Metallic Stearates Market by Type (Magnesium Stearates, Zinc Stearates, Calcium Stearates), End-Use Industry (Polymer & Rubber, Pharmaceuticals & Cosmetics, Building and Construction), & Region (APAC, North America, Europe, RoW) - Global Forecast to 2028

Updated on : October 10, 2024

Metallic Stearates Market

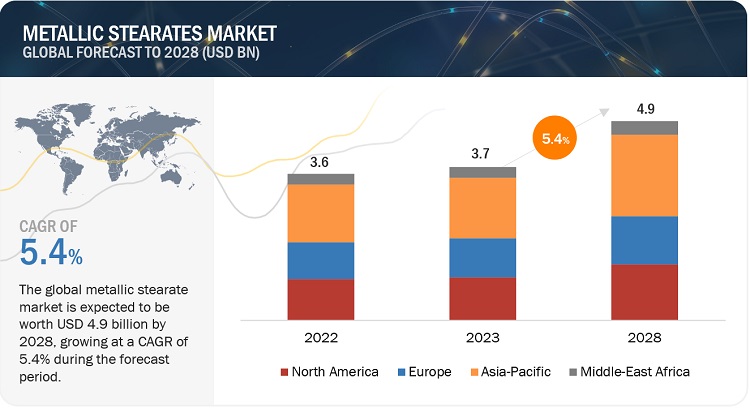

The metallic stearates market was valued at USD 3.7 billion in 2023 and is projected to reach USD 4.9 billion by 2028, growing at 5.4% cagr from 2023 to 2028.

Metallic stearates are metal salts of stearic acid that are commonly used as release agents, lubricants, stabilizers, and water repellents in various industries such as plastics, rubber, coatings, and construction. The global metallic stearates market has been growing steadily in recent years and is expected to continue to grow in the coming years. The Metallic Stearates market is segmented on the basis of the type such as Zinc Stearates, Calcium Stearates, Magnesium Stearates, Aluminium Stearates, and Others. The market of Metallic Stearates has been segmented on the basis of end-use industries such as polymer & rubber, pharmaceutical & cosmetics, building & construction, paints & coatings, and others.

Attractive Opportunities in the Metallic Stearates Market

To know about the assumptions considered for the study, Request for Free Sample Report

Metallic Stearates Market Dynamics

Driver: Rising use of polymer in various end-use imdustries

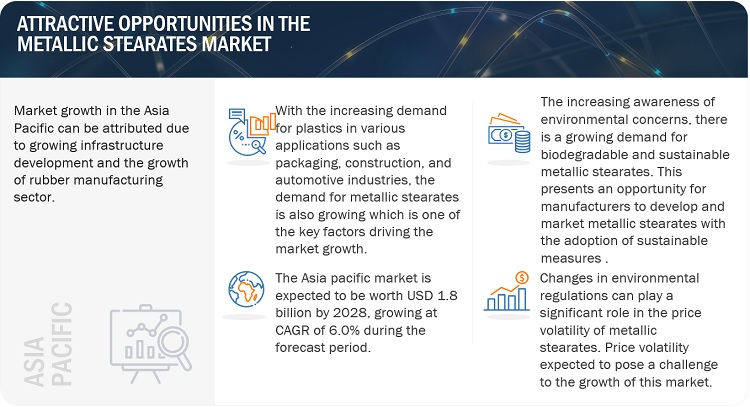

The use of polymers in various end-use industries has been on the rise in recent years due to their unique properties, such as high strength, durability, flexibility, and light-weight nature. Polymer demand is growing in the automotive, construction, packaging, and electronics industries, among others. As the demand for polymers increases, so does the demand for metallic stearates, which are essential additives in the production of polymers. Metallic stearates are used as lubricants, stabilizers, and release agents in the processing of polymers, which improves their quality and efficiency. For example, metallic stearates are added to polyvinyl chloride (PVC) products to improve their processing characteristics and mechanical properties. The growing demand for high-performance polymers and the need to improve the efficiency of polymer processing are driving the growth of the metallic stearates market.

Restraint: Stringent Environmental Regulations

Stringent environmental regulations are one of the major factors restraining the growth of the metallic stearates market. Many countries have implemented strict regulations on the use of metallic stearates due to their potential environmental and health hazards. For example, metallic stearates can release toxic gases when burned, and they can also accumulate in soil and water, leading to environmental pollution. In addition, some metallic stearates have been classified as hazardous chemicals by regulatory authorities, which restricts their use in certain applications.

