Rat Model Market by Model Type (Outbred, Inbred, Knockout), Technology (CRISPR, Micro Injection), Therapeutic Area (Neurology, Oncology), Service (Breeding, Cryopreservation), Care Products (Cages, Feed, Bedding) & End User -Global Forecast to 2021

[253 Pages Report] The overall rat model market is expected to grow from USD 387.7 million in 2016 to USD 588.9 million by 2021, at a CAGR of 8.7% from 2016 to 2021. Continuous support in the form of investments and grants, and personalized medicine fueling the demand for personalized humanized rat models are some of the factors driving the growth of the rat model market. The rat model market is expanding with the increase in R&D activities in pharmaceutical industries. These rat model are being used in many applications such as toxicology, oncology, diabetes, neurology, immunology and infectious diseases, and others (rare disease, cardiovascular, metabolic disease, hematopoiesis, and regenerative medicines). The base year considered for rat model industry study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Advancements in gene editing tools set to augment the demand for rat models

- Advantages offered by rats over mice

- Continuous support in the form of investments and grants

- Increased demand for personalized humanized rat models due to growing consumption of personalized medicines

Restraints

-

Regulations & laws formulated for ethical use of animals

- The Animal Welfare Act (AWA)

- Public health service policy (PHS) on humane care and use of laboratory animals

- Increased benefits offered by cryopreservation

Opportunities

- Increased production of monoclonal antibodies

- Rising demand of humanized rat models

Challenges

- Advancements in zebrafish model development

- Development of methods alternative to animal testing

The development of advanced rat genome manipulation techniques (such as creation of transgenic rats and knockout rats), drives the global rat model market.

Preclinical animal models, such as mice and rats that are used to predict drug efficacy and toxicity in humans, are needed. Rats are commonly used due to their genetic similarity to humans as well as their unlimited supply and ease of manipulation. Knockout rats are produced by inactivating/silencing or "knocking out" an existing gene and replacing it with an artificial piece of DNA, thereby resulting in the loss of gene activity. This leads to changes in the rat’s phenotypic characteristics, such as appearance, behavior, and other observable biochemical characteristicsc. Knockout/genetically engineered rats segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of knockout/genetically engineered rats segment can be attributed to the use of this type of rat model to carry out researches on disease such as oncology, obesity, heart disease, diabetes, arthritis, drug abuse, anxiety, aging, and Parkinson’s.

The following are the major objectives of the study.

- To describe and forecast the rat model market, in terms of value, by model type, technology, therapeutic area, end user, service, and care product.

- To describe and forecast the rat model market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the rat model ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, approvals, acquisitions, contracts, agreements, collaborations, and partnerships in the rat model market

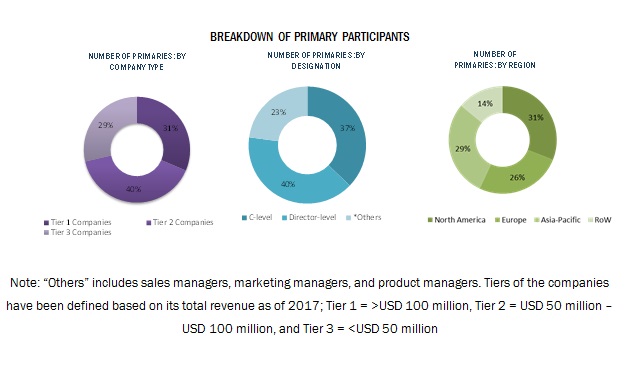

During this research study, major players operating in the rat model market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

The rat model market comprises a network of players involved in the research and product development; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the rat model market are Charles River Laboratories International (US), Envigo (UK), and Taconic Biosciences (US).

Major Market Developments

- In August 2016, Charles River Laboratories, Inc. entered into a strategic partnership with The Milner Therapeutics Institute and Consortium (UK). This partnership with the Consortium allows the academic institutions access to Charles River’s early discovery and drug development and services for the early stage drug development processes.

