Liquid Nitrogen Market by End-Use Industry (Chemicals & Pharmaceuticals), by Storage, Distribution & Transportation (Cylinder & Packaged Gas), by Function (Coolant, Refrigerant), by Production Technology (Cryogenic Distillation) - Global Forecast to 2020

[222 Pages Report] The liquid nitrogen market is projected to grow from USD 12,483.7 Million in 2015 to USD 16,144.6 Million by 2020, at an estimated CAGR of 5.28%. The liquid nitrogen market is expected to grow rapidly in accordance with the growth in the industrial gas market globally. Liquid nitrogen is used as a cryogen, wherever low temperatures is required. It is widely used in cryosurgeries, cryotherapies, and cryopreservation to destroy decayed tissues and to remove warts, moles, skin tags, verrucas, and some skin cancers. Additionally, it is used as a coolant in temporary shrinking of mechanical gears at the time of machine assembly, thus make better intrusion fits. This function is expected to foster the demand for liquid nitrogen during the forecast period. This report aims at estimating the market size and future growth potential of the liquid nitrogen market across different segments such as function, production technology, end-use industry, distribution mode, and region. Base year considered for the study is 2014 and the market size is projected from 2015 to 2020. Factors such as growing industrialization and burgeoning energy markets and medical sector are expected to be the major growth drivers of the liquid nitrogen market in the next five years.

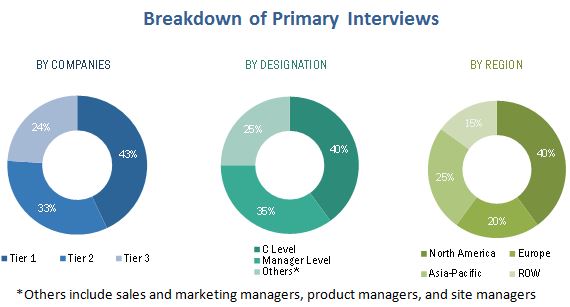

The research methodology used to estimate and forecast the liquid nitrogen market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global liquid nitrogen market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The eco-system of liquid nitrogen market comprises liquid nitrogen companies such as Air Products and Chemicals Inc. (U.S), Linde Ag (Germany), Praxair Inc., (U.S.), Nexair LLC. (U.S.), Air Liquide S.A. (France), Taiyo Nippon Sanso Corporation (Japan), Gulf Cryo (United Arab Emirates), Emirates Industrial Gases Co. LLC. (United Arab Emirates), and Southern Industrial Gas BHD (Malaysia).

Target Audience

- OEM companies

- Electronic equipment manufacturers

- Metal manufacturers and fabricators

- Medical equipment manufacturers

- Consulting firms

Scope of the Report

The research report segments the liquid nitrogen market to following submarkets:

By End-use Industry:

- Chemicals & pharmaceuticals

- Food & beverage

- Healthcare

- Metal manufacturing & construction

- Rubber & Plastic

- Others (electronics and energy)

By storage, distribution, and transportation:

- Cylinder & packaged distribution

- Merchant liquid distribution

- Tonnage distribution

By Function:

- Coolant

- Refrigerant

By manufacturing process:

- Cryogenic distillation

- Pressure swing adsorption

By Region:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America liquid nitrogen market

- Further breakdown of the Europe liquid nitrogen market

- Further breakdown of the APAC liquid nitrogen market

- Further breakdown of the RoW liquid nitrogen market

Company Information

- Detailed analysis and profiling of additional market players

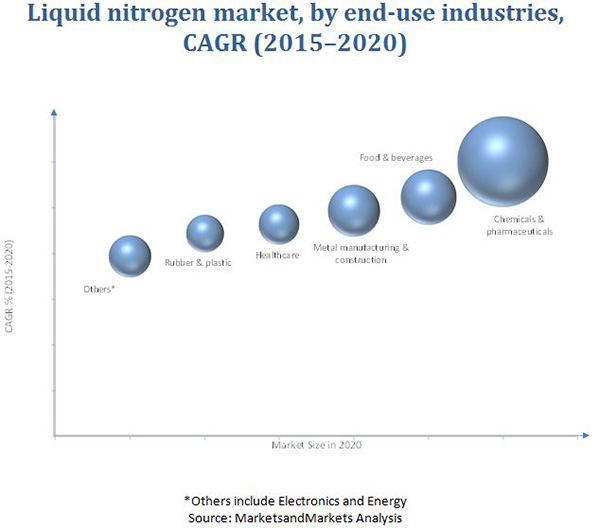

MarketsandMarkets projects that the liquid nitrogen market size will grow from USD 12.48 Billion in 2015 to USD 16.14 Billion by 2020, at an estimated CAGR of 5.28%. The increasing demand in various applications such as metal fabrication, electronics, healthcare, automotive, and lighting are the major factors driving the growth of the liquid nitrogen industry. Additionally, with rapid urbanization, growth in infrastructural activities, and increasing industrialization and the medical sector across the globe, there is a rapid increase in the demand for liquid nitrogen. Liquid nitrogen is used in electronics, fabrication of specialty alloys, lasers, metals, and other industrial applications. The chemicals & pharmaceuticals segment is projected to have the largest market share and dominate the liquid nitrogen market from 2015 to 2020, as various applications in these industries use liquid nitrogen. Chemicals and medical & healthcare sectors are to play a key role in changing the liquid nitrogen landscape and grow at a high rate during the forecast period.

