Rubber Additives Market by Type (Antidegradants, Accelerators), Application (Tire and Non-Tire), and Region (Asia Pacific, North America, Europe, Middle East & Africa, South America) - Global Forecast to 2026

Updated on : April 23, 2024

Rubber Additives Market

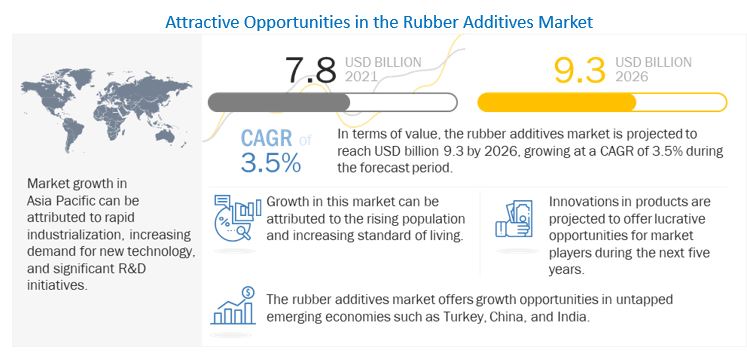

The global rubber additives market was valued at USD 7.8 billion in 2021 and is projected to reach USD 9.3 billion by 2026, growing at 3.5% cagr from 2021 to 2026. Rubber additives are used to improve the resistance of rubber against the effects of heat, sunlight, mechanical stress, and others. Different types of rubber additives are antidegradants, accelerators, and processing aids. Antidegradants include phenylenediamine, phosphite, phenolic compounds, and other chemicals. Accelerators comprise benzothiazole, sulfenamides, and others. Moreover, blowing agents, peptizers, and retarders are also used for processing rubber. The growth of the rubber additives market is primarily triggered by the growing automobile industry which in turn drives the need for rubber additives. The stringent government regulations foster manufacturers to comply with the environment standards. Thus, the government regulations coupled with the growing environmental concerns are expected to restrain the growth of the market. The opportunities for this market are rapidly increasing demand from the Asia-Pacific region and emergence of high-performance rubbers.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Rubber Additives Market

The global pandemic has affected almost every sector in the world. The rubber additives market is expected to be moderately affected due to disruptions in the global supply chain. The market is highly dependent on the automotive and electrical and electronics industries. China is a major market for exports and industrial production. Strict lockdowns in the country’s major provinces affected the industrial activities in the country. The demand for industrial equipment declined significantly in the first quarter of 2020, mainly due to the outbreak of COVID-19. China is among the largest producers of automobiles. However, disruptions in the supply of raw materials have weakened the production of rubber additives in the country.

Rubber Additives Market Dynamics

Driver: Increasing demand from non-tire rubber applications

The demand for rubber additives is estimated to increase owing to their high demand from the non-tire applications. The non-tire applications of rubber additives include rubber goods, rubber mats, wipers, footwears, automotive body parts, mining industry, rubber insulation tapes, insulations, conveyor belts, etc. The rapid industrialization in the developing nations of Asia-Pacific, particularly in China and India, leads to the increased demand for rubber products. Moreover, the increased need for superior quality rubber products drives the market for rubber additives that impart superior qualities to rubber products. Improved use of non-tire rubber in automotive sector such as automotive guards, wipers, protection covers, etc. to minimize vehicle weight for fuel economy increases consumer demand for non-tire rubber.

Restraints: Stringent environmental regulations

Rubber formulations are comprised of many different chemicals, which are specifically added to meet a given requirement. Since the development of rubber compounds is such a unique process, there are many regulations that rubber chemists must follow. Here are some of the most critical rules set in place: EPA, REACH, IPC 1752, International Material Data System (IMDS), Proposition 65, European Union Medical Device Regulations (EUMDR), etc. Therefore, stringent rules and regulations imposed by government also restraint the rubber additives market. In addition, the emission of hazardous gases and pollutants hampers the ecosystem, and restriction imposed on the same may hinder the market growth.