- In September, 2016, Charles River Laboratories International, Inc. acquired Agilux Laboratories (US), a provider of bioanalytical services, drug metabolism and pharmacokinetic services, and pharmacology services. This acquisition is expected to compliment Charles River’s non-clinical portfolio and improve the clients’ early-stage research efforts by enabling them to seamlessly transition their drug candidates through the discovery and safety assessment process.

- In October 2015, Horizon Discovery Group plc expanded its UK based headquarters. The new facility is likely to accommodate 200 employees across manufacturing, services, research, and general and administrative functions.

Target Audience

- Rat Model and Service Companies

- Government and Private Research Institutes

- Manufacturers and Suppliers of Animal Care Products

- Academic & Research Institutes

- Venture Capitalists

- Medical Research Centers

- Animal Care Associations

- Public and Private Animal Health Agencies

Report Scope:

This research report categorizes the global rat model market into the following segments:

By Model Type

- Outbred Rats

- Inbred Rats

- Knockout/Genetically Modified Rats

- Hybrid/Congenic Rats

- Conditioned/Surgically Modified Rats

- Immunodeficient Rats

By Service

- Breeding

- Cryopreservation

- Quarantine

- Rederivation

- Model-in-licensing

- Genetic Testing

- Other Services

By Therapeutic Area

- Toxicology

- Oncology

- Immunology and Inflammation

- Neurology

- Diabetes

- Other Therapeutic Areas

By Technology

- CRISPR

- Microinjection

- Embryonic Stem Cell Injection

- Nuclear Transfer

- Other Technologies

By Care Product

- Cages

- Feed

- Bedding

- Other Care Products

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

By Geography

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The rat model market is expected to reach USD 588.9 million by 2021 from USD 387.7 million in 2016, at a CAGR of 8.7% from 2016 to 2021. The market is mainly driven by factors such as advancements in gene editing tools set to augment the demand for rat models, advantages offered by rats over mice, Continuous support in the form of investments and grants, and Increase in R&D activities carried out by pharmaceutical and biotechnology companies.

The global rat model market involves use of different varieties of rats (inbred rats, outbred rats, and hybrid rats, among others) in the research studies across the globe. Rat models are widely used as research models to study human genes and human diseases. Researchers in academia and industry as well as clinicians use rats extensively in their research works.

On the basis of type, the rat model market is segmented into outbred rats, inbred rats, knockout/genetically engineered rats, hybrid/congenic rats, conditioned/surgically modified rats, and immunodeficient rats model. Knockout/genetically engineered rats segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of knockout/genetically engineered rats segment can be attributed to the use of this type of rat model to carry out researches on disease such as oncology, obesity, heart disease, diabetes, arthritis, drug abuse, anxiety, aging, and Parkinson’s.

On the basis of services, the rat model market is segmented into breeding, cryopreservation, quarantine, rederivation, model in-licensing, genetic testing, and others such as surgical services, line rescue services, and in vivo pharmacology services. The cryopreservation segment is estimated grow at the highest CAGR during the forecast period, as this segment help in obtaining the genetic material of rats even after the reproductive lifespan of these rats is over. This cuts down time and cost needed for reproduction of rats.

On the basis of technology, the rat model market is segmented into CRISPR, microinjection, embryonic stem cell injection, nuclear transfer technology, and others (genetically modified sperm-mediated gene transfer, Virus/vector-mediated gene transfer, Liposome-Mediated DNA Transfers, Electroporation of DNA, Biolistics, and TALENs & ZFN). The CRISPR segment accounted for the largest share of the rat model market in 2016. The large share of this segment is mainly attributed to its ease of use and ability to multiply.

On the basis of therapeutic area, the rat model market is segmented into toxicology, oncology, diabetes, neurology, immunology and infectious diseases, and others (rare disease, cardiovascular, metabolic disease, hematopoiesis, and regenerative medicines). The toxicology settings segment commanded the largest share of the rat model market in 2016. The large share of this segment can primarily be attributed to its use for new drug testing in preclinical stages, and toxicity and safety assessment studies.

On the basis of end users, the rat model market is segmented into academic & research institutes, pharmaceutical & biotechnology companies, and Contract Research Organizations (CROs). The pharmaceutical & biotechnology companies segment commanded the largest share of the rat model market in 2016. The large share of this segment can primarily be attributed to the increasing R&D expenditure by companies.