Coolant is projected to form the fastest-growing function in the liquid nitrogen market as it is used in many end-use industries such as metal manufacturing & construction, chemicals & pharmaceuticals, and healthcare. The cylinder & packaged distribution mode is projected to account for the largest market share in the liquid nitrogen market. Verticals such as tonnage distribution and merchant liquid distribution will be key growing distribution modes during the forecast period.

North America is projected to have the largest market share and dominate the market for liquid nitrogen from 2015 to 2020. Asia-Pacific offers potential growth opportunities, as developing countries such as China and India are projected to be emerging markets, making the Asia-Pacific region the fastest-growing market for liquid nitrogen. The growth of the liquid nitrogen market in this region is driven by factors such as the growth of the metal manufacturing & fabrication industry, rise in demand for electronic products from the growing population, and economic development.

However, the structural and regulatory restrictions are restraining the growth of the liquid nitrogen market. The manufacturers must take necessary precautions in the handling, storage, & transportation of liquid nitrogen as per the regulations. The major vendors in the liquid nitrogen market include Praxair Inc. (U.S.), Air Liquide S.A. (France), The Linde Group (Germany), Messer Group (Germany), Nexair LLC. (U.S.), Taiyo Nippon Sanso Corporation (Japan), Air Products and Chemicals, Inc. (U.S.), Gulf Cryo (United Arab Emirates), Emirates Industrial Gases Co. LLC. (United Arab Emirates), and Southern Industrial Gas Berhad (Malaysia). These players adopted various strategies such as mergers & acquisitions, partnerships, joint ventures, new product developments, and business expansion to cater to the needs of the liquid nitrogen market.

Table of Contents

1 Introduction (Page No. - 25)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered for the Liquid Nitrogen Market

1.4 Currency Considered for the Liquid Nitrogen Market

1.5 Unit Considered for the Liquid Nitrogen Market

1.6 Stakeholders

2 Research Methodology (Page No. - 28)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Population

2.2.2.2 Increasing Income and Spending Capacity

2.2.3 Supply-Side Analysis

2.2.3.1 Industry Regulations

2.2.3.2 Fluctuations in Fuel Prices

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Assumptions Made for This Study

2.6.3 Limitations

3 Executive Summary (Page No. - 41)

3.1 Chemicals & Pharmaceuticals is Projected to Account for the Largest Share By 2020

3.2 North America is Projected to Dominate the Global Liquid Nitrogen Market By 2020

3.3 The Indian Market is Projected to Grow at the Highest CAGR From 2015 to 2020

4 Premium Insights (Page No. - 46)

4.1 Attractive Market Opportunities in the Liquid Nitrogen Market

4.2 Liquid Nitrogen Market in the Asia-Pacific Region

4.3 Emerging and Developed Markets for Liquid Nitrogen, 2015 vs 2020

5 Market Overview (Page No. - 50)

5.1 Introduction

5.2 Market Evolution

5.3 Liquid Nitrogen Market Segmentation

5.3.1 By End-Use Industry

5.3.2 By Function

5.3.3 By Storage, Transportation & Distribution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Electronic Products Have Seen an Increased Demand

5.4.1.2 Healthcare Sector has Seen A Steady Growth

5.4.1.3 Growing Food & Beverage Industry

5.4.2 Restraints

5.4.2.1 Structural and Regulatory Restrictions

5.4.3 Opportunities

5.4.3.1 High Demand From Chemical Industry

5.4.4 Challenges

5.4.4.1 Intricate Manufacturing Process

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Value Chain

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threats of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Liquid Nitrogen Market, By End-Use Industry (Page No. - 64)

