Low-Frequency Sound-Absorbing Insulation Materials Market by Type (Foam, Others), Application (Under the Bonnet, Interior) and Region (Europe, North America, Rest of the World) - Global Forecast to 2025

Updated on : April 17, 2024

Low Frequency Sound Absorbing Insulation Materials Market

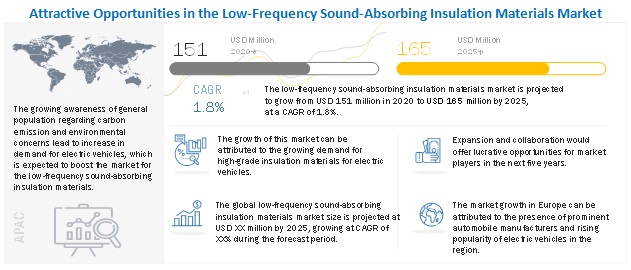

The global low frequency sound absorbing insulation materials market was valued at USD 151 million in 2020 and is projected to reach USD 165 million by 2025, growing at 1.8% cagr from 2020 to 2025. The market is mainly driven by Several regulatory authorities guide and regulate the North American automotive industry, including Federal Motor Vehicle Safety Standards (FMVSS) and National Highway and Traffic Safety Administration (NHTSA) regulate the vehicle and road safety norms. In Canada, the Canada Motor Vehicle Safety Standards (CMVSS) is the regulatory body for traffic and automobile safety. Europe is the key market for Low-frequency sound-absorbing insulation materials, globally, followed by North America.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Low-frequency sound-absorbing insulation materials Market

In 2020, the outbreak of COVID-19 has impacted the global economy and different industries altogether. The electric vehicle market is taking a serious hit amid COVID-19. For now, it appears to be a short-term stall. But with the economy headed for recession and the price of oil reaching historic lows, bigger challenges could lie ahead for the EV industry unless governments take proactive measures to ensure a clean-energy transit in future. Leading private automakers such as Tesla, Volkswagen, Nissan, Toyota, and Honda have gradually shifted focus on electric vehicles. For instance, leading German vehicle manufacturer, Volkswagen, announced its plan to launch 70 new electric models by 2028 instead of the 50 planned previously. The reducing price of batteries has significantly lowered the cost of an electric vehicle, which, in turn, allows to target a larger customer base. Hence, the popularity of EVs has grown in the recent past.

Market Dynamics

Driver: Vehicle refinement levels influencing consumer buying decision

Increased awareness about noise, vibration, and harshness levels in automobiles has resulted in demand for overall refinement level of a vehicle, which is an important factor influencing the decision of automobile buyers. As a result, manufacturers have to demonstrate superiority by focusing on NVH concerns. At a particular price point, buyers tend to choose a vehicle that offers better NVH levels, given that the other factors, such as fuel efficiency, safety, brand value, and after-sale service are compromised, as NVH levels are directly related to vehicle safety. This has led to automotive manufacturers making significant investments to develop and market automobiles with low NVH levels. This trend is expected to increase the demand for automotive NVH control materials and is further driving the low-frequency sound-absorbing insulation materials.

Restraints: Installation of active noise control systems

Active noise control system is one such technology that allows automotive manufacturers to achieve better noise control without using more NVH materials in vehicles. This technology uses the vehicle’s audio system to cancel low-frequency unwanted noise by emitting sound waves with the same amplitude, but with an inverted phase to the original sound. However, the development of such technology may substitute NVH control materials in the coming years, thus reducing their demand.

Opportunities: Rising sales of electric vehicles across the globe

There is an increasing demand and popularity of electric vehicles owing to initiatives taken by government and policymakers to promote the manufacture of emission-free vehicles. Governments in countries such as the US, EU countries, India, and China are providing various kinds of incentives such as low or zero registration fee and exemption in import tax, purchase tax, and road tax. For instance, the US government recently invested USD 5 billion for promoting electric infrastructure. Europe has set a very ambitious goal of reducing 80% CO2 emission by 2050 and has created a roadmap for the same. The governments of various countries in Europe are subsidizing electric infrastructure, and the focus will continue to be on electric vehicles in the long run.

The foam segment is expected to dominate the market during the forecast period

Foam is the most widely used insulation material used as low-frequency sound-absorbing insulation material. Both open and closed-cell foams are used in acoustic insulation. Foam and foam-based materials are the materials that cater to a wide range of application segments when it comes to the handling of different frequencies of noise. Both closed-cell and open-cell foams are used in noise insulation. Companies are mostly catering to mid-and-high-frequency requirements. But, with further modifications, the same material could be used for low-frequency ranges.

