Manufacturing Execution System Market Size 2030

Manufacturing Execution System Market by Deployment Mode (On-premises, Cloud, Hybrid), Application (Production Management, Quality Management, Material and Inventory Management, Maintenance Management, Performance Analysis) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

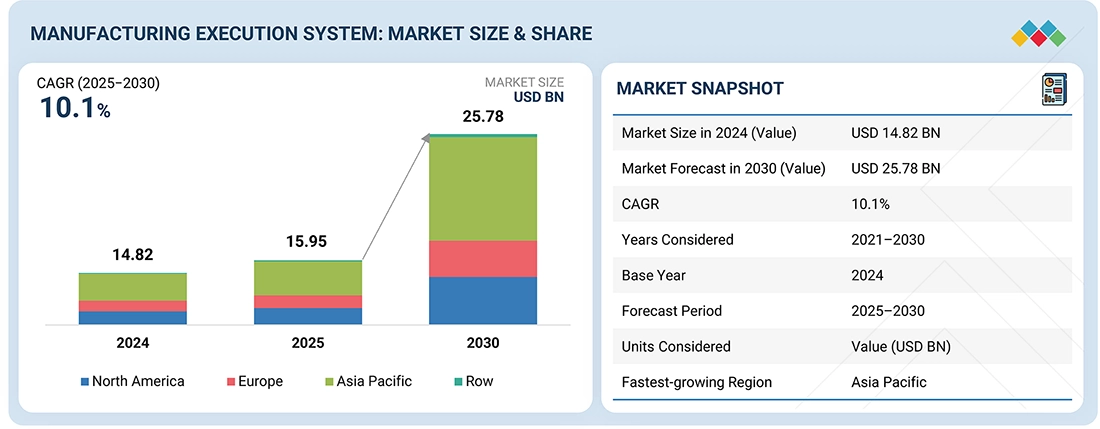

The global manufacturing execution systems market is projected to grow from USD 15.95 billion in 2025 to USD 25.78 billion by 2030, with a CAGR of 10.1%. The market is expected to expand significantly, driven by the increasing demand for real-time production monitoring and process optimization, along with the adoption of Industry 4.0 technologies. Manufacturing execution systems (MES) solutions, which include software and systems, facilitate connections between production planning systems and shop floor activities to enable data sharing and enhance production visibility.

KEY TAKEAWAYS

-

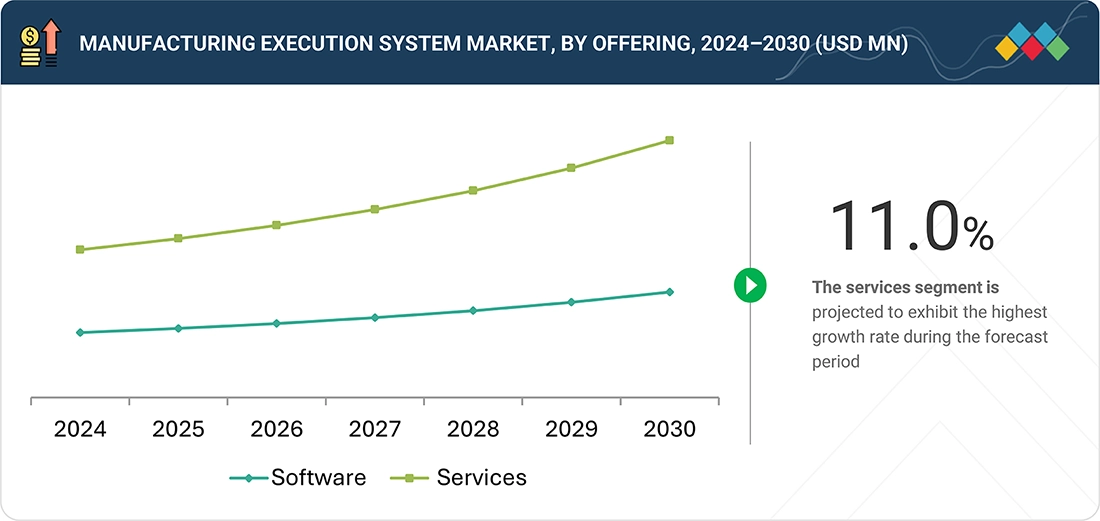

BY OFFERINGThe manufacturing execution system market is divided into software and services. The services segment is expanding the fastest because MES solutions need extensive, custom implementation and integration with factory-specific IT/OT systems. This is further driven by the high demand for ongoing maintenance, support, and specialized consulting for digital transformation efforts. Ultimately, successful MES adoption depends heavily on expert services for configuration and validation.