Rat model applications in various therapeutic indications such as toxicology, oncology, diabetes, neurology, immunology and infectious diseases, and others (rare disease, cardiovascular, metabolic disease, hematopoiesis, and regenerative medicines) coupled with the increase in R&D activities carried out by pharmaceutical and biotechnology companies drive the growth of rat model market

TOXICOLOGY

Toxicology is the study of adverse effects of chemical, physical, or biological agents on people, animals, and the environment. Rats are predominantly used in the toxicity and safety assessment studies of a drug substance. Other animals that are used in these studies include mice, rabbits, and guinea pigs. Toxicology testing in animals is required to prove that the new drugs are safe before their administration in humans. A high proportion of new drugs fail in preclinical stage is due to the unacceptable toxicity in animals.

ONCOLOGY

Rat models recapitulate various aspects of genesis, progression, and clinical course of human cancers. Hence, they act as ideal study models for cancer researchers engaged in a variety of basic, translational, clinical, and epidemiological investigations.

IMMUNOLOGY AND INFLAMMATION

Rat models are used in immunology and inflammation studies as they help to assess the physiological relevance of an experimental finding. They also assist in identifying the functions of newly identified surface receptors in host defense as well as the developmental consequences of a disturbed signaling pathway or removing a transcription factor.

NEUROLOGY

Rat models serve as suitable animal models for detailed and accurate analysis of the mechanism of human neurodegenerative diseases. They help in the development and evaluation of new therapeutic strategies. Transgenic rat models are available for several neurological human conditions such as prion diseases, human retroviral diseases, Alzheimer’s disease, Parkinson’s disease, motor neuron diseases, anxiety, and others. Rat models for anxiety disorder have been useful for providing information on brain and behavioral mechanisms involved in the etiology and physiopathology of anxiety disorder.

DIABETES

Rats are considered to be excellent experimental models for understanding the complex genetic basis of diseases such as diabetes. Due to the ever-increasing prevalence of diabetes globally; it has become important to study the mechanism of the disease. However, it is quite difficult to carry out research studies in human beings, owing to problems such as genetic heterogeneity and lack of controlled lifestyles. Rat models act as suitable models to study specific genetic mutations and to understand the function of genes on a homogeneous genetic background.

Critical questions the report answers:

- Which of the therapeutic application market will dominate in future?

- Which regions will provide the high growth opportunities?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Regulations & laws formulated for ethical use of animals and increased benefits offered by cryopreservation are the major factor restraining the growth of the market. Various regulations and laws have been laid down by governments for ensuring ethical use of animals in research activities. Research institutes and companies carrying out studies on animals have to comply with these standards and requirements formulated for animal testing.

The key players in the global rat model market include Charles River Laboratories International (US), Envigo (UK), and Taconic Biosciences (US). Other players include Horizon Discovery Group (UK), genOway (France), Laboratory Corporation of America Holdings (US), Transposagen Biopharmaceuticals (US), Transviragen (US), Janvier Labs (France), and Biomere (US).

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Methodology

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Research

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Insights From Primary Sources

2.2.2.3 Key Industry Insights

2.3 Market Size Estimation Methodology

2.4 Market Forecast Methodology

2.5 Market Data Validation and Triangulation

2.6 Assumptions for the Study

3 Executive Summary (Page No. - 35)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 43)

4.1 Rat Model Market Overview

4.2 Regional Analysis: Global Rat Care Product Market, By Type

4.3 Global Rat Model Market, By Therapeutic Area, 2016 & 2021

4.4 Regional Snapshot of the Global Rat Model Market

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Advancements in Gene Editing Tools Set to Augment the Demand for Rat Models

5.2.1.2 Advantages Offered By Rats Over Mice

5.2.1.3 Continuous Support in the Form of Investments and Grants

5.2.1.4 Increased Demand for Personalized Humanized Rat Models Due to Growing Consumption of Personalized Medicines

5.2.1.5 Increase in R&D Activities Carried Out By Pharmaceutical and Biotechnology Companies

5.2.2 Restraints

5.2.2.1 Regulations & Laws Formulated for Ethical Use of Animals

5.2.2.1.1 the Animal Welfare Act (AWA)