Opportunities: Adoption of Sustainable Measures

The adoption of sustainable measures is creating new opportunities for metallic stearates in the market. With increasing awareness of the environmental impact of traditional metallic stearates, many end-use industries are seeking more sustainable alternatives that meet their performance requirements. This has led to the development of bio-based metallic stearates, which are derived from renewable sources and have a lower environmental footprint compared to traditional metallic stearates. Bio-based metallic stearates are considered safer and more sustainable, making them a preferred choice for many end-use industries.

Challenges: Price Volatility

The prices of raw materials used in the production of metallic stearates, such as stearic acid and metal oxides, can be subject to significant fluctuations due to various factors such as supply-demand dynamics, geopolitical events, and changes in trade policies. This volatility can impact the profitability of manufacturers and increase the overall cost of production, which can then be passed on to customers in the form of higher prices. This, in turn, can affect the demand for metallic stearates, particularly in price-sensitive markets.

Metallic Stearates Market Ecosystem

By Type, Zinc Stearates projected to register the highest CAGR during the forecast period

Zinc stearates have excellent release properties and are highly effective in preventing sticking and fouling of molds during the production of rubber and plastics. Zinc stearates are one of the most widely used releasing agents among all metallic stearates. They are also used as emulsifiers in cosmetics and toiletries. They have a very sharp melting point in comparison to other stearates, which helps them to liquefy faster while melting. They are hydrophobic, lipophilic, non-sticky, and are soluble in nonpolar polyolefin medium as well as aromatic compounds, but are not soluble in polar solvents such as alcohols and ethers. This has led to widespread use of zinc stearates in various industries. Rising demands from several end-use industries such as pharmaceuticals & cosmetics, and others helps to grow the market of Metallic Stearates during the forecast period.

By End-Use Industry, Polymer & Rubber segment accounted for the largest market share during the forecast period

Most metallic stearates are used as lubricants in polymer processing and are good water-repelling agents as well as releasing and gelling agents. Among metallic stearates, zinc stearates are widely used in the production of fiberglass-reinforced polyesters, phenolic resins and compounds, polyolefin, polystyrene, PVC, and others. Calcium stearates act as an effective acid scavengers for PVC processing, processing aids for high throughput PVC extrusion processes, and lubricants for polymer applications. Metallic stearates are also used as dispersion agents in the polymer industry. Metallic stearates are widely used in powdered form in unvulcanized rubber to prevent decomposition. They act as anti-blocking agents and elastomer processing aids/release agents. Metallic stearates find major applications in the manufacture of rubber tires.

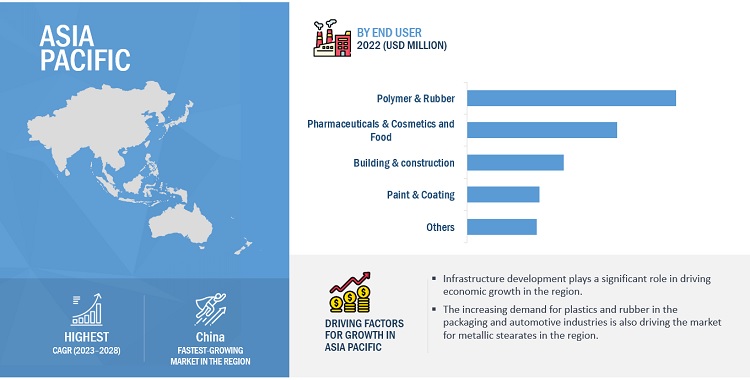

Asia Pacific is projected to account for the highest CAGR in the Metallic Stearates market during the forecast period

The Asia-Pacific region has been experiencing significant economic growth over the past few decades. This growth has been driven by several factors, including increased trade and investment, improved infrastructure, and technological advancements. China, India, and Japan are among the largest economies in the Asia-Pacific region, and have been major drivers of economic growth in the region. In recent years, other countries such as Indonesia, Malaysia, and Vietnam have also emerged as important players in the regional economy. Increasing urbanization and infrastructure development are boosting the demand for lubricants, adhesives and coatings, which are the other prominent applications for the metallic steartes.