7.1 Introduction

7.1.1 By End-Use Industry

7.1.1.1 Chemicals & Pharmaceuticals is the Fastest-Growing Segment for Liquid Nitrogen During the Review Period

7.2 Healthcare

7.3 Food & Beverages

7.4 Chemicals & Pharmaceuticals

7.5 Metal Manufacturing & Construction

7.6 Rubber & Plastic

7.7 Others

8 Liquid Nitrogen Market, By Storage, Distribution & Transportation (Page No. - 69)

8.1 Introduction

8.1.1 By Storage, Distribution & Transportation

8.1.1.1 Cylinder & Packaged Gas Segment is Projected to Grow at the Highest CAGR

8.2 Cylinders & Packaged Gas

8.3 Merchant Liquid/Bulk

8.4 Tonnage

9 Liquid Nitrogen Market, By Function (Page No. - 74)

9.1 Introduction

9.1.1 By Function

9.1.1.1 Coolant Projected to Be the Fastest-Growing Function in Liquid Nitrogen, By 2020

9.2 Coolant

9.2.1 Coolant in Liquid Nitrogen Market, By End-Use Industry

9.2.1.1 Chemicals & Pharmaceuticals Dominated the Market in 2014

9.3 Refrigerant

9.3.1 Refrigerant in Liquid Nitrogen Market Size, By End-Use Industry

9.3.1.1 Food & Beverages Projected to Be the Fastest-Growing End-Use Industry of Refrigerant, By 2020

10 Liquid Nitrogen Market, By Production Technology (Page No. - 80)

10.1 Introduction

10.1.1 Size, By Production Technology

10.1.1.1 Cryogenic Distillation Dominated the Market, By Production Technology, in 2014

10.2 Cryogenic Distillation

10.3 Pressure Swing Adsorption

11 Liquid Nitrogen Market, By Region (Page No. - 84)

11.1 Introduction

11.1.1 Size, By Region

11.1.1.1 North America Dominated the Market for Liquid Nitrogen in 2014

11.2 North America

11.2.1 North America: Size, By Country

11.2.1.1 U.S. is Projected to Be the Fastest-Growing Market By 2020

11.2.1.2 North America: Size, By End-Use Industry

11.2.1.2.1 North American Market Driven By Growing Chemicals & Pharmaceuticals Industry

11.2.1.3 North America: Size, By Storage, Distribution & Transportation

11.2.1.3.1 Cylinder & Packaged Gas Distribution Segment Dominated the Market in North America

11.2.1.4 North America: Size, By Function

11.2.1.4.1 Coolant Segment Accounted for the Largest Share Owing to Its Growing Function in the Liquid Nitrogen Industry

11.2.1.5 North America: Size, By Production Technology

11.2.1.5.1 Pressure Swing Adsorption Segment to Grow at the Highest Rate By 2020

11.2.2 U.S.

11.2.2.1 U.S.: Size, By End-Use Industry

11.2.2.1.1 Chemicals & Pharmaceuticals Segment Dominated the Market in the U.S., in 2014

11.2.2.2 U.S.: Size, By Storage, Distribution & Transportation

11.2.2.2.1 Cylinder & Packaged Gas Distribution Segment Dominated the Market in 2014

11.2.2.3 U.S.: Size, By Function

11.2.2.3.1 Coolant Showing Signs of Potential Growth in the U.S.

11.2.2.4 U.S.: Size, By Production Technology

11.2.2.4.1 Cryogenic Distillation Segment Accounted for the Largest Share in 2014

11.2.3 Canada

11.2.3.1 Canada: Size, By End-Use Industry

11.2.3.1.1 Chemicals & Pharmaceuticals Was the Largest Segment in 2014

11.2.3.2 Canada: Size, By Storage, Distribution, & Transportation

11.2.3.2.1 Cylinder & Packaged Gas Distribution Segment to Grow at the Highest Rate By 2020

11.2.3.3 Canada: Size, By Function

11.2.3.3.1 Coolant Function Dominated the Liquid Nitrogen Market in 2014

11.2.3.4 Canada: Size, By Production Technology

11.2.3.4.1 Pressure Swing Adsorption Segment to Grow at the Highest CAGR in the Canadian Market

11.2.4 Mexico

11.2.4.1 Mexico: Size, By End-Use Industry

11.2.4.1.1 Mexican , By End-Use Industry, Was Dominated By Chemicals & Pharmaceuticals Segment in 2014

11.2.4.2 Mexico: Size, By Storage, Distribution, & Transportation

11.2.4.2.1 Cylinder & Packaged Gas Distribution Segment to Grow at the Highest Rate By 2020

11.2.4.3 Mexico: Size, By Function

11.2.4.3.1 Refrigerant Segment to Grow at the Second-Highest Rate By 2020

11.2.4.4 Mexico: Size, By Production Technology

11.2.4.4.1 Cryogenic Distillation Segment Dominated the Market in 2014

11.3 Asia-Pacific

11.3.1 Asia-Pacific: Size, By Country

11.3.1.1 China Dominated the Asia-Pacific Liquid Nitrogen in 2014

11.3.1.2 Asia-Pacific: Size, By End-Use Industry

11.3.1.2.1 Chemicals & Pharmaceuticals Accounted for the Largest Market Share in 2014, By Value

11.3.1.3 Asia-Pacific: Size, By Storage, Distribution, & Transportation

11.3.1.3.1 Cylinder & Packaged Gas Distribution to Grow at the Highest CAGR By 2020

11.3.1.4 Asia-Pacific: Size, By Function

11.3.1.4.1 Coolant to Grow at the Highest Rate By 2020

11.3.1.5 Asia-Pacific: Size, By Production Technology

11.3.1.5.1 Cryogenic Distillation Was the Largest Market in 2014

11.3.2 China

11.3.2.1 China: Size, By End-Use Industry

11.3.2.1.1 Growing Chemicals & Pharmaceuticals Industry is Driving the in China

11.3.2.2 China: Size, By Storage, Distribution, & Transportation