-

BY DEPLOYMENTThe market is divided into on-premises, cloud, and hybrid solutions. The hybrid deployment model is rapidly expanding in the MES market because it provides the optimal balance between the main benefits of both cloud and on-premises systems. Manufacturers can keep low-latency, mission-critical operations on-site, ensuring data control and compliance. At the same time, they utilize the cloud for scalable, enterprise-wide analytics, remote access, and reduced maintenance costs, offering a flexible approach to digital transformation.

-

BY INDUSTRYThe market serves a wide range of industries, including food & beverages, oil & gas, chemicals, pharmaceuticals & life sciences, automotive, aerospace, medical devices, electronics & semiconductors, metals & mining, and others. The automotive industry holds the largest market share due to the highly complex and large-scale assembly processes involved in vehicle manufacturing. MES is critical for ensuring complete traceability of thousands of components, enforcing strict quality control, and maximizing efficiency in line with lean manufacturing principles.

-

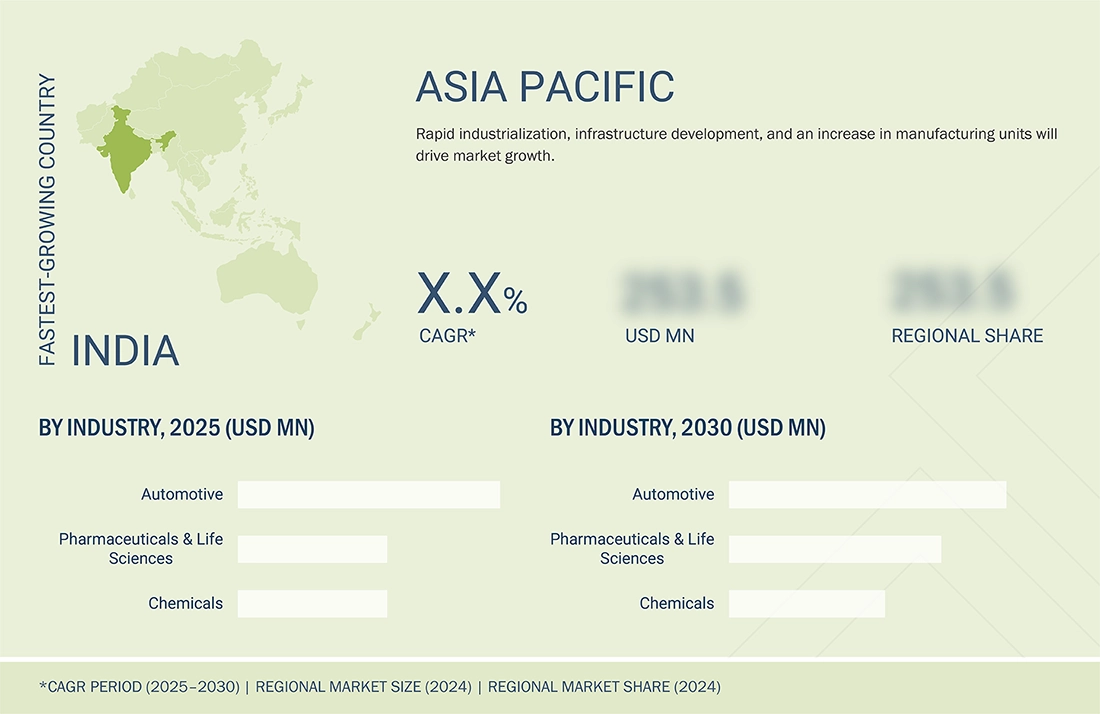

BY REGIONAsia Pacific is expected to experience the fastest growth with a CAGR of 11.2%, driven by increasing industrialization and major government-supported smart manufacturing policies. This trend is reinforced by rising demand for operational efficiency and quality control across a large manufacturing sector, especially in economies like China and India.

-

COMPETITIVE LANDSCAPEThe top players in the market are Siemens, Dassault Systèmes, SAP SE, Rockwell Automation, and Honeywell International. Competition is driven by innovation in cloud computing and AI. Companies are making strategic acquisitions and forming partnerships to expand their product offerings and deliver manufacturing solutions, thus strengthening their market position.