To know about the assumptions considered for the study, download the pdf brochure

Metallic Stearates Market Players

Metallic Stearates comprises major manufacturers such as Baerlocher GmbH (Germany), Dover Chemical Corporation (US), Valtris Specialty Chemicals (US), Faci Spa (Italy) were the leading players in the Metallic Stearates market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the Metallic Stearates market.

Metallic Stearates Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2022–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Billion), Volume (Kilo tons) |

|

Segments |

Type, End-Use Industry, and Region |

|

Regions |

Asia-Pacific, North America, Europe, South America, and Middle East & Africa |

|

Companies |

The major players are Baerlocher GmbH (Germany), Faci spa (Italy), Peter Greven GmbH & Co. KG (Germany), Valtris Specialty Chemicals (US), Sun Ace Kakoh (Japan), Dover Chemical Corporation (US), IRRH Specialty Chemicals (US), and others covered in the Metallic Stearates market. |

This research report categorizes the global Metallic Stearates industry on the basis of Type, End-use, and Region.

Metallic Stearates Industry, By Type

- Zinc Stearates

- Calcium Stearates

- Magnesium Stearates

- Aluminium Stearates

- Others

Metallic Stearates Industry, By End-Use Industry

- Polymer & Rubber

- Pharmaceutical & Cosmetics

- Building & Construction

- Paints & Coatings

- Others

Metallic Stearates Industry, By Region

- Asia Pacific (APAC)

- North America

- Europe

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In October 2021, Baerlocher GmbH (Germany) is investing in its production plant in Bury. It will increase the capacity of its calcium-based PVC stabilizer plant by more than 50% with the installation of additional new Mixing and Granulation units in 2022.

- In March 2021, Baerlocher GmbH (Germany) expanded its production site in Dewas in the Indian state of Madhya Pradesh. The new production facility will have a capacity of 30,000 tons per year and will exclusively produce Ca-based PVC stabilizers. After the last expansion at the beginning of 2020, this new expansion

- In June 2020, Peter Greven GmbH & Co. KG, a leading manufacturer of oleochemical additives, signed an exclusive distribution agreement with Solenis Switzerland GmbH, a leading manufacturer of specialty chemicals.

- In June 2019, PMC Biogenix (US) announced a significant expansion of its production capacity for various specialty chemicals, including fatty acids, esters, and metal soaps, at its plant in Memphis, Tennessee.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Metallic Stearates market?

The major drivers influencing the growth of the Metallic Stearates market are rising use of polymer in various end-use industries.

What are the major challenges in the Metallic Stearates market?

The major challenge in the Metallic Stearates market is price volatility.

What are the restraining factors in the Metallic Stearates market?

The major restraining factor faced by the Metallic Stearates market is stringent environmental regulations.

What is the key opportunity in the Metallic Stearates Market?

Adoption of sustainable measures has a new opportunity for the Metallic Stearates market.

What are the end-uses of Metallic Stearates?

Metallic Stearates is majorly used in polymer & rubber industry, pharmaceuticals & cosmetics industries, and building & construction industry .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for polymers in various end-use industries- Growth of rubber manufacturing sectorRESTRAINTS- Stringent environmental regulationsOPPORTUNITIES- Increasing demand for PVC and other polymers in various applications- Adoption of sustainable measureCHALLENGES- Price volatility

-

6.1 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4 VALUE CHAIN ANALYSIS

-

6.5 PROMINENT COMPANIESSMALL AND MEDIUM-SIZED ENTERPRISES

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 PRICING ANALYSIS

-

6.8 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS (2013–2022)INSIGHTSJURISDICTION ANALYSIS

- 6.9 TRADE ANALYSIS

-

6.10 ECOSYSTEM MAPBUYING CRITERIA

- 6.11 IMPACT OF RECESSION

- 6.12 KEY CONFERENCES & EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 ZINC STEARATESASIA PACIFIC TO BE DOMINANT MARKET FOR ZINC STEARATESPOLYMER & RUBBERPHARMACEUTICALS & COSMETICS

-

7.3 CALCIUM STEARATESHIGH DEMAND FOR CALCIUM STEARATES IN POLYMER & RUBBER AND PHARMACEUTICALSPOLYMER & RUBBERPHARMACEUTICALS & COSMETICS

-

7.4 MAGNESIUM STEARATESINCREASING USE OF MAGNESIUM STEARATES IN COSMETICS & PHARMACEUTICALSPOLYMER & RUBBERPHARMACEUTICALS & COSMETICS