11.3.2.2.1 Cylinder & Packaged Gas Distribution Dominated the Chinese Market

11.3.2.3 China: Size, By Function

11.3.2.3.1 Coolant Dominated the Market in China

11.3.2.4 China: Size, By Production Technology

11.3.2.4.1 Cryogenic Distillation Projected to Grow at the Highest Rate By 2020

11.3.3 India

11.3.3.1 India: Size, By End-Use Industry

11.3.3.1.1 Chemicals & Pharmaceuticals Projected to Grow at the Highest Rate By 2020

11.3.3.2 India: Size, By Storage, Distribution & Transportation

11.3.3.2.1 Cylinder & Packaged Gas Distribution Dominated the Market in 2014

11.3.3.3 India: Size, By Function

11.3.3.3.1 India is Largely Driven By Growth in the Income of Middle-Class Population

11.3.3.4 India: Size, By Production Technology

11.3.3.4.1 Cryogenic Distillation Showing Potential for Growth in India

11.3.4 Japan

11.3.4.1 Japan: Size, By End-Use Industry

11.3.4.1.1 Chemicals & Pharmaceuticals to Grow at the Highest CAGR By 2020

11.3.4.2 Japan: Size, By Storage, Distribution & Transportation

11.3.4.2.1 Cylinder & Packaged Gas Distribution Dominated the Market in 2014

11.3.4.3 Japan: Size, By Function

11.3.4.3.1 Function of Liquid Nitrogen in Coolant Was the Highest in 2014

11.3.4.4 Japan: Size, By Production Technology

11.3.4.4.1 Cryogenic Distillation Projected to Grow at the Highest Rate By 2020

11.3.5 South Korea

11.3.5.1 South Korea: Size, By End-Use Industry

11.3.5.1.1 Food & Beverage to Grow at the Second-Highest CAGR By 2020

11.3.5.2 South Korea: Size, By Storage, Distribution & Transportation

11.3.5.2.1 Merchant Liquid Distribution to Grow at the Second Highest Rate By 2020

11.3.5.3 South Korea: Size, By Function

11.3.5.3.1 Function of Liquid Nitrogen in Coolant Was the Largest in 2014

11.3.5.4 South Korea: Size, By Production Technology

11.3.5.4.1 Cryogenic Distillation Accounted for the Largest Market Share in 2014

11.3.6 Rest of Asia-Pacific

11.3.6.1 Rest of Asia-Pacific: Size, By End-Use Industry

11.3.6.1.1 Chemicals & Pharmaceuticals Held the Largest Share in the Rest of Apac Liquid Nitrogen Market

11.3.6.2 Rest of Asia-Pacific:Size, By Storage, Distribution & Transportation

11.3.6.2.1 Cylinder & Packaged Gas Distribution Was the Largest Market in 2014

11.3.6.3 Rest of Asia-Pacific: Size, By Function

11.3.6.3.1 Refrigerant Was the Second-Largest Function for Liquid Nitrogen in 2014

11.3.6.4 Rest of Asia-Pacific:Size, By Production Technology

11.3.6.4.1 Pressure Swing Adsorption Was the Second-Largest Market in 2014

11.4 Europe

11.4.1 Europe: Liquid Nitrogen Market Size, By Country

11.4.1.1 Germany Held the Largest Share in the European Liquid Nitrogen Market

11.4.1.2 Europe: Liquid Nitrogen Market Size, By End-Use Industry

11.4.1.2.1 Chemicals & Pharmaceuticals to Grow at The Highest CAGR By 2020

11.4.1.3 Europe: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.4.1.3.1 Cylinder & Packaged Gas Distribution Dominated the Market in Europe

11.4.1.4 Europe: Liquid Nitrogen Market Size, By Function

11.4.1.4.1 Coolant Dominated the Market in Europe in 2014

11.4.1.5 Europe: Liquid Nitrogen Market Size, By Production Technology

11.4.1.5.1 Cryogenic Distillation Dominated the Liquid Nitrogen in Europe

11.4.2 Germany

11.4.2.1 Germany: Liquid Nitrogen Market Size, By End-Use Industry

11.4.2.1.1 Chemicals & Pharmaceuticals Accounted for the Largest Market Share in 2014

11.4.2.2 Germany: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.4.2.2.1 Merchant Liquid Distribution Was the Second-Largest Market in 2014 in Germany

11.4.2.3 Germany: Liquid Nitrogen Market Size, By Function

11.4.2.3.1 Refrigerant Was the Second-Largest Market in 2014 in Germany

11.4.2.4 Germany: Liquid Nitrogen Market Size, By Production Technology

11.4.2.4.1 Cryogenic Distillation Accounted for the Largest Market Share in 2014

11.4.3 France

11.4.3.1 France: Liquid Nitrogen Market Size, By End-Use Industry

11.4.3.1.1 Chemicals & Pharmaceuticals Projected to Grow at the Highest Rate By 2020

11.4.3.2 France: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.4.3.2.1 Cylinder & Packaged Gas Distribution Accounted for the Largest Share in France

11.4.3.3 France: Liquid Nitrogen Market Size, By Function

11.4.3.3.1 Coolant Dominated the Liquid Nitrogen Market in 2014

11.4.3.4 France: Liquid Nitrogen Market Size, By Production Technology

11.4.3.4.1 Cryogenic Distillation Dominated the Liquid Nitrogen Market in 2014

11.4.4 U.K.

11.4.4.1 U.K.: Liquid Nitrogen Market Size, By End-Use Industry

11.4.4.1.1 Food & Beverages Projected to Grow at the Second-Highest Rate

11.4.4.2 U.K.: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.4.4.2.1 Cylinder & Packaged Gas Distribution Showing Growth Potential in the U.K.

