from the U.S. and Europe are focusing on the Asia-Pacific region to expand their businesses. It is expected that there would be in an increase in the adoption of water treatment technologies in the Asia-Pacific region during the forecast period. This increased adoption of water treatment technologies can be attributed to the expansion of power generation sector and an increase in the number of municipal water treatment plants in the region.

High cost of installation and manufacturing of self-cleaning filters for various end-use industries are expected to act as restraints for the growth of the self-cleaning filters market during the forecast period.

Eaton Corporation plc (Ireland), Parker Hannifin Corporation (U.S.), Alfa Laval AG (Sweden), Amiad Water Systems Ltd. (Israel), 3M Company (U.S.), Baleen Filters Pty. Ltd. (Australia), The Dow Chemical Company (U.S.), Oxford Filtration Limited (U.K.), Pall Corporation (U.S.), Cummins, Inc. (U.S.), HYDAC Filter System GmbH (Germany), JUDO Water Treatment GmbH (Germany), VAF Filtration Systems (U.S.), Morrill Industries, Inc. (U.S.), SCAM Filters (Filters), Forsta Filters, Inc. (U.S.), STF Filtros (Spain), Georg Schünemann GmbH (Germany), and Orival Inc.(U.S.), among others, are the key companies operating in the self-cleaning filters market. These players, with a wide market reach and established distribution networks, are investing increasingly in research & development activities for development of new self-cleaning filters. They also have strong technical and market development capabilities, which enable them to upgrade their existing products for new applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Self-Cleaning Filters Market

4.2 Self-Cleaning Filters Market, By Region

4.3 Self-Cleaning Filters Market, By Material

4.4 North America Self-Cleaning Filters Market, By End-Use Industry and Country

4.5 Self-Cleaning Filters Market: Emerging vs Developed Countries

5 Market Overview (Page No. - 32)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Stringent Government Regulations Formulated to Minimize Industrial Waste

5.1.1.2 Rapid Industrialization and Increase in Demand for Self-Cleaning Filters From End-Use Industries

5.1.2 Opportunities

5.1.2.1 Minimizing Energy and Water Consumption With Continuous Flow

5.1.3 Challenges

5.1.3.1 High Cost of Installation& Manufacturing of Self-Cleaning Filters

5.1.3.2 Volatile Raw Material Prices

5.2 Porter’s Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitutes

5.2.4 Bargaining Power of Suppliers

5.2.5 Intensity of Competitive Rivalry

5.3 Macroeconomic Indicators

5.3.1 Trends and Forecast of GDP

5.4 Industry Outlook

5.4.1 Food & Beverage Industry

6 Self-Cleaning Filters Market, By Material (Page No. - 43)

6.1 Introduction

6.1.1 Stainless Steel

6.1.2 Carbon

6.1.3 Others

7 Self-Cleaning Filters Market, By End-Use Industry (Page No. - 49)

7.1 Introduction

7.2 Food & Beverage

7.3 Steel

7.4 Pharmaceutical

7.5 Automotive

7.6 Chemical & Power

7.7 Oil & Gas

7.8 Wastewater Treatment

7.9 Marine

7.10 Agricultural Irrigation & Domestic Water

7.11 Others

8 Regional Analysis (Page No. - 58)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Asia-Pacific

8.3.1 China

8.3.2 Japan

8.3.3 India

8.3.4 Austria

8.3.5 South Korea

8.3.6 Taiwan

8.3.7 Rest of Asia-Pacific

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 Russia

8.4.4 U.K.

8.4.5 Italy

8.4.6 Belgium

8.4.7 Spain

8.4.8 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 Iran

8.5.4 South Africa

8.5.5 Turkey

8.5.6 Iraq

8.5.7 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Egypt

8.6.4 Rest of South America

9 Competitive Landscape (Page No. - 100)

9.1 Introduction

9.1.1 Dynamic Players

9.1.2 Innovator

9.1.3 Vanguard

9.1.4 Emerging

9.2 Competetive Leadership Mapping

9.3 Product Offerings

9.4 Business Strategies

9.5 Market Player Ranking

10 Company Profiles (Page No. - 105)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Eaton Corporation PLC.

10.2 Amiad Water Systems Ltd.

10.3 Forsta Filters, Inc.

10.4 Alfa Laval AB

10.5 Jiangsu YLD Water Processing Equipment Co., Ltd.

10.6 Parker Hannifin Corporation

10.7 Georg Schünemann GmbH

10.8 Morrill Industries Inc.

10.9 Russell Finex Ltd.

10.10 North Star Water Treatment Systems

10.11 Orival Inc.

10.12 Other Companies

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 135)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (64 Tables)

Table 1 Self-Cleaning Filters Market Snapshot

Table 2 Environmental Protection Acts of Major Countries

Table 3 Trends and Forecast of GDP, 2015-2021 (USD Billion)

Table 4 Self-Cleaning Filters Market, By Material, 2015-2022 (USD Million)

Table 5 Stainless Steel Self-Cleaning Filters Market, By Region, 2015-2022 (USD Million)

Table 6 Carbon Self-Cleaning Filters Market, By Region, 2015-2022 (USD Million)

Table 7 Other Self-Cleaning Filters Market, By Region, 2015-2022 (USD Million)

Table 8 Self-Cleaning Filters Market, By End-Use Industry, 2015–2022 (USD Million)

Table 9 Self-Cleaning Filters Market for Food & Beverage, By Region, 2015–2022 (USD Million)

Table 10 Self-Cleaning Filters Market for Steel, By Region, 2015–2022 (USD Million)