-

7.5 ALUMINUM STEARATESPOLYMER & RUBBERPHARMACEUTICALS & COSMETICSPAINTS & COATINGS

- 7.6 OTHER STEARATES

- 8.1 INTRODUCTION

- 8.2 POWDER

- 8.3 GRANULES

- 8.4 OTHERS

- 9.1 INTRODUCTION

-

9.2 POLYMER & RUBBERASIA PACIFIC TO DRIVE MARKET IN POLYMER & RUBBER SEGMENTPOLYMERRUBBER

-

9.3 PHARMACEUTICALS & COSMETICS AND FOODINCREASING DEMAND FOR PHARMACEUTICALS & COSMETICS AND FOOD TO FUEL MARKET GROWTHPHARMACEUTICALSCOSMETICSFOOD SUPPLEMENTSFOOD

-

9.4 BUILDING & CONSTRUCTIONASIA PACIFIC TO DOMINATE MARKET IN BUILDING & CONSTRUCTION SEGMENTHYDROPHOBIC AGENTSWATERPROOFING AND EFFLORESCENCE CONTROL

-

9.5 PAINTS & COATINGSSOUTH AMERICA TO BE FASTEST-GROWING MARKET FOR METALLIC STEARATES IN PAINTS & COATINGS SEGMENT

- 9.6 OTHER END-USE INDUSTRIES

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACTCHINA- China to be largest producer and consumer of metallic stearates in Asia PacificJAPAN- Presence of strong manufacturing base to promote market growthINDIA- Increasing number of pharmaceuticals manufacturers to drive marketSOUTH KOREA- Growth of end-use industries to fuel demand for metallic stearatesREST OF ASIA PACIFIC

-

10.3 NORTH AMERICARECESSION IMPACTUS- Increasing use in pharmaceutical and cosmetics sectors to boost marketCANADA- Growth in pharmaceutical and cosmetics sectors to boost marketMEXICO- Government policies to promote industrial growth to fuel demand

-

10.4 EUROPERECESSION IMPACTGERMANY- Germany to lead metallic stearates market in EuropeFRANCE- Increase in production of cosmetics to support market growthITALY- Calcium stearates to be largest and fastest-growing segmentUK- Pharmaceuticals & cosmetics and food industry to be fastest-growing segmentREST OF EUROPE

-

10.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing end-use industries to fuel consumption of metallic stearatesARGENTINA- Polymer & rubber industry to be major consumer of metallic stearatesREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Dominant market for metallic stearates in Middle East & AfricaEGYPT- Building & construction to be fastest-growing end-industrySOUTH AFRICA- Increasing construction and manufacturing activities to drive marketREST OF MIDDLE EAST & AFRICA

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

-

11.3 STRATEGIES ADOPTED BY KEY PLAYERSTRATEGIC POSITIONING OF KEY PLAYERS

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSDOVER CHEMICAL CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewBAERLOCHER GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFACI S.P.A- Business overview- Products/Solutions/Services offered- MnM viewPETER GREVEN GMBH & CO. KG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVALTRIS SPECIALTY CHEMICALS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORAC ADDITIVES (PETER GREVEN GROUP)- Business overview- Products/Solutions/Services offered- MnM viewNITIKA PHARMACEUTICAL SPECIALITIES PVT. LTD.- Business overview- Products/Solutions/Services offered- MnM viewMALLINCKRODT PHARMACEUTICALS- Business overview- Products/Solutions/Services offered- MnM viewSUN ACE KAKOH (PTE.) LIMITED- Business overview- Products/Solutions/Services offeredPMC BIOGENIX, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsJAMES M. BROWN LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsNIMBASIA STABILIZERS- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSMARATHWADA CHEMICAL INDUSTRIES PVT. LTD.LUMEGA INDUSTRIESSEOUL FINE CHEMICALS INDIRRH SPECIALTY CHEMICALSHALLSTAR COMPANYSYNERGY ADDITIVESSHIVKRUPA INDUSTRIESMITTAL DHATU RASHAYAN UDYOG LIMITEDSNG MICRONS PRIVATE LIMITED

- 14.1 INTRODUCTION

-

14.2 LIMITATIONSBIOPLASTICS & BIOPOLYMERS MARKETBIOPLASTICS & BIOPOLYMERS MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 METALLIC STEARATES MARKET: PORTER’S FIVE FORCE ANALYSIS

