Metamaterial Market Size, Share and Trends

Metamaterial Market by Product (Antenna, Reconfigurable Intelligent Surfaces, Lenses & Optical Modules, Sensors & Beam Steering, Anti-Reflective Films), Wave Steering, Electromagnetic, Terahertz, Application [Radio Frequency (RF), Optical], and Region – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The metamaterial market is projected to reach USD 5.45 billion by 2032, growing from USD 0.49 billion in 2026 at a CAGR of 49.5% during the forecast period. Market growth is driven by the increasing adoption of metamaterials across advanced electronics, telecommunications, aerospace and defense, and energy applications. The rising demand for next-generation antennas, electromagnetic interference shielding, and miniaturized high performance components is accelerating the integration of metamaterials in wireless communication systems, including 5G and emerging 6G technologies. In addition, the ability of metamaterials to manipulate electromagnetic waves, acoustic signals, and light beyond conventional material limits is enabling innovation in radar systems, imaging, sensing, and stealth technologies. Advancements in nanofabrication, additive manufacturing, and scalable material engineering are improving production feasibility and cost efficiency, supporting broader commercial adoption. Furthermore, growing investments in defense modernization programs, satellite communication infrastructure, and smart consumer electronics are strengthening market expansion. Increasing collaboration between research institutions, technology developers, and industrial manufacturers is also accelerating the transition of metamaterials from laboratory scale research to real world, high value applications across multiple industries globally.

KEY TAKEAWAYS

-

By RegionBy region, Asia Pacific is projected to register the highest growth (56.7%) during the forecast period.

-

By TypeBy type, the electromagnetic segment dominated the metamaterial market with share of ~91% in 2025.

-

By ProductBy product, the lenses & optical modules segment is projected to grow at a CAGR of 60.8% during the forecast period.

-

By ApplicationBy application, the optical segment is projected to grow at the highest CAGR of 58.6% during the forecast period.

-

Competitive Landscape - Key PlayersCompany Kymeta Corporation (US), PIVOTAL COMMWARE (US), Echodyne Corp. (US), Lumotive (US), and, Radi-Cool, Inc. (US) were identified as star players in the metamaterial market (global) given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsCompanies 2Pi Inc. (US), JEM Engineering (US,) and MetaSonixx (UK) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The metamaterial market is expected to grow significantly over the next decade, driven by rising demand across telecommunications, aerospace and defense, consumer electronics, and advanced industrial applications. Increasing adoption of wave control, signal optimization, and miniaturized high performance components, supported by advancements in scalable fabrication and digital material design, is further accelerating global market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The metamaterial market is undergoing a structural shift toward new revenue sources driven by the evolution from passive and fixed material designs to programmable, software defined, and system integrated metamaterial platforms. Traditional revenue streams based on passive metamaterials, fixed RF and optical components, and prototype driven applications are gradually giving way to advanced solutions such as smart metamaterials, adaptive and reconfigurable electromagnetic systems, and real-time tunable material architectures. This transition is expanding metamaterial adoption across consumer electronics, aerospace and defense, automotive, telecommunications, robotics, healthcare, and photovoltaics. Growing demand for beam steering, wavefront control, antenna miniaturization, low power control mechanisms, and compact high performance designs is further reshaping the value chain. As a result, future revenue growth is increasingly driven by intelligent, connected, and application specific metamaterial solutions enabling smart wireless connectivity, autonomous sensing, AR and VR optics, and advanced machine vision systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising personnel and asset protection in the industrial sector

-

Mandatory safety standards for equipment and machinery

Level

-

Growing demand for enhanced wireless communication systems

-

Advancements in optical metamaterials

Level

-

Expansion of renewable energy sector

-

Advancements in thermal metamaterials

Level

-

Scaling up production of metamaterials for mass markets

-

Limited availability of resources

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising personnel and asset protection in the industrial sector

Advanced metamaterials are increasingly being adopted across industrial, defense, and infrastructure applications to enhance personnel safety, asset protection, and system reliability. Growing deployment of metamaterial-based electromagnetic shielding, impact resistant structures, stealth coatings, and thermal management solutions is supporting safer operating environments in high risk industrial settings. This shift toward intelligent material engineering is driven by the need for improved durability, reduced interference, and enhanced operational efficiency. Integration of digital design tools, AI-driven material optimization, and system level connectivity is further improving metamaterial performance, enabling adaptive protection, predictive maintenance, and real time response capabilities. As industries prioritize safety compliance, asset longevity, and operational continuity, demand for advanced metamaterial solutions continues to strengthen.