Opportunities: Adoption of green technology and high-performance rubbers

According to the report of IARC (International Agency on Research for Cancer), rubber manufacturing industry has proven to be a great contributor towards air pollution. This industry basically adds unwanted latex vapours into the air during the process of heating and forming latex sheets. Hence, manufacturers, with the help of green chemistry, are developing methods for the utilization of safer chemicals which can be easily disposed of. The notable techniques include dry vacuuming is used to prevent the spreading of spilled chemicals; the recycling of wastewater must be done. Other techniques are chemical recovery methods like pyrolysis, devulcanization, and the production of reclaimed rubber.

The antidegradants is the largest type of rubber additives for rubber additives market in 2020

The demand for antidegradants is fuelled by the expansion in its applications such as tire and industrial rubber products. These are used to improve the rubber’s resistance against the effects of sunlight, oxidation, heat, and mechanical stress. Moreover, they are used to improve the performance and lengthen the service life of rubber products. The market for accelerators is estimated to witness a decent growth due to their increased demand for vulcanizing rubber products. The others segment is estimated to witness slow growth during the forecast period. Processing aids, blowing agents, among others are used to improve the plasticity of rubber.

Tire is estimated to be the largest application of rubber additives market in 2020.

Rubber is the primary raw material used in the production of tires. Several additives are used to attain the desired properties of rubber. Rubber additives are used in tires to provide specific characteristics such as high friction for racing tires and high mileage for passenger car tires. The growing automotive industry in Asia-Pacific demands processed tires to meet the demand of the customers. The stringent environmental norms in Europe demand the use of high-tech rubber for various applications. Therefore, rubber is processed using additives to attain the desired properties of heat resistance, friction, mechanical stress, and others. The rising global motor vehicle production is the key factor driving the market for rubber additives.

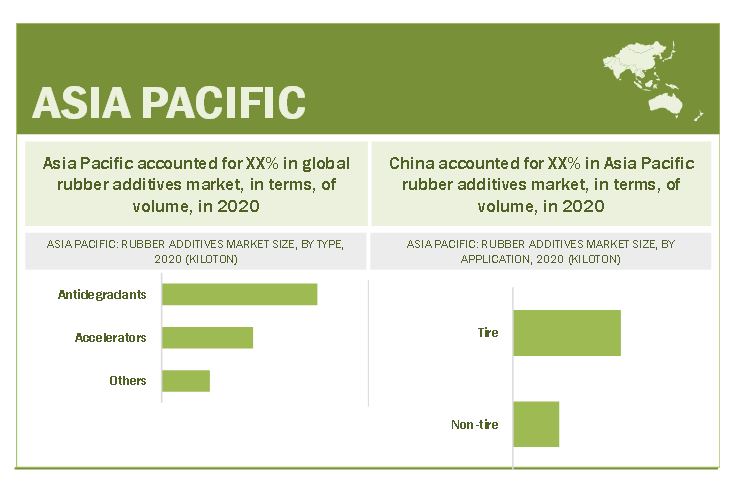

Asia Pacific is expected to be the largest rubber additives market during the forecast period, in terms of value.

Asia Pacific is the fastest-growing region in rubber additives market owing to rapid economic growth in the region. The increased demand for superior quality processed rubber from the automotive industry is driving the market for rubber additives in the region. The growing population coupled with the increasing purchasing power of consumers is boosting the demand for automobiles in the region. This in turn drives the market for rubber additives as they are required to enhance the properties of rubber which is used to manufacture automotive tires.

To know about the assumptions considered for the study, download the pdf brochure

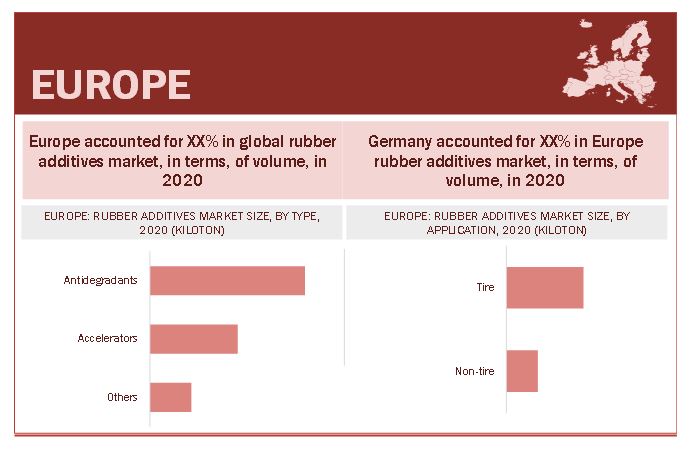

Europe is estimated to be the second-largest rubber additives market during the forecast period.