- TABLE 2 METALLIC STEARATES MARKET: STAKEHOLDERS IN VALUE CHAIN

- TABLE 3 METALLIC STEARATES EXPORT DATA, 2022

- TABLE 4 METALLIC STEARATES IMPORT DATA, 2022

- TABLE 5 KEY BUYING CRITERIA FOR MAJOR END-USE INDUSTRIES

- TABLE 6 METALLIC STEARATES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 7 METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 8 METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 9 ZINC STEARATES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 10 ZINC STEARATES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 11 CALCIUM STEARATES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 12 CALCIUM STEARATES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 13 MAGNESIUM STEARATES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 14 MAGNESIUM STEARATES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 15 ALUMINUM STEARATES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 16 ALUMINUM STEARATES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 17 OTHER STEARATES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 18 OTHER STEARATES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 19 METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 20 METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 21 METALLIC STEARATES MARKET IN POLYMER & RUBBER, BY REGION, 2022–2028 (KILOTON)

- TABLE 22 METALLIC STEARATES MARKET IN POLYMER & RUBBER, BY REGION, 2022–2028 (USD MILLION)

- TABLE 23 METALLIC STEARATES MARKET IN PHARMACEUTICALS & COSMETICS AND FOOD, BY REGION, 2022–2028 (KILOTON)

- TABLE 24 METALLIC STEARATES MARKET IN PHARMACEUTICALS & COSMETICS AND FOOD, BY REGION, 2022–2028 (USD MILLION)

- TABLE 25 METALLIC STEARATES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2022–2028 (KILOTON)

- TABLE 26 METALLIC STEARATES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 27 METALLIC STEARATES MARKET IN PAINTS & COATINGS, BY REGION, 2022–2028 (KILOTON)

- TABLE 28 METALLIC STEARATES MARKET IN PAINTS & COATINGS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 29 METALLIC STEARATES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2028 (KILOTON)

- TABLE 30 METALLIC STEARATES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2028 (USD MILLION)

- TABLE 31 METALLIC STEARATES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 32 METALLIC STEARATES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 34 ASIA PACIFIC: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 38 ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 39 CHINA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 40 CHINA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 41 CHINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 42 CHINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 43 JAPAN: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 44 JAPAN: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 45 JAPAN: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 46 JAPAN: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 47 INDIA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 48 INDIA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 49 INDIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 50 INDIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 51 SOUTH KOREA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 52 SOUTH KOREA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 53 SOUTH KOREA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 54 SOUTH KOREA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 56 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 58 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 60 NORTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 62 NORTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 64 NORTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 65 US: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 66 US: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 67 US: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 68 US: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 69 CANADA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 70 CANADA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 71 CANADA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 72 CANADA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 73 MEXICO: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 74 MEXICO: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 75 MEXICO: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 76 MEXICO: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 77 EUROPE: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 78 EUROPE: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 79 EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 80 EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 81 EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 82 EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 83 GERMANY: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 84 GERMANY: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 85 GERMANY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 86 GERMANY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 87 FRANCE: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 88 FRANCE: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 89 FRANCE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 90 FRANCE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 91 ITALY: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 92 ITALY: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 93 ITALY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 94 ITALY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 95 UK: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 96 UK: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 97 UK: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 98 UK: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 99 REST OF EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 100 REST OF EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 102 REST OF EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 103 SOUTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 104 SOUTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 105 SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 106 SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 107 SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 108 SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 109 BRAZIL: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 110 BRAZIL: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 111 BRAZIL: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 112 BRAZIL: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 113 ARGENTINA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 114 ARGENTINA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 115 ARGENTINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 116 ARGENTINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 117 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 118 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 119 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 120 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 122 MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 123 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 124 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 125 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 126 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 127 SAUDI ARABIA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 128 SAUDI ARABIA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 129 SAUDI ARABIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 130 SAUDI ARABIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 131 EGYPT: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 132 EGYPT: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 133 EGYPT: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 134 EGYPT: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 135 SOUTH AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 136 SOUTH AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 137 SOUTH AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 138 SOUTH AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 143 METALLIC STEARATES MARKET: DEGREE OF COMPETITION

- TABLE 144 METALLIC STEARATES MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 145 METALLIC STEARATES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 146 PRODUCT LAUNCH, 2019–2023

