Life Sciences & Analytical Reagents Market - Applications, Current Trends, Opportunities & Global Forecasts (2011 2016)

Please click here to get the relevant report of Biotechnology Reagents Market by Technology, Applications and End-Users - Current Trends, Opportunities and Global Forecasts to 2016

Life Sciences (PCR, Cell Culture, In-Vitro Diagnostics, Expression & Transfection) & Analytical Reagents (Chromatography, Mass Spectrometry, Electrophoresis, Flow Cytometry) Market - Applications (Protein Purification, Gene Expression, DNA & RNA Analysis & Drug Testing), Current Trends, Opportunities & Global Forecasts (2011 2016)

Biotechnology (life science and analytical) reagents are the substances or compounds used to detect or synthesize another substance in order to provide a test reading. These reagents are used in the field of research, diagnosis, bioscience, and education.

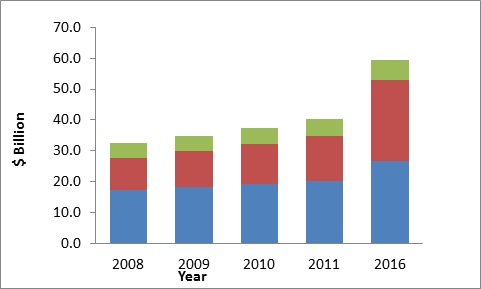

The life sciences and analytical reagents market report studies the life science and analytical reagents market, by technology, end-users, and applications. The life sciences and analytical reagents market, by technology studied in this report are segmented as life science reagents and analytical reagents; of which life science segment accounted for the largest share of 59.37% of the total market in 2011. The global life science and analytical reagents market was valued at $40,308.8 million in 2011 and is expected to reach $59,319.2 million by 2016; growing at a CAGR of 8% from 2011 to 2016.

The life sciences and analytical reagents market is driven by the increasing use of reagents in therapeutics, basic research and commercial applications. The demand for biotechnology reagents is mainly dependent upon the growth of the biotechnology instrumentation market. The biotechnology instrumentation market continues to witness significant growth due to an increase in the number of biotechnology firms around the globe and increase in research and development expenditure by the biotechnology companies, thus augmenting the demand for biotechnology instruments. Continual product developments are being witnessed in various industries, such as pharmaceutical/bio-pharmaceutical, agri-biotech, and food and beverages; this is expected to facilitate market growth.

North America dominated the life sciences and analytical reagents market with 46.28% share in 2011. Successful completion of the first phase of the Human Genome Project, ahead of schedule, has given rise in the U.S. reagent market. Investments, government funding, and new products are driving the reagents market in the U.S. The Asian market, however, shows greater opportunities, when compared to other regions, with the highest CAGR of 11.8% from 2011 to 2016; due to increased research outsourcing activities in the life technology field.

Major players in the global life science and analytical reagents market include Life Technologies, (U.S.), Bio-Rad (U.S.), Thermo Fisher Scientific (U.S.), Water Corporation (U.S.), Sigma-Aldrich (U.S.), Agilent Technologies Inc. (U.S.), Betcon Dickinson (U.S.), Beckman Coulter (U.S.), Roche (Switzerland), and Abbott (U.S.).

Scope of the Report

This life sciences and analytical reagents market report will enable strategic understanding of the following key segments of the market:

- Global life science and analytical reagents market, by