11.4.4.3 U.K.: Liquid Nitrogen Market Size, By Function

11.4.4.3.1 Coolant Dominated the U.K. Market for Liquid Nitrogen

11.4.4.4 U.K.: Liquid Nitrogen Market Size, By Production Technology

11.4.4.4.1 Cryogenic Distillation Dominated the U.K. Market for Liquid Nitrogen

11.4.5 Belgium

11.4.5.1 Belgium: Liquid Nitrogen Market Size, By End-Use Industry

11.4.5.1.1 Food & Beverages to Grow at the Second-Highest Rate By 2020 in Belgium

11.4.5.2 Belgium: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.4.5.2.1 Cylinder & Packaged Gas Distribution Showing Growth Potential in Belgium

11.4.5.3 Belgium: Liquid Nitrogen Market Size, By Function

11.4.5.3.1 Coolant Segment Dominated the Belgium Market for Liquid Nitrogen

11.4.5.4 Belgium: Liquid Nitrogen Market Size, By Production Technology

11.4.5.4.1 Cryogenic Distillation Dominated the Belgium Market for Liquid Nitrogen

11.4.6 Rest of Europe

11.4.6.1 Rest of Europe: Liquid Nitrogen Market Size, By End-Use Industry

11.4.6.1.1 Chemicals & Pharmaceuticals to Grow at the Highest CAGR By 2020

11.4.6.2 Rest of Europe: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.4.6.2.1 Merchant Liquid Distribution Projected to Grow at the Second-Highest CAGR By 2020

11.4.6.3 Rest of Europe: Liquid Nitrogen Market Size, By Function

11.4.6.3.1 Coolant Segment Accounted for the Largest Share in 2014 and is Also Projected to Grow at the Highest CAGR By 2020

11.4.6.4 Rest of Europe: Liquid Nitrogen Market Size, By Production Technology

11.4.6.4.1 Cryogenic Distillation to Grow at the Second-Highest Rate By 2020

11.5 RoW

11.5.1 RoW: Liquid Nitrogen Market Size, By Country

11.5.1.1 Brazil Dominated the RoW Liquid Nitrogen Market in 2014

11.5.1.2 RoW: Liquid Nitrogen Market Size, By End-Use Industry

11.5.1.2.1 Food & Beverages Segment to Grow at the Second-Highest Rate By 2020

11.5.1.3 RoW: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.5.1.3.1 Cylinder & Packaged Gas Distribution Segment Dominated the Market in 2014

11.5.1.4 RoW: Liquid Nitrogen Market Size, By Function

11.5.1.4.1 Coolant Segment Dominated the Market in 2014, in RoW

11.5.1.5 RoW: Liquid Nitrogen Market Size, By Production Technology

11.5.1.5.1 Pressure Swing Adsorption Segment is Projected to Have Potential Growth By 2020

11.5.2 Brazil

11.5.2.1 Brazil: Liquid Nitrogen Market Size, By End-Use Industry

11.5.2.1.1 Liquid Nitrogen Market in Brazil Was Dominated By the Chemicals & Pharmaceuticals Segment in 2014

11.5.2.2 Brazil: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.5.2.2.1 Cylinder & Packaged Gas Distribution to Grow at the Highest Rate By 2020

11.5.2.3 Brazil: Liquid Nitrogen Market Size, By Function

11.5.2.3.1 Coolant Segment Dominated the Brazilian Market for Liquid Nitrogen in 2014

11.5.2.4 Brazil: Liquid Nitrogen Market Size, By Production Technology

11.5.2.4.1 Pressure Swing Adsorption Segment is Projected to Grow at the Highest CAGR By 2020

11.5.3 Saudi Arabia

11.5.3.1 Saudi Arabia: Liquid Nitrogen Market Size, By End-Use Industry

11.5.3.1.1 Chemicals & Pharmaceuticals Segment Dominated the Market in Saudi Arabia

11.5.3.2 Saudi Arabia: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.5.3.2.1 Cylinder & Packaged Gas Distribution Segment Projected to Grow at the Highest Rate By 2020

11.5.3.3 Saudi Arabia: Liquid Nitrogen Market Size, By Function

11.5.3.3.1 Coolant Segment is Expected to Have Potential Growth Opportunities By 2020

11.5.3.4 Saudi Arabia: Liquid Nitrogen Market Size, By Production Technology

11.5.3.4.1 Cryogenic Distillation Segment Dominated the Market in 2014

11.5.4 South Africa

11.5.4.1 South Africa: Liquid Nitrogen Market Size, By End-Use Industry

11.5.4.1.1 Chemicals & Pharmaceuticals Segment Dominated the Market in South Africa

11.5.4.2 South Africa: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.5.4.2.1 Merchant Liquid Distribution Segment Projected to Grow at the Second-Highest Rate By 2020

