Medical Device Reprocessing Market by Type (Reprocessed Medical Devices), Device Category (Critical- Devices, Semi-Critical Devices, Non-Critical Devices), Application (Cardiology, Gynecology, Gastroenterology, Anesthesia) - Global Forecast to 2027

Market Growth Outlook Summary

The global medical device reprocessing market growth forecasted to transform from USD 2.0 billion in 2022 to USD 3.9 billion by 2027, driven by a CAGR of 13.7%. Growth in the market is mainly driven by the favorable regulatory standards for adoption of reprocessed medical devices by healthcare providers. On the other hand, the risk of infection from reprocessed medical devices may pose a threat to the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Device Reprocessing Market Dynamics

Drivers: Increasing level of supply chain cost savings in healthcare facilities

Reprocessing of medical devices and equipment has gained a lot of attention in recent years, not just across healthcare facilities for saving millions of dollars annually, but among manufacturers who are seeing it as a means of achieving substantial competitive advantage. According to the Association of the Medical Devices Reprocessors (AMDR, US), on average, reprocessed medical devices are 30% to 50% cheaper than their new counterparts; due to this, medical device reprocessing has become one of the most adopted strategies for supply chain cost reduction among hospitals, surgical centers, and other healthcare facilities. This frees up funds for end users to hire additional staff, upgrade technologies, and enhance healthcare quality, among other improvements.

Restraints: Increasing risk of hospital acquired infections

Hospital-acquired infections (HAIs) are nosocomial infections that occur during a patient’s stay at hospitals and related facilities. HAIs are not observed at admission and are considered a major cause of morbidity and mortality worldwide. Despite the existence of reprocessing guidelines and advances in device reprocessing methods, inadequate reprocessing of medical devices contribute to a significant proportion of hospital-acquired infection, where 22% of all surgical site infections (SSIs), one of the most common types of HAIs cases, are related to equipment reprocessing.

Opportunities: Regulatory changes favoring adoption of medical device reprocessing

Changing dynamics in a number of countries, such as France, Japan, and the Middle East & Africa, are expected to provide significant growth opportunities for medical device reprocessing. According to the AMDR, Japan is the most recent country to take steps to give hospitals access to remanufactured (commercially reprocessed) single-use medical devices. AMDR sees this as a major development for the global remanufacturing medical device industry, as Japan joins the growing number of countries that are adopting a clear regulatory path for remanufactured single-use devices. Thus, the emergence of regulatory guidelines for reprocessing medical devices in these countries provides significant opportunities for the players in this market to increase their geographic presence and garner a larger share in the medical device reprocessing market in the future.

Challenges: Stringent regulatory procedures for reprocessed medical devices

Reprocessed medical devices should comply with all the standards applicable to a new medical device. The guidelines on reprocessing medical devices do not differentiate between single-use and multi-use medical devices and require the same high standards for both. The safety and performance of the reprocessed device must be equivalent to the original device and must comply with the regulatory standards for medical devices stated in the FDA and EU regulations to receive 510K approval or ISO/CE certifications for marketing in North America and Europe. The pressure to comply with these stringent regulations while reprocessing medical devices serves as a major challenge to the growth of the medical device reprocessing market.

The reprocessed support and services segment is expected to have the highest CAGR during the forecast period

Based on type, the medical device reprocessing market is segmented into reprocessing support & services and reprocessed medical devices. Reprocessing support & services segment is expected to register the highest growth during the forecast period. This is mainly due to the increasing adoption of third party reprocessing services by healthcare facilities to reduce in-house reprocessing costs.

Critical devices segment accounted for the largest share of the medical device reprocessing market in 2021

Based on the device type, the medical device reprocessing market is segmented into critical devices, semi-critical devices, and non-critical devices. In 2021, the critical devices segment accounted for the largest share of this market. The rising number of cardiac diseases and their diagnosis globally, as well as the adoption of reprocessed catheters, have further increased as a means to reduce hospital and procedure costs, thereby, driving the market growth.

The cardiology segment accounted for the largest share of the medical device reprocessing market in 2021

Based on application, the medical device reprocessing market is segmented into cardiology, gastroenterology, gynecology, arthroscopy and orthopedic surgery, general surgery & anesthesia, and other applications (urology, non-invasive surgeries, and patient monitoring). The cardiology segment accounted for the largest share of the global medical device reprocessing market in 2021. This can be attributed to the increasing prevalence of cardiac diseases leading to higher demand for diagnostic and cardiac procedures. The increasing diagnostic and surgical procedures in the specialty area is thereby responsible for the adoption of reprocessed medical devices, as a means to reduce costs associated with buying new device for every new procedure.

