Scroll & Absorption Chillers Market by Product (Scroll Chiller & Absorption Chiller), Capacity (<100 kW, 101 kW–300 kW, 301 kW–700 kW, & >701 kW), Vertical, and Geography - Global Forecast to 2022

The scroll & absorption chillers market is expected to grow from USD 5.61 Billion in 2015 to USD 7.13 Billion by 2022, at a CAGR of 4.1% between 2016 and 2022. This report aims to estimate the size and future growth potential of the market across different segments such as product, capacity, vertical, and geography. The base year considered for the study is 2015 and the market size is forecast for the period between 2016 and 2022.

According to the MarketsandMarkets forecast, the scroll & absorption chillers market is expected to grow from USD 5.61 Billion in 2015 to USD 7.13 Billion by 2022, at a CAGR of 4.1% between 2016 and 2022. This market is driven by factors such as the growing awareness about energy-efficient products, deployment of scroll & absorption chillers in a wide range of application areas, and increased electricity costs.

The scroll chillers held the largest market share in 2015 and the same trend is expected to continue during the forecast period. The market is expected to grow at the highest rate between 2016 and 2022. The growing demand for large absorption chillers in the industrial vertical in developing countries such as China, Japan, and India is expected to drive the market in the next six years.

Scroll & absorption chillers offer cost-effective services at low costs for applications in institutions, hospitals, and commercial buildings. The high growth rate of the scroll & absorption chillers market in Asia-Pacific is mainly attributed to the increasing demand from emerging economies such as India and China as well as the growing construction industry, especially for the commercial vertical, in the developing countries in Asia-Pacific. In the industrial verticals, scroll & absorption chillers are used for cooling the machinery, plant, and the environment to better support the system performance. Furthermore, they incur low operating costs. Scroll chillers use scroll compressors, which are less expensive than other chillers and cover large application areas. Absorption chillers are used to cool water by using the energy provided by a heat source. These chillers are used in various industrial verticals. The applications of these chillers include plastic, chemical & petroleum, food & beverages, geothermal appliances, pharma, and textile.

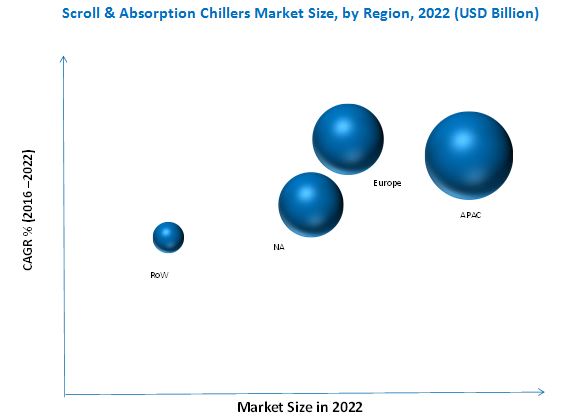

The APAC region is expected to hold the largest share of the scroll & absorption chillers market during the forecast period owing to the increasing capacities of nuclear, geothermal, and solar power plants in Asia-Pacific, which drive the demand for chillers in the region.

Europe held the second-largest market share in 2015 and is expected to grow at the highest CAGR between 2016 and 2022. This growth is supported by the growing commercial building & construction industry, resulting in increased deployments of heating, ventilating, air conditioning, and refrigeration (HVACR) systems.

One of the key challenges faced by the scroll & absorption chillers market is the regulations pertaining to fluorinated greenhouse gases.

The major vendors in the market include Daikin Industries, Ltd., Johnson Controls Inc., Thermax, Ltd., and Trane, Inc. These players have adopted various strategies such as new technology launches, partnerships, and mergers & acquisitions to cater to the needs of the scroll & absorption chillers market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Significant Market Opportunities in the Market

4.2 Market Analysis, By Product

4.3 Scroll & Absorption Chillers Analysis, By Vertical, 2015

4.4 Scroll & Absorption Chillers Analysis, By Major Region & Capacity, 2015

4.5 Scroll & Absorption Chillers Share, By Region

5 Market Overview (Page No. - 35)

5.2 Introduction

5.3 Evolution: Scroll & Absorption Chillers Market

5.4 Market Segmentation

5.4.1 Market, By Product

5.4.2 Scroll & Absorption Chillers By Capacity

5.4.3 Scroll & Absorption Chillers By Vertical

5.4.4 Scroll & Absorption Chillers By Geography

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Rising Awareness About Energy-Efficient Products