11.5.4.3 South Africa: Liquid Nitrogen Market Size, By Function

11.5.4.3.1 Coolant Segment is Expected to Have Potential Growth Opportunities By 2020

11.5.4.4 South Africa: Liquid Nitrogen Market Size, By Production Technology

11.5.4.4.1 Cryogenic Distillation Segment Dominated the Market in 2014

11.5.5 Other RoW Countries

11.5.5.1 Other RoW. Countries: Liquid Nitrogen Market Size, By End-Use Industry

11.5.5.1.1 Chemicals & Pharmaceuticals Segment Projected to Grow at the Highest Rate By 2020

11.5.5.2 Other RoW. Countries: Liquid Nitrogen Market Size, By Storage, Distribution, & Transportation

11.5.5.2.1 Cylinder & Packaged Gas Distribution Segment is Projected to Grow at the Highest CAGR By 2020

11.5.5.3 Other RoW Countries: Liquid Nitrogen Market Size, By Function

11.5.5.3.1 Refrigerant Segment is Projected to Grow at the Second-Highest CAGR By 2020

11.5.5.4 Other RoW Countries: Liquid Nitrogen Market Size, By Production Technology

11.5.5.4.1 Cryogenic Distillation Segment Accounted for the Largest Market Share in 2014

12 Competitive Landscape (Page No. - 183)

12.1 Overview

12.2 Development Analysis

12.3 Competitive Situations & Trends

12.4 Partnerships, Agreements, and Joint Ventures the Key Growth Strategy, 20112015

12.4.1 Partnerships, Agreements, and Joint Ventures

12.4.2 Expansions

12.4.3 Mergers & Acquisitions

12.4.4 New Product Launches

13 Company Profiles (Page No. - 190)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 The Linde Group

13.3 Praxair Inc.

13.4 Air Liquide S.A.

13.5 Air Products and Chemicals, Inc.

13.6 Gulf Cryo

13.7 Southern Industrial Gas Berhad

13.8 Messer Group

13.9 Emirates Industrial Gases Co. LLC

13.10 Taiyo Nippon Sanso Corporation

13.11 Nexair LLC

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted

Companies.

14 Appendix (Page No. - 212)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Company Developments

14.3.1 Partnerships, Agreements, and Joint Ventures

14.3.2 Expansions

14.3.3 Mergers & Acquisitions

14.3.4 New Product Launches

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

List of Tables (200 Tables)

Table 1 Liquid Nitrogen Market Snapshot

Table 2 End-Use Industry & Description

Table 3 Manufacturing Process & Description

Table 4 Distribution Mode & Description

Table 5 The Standard By Compressed Gas Association:

Table 6 Size, By End-Use Industry, 20132020 (Usd Million)

Table 7 Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 8 Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 9 Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 10 Regulations On Transportation And Storage Of Gas Cylinders

Table 11 Size, By Function, 20132020 (Usd Million)

Table 12 Market Size, By Function, 20132020 (Million Tons)

Table 13 Coolant: Size, By End-Use, 20132020 (Usd Million)

Table 14 Coolant: Market Size, By End-Use, 20132020 (Million Tons)

Table 15 Refrigerant: Size, By End-Use, 20132020 (Usd Million)

Table 16 Refrigerant: Size, By End-Use, 20132020 (Million Tons)

Table 17 Size, By Production Technology, 20132020 (Usd Million)

Table 18 Market Size, By Production Technology, 20132020 (Million Tons)

Table 19 Market Size, By Region, 20132020 (Usd Million)

Table 20 Market Size, By Region, 20132020 (Million Tons)

Table 21 North America: Size, By Country, 20132020 (Usd Million)

Table 22 North America: Size, By Country, 20132020 (Million Tons)

Table 23 North America: Size, By End-Use Industry, 20132020 (Usd Million)

Table 24 North America: Size, By End-Use Industry, 20132020 (Million Tons)

Table 25 North America: Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 26 North America: Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 27 North America: Size, By Function, 20132020 (Usd Million)

Table 28 North America: Size, By Function, 20132020 (Million Tons)

Table 29 North America: Size, By Production Technology, 20132020 (Usd Million)

Table 30 North America: Size, By Production Technology, 20132020 (Million Tons)

Table 31 U.S.: Size, By End-Use Industry, 20132020 (Usd Million)

Table 32 U.S.: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 33 U.S.: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 34 U.S.: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 35 U.S.: By Market Size, By Function, 20132020 (Usd Million)

Table 36 U.S.: By Market Size, By Function, 20132020 (Million Tons)

Table 37 U.S.: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 38 U.S.: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 39 Canada: Size, By End-Use Industry, 20132020 (Usd Million)

Table 40 Canada: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 41 Canada: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 42 Canada: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 43 Canada: By Market Size, By Function, 20132020 (Usd Million)

Table 44 Canada: By Market Size, By Function, 20132020 (Million Tons)

Table 45 Canada: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 46 Canada: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 47 Mexico: Size, By End-Use Industry, 20132020 (Usd Million)

Table 48 Mexico: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 49 Mexico: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 50 Mexico: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 51 Mexico: By Market Size, By Function, 20132020 (Usd Million)

Table 52 Mexico: By Market Size, By Function, 20132020 (Million Tons)

Table 53 Mexico: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 54 Mexico: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 55 Asia-Pacific: Size, By Country, 20132020 (Usd Million)

Table 56 Asia-Pacific: By Market Size, By Country, 20132020 (Million Tons)

Table 57 Asia-Pacific: By Market Size, By End-Use Industry, 20132020 (Usd Million)

Table 58 Asia-Pacific: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 59 Asia-Pacific: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 60 Asia-Pacific: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 61 Asia-Pacific: By Market Size, By Function, 20132020 (Usd Million)

Table 62 Asia-Pacific: By Market Size, By Function, 20132020 (Million Tons)

Table 63 Asia-Pacific: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 64 Asia-Pacific: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 65 China: Size, By End-Use Industry, 20132020 (Usd Million)

Table 66 China: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 67 China: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 68 China: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 69 China: By Market Size, By Function, 20132020 (Usd Million)