Asia Pacific segment is expected to register the highest CAGR during the forecast period

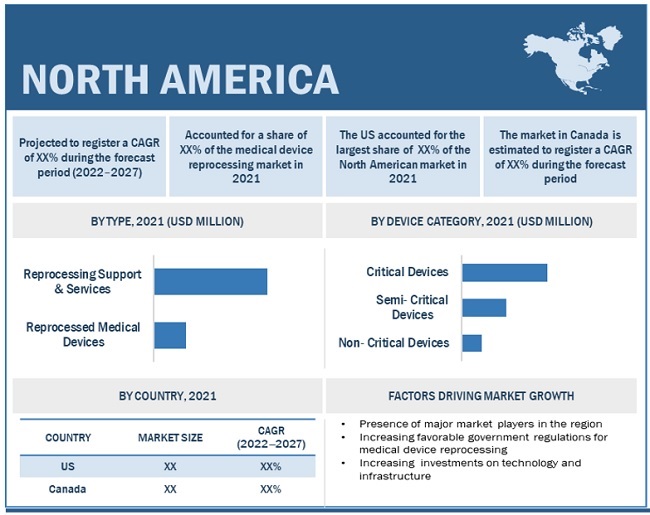

North America accounted for the largest share of the medical device reprocessing market in 2021. However, the medical device reprocessing market in the Asia Pacific is expected to register the highest growth during the forecast period. This can be attributed to the growing economy, the increasing prevalence of chronic diseases, and the growing need to reduce hospital costs.

To know about the assumptions considered for the study, download the pdf brochure

Medical Device Reprocessing Market Key Players

The prominent players in the medical device reprocessing market include Stryker Corporation (US), Johnson & Johnson (US), Vanguard AG (Germany), Medtronic PLC (Ireland), Steris Healthcare (US), Medline ReNewal (US), Innovative Health (US), Arjo Group (ReNu Medical, Inc.) (Sweden), SteriPro Canada, INC. (Canada), Northeast Scientific, INC. (US), Cardinal Health (Sustainable Technologies) (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Type, Device Category, and Application |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

Stryker Corporation (US), Johnson & Johnson (US), Vanguard AG (Germany), Medtronic PLC (Ireland), Steris Healthcare (US), Medline ReNewal (US), Innovative Health (US), Arjo Group (ReNu Medical, Inc.) (Sweden), SteriPro Canada, INC. (Canada), Northeast Scientific, INC. (US), Cardinal Health (Sustainable Technologies) (US), SureTek Medical (US), Konoike Group (Japan), Avante Health Solutions (US), Medsalv (New Zealand), and Vitruvia Medical AG (Switzerland). |

The study categorizes the Medical Device Reprocessing Market based on type, device category, application, and regional level.

By Type

- Reprocessing Support & Services

- Reprocessed medical devices

By Device Category

- Critical Devices

- Semi- Critical Devices

- Non- Critical Devices

By Application

- Cardiology

- Gastroenterology

- Gynecology

- Arthroscopy & Orthopedic Surgery

- General Surgery and Anesthesia

- Other Applications (Urology, non-invasive surgeries, patient monitoring)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Australia

- Japan

- China

- India

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments

- In 2022, Innovative Health, LLC has received clearance to reprocess the Philips Eagle Eye Platinum digital IVUS (intravascular ultrasound) catheter. This clearance effectively marks the company’s entry into the cath lab space, thereby expanding the company’s medical device reprocessing market reach in cardiology applications.

- In 2022, Medline ReNewal opened a new distribution center in Southaven, Mississippi. The facility serves major hospitals, nursing homes, and military facilities in the region. The company invested in expanding its storage and distribution capacity in Mississippi to meet the product needs of its healthcare customers. Over USD 350.0 million in annual orders are expected to be handled from the Southaven facility.

- In 2021, a group of private equity giants acquired Medline industries for more than USD 30 billion. However, even after the transaction, Medline remained a privately-held company.

- In 2021, Innovative Health, LLC announced the opening of its new Research & Innovation Center, which will focus on expanding the power of reprocessing into new therapeutic areas and device technologies. With a focus on technology and innovation, the company aims to enhance its current medical device reprocessing technology and expand its service portfolio in various therapeutic application areas.