Europe is the second-largest market for rubber additives. This is due to the huge automotive industry in Germany. European manufacturers are facing stiff competition from Chinese manufacturers, impelling them to produce high-tech products. Furthermore, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations in the region have compelled the producers of rubber additives to formulate environmental-friendly products.

Rubber Additives Market Players

The key market players profiled in the report include Arkema S.A.(France), Lanxess AG (Germany), BASF SE (Germany), Solvay S.A. (Belgium), Sinopec Corporation (China), R.T. Vanderbilt Holding Company, Inc. (US), Emery Oleochemicals (US), Behn Meyer Group (Germany), Toray Industries, Inc. (Japan), and Sumitomo Chemical (Japan).

Rubber Additives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021

|

USD 7.8 billion |

| Revenue Forecast in 2026 | USD 9.3 billion |

| CAGR | 3.5% |

| Years considered for the study | 2016-2026 |

| Base Year | 2020 |

| Forecast period | 2021–2026 |

| Units considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Application, and Region |

| Regions | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

| Companies | Arkema S.A.(France), Lanxess AG (Germany), BASF SE (Germany), Solvay S.A. (Belgium), Sinopec Corporation (China), R.T. Vanderbilt Holding Company, Inc. (US), Emery Oleochemicals (US), Behn Meyer Group (Germany), Toray Industries, Inc. (Japan), and Sumitomo Chemical (Japan) |

This report categorizes the global rubber additives market based on type, application, and region.

On the basis of type, the rubber additives market has been segmented as follows:

- Antidegradants

- Accelerators

- Others

On the basis of application, the rubber additives market has been segmented as follows:

- Tire

- Non-tire

On the basis of region, the rubber additives market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In 2019, Lanxess AG has expanded its existing portfolio of Rhenogran rubber additive by new masterbatches for manufacturing reinforced rubber parts with improved stability and extend the service life of the end products.

- In 2020, The Solvay SA has announced that its new distributor, Vanderbilt Chemicals LLC, will distribute Tecnoflon FKM and PFR FFKM fluoroelastomers along with technical and problem-solving resources in North America.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of rubber additives?

The growth of the rubber additives market is primarily triggered by the growing automobile industry which in turn drives the need for rubber additives. The stringent government regulations foster manufacturers to comply with the environment standards. Thus, the government regulations coupled with the growing environmental concerns are expected to restrain the growth of the market. The opportunities for this market are rapidly increasing demand from the Asia-Pacific region and emergence of high-performance rubbers.

What are different application of rubber additives?

The rubber additives market is segmented into two application categories, namely, tire and non-tire. Tire application is projected to hold the largest market share during the forecast period. Manufacturers of rubber additives are striving to make their products comply with the environmental regulations. Most of the companies are trying to meet the regulatory standards to provide high-performance characteristics to their products.

What is the biggest restraint for rubber additives?

Regulatory pressure is forcing the rubber industry to reduce waste and develop a sustainable vision for the future. In 2006 the European Union prohibited tires from being dumped in landfills, so other solutions for waste tire disposal must be found. The WEEE product take back legislation in the EU, puts pressure on the manufacturers to create pathways where their products can be taken back and recycled. By introducing a reusable recycled-rubber compound that only uses established chemicals into the rubber production chain, Green Rubber Company and few other emerging companies provides an effective material for the growing number of producers and retailers falling under this increasing public policy pressure. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 RUBBER ADDITIVES MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 RUBBER ADDITIVES MARKET: DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 RUBBER ADDITIVES MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

1.3 MARKET SCOPE

1.3.1 RUBBER ADDITIVES MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 RUBBER ADDITIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY-SIDE): COLLECTIVE REVENUE AND SHARE OF MAJOR PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND-SIDE)

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 6 RUBBER ADDITIVES MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY-SIDE

FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY-SIDE

2.4.2 DEMAND-SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 RUBBER ADDITIVES MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 ANTIDEGRADANTS TO BE LARGEST TYPE OF RUBBER ADDITIVES

FIGURE 10 NON-TIRE SEGMENT TO BE FASTER-GROWING APPLICATION OF RUBBER ADDITIVES

FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF RUBBER ADDITIVES MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN RUBBER ADDITIVES MARKET

FIGURE 12 ASIA PACIFIC TO LEAD RUBBER ADDITIVES MARKET DURING FORECAST PERIOD

4.2 RUBBER ADDITIVES MARKET, BY REGION

FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY TYPE AND COUNTRY

FIGURE 14 CHINA LED RUBBER ADDITIVES MARKET IN ASIA PACIFIC IN 2020

4.4 RUBBER ADDITIVES MARKET SIZE, BY APPLICATION VS. REGION

FIGURE 15 TIRE APPLICATION DOMINATED OVERALL MARKET IN MOST REGIONS IN 2020

4.5 RUBBER ADDITIVES MARKET, BY KEY COUNTRIES

FIGURE 16 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 OVERVIEW OF FACTORS GOVERNING RUBBER ADDITIVES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand from non-tire rubber applications

TABLE 2 TOTAL MINERALS PRODUCTION, BY CONTINENT (MILLION METRIC TONS)

5.2.1.2 Increasing demand for natural rubbers

FIGURE 18 NATURAL RUBBER PRODUCTION: 2016–2021

5.2.1.3 Increasing demand for rubber in electric vehicles (EVs)

FIGURE 19 ELECTRIC VEHICLE (EV) SALES, GLOBALLY (2010–2020)

5.2.2 RESTRAINTS

5.2.2.1 Stringent environmental regulations

5.2.2.2 Improper disposal of effluents by rubber industry affecting genuine rubber additives market

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of green technology and high-performance rubbers

5.2.3.2 Rising developmental and cross-industry collaboration activities

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in raw material prices

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 RUBBER ADDITIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 RUBBER ADDITIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 21 RUBBER ADDITIVES MARKET: SUPPLY CHAIN

5.4.1 RAW MATERIALS

5.4.2 RUBBER ADDITIVE MANUFACTURERS

5.4.3 DISTRIBUTION NETWORK

5.4.4 END-USE INDUSTRY

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 4 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

5.5.2 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2020

TABLE 5 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2020 (UNITS)

5.6 IMPACT OF COVID-19

5.6.1 INTRODUCTION

5.6.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COUNTRY-WISE SPREAD OF COVID-19

5.6.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.6.4 IMPACT OF COVID-19 ON ECONOMY—SCENARIO ASSESSMENT

FIGURE 24 FACTORS IMPACTING GLOBAL ECONOMY

5.7 IMPACT OF COVID-19: CUSTOMER ANALYSIS

5.8 POLICY AND REGULATIONS

5.8.1 REACH

5.8.2 EPA

5.9 PATENT ANALYSIS

5.9.1 APPROACH

5.9.2 DOCUMENT TYPE

TABLE 6 GRANTED PATENTS ACCOUNT FOR 7% OF ALL PATENTS BETWEEN 2011 AND 2021

FIGURE 25 PATENTS REGISTERED FOR RUBBER ADDITIVES, 2011–2021

FIGURE 26 PATENT PUBLICATION TRENDS FOR RUBBER ADDITIVES, 2011–2021

5.9.3 LEGAL STATUS OF PATENTS

FIGURE 27 LEGAL STATUS OF PATENTS FILED FOR RUBBER ADDITIVES

5.9.4 JURISDICTION ANALYSIS

FIGURE 28 HIGHEST NUMBER OF PATENTS FILED BY COMPANIES IN CHINA

5.9.5 TOP APPLICANTS

FIGURE 29 LANXESS AG REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2011 AND 2021

TABLE 7 LIST OF PATENTS BY LANXESS AG

TABLE 8 LIST OF PATENTS BY BRIDGESTONE CORPORATION

TABLE 9 LIST OF PATENTS BY BASF SE

TABLE 10 TOP TEN PATENT OWNERS (US) BETWEEN 2011 AND 2021

6 RUBBER ADDITIVES MARKET, BY TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 30 ANTIDEGRADANTS TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