5.5.1.2 Deployment of Scroll & Absorption Chillers in A Wide Range of Application Areas

5.5.2 Restraints

5.5.2.1 Competition From the Centrifugal Chiller Industry

5.5.2.2 High Set-Up Cost and Low Efficiency Rates

5.5.3 Opportunities

5.5.3.1 Rapid Growth of Scroll & Absorption Chillers in Commercial Sector & Data Centers

5.5.4 Challenges

5.5.4.1 Regulations Pertaining to Fluorinated Greenhouse Gases

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Scroll & Absorption Chillers Market, By Product (Page No. - 49)

7.1 Introduction

7.2 Scroll Chillers

7.2.1 Water-Cooled Scroll Chillers

7.2.2 Air-Cooled Scroll Chillers

7.3 Absorption Chillers

7.3.1 Absorption Chillers, By Type

7.3.1.1 Steam Absorption Chillers

7.3.1.2 Hot Water Absorption Chillers

7.3.1.3 Direct Fired Absorption Chillers

7.3.2 Absorption Chillers, By Design Technology

7.3.2.1 Single-Effect Chillers

7.3.2.2 Double-Effect Chillers

7.3.2.3 Triple-Effect Chillers

8 Scroll & Absorption Chillers Market, By Capacity Range (Page No. - 65)

9 Scroll & Absorption Chillers Market, By Vertical (Page No. - 67)

9.1 Introduction

9.2 Industrial

9.2.1 Plastics

9.2.2 Chemicals & Petrochemicals

9.2.3 Food & Beverages

9.2.4 Geothermal Appliances

9.2.5 Pharma

9.2.6 Textile

9.3 Commercial

9.3.1 Institutions

9.3.2 Hospitals

9.3.3 Commercial Buildings

9.4 Other Vertical

9.4.1 Energy & Power

9.4.2 Paper & Packaging

10 Geographic Analysis (Page No. - 94)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 Spain

10.3.3 Italy

10.3.4 Russia

10.3.5 U.K.

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 Rest of the World

10.5.1 Middle East & Africa

10.5.2 Latin America

11 Competitive Landscape (Page No. - 112)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Partnerships, Joint Ventures, & Expansions, 2015-2016

11.3.3 Mergers & Acquisitions, 2015-2016

12 Company Profile (Page No. - 117)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Daikin Industries Ltd.

12.3 Johnson Controls, Inc.

12.4 Thermax, Ltd.

12.5 Trane, Inc.

12.6 Broad Air Conditioning Co., Ltd.

12.7 Carrier Corporation

12.8 Hitachi Appliances Inc.

12.9 Midea Group Co., Ltd.

12.10 Robur Corporation

12.11 Shuangliang Eco-Energy Systems Co., Ltd.

12.12 Other Companies

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 139)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (68 Tables)

Table 1 the Porter’s Five Forces Analysis: Intensity of Competitive Rivalry Likely to Have the Highest Impact on the Overall Market in 2015

Table 2 Market, By Product, 2013–2022 (USD Million)

Table 3 Scroll & Absorption Chillers Market, By Product, 2014–2022 (Thousand Units)

Table 4 Scroll Chillers Market, By Product, 2013–2022 (USD Million)

Table 5 Scroll Chillers Market, By Vertical, 2013–2022 (USD Million)

Table 6 Scroll Chillers Market for Commercial Vertical, By Application, 2013–2022 (USD Million)

Table 7 Scroll Chillers Market for Industrial Vertical, By Application, 2013–2022 (USD Million)

Table 8 Scroll Chillers Market for Other Verticals, By Application, 2013–2022 (USD Million)

Table 9 Absorption Chillers Market, By Product, 2013–2022 (USD Million)

Table 10 Absorption Chillers Market, By Design Technology, 2013–2022 (USD Million)

Table 11 Market, By Vertical, 2013–2022 (USD Million)

Table 12 Market for Industrial Vertical, By Application, 2013–2022 (USD Million)

Table 13 Market for Commercial Vertical, By Application, 2013–2022 (USD Million)

Table 14 Market for Other Verticals, By Application, 2013–2022 (USD Million)

Table 15 Market, By Capacity Range (Kw Million), 2014–2022

Table 16 Scroll & Absorption Chillers Market, By Vertical, 2013–2022 (USD Million)

Table 17 Market for Industrial Vertical, By Application, 2013–2022 (USD Million)

Table 18 Scroll & Absorption Chillers Market for Industrial Vertical, By Product, 2013–2022 (USD Million)

Table 19 Scroll Chillers Market for Industrial Vertical, By Region, 2013–2022 (USD Million)

Table 20 Scroll Chillers Market for Industrial Vertical in North America, By Country, 2013–2022 (USD Million)

