Protein Ingredients Market Size, Share, Growth Analysis, Industry Trends Report by Source (Animal, Plant, Insect, and Microbial), Form, Application (Food & Beverages, Feed, Cosmetics & Personal Care Products, and Pharmaceuticals), and Region - Global Forecast to 2028

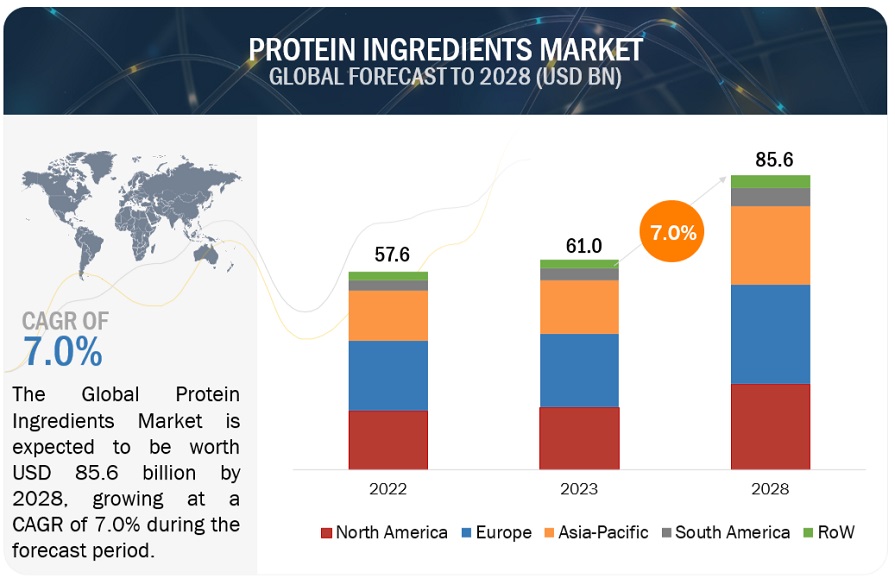

According to MarketsandMarkets, the protein ingredients market is projected to reach USD 85.6 billion by 2028 from USD 61.0 billion in 2023, at a CAGR of 7.0% during the forecast period.

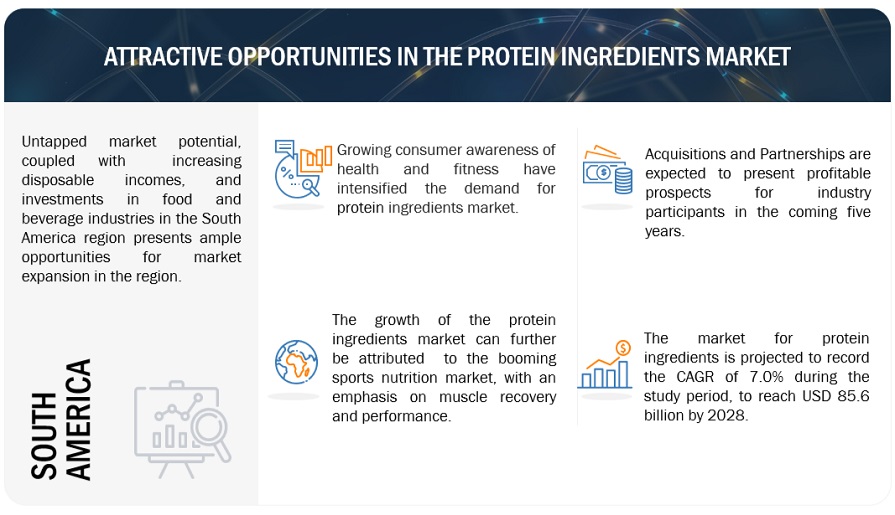

Rising health and wellness awareness has prompted consumers to seek protein-rich and functional foods, leading to increased consumption of protein supplements and fortified products. According to the International Food Information Council's 2024 survey, the percentage of consumers actively trying to consume more protein has grown from 59% in 2022 to 71% in 2024. High-protein diets are becoming more and more popular as a means of supporting muscle growth and recovery due to the growing trends in fitness and sports nutrition. Additionally, the growing prevalence of health-conscious lifestyles and the expanding market for plant-based and functional foods has also significantly boosted its demand. Fitness trends, higher disposable incomes, and a growing preference for healthier dietary choices, further accelerates this growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Increasing demand for proteins as nutritional and functional ingredient

In response to rising consumer demand for ingredients that are both functional and nutritious, the global protein market has grown significantly. As consumers prioritize health and wellness, protein has emerged as a key component in their diets due to its benefits for muscle maintenance, weight management, and overall vitality. Proteins, especially from plant and dairy sources, have become popular due to their versatile uses, from improving plant-based meats to providing convenient protein snacks and sports nutrition products. According to Glanbia's December 2021 report, this demand spans a variety of products, from innovative plant-based proteins that address dietary preferences and sustainability issues to bioactive dairy proteins aimed at enhancing athletic performance. As consumers increasingly prioritize their health, sustainability, and convenience aspects, the protein market is adapting to provide a diverse array of functional and nutritious options.

