North American Food Safety Market by Contaminant (Pathogen, GMO, Toxin, Pesticides), Technology (Traditional & Rapid), Food Tested (Meat & Poultry, Dairy, Fruit & Vegetable, Processed Food), & by Country - Trend & Forecast to 2020

In North America, foodborne illnesses and poisoning has been increasing. The major outbreaks of foodborne diseases have been reported due to pathogens such as salmonella, campylobacter, E. coli, and listeria. It has been estimated that nearly 48 million people in the U.S. contract foodborne poisoning each year. Apart from pathogens contamination, toxic materials are found in food products that may be responsible for foodborne toxicity. Hence, it has become necessary for the food manufacturers to establish new food safety standards and implement food testing at different stages of the food value chain. Food manufacturers have been adopting new food processing, packaging, and testing technologies for sustainability. The increase in the outbreaks has emanated the food safety testing market.

The North American food safety testing market has been showing dynamic growth with increasing concern for food contamination, spoilage, and foodborne illnesses. The market has been experiencing growth, driven by increasing consumer awareness on food safety and media influence related to food safety issues. In North America, stringent food safety regulations have been implemented to restrict the presence of pathogens or chemical contaminants that are responsible for the outbreak of foodborne illness. The market includes food testing laboratories as well as technology providers. These market players are experiencing an increasing demand for food safety testing due to the concern of products recall from food manufacturers and health issues from consumers and the government.

The segmentation on the basis of contaminants, technologies, and food tested was determined using secondary sources and verified through primary respondents. The market estimation was based on various parameters, such as the number of players, demand trends, supply trends, and the extent of research activity in a particular country. The North American food safety testing market is projected to reach USD 6.4 Billion by 2020, at a CAGR of 7.4% from 2015 to 2020.

The North American food safety testing market is segmented as mentioned below:

By Contaminant:

-

Pathogens

- Salmonella

- Listeria

- E.coli

- Campylobacter

- Others (Staphylococcus, Clostridium, and Bacillus)

- Pesticides

- GMOs

- Toxins

- Others (food allergens and chemical residues)

By Technology:

- Traditional technology

-

Rapid technology

- Convenience-based technology

- PCR-based technology

- Immunoassay-based technology

- Others (GC, HPLC, LC, and LC-MS-MS)

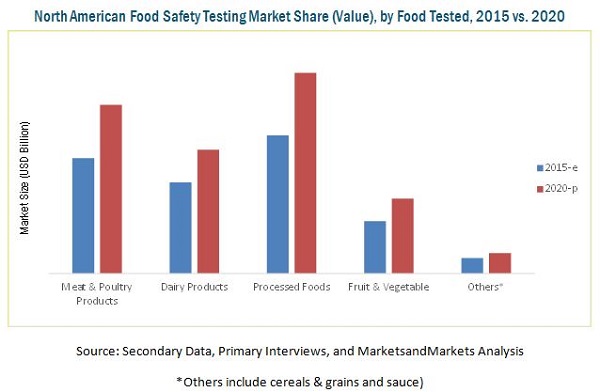

By Food Tested:

- Meat & poultry products

- Dairy products

- Processed foods

- Fruit & vegetable

- Others (cereals & grains and sauce)

By Country:

- U.S.

- Canada

- Mexico

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Customer Interested in this report also can view

European Food Safety Testing Market By Contaminant (Pathogen, GMO, Toxin, Pesticide), Technology (Traditional & Rapid), Food Type (Meat & Poultry Product, Dairy Product, Fruit & Vegetable, Processed Food) & Country - Trends & Forecast To 2018

Impact Analysis: China Food Safety Testing Market & Regulations

Food Safety Testing Market by Contaminant (Pathogen, GMO, Toxin, Pesticide), Technology (Traditional & Rapid), Food Type (Meat & Poultry, Dairy, Fruit & Vegetable, Convenience Food) & Region - Global Trends & Forecast to 2020

The North American food safety testing market is projected to reach USD 6.4 Billion by 2020, at a CAGR of 7.4% from 2015.