Table 21 Scroll Chillers Market for Industrial Vertical in Europe, By Country, 2013–2022 (USD Million)

Table 22 Scroll Chillers Market for Industrial Vertical in APAC, By Country, 2013–2022 (USD Million)

Table 23 Scroll Chillers Market for Industrial Vertical in RoW, By Region, 2013–2022 (USD Million)

Table 24 Absorption Chillers Market for Industrial Vertical, By Region, 2013–2022 (USD Million)

Table 25 Market for Industrial Vertical in North America, By Country, 2013–2022 (USD Million)

Table 26 Market for Industrial Vertical in Europe, By Country, 2013–2022 (USD Million)

Table 27 Absorption Chillers Market Industrial Vertical in APAC, By Country, 2013–2022 (USD Million)

Table 28 Market for Industrial Vertical in RoW, By Region, 2013–2022 (USD Million)

Table 29 Scroll & Absorption Chillers Market for Commercial Vertical, By Application, 2013–2022 (USD Million)

Table 30 Scroll & Absorption Chillers Market for Commercial Vertical, By Product, 2013–2022 (USD Million)

Table 31 Scroll Chillers Market for Commercial Vertical, By Region, 2013–2022 (USD Million)

Table 32 Scroll Chillers Market for Commercial Vertical in North America, By Country, 2013–2022 (USD Million)

Table 33 Scroll Chillers Market for Commercial Vertical in Europe, By Country, 2013–2022 (USD Million)

Table 34 Scroll Chillers Market for Commercial Vertical in APAC, By Country, 2013–2022 (USD Million)

Table 35 Scroll Chillers Market for Commercial Vertical in RoW, By Region, 2013–2022 (USD Million)

Table 36 Absorption Chillers Market for Commercial Vertical, By Region, 2013–2022 (USD Million)

Table 37 Market for Commercial Vertical in North America, By Country, 2013–2022 (USD Million)

Table 38 Market for Commercial Vertical in Europe, By Country, 2013–2022 (USD Million)

Table 39 Market for Commercial Vertical in APAC, By Country, 2013–2022 (USD Million)

Table 40 Market for Commercial Vertical in RoW, By Region, 2013–2022 (USD Million)

Table 41 Market for Other Verticals, By Application, 2013–2016–2022 (USD Million)

Table 42 Scroll & Absorption Chillers Market for Other Verticals, By Product, 2013–2022 (USD Million)

Table 43 Scroll Chillers Market for Other Verticals, By Region, 2013–2022 (USD Million)

Table 44 Scroll Chillers Market for Other Verticals in North America, By Country, 2013–2016–2022 (USD Million)

Table 45 Scroll Chillers Market for Other Verticals in Europe, By Country, 2013–2022 (USD Million)

Table 46 Scroll Chillers Market for Others Verticals in APAC, By Country, 2013–2022 (USD Million)

Table 47 Scroll Chillers Market for Other Verticals in RoW, By Region, 2013–2022 (USD Million)

Table 48 Absorption Chillers Market for Other Verticals, By Region, 2013–2022 (USD Million)

Table 49 Absorption Chillers for Other Verticals in North America, By Country, 2013–2022 (USD Million)

Table 50 Absorption Chillers Market for Other Verticals in Europe, By Country, 2013–2022 (USD Million)

Table 51 Market for Other Verticals in APAC, By Country, 2013–2022 (USD Million)

Table 52 Market for Other Vertical in RoW, By Region, 2013–2022 (USD Million)

Table 53 Market, By Region, 2013–2022 (USD Million)

Table 54 Chillers Market in North America, By Country, 2013–2022 (USD Million)

Table 55 Chillers Market in North America, By Product, 2013–2022 (USD Million)

Table 56 Scroll Chillers Market in North America, By Type, 2013–2022 (USD Million)

Table 57 Market in Europe, By Country, 2013–2022 (USD Million)

Table 58 Chillers Market in Europe, By Type, 2013–2022 (USD Million)

Table 59 Scroll Chillers Market in Europe, By Product, 2013–2022 (USD Million)

Table 60 Market in APAC, By Country, 2013–2022 (USD Million)

Table 61 Scroll & Absorption Chillers Market in APAC, By Product, 2013–2022 (USD Million)

Table 62 Scroll Chillers Market in APAC, By Type, 2013–2022 (USD Million)

Table 63 Chillers Market in RoW, By Region, 2013–2022 (USD Million)

Table 64 Market in RoW, By Product, 2013–2022 (USD Million)

Table 65 Scroll Chillers Market in RoW, By Type, 2013–2022 (USD Million)