Restraint: Allergies associated with plant-based protein sources

The market expansion for protein ingredients has been severely hampered by allergies to plant-based protein sources like soy, peas, and certain nuts. These allergies pose a serious risk to one's health as they can cause reactions ranging from minor symptoms like hives and itching to severe anaphylaxis. For instance, as per an article by Food Allergy Research & Education (FARE), soy allergy affects around 0.4% of infants in the US and is more common in newborns and early childhood. These allergies restrict the market growth and make it difficult for producers to develop substitutes free of allergens. This restriction prevents businesses from expanding their market reach as they have to deal with regulatory obstacles as well as invest money on research to ensure the safety of their products. This results in increased production costs and less innovation in the market for protein ingredients.

Opportunity : Demand for plant-based protein from growing vegan population

Vegan population has grown globally due to growing environmental awareness, animal welfare, and health consciousness. Demand for plant-based proteins has increased dramatically due to the growing vegan population. This shift in dietary preferences presents a substantial opportunity for the protein ingredients market. There's a growing need for plant-based protein substitutes as more and more individuals embrace vegan lifestyles. Plant-based proteins, which cater to these dietary choices, are becoming mainstream, leading to innovation and expansion in the protein ingredients market. A 2022 report by the Good Food Institute states that sales of vegan foods—such as dairy and meat substitutes—grew by 54% between 2018 and 2021. This surge reflects the broader trend toward plant-based diets, highlighting the growing market potential for protein ingredients tailored to vegan consumers.

Challenge: Concerns over quality of food & beverages due to adulteration of GM ingredients

Concerns over quality of food & beverages due to the adulteration of genetically modified ingredients pose challenge in the protein ingredients market. Consumers are aware of GM ingredients, fearing potential health risks and environmental impacts. Food and beverage products that contain genetically modified proteins may lose their integrity and lose the trust and demand of consumers. dynamics. This shift has created challenges for manufacturers in sourcing non-GM protein ingredients and maintaining product purity. Production has become more expensive and complex as a result of increased regulatory scrutiny of GM labelling and ingredient traceability. Companies have been compelled to make investments in strict quality controls in order to ensure transparency and maintain consumer trust, which has further complicated the dynamics of the protein ingredients market.

Protein Ingredients Market Ecosystem

Key players within this market consist of reputable and financially robust protein ingredient product manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks.

Plant, By source, is the fastest growing segment among protein ingredient source segment during the study period.

The plant segment within the protein ingredients market is expected to grow at the highest CAGR, driven by increasing consumer demand for sustainable and health-conscious alternatives. People are increasingly turning to plant proteins as they are seen as more environmentally friendly and ethical compared to animal-based proteins. Concerns about animal welfare and the desire for vegan or flexitarian diets are also driving this shift. Additionally, the fact that these proteins are free of cholesterol and have fewer saturated fats makes them preferred for other health reasons. According to the Good Food Institute, sales of plant-based protein powders and liquids in the US has grown by 29% from 2018 to 2021, reflecting this trend. Compared to animal and insect sources, plant proteins are perceived as more versatile and acceptable option, further boosting their growth prospects in the protein ingredients market.

Pharmaceuticals, by application, is the fastest growing segment among application segment during the study period.

The growing emphasis on personalized medicine and advanced treatments is boosting the demand for high-quality protein ingredients in both drug formulations and supplements. Proteins, such as peptides and amino acids, are essential for creating treatments for chronic illnesses, improving muscle recovery, and supporting overall health. They are also important in biopharmaceuticals and injectable therapies, where their stability and effectiveness are crucial. Pharmaceuticals require highly specialized and pure protein ingredients, due to which they are growing at a significantly faster rate than food and beverage, feed, and cosmetics. Additional growth in this field is being driven by the rise in health issues and preventive healthcare.