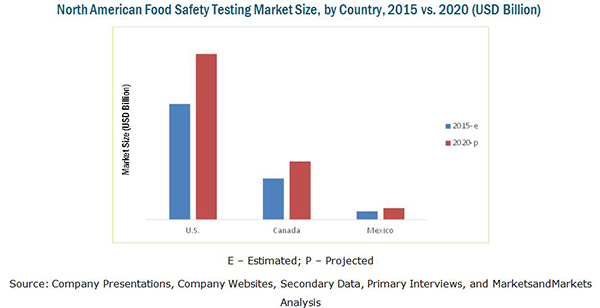

In 2014, the U.S. dominated the North American food safety testing market. Food safety testing is a method of manufacturing, handling, and storing food and food products to prevent foodborne illnesses and poisoning. The North American food safety testing market has expanded due to the increased number of foodborne disease outbreaks and food contamination caused by pathogens such as Salmonella, E. coli, Listeria, Campylobacter, and others (Staphylococcus, Clostridium, and Bacillus). The North American government has spent billions to recover from the pathogen epidemic. Food safety regulations in North America have been strictly implemented to eliminate the food contamination chances and unwanted occurrences of foodborne illnesses and poisoning.

The food safety testing market has been divided into four segments, namely, contaminant, food tested, technology, and country. The food safety testing is been conducted to detect contaminants under the category of pathogens, pesticides, GMOs, toxins, and others which include food allergens and chemical residues. The common pathogen testing for food safety include E.coli, salmonella, listeria, and campylobacter. Food safety testing has been generally carried in meat and poultry products, processed foods, fruits, vegetables, dairy products, and other foods which include cereals and raw food materials. Food safety testing has been segmented into traditional and rapid technology. Rapid technology includes convenience-based, PCR-based, immunoassay-based, and other methods such as GC, HPLC, LC, and LC-MS-MS. The North American food safety testing market is explicitly determined for three countries: U.S., Canada, and Mexico.

The key market players include SGS S.A. (Switzerland), Intertek Group Plc. (U.K.), Eurofins Scientific (Luxembourg), Bio-Rad Laboratories Inc. (U.S.), DNV GL (Norway), Iddex Laboratories (U.S.), and Bureau Veritas S.A. (France). The other players include E I Dupont India Private Limited DuPont (U.S.), Lloyd’s Assurance Ltd. (U.K.), Silliker Inc. (U.S.), and Romer Labs Inc. (U.S.). These market leaders use strategies such as new product/service launches, supply agreements, expansions, and acquisitions to strengthen their position in the market. The major market players have focused in offering new services for the detection of different contaminants.

The figure above depicts the North American market size of food safety testing by country. The U.S. is estimated to hold the major share in 2015.

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Periodization Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries By Company Type & Designation

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Rise in Number of Technical Barriers to Trade (TBT) Concerns Raised in Wto

2.2.1.2 Labeling of GM Food

2.2.1.3 Supply-Side Analysis

2.2.1.4 Ease of Food Safety Testing and Reduction of Cost in Auditing Have Led to the Growth of Outsourced Food Safety Testing

2.2.1.5 Growing Market for Food Diagnostics

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.6 Limitations

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 39)

4.1 Opportunities in the North American Food Safety Testing Market

4.2 Food Safety Testing Market, By Technology, 2015 vs 2020

4.3 The U.S. is Market Leader for North America Food Safety Testing, 2014

4.4 North American Food Safety Testing Market, By Country, 2015 vs 2020

4.5 Food Safety Testing Market, By Technology, 2014

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Contaminant

5.2.2 By Technology

5.2.3 By Food Tested

5.2.4 By Country

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Outbreak of Foodborne Illnesses