Table 66 New Product Launches, 2015–2016

Table 67 Partnerships, Joint Ventures & Expansions , 2014–2016

Table 68 Mergers/Acquisitions, 2015–2016

List of Figures (77 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology

Figure 4 Bottom-Up Approch

Figure 5 Top-Down Approch

Figure 6 Data Triangulation

Figure 7 Scroll & Absorption Chiller Market Size: Value vs Volume, 2013–2022

Figure 8 Market, By Product, 2015 vs 2022

Figure 9 Scroll & Chillers Market, By Capacity, 2015

Figure 10 Market, Industry Ranking Analysis, 2015

Figure 11 APAC Held the Largest Share of the Scroll & Absorption Chillers Market in 2015

Figure 12 Market Expected to Have Attractive Growth Opportunities Between 2016 and 2022

Figure 13 Absorption Chillers to Grow at A High Rate Between 2016 and 2022

Figure 14 Commercial Vertical to Continue to Lead the Market During the Forecast Period

Figure 15 Market in APAC Held the Largest Market Share in 2015

Figure 16 U.S. Held the Largest Market Share in 2015

Figure 17 Evolution of Scroll & Absorption Chillers Technology

Figure 18 Deployment of Scroll & Absorption Chillers in A Wide Range of Applications Driving the Growth of the Market

Figure 19 Value Chain Analysis: Major Value is Added During the Hardware Integration and Assembly Stages

Figure 20 Scroll & Absorption Chillers: Porter’s Five Forces Analysis, 2015

Figure 21 Porters Five Force Analysis of the Market

Figure 22 Low Impact of Threat of New Entrants Due to Moderate Entry Barriers

Figure 23 Medium Impact of Threat of New Substitutes Because of the Price of Substitutes

Figure 24 Medium Impact of Bargaining Power of Suppliers Due to Large Number of Suppliers

Figure 25 High Impact of Bargaining Power of Buyers Due to High Buyers’ Volume Leverage

Figure 26 High Impact of the Intensity of Competitive Rivalry Due to High Concentration of Players in the Market Space

Figure 27 Market, By Product

Figure 28 Absorption Chillers to Witness the Highest Growth in the Scroll & Chillers Market Between 2016 and 2022

Figure 29 Scroll Chillers vs Absorption Chillers Market Size, in Terms of Volume, 2016 & 2022

Figure 30 Water Cooled Scroll Chillers Held the Largest Share of the Scroll Chillers Market in 2015

Figure 31 Commercial Vertical of the Scroll Chillers Market Earned Maximum Revenue in 2015

Figure 32 Plastics Application Led the Scroll Chillers Market for the Industrial Vertical in 2015

Figure 33 Hot Water Abosrption Chillers Held the Largest Share of the Global Absorption Chillers Product Market in 2015

Figure 34 Double-Effect Abosrption Chillers to Lead the Global Absorption Chillers Product Market During the Forecast Period

Figure 35 The Market for the Industrial Vertical of Absorption Chillers to Grow at the Highest Rate During the Forecast Period

Figure 36 Hospital Application of Absorption Chiller Expected to Hold the Largest Market Size During the Forecast Period

Figure 37 Scroll & Abosrption Chillers Market, By Capacity Range

Figure 38 Capacity Range Chart for Scroll & Absorption Chillers

Figure 39 Commercial Vertical to Grow at the Highest Rate in the Scroll & Absoption Chillers Market Between 2016 and 2022

Figure 40 Plastics Application Held the Largest Market Size in the Scroll & Absoption Chillers Market in 2015

Figure 41 Scroll Chillers Led the Market for the Industrial Vertical in 2015

Figure 42 In Absorption Chiller Market By Industrial Vertical, APAC is the Fastest Growing Market Between 2016 and 2022

Figure 43 Market in Commercial Building Application to Grow at the Highest Rate Between 2016 and 2022

Figure 44 APAC Led the Scroll Chillers Market for Commercial Vertical, in Terms of Market Size, in 2015

Figure 45 APAC Led the Absorption Chillers Market for the Commercial Vertical, in Terms of Size, in 2015

Figure 46 Energy & Power Application Led the Market for the Other Verticals in 2015

Figure 47 Scroll Chillers Market for Other Verticals in APAC to Grow at the Highest Rate Between 2016 and 2022

Figure 48 APAC to Witness the Highest Growth for the Absorption Chillers Market for Other Verticals During the Forecast Period

Figure 49 China to Lead the Absorption Chillers Market for Other Verticals During the Forecast Period

Figure 50 Top Emerging Growth Markets for the Market Between 2016 and 2022

Figure 51 APAC Expected to Lead the Global Scroll & Chillers Market, 2013–2022 (USD Million)