5.2.2.1.2 Public Health Service Policy (PHS) on Humane Care and Use of Laboratory Animals

5.2.2.2 Increased Benefits Offered By Cryopreservation

5.2.3 Opportunities

5.2.3.1 Increased Production of Monoclonal Antibodies

5.2.3.2 Rising Demand of Humanized Rat Models

5.2.4 Challenges

5.2.4.1 Advancements in Zebrafish Model Development

5.2.4.2 Development of Methods Alternative to Animal Testing

6 Clinical Trials & Research Studies Assessment (Page No. - 56)

6.1 Introduction

6.2 Clinical Trials

6.3 Research Studies

7 Global Rat Model Market, By Model Type (Page No. - 65)

7.1 Introduction

7.2 Outbred Rats

7.3 Inbred Rats

7.4 Knockout/Genetically Engineered Rats

7.5 Hybrid/Congenic Rats

7.6 Conditioned/Surgically Modified Rats

7.7 Immunodeficient Rats

8 Global Rat Model Market, By Service (Page No. - 74)

8.1 Introduction

8.2 Breeding

8.3 Cryopreservation

8.4 Quarantine

8.5 Rederivation

8.6 Model In-Licensing

8.7 Genetic Testing

8.8 Others

8.8.1 Surgical Services

8.8.2 Line Rescue Services

8.8.3 In Vivo Pharmacology Services

9 Global Rat Model Market, By Technology (Page No. - 85)

9.1 Introduction

9.2 Crispr

9.3 Microinjection

9.4 Embryonic Stem Cell Injection

9.5 Nuclear Transfer

9.6 Other Technologies

10 Global Rat Model Market, By Therapeutic Area (Page No. - 94)

10.1 Introduction

10.2 Toxicology

10.3 Oncology

10.3.1 New Product Launches for Oncology Research

10.3.2 Continuous Grants/Funds to Support Cancer Research Studies

10.4 Immunology and Inflammation

10.5 Neurology

10.6 Diabetes

10.7 Others

11 Global Rat Model Market, By End User (Page No. - 106)

11.1 Introduction

11.2 Pharmaceutical & Biotechnology Companies

11.3 Academic & Research Institutions

11.4 Contract Research Organizations (CRO)

12 Global Rat Model Market, By Care Product (Page No. - 112)

12.1 Introduction

12.2 Cages

12.3 Feed

12.4 Bedding

12.5 Other Care Products

13 Global Rat Model Market, By Region (Page No. - 119)

13.1 Introduction

13.2 North America

13.2.1 U.S.

13.2.1.1 Growing Biomedical Research in the U.S.

13.2.1.2 Preclinical Activities By Cros and Pharmaceutical R&D

13.2.1.3 Continued and Responsible Use of Animals Ensured By Animal Care Organizations

13.2.1.4 Development of Biosimilars Product Boosting the Demand for Preclinical Services

13.2.1.5 Monoclonal Antibody Production to Augment the Use of Rat Models

13.2.1.6 Partnership Between Cros and Pharmaceutical Companies

13.2.2 Canada

13.2.2.1 Growing Stem Cell Research Activities in Canada

13.2.2.2 Government Support for Development of Protein Drugs is Expected to Drive the Market

13.3 Europe

13.3.1 Germany

13.3.1.1 Launch of Pro-Test Deutschland

13.3.1.2 Flourishing Biotechnology Industry

13.3.2 U.K.

13.3.2.1 Investors Demand Strong Statistics for Animal Studies in the U.K.

13.3.2.2 Increase in Cell Therapy Preclinical Research

13.3.3 France

13.3.3.1 Funding for Rare Disease Projects in France

13.3.4 Russia

13.3.4.1 Growing Biomedical Industry in Russia

13.3.5 Rest of Europe

13.3.5.1 Growth in Biotech and Pharma Sector of Italy

13.3.5.2 Growing Investments in Research By Sweden & Denmark

13.3.5.3 Focus on Rare Disease Research Projects

13.3.5.4 Growth in Biosimilars Market to Lead to Increased Preclinical Activities

13.4 Asia-Pacific

13.4.1 China