The interior application segment is expected to hold the largest market share, in terms of value, between 2020 and 2025

Interior applications includes floor covering, underbody cladding, luggage compartment, and door trims among others. In any luxury vehicle, the engine is quiet when compared to a normal vehicles. This is the reason that insulation of interior space is slightly more when compared to engines in a luxury vehicle. On the other hand, Engine and under the bonnet application include engine and under the bonnet area which is insulated. This application area accounted for a smaller share when compared to interior segment. This is because engine area of luxury cars is quite and needs less insulation.

Europe is expected to record the highest growth rate in the low-frequency sound-absorbing insulation materials market during the forecast period

Europe was the largest market for low-frequency sound-absorbing insulation material. This is because of the presence of major manufacturers of luxury and electric vehicles in European region. In Europe, Germany was the largest market for low-frequency sound-absorbing insulation material. This is because of the presence of major manufacturers of luxury and electric vehicles in Germany including BMW, and Mercedes Benz among others. Over the years, electric vehicles have emerged as the most appropriate solution to reduce the emission of gases by ICE vehicles. Initially, high production cost, limited drive range, and long charging time were the key obstacles in the electric vehicles market. However, over the last decade, advancements in technology have helped manufacturers overcome these obstacles. For instance, Tesla has introduced innovative superchargers that can charge electric vehicle battery up to 80% in less than 30 minutes. In recent years, over-dependency on oil for transportation has caused tremendous loss to the environment

Key Market Players

Saint-Gobain (France), Autoneum (Switzerland), 3M (US), DuPont (US), BASF (Germany), Mitsubishi Chemical Holdings (Japan), and Stevens Insulation LLC (US).

In May 2019, Saint-Gobain acquired Pritex (UK), a key company in the thermo-acoustic insulation solutions market. The acquisition will enable the mobility business unit of Saint-Gobain High Performance solutions to expand its business model beyond automotive glazing and offer advanced solutions in the mobility market for comfort, safety, and energy savings. Similarly, In November 2019, Autoneum launched a new material, Hybrid-Acoustics PET. Compared to conventional insulation material, this is up to 40% lighter. They are also flameproof and are used in powertrain-mounted insulators for combustion engines. They have a temperature resistance of up to 180°C.

Scope of the Report

|

Report Metric |

Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This report categorizes the Low frequency sound absorbing insulation materials market based on material, application, and region.

On the basis of material, the Low frequency sound absorbing insulation materials market has been segmented as

- Foam

- Others

On the basis of application, the Low frequency sound absorbing insulation materials market has been segmented as follows:

- Engine and under the bonnet

- Interior

On the basis of region, the Low frequency sound absorbing insulation materials market has been segmented as follows:

- North America

- Europe

- Rest of the World

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

Emergence of electric vehicle is and regiulations with respect to sound in vehicle to impact the market

What are the major factors impacting market growth during the forecast period?

Increase in sale of premium cars to impact the market during the forecast period

Which insulation material is widely used across a the applications?

Foam and foam-based materials are the materials that cater to a wide range of application segments when it comes to handling of different frequencies of noise. Both closed-cell and open-cell foams are used in noise insulation.

What are the major applications for low-frequency sound-absorbing insulation materials?

Key applications include floor covering, underbody cladding, luggage compartment shelf, door trims, and so on. Engine and under the bonnet application include engine and under the bonnet area which is insulated. This application area accounted for a smaller share when compared to interior segment. This is because engine area of luxury cars is quite and needs less insulation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET DEFINITION: APPLICATION

1.2.2 MARKET DEFINITION: MATERIAL

1.2.3 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of primary sources – demand side

2.1.2.3 Key verbatim comments

2.1.2.4 Breakdown of primary

2.2 BASE NUMBER CALCULATION: DEMAND SIDE ANALYSIS

2.3 STUDY APPROACH

2.4 MARKET SIZE ESTIMATION

2.4.1 TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

2.5 DATA TRIANGULATION

2.6 PARAMETERS & ASSUMPTIONS

2.6.1 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET: FACTORS IMPACTING THE MARKET FOR LUXURY VEHICLES

3 EXECUTIVE SUMMARY

3.1 INTRODUCTION

3.2 LOW FREQUENCY INSULATION MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND PRE-COVID-19 SCENARIOS

3.2.1 REALISTIC SCENARIO

3.1.2 NON-COVID-19 SCENARIO

3.1.3 OPTIMISTIC SCENARIO

3.1.4 PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET

4.2 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY APPLICATION, 2020-2025

4.3 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY APPLICATION AND PRODUCT TYPE, 2019

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 REGULATIONS AND ITS IMPACT ON LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET

5.4.1 NORTH AMERICA: AN OVERVIEW

5.4.2 EUROPE: AN OVERVIEW

5.4.3 ASIA PACIFIC: AN OVERVIEW

5.5 VALUE CHAIN ANALYSIS AND COST ANALYSIS OF LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS

5.6 PROFIT MARGIN ANALYSIS

5.7 FUTURE REVENUE MIX: YC SHIFT AND YCC SHIFT

5.8 CASE STUDY

5.9 PATENT ANALYSIS

5.10 MACROECONOMIC INDICATORS

5.11 COVID-19 IMPACT

5.12 COVID-19 IMPACT ECONOMIC SCENARIO

6 INDUSTRY TRENDS

6.1 SOURCES OF NVH

6.2 SOURCES OF ORIGIN FOR LOW-FREQUENCY NOISE IN AUTOMOTIVE PARTS

6.3 IN-BUILT FEATURES AND MATERIALS USED TO REDUCE LOW FREQUENCY NOISE

6.4 VERBATIMS

7 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET – COVID-19 IMPACT

7.1 INSIGHTS ON EV SALES AND COVID-19 PANDEMIC IMPACT

7.1.1 COVID-19 IMPACT ON ELECTRIC VEHICLES

7.1.2 COVID-19 IMPACT ON PREMIUM VEHICLES

7.1.3 COVID-19 IMPACT ON VEHICLES

8 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY MATERIAL

8.1 INTRODUCTION

8.2 FOAM

8.3 OTHERS

9 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY APPLICATION

9.1 INTRODUCTION

9.2 ENGINE AND UNDER THE BONNET

9.3 INTERIOR

10 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY REGION

10.1 INTRODUCTION

10.2 EUROPE

10.2.1 GERMANY

10.2.2 REST OF EUROPE

10.3 NORTH AMERICA

10.3.1 US

10.3.2 REST OF NORTH AMERICA

10.4 REST OF THE WORLD

10.4.1 CHINA

10.4.2 OTHERS

11 CUSTOMER INSIGHTS

11.1 INFLUECING FACTORS FOR INNOVATION IN NVH MATERIALS

11.2 OEM PREFERENCE AND KEY CHALLENGES

11.3 KEY PARAMETERS FOR CHOOSING INSULATION MATERIALS FOR LOW FREQUENCY- IMPORTANCE VS. SATISFACTION LEVEL

11.4 SATISFACTION LEVELS & UNMET NEEDS

11.5 WILLINGNESS TO PAY PREMIUM PRICES

12 COMPETITIVE LANDSCAPE

12.1 INTRODUCTION

12.2 MARKET RANKING OF KEY PLAYERS IN LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, 2019

12.3 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

12.3.1 STAR

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE

12.3.4 EMERGING COMPANIES

12.4 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN LOW FREQUENCY INSULATION MARKET, 2019

12.5 PRODUCT COMPARISON OFFERED BY KEY PLAYERS

13 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat from Competition, Feedback from Customers, Unique Selling Points, Saint-Gobain’s Right to Win, MNM view)*

13.1 SAINT-GOBAIN

13.2 AUTONEUM

13.3 3M

13.4 DUPONT

13.5 BASF SE

13.6 MITSUBISHI CHEMICAL HOLDINGS

13.7 STEVENS INSULATION, LLC

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat from Competition, Feedback from Customers, Unique Selling Points, Saint-Gobain’s Right to Win, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

14.1 ELECTRIC VEHICLE INSULATION MARKET

15 APPENDIX

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 RELATED REPORTS

15.4 AUTHOR DETAILS

LIST OF TABLES (78 Tables)

TABLE 1 INCLUSIONS & EXCLUSIONS

TABLE 2 LIST OF PRIMARY SOURCES: DEMAND SIDE

TABLE 3 EURO VI EMISSION LIMITS (PETROL)

TABLE 4 EURO VI EMISSION LIMITS (DIESEL)

TABLE 5 PREVIOUS EURO EMISSION STANDARDS

TABLE 6 EURO VI STAGES AND OCE/ISC REQUIREMENTS

TABLE 7 PATENT ANALYSIS

TABLE 8 GDP FORECAST FOR KEY COUNTRIES

TABLE 9 SOURCES OF NVH

TABLE 10 INSULATION MATERIALS ARE/CAN BE USED FOR LOW FREQUENCY SOUND ABSORPTION

TABLE 11 COVID-19 IMPACT ON ELECTRIC VEHICLE ECOSYSTEM

TABLE 12 COVID-19 IMPACT ON ELECTRIC VEHICLE OEMS

TABLE 13 COVID-19 IMPACT ON PREMIUM VEHICLE PRODUCTION, CURRENT AND FORECAST, 2019-2025 (THOUSAND UNITS)