5.3.1.2 Implementation of Stringent Food Safety Regulations

5.3.1.3 Availability of Advanced Technologies Capable of Rapid Testing

5.3.1.4 Media Influence on Consumer Awareness for Food Safety

5.3.2 Restraints

5.3.2.1 Concern for GMOs Food Labelling

5.3.3 Opportunities

5.3.3.1 Breakthrough Technologies & Services

5.3.3.2 Increasing Consumer Awareness for Food Safety

5.3.4 Challenges

5.3.4.1 Inappropriate Sample Collection Standardization

5.3.4.2 Time-Consuming Procedure

6 Industry Trends (Page No. - 55)

6.1 Introduction

6.2 Food Testing Industry

6.3 Value Chain Analysis

6.3.1 Input Market

6.3.2 Food Market

6.3.3 Distribution

6.4 Supply Chain Analysis

6.4.1 Upstream Process

6.4.1.1 R&D

6.4.1.2 Production

6.4.2 Midstream Process

6.4.2.1 Processing & Transforming

6.4.2.2 Transportation

6.4.3 Downstream Process

6.4.3.1 Final Preparation

6.4.3.2 Distribution

6.5 Patent Analysis

6.6 Latest Technologies in Food Safety Testing

6.6.1 Microarray

6.6.2 Phages

6.6.3 Bio-Chip

6.6.4 Biosensors

6.6.5 Flow Cytometry

6.7 Factors Affecting the Choice of Food Safety Testing

6.7.1 Food Safety Testing Helps in Traceability of Products

6.7.2 Contamination of Food Ingredients & Regulatory Challenges

6.7.3 Introduction of Global Food Safety Initiative (GFSI)

6.8 Porter’s Five Forces Analysis

6.8.1 Intensity of Competitive Rivalry

6.8.2 Bargaining Power of Suppliers

6.8.3 Bargaining Power of Buyers

6.8.4 Threat of New Entrants

6.8.5 Threat of Substitutes

6.9 New Service Launche Was the Preferred Strategy By Major Players

7 North American Food Safety Testing Market, By Contaminant (Page No. - 71)

7.1 Introduction

7.2 Pathogens

7.2.1 Salmonella

7.2.2 Listeria

7.2.3 E.Coli

7.2.4 Campylobacter

7.2.5 Other Pathogens

7.3 Pesticides

7.4 GMOs

7.5 Toxins

7.6 Other Contaminants

8 North America Food Safety Testing Market, By Technology (Page No. - 103)

8.1 Introduction

8.2 Traditional Technology

8.3 Rapid Technology

8.3.1 Convenience-Based Technology

8.3.2 PCR-Based Technology

8.3.3 Immunoassay-Based Technology

8.3.4 Other Rapid Testing Technologies

9 North American Food Safety Testing Market, By Food Tested (Page No. - 119)

9.1 Introduction

9.2 Meat & Poultry Products

9.3 Dairy Products

9.4 Processed Foods

9.5 Fruits & Vegetables

9.6 Other Food Products

10 North America Food Safety Testing Market, By Country (Page No. - 129)

10.1 Introduction

10.2 U.S.

10.3 Canada

10.4 Mexico

11 Regulation for Food Safety Testing Market (Page No. - 137)

11.1 Introduction

11.2 U.S.

11.2.1 Federal Legislations

11.2.1.1 Key Developments From 2013 to 2015

11.2.2 State Legislations

11.2.3 U.S. Regulations for Pathogens

11.2.3.1 E. Coli Eradication Act

11.2.3.2 Listeria Legislation

11.2.3.3 Salmonella Legislation

11.2.4 U.S. Regulation for Pathogens in Specified Food Products

11.2.4.1 Standards for Foodborne Pathogens in Poultry

11.2.4.2 Food Safety Regulations for Fruit & Vegetable Growers

11.2.4.3 Food Safety in Retail Food

11.2.5 Food Safety in Trade

11.2.6 Haccp Regulations in U.S.

11.2.7 GMO Regulations in U.S.

11.2.7.1 Labeling of GM Foods

11.2.8 Canada

11.2.9 Mexico

12 Competitive Landscape (Page No. - 144)

12.1 Overview

12.2 Food Safety Testing Market Share Analysis

12.3 Competitive Situation & Trends

12.3.1 New Service Launches

12.3.2 Acquisitions

12.3.3 Expansions & Investments

12.3.4 Agreements, Partnerships, Joint Ventures & Collaborations

13 Company Profiles (Page No. - 151)

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 Introduction

13.2 SGS S.A.

13.3 Bureau Veritas S.A.

13.4 Intertek Group PLC

13.5 Bio-Rad Laboratories, Inc.

13.6 Eurofins Scientific

13.7 Dupont

13.8 DNV Gl (Formerly Det Norske Veritas Sa (DNV))

13.9 Silliker, Inc.

13.10 Romer Labs Inc.

13.11 Lloyd’s Register Quality Assurance Limited

13.12 Accugen Laboratories

13.13 Adpen Laboratories

13.14 Avomeen Analytical Services

“ * The companies listed are a representative sample of the market’s ecosystem and in no particular order”