13.4.1.1 International Alliances for R&D Activities in China

13.4.1.2 Initiatives to Reduce Longer Approval Times

13.4.1.3 Intellectual Property (Ip) Breaches, A Challenge for the China Market

13.4.1.4 Mandatory Animal Testing for All Pharmaceutical Drugs and Cosmetics in China

13.4.1.5 Increasing Investments From Government and Private Sectors in China’s Life Sciences Sector

13.4.2 Japan

13.4.2.1 Growth in Biomedical and Medical Research in Japan

13.4.2.2 Research in Regenerative Medicine

13.4.2.3 Focus on Cancer Research and Treatment

13.4.3 India

13.4.3.1 Growth of the Pharmaceutical Industry in India

13.4.3.2 Development of Bio-Clusters to Boost India’s Biotechnology

13.4.3.3 Growing Presence of Global Players

13.4.3.4 Shift of Outsourcing Preclinical Activities From India to European Nations

13.4.3.5 Weak Intellectual Property Environment in India

13.4.3.6 Limited Infrastructural Facilities in India, A Major Hindrance for Growth of the Rat Model Market

13.4.4 Rest of Asia-Pacific

13.4.4.1 Ongoing Biomedical Research Activities in Australia to Strengthen the Market

13.4.4.2 Growth in Translational and Biomedical Research in Singapore

13.4.4.3 Increase in Animal Research in Malaysia

13.4.4.4 Government Support for Strong Academic and Commercial R&D Activities in Taiwan

13.4.4.5 Rising Pharmaceutical and Biotechnology R&D Activities in Korea

13.5 Rest of the World

13.5.1 Pharmaceutical, Biotechnology, and Research Industries in Brazil to Drive Market Growth

13.5.2 Favorable Business Environment for Pharmaceutical and Biotechnology Industries in Saudi Arabia and the UAE

13.5.3 Increasing Investments in Mexico

14 Competitive Landscape (Page No. - 194)

14.1 Overview

14.2 Market Share Analysis

14.2.1 Introduction

14.2.2 Charles River Laboratories International, Inc. (U.S.)

14.2.3 Envigo (U.K.)

14.2.4 Taconic Biosciences, Inc. (U.S.)

14.3 Competitive Situation and Trends

14.4 Agreements, Collaborations, and Partnerships

14.5 Acquisitions

14.6 Expansions

14.7 New Product Launches

14.8 Other Strategies

15 Company Profiles (Page No. - 206)

(Overview, Products and Services, Financials, Strategy & Development)*

15.1 Introduction

15.2 Charles River Laboratories International, Inc.

15.3 Taconic Biosciences, Inc.

15.4 Envigo

15.5 Laboratory Corporation of America Holdings

15.6 Janvier Labs

15.7 Genoway S.A.

15.8 Biomere

15.9 Transposagen Biopharmaceuticals, Inc.

15.10 Horizon Discovery Group PLC

15.11 Transviragen, Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 237)

16.1 Discussion Guide

16.2 Other Developments

16.2.1 Charles River Laboratories International, Inc.

16.2.2 Taconic Biosciences, Inc.

16.2.3 Envigo

16.2.4 Laboratory Corporation of America Holdings

16.2.5 Genoway S.A.

16.2.6 Horizon Discovery Group PLC

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

16.7 Author Details

List of Tables (132 Tables)

Table 1 Indicative List of Clinical Trials Conducted on Rat Models

Table 2 Indicative List of Research Studies Conducted on Rat Models

Table 3 Global Rat Model Market, By Model Type, 2014-2021 (USD Million)

Table 4 Market for Outbred Rats, By Region, 2014-2021 (USD Thousand)

Table 5 Market for Inbred Rats, By Region, 2014-2021 (USD Thousand)

Table 6 Market for Knockout/Genetically Engineered Rats, By Region, 2014-2021 (USD Thousand)