TABLE 11 RUBBER ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 RUBBER ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 13 RUBBER ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 14 RUBBER ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

6.2 ANTIDEGRADANTS

6.2.1 HIGH RESISTANCE AGAINST OZONE, HEAT, AND MECHANICAL STRESS DRIVE DEMAND FOR ANTIDEGRADANTS

FIGURE 31 ASIA PACIFIC TO BE LARGEST MARKET FOR ANTIDEGRADANTS BETWEEN 2021 AND 2026

TABLE 15 ANTIDEGRADANTS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 ANTIDEGRADANTS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 17 ANTIDEGRADANTS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 18 ANTIDEGRADANTS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

6.3 ACCELERATORS

6.3.1 ENHANCED VULCANIZATION PROCESS AND INCREASED EFFICIENCY OF RUBBER PRODUCTS DRIVES DEMAND FOR ACCELERATORS

FIGURE 32 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN ACCELERATORS SEGMENT BETWEEN 2021 AND 2026

TABLE 19 ACCELERATORS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 ACCELERATORS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 21 ACCELERATORS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 22 ACCELERATORS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

6.4 OTHERS

TABLE 23 OTHERS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 OTHERS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 25 OTHERS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 26 OTHERS: RUBBER ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

7 RUBBER ADDITIVES MARKET, BY APPLICATION (Page No. - 84)

7.1 INTRODUCTION

FIGURE 33 NON-TIRE SEGMENT PROJECTED TO BE FASTER-GROWING APPLICATION DURING FORECAST PERIOD

TABLE 27 RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 28 RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 29 RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 30 RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

7.2 TIRE

7.2.1 RISING GLOBAL MOTOR VEHICLE PRODUCTION DRIVING DEMAND FOR RUBBER ADDITIVES

FIGURE 34 ASIA PACIFIC TO DRIVE RUBBER ADDITIVES MARKET IN TIRE APPLICATION BETWEEN 2021 AND 2026

TABLE 31 RUBBER ADDITIVES MARKET SIZE IN TIRE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 RUBBER ADDITIVES MARKET SIZE IN TIRE APPLICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 33 RUBBER ADDITIVES MARKET SIZE IN TIRE APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 34 RUBBER ADDITIVES MARKET SIZE IN TIRE APPLICATION, BY REGION, 2020–2026 (KILOTON)

7.3 NON-TIRE

7.3.1 ECONOMIC DEVELOPMENT AND DEMAND FOR HIGH-QUALITY FOOTWEAR DRIVING MARKET

FIGURE 35 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING RUBBER ADDITIVES MARKET IN NON-TIRE APPLICATION

TABLE 35 RUBBER ADDITIVES MARKET SIZE IN NON-TIRE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 RUBBER ADDITIVES MARKET SIZE IN NON-TIRE APPLICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 37 RUBBER ADDITIVES MARKET SIZE IN NON-TIRE APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 38 RUBBER ADDITIVES MARKET SIZE IN NON-TIRE APPLICATION, BY REGION, 2020–2026 (KILOTON)

8 RUBBER ADDITIVES MARKET, BY REGION (Page No. - 91)

8.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC TO BE LARGEST RUBBER ADDITIVES MARKET BETWEEN 2021 AND 2026

TABLE 39 RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 RUBBER ADDITIVES MARKET SIZE, BY REGION 2020–2026 (USD MILLION)

TABLE 41 RUBBER ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 42 RUBBER ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

8.2 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC MARKET SNAPSHOT: CHINA TO CONTINUE DOMINATING MARKET

8.2.1 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY TYPE

TABLE 43 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 44 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 45 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 46 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

8.2.2 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY APPLICATION

TABLE 47 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 49 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 50 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.2.3 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY COUNTRY

TABLE 51 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 52 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 53 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 54 ASIA PACIFIC: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.2.3.1 China

8.2.3.1.1 Heavy investments in manufacturing sector drive demand for rubber additives

TABLE 55 CHINA: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 56 CHINA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 57 CHINA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 58 CHINA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.2.3.2 Japan