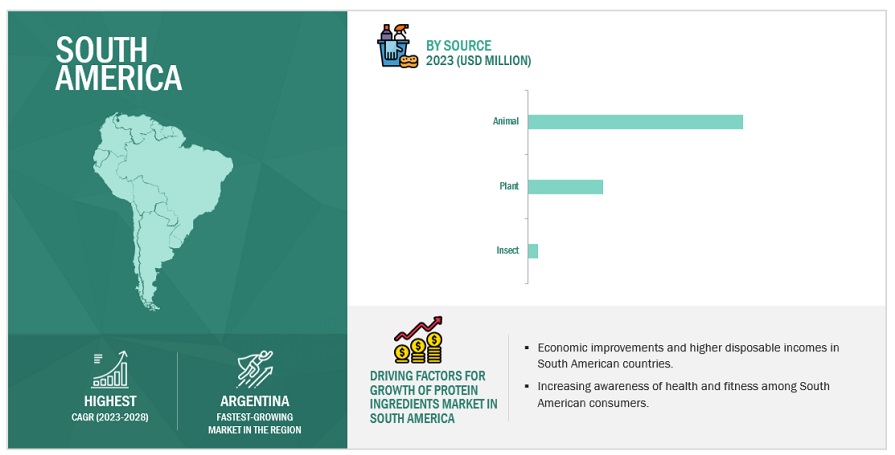

South America is the fastest growing market for protein ingredient among the regions.

South America's protein ingredients market is expected to grow the fastest due to its important role in global protein production and export. Brazil, a major player, is one of the top producers of soybeans and beef worldwide, offering a large supply of protein-rich ingredients. A USDA article from May 2024 states Argentina as the world's top exporter of soymeal, which further increases the region's influence in the protein ingredient market. Growth in the South American protein ingredient market is fueled by these countries strong production capacities as well as growing domestic and international demand. This robust supply chain and export strength make South America a key area of growth in the global protein ingredients market.

Key Market Players

The key players in the protein ingredients market include DuPont (US), ADM (US), Cargill, Incorporated (US), Kerry Group plc (Ireland), Arla Foods amba (Denmark), BRF Global (Brazil), The Scoular Company (US), Roquette Freres (France), AMCO Proteins (US), and Puris (US). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, Europe, South America, and RoW, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments Covered |

By Source, Form, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

|

Target Audience

- Protein raw material (ingredients) suppliers

- Protein based product manufacturers

- Intermediate suppliers, such as traders and distributors of protein ingredients based food & beverages, feed, cosmetics & personal care products, and pharmaceuticals

- Protein ingredients based food & beverages, feed, cosmetics and pharmaceutical companies

- Government and protein research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFSA)

- The Association of American Feed Control Officials

- Food Standards Australia New Zealand

- US Food and Drug Administration (FDA) (US)

- World Health Organization (WHO)

Protein Ingredients Market:

By Source

-

Animal Source

-

Dairy Protein Ingredients

-

Milk Protein

- MPC

- Milk Protein Isolates

- Milk Protein Hydrolysates

-

Whey Protein

- Whey Protein Concentrate

- Whey Protein Isolates

- Casein & Caseinates

-

Milk Protein

- Egg Protein

- Collagen

-

Dairy Protein Ingredients

-

Plant Source

- Soy

- Wheat

- Pea

- Other Sources

- Insect Source

- Microbial Source

By Form

- Dry

- Liquid

By Application

-

Food & Beverages

- Meat & Meat Alternatives

- Dairy & Dairy Alternatives

- Bakery Products

- Performance Nutrition

- Convenience Foods

- Other Food Applications

- Feed

- Cosmetics & Personal Care Products

- Pharmaceuticals

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In April 2024, Arla Foods amba (Denmark) announced an agreement to acquire Volac’s (UK) Whey Nutrition business, including Volac Whey Nutrition Holdings Limited and its subsidiaries. The deal, pending regulatory approval, was set to close later this year. The acquisition aimed to establish the Felinfach site as a global production hub, enhancing Arla Foods Ingredients' offerings in sports nutrition, health, and food sectors.

- In September 2023, Cargill, Incorporated (US) announced the opening of its first European Protein Innovation Hub at its Saint-Cyr en Val facility in France, part of a USD 54.1 million investment. The new hub, which included a test kitchen and pilot plant, aimed to support customers in co-creating and testing protein-rich products. This expansion increased the site's output capacity by 10% and enhanced its sustainability efforts.

- In May 2023, Arla Foods amba (Denmark) launched Lacprodan Alpha-50, a new alpha-lactalbumin-rich ingredient for low-protein infant formulas. This product meets the rising demand for reduced protein content due to obesity concerns and regulatory changes. With 90% of its protein as alpha-lactalbumin, Lacprodan Alpha-50 allows manufacturers to match human milk protein levels with smaller doses.