Table 70 China: By Market Size, By Function, 20132020 (Million Tons)

Table 71 China: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 72 China: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 73 India: Size, By End-Use Industry, 20132020 (Usd Million)

Table 74 India: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 75 India: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 76 India: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 77 India: By Market Size, By Function, 20132020 (Usd Million)

Table 78 India: By Market Size, By Function, 20132020 (Million Tons)

Table 79 India: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 80 India: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 81 Japan: Size, By End-Use Industry, 20132020 (Usd Million)

Table 82 Japan: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 83 Japan: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 84 Japan: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 85 Japan: By Market Size, By Function, 20132020 (Usd Million)

Table 86 Japan: By Market Size, By Function, 20132020 (Million Tons)

Table 87 Japan: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 88 Japan: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 89 South Korea: Size, By End-Use Industry, 20132020 (Usd Million)

Table 90 South Korea: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 91 South Korea: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 92 South Korea: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 93 South Korea: By Market Size, By Function, 20132020 (Usd Million)

Table 94 South Korea: By Market Size, By Function, 20132020 (Million Tons)

Table 95 South Korea: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 96 South Korea: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 97 Rest Of Asia-Pacific: Size, By End-Use Industry, 20132020 (Usd Million)

Table 98 Rest Of Asia-Pacific: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 99 Rest Of Asia-Pacific: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 100 Rest Of Asia-Pacific: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 101 Rest Of Asia-Pacific: By Market Size, By Function, 20132020 (Usd Million)

Table 102 Rest Of Asia-Pacific: By Market Size, By Function, 20132020 (Million Tons)

Table 103 Rest Of Asia-Pacific: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 104 Rest Of Asia-Pacific: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 105 Europe: Size, By Country, 20132020 (Usd Million)

Table 106 Europe: By Market Size, By Country, 20132020 (Million Tons)

Table 107 Europe: By Market Size, By End-Use Industry, 20132020 (Usd Million)

Table 108 Europe: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 109 Europe: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 110 Europe: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 111 Europe: By Market Size, By Function, 20132020 (Usd Million)

Table 112 Europe: By Market Size, By Function, 20132020 (Million Tons)

Table 113 Europe: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 114 Europe: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 115 Germany: Size, By End-Use Industry, 20132020 (Usd Million)

Table 116 Germany: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 117 Germany: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 118 Germany: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 119 Germany: By Market Size, By Function, 20132020 (Usd Million)

Table 120 Germany: By Market Size, By Function, 20132020 (Million Tons)

Table 121 Germany: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 122 Germany: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 123 France: Size, By End-Use Industry, 20132020 (Usd Million)

Table 124 France: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 125 France: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 126 France: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 127 France: By Market Size, By Function, 20132020 (Usd Million)

Table 128 France: By Market Size, By Function, 20132020 (Million Tons)

Table 129 France: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 130 France: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 131 U.K.: Size, By End-Use Industry, 20132020 (Usd Million)

Table 132 U.K.: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 133 U.K.: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 134 U.K.: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 135 U.K.: By Market Size, By Function, 20132020 (Usd Million)

Table 136 U.K.: By Market Size, By Function, 20132020 (Million Tons)

Table 137 U.K.: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 138 U.K.: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 139 Belgium: Size, By End-Use Industry, 20132020 (Usd Million)

Table 140 Belgium: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 141 Belgium: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 142 Belgium: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 143 Belgium: By Market Size, By Function, 20132020 (Usd Million)

Table 144 Belgium: By Market Size, By Function, 20132020 (Million Tons)

Table 145 Belgium: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 146 Belgium: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 147 Rest Of Europe: Size, By End-Use Industry, 20132020 (Usd Million)

Table 148 Rest Of Europe: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 149 Rest Of Europe: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 150 Rest Of Europe: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 151 Rest Of Europe: By Market Size, By Function, 20132020 (Usd Million)

Table 152 Rest Of Europe: By Market Size, By Function, 20132020 (Million Tons)

Table 153 Rest Of Europe: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 154 Rest Of Europe: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 155 Row: By Market Size, By Country, 20132020 (Usd Million)

Table 156 Row: By Market Size, By Country, 20132020 (Million Tons )

Table 157 Row: By Market Size, By End-Use Industry, 20132020 (Usd Million)

Table 158 Row: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 159 Row: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 160 Row: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 161 Row: By Market Size, By Function, 20132020 (Usd Million)

Table 162 Row: By Market Size, By Function, 20132020 (Million Tons)

Table 163 Row: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 164 Row: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 165 Brazil: Size, By End-Use Industry, 20132020 (Usd Million)

Table 166 Brazil: Size, By End-Use Industry, 20132020 (Million Tons)

Table 167 Brazil: Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 168 Brazil: Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 169 Brazil: Size, By Function, 20132020 (Usd Million)

Table 170 Brazil: Size, By Function, 20132020 (Million Tons)

Table 171 Brazil: Size, By Production Technology, 20132020 (Usd Million)

Table 172 Brazil: Size, By Production Technology, 20132020 (Million Tons)

Table 173 Saudi Arabia: Size, By End-Use Industry, 20132020 (Usd Million)

Table 174 Saudi Arabia: Size, By End-Use Industry, 20132020 (Million Tons)