The manufacturing execution system (MES) market is expected to grow significantly over the next decade, driven by increasing demand for industrial automation across various industries. MES can perform multiple tasks and improve efficiency by checking product quality as well as optimizing production. They can monitor processes that are automated through industrial automation. This helps users keep track of the entire supply chain, from the initial phase of raw materials to the final distribution of products to end users.

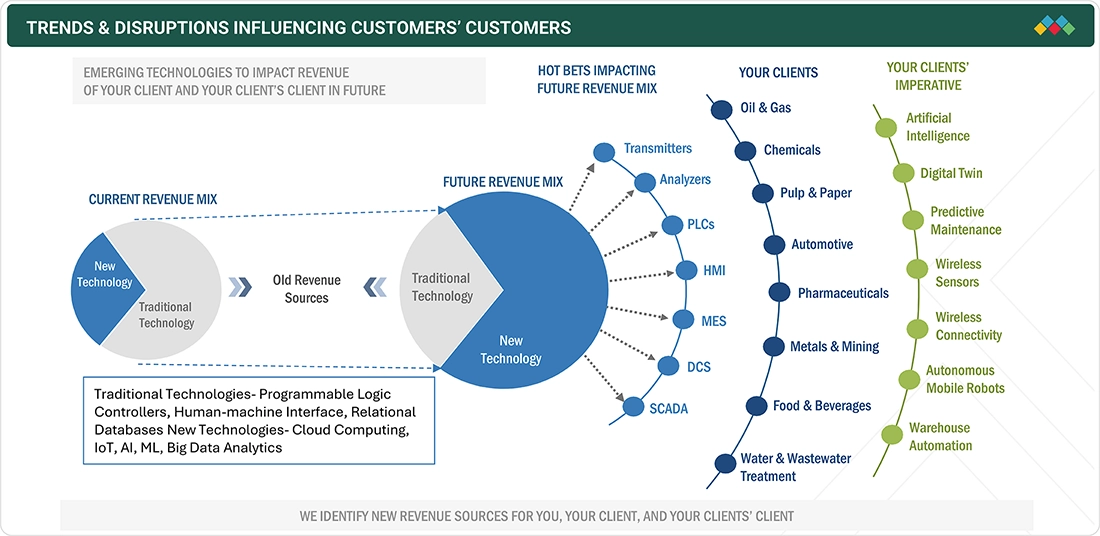

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The manufacturing execution systems (MES) market is quickly changing with increased digitalization and the adoption of advanced technologies like AI, digital twins, predictive maintenance, and IoT. The revenue is shifting toward next-generation, tech-focused solutions as industries seek smarter, connected operations. This trend is pushing MES providers to integrate these technologies smoothly while offering sector-specific solutions tailored to industries such as automotive and pharmaceuticals, gradually replacing traditional, generic systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for industrial automation across industries

-

Rising integration of information technology (IT) with operational

Level

-

High costs associated with MES upgrades and maintenance

-

Customization and integration issues

Level

-

MES integration with ERP and PLM solutions

-

Increasing need for regulatory compliance in pharmaceuticals & life sciences industry

Level

-

Complexities associated with deployment of MES in various industries

-

Data security concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for industrial automation across industries

Industrial automation, using control systems like computers and robots, is increasingly vital for achieving high productivity and enhanced product quality. Manufacturing Execution Systems (MES) integrate these automated processes with other solutions (ERP, SCADA) for real-time tracking across the entire supply chain. This integrated approach ensures efficient data accuracy and helps optimize production, overcoming the high-error risk associated with manual data entry

Restraint: Issues related to customization and integration

Integrating an MES with existing organizational systems, like ERP and legacy platforms, presents significant challenges due to data format and communication protocol inconsistencies. Successful deployment requires extensive customization, specialized expertise, detailed testing, and consistent employee training, all of which drive up costs and integration time. Furthermore, continuous system monitoring and optimization are mandatory to prevent performance degradation, maintain real-time data accuracy, and adapt to evolving production needs.

Opportunity: MES integration with ERP and PLM solutions

Manufacturing execution systems connect with ERP, SCM, WMS, DSS, and PLM to ensure smooth operations, real-time visibility, and efficient decision-making. This connection improves planning, productivity, and compliance by enhancing data accuracy and traceability. By linking across enterprise systems, MES supports automated workflows, fewer errors, and better resource use. Additionally, integration with digital twin technology boosts predictive maintenance and process improvement, further increasing operational efficiency.

