Management System Certification Market Size, Share & Trends

Management System Certification Market by Quality Management, Environmental Management, Occupational Health and Safety, Information Security, IT & Telecom, Consumer Goods & Retail, Medical & Life Sciences - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

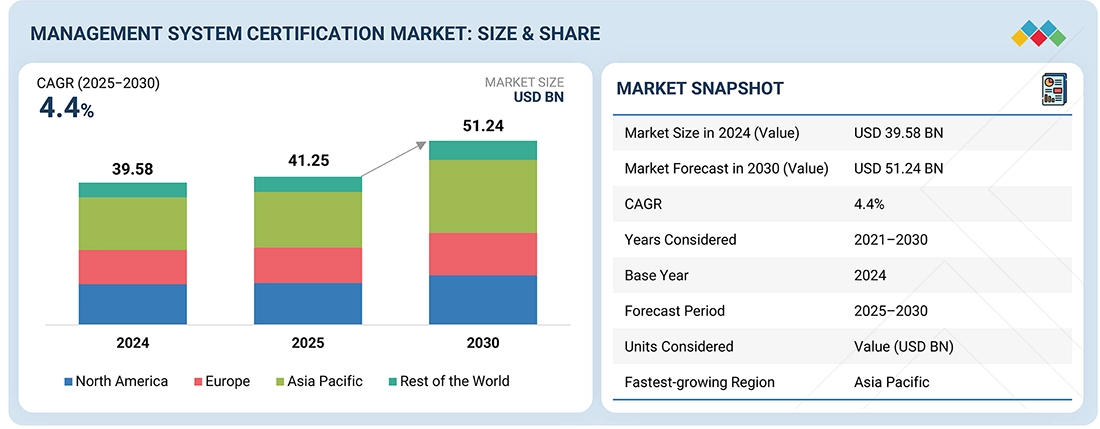

The global management system certification market is expected to grow from USD 41.25 billion in 2025 to USD 51.24 billion by 2030, at a CAGR of 4.4% during the forecast period. The demand for management system certification is growing rapidly, driven by mounting regulatory pressures, heightened consumer awareness, and strong growth in leading industries, such as manufacturing, healthcare, energy, and automotive. Standardized management practices are gaining traction as companies strive to improve compliance, efficiency, and stakeholder confidence. This trend is augmented by the interface between digital technologies and AI, simplifying audits and enhancing the speed and efficiency of certification processes. Furthermore, increased global trade and new international regulations also increase the reliance on harmonized systems, with certification becoming a necessity in a wide industrial spectrum.

KEY TAKEAWAYS

-

BY VERTICALThis segment includes consumer goods & retail, agriculture & food, construction, energy, manufacturing, healthcare, marine, logistics, IT & telecom, and finance. Growth is driven by the rising focus on regulatory compliance, sustainability, and operational transparency. Increasing globalization, supply chain risks, and customer expectations for quality and safety are prompting organizations to adopt internationally recognized certification frameworks.

-

BY CERTIFICATION TYPEThe market is segmented into product certification and management system certification. Management system certification dominates, supported by stringent quality, environmental, and safety standards across industries. Organizations are increasingly pursuing certifications like ISO 9001 and ISO 14001 to enhance credibility, ensure compliance, and streamline business operations in competitive global markets, particularly in regulated sectors such as manufacturing and energy.