*Details Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 187)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (98 Tables)

Table 1 Food Safety: Inspection Rate & Incidence of Foodborne Illness, By Pathogen (Per 100,000 Population)

Table 2 USDa: Food Recall Classifications

Table 3 U.S.: Domestically Acquired Illnesses, Hospitalizations, and Deaths By Foodborne Agents, , 2011

Table 4 Food Safety Testing Market Size By Contaminant, 2013–2020 (USD Million)

Table 5 Pathogenesis of Common Pathogens

Table 6 Pathogens in Food Safety Testing Market Size, By Subtype, 2013–2020 (USD Million)

Table 7 Pathogen in Food Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 8 U.S.: Pathogen Safety Testing, Market Size, By Subtypes, 2013–2020 (USD Million)

Table 9 U.S.: Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 10 Canada: Pathogen Safety Testing Market Size, By Subtype, 2013–2020 (USD Million)

Table 11 Canada: Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 12 Mexico: Pathogen Safety Testing Market Size, By Subtype, 2013–2020 (USD Million)

Table 13 Mexico: Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 14 Salmonella: Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 15 U.S.: Salmonella Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 16 Canada: Salmonella Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 17 Mexico: Salmonella Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 18 Listeria: Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 19 U.S.: Listeria Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 20 Canada: Listeria Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 21 Mexico: Listeria Safety Testing, Market Size, By Food Tested, 2013–2020 (USD Million)

Table 22 E.Coli: Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 23 U.S.: E.Coli Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 24 Canada: E.Coli Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 25 Mexico: E.Coli Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 26 Campylobacter in Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 27 U.S.: Campylobacter Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 28 Canada: Campylobacter Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 29 Mexico: Campylobacter Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 30 Others in Pathogen Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 31 U.S.: Other Pathogens Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 32 Canada: Other Pathogens Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 33 Mexico: Other Pathogens Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 34 Pesticides in Food Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 35 U.S.: Pesticide Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 36 Canada: Pesticide Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 37 Mexico: Pesticide Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 38 GMOs Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 39 U.S.: GMOs Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 40 Canada: GMO Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 41 Mexico: GMO Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 42 Toxin Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 43 U.S.: Toxin Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 44 Canada: Toxin Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 45 Mexico: Toxin Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 46 Other Contaminants Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 47 U.S.: Other Contaminants Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 48 Canada: Other Contaminants Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 49 Mexico: Other Contaminants Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 50 Food Safety Testing Market Size, By Technologies, 2013–2020 (USD Million)

Table 51 Traditional Technology in Food Safety Testing Market Size, By Country, 2013–2020 (USD Million)

Table 52 Rapid Technology in Food Safety Testing Market Size, By Subtype, 2013–2020 (USD Million)

Table 53 Rapid Technology in Food Safety Testing Market Size, By Country, 2013–2020 (USD Million)

Table 54 Rapid Technology in Food Safety Testing Market Size, By Contaminant, 2013–2020 (USD Million)

Table 55 Rapid Technology in Food Safety Testing Market Size, By Pathogen, 2013–2020 (USD Million)

Table 56 Convenience-Based Food Safety Tests in Market

Table 57 Convenience-Based Technology in Food Safety Testing Market Size, By Country, 2013–2020 (USD Million)

Table 58 Convenience-Based Technology in Food Safety Testing Market Size, By Contaminant, 2013–2020 (USD Million)

Table 59 Convenience-Based in Food Safety Testing Market Size, By Pathogens, 2013–2020 (USD Million)

Table 60 PCR Technology: Suppliers for Various Pathogens

Table 61 PCR-Based Technology in Food Safety Testing Market Size, By Country, 2013–2020 (USD Million)

Table 62 PCR-Based Technology in Food Safety Testing Market Size, By Contaminant, 2013–2020 (USD Million)

Table 63 PCR-Based Technology in Food Safety Testing Market Size, By Pathogen, 2013–2020 (USD Million)