- TABLE 147 MERGER & ACQUISITION, 2019–2023

- TABLE 148 OTHER DEVELOPMENTS, 2019–2023

- TABLE 149 DOVER CHEMICAL CORPORATION: BUSINESS OVERVIEW

- TABLE 150 BAERLOCHER GMBH: BUSINESS OVERVIEW

- TABLE 151 BAERLOCHER GMBH: OTHERS

- TABLE 152 FACI S.P.A: BUSINESS OVERVIEW

- TABLE 153 PETER GREVEN GMBH & CO. KG.: BUSINESS OVERVIEW

- TABLE 154 PETER GREVEN GMBH & CO. KG.: DEALS

- TABLE 155 PETER GREVEN GMBH & CO. KG.: PRODUCT LAUNCH

- TABLE 156 PETER GREVEN GMBH & CO. KG.: OTHERS

- TABLE 157 VALTRIS SPECIALTY CHEMICALS: BUSINESS OVERVIEW

- TABLE 158 VALTRIS SPECIALTY CHEMICALS: DEALS

- TABLE 159 VALTRIS SPECIALTY CHEMICALS: OTHERS

- TABLE 160 NORAC ADDITIVES: BUSINESS OVERVIEW

- TABLE 161 NITIKA PHARMACEUTICALS SPECIALTIES PVT. LTD.: BUSINESS OVERVIEW

- TABLE 162 MALLINCKRODT PHARMACEUTICALS: BUSINESS OVERVIEW

- TABLE 163 SUN ACE KAKOH (PTE.) LIMITED: BUSINESS OVERVIEW

- TABLE 164 PMC BIOGENIX, INC.: BUSINESS OVERVIEW

- TABLE 165 PMC BIOGENIX, INC.: OTHERS

- TABLE 166 JAMES M. BROWN LTD.: BUSINESS OVERVIEW

- TABLE 167 JAMES M. BROWN LTD.: OTHERS

- TABLE 168 NIMBASIA STABILIZERS: BUSINESS OVERVIEW

- TABLE 169 MARATHWADA CHEMICAL INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 170 LUMEGA INDUSTRIES: COMPANY OVERVIEW

- TABLE 171 SEOUL FINE CHEMICALS IND: COMPANY OVERVIEW

- TABLE 172 IRRH SPECIALTY CHEMICALS: COMPANY OVERVIEW

- TABLE 173 HALLSTAR COMPANY: COMPANY OVERVIEW

- TABLE 174 SYNERGY ADDITIVES: COMPANY OVERVIEW

- TABLE 175 SHIVKRUPA INDUSTRIES: COMPANY OVERVIEW

- TABLE 176 MITTAL DHATU RASHAYAN UDYOG LIMITED: COMPANY OVERVIEW

- TABLE 177 SNG MICRONS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 178 NORTH AMERICA: STEARIC ACID MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 179 NORTH AMERICA: STEARIC ACID MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 180 NORTH AMERICA: STEARIC ACID MARKET, BY FEEDSTOCK, 2022–2028 (KILOTON)

- TABLE 181 NORTH AMERICA: STEARIC ACID MARKET, BY FEEDSTOCK, 2022–2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: STEARIC ACID MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 183 NORTH AMERICA: STEARIC ACID MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 184 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

- TABLE 185 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

- TABLE 186 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

- TABLE 187 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 METALLIC STEARATES MARKET SEGMENTATION

- FIGURE 2 METALLIC STEARATES MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 METALLIC STEARATES MARKET: DATA TRIANGULATION

- FIGURE 7 ZINC STEARATES TO LEAD METALLIC STEARATES MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC LED METALLIC STEARATES MARKET IN 2022

- FIGURE 9 DEVELOPING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN METALLIC STEARATES MARKET

- FIGURE 10 CHINA ACCOUNTED FOR LARGEST SHARE OF METALLIC STEARATES MARKET IN 2022

- FIGURE 11 ZINC STEARATES SEGMENT TO LEAD METALLIC STEARATES MARKET DURING FORECAST PERIOD

- FIGURE 12 POLYMER & RUBBER TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 CHINA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METALLIC STEARATES MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS: METALLIC STEARATES MARKET