Restraint: Growing demand for enhanced wireless communication systems

Despite strong growth potential, the metamaterial market faces constraints related to high development costs, complex fabrication processes, and integration challenges. Advanced metamaterials often require precision nanofabrication, specialized materials, and rigorous testing, leading to elevated production and lifecycle costs. Maintenance, system customization, and performance validation further add to the total cost of ownership. Small and medium-scale manufacturers and cost-sensitive industries may face adoption barriers due to limited capital investment capacity. Additionally, harsh industrial environments require robust material designs, increasing engineering complexity and slowing large scale deployment in price sensitive markets.

Opportunity: Expansion of renewable energy sector

The increasing focus on renewable energy and energy efficiency is creating new growth opportunities for the metamaterial market. Metamaterials are gaining traction in solar photovoltaics, wind energy systems, and energy harvesting applications by improving wave absorption, signal control, and structural performance. Advanced metamaterial coatings and components enable higher efficiency, reduced energy losses, and improved durability under variable environmental conditions. Integration with digital monitoring platforms and smart energy systems further enhances performance optimization and long term operational efficiency, positioning metamaterials as a key enabler in next generation renewable energy infrastructure.

Challenge: Scaling up production of metamaterials for mass markets

One of the key challenges to the metamaterial market is achieving consistent performance and scalability for mass market applications. Manufacturing metamaterials at volume while maintaining precision, reliability, and cost efficiency remains technically demanding. Variability in environmental conditions, such as temperature, humidity, and mechanical stress can impact material behavior, requiring extensive testing and validation. In addition, compliance with industry standards, performance certification, and data security requirements adds complexity to system integration. These factors compel manufacturers to invest heavily in advanced fabrication technologies, quality assurance systems, and digital simulation platforms, slowing commercialization timelines.

METAMATERIAL MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed flat-panel, electronically steered metamaterial antennas to enable reliable mobile satellite connectivity for maritime, land vehicle, and remote broadband applications without mechanical steering | Reduce antenna size, weight, and power consumption, eliminated mechanical complexity | Enable seamless connectivity in motion | Lower deployment and operational costs |

|

Integrated MESA-based metamaterial radar systems to deliver electronically scanned, high-resolution radar for defense, border security, and counter-UAS applications | Achieve real-time radar performance with no moving parts | Reduce SWaP requirements | Improve detection accuracy | Enable cost-effective deployment in mobile and constrained environments |

|

Adopted liquid crystal-based, electronically reconfigurable smart antennas to support mmWave 5G beam steering and coverage expansion | Lower antenna system costs | Improve mmWave coverage efficiency | Enable scalable 5G deployments | Accelerate network rollout with faster ROI |

|

Implemented Holographic Beam Forming (HBF) antennas and the Pivotal Turnkey solution to simplify mmWave network planning and deployment for MNOs | Enable rapid mmWave coverage expansion | Optimize network planning and capacity | Reduce deployment complexity | Improve indoor and outdoor coverage | Accelerate time-to-revenue |

|

Deployed metasurface flat lenses to replace multi-element optics, enabling compact, high-performance optical modules | Reduce thickness and weight | Simplify manufacturing | Improve optical performance | Enable scalable mass production |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The metamaterial market ecosystem comprises a diverse set of stakeholders spanning raw material providers, R&D engineers, manufacturers, distributors, and end users, collectively driving innovation and commercialization. Raw material suppliers, such as specialty chemical and advanced material companies, support the development of engineered substrates, composites, and nanostructures. R&D engineers and design specialists play a critical role in advancing electromagnetic, optical, and acoustic material architectures through simulation driven design and prototyping. Manufacturers focus on translating these designs into scalable, application ready metamaterial solutions, while distributors facilitate market access and integration across industries. End users across the aerospace and defense, telecommunications, electronics, and industrial sectors are driving adoption by demanding high performance, adaptive, and compact system solutions. Strong collaboration across the ecosystem is enabling continuous innovation, faster product development cycles, and the transition from research focused implementations to commercially viable, system integrated metamaterial platforms globally.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Metamaterial Market, By Type

The electromagnetic segment led the market in 2025, driven by widespread adoption across telecommunications, aerospace and defense, automotive, and advanced electronics applications. Electromagnetic metamaterials are extensively used for wave manipulation, beam steering, signal filtering, and electromagnetic interference mitigation. Their ability to enhance system efficiency, reduce size and weight, and improve performance reliability supports strong demand across radar systems, antennas, and wireless communication infrastructure, particularly in 5G and next generation network deployments.

Metamaterial Market, By Product

The antenna, radar, and reconfigurable intelligent surfaces segment accounted for a significant market share in 2025, supported by increasing deployment of adaptive and programmable metamaterial based components. Growing demand for self reconfiguring antennas, compact radar systems, and software defined electromagnetic platforms is accelerating adoption across defense, satellite communication, and smart infrastructure applications. These products enable improved signal control, reduced interference, and enhanced spectral efficiency, strengthening their commercial and strategic value.