Table 64 Suppliers of Immunoassay for Food Pathogen & Toxin

Table 65 Immunoassay-Based Technology in Food Safety Testing Market Size, By Country, 2013–2020 (USD Million)

Table 66 Immunoassay-Based Technology in Food Safety Testing Market Size, By Contaminant, 2013–2020 (USD Million)

Table 67 Immunoassay-Based Technology in Food Safety Testing Market Size, By Pathogen, 2013–2020 (USD Million)

Table 68 Other Rapid Testing Technologies in Food Safety Testing Market Size, By Country, 2013–2020 (USD Million)

Table 69 Other Rapid Testing Technologies in Food Safety Testing Market Size, By Contaminant, 2013–2020 (USD Million)

Table 70 Other Rapid Testing Technologies in Food Safety Testing Market Size, By Pathogen, 2013–2020 (USD Million)

Table 71 Food Safety Testing Market: Foodborne Pathogens, By Food Source

Table 72 Food Safety Testing Market Size, By Food Tested, 2013–2020 (USD Million)

Table 73 Meat & Poultry Products Testing Market Size, By Country, 2013–2020 (USD Million)

Table 74 Dairy Products Testing Market Size, By Country, 2013–2020 (USD Million)

Table 75 Processed Foods Testing Market Size, By Country, 2013–2020 (USD Million)

Table 76 Fruits & Vegetables Testing Market Size, By Country, 2013–2020 (USD Million)

Table 77 Other Food Products Testing Market Size, By Country, 2013–2020 (USD Million)

Table 78 Food Safety Testing Market Sizesize, By Country, 2013–2020 (USD Million)

Table 79 U.S.: Food Safety Testing Market Size, By Contaminant, 2013–2020 (USD Million)

Table 80 U.S: Food Safety Testing Market Size, By Food Tested, 2013 – 2020 (USD Million)

Table 81 Canada: Food Safety Testing Market Size, By Contaminant, 2013 – 2020 (USD Million)

Table 82 Canada: Food Safety Testing Market Size, By Food Tested, 2013 – 2020 (USD Million)

Table 83 Mexico: Food Safety Testing Market Size, By Contaminant, 2013 – 2020 (USD Million)

Table 84 Mexico: Food Safety Testing Market Size, By Food Tested, 2013 – 2020 (USD Million)

Table 85 Federal Food, Drug & Cosmetic Act, By Tolerances of Raw & Processed Food

Table 86 New Service Launches, 20122015

Table 87 Acquisitions, 2010–2015

Table 88 Expansions & Investments, 20112014

Table 89 Agreements, Partnerships, Joint Ventures & Collaborations, 2010–2015

Table 90 SGS S.A.: Services Offered

Table 91 Bureau Veritas S.A.: Services Offered

Table 92 Intertek Group PLC: Services Offered

Table 93 Bio-Rad Laboratories, Inc.: Services Offered

Table 94 Eurofins Scientific: Services Offered

Table 95 DNV: Services Offered

Table 96 Silliker, Inc.: Services Offered

Table 97 Romer Labs : Services Offered

Table 98 Lloyd’s Register Quality Assurance Limited: Services Offered

List of Figures (66 Figures)

Figure 1 Food Safety Testing Market Segmentation

Figure 2 Food Safety Testing: Research Design

Figure 3 TBT-Specific Trade Concerns During 2008-2012

Figure 4 Global GM Food Labeling: Present Situation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 North American Food Safety Testing Market Snapshot, By Contaminant (2015 vs 2020)

Figure 9 Food Safety Testing Market Size (Value), By Region, 2015–2020

Figure 10 Food Safety Testing Market Size, By Technology, 2015 vs 2020 (USD Million)

Figure 11 Stringent Regulations & Growing Food Trade to Drive the Food Safety Testing Market

Figure 12 Rapid Technology to Grow at A Higher CAGR Between 2015 & 2020

Figure 13 Pathogens Would Account for the Largest Share in the Food Safety Testing Market in the U.S., 2014

Figure 14 Incresing Food Borne Ilnesses, Government Initiatives & Food Trade Across the Borders Influence the Market Growth in U.S.