- FIGURE 16 REVENUE SHIFT FOR METALLIC STEARATE MANUFACTURERS

- FIGURE 17 PRODUCTION PROCESS CONTRIBUTES SIGNIFICANT VALUE ADDITION TO METALLIC STEARATES

- FIGURE 18 AVERAGE SELLING PRICE (2022)

- FIGURE 19 GRANTED PATENTS ACCOUNT FOR 36% OF ALL PATENTS

- FIGURE 20 NUMBER OF PATENTS REGISTERED IN LAST TEN YEARS

- FIGURE 21 TOP JURISDICTION, BY DOCUMENT

- FIGURE 22 KEY BUYING CRITERIA FOR MAJOR END-USE INDUSTRIES

- FIGURE 23 MAGNESIUM STEARATES SEGMENT TO DRIVE OVERALL METALLIC STEARATES MARKET

- FIGURE 24 POLYMER & RUBBER SEGMENT TO DRIVE METALLIC STEARATES MARKET FROM 2023 TO 2028

- FIGURE 25 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 26 ASIA PACIFIC: METALLIC STEARATES MARKET SNAPSHOT

- FIGURE 27 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2023

- FIGURE 28 RANKING OF KEY PLAYERS IN METALLIC STEARATES MARKET, 2022

- FIGURE 29 TOP FIVE PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

- FIGURE 30 COMPETITIVE LEADERSHIP MAPPING: METALLIC STEARATES MARKET, 2022

- FIGURE 31 SME MATRIX: METALLIC STEARATES MARKET, 2022

- FIGURE 32 MALLINCKRODT PHARMACEUTICALS: COMPANY SNAPSHOT

- FIGURE 33 BIODEGRADABLE SEGMENT TO LEAD BIOPLASTICS & BIOPOLYMERS MARKET DURING FORECAST PERIOD

- FIGURE 34 PLA TO LEAD BIODEGRADABLE PLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 35 SUGARCANE/SUGAR BEET SEGMENT TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 36 PACKAGING TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

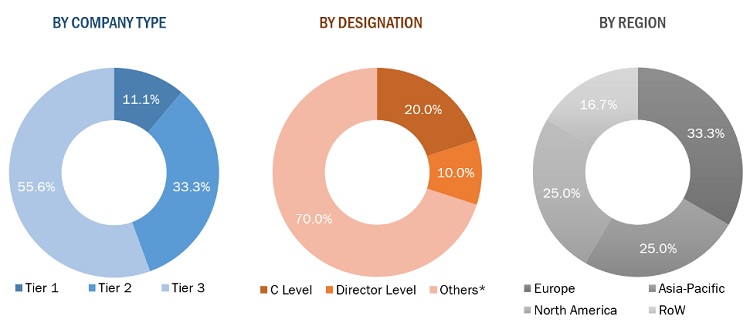

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Metallic stearates market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Metallic Stearates market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Metallic Stearates market. Primary sources from the supply side include associations and institutions involved in the Metallic Stearates industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, engineers, and product managers.

Tier 1= USD 1 Billion; Tier 2 = below USD 1 Billion to USD 500 Million; and Tier 3 = Below USD 500 Million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Metallic Stearates market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

Metallic stearates are compounds derived from the reaction of stearic acid with a metal ion, typically a divalent or trivalent metal such as calcium, magnesium, zinc, or aluminum. The resulting metallic stearate compounds are insoluble in water but soluble in organic solvents, and they have a range of properties that make them useful in various applications

Metallic stearates are often used as lubricants, mold release agents, and stabilizers in the plastics, rubber, and pharmaceutical industries. They can also act as gelling agents in cosmetics, and they are used as pigment dispersants and emulsifiers in the paint and coatings industry. Additionally, metallic stearates are used as a processing aid and anti-caking agent in the food industry.

The properties of metallic stearates can vary depending on the specific metal ion used, and they can be modified by changing the degree of saturation of the stearic acid molecule. Overall, metallic stearates have a wide range of industrial applications due to their unique properties and versatility.

Key Stakeholders

- Raw Material Suppliers and Producers

- Regulatory Bodies

- End User

- Research and Development Organizations

- Industrial Associations

- Metallic Stearates manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global Metallic Stearates market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, raw material, end-use industry, region, and application.

- To forecast the market size, in terms of value and volume, with respect to four main regions: North America, Europe, Asia Pacific, South America and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Metallic Stearates market

- Further breakdown of the Rest of Europe’s Metallic Stearates market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metallic Stearates Market