-

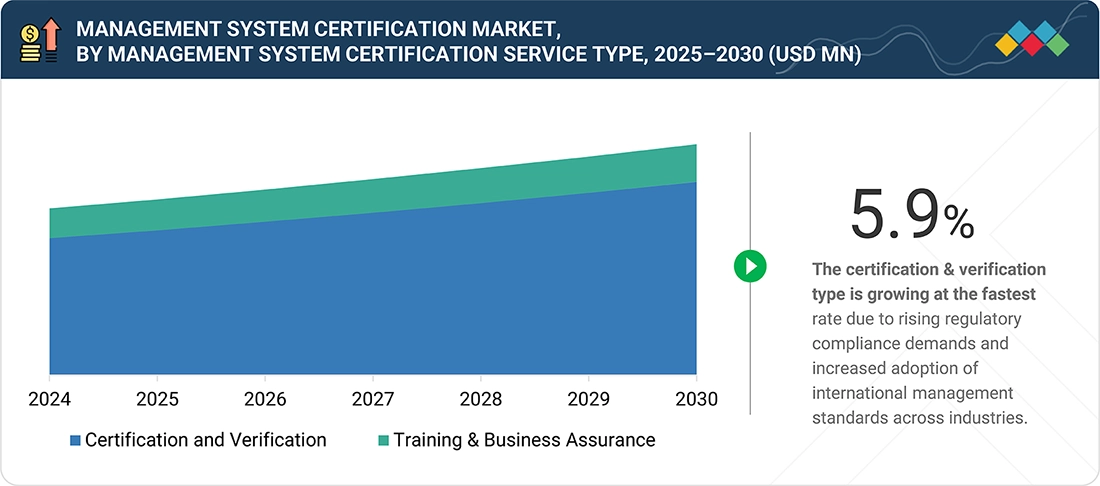

BY MANAGEMENT SYSTEM CERTIFICATION SERVICE TYPEThis segment comprises certification & verification and training & business assurance services. Certification & verification leads the market, driven by rising demand for independent third-party validation of management systems. Meanwhile, training and business assurance services are expanding as companies seek to build internal competencies, mitigate compliance risks, and foster continuous improvement across integrated management frameworks.

-

BY APPLICATIONApplications span quality management, occupational health and safety, information security, food safety, environmental management, and social responsibility certifications. The key growth driver is the growing emphasis on data security, employee welfare, and sustainable business practices. Expanding adoption of ISO, HACCP, and ESG-related certifications is reshaping compliance landscapes and promoting organizational resilience and stakeholder trust.

-

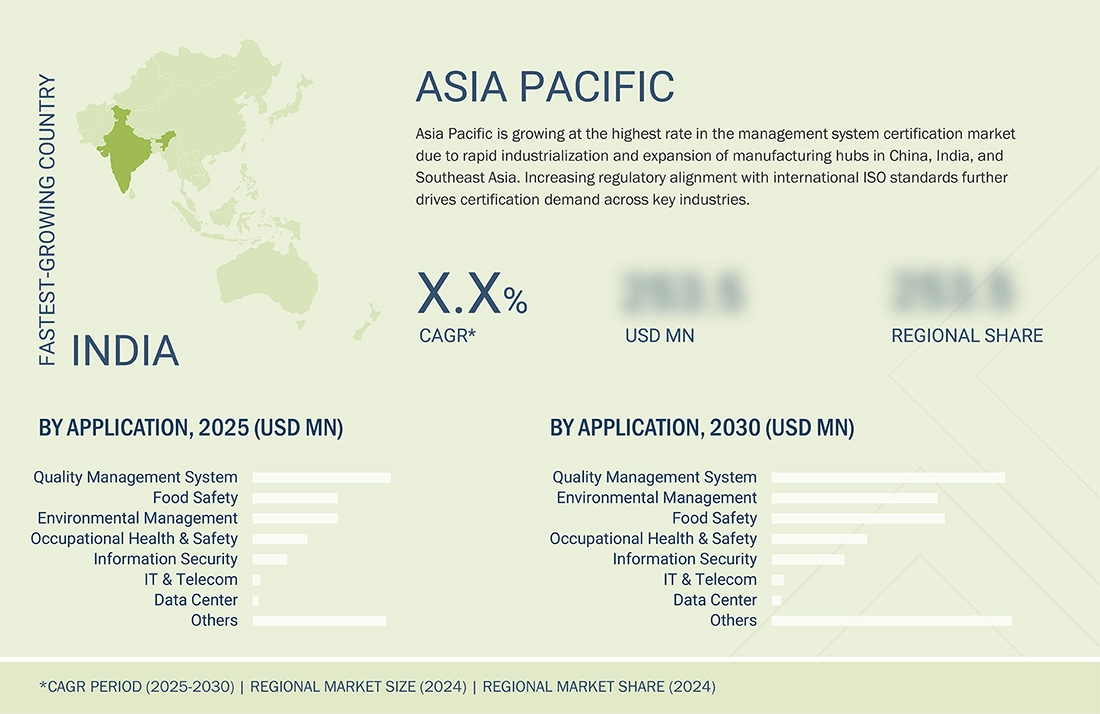

BY REGIONThe Management System Certification Market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). Asia Pacific dominates the market and is projected to grow at the fastest rate, supported by expanding industrial bases, rapid digitalization, and the widespread implementation of international quality standards in China, India, and Japan. Europe and North America maintain steady growth due to established regulatory frameworks and a mature certification culture, while RoW is emerging as a developing market with rising demand for compliance and sustainability certifications.