8.2.3.2.1 Growth of automotive industry boosting demand for rubber additives

TABLE 59 JAPAN: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 60 JAPAN: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 61 JAPAN: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 62 JAPAN: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.2.3.3 South Korea

8.2.3.3.1 Increasing FDI to generate high demand from end-use industries

TABLE 63 SOUTH KOREA: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 64 SOUTH KOREA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 65 SOUTH KOREA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 66 SOUTH KOREA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.2.3.4 India

8.2.3.4.1 Favorable government policies to fuel demand for rubber additives

TABLE 67 INDIA: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 INDIA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 69 INDIA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 70 INDIA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3 NORTH AMERICA

FIGURE 38 NORTH AMERICA RUBBER ADDITIVES MARKET SNAPSHOT

8.3.1 NORTH AMERICA: RUBBER ADDITIVE MARKET, BY TYPE

TABLE 71 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 74 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

8.3.2 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY APPLICATION

TABLE 75 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 78 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY COUNTRY

TABLE 79 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 82 NORTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.3.3.1 US

8.3.3.1.1 Presence of major players in automotive industry to drive market

TABLE 83 US: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 84 US: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 85 US: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 86 US: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3.2 Canada

8.3.3.2.1 Rising demand from automotive and consumer goods industries to boost market

TABLE 87 CANADA: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 CANADA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 89 CANADA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 90 CANADA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3.3 Mexico

8.3.3.3.1 High growth opportunities in manufacturing sector to drive demand

TABLE 91 MEXICO: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 92 MEXICO: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 93 MEXICO: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 94 MEXICO: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4 EUROPE

FIGURE 39 EUROPE RUBBER ADDITIVES MARKET SNAPSHOT

8.4.1 EUROPE RUBBER ADDITIVE MARKET, BY TYPE

TABLE 95 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 96 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 97 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 98 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

8.4.2 EUROPE RUBBER ADDITIVES MARKET, BY APPLICATION

TABLE 99 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 101 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 102 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3 EUROPE RUBBER ADDITIVES MARKET, BY COUNTRY

TABLE 103 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 104 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 105 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 106 EUROPE: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.4.3.1 Germany

8.4.3.1.1 Presence of developed automotive sector to propel market

TABLE 107 GERMANY: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 GERMANY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 109 GERMANY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 110 GERMANY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3.2 France

8.4.3.2.1 Demand for lightweight and electric vehicles to drive market

TABLE 111 FRANCE: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 FRANCE: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 113 FRANCE: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 114 FRANCE: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3.3 Italy

8.4.3.3.1 High investment in automotive industry to drive market

TABLE 115 ITALY: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 116 ITALY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 117 ITALY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 118 ITALY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3.4 UK

8.4.3.4.1 Rising environmental concerns, high demand from automotive industry, and growing population to propel market

TABLE 119 UK: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 UK: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 121 UK: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 122 UK: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA RUBBER ADDITIVES MARKET, BY TYPE

TABLE 123 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 126 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

8.5.2 MIDDLE EAST & AFRICA RUBBER ADDITIVE MARKET, BY APPLICATION

TABLE 127 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 130 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5.3 MIDDLE EAST & AFRICA RUBBER ADDITIVES MARKET, BY COUNTRY

TABLE 131 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 134 MIDDLE EAST & AFRICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.5.3.1 Iran

8.5.3.1.1 Government’s investment in non-oil sectors to boost market

TABLE 135 IRAN: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 136 IRAN: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 137 IRAN: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 138 IRAN: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5.3.2 South Africa

8.5.3.2.1 Increasing economic growth to develop market

TABLE 139 SOUTH AFRICA: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 140 SOUTH AFRICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 141 SOUTH AFRICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 142 SOUTH AFRICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5.3.3 Turkey

8.5.3.3.1 Increasing FDI propelling demand for rubber additives

TABLE 143 TURKEY: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 144 TURKEY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 145 TURKEY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 146 TURKEY: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.6 SOUTH AMERICA

8.6.1 SOUTH AMERICA RUBBER ADDITIVES MARKET, BY TYPE

TABLE 147 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 148 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 149 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 150 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