Table 175 Saudi Arabia: Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 176 Saudi Arabia: Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 177 Saudi Arabia: Size, By Function, 20132020 (Usd Million)

Table 178 Saudi Arabia: Size, By Function, 20132020 (Million Tons)

Table 179 Saudi Arabia: Size, By Production Technology, 20132020 (Usd Million)

Table 180 Saudi Arabia: Size, By Production Technology, 20132020 (Million Tons)

Table 181 South Africa: By Market Size, By End-Use Industry, 20132020 (Usd Million)

Table 182 South Africa: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 183 South Africa: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 184 South Africa: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 185 South Africa: By Market Size, By Function, 20132020 (Usd Million)

Table 186 South Africa: By Market Size, By Function, 20132020 (Million Tons)

Table 187 South Africa: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 188 South Africa: By Market Size, By Production Technology, 20132020 (Million Tons)

Table 189 Other Row Countries: By Market Size, By End-Use Industry, 20132020 (Usd Million)

Table 190 Other Row Countries: By Market Size, By End-Use Industry, 20132020 (Million Tons)

Table 191 Other Row Countries: By Market Size, By Storage, Distribution & Transportation, 20132020 (Usd Million)

Table 192 Other Row Countries: By Market Size, By Storage, Distribution & Transportation, 20132020 (Million Tons)

Table 193 Other Row Countries: By Market Size, By Function, 20132020 (Usd Million)

Table 194 Other Row Countries: By Market Size, By Function, 20132020 (Million Tons)

Table 195 Other Row Countries: By Market Size, By Production Technology, 20132020 (Usd Million)

Table 196 Other Row Countries: By Market Size, By Manufacturing Process, 20132020 (Million Tons)

Table 197 Partnerships, Agreements, And Joint Ventures, 20112015

Table 198 Expansions, 20112015

Table 199 Mergers & Acquisitions, 2011-2015

Table 200 New Product Launches, 20112015

List of Figures (54 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 Population Growth has Increased Tremendously in the Last Three Decades

Figure 4 Increase in Total Expenditure of Middle-Class Families

Figure 5 Crude Oil Spot Prices, 20042014

Figure 6 Natural Gas Prices, 2004-2014

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation Methodology

Figure 10 Size, By End-Use Industry, 2015 vs 2020 (USD Million)

Figure 11 Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 12 India is Projected to Be the Fastest-Growing Market for Liquid Nitrogen From 2015 to 2020

Figure 13 Cylinder & Packaged Gas is Projected to Dominate the Market By 2020

Figure 14 Key Market Players Adopted Mergers & Acquisitions as Key Strategies From 2011 to 2015

Figure 15 Emerging Economies Offer Attractive Opportunities

Figure 16 Chemicals & Pharmaceuticals Captured the Largest Share in the Emerging Asia-Pacific Market in 2014

Figure 17 Country-Wise Growth Potential of Liquid Nitrogen, 20152020

Figure 18 Region-Wise Snapshot, 2014

Figure 19 Emerging Markets to Grow Faster Than Developed Markets, 20152020

Figure 20 End-Use Industries Snapshot, 2014

Figure 21 Evolution

Figure 22 Segmentation

Figure 23 Drivers, Restraints, Opportunities, and Challenges

Figure 24 Silicon Wafer Industry Trends

Figure 25 Global Healthcare Sector Outlook for 2009 to 2013

Figure 26 Chemicals Market, CAGR (2013-2020)

Figure 27 Liquid Nitrogen Value Chain

Figure 28 Porters Five Forces Analysis

Figure 29 Chemicals & Pharmaceuticals Dominated in 2015

Figure 30 Cylinder & Packaged Gas Segment Dominated in 2015

Figure 31 By Function, 2015 vs 2020 (USD Million)

Figure 32 Cryogenic Distillation Segment Dominated in 2015

Figure 33 Geographical Snapshot: Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 India Poised to Grow at the Highest CAGR By 2020

Figure 35 North America: Market Snapshot

Figure 36 Asia-Pacific: Market Snapshot

Figure 37 Europe: Market Snapshot

Figure 38 RoW: Market Snapshot

Figure 39 Companies Adopted Expansions as Their Key Growth Strategy Over the Last Five Years

Figure 40 Developments, By Key Players, 2014

Figure 41 Partnerships, Agreements, and Joint Ventures Fueled Growth of the Liquid Nitrogen Market (20112015)

Figure 42 Key Growth Strategies, 20112015

Figure 43 Geographic Revenue Mix of Top Five Players

Figure 44 The Linde Group: Company Snapshot

Figure 45 SWOT Analysis: the Linde Group

Figure 46 Praxair Inc.: Company Snapshot

Figure 47 SWOT Analysis: Praxair Inc.

Figure 48 Air Liquide S.A.: Company Snapshot

Figure 49 Air Liquide S.A.: SWOT Analysis

Figure 50 Air Products and Chemicals, Inc.: Company Snapshot

Figure 51 Air Products and Chemicals, Inc.: SWOT Analysis

Figure 52 Southern Industrial Gas Berhad: Company Snapshot

Figure 53 Messer Group: Company Snapshot

Figure 54 Taiyo Nippon Sanso Corporation: Company Snapshot

Growth opportunities and latent adjacency in Liquid Nitrogen Market