-

COMPETITIVE LANDSCAPEThe management system certification market is moderately fragmented, with major players such as SGS SA, Bureau Veritas, Intertek Group, TÜV SÜD, and TÜV Rheinland leading through global reach and technological innovation. These companies focus on AI-driven auditing, digital certification tools, and sustainability-based standards. Meanwhile, regional certification bodies intensify competition by offering specialized and cost-effective certification solutions across emerging industries.

The management system certification market is witnessing steady growth, driven by the rising emphasis on quality, safety, and sustainability across industries such as manufacturing, healthcare, IT, and energy. Organizations are increasingly adopting certifications like ISO 9001, ISO 14001, and ISO/IEC 27001 to ensure compliance, operational excellence, and stakeholder trust. Advancements in digital auditing tools, AI-based verification systems, and remote assessment technologies are transforming certification processes. Additionally, growing awareness of environmental management, data security, and social responsibility continues to fuel market expansion globally.

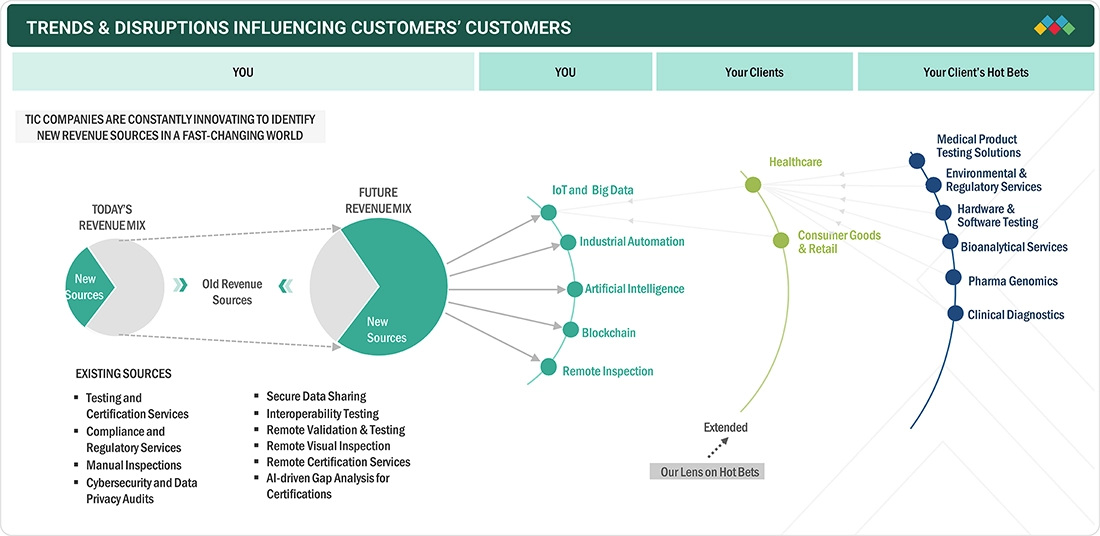

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Management System Certification Market is evolving rapidly, driven by digital transformation and emerging technologies such as IoT, AI, blockchain, and remote inspection tools. These advancements are reshaping how organizations manage compliance, security, and quality systems. Customers increasingly demand data-driven, transparent, and remote auditing processes to ensure operational efficiency and sustainability. Growing emphasis on cybersecurity, interoperability, and ESG standards is creating new certification needs across industries like healthcare, consumer goods, and manufacturing, enabling companies to build trust, resilience, and regulatory alignment in a highly digitalized business environment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Proliferation of global trade and need for harmonized standards

-

Enforcement of stringent global regulatory and compliance standards across multiple industries

Level

-

High cost of certification and compliance

-

Complex and fragmented regulatory landscape

Level

-

Expansion of certification service providers into ESG and non-financial reporting assurance

-

Digital transformation of certification services

Level

-

Disrupted supply chains due to geopolitical tensions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Proliferation of global trade and need for harmonized standards

The expansion of global trade and cross-border manufacturing has intensified the need for uniform management system standards to ensure product quality, safety, and regulatory compliance. Organizations are increasingly adopting international certifications such as ISO 9001, ISO 14001, and ISO/IEC 27001 to meet diverse market requirements. This harmonization of standards enhances supply chain reliability and fosters global competitiveness among businesses.