8.6.2 SOUTH AMERICA RUBBER ADDITIVES MARKET, BY APPLICATION

TABLE 151 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 152 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 153 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 154 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.6.3 SOUTH AMERICA RUBBER ADDITIVES MARKET, BY COUNTRY

TABLE 155 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 156 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 157 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 158 SOUTH AMERICA: RUBBER ADDITIVE MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.6.3.1 Brazil

8.6.3.1.1 Rising middle-class population to boost demand for rubber additives

TABLE 159 BRAZIL: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 160 BRAZIL: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 161 BRAZIL: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 162 BRAZIL: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.6.3.2 Argentina

8.6.3.2.1 High growth in rubber industry driven by growing automotive industry

TABLE 163 ARGENTINA: RUBBER ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 164 ARGENTINA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 165 ARGENTINA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 166 ARGENTINA: RUBBER ADDITIVE MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 137)

9.1 INTRODUCTION

9.2 KEY PLAYERS' STRATEGIES

TABLE 167 OVERVIEW OF STRATEGIES ADOPTED BY KEY RUBBER ADDITIVES MANUFACTURERS

9.3 MARKET SHARE ANALYSIS

FIGURE 40 ARKEMA SA IS LEADING PLAYER IN RUBBER ADDITIVES MARKET

9.3.1 ARKEMA SA

9.3.2 LANXESS AG

9.3.3 BASF SE

9.3.4 SOLVAY SA

9.4 COMPETITIVE SITUATION AND TRENDS

9.4.1 DEALS

TABLE 168 RUBBER ADDITIVES MARKET: DEALS, 2018–2021

9.4.2 OTHER DEVELOPMENTS

TABLE 169 RUBBER ADDITIVES MARKET: OTHER DEVELOPMENTS, 2018–2021

10 COMPANY PROFILES (Page No. - 142)

10.1 MAJOR PLAYERS

(Business Overview, Products Offered, Other Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

10.1.1 BASF SE

FIGURE 41 BASF SE: COMPANY SNAPSHOT

TABLE 170 BASF SE: COMPANY OVERVIEW

10.1.2 LANXESS AG

FIGURE 42 LANXESS AG: COMPANY SNAPSHOT

TABLE 171 LANXESS AG: COMPANY OVERVIEW

10.1.3 ARKEMA SA

FIGURE 43 ARKEMA SA: COMPANY SNAPSHOT

TABLE 172 ARKEMA SA: COMPANY OVERVIEW

10.1.4 SOLVAY SA

FIGURE 44 SOLVAY SA: COMPANY SNAPSHOT

TABLE 173 SOLVAY SA: COMPANY OVERVIEW

10.1.5 SINOPEC CORPORATION

FIGURE 45 SINOPEC CORPORATION: COMPANY SNAPSHOT

TABLE 174 SINOPEC CORPORATION: COMPANY OVERVIEW

10.1.6 R.T. VANDERBILT COMPANY, INC.

TABLE 175 R.T. VANDERBILT COMPANY, INC.: COMPANY OVERVIEW

10.1.7 EMERY OLEOCHEMICALS LLC

TABLE 176 EMERY OLEOCHEMICALS LLC: COMPANY OVERVIEW

10.1.8 BEHN MEYER GROUP

TABLE 177 BEHN MEYER GROUP: COMPANY OVERVIEW

10.1.9 TORAY INDUSTRIES, INC.

FIGURE 46 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 178 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