Frequently Asked Questions (FAQ):

What is the current size of the protein ingredient market?

The protein ingredient market is estimated at USD 61.0 billion in 2023 and is projected to reach USD 85.6 billion by 2028, at a CAGR of 7.0% from 2023 to 2028.

Which are the key players in the market, and how intense is the competition?

The key players in the protein ingredient market include DuPont (US), ADM (US), Cargill, Incorporated (US), Kerry Group plc (Ireland), Arla Foods amba (Denmark), BRF Global (Brazil), The Scoular Company (US), Roquette Freres (France), AMCO Proteins (US), and Puris (US).

The protein ingredient market witnesses increased scope for growth. The market is seeing an increase in the number of new product launches, agreement, acquisitions, and new expansions. Moreover, the companies involved in manufacturing protein ingredient products are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the protein ingredient market?

The European market is expected to dominate during the forecast period. In the European region, there is a strong demand for protein ingredients driven by the growing health-conscious consumer base and increasing prevalence of protein-rich diets. The region's emphasis on sustainability and clean-label products further supports this demand.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the factors driving the protein ingredient market?

The demand for protein ingredient is primarily driven by increasing demand for proteins as nutritional and functional ingredient, rising demand for livestock products, and growing demand for personal and healthcare products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASE IN RETAIL SALESGROWTH OPPORTUNITIES IN DEVELOPING REGIONS

-

5.3 MARKET DYNAMICSDRIVERS- Increasing demand for proteins as nutritional and functional ingredients post COVID-19- Rising demand for livestock products- Growing demand for personal and healthcare productsRESTRAINTS- Ban on plant proteins of GM origin- Cultural restriction on gelatin consumption- Allergies associated with plant-based protein sourcesOPPORTUNITIES- Growing potential of dairy and plant proteins- Demand for plant-based protein from growing vegan populationCHALLENGES- Concerns over quality of food & beverages due to adulteration of GM ingredients- Economic constraints related to processing capacity of pea protein

- 6.1 INTRODUCTION

-

6.2 VALUE CHAINRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGDISTRIBUTIONMARKETING & SALES

-

6.3 TECHNOLOGY ANALYSISCARBON DIOXIDE-BASED PROTEIN INGREDIENTSRECOMBINANT TECHNOLOGY FOR COLLAGEN PRODUCTIONEXTRUSION

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE, BY SOURCE

-

6.5 MARKET MAPPING AND ECOSYSTEMMARKET MAPPING OF ECOSYSTEM- Demand side- Supply side

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.7 PATENT ANALYSIS

-

6.8 TRADE ANALYSISPEPTONES AND THEIR DERIVATIVES (2021)GELATIN (2021)SOYBEAN (2021)PEA (2021)WHEAT AND MESLIN (2021)

- 6.9 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.10 TARIFF AND REGULATORY LANDSCAPE

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.13 CASE STUDIES

- 7.1 INTRODUCTION

-

7.2 ANIMAL SOURCEDIVERSE FLAVOR AND NUTRITION-RICH PROFILE TO DRIVE DEMAND FOR PROTEIN INGREDIENTSDAIRY PROTEIN INGREDIENTS- Milk Protein- Whey Protein- Casein & caseinatesEGG PROTEINCOLLAGEN

-

7.3 PLANT SOURCECONSUMER INCLINATION TOWARD FOOD SUSTAINABILITY AND CONCERN ABOUT ANIMAL CRUELTY TO DRIVE DEMANDSOYWHEATPEAOTHER SOURCES

-

7.4 INSECT SOURCERISING DEMAND FOR ALTERNATIVE PROTEIN TO DRIVE MARKET

-

7.5 MICROBIAL SOURCESUSTAINABLE AND EFFICIENT PRODUCTION PROCESS TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 DRYLONGER SHELF LIFE, CONSISTENT MOUTH FEEL AND TEXTURE, AND EASE OF USE IN RECIPES TO DRIVE DEMAND

-

8.3 LIQUIDEASY BLEND-ABILITY AND GROWING DEMAND FOR RTD BEVERAGES AND INFANT NUTRITION TO INCREASE DEMAND

- 9.1 INTRODUCTION

-

9.2 FOOD & BEVERAGESCONSUMER SHIFT TOWARD HEALTHY AND NUTRITIVE LIFESTYLES TO DRIVE MARKETMEAT & MEAT ALTERNATIVESDAIRY & DAIRY ALTERNATIVESBAKERY PRODUCTSPERFORMANCE NUTRITIONCONVENIENCE FOODSOTHER FOOD APPLICATIONS