Figure 52 North America: Scroll & Absorption Chillers Market Snapshot (2015)

Figure 53 U.S. to Dominate the North American Scroll & Absorption Chillers Market During the Forecast Period

Figure 54 Scroll Chillers Expected to Hold the Largest Share of the North American Market During the Forecast Period

Figure 55 Europe: Scroll and Absorption Chillers Market Snapshot (2015)

Figure 56 Germany Led the Market in Europe in 2015

Figure 57 Asia-Pacific: Scroll & Absorption Chillers Snapshot (2015)

Figure 58 China to Be the Leading Market for Scroll & Absorption Chillers in Asia-Pacific Till 2022

Figure 59 Middle East & Africa is the Largest Consumer of Scroll & Absorption Chillers in the RoW Region

Figure 60 Scroll Chillers Held the Largest Share of the RoW Market in 2015

Figure 61 Companies Adopted New Product Launches as the Key Growth Strategy Between 2014 and 2016

Figure 62 Market Ranking Analysis in the Global Scroll & Absorption Chiller Market, 2015

Figure 63 Market Evolution Framework – New Product Launches Fueled Growth and Innovation in the Scroll & Absorption Chiller Market Between 2014 and 2016

Figure 64 Battle for Market Share: New Product Launches Was the Key Growth Strategy, 2014-2016

Figure 65 Regional Revenue Mix of Major Players

Figure 66 Daikin Industries, Ltd.: Company Snapshot

Figure 67 Daikin Industries Ltd.: SWOT Analysis

Figure 68 Johnson Controls, Inc.: Company Snapshot

Figure 69 Johnson Controls Inc.: SWOT Analysis

Figure 70 Thermax, Ltd.: Company Snapshot

Figure 71 Thermax, Ltd.: SWOT Analysis

Figure 72 Trane Inc.: SWOT Analysis

Figure 73 Midea Group Co., Ltd.: Company Snapshot

Figure 74 Shuangliang Eco-Energy Systems Co., Ltd.: Company Snapshot

Figure 75 Yazaki Energy Systems, Inc.: Company Snapshot

Figure 76 Century Corporation: Company Snapshot

Figure 77 EAW Energieanlagenbau GmbH: Company Snapshot

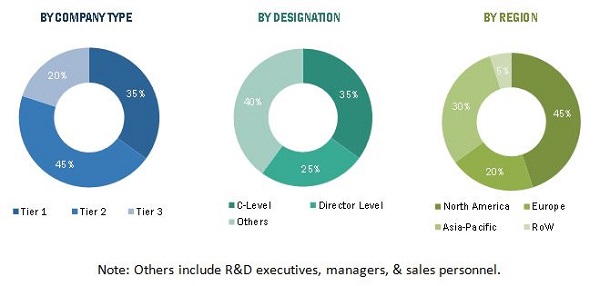

The research methodology used to estimate and forecast the scroll & absorption chillers market begins with gathering data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights regarding the ecosystem of this market such as product manufacturers and suppliers, OEMs, system integrators, alliances, suppliers, distributors, technology providers, and so on. The key players in the scroll & absorption chillers market include Daikin Industries, Ltd. (Japan), Johnson Controls Inc. (U.S.), Thermax, Ltd. (India), Trane, Inc. (Ireland), Carrier Corporation (U.S.), Broad Air Conditioning Co., Ltd. (China), Century Corporation (South Korea), Yazaki Energy Systems, Inc. (U.S.), Shuangliang Eco-Energy Systems Co., Ltd. (China), Hitachi Appliances, Inc. (Japan), and MIDEA Group Co., Ltd. (China).

Key Target Audience:

- Raw material and manufacturing equipment suppliers

- Scroll and absorption chiller OEMs

- Asset management consultants who specialize in physical asset management

- Research institutes and organizations

- Associations and regulatory authorities related to plant maintenance

- Government bodies, venture capitalists, and private equity firms

- Chiller distributors and suppliers

The study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report:

The research report classifies the scroll & absorption chillers market on the basis of the following submarkets:

By Product:

- Scroll Chillers

- Absorption Chillers

By Capacity:

- <100 KW

- 101 KW–300 KW

- 301 KW–700 KW

- >701 KW

By Vertical:

- Commercial

- Industrial

- Others

By Geography:

- North America

- Europe

- APAC

- RoW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the market in North America

- Further breakdown of the scroll & absorption chillers market in Europe

- Further breakdown of the market in APAC

- Further breakdown of the market in RoW

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Scroll & Absorption Chillers Market