Challenge: Complexities associated with MES deployment in industries

Implementing a manufacturing execution system is a complex, multi-year process that often takes about four years because of the need for extensive industry-specific customization. The process is lengthy, starting with adapting business processes, then investing in supporting solutions like ERP and PLM, and ending with moving to electronic records and final system integration. This long and detailed implementation, along with the challenge of adjusting the system to fit complex existing shop-floor hardware, presents a major challenge for market players.

Manufacturing Execution System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Real-time shopfloor MES for integrated production monitoring, digital workflows, and resource management | Complete production control, streamlined compliance, improved operational agility, and lower downtime |

|

DELMIA MES for live quality control, batch traceability, and plant-wide process optimization | Enhanced plant productivity, cost savings, reduced scrap, and improved regulatory compliance |

|

SAP MES integration with ERP; digitized work instructions, equipment monitoring, and full product traceability | Improved product quality, higher equipment uptime, reduced inventory costs, and real-time process visibility |

|

FactoryTalk MES: Real-time production management, workflow tracking, and operation intelligence | Boosted supply chain efficiency, regulatory compliance, greater traceability, reduced waste, and fast scale-up |

|

MES for process industries with deep DCS integration, modular batch digitization, and automated decision support | Real-time production insights, accelerated innovation, easier compliance/traceability, and scalable deployment |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The manufacturing execution system ecosystem includes established software and service providers such as Siemens (Germany), Dassault Systèmes (France), SAP SE (Germany), Rockwell Automation (US), and Honeywell International Inc. (US). These companies supply advanced manufacturing execution systems. The ecosystem also includes system integrators and service providers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Manufacturing Execution System Market, By Offering

The services segment held the largest market share in 2024, mainly because successful MES deployment needs extensive, specialized professional support beyond just the software. This support includes complex and time-consuming tasks like seamless integration with legacy systems (ERP, SCADA), custom configuration tailored to specific industrial processes, and thorough system validation.

Manufacturing Execution System Market, By Deployment

The on-premises segment held a significant share in 2024 because it provides essential benefits for highly regulated and data-sensitive industries such as aerospace, automotive, and pharmaceuticals. On-site deployments ensure superior data security, allow full control over critical manufacturing data, and maintain strict regulatory compliance.

Manufacturing Execution System Market, By Industry

The pharmaceuticals and life sciences sector is expected to see the fastest growth because of the critical requirement for strict regulatory standards like FDA's Good Manufacturing Practices (GMP). MES solutions are vital because they automate electronic batch records (EBRs), provide real-time quality checks, and standardize procedures to reduce human error. This trend is also propelled by the industry's move toward Industry 4.0 technologies, which enhance resource use and boost overall manufacturing efficiency.

REGION

Asia Pacific expected to register highest CAGR in global manufacturing execution system market during forecast period

Asia Pacific is expected to be the fastest-growing market for manufacturing execution systems, driven by rapid industrialization and comprehensive government initiatives such as China's "Made in China 2025," Japan's Manufacturing DX Support, and India's "Make in India" programs. These initiatives actively promote the adoption of MES software to increase production intelligence and improve operational efficiency across key industries like automotive, semiconductors, and electronics. As a result, the substantial manufacturing expansion, led by China, creates ongoing demand for MES, positioning the region as a global market leader.

The North America manufacturing execution system market is projected to reach USD 7.89 billion by 2030 from USD 4.90 billion in 2025, at a CAGR of 10.0% from 2025 to 2030. The market in North America is driven by the rapid digital transformation and Industry 4.0 adoption. The adoption of MES is aimed at improving shop-floor visibility, asset performance, and real-time decision-making. Additionally, strong regulatory compliance needs in sectors such as pharmaceuticals, food, aerospace, and automotive push manufacturers to deploy MES for traceability, quality assurance, and paperless operations.