Figure 15 Processed Food is Estimated to Dominate the Food Safety Testing Market in 2015

Figure 16 Pathogens Segment Drove the Food Safety Testing Market, By Contaminant, 2014 (USD Billion)

Figure 17 Food Safety Testing Market, By Contaminant

Figure 18 North American Food Safety Testing Market, By Technology

Figure 19 North American Food Safety Testing Market, By Food Tested

Figure 20 North American Food Safety Testing Market, By Country (2014)

Figure 21 Market Dynamics: Food Safety Testing

Figure 22 Food Safety Testing: Changes in Incidences of Foodborne Bacterial Infection in the U.S., 2013

Figure 23 Most Americans Opt for News Channels and Health Websites for Information About Contaminants

Figure 24 Consumers Perception Towards the Safety of Food Supply in U.S.

Figure 25 Food Lost/Wasted at Each Stage of Production Chain (2012)

Figure 26 Food Safety Management System (FSMS)

Figure 27 Food Testing Industry Structure

Figure 28 Value Chain Analysis: Food Testing Adds About 4%-6% to the Overall Product Price

Figure 29 Supply Chain Analysis

Figure 30 Food Safety Testing: Patent Analysis, 2009-2014

Figure 31 Food Safety Testing: Patent Analysis, By Company, 2009–2014

Figure 32 Food Safety Testing: U.S. Patent Analysis, By Contaminant, 2009–2014

Figure 33 Reported Adulterated Food Ingredients Share (2013)

Figure 34 Porter’s Five Forces Analysis: Government Regulations & Consumer Awareness About Food Safety Increasing Competition

Figure 35 Pathogen Testing Leads the North American Food Safety Testing Market

Figure 36 Salmonella is the Most Widely Tested Pathogen in Food Safety

Figure 37 Transmission Cycle of Etec

Figure 38 Effect of Food Allergens Upon Ingestion

Figure 39 Key Factors Responsible for Food Contamination & Food-Borne Illness

Figure 40 Rapid Technology Advancement Drives the Food Safety Testing Market

Figure 41 Meat & Poultry Dominated the North American Food Safety Testing Market

Figure 42 U.S.: Food Commodities Responsible for Illnesses, 2000–2012

Figure 43 Bacterial Contamination of Meat & Poultry Products at Various Stages of Slaughter

Figure 44 Meat & Poultry Safety Testing: Market Size, By Country, 2013–2020 (USD Million)

Figure 45 North America Market Snapshot: U.S. Commands the Largest Share in Food Safety Testing Market (2015–2020)

Figure 46 Canada: Information Flow Overview, By Food Contamination & Recalls

Figure 47 New Service Launches Was the Key Strategy By Food Safety Testing Companies in North America From 2010 to 2015

Figure 48 North American Food Safety Testing Market Share Analysis, By Revenue (2014)

Figure 49 North American Food Safety Testing Market Share Analysis, By Developments, 2010 to 2014

Figure 50 Consistent Innovations to Meet the Accuracy of Food Safety Tests

Figure 51 New Service Launches: the Key Strategy, 2010 to 2015

Figure 52 Geographical Revenue Mix of Top Five Market Players

Figure 53 SGS S.A.: Company Snapshot

Figure 54 SGS S.A.: SWOT Analysis

Figure 55 Bureau Veritas S.A.: Company Snapshot

Figure 56 Bureau Veritas S.A.: SWOT Analysis

Figure 57 Intertek Group PLC: Company Snapshot

Figure 58 Intertek Group PLC: SWOT Analysis

Figure 59 Bio-Rad Laboratories, Inc.: Company Snapshot

Figure 60 Bio-Rad Laboratories, Inc.: SWOT Analysis

Figure 61 Eurofins Scientific: Company Snapshot

Figure 62 Eurofins Scientific: SWOT Analysis

Figure 63 Dupont: Company Snapshot

Figure 64 Det Norske Veritas as (DNV): Company Snapshot

Figure 65 Silliker Inc.: SWOT Analysis

Figure 66 Lloyd’s Register Quality Assurance Limited: Company Snapshot

Growth opportunities and latent adjacency in North American Food Safety Market