Table 11 Self-Cleaning Filters Market for Pharmaceutical, By Region, 2015–2022 (USD Million)

Table 12 Self-Cleaning Filters Market for Automotive, By Region, 2015–2022 (USD Million)

Table 13 Self-Cleaning Filters Market for Chemical & Power, By Region, 2015–2022 (USD Million)

Table 14 Self-Cleaning Filters Market for Oil & Gas, By Region, 2015–2022 (USD Million)

Table 15 Self-Cleaning Filters Market for Wastewater Treatment, By Region, 2015–2022 (USD Million)

Table 16 Self-Cleaning Filters Market for Marine, By Region, 2015–2022 (USD Million)

Table 17 Self-Cleaning Filters Market for Agricultural Irrigation & Domestic Water, By Region, 2015–2022 (USD Million)

Table 18 Self-Cleaning Filters Market for Others, By Region, 2015–2022 (USD Million)

Table 19 Self-Cleaning Filters Market, By Region, 2015–2022 (USD Million)

Table 20 North America: Self-Cleaning Filters Market, By Country, 2015–2022 (USD Million)

Table 21 North America: By Market Size, By Material, 2015–2022 (USD Million)

Table 22 North America: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 23 U.S. : Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 24 Canada: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 25 Mexico: Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 26 Asia-Pacific: Self-Cleaning Filters Market Size, By Country, 2015–2022 (USD Million)

Table 27 Asia-Pacific: By Market Size, By Material, 2015–2022 (USD Million)

Table 28 Asia-Pacific: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 29 China: Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 30 Japan: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 31 India: Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 32 Austria: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 33 South Korea: Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 34 Taiwan: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 35 Rest of the Asia-Pacific: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 36 Europe: Self-Cleaning Filter Market Size, By Country, 2015–2022 (USD Million)

Table 37 Europe: By Market Size, By Material, 2015–2022 (USD Million)

Table 38 Europe: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 39 Germany: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 40 France: Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 41 Russia: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 42 U.K.: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 43 Italy: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 44 Belgium: Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 45 Spain: Self-Cleaning Filters Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 46 Rest of the Europe: Self-Cleaning Filter Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 47 Middle East & Africa: Self-Cleaning Filters Market Size, By Country, 2015–2022 (USD Million)

Table 48 Middle East & Africa: By Market Size, By Material, 2015–2022 (USD Million)

Table 49 Middle East & Africa: By Market Size, By End-Use Industry, 2015–2022(USD Million)

Table 50 Saudi Arabia: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 51 UAE: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 52 Iran: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 53 South Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 54 Turkey: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 55 Iraq: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 56 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 57 South America: Self-Cleaning Filter Market Size, By Country, 2015–2022 (USD Million)

Table 58 South America: By Market Size, By Material, 2015–2022 (USD Million)

Table 59 South America: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 60 Brazil: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 61 Argentina: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 62 Egypt: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 63 Rest of South America: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 64 Eaton Corporation PLC. Accounted for the Largest Share of the Self-Cleaning Filter Market

List of Figures (34 Figures)

Figure 1 Self-Cleaning Filters Market Segmentation

Figure 2 Self-Cleaning Filter Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Self-Cleaning Filters Market: Data Triangulation

Figure 7 Wastewater Treatment Estimated to Be the Largest End-Use Industry Segment of the Self-Cleaning Filter Market in 2017

Figure 8 The Self-Cleaning Filters Market in Stainless Steel Segmant is Expected to Lead the Market During the Forecas Period

Figure 9 Self-Cleaning Filter Market, By Region

Figure 10 The Increasing Demand for Self-Cleaning Filters From Various End-Use Industries is Driving the Growth of the Market

Figure 11 The Self-Cleaning Filter Market in Asia-Pacific is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 12 The Stainless Steel Segment is Projected to Lead the Self-Cleaning Filters Market During the Forecast Period

Figure 13 The Wastewater Treatment End-Use Industry Segment Accounted for the Largest Share of the North America Self-Cleaning Filter Market in 2016

Figure 14 Drivers, Opportunities, and Challenges in the Self-Cleaning Filters Market

Figure 15 World’s Stainless Steel Prices-USD/Metric Ton(2016)

Figure 16 Porter’s Five Forces Analysis

Figure 17 Global Food and Beverage Water and Wastewater Market Revenue Forecast

Figure 18 The Stainless Steel Segment is Projected to Lead the Self-Cleaning Filter Market During the Forecast Period

Figure 19 The Stainless Steel Segment of the Self-Cleaning Filters Market in Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 The Carbon Segment is Projected to Lead the Self-Cleaning Filter Market in North America During the Forecast Period

Figure 21 Others in the European Self-Cleaning Filters Market is the Fastest-Growing Segment During the Forecast Period

Figure 22 The Food & Beverage Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia-Pacific Accounted for the Largest Share of the Amphibious Vehicles Market in 2016

Figure 24 North America Self-Cleaning Filters Market Snapshot

Figure 25 Asia-Pacific Self-Cleaning Filter Market Snapshot

Figure 26 Europe Self-Cleaning Filters Market Snapshot

Figure 27 Dive Chart

Figure 28 Eaton Corporation PLC.: Company Snapshot

Figure 29 Amiad Water Systems Ltd.: Company Snapshot

Figure 30 Forsta Filters, Inc.: Company Snapshot

Figure 31 Alfa Laval AB: Company Snapshot

Figure 32 Parker Hannifin Corporation: Company Snapshot

Figure 33 Russell Finex Ltd.: Company Snapshot

Figure 34 Orival Inc.: Business Strategy Scorecard

Growth opportunities and latent adjacency in Self-Cleaning Filters Market