- In 2020, Northeast Scientific Inc. received the FDA clearance for reprocessing the .014 Digital IVUS catheter. With this clearance, the company was able to add the 0.14 Digital IVUS catheter to its existing portfolio of reprocessed medical devices.

Frequently Asked Questions (FAQ):

Which are the top industry players in the medical device reprocessing market?

The top market players in the global medical device reprocessing market include Stryker Corporation (US), Johnson & Johnson (US), Vanguard AG (Germany), Medtronic PLC (Ireland), Steris Healthcare (US), Medline ReNewal (US), Innovative Health (US), Arjo Group (ReNu Medical, Inc.) (Sweden), SteriPro Canada, INC. (Canada), Northeast Scientific, INC. (US), and Cardinal Health (Sustainable Technologies) (US).

Which global medical device reprocessing services have been included in this report?

This report contains the following main segments:

- Reprocessing support & services

- Reprocessed medical devices

Which geographical region is dominating the global medical device reprocessing market?

The global medical device reprocessing market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. North America accounted for the largest share of the medical device reprocessing market, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America has the larger share in the medical device reprocessing market due to factors such as favorable regulatory standards increasing the adoption of reprocessed medical devices by healthcare providers, and the increasing need to reduce hospital costs.

Which is the leading reprocessed medical device?

Based on device type, the medical device reprocessing market is segmented into critical devices, semi-critical devices, and non-critical devices. In 2021, the critical devices segment accounted for the largest share of this market. The growth of this segment is mainly attributed to the rising number of hospital admissions and surgical procedures, leading to an increased use of reprocessed critical devices that costs less than purchasing a new device. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 MEDICAL DEVICE REPROCESSING MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 2 MEDICAL DEVICE REPROCESSING MARKET: RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

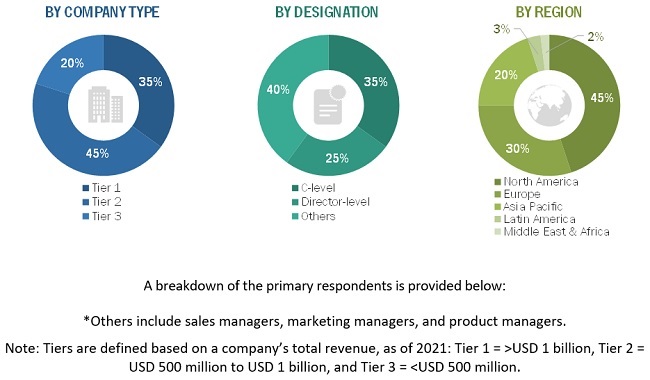

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 8 TOP-DOWN APPROACH

FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 10 CAGR PROJECTIONS

2.4 DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 RESEARCH ASSUMPTIONS

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MEDICAL DEVICE REPROCESSING MARKET

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 12 MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF MEDICAL DEVICE REPROCESSING MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 BRIEF OVERVIEW OF MEDICAL DEVICE REPROCESSING MARKET

FIGURE 16 INCREASING NEED TO MINIMIZE MEDICAL WASTE AND REDUCE HEALTHCARE COSTS TO DRIVE MARKET

4.2 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE AND COUNTRY (2021)

FIGURE 17 AUSTRALIA TO DOMINATE ASIA PACIFIC MEDICAL DEVICE REPROCESSING MARKET DURING FORECAST PERIOD

4.3 MEDICAL DEVICE REPROCESSING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.4 MEDICAL DEVICE REPROCESSING MARKET, BY REGION (2020–2027)

FIGURE 19 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 MEDICAL DEVICE REPROCESSING MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MEDICAL DEVICE REPROCESSING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing level of supply chain cost savings in healthcare facilities

5.2.1.2 Growing adoption of strategies for sustainability and environmental safety

TABLE 3 EXAMPLES OF MARKET PLAYERS PROVIDING SUSTAINABILITY THROUGH REPROCESSING

5.2.1.3 Rising geriatric population

FIGURE 22 GLOBAL GERIATRIC POPULATION (65 YEARS & ABOVE), BY REGION

TABLE 4 IMPACT ANALYSIS: MARKET DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Increasing risk of hospital-acquired infections among patients

5.2.2.2 Increasing number of medical device surface alterations due to reprocessing

TABLE 5 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Regulatory changes favoring adoption of medical device reprocessing