Metamaterial Market, By End User

The aerospace & defense segment accounted for the largest market share in 2025, driven by rising investments in advanced radar, stealth technologies, satellite communication, and electronic warfare systems. Metamaterials are increasingly integrated to enhance performance, reduce system signatures, and enable lightweight and compact designs. In parallel, growing adoption across telecommunications, automotive, and consumer electronics is expanding the end use landscape, supported by demand for high performance and miniaturized system architectures.

Metamaterial Market, By Application

The RF segment accounted for the largest market share in 2025, owing to its extensive use in antennas, radar systems, wireless communication equipment, and signal processing applications. Metamaterial-based RF solutions enable superior wave control, improve bandwidth efficiency, and reduce component size, which makes them critical for modern communication networks. Increasing deployment in 5G infrastructure, satellite systems, and connected devices continues to support sustained growth of this application segment.

REGION

Asia Pacific is projected to register highest growth in global metamaterial market during forecast period

The Asia Pacific market is projected to achieve the highest growth during the forecast period. This projection is driven by rapid industrial digitalization, strong government initiatives supporting advanced manufacturing, and expanding electronics, telecommunications, and aerospace production across countries such as China, Japan, South Korea, and India. Additionally, the growing deployment of next generation wireless infrastructure, defense modernization programs, and smart manufacturing systems is accelerating the demand for electromagnetic, RF, and optical metamaterial solutions. Increasing investment in nanotechnology research, semiconductor fabrication, and AI-driven material design platforms is further supporting innovation and commercialization. The region’s large-scale manufacturing capabilities, robust supply chain for advanced materials and components, and cost competitive production environment also position it as a key hub for metamaterial development, integration, and volume manufacturing globally.

METAMATERIAL MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

In the metamaterial market evaluation matrix, Kymeta (Star) offers a strong combination of advanced product footprint and growing market share. The company is recognized for its electronically steered metamaterial-based flat-panel antennas, which enable high-performance, low-profile, and mobile satellite connectivity solutions. Kymeta’s technology addresses critical requirements in defense, maritime, land mobility, and remote broadband communications, where reliability, rapid deployment, and reduced mechanical complexity are essential. On the other hand, Greenerwave (Emerging Player) is gaining traction through reconfigurable, software-controlled metamaterial antennas, signaling growing innovation and competitive momentum in the evolving metamaterial landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Kymeta Corporation (US)

- PIVOTAL COMMWARE (US)

- Echodyne Corp. (US)

- Radi-Cool, Inc. (US)

- Lumotive (US)

- Metalenz, Inc. (US)

- ALCAN Systems GmbH i.L. (Germany)

- Greenerwave (France)

- Edgehog Advanced Technologies Inc. (Canada)

- Metamagnetics Inc. (US)

- Fractal Antenna Systems, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.34 BN |

| Market Forecast in 2032 (Value) | USD 5.45 BN |

| Growth Rate | 49.5% from 2026–2032 |

| Years Considered | 2022–2032 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: METAMATERIAL MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Metamaterial Technology Developer | Detailed competitive profiling of metamaterial companies by type, application focus, and core technology platforms | Conduct technology roadmap mapping across electromagnetic, RF, and optical metamaterial architectures, including tunability, reconfigurability, and scalability trends |

| Aerospace and Defense System Integrator | Comprehensive mapping of metamaterial vendors offering antennas, radar components, beam steering modules, and stealth-enabling solutions | Benchmark key performance metrics, such as gain, bandwidth, weight reduction, and environmental durability across defense-grade applications |

| Telecommunications and Connectivity Provider | Profiling of metamaterial suppliers focused on satellite communications, 5G and next-generation networks, and reconfigurable intelligent surfaces | Evaluate integration readiness with existing network infrastructure, electronically steered systems, and evolving wireless standards |

| Automotive and Mobility OEM | Product and application mapping of metamaterials used in ADAS radar, vehicle connectivity, sensing, and electromagnetic interference management | Assess manufacturability, cost-performance trade-offs, and readiness for high-volume automotive deployment |

| Consumer Electronics and Industrial Manufacturer | Analysis of metamaterial-enabled lenses, sensors, films, and compact RF components for miniaturized electronic and industrial systems | Evaluate commercialization maturity, supply chain readiness, and performance differentiation versus conventional materials |

RECENT DEVELOPMENTS

- November 2025 : Metalenz and UMC entered into a manufacturing partnership to bring Metalenz’s Polar ID meta surface-based face authentication solution into mass production. The collaboration leveraged UMC’s semiconductor manufacturing capabilities to scale production of metalens-enabled optical modules for consumer electronics applications.