TABLE 14 COVID-19 IMPACT ON PREMIUM VEHICLE OEMS

TABLE 15 PREMIUM VEHICLE PRODUCTION, BY COMPANY, 2018-2019

TABLE 16 COVID-19 IMPACT ON SALES REVENUE, BY COMPANY, 2018-2019

TABLE 17 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY MATERIAL, 2019-2025 (USD MILLION)

TABLE 18 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY APPLICATION, 2019-2025 (USD MILLION)

TABLE 19 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY REGION, 2019-2025 (USD MILLION)

TABLE 20 EUROPE: LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, 2019-2025 (USD MILLION)

TABLE 21 NORTH AMERICA: LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, 2019-2025 (USD MILLION)

TABLE 22 ROW: LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, 2019-2025 (USD MILLION)

TABLE 23 PRODUCT COMPARISON OFFERED BY KEY PLAYERS

TABLE 24 ELECTRIC VEHICLE INSULATION MARKET SIZE, BY PRODUCT TYPE, 2017–2024 (USD MILLION)

TABLE 25 ELECTRIC VEHICLE INSULATION MARKET SIZE, BY PROPULSION TYPE, 2017–2024 (USD MILLION)

TABLE 26 ELECTRIC VEHICLE SALES MARKET, BY PROPULSION TYPE, 2017–2030 (THOUSAND UNITS)

TABLE 27 ELECTRIC VEHICLE INSULATION MARKET SIZE IN BEV, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 28 ELECTRIC VEHICLE INSULATION MARKET SIZE IN BEV, BY INSULATION TYPE, 2017–2024 (USD MILLION)

TABLE 29 BEV SALES, BY REGION 2017–2030 (THOUSAND UNITS)

TABLE 30 ELECTRIC VEHICLE INSULATION MARKET SIZE IN PHEV, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 31 ELECTRIC VEHICLE INSULATION MARKET SIZE IN PHEV, BY INSULATION TYPE, 2017–2024 (USD MILLION)

TABLE 32 PHEV SALES, BY REGION 2017–2030 (THOUSAND UNITS)

TABLE 33 FCEV SALES, BY REGION 2017–2030 (THOUSAND UNITS)

TABLE 34 PHEV SALES, BY REGION 2017–2030 (THOUSAND UNITS)

TABLE 35 ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 36 ELECTRIC VEHICLE INSULATION MARKET SIZE IN UNDER THE BONNET AND BATTERY PACK APPLICATION, BY PROPULSION TYPE, 2017–2024 (USD MILLION)

TABLE 37 BATTERY SUPPLY CHAIN OF MAJOR ELECTRIC VEHICLE MODELS

TABLE 38 ELECTRIC VEHICLE INSULATION MARKET SIZE IN INTERIOR APPLICATION, BY PROPULSION TYPE, 2017–2024 (USD MILLION)

TABLE 39 ELECTRIC VEHICLE INSULATION MARKET SIZE IN OTHER APPLICATIONS, BY PROPULSION TYPE, 2017–2024 (USD MILLION)

TABLE 40 ELECTRIC VEHICLE INSULATION MARKET SIZE, BY INSULATION TYPE, 2017–2024 (USD MILLION)

TABLE 41 ELECTRIC VEHICLE INSULATION MARKET SIZE, BY PROPULSION TYPE, 2017–2024 (USD MILLION)

TABLE 42 ACOUSTIC INSULATION MARKET SIZE, BY PROPULSION TYPE, 2017–2024 (USD MILLION)

TABLE 43 ELECTRICAL INSULATION MARKET SIZE, BY PROPULSION TYPE, 2017–2024 (USD MILLION)

TABLE 44 ELECTRIC VEHICLE INSULATION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 45 ELECTRIC VEHICLE SALES, BY REGION, 2017–2030 (THOUSAND UNITS)

TABLE 46 APAC: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 47 APAC: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 48 APAC: SALES OF PASSENGER ELECTRIC CAR, BY COUNTRY, 2017–2030 (UNITS)

TABLE 49 CHINA: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 50 CHINA: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 51 JAPAN: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 52 JAPAN: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 53 SOUTH KOREA: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 54 SOUTH KOREA: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 55 INDIA: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 56 NORTH AMERICA: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 57 NORTH AMERICA: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 58 NORTH AMERICA: SALES OF PASSENGER ELECTRIC CAR, BY COUNTRY, 2017–2030 (UNITS)