Restraint: High cost of certification and compliance

Obtaining and maintaining management system certifications involves significant financial investment, especially for small and medium-sized enterprises. Costs related to audits, documentation, training, and periodic renewals can act as a deterrent. Additionally, adapting to evolving regulatory frameworks and sustainability standards requires continuous process upgrades, making compliance both time-intensive and resource-demanding. This financial burden often limits participation from emerging or cost-sensitive industries.

Opportunity: Expansion of certification service providers into ESG and non-financial reporting assurance

The growing emphasis on environmental, social, and governance (ESG) reporting has opened new avenues for certification service providers. Companies are increasingly seeking independent verification of non-financial disclosures, such as sustainability, diversity, and ethical governance metrics. This trend allows certification firms to expand their portfolios, offering ESG assurance, carbon footprint verification, and social impact assessments, aligning with global corporate responsibility goals and investor transparency requirements.

Challenge: Disrupted supply chains due to geopolitical tensions

Ongoing geopolitical conflicts, trade restrictions, and supply chain disruptions are creating operational uncertainties for certification bodies and clients alike. These disruptions affect the scheduling of audits, on-site inspections, and certification renewals, particularly in high-risk regions. Moreover, shifting trade policies and localization mandates compel certification providers to continuously adapt to new regional compliance frameworks, impacting consistency in certification delivery.

Management System Certification Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implements ISO 9001 (Quality Management) and ISO 14001 (Environmental Management) certifications across industrial and energy facilities to ensure consistent process quality and sustainability compliance. | Enhances operational efficiency, reduces environmental impact, and ensures global compliance with ISO standards. |

|

Maintains ISO/IEC 27001 (Information Security Management) and ISO/IEC 22301 (Business Continuity Management) certifications for global data centers under the IT & Telecommunications vertical. | Protects sensitive data, ensures operational resilience, and meets international cybersecurity compliance. |

|

Applies ISO 13485 and ISO 45001 (Occupational Health & Safety) certifications across its Medical & Life Sciences operations for manufacturing and workforce protection. | Ensures patient safety, regulatory alignment, and improved workplace health standards. |

|

Implements ISO 9001 and ISO 14001 certifications under Transportation & Logistics, focusing on global supply chain efficiency and sustainability initiatives. | Improves service reliability, reduces carbon footprint, and ensures compliance with environmental and quality benchmarks. |

|

Adopts ISO 26000 (Social Responsibility) and ISO 50001 (Energy Management) certifications under Finance and Sustainable Governance verticals. | Demonstrates ESG commitment, enhances energy efficiency, and strengthens brand reputation for sustainable operations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Management System Certification Market ecosystem comprises regulatory bodies, certification service providers, and end users. Key standard-setting organizations such as ISO, IEC, ANSI, and ASTM define global frameworks for quality, safety, and sustainability. Certification providers including SGS, DEKRA, Intertek, TÜV NORD, and UL ensure compliance through audits and verification services. End users like Samsung, Boeing, Siemens, LG, and GE Healthcare adopt certifications to enhance credibility, streamline operations, and meet industry-specific regulatory and customer requirements across global markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Management System Certification Market, By Certification Type

Product Certification holds the largest market share, driven by increasing regulatory scrutiny and consumer demand for verified quality and safety standards. The growing complexity of global trade, coupled with stringent compliance norms in sectors such as manufacturing, food, and electronics, has reinforced the importance of third-party product validation. Meanwhile, Management System Certification is expanding rapidly as organizations adopt integrated systems for quality, environment, and information security management.

Management System Certification Market, By Management System Certification Service Type

The Certification and Verification segment dominates the market, supported by heightened requirements for independent audits and accreditation across industries. Rising focus on operational transparency, ESG compliance, and digital certification processes further drives this segment. In contrast, Training and Business Assurance services are gaining traction as companies prioritize workforce competence, risk management, and continuous improvement to sustain compliance and maintain certification validity.

Management System Certification Market, By Application

The Quality Management System (QMS) segment holds the largest share, as ISO 9001 remains the most widely adopted standard globally. Organizations across manufacturing, logistics, and healthcare rely on QMS certifications to enhance process efficiency and customer satisfaction. Meanwhile, Food Safety and Environmental Management certifications are growing steadily, propelled by sustainability mandates, supply chain accountability, and stricter food safety regulations worldwide.