- October 2025 : Echodyne Corp. introduced EchoWare, a next-generation software platform that streamlines integration, command and control, configuration, and lifecycle management of MESA radar networks. EchoWare enhances unified high-fidelity tracking and enables seamless operation.

- September 2025 : Echodyne Corp. launched the EchoShield Rapid Deployment Kit (RDK), a pre-integrated set of four metamaterial MESA radar with supporting hardware designed to be operational in under an hour. The RDK provides up to 25 km of hemispherical situational awareness for counter-UAS and airspace security missions, featuring a simplified setup and robust performance.

Table of Contents

Methodology

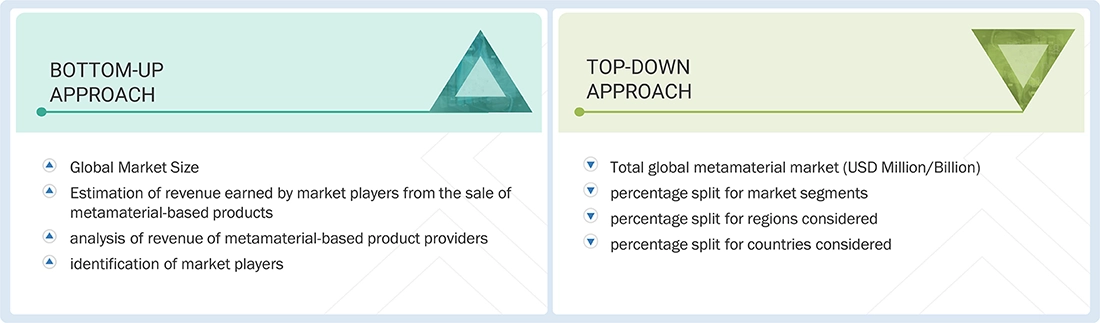

The research study involved 4 major activities in estimating the size of the metamaterial market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the metamaterial market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the metamaterial market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the metamatrials and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the metamaterial market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and service providers in the metamaterial market and studying their solutions

- Analyzing trends related to the adoption of metamaterials

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, agreements, collaborations, acquisitions, contracts, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of metamaterials

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Metamaterial Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall metamaterial market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Metamaterials is a term which encompasses the manufacture and application of engineered materials with certain properties of electromagnetic waves unavailable in nature. Such materials can be structured microscopically to manipulate electromagnetic waves, such as manipulation of visible light, sound, or radio frequencies, hence enabling functionalities like cloaking, superlensing, or improved antenna performance. Through such metamaterials, sectors such as telecommunications, medical imaging, aerospace & defense, and automotive form a basis. As smart devices and advanced telecommunication innovations proliferate, the application of metamaterials is expected to grow. New features, improved product performance, and extraordinary device performance make metamaterials especially attractive. As metamaterial research and development are ongoing, new applications are still being discovered, and production techniques are being continuously optimized, keeping the market very competitive for the manufacturers. Among the key applications of metamaterials, sensors, filters, and imaging systems are major areas where the material offers superior results compared to conventional materials. The pressure to have the most advanced technological solution puts a great importance on the metamaterials market in shaping the future of modern electronics and communications.

Key Stakeholders

- Raw Material and Component Suppliers

- OEMs

- Metamaterial-based Solutions Manufacturer

- Third-party Service Providers

- Distributors and Resellers

- Service Providers

- Regulatory Bodies

- Research and Development Institutes

- End Users

Report Objectives

- To define, describe, and forecast the size of the metamaterial market, by product, application, type, end use, and region, in terms of value

- To define and describe the metamaterial market based on frequency band

- To forecast the market for Antenna, Radar, and Reconfigurable Intelligent Surfaces (RIS) and Lenses and Optical Modules, in terms of volume, at the global and regional levels

- To forecast the size of various segments with respect to three regions, namely, the North America, Europe, Asia Pacific, and Rest of the World

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the metamaterial market

- To study the value chain and related industry segments of metamaterial market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze trends and disruptions impacting customers’ businesses’ pricing trends, patents and innovations, trade data, regulatory landscape, Porter’s five forces, case studies, key stakeholders and buying criteria, technology trends, market ecosystem, key conferences and events, impact of AI/Gen AI, and connectors used in manufacturing facilities related to the metamaterial market

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of revenue, market share, and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches, acquisitions, partnerships, collaborations, agreements, expansions, contracts, and research & development (R&D) activities carried out by players in the metamaterial market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Metamaterial Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Metamaterial Market

Kai

Apr, 2014

I want to understand market size for RF devices for broadcasting and telecommunication infrastructure, radar, satcom, RF sensors etc. and information about industry trends..