TABLE 59 US: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 60 US: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 61 CANADA: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 62 CANADA: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 63 EUROPE: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 64 EUROPE: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 65 EUROPE: SALES OF PASSENGER ELECTRIC CAR, BY COUNTRY, 2017–2030 (UNITS)

TABLE 66 GERMANY: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 67 GERMANY: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 68 FRANCE: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 69 FRANCE: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 70 UK: ELECTRIC VEHICLE INSULATION MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

TABLE 71 UK: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 72 NETHERLANDS: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 73 NORWAY: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 74 SWEDEN: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 75 DENMARK: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 76 AUSTRIA: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 77 SWITZERLAND: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

TABLE 78 SPAIN: SALES OF PASSENGER ELECTRIC CAR, BY PROPULSION TYPE, 2017–2030 (UNITS)

LIST OF FIGURES (26 Figures)

FIGURE 1 STUDY SCOPE

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

FIGURE 3 KEY DATA FROM PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARIES

FIGURE 5 INSULATION MATERIALS DEMAND IN THE AUTOMOTIVE: PREMIUM CARS AND EVS

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 RESEARCH APPROACH

FIGURE 10 POTENTIAL SOURCES OF INFORMATION

FIGURE 11 RESEARCH METHEODOLOGY: PARAMETERS & ASSUMPTIONS

FIGURE 12 FOAM SEGMENT TO DOMINATE LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET FROM 2020 TO 2025

FIGURE 13 INTERIOR SEGMENT TO DOMINATE LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET FROM 2020 TO 2025

FIGURE 14 EUROPE TO COMMAND LARGEST SHARE OF LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET FROM 2020 TO 2025

FIGURE 15 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET TO WITNESS THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 16 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY APPLICATION, 2020–2025

FIGURE 17 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET, BY APPLICATION AND MATERIAL, 2020

FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 GDP GROWTH FORECAST BEFORE AND POST COVID-19 OUTBREAK

FIGURE 20 COVID-19 IMPACT ON ELECTRIC PASSENGER CAR MARKET, REALISTIC MARKET SCENARIO, 2019 – 2021 (MILLION UNITS)

FIGURE 21 COVID-19 IMPACT ON ELECTRIC PASSENGER CAR MARKET, REALISTIC SCENARIO, BY REGION, 2019 – 2021 (MILLION UNITS)

FIGURE 22 LOW FREQUENCY SOUND ABSORBING MATERIALS MARKET SIZE, 2019-2025 (USD MILLION)

FIGURE 23 FOAM SEGMENT TO LEAD THE OVERALL LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET

FIGURE 24 INTERIOR SEGMENT TO LEAD THE OVERALL LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET

FIGURE 25 EUROPE REGION LEAD THE OVERALL LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET (2020-2025)

FIGURE 26 LOW-FREQUENCY SOUND-ABSORBING INSULATION MATERIALS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

The study involves four major activities in estimating the market size for Low-frequency sound-absorbing insulation materials market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study includes annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, and Bloomberg. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

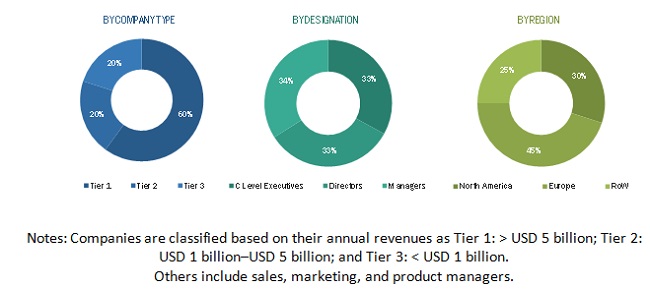

The Low frequency sound absorbing insulation materials market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of automotive applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents-

To know about the assumptions considered for the study, download the pdf brochure

Notes: Companies are classified based on their annual revenues as Tier 1: > USD 5 billion; Tier 2: USD 1 billion–USD 5 billion; and Tier 3: < USD 1 billion.

Others include sales, marketing, and product managers.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Low frequency sound absorbing insulation materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive industries.

Report Objectives

- To define, describe, and forecast the low-frequency sound-absorbing insulation materials market size, in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, and opportunities) influencing the market growth

- To estimate and forecast the Low frequency sound absorbing insulation materials market size based on material and application

- To forecast the Low frequency sound absorbing insulation materials market size based on major regions–North America, Europe, and Rest of the World (RoW)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze recent developments in the market

- To strategically profile the key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Regional Analysis

- A further breakdown of a region with respect to a particular country or additional application

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Low-Frequency Sound-Absorbing Insulation Materials Market