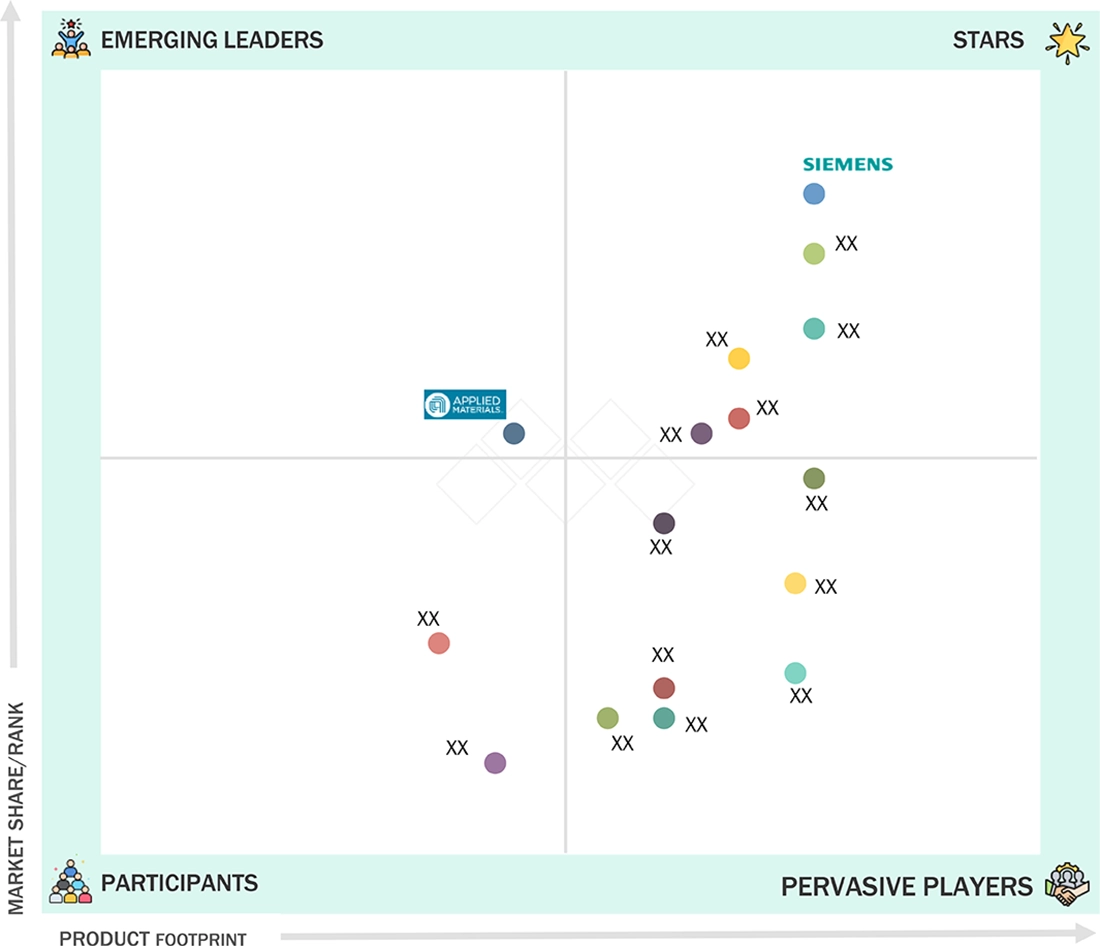

Manufacturing Execution System Market: COMPANY EVALUATION MATRIX

In the manufacturing execution system market matrix, Siemens (Star) and Applied Materials (Emerging Leader) maintain strong positions as a Star player and Emerging Leader through their extensive product portfolios, global reach, and solid financial strength. Their ongoing innovation and brand reputation allow them to lead the widespread adoption of MES solutions globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.82 Billion |

| Market Forecast in 2030 (Value) | USD 25.78 Billion |

| Growth Rate | CAGR of 10.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East, RoW |