Management System Certification Market, By Vertical

Consumer Goods and Retail represents the largest vertical in the management system certification market, reflecting strong demand for quality, sustainability, and ethical sourcing compliance. Retailers increasingly adopt certifications to meet customer expectations and regulatory standards. Healthcare, Manufacturing, and Agriculture sectors also contribute significantly, supported by rising emphasis on product traceability, energy management, and workplace safety certification programs.

REGION

Asia Pacific to be the fastest-growing region in the global management system certification market during the forecast period

The Asia Pacific region is witnessing the fastest growth in the Management System Certification Industry, driven by rapid industrialization, expanding manufacturing hubs, and increasing regulatory alignment with international ISO standards. Countries like China, India, and Japan are at the forefront, emphasizing quality management, environmental sustainability, and workplace safety. Government initiatives supporting industrial modernization and digital transformation are further encouraging certification adoption. Additionally, growing export activities and the rising presence of global certification providers are strengthening regional market development across diverse industry sectors.

The North America management system certification market is projected to grow from USD 11.71 billion in 2025 to USD 13.82 billion by 2030, at a CAGR of 3.37%. One of the major growth drivers of the management system certification market in North America is the tightening regulatory landscape across environmental, safety, and data security domains. As federal, state, and provincial authorities strengthen compliance requirements, organizations increasingly adopt standards such as ISO 9001, ISO 14001, ISO 45001, and ISO/IEC 27001 to demonstrate adherence, mitigate legal and operational risks, and maintain eligibility for customer and government contracts. This surge in regulatory scrutiny, combined with rising expectations for transparency, ESG accountability, and supply-chain assurance, is accelerating the demand for third-party certification across multiple industries in the region.

Management System Certification Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the management system certification companies highlights a competitive landscape shaped by diverse service portfolios and global reach. SGS stands out in the Stars quadrant with a strong market presence, extensive service footprint, and leadership in sustainability and digital certification solutions. Eurofins, positioned among Emerging Leaders, is expanding its capabilities through specialized certifications and regional diversification. Other players are enhancing their footprint through technological integration, partnerships, and sector-specific certifications, reflecting an industry evolving toward innovation, automation, and compliance-driven differentiation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 39.58 BN |

| Market Forecast in 2030 (Value) | USD 51.24 BN |

| Growth Rate | CAGR of 4.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Rest of the World |

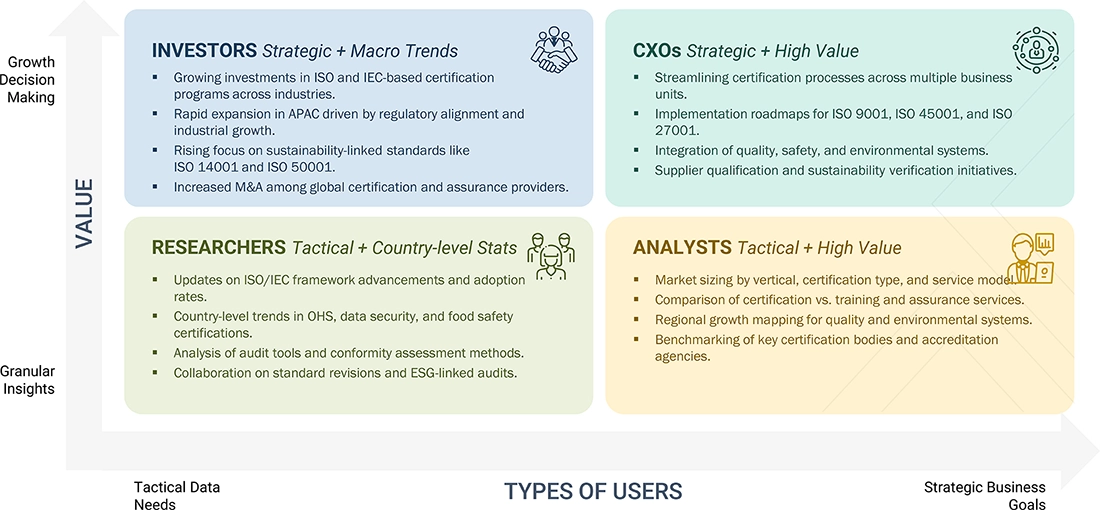

WHAT IS IN IT FOR YOU: Management System Certification Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Certification Body / Audit Firm |

|

|

| Industrial & Manufacturing Enterprise |

|

|

| Technology & IT Service Provider |

|

|

| Government / Regulatory Bodies |

|

|

| Healthcare & Life Sciences Companies |

|

|

RECENT DEVELOPMENTS

- April 2025 : The EU Machinery Regulation designated TÜV Rheinland as its official Notified Body. The company can now perform conformity assessments for machinery products under the new regulatory framework, which helps manufacturers achieve EU compliance and market readiness.