10.1.10 SUMITOMO CHEMICAL

FIGURE 47 SUMITOMO CHEMICAL: COMPANY SNAPSHOT

TABLE 179 SUMITOMO CHEMICAL: COMPANY OVERVIEW

10.2 OTHER KEY MARKET PLAYERS

10.2.1 CHINA SUNSHINE CHEMICAL HOLDINGS LIMITED

TABLE 180 CHINA SUNSHINE CHEMICAL HOLDINGS LIMITED: COMPANY OVERVIEW

10.2.2 KEMAI CHEMICAL CO. LTD.

TABLE 181 KEMAI CHEMICAL CO. LTD.: COMPANY OVERVIEW

10.2.3 NATIONAL ORGANIC CHEMICAL INDUSTRIES LIMITED

TABLE 182 NATIONAL ORGANIC CHEMICAL INDUSTRIES LIMITED: COMPANY OVERVIEW

10.2.4 PUKHRAJ ADDITIVES LLP

TABLE 183 PUKHRAJ ADDITIVES LLP: COMPANY OVERVIEW

10.2.5 THOMAS SWAN & CO. LTD.

TABLE 184 THOMAS SWAN & CO. LTD.: COMPANY OVERVIEW

10.2.6 CELANESE CORPORATION

TABLE 185 CELANESE CORPORATION: COMPANY OVERVIEW

10.2.7 STRUKTOL COMPANY OF AMERICA, LLC

TABLE 186 STRUKTOL COMPANY OF AMERICA, LLC: COMPANY OVERVIEW

10.2.8 PRISMA RUBBER ADDITIVES

TABLE 187 PRISMA RUBBER ADDITIVES: COMPANY OVERVIEW

10.2.9 KRATON CORPORATION

TABLE 188 KRATON CORPORATION: COMPANY OVERVIEW

10.2.10 TAOKA CHEMICAL CO., LTD.

TABLE 189 TAOKA CHEMICAL CO., LTD.: COMPANY OVERVIEW

10.2.11 PETER GREVEN GMBH & CO. KG

TABLE 190 PETER GREVEN GMBH & CO. KG: COMPANY OVERVIEW

10.2.12 KING INDUSTRIES INC.

TABLE 191 KING INDUSTRIES INC.: COMPANY OVERVIEW

10.2.13 W.R. GRACE & CO.

TABLE 192 W.R. GRACE & CO.: COMPANY OVERVIEW

10.2.14 WACKER CHEMIE AG

TABLE 193 WACKER CHEMIE AG: COMPANY OVERVIEW

10.2.15 QINGDAO SCIENOC CHEMICAL CO., LTD.

TABLE 194 QINGDAO SCIENOC CHEMICAL CO., LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS (Page No. - 174)

11.1 INTRODUCTION

11.2 LIMITATION

11.3 SYNTHETIC RUBBER MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.4 SYNTHETIC RUBBER MARKET, BY REGION

TABLE 195 SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 196 SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.4.1 ASIA PACIFIC

TABLE 197 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 198 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 199 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 200 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 201 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 202 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.2 NORTH AMERICA

TABLE 203 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 204 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 205 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 206 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 207 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 208 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.3 EUROPE

TABLE 209 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 210 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 211 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 212 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 213 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 214 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.4 MIDDLE EAST & AFRICA

TABLE 215 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 216 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 218 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 220 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.5 SOUTH AMERICA

TABLE 221 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 222 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 223 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 224 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 225 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 226 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

12 APPENDIX (Page No. - 186)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATION

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

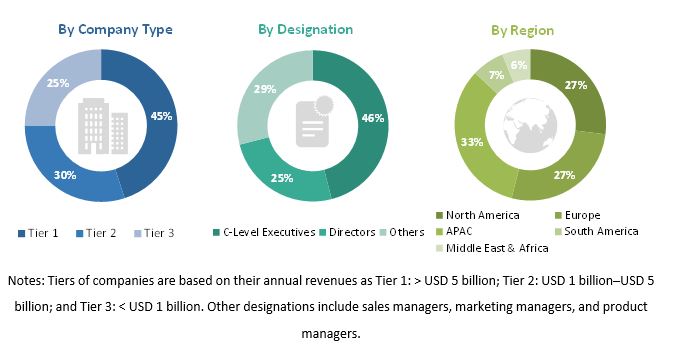

The study involved four major activities to estimate the market size for rubber additives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The rubber additives market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end-users. Various primary sources from the supply and demand sides of the rubber additives market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders in end-use sectors. The primary sources from the supply side included manufacturers, associations, and institutions involved in the rubber additives market. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the rubber additives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the rubber additives market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size by type, and application

- To forecast the size of the market with respect to five main regions (along with key countries of each region), namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To analyze competitive developments such as new product launch, acquisition, and collaboration

- To analyze the impact of COVID-19 on the market and applications

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Regional Analysis

- A further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Application Analysis

- Analysis of rubber additives market with respect to various applications

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rubber Additives Market