-

9.3 FEEDRISING DEMAND FOR LIVESTOCK PRODUCTS TO FUEL DEMAND FOR PROTEIN INGREDIENTS IN FEED INDUSTRY

-

9.4 COSMETICS & PERSONAL CARE PRODUCTSFUELING DEMAND FOR COSMETIC PRODUCTS DUE TO HIGH STRESS ON PERSONAL GROOMING TO DRIVE MARKET

-

9.5 PHARMACEUTICALSINCREASING NUMBER OF AGED POPULATION WORLDWIDE TO BOOST MARKET GROWTH

- 10.1 INTRODUCTION

- 10.2 MACRO INDICATORS OF RECESSION

-

10.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Consumer inclination toward protein-rich products due to rising prevalence of chronic diseases to propel market growthCANADA- Booming food and beverage industry and strengthening insect protein sector to boost marketMEXICO- Strong food industry and surging meat exports to boost market

-

10.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Rise in penetration of collagen and increasing consumption of plant-based food to drive marketFRANCE- Government initiatives for producing insect and plant-based protein and growing cosmetic industry to boost marketUK- Increased health awareness and high dairy products consumption to drive marketITALY- Dominant position in pharmaceutical sector and rising consumer preference for plant-based proteins to boost marketSPAIN- High sales of collagen-based food supplements and meat alternatives to propel marketREST OF EUROPE

-

10.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Increasing application in infant nutrition to drive marketINDIA- Well-established dairy protein industry to support market growthJAPAN- Global partnerships and agreements to influence protein ingredients marketAUSTRALIA & NEW ZEALAND- Investment activities in protein ingredients to drive marketREST OF ASIA PACIFIC

-

10.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Growing soybean production, animal meat exports, and popularity of insect protein to boost marketARGENTINA- Increasing demand for bovine-sourced collagen to drive marketREST OF SOUTH AMERICA

-

10.7 ROWROW: RECESSION IMPACT ANALYSISAFRICA- Surge in cases of malnutrition to drive demand for protein ingredientsMIDDLE EAST- Rising incidences of obesity and diabetes to fuel demand for protein-rich food

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2021

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 KEY PLAYER STRATEGIES

-

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 PRODUCT FOOTPRINT

-

11.7 GLOBAL PROTEIN INGREDIENTS MARKET: EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.8 COMPETITIVE SCENARIONEW PRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSDUPONT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewADM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARLA FOODS AMBA- Business overview- Recent developments- MnM viewBRF GLOBAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE SCOULAR COMPANY- Business overview- Products/Solutions/Services offered- MnM viewROQUETTE FRÈRES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMCO PROTEINS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewA&B INGREDIENTS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPURIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOSUCRA- Business overview- Products/Solutions/Services offered- MnM viewBURCON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOTEXPRO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGT FOOD AND INGREDIENTS- Business overview- Products/Solutions/Services offered- Recent developments- MnM View

-

12.2 OTHER PLAYERSNOW FOODSSHANDONG SINOGLORY HEALTH FOOD CO., LTDPROCESS AGROCHEM INDUSTRIES PVT LTD.CJ SELECTAAMINOLA BVTHE GREEN LABS LLC.ETCHEMBREMIL GROUPCHAITANYA GROUP OF INDUSTRIESNORDIC SOYA OYJR UNIQUE FOODSHIPROMINE S.A.BIOFLYTECHTEBRIO

- 13.1 INTRODUCTION

- 13.2 RESEARCH LIMITATIONS

-

13.3 DAIRY INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 PLANT-BASED PROTEIN MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 PROTEIN INGREDIENTS MARKET SNAPSHOT, 2022 VS. 2028

- TABLE 3 SOY: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TONS)

- TABLE 4 WHEAT: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TONS)

- TABLE 5 PEA: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TONS)

- TABLE 6 PROTEIN INGREDIENTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 7 PATENTS PERTAINING TO PROTEIN INGREDIENTS, 2021–2023

- TABLE 8 TOP TEN IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2021 (KG)

- TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF GELATIN, 2021 (KG)

- TABLE 10 TOP TEN IMPORTERS AND EXPORTERS OF SOYBEAN, 2021 (KG)

- TABLE 11 TOP TEN IMPORTERS AND EXPORTERS OF PEA, 2021 (KG)

- TABLE 12 TOP TEN IMPORTERS AND EXPORTERS OF WHEAT AND MESLIN, 2021 (USD THOUSAND)

- TABLE 13 KEY CONFERENCES AND EVENTS IN PROTEIN INGREDIENTS MARKET, 2023–2024

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 PROTEIN INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOURCES (%)

- TABLE 19 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 20 GELITA AG: COLLAGEN FOR LEAN MUSCLE

- TABLE 21 ADM: SPICED APPLE DRINKABLE YOGURT

- TABLE 22 PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 23 PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 24 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 25 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 DAIRY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 29 DAIRY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 MILK PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 MILK PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 WHEY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 WHEY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 CASEIN & CASEINATES PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 CASEIN & CASEINATES PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 EGG PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 EGG PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 COLLAGEN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 COLLAGEN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 41 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 42 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 45 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 46 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 WHEAT PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 WHEAT PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 PEA PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 PEA PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 OTHER SOURCES: OTHER PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 OTHER SOURCES: OTHER PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 INSECT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 INSECT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 PROTEIN INGREDIENTS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 57 PROTEIN INGREDIENTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 58 DRY FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 DRY FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 LIQUID FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 LIQUID FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY SUB-APPLICATION, 2019–2022 (USD MILLION)

- TABLE 67 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY SUB-APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 MEAT & MEAT ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 MEAT & MEAT ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 DAIRY & DAIRY ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 DAIRY & DAIRY ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 BAKERY PRODUCTS: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 BAKERY PRODUCTS: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 PERFORMANCE NUTRITION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 PERFORMANCE NUTRITION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 CONVENIENCE FOODS: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 CONVENIENCE FOODS: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 OTHER FOOD APPLICATIONS: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 OTHER FOOD APPLICATIONS: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 FEED APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 FEED APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 PET FOOD APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 PET FOOD APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 COSMETICS & PERSONAL CARE PRODUCTS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 COSMETICS & PERSONAL CARE PRODUCTS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 PHARMACEUTICALS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 PHARMACEUTICALS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 98 US: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 99 US: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 100 CANADA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 101 CANADA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 102 MEXICO: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 103 MEXICO: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 105 EUROPE: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 107 EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 EUROPE: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: PROTEIN INGREDIENTS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 111 EUROPE: PROTEIN INGREDIENTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 112 GERMANY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 113 GERMANY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 114 FRANCE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 115 FRANCE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 116 UK: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 117 UK: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 118 ITALY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 119 ITALY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 120 SPAIN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 121 SPAIN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 123 REST OF EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 132 CHINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 133 CHINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 134 INDIA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 135 INDIA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 136 JAPAN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 137 JAPAN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 138 AUSTRALIA & NEW ZEALAND: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 139 AUSTRALIA & NEW ZEALAND: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 147 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 150 BRAZIL: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 151 BRAZIL: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 152 ARGENTINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 153 ARGENTINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 154 REST OF SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 155 REST OF SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 156 ROW: PROTEIN INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 157 ROW: PROTEIN INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 158 ROW: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 159 ROW: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 160 ROW: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 161 ROW: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 162 ROW: PROTEIN INGREDIENTS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 163 ROW: PROTEIN INGREDIENTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 164 AFRICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 165 AFRICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 168 GLOBAL PROTEIN INGREDIENTS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 169 STRATEGIES ADOPTED BY KEY PROTEIN INGREDIENTS MANUFACTURERS

- TABLE 170 COMPANY SOURCE FOOTPRINT

- TABLE 171 COMPANY APPLICATION FOOTPRINT

- TABLE 172 COMPANY REGIONAL FOOTPRINT

- TABLE 173 OVERALL COMPANY FOOTPRINT

- TABLE 174 GLOBAL PROTEIN INGREDIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 175 GLOBAL PROTEIN INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 176 PROTEIN INGREDIENTS: NEW PRODUCT LAUNCHES, 2019–2020

- TABLE 177 PROTEIN INGREDIENTS: DEALS, 2020–2022

- TABLE 178 PROTEIN INGREDIENTS: OTHERS, 2019–2022

- TABLE 179 DUPONT: BUSINESS OVERVIEW

- TABLE 180 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 DUPONT: NEW PRODUCT LAUNCHES

- TABLE 182 DUPONT: DEALS

- TABLE 183 DUPONT: OTHERS

- TABLE 184 ADM: BUSINESS OVERVIEW

- TABLE 185 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ADM: DEALS

- TABLE 187 ADM: OTHERS

- TABLE 188 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 189 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 CARGILL, INCORPORATED: NEW PRODUCT LAUNCHES

- TABLE 191 CARGILL, INCORPORATED: DEALS

- TABLE 192 CARGILL, INCORPORATED: OTHERS

- TABLE 193 KERRY GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 KERRY GROUP PLC: DEALS

- TABLE 195 ARLA FOODS AMBA: BUSINESS OVERVIEW

- TABLE 196 ARLA FOODS AMBA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 ARLA FOODS AMBA: NEW PRODUCT LAUNCHES

- TABLE 198 ARLA FOODS AMBA: OTHERS

- TABLE 199 BRF GLOBAL: BUSINESS OVERVIEW

- TABLE 200 BRF GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- TABLE 202 THE SCOULAR COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 THE SCOULAR COMPANY: OTHERS

- TABLE 204 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 205 ROQUETTE FRÈRES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ROQUETTE FRERES: NEW PRODUCT LAUNCHES

- TABLE 207 ROQUETTE FRÈRES: OTHERS

- TABLE 208 AMCO PROTEINS: BUSINESS OVERVIEW

- TABLE 209 AMCO PROTEINS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 AMCO PROTEINS: NEW PRODUCT LAUNCHES

- TABLE 211 A&B INGREDIENTS: BUSINESS OVERVIEW

- TABLE 212 A&B INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 A&B INGREDIENTS: DEALS

- TABLE 214 PURIS: BUSINESS OVERVIEW

- TABLE 215 PURIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 PURIS: OTHERS

- TABLE 217 COSUCRA: BUSINESS OVERVIEW

- TABLE 218 COSUCRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 COSUCRA: OTHERS

- TABLE 220 BURCON: BUSINESS OVERVIEW

- TABLE 221 BURCON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 BURCON: DEALS

- TABLE 223 BURCON: OTHERS

- TABLE 224 SOTEXPRO: BUSINESS OVERVIEW

- TABLE 225 SOTEXPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 AGT FOOD AND INGREDIENTS: BUSINESS OVERVIEW

- TABLE 227 AGT FOOD AND INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 AGT FOOD AND INGREDIENTS: DEALS

- TABLE 229 NOW FOODS: COMPANY OVERVIEW

- TABLE 230 SHANDONG SINOGLORY HEALTH FOOD CO., LTD: COMPANY OVERVIEW

- TABLE 231 PROCESS AGROCHEM INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 232 CJ SELECTA: COMPANY OVERVIEW

- TABLE 233 AMINOLA BV: COMPANY OVERVIEW

- TABLE 234 THE GREEN LABS: COMPANY OVERVIEW

- TABLE 235 ETCHEM: COMPANY OVERVIEW

- TABLE 236 BREMIL GROUP: COMPANY OVERVIEW

- TABLE 237 CHAITANYA GROUP OF INDUSTRIES: COMPANY OVERVIEW

- TABLE 238 NORDIC SOYA OY: COMPANY OVERVIEW

- TABLE 239 JR UNIQUE FOODS: BUSINESS OVERVIEW

- TABLE 240 PROTENGA: BUSINESS OVERVIEW

- TABLE 241 HIPROMINE S.A.: BUSINESS OVERVIEW

- TABLE 242 BIOFLYTECH: BUSINESS OVERVIEW

- TABLE 243 TEBRIO: BUSINESS OVERVIEW

- TABLE 244 ADJACENT MARKETS

- TABLE 245 DAIRY INGREDIENTS MARKET, BY SOURCE, 2021–2026 (USD MILLION)

- TABLE 246 PLANT-BASED PROTEIN MARKET, BY TYPE, 2019–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 PROTEIN INGREDIENTS MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 PROTEIN INGREDIENTS MARKET SIZE, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 PROTEIN INGREDIENTS MARKET SIZE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 PROTEIN INGREDIENTS MARKET SIZE, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 PROTEIN INGREDIENTS MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 8 RISING CONSUMER HEALTH AWARENESS AND DEMAND FOR MEAT AND MEAT ALTERNATIVES TO DRIVE MARKET

- FIGURE 9 ANIMAL SOURCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN EUROPE AMONG PROTEIN INGREDIENTS SOURCES

- FIGURE 10 ANIMAL SOURCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 DRY FORM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 RETAIL AND FOOD SERVICE SALES IN US (BILLION USD)

- FIGURE 14 GDP GROWTH RATE IN ASIAN COUNTRIES, 2020–2021

- FIGURE 15 MARKET DYNAMICS

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 GLOBAL: AVERAGE SELLING PRICE, BY SOURCE

- FIGURE 18 PROTEIN INGREDIENTS: MARKET MAP

- FIGURE 19 PROTEIN INGREDIENTS: ECOSYSTEM MAPPING

- FIGURE 20 REVENUE SHIFT FOR PROTEIN INGREDIENTS MARKET

- FIGURE 21 NUMBER OF PATENTS GRANTED BETWEEN 2013 TO 2022

- FIGURE 22 TOP TEN INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 23 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- FIGURE 25 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 26 ANIMAL SOURCE TO DOMINATE MARKET FROM 2023 TO 2028 (USD MILLION)

- FIGURE 27 DRY INGREDIENTS SUB-SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 28 PROTEIN INGREDIENTS MARKET SIZE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 29 BIFURCATION OF COSMETICS AND PERSONAL CARE PRODUCT SEGMENTS, MARKET SHARE (%)

- FIGURE 30 PROTEIN INGREDIENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 31 INDICATORS OF RECESSION

- FIGURE 32 WORLD INFLATION RATE: 2011–2021

- FIGURE 33 GLOBAL GDP: 2011–2021 (USD TRILLION)

- FIGURE 34 GLOBAL FOOD INGREDIENTS MARKET: EARLIER FORECAST VS RECESSION FORECAST

- FIGURE 35 RECESSION INDICATORS AND THEIR IMPACT ON PROTEIN INGREDIENTS MARKET

- FIGURE 36 GLOBAL PROTEIN INGREDIENTS MARKET: EARLIER FORECAST VS RECESSION FORECAST

- FIGURE 37 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 38 NORTH AMERICA PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 39 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 40 EUROPE PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 41 EUROPE: PROTEIN INGREDIENTS MARKET SNAPSHOT

- FIGURE 42 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 43 ASIA PACIFIC PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 44 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 45 SOUTH AMERICA PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 46 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET SNAPSHOT

- FIGURE 47 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 48 ROW PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 49 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

- FIGURE 50 GLOBAL PROTEIN INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 51 GLOBAL PROTEIN INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- FIGURE 52 DUPONT: COMPANY SNAPSHOT

- FIGURE 53 ADM: COMPANY SNAPSHOT

- FIGURE 54 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 55 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 56 ARLA FOODS AMBA: COMPANY SNAPSHOT

- FIGURE 57 BRF GLOBAL: COMPANY SNAPSHOT

- FIGURE 58 THE SCOULAR COMPANY: COMPANY SNAPSHOT

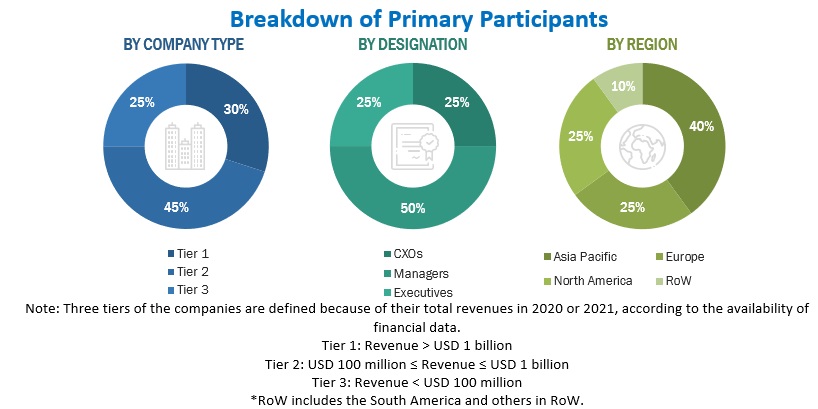

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the global protein ingredients market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the protein ingredients market.

To know about the assumptions considered for the study, download the pdf brochure

Protein Ingredients Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and market have been identified through extensive secondary research.

The revenues of major protein ingredients-based food & beverages, feed, cosmetics & personal care products, and pharma manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

All macroeconomic and microeconomic factors affecting the protein ingredients market growth were considered while estimating the market size.

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Protein Ingredients Market Report Objectives

- To define, segment, and project the global market for protein ingredients on the basis of source, application, form, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the protein ingredients market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis of Protein Ingredients Industry

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe region for protein ingredients market into Belgium, Netherlands, Russia, and other EU and non-EU countries.

- Further breakdown of the Asia Pacific region for the market into Thailand, Vietnam, Indonesia, South Korea, Malaysia, and the Philippines.

- Further breakdown of the Rest of South America region for the market into Colombia, Venezuela, Chile, and Peru.

- Further breakdown of other countries in the RoW market for protein ingredients into Middle East and Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protein Ingredients Market