- January 2025 : The Mobile Manipulation Robot (MMR) RockyOne received its CE-MD conformity certificate from TÜV Rheinland (China) for XYZ Robotics China Inc. The certification demonstrates compliance with the European Union Machinery Directive and requires technical standards for market entry authorization throughout European territory.

- January 2025 : RTI Laboratories in Detroit joined hands with SGS SA through a purchasing agreement that brought the TIC services company under SGS SA ownership. The acquisition helps SGS expand its North American operations and certification services for commercial and federal standards while bringing in thirty new team members.

- December 2024 : Luxury Brand Services became part of Bureau Veritas after its acquisition for quality assurance and control services in the luxury market. The acquisition links up with LEAP | 28 to expand its luxury and fashion business sector presence while reinforcing logistics solutions throughout Italy.

- October 2024 : TÜV SÜD granted its first IEEE CertifAIEd certification for ethically responsible AI applications to Austrian logistics startup Digicust GmbH. The international certification evaluates the ethical responsibility of AI systems.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the management system certification market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step has been to validate these findings and assumptions and size them with industry experts across the supply chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the management system certification market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the management system certification market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: RoW mainly comprises the Middle East, Africa, and South America.

Other designations include product managers, sales managers, and marketing managers.

Three tiers of companies have been defined based on their total revenue as of 2024; tier 3: revenue lesser than USD 500 million; tier 2: revenue between USD 500 million and 1 billion; and tier 1: revenue more than USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the management system certification market.

- Identified major companies that provide management system certification services. This included analyzing company portfolios, service offerings, and presence across various regions.

- Their segment-specific revenues, particularly those related to certification services, were determined.

- These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

- Using this consolidated data, the global market size for management system certification was obtained.

The top-down approach has been used to estimate and validate the total size of the management system certification market.

- Estimated the total market size for management system certification, outlining the overall scope and growth potential of the market

- Analyzed the regional market distribution, with further estimation of individual country shares within each region to identify localized trends and differences

- Estimated the percentage split of the market segment based on certification type, service type, and vertical at regional and country levels

- Estimated the percentage split of the market segment based on application at regional levels

- Determine the global market size by certification type, service type, vertical, and application; and further, break down application segment into sub-applications to understand specific contributions and trends

Management System Certification Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the management system certification market.

Market Definition

The management system certification market encompasses a range of services provided by accredited bodies to assess and certify that an organization’s management systems comply with recognized international, national, or sector-specific standards. These certifications, covering standards, such as ISO 9001 (Quality Management Systems), ISO 14001 (Environmental Management Systems), ISO 45001 (Occupational Health and Safety Management Systems), ISO 27001 (Information Security Management), and ISO 50001 (Energy Management Systems), validate an organization’s commitment to operational excellence, regulatory compliance, risk management, sustainability, and continual improvement. Certification services include auditing, gap assessments, consulting, training, and recertification processes, often supported by digital platforms and remote auditing technologies.

Key Stakeholders

- Raw material and testing equipment suppliers

- Research organizations

- Original equipment manufacturers (OEMs)

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users

Report Objectives

- To define, describe, and forecast the size of the management system certification market by certification type, management system certification service type, application, and vertical in terms of value

- To describe and forecast the market size for various segments concerning four key regions, namely North America, Europe, Asia Pacific, and RoW, in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To understand and analyze the impact of evolving technologies on the overall value chain of the market and upcoming trends in the ecosystem

- To offer macroeconomic outlooks with respect to main regions, namely North America, Europe, Asia Pacific, and RoW

- To give a detailed overview of the management system certification market industry trends, technology trends, use cases, regulatory landscape, and Porter’s five forces

- To strategically analyze micromarkets for individual growth trends, prospects, and contributions to the total market

- To provide ecosystem analysis, trends/disruptions impacting customer business, technology analysis, pricing analysis, key stakeholders & buying criteria, case study analysis, patent analysis, key conferences & events, Gen AI/ AI impact, Trump Tariff impact, and regulations related to the management system certification market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders

- To analyze the competitive developments, such as acquisitions, service launches, expansions, agreements, partnerships, accreditations, and collaborations, carried out by market players

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of service portfolio

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Management System Certification Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Management System Certification Market