Table 7 Market for Hybrid/Congenic Rats, By Region, 2013-2021 (USD Thousand)

Table 8 Market for Conditioned/Surgically Modified Rats, By Region, 2013-2021 (USD Thousand)

Table 9 Market for Immunodeficient Rats, By Region, 2013-2021 (USD Thousand)

Table 10 Global Market, By Service, 2014-2021 (USD Million)

Table 11 Market for Breeding, By Region, 2014-2021 (USD Thousand)

Table 12 Market for Cryopreservation, By Region, 2014-2021 (USD Thousand)

Table 13 Market for Quarantine, By Region, 2014-2021 (USD Thousand)

Table 14 Market for Rederivation, By Region, 2014-2021 (USD Thousand)

Table 15 Market for Model In-Licensing, By Region, 2014-2021 (USD Thousand)

Table 16 Market for Genetic Testing, By Region, 2014-2021 (USD Thousand)

Table 17 Market for Others , By Region, 2014-2021 (USD Thousand)

Table 18 Global Market, By Technology, 2014-2021 (USD Million)

Table 19 Market for Crispr, By Region, 2014-2021 (USD Thousand)

Table 20 Market for Microinjection, By Region, 2014-2021 (USD Thousand)

Table 21 Market for Embryonic Stem Cell Injection, By Region, 2014-2021 (USD Thousand)

Table 22 Market for Nuclear Transfer, By Region, 2014-2021 (USD Thousand)

Table 23 Market for Other Technologies, By Region, 2014-2021 (USD Thousand)

Table 24 Global Market, By Therapeutic Area, 2014-2021 (USD Million)

Table 25 Market in Toxicology, By Region, 2014-2021 (USD Thousand)

Table 26 List of Cancer Research Studies Using Rat Models

Table 27 Market in Oncology, By Region, 2013-2021 (USD Thousand)

Table 28 Market in Immunology and Inflammation, By Region, 2014-2021 (USD Thousand)

Table 29 Indicative List of Neurological Research Studies Using Rat Model

Table 30 Market in Neurology, By Region, 2014-2021 (USD Thousand)

Table 31 Market in Diabetes, By Region, 2014-2021 (USD Thousand)

Table 32 Market in Others, By Region, 2014-2021 (USD Thousand)

Table 33 Global Market, By End User, 2014-2021 (USD Million)

Table 34 Market for Pharmaceutical & Biotechnology Companies, By Region, 2014-2021 (USD Thousand)

Table 35 Market for Academic & Research Institutions, By Region, 2014-2021 (USD Thousand)

Table 36 Market for Contract Research Organizations, By Region, 2014-2021 (USD Thousand)

Table 37 Global Rat Care Product Market, By Type, 2014-2021 (USD Thousand)

Table 38 Rat Care Product Market for Cages, By Region, 2014-2021 (USD Thousand)

Table 39 Rat Care Product Market for Feed, By Region, 2014-2021 (USD Thousand)

Table 40 Rat Care Product Market for Bedding, By Region, 2014-2021 (USD Thousand)

Table 41 Rat Care Product Market for Other Care Products, By Region, 2014-2021 (USD Thousand)

Table 42 Market, By Region, 2014–2021 (USD Million)

Table 43 North America: Market, By Country, 2014–2021 (USD Million)

Table 44 North America: Market, By Model Type, 2014–2021 (USD Million)

Table 45 North America: Market, By Service, 2014–2021 (USD Thousand)

Table 46 North America: Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 47 North America: Market, By Technology, 2014–2021 (USD Thousand)

Table 48 North America: Market, By End User, 2014–2021 (USD Million)

Table 49 North America: Rat Care Product Market, By Care Product, 2014–2021 (USD Thousand)

Table 50 Nih Funding for Projects Related to Animal Models

Table 51 Associations Directly Related to the Animal Model Market

Table 52 Associations Indirectly Related to the Animal Model Market

Table 53 U.S.: Market, By Model Type, 2014–2021 (USD Million)

Table 54 U.S.: Market, By Service, 2014–2021 (USD Million)