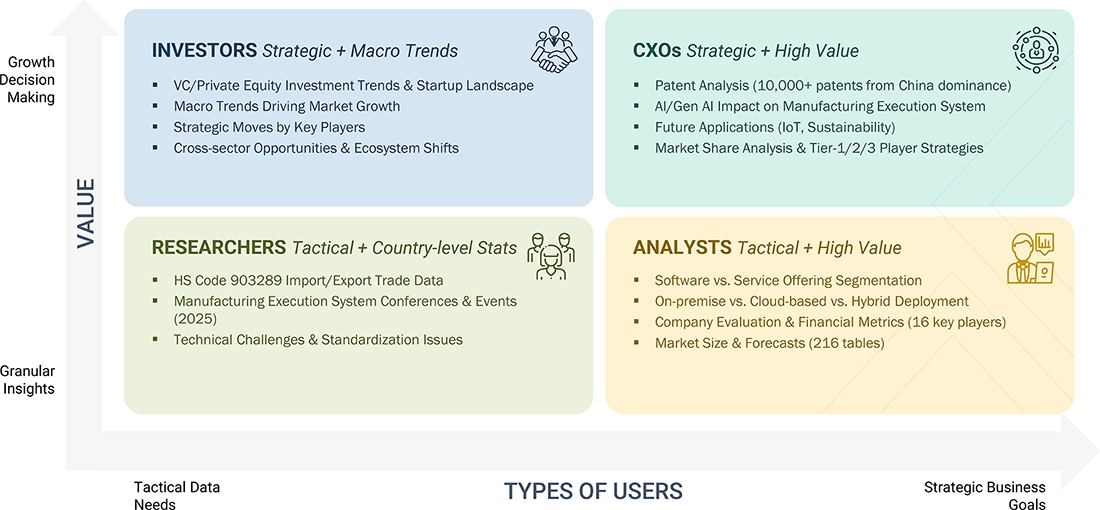

WHAT IS IN IT FOR YOU: Manufacturing Execution System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Automotive Manufacturer |

|

|

| Pharmaceutical MES Provider |

|

|

| Electronics & Semiconductor Manufacturer |

|

|

| Food & Beverage Producer |

|

|

RECENT DEVELOPMENTS

- October 2024 : Yokogawa Electric Corporation announced the launch of OpreX Batch MES, a product in the OpreX Asset Operations and Optimization family. This MES software package is designed for batch plants manufacturing specialty and fine chemicals.

- April 2024 : Emerson Electric Co. introduced DeltaV Workflow Management, a next-generation MES software designed for early-stage development in the life sciences industry. This new MES will help enhance the DeltaV automation platform, offering more scalable options for innovators in the field.

- February 2024 : Dassault Systèmes announced a partnership with Groupe Clarins, the family-owned global cosmetics company. The group has chosen Dassault Systèmes’ 3DEXPERIENCE platform, utilizing DELMIA Apriso to optimize manufacturing processes and boost production capacity.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the manufacturing execution systems market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the manufacturing execution systems market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the manufacturing execution systems market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: RoW mainly comprises the Middle East, Africa, and South America.

Other designations include product managers, sales managers, and marketing managers.

Three tiers of companies have been defined based on their total revenue as of 2024; tier 3: revenue lesser than USD 500 million; tier 2: revenue between USD 500 million and 1 billion; and tier 1: revenue more than USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the manufacturing execution systems market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Manufacturing Execution System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the manufacturing execution systems market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches..

Market Definition

The Manufacturing Execution Systems (MES) market refers to software designed to maximize real-time factory production management by integrating operational technology (OT) with information technology (IT). Unlike enterprise resource planning (ERP) systems, MES offers granular visibility, control, and coordination of the manufacturing process at the shop floor level. These systems maximize production efficiency through optimized monitoring, quality assurance, workflow automation, and compliance with regulatory requirements.

Propelled by Industry 4.0, smart manufacturing, and real-time analytics needs, MES solutions assist manufacturers in minimizing downtime, enhancing agility, and maximizing the use of resources. Industries such as automotive, electronics, pharmaceuticals, aerospace, and food & beverage depends on MES for smooth production, supply chain synchronization, and improved decision-making.

Key Stakeholders

- Associations and regulatory authorities (especially responsible for developing standards related to plant maintenance)

- Government bodies, venture capitalists, and private equity firms

- Automation consultants

- Automation system integrators

- ERP developers

- MES distributors and providers

- Process and discrete industries

- Research organizations and consulting companies

- Technology providers

- Technology investors, standards organizations, forums, alliances, and associations

Report Objectives

- To describe, segment, and forecast the overall manufacturing execution systems market, by deployment mode, offering, application, and industry, in terms of value.

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries, in terms of value.

- To describe the applications and leveraging entities of manufacturing execution systems and software.

- To provide an overview of the recent trends in the market.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To analyze the supply chain, trends/disruptions impacting customers’ business, market/ecosystem map, pricing analysis, and regulatory landscape pertaining to manufacturing execution systems market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market.

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, along with detailing the competitive landscape for market leaders,

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the manufacturing execution systems market.

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, value chain analysis, trends/disruptions impacting customer business, the impact of AI/Gen AI, key conferences and events, pricing analysis, Porter’s five forces analysis, and regulations pertaining to the market under study.

- To provide a macroeconomic outlook based on all the regions in the region chapter.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Manufacturing Execution System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Manufacturing Execution System Market

Christopher

Apr, 2022

Looking for market reports that include, quantify, and segment Redzone Business Systems. .