5.2.3.2 Growing opportunities and favorable regulations in developing countries

TABLE 6 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory procedures for reprocessed medical devices

TABLE 7 IMPACT ANALYSIS: CHALLENGES

5.3 KEY CONFERENCES AND EVENTS

TABLE 8 MEDICAL DEVICE REPROCESSING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.4 INDUSTRY TRENDS

5.4.1 EXPANDING SERVICE PORTFOLIO AND MARKET REACH THROUGH ACQUISITIONS

TABLE 9 MAJOR ACQUISITIONS IN MEDICAL DEVICE REPROCESSING MARKET

5.4.2 SPECIALTY REPROCESSING

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT FROM NEW ENTRANTS

5.5.2 THREAT FROM SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7 REGULATORY ANALYSIS

5.7.1 NORTH AMERICA

5.7.1.1 US

FIGURE 23 PREMARKET NOTIFICATION: 510 (K) APPROVAL FOR REPROCESSED MEDICAL DEVICES

5.7.1.2 Canada

5.7.2 EUROPE

TABLE 12 EU COUNTRIES AND THEIR TERRITORY LAWS THAT AUTHORIZE SINGLE-USE DEVICE REPROCESSING

5.7.3 ASIA PACIFIC

5.7.3.1 Japan

5.7.3.2 Australia

5.7.3.3 Rest of Asia Pacific

TABLE 13 INTERNATIONAL STANDARDS FOR MEDICAL DEVICE REPROCESSING

5.8 TECHNOLOGY ANALYSIS

TABLE 14 TECHNOLOGY AND INNOVATION IN MEDICAL DEVICE REPROCESSING MARKET

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN: MEDICAL DEVICE REPROCESSING MARKET

5.10 ECOSYSTEM ANALYSIS

FIGURE 25 MEDICAL DEVICE REPROCESSING MARKET: ECOSYSTEM ANALYSIS

5.11 MEDICAL DEVICE REPROCESSING MARKET: PATENT ANALYSIS

5.11.1 PATENT PUBLICATION TRENDS FOR MEDICAL DEVICE REPROCESSING

FIGURE 26 PATENT PUBLICATION TRENDS (2011–JULY 2022)

5.11.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 27 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR MEDICAL DEVICE REPROCESSING (JANUARY 2011–JULY 2022)

FIGURE 28 TOP APPLICANT JURISDICTIONS FOR MEDICAL DEVICE REPROCESSING PATENTS (JANUARY 2011–JULY 2022)

TABLE 15 LIST OF PATENTS/PATENT APPLICATIONS IN MEDICAL DEVICE REPROCESSING MARKET, 2021–2022

5.12 IMPACT OF COVID-19 ON MEDICAL DEVICE REPROCESSING MARKET

6 MEDICAL DEVICE REPROCESSING MARKET, BY TYPE (Page No. - 69)

6.1 INTRODUCTION

TABLE 16 MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 REPROCESSING SUPPORT AND SERVICES

6.2.1 REDUCING IN-HOUSE REPROCESSING COSTS AND INCREASING REGULATORY MANDATES TO DRIVE MARKET

TABLE 17 REPROCESSING SUPPORT AND SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 REPROCESSED MEDICAL DEVICES

6.3.1 INCREASING ADOPTION OF REPROCESSED DEVICES AT LOWER COSTS TO DRIVE MARKET

TABLE 18 REPROCESSED MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

TABLE 19 REPROCESSED MEDICAL DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE (Page No. - 75)

7.1 INTRODUCTION

TABLE 20 MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

7.2 CRITICAL DEVICES

7.2.1 HIGH COST OF BUYING NEW DEVICES TO DRIVE MARKET

TABLE 21 REPROCESSED CRITICAL MEDICAL DEVICE CATEGORY

TABLE 22 CRITICAL DEVICES REPROCESSING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 SEMI-CRITICAL DEVICES

7.3.1 INCREASED CASES OF HOSPITAL-ACQUIRED INFECTIONS TO DRIVE MARKET

TABLE 23 SEMI-CRITICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 NON-CRITICAL DEVICES

7.4.1 INCREASING MEDICAL PROCEDURES AND SURGERIES TO DRIVE MARKET

TABLE 24 NON-CRITICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION (Page No. - 81)

8.1 INTRODUCTION

TABLE 25 MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 CARDIOLOGY

8.2.1 RISING CORONARY ARTERY DISEASE CASES TO PROPEL MARKET

TABLE 26 MEDICAL DEVICE REPROCESSING MARKET FOR CARDIOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 GASTROENTEROLOGY

8.3.1 INCREASING USE OF ENDOSCOPES FOR DISEASE DIAGNOSIS TO DRIVE MARKET

TABLE 27 MEDICAL DEVICE REPROCESSING MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 ARTHROSCOPY AND ORTHOPEDIC SURGERY

8.4.1 REGULATORY INITIATIVES AND COST REDUCTION TO DRIVE MARKET

TABLE 28 APPROVED ORTHOPEDIC/ARTHROSCOPIC DEVICES FOR REPROCESSING

TABLE 29 MEDICAL DEVICE REPROCESSING MARKET FOR ARTHROSCOPY AND ORTHOPEDIC SURGERY, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 GYNECOLOGY

8.5.1 INCREASING GYNECOLOGY PROCEDURES TO DRIVE MARKET

TABLE 30 MEDICAL DEVICE REPROCESSING MARKET FOR GYNECOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.6 GENERAL SURGERY

8.6.1 LOW-COST GENERAL SURGERY DEVICES TO IMPACT MARKET

TABLE 31 MEDICAL DEVICE REPROCESSING MARKET FOR GENERAL SURGERIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.7 OTHER APPLICATIONS

TABLE 32 MEDICAL DEVICE REPROCESSING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 MEDICAL DEVICE REPROCESSING MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 29 MEDICAL DEVICE REPROCESSING MARKET: GEOGRAPHIC SNAPSHOT (2021)

TABLE 33 MEDICAL DEVICE REPROCESSING MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET SNAPSHOT

TABLE 34 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Presence of major players and healthcare cost reduction strategies to drive market

FIGURE 31 US: TOTAL NUMBER OF HOSPITALS

TABLE 38 US: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 39 US: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 40 US: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing geriatric population and increasing chronic diseases to drive market

TABLE 41 CANADA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 CANADA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 43 CANADA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 44 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 46 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 47 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Government initiatives and well-established standards to drive market

TABLE 48 GERMANY: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 GERMANY: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 50 GERMANY: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Increasing hospital admissions to drive market

TABLE 51 UK: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 UK: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 53 UK: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Growing diagnostic medical device market with rising chronic diseases to propel market

TABLE 54 FRANCE: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 FRANCE: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 56 FRANCE: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing use of diagnostic devices and government initiatives to drive market

TABLE 57 ITALY: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 ITALY: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 59 ITALY: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Increasing focus on reducing hospital costs to drive market

TABLE 60 SPAIN: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 SPAIN: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 62 SPAIN: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 63 REST OF EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 REST OF EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 65 REST OF EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET SNAPSHOT

TABLE 66 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 69 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.1 AUSTRALIA

9.4.1.1 Growing adoption of medical devices for diagnosis and treatment to drive market

TABLE 70 AUSTRALIA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 AUSTRALIA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 72 AUSTRALIA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Regulatory reforms and need to reduce hospital costs to drive market

TABLE 73 JAPAN: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 JAPAN: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 75 JAPAN: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.3 CHINA

9.4.3.1 Government initiatives and developing economy to drive market

TABLE 76 CHINA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 CHINA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 78 CHINA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4 INDIA

9.4.4.1 Government initiatives for diagnosis and treatment to drive market

TABLE 79 INDIA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 INDIA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE 2020–2027 (USD MILLION)

TABLE 81 INDIA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 82 REST OF ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 REST OF ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 INCREASING CHRONIC DISEASES AND ADOPTION OF MEDICAL DEVICES TO DRIVE MARKET

TABLE 85 LATIN AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 LATIN AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 87 LATIN AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 EMERGENCE OF REGULATORY FRAMEWORKS TO DRIVE MARKET

TABLE 88 MIDDLE EAST & AFRICA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 126)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MEDICAL DEVICE REPROCESSING MARKET

10.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS

FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN MEDICAL DEVICE REPROCESSING MARKET

10.4 MARKET SHARE ANALYSIS, 2021

FIGURE 34 MEDICAL DEVICE REPROCESSING MARKET SHARES, BY KEY PLAYER, 2021

TABLE 91 MEDICAL DEVICE REPROCESSING MARKET: DEGREE OF COMPETITION

10.5 COMPETITIVE BENCHMARKING

TABLE 92 MEDICAL DEVICE REPROCESSING MARKET: DETAILED LIST OF SMALL AND MEDIUM PLAYERS

10.6 COMPANY FOOTPRINT

TABLE 93 FOOTPRINT OF COMPANIES IN MEDICAL DEVICE REPROCESSING MARKET

TABLE 94 SERVICE FOOTPRINT OF COMPANIES (16 COMPANIES)

TABLE 95 APPLICATION FOOTPRINT OF COMPANIES (16 COMPANIES)

TABLE 96 REGIONAL FOOTPRINT OF COMPANIES (16 COMPANIES)

10.7 COMPANY EVALUATION QUADRANT

10.7.1 STARS

10.7.2 EMERGING LEADERS

10.7.3 PERVASIVE PLAYERS

10.7.4 PARTICIPANTS

FIGURE 35 MEDICAL DEVICE REPROCESSING MARKET: COMPANY EVALUATION QUADRANT (2021)

10.8 COMPETITIVE SCENARIO

10.8.1 FDA APPROVALS/SERVICE ENHANCEMENTS

10.8.2 DEALS

10.8.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 140)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 STRYKER CORPORATION

TABLE 100 STRYKER CORPORATION: COMPANY OVERVIEW

FIGURE 36 STRYKER CORPORATION: COMPANY SNAPSHOT (2021)

11.1.2 JOHNSON & JOHNSON

TABLE 101 JOHNSON & JOHNSON: COMPANY OVERVIEW

FIGURE 37 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

11.1.3 MEDTRONIC PLC

TABLE 102 MEDTRONIC PLC: COMPANY OVERVIEW

FIGURE 38 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

11.1.4 STERIS HEALTHCARE

TABLE 103 STERIS HEALTHCARE: COMPANY OVERVIEW

FIGURE 39 STERIS HEALTHCARE: COMPANY SNAPSHOT (2021)

11.1.5 CARDINAL HEALTH (SUSTAINABLE TECHNOLOGIES)

TABLE 104 CARDINAL HEALTH: COMPANY OVERVIEW

FIGURE 40 CARDINAL HEALTH: COMPANY SNAPSHOT (2021)

11.1.6 ARJO GROUP (RENU MEDICAL, INC.)

TABLE 105 ARJO GROUP: COMPANY OVERVIEW

FIGURE 41 ARJO GROUP: COMPANY SNAPSHOT (2021)

11.1.7 VANGUARD AG

TABLE 106 VANGUARD AG: COMPANY OVERVIEW

11.1.8 MEDLINE RENEWAL

TABLE 107 MEDLINE RENEWAL: COMPANY OVERVIEW

11.1.9 INNOVATIVE HEALTH

TABLE 108 INNOVATIVE HEALTH: COMPANY OVERVIEW

11.1.10 STERIPRO CANADA, INC

TABLE 109 STERIPRO CANADA, INC.: COMPANY OVERVIEW

11.1.11 NORTHEAST SCIENTIFIC, INC.

TABLE 110 NE SCIENTIFIC, INC.: COMPANY OVERVIEW

11.2 OTHER PLAYERS

11.2.1 SURETEK MEDICAL

11.2.2 KONOIKE GROUP

11.2.3 AVANTE HEALTH SOLUTIONS

11.2.4 MEDSALV

11.2.5 VITRUVIA MEDICAL AG

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 169)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global medical device reprocessing market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply side and other participants were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, presidents, vice presidents, directors, marketing directors, marketing managers, and related executives from various key companies and organizations in the medical device reprocessing industry. The primary sources from the other participants group including hospital personnel, C-level executives, department heads, hospital directors, and long-term care center personnel. And others including, private consultants, contract manufacturers, suppliers, distributers and officials from government regulatory bodies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, device type, application, and region).

Data Triangulation

After arriving at the market size, the total medical device reprocessing market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the medical device reprocessing market by type, device type, application and by region.

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall medical device reprocessing market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the medical device reprocessing market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the medical device reprocessing market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, FDA approvals, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the medical device reprocessing market

- To benchmark players within the medical device reprocessing market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offering

- To evaluate and analyze the overall impact of COVID-19 on the medical device reprocessing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe medical device reprocessing market into Switzerland, Russia, the Netherlands, Portugal, Poland, and Belgium

- Further breakdown of the Latin America medical device reprocessing market into Brazil, Mexico, and others.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Device Reprocessing Market