Table 55 U.S.: Market, By Therapeutic Area, 2014–2021 (USD Million)

Table 56 U.S.: Market, By Technology, 2014–2021 (USD Thousand)

Table 57 U.S.: Market, By End User, 2014–2021 (USD Million)

Table 58 Canada: Market, By Model Type, 2014–2021 (USD Thousand)

Table 59 Canada: Market, By Service, 2014–2021 (USD Thousand)

Table 60 Canada: Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 61 Canada: Market, By Technology, 2014–2021 (USD Thousand)

Table 62 Canada: Market, By End User, 2014–2021 (USD Thousand)

Table 63 Europe: Market, By Country, 2014–2021 (USD Thousand)

Table 64 Europe: Market, By Model Type, 2014–2021 (USD Million)

Table 65 Europe: Market, By Service, 2014–2021 (USD Thousand)

Table 66 Europe: Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 67 Europe: Market, By Technology, 2014–2021 (USD Thousand)

Table 68 Europe: Market, By End User, 2014–2021 (USD Million)

Table 69 Europe: Rat Care Product Market, By Care Product, 2014–2021 (USD Thousand)

Table 70 Germany: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 71 Germany: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 72 Germany: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 73 Germany: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 74 Germany: Rat Model Market, By End User, 2014–2021 (USD Million)

Table 75 U.K.: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 76 U.K.: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 77 U.K.: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 78 U.K.: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 79 U.K.: Rat Model Market, By End User, 2014–2021 (USD Million)

Table 80 France: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 81 France: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 82 France: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 83 France: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 84 France: Rat Model Market, By End User, 2014–2021 (USD Thousand)

Table 85 Russia: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 86 Russia: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 87 Russia: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 88 Russia: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 89 Russia: Rat Model Market, By End User, 2014–2021 (USD Thousand)

Table 90 RoE: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 91 RoE: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 92 RoE: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 93 RoE: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 94 RoE: Rat Model Market, By End User, 2014–2021 (USD Thousand)

Table 95 Asia-Pacific: Rat Model Market, By Country, 2014–2021 (USD Million)

Table 96 Asia-Pacific: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 97 Asia-Pacific: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 98 Asia-Pacific: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 99 Asia-Pacific: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 100 Asia-Pacific: Rat Model Market, By End User, 2014–2021 (USD Million)

Table 101 Asia-Pacific: Rat Care Products Market, By Care Product, 2014–2021 (USD Thousand)

Table 102 China: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 103 China: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 104 China: Rat Model Market Size, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 105 China: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 106 China: Rat Model Market, By End User, 2014–2021 (USD Million)

Table 107 Japan: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 108 Japan: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 109 Japan.: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 110 Japan: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 111 Japan: Rat Model Market, By End User, 2014–2021 (USD Thousand)

Table 112 India: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 113 India: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 114 India: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 115 India: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 116 India: Rat Model Market, By End User, 2014–2021 (USD Thousand)

Table 117 Rest of APAC: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 118 Rest of APAC: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 119 Rest of APAC: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 120 Rest of APAC: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 121 Rest of APAC: Rat Model Market, By End User, 2014–2021 (USD Thousand)

Table 122 RoW: Rat Model Market, By Model Type, 2014–2021 (USD Thousand)

Table 123 RoW: Rat Model Market, By Service, 2014–2021 (USD Thousand)

Table 124 RoW: Rat Model Market, By Therapeutic Area, 2014–2021 (USD Thousand)

Table 125 RoW: Rat Model Market, By Technology, 2014–2021 (USD Thousand)

Table 126 RoW: Rat Model Market, By End User, 2014–2021 (USD Thousand)

Table 127 RoW: Rat Care Product Market, By Care Product, 2014–2021 (USD Thousand)

Table 128 Agreements, Collaborations, and Partnerships, 2013–2016

Table 129 Acquisitions, 2013–2016

Table 130 Expansions, 2013–2016

Table 131 New Product Launches, 2013–2016

Table 132 Other Strategies, 2013–2016

List of Figures (47 Figures)

Figure 1 Global Rat Model Market: Research Methodology

Figure 2 Sampling Frame: Primary Research

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Research Design

Figure 7 Data Triangulation Methodology

Figure 8 Global Rat Model Market, By Therapeutic Area (2016)

Figure 9 Global Rat Model Market, By Model Type

Figure 10 Global Rat Model Market, By Service

Figure 11 Global Rat Model Market, By End User

Figure 12 Global Rat Model Market, By Technology

Figure 13 Global Rat Model Market, By Care Product

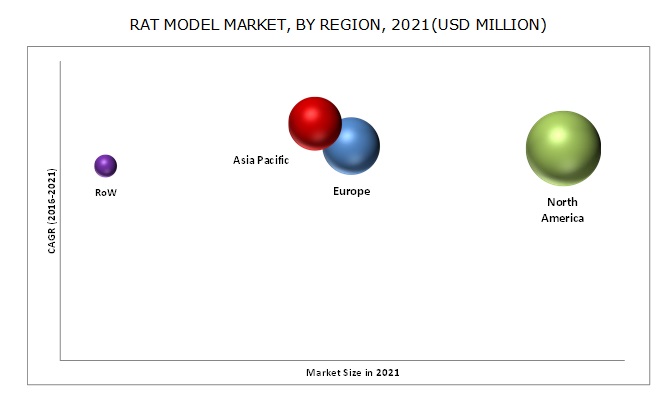

Figure 14 The Asia-Pacific Rat Model Market to Witness the Highest Growth During the Forecast Period

Figure 15 Attractive Opportunities in the Global Rat Model Market

Figure 16 North America Dominated the Global Rat Care Product Market in 2016

Figure 17 The Toxicology Segment to Account for the Largest Share of the Global Rat Model Market During the Forecast Period

Figure 18 The Asia-Pacific Region to Witness the Highest Growth in the Global Rat Model Market From 2016 to 2021

Figure 19 Drivers, Restraints, Opportunities, and Challenges

Figure 20 Clinical Trials Using Rat Models, By Indication

Figure 21 Clinical Trials Using Rat Models, By Phase

Figure 22 Research Studies Using Rat Models, By Indication

Figure 23 Based on Model Type, the Outbred Rats Segment is Estimated to Dominate the Rat Model Market in 2016

Figure 24 Based on Service, the Breeding Segment is Estimated to Dominate the Rat Model Market in 2016

Figure 25 Rat Model Market, By Technology, 2016-2021

Figure 26 Based on Therapeutic Area, the Toxicology Segment is Estimated to Dominate the Rat Model Market in 2016

Figure 27 Based on End User, the Pharmaceutical & Biotechnology Companies Segment is Estimated to Dominate the Rat Model Market in 2016

Figure 28 Based on Care Product, the Cages Segment is Estimated to Dominate the Rat Care Products Market in 2016

Figure 29 North America Dominates the Market for Rat Model Products

Figure 30 North America: Rat Model Market Snapshot

Figure 31 Europe: Rat Model Market Snapshot

Figure 32 Number of Cell Therapy Preclinical Studies Listed in the U.K. Preclinical Research Database , 2013-2016

Figure 33 Asia-Pacific: Rat Model Market Snapshot

Figure 34 Rest of the World: Rat Model Market Snapshot

Figure 35 Major Players Focusing on Inorganic Growth Strategies

Figure 36 Market Share Analysis, By Key Player, 2015

Figure 37 Agreements, Collaborations, and Partnerships Was the Key Growth Strategy Adopted By Market Players

Figure 38 Agreements, Collaborations, and Partnerships, By Company (2013–2016)

Figure 39 Acquisitions, By Company (2013–2016)

Figure 40 Expansions, By Company (2013–2016)

Figure 41 New Product Launches, By Company (2013–2016)

Figure 42 Other Strategies, By Company (2013–2016)

Figure 43 Geographic Revenue Mix of Top Market Players

Figure 44 Charles River Laboratories International, Inc.: Company Snapshot

Figure 45 Laboratory Corporation of America Holdings: Company Snapshot

Figure 46 Genoway S.A.: Company Snapshot

Figure 47 Horizon Discovery Group PLC: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rat Model Market