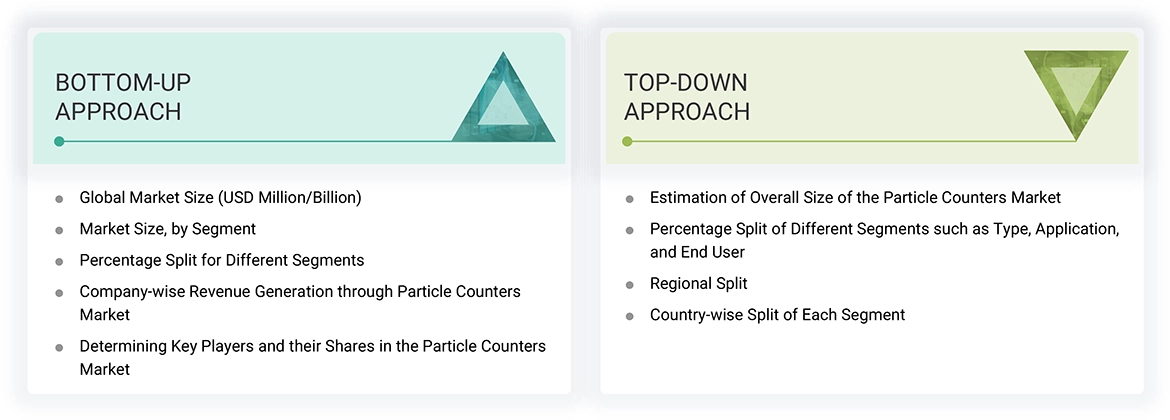

To make a balance between primary and secondary research for the particle counters market, different market variables for small and medium-sized businesses and major businesses were analyzed as part of this study. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The study consists of significant market segments, evolving patterns, regulatory frameworks, and competitive environments. This study also considers leading market players and the strategies they deploy in this market. In conclusion, the total market size was estimated through top-down and bottom-up approaches along with data triangulation to reach the number for the final market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research employed a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach was used to collect and generate data that offers comprehensive, technical, and market-focused insights into the particle counters market. The data provides insights into key players and market segmentation based on recent industry trends, as well as significant developments in the market. A database comprising leading industry figures was also created through this secondary research.

Primary Research

Primary research involved activities aimed at obtaining qualitative and quantitative data. A range of personalities from both supply and demand sides were questioned during this phase. For the supply side, folks from key designations like CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by key players. Among the demand-side primary sources were academic institutions, and research organizations. To validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics of the real-world primary study was carried out.

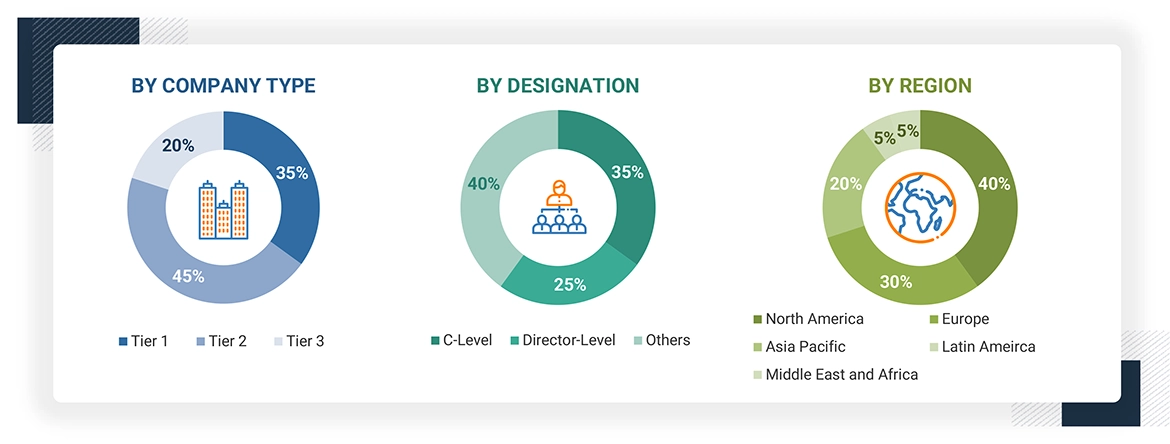

A breakdown of the primary respondents is provided below:

*Others include distributors, suppliers, product managers, business development managers, marketing managers and sales managers.

Note: Companies are categorized into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As per the review of prominent companies and their revenue shares, market size of the global particle counters market was calculated in this report. Key players with significant share in the market were identified as part of secondary research and their particle counters business revenue was calculated, the same was validated by primaries. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

For calculation of global market value, segmental revenue was calculated in the basis of revenue mapping of service/product providers. Process involved below mentioned steps:

-

List of key players that operate in the particle counters market on regional or on country level.

-

Formation of product mapping of manufacturers of particle counters and related product lines at regional and country level

-

Revenue mapping for listed players from particle counters and related product and services.

-

Revenue mapping of major players to cover at least ~70% of the global market share as of 2023. Revenue mapping for major players that cover nearly 70% of the global market share for year 2023.

-

Revenue mapping extrapolation for players will drive the global market value for the respective segment.

-

Summation for market value for all segment and subsegment to achieve actual value of the global value of particle counters market.

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the Particle counters market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, the Particle counters market was verified and validated using both top-down and bottom-up approaches.

Market Definition

Particle counters are monitoring instruments that work on light scattering or light obscuration and measure the particle size and concentration in air or liquid medium samples or environments. Particle counters are an indispensable Quality Assurance (QA) and Quality Control (QC) tool for pharmaceutical and biotechnology product testing, semiconductor testing, medical device testing, and food & beverage testing, among other applications. The market consists of particle counters that are used for environmental monitoring, process control, and quality assurance by various end–users.

Stakeholders

-

Pharmaceutical Industry

-

Medical Device Industry

-

Manufacturers and suppliers of particle counters.

-

Product suppliers, distributors, and channel partners

-

Semiconductor & Electronics Industry

-

Food & beverage industry

-

Chemical Industry

-

Academic & research institutes

-

Community centers and hospitals

-

Regulatory authorities and industry associations

-

Venture capitalists and investment firms

Report Objectives

-

To define, describe, and forecast the market for particle counters based on the types of samples they can detect particles.

-

To give detailed information regarding factors influencing the growth potential of the particle counters market (drivers, restraints, opportunities, challenges, and trends)

-

To study the micro markets by considering individual growth trends, future prospects, and contributions to the particle counters market

-

To study and analyze crucial growth opportunities in the particle counters market for prominent stakeholders and to give insights into the competitive landscape for market leaders.

-

To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

-

To profile the key players in the global particle counters market and deeply analyze their market shares and core capabilities.

-

To study, track, and analyze the competitive developments undertaken in the global particle counters market, such as product launches; agreements; expansions; and mergers & acquisitions.

Growth opportunities and latent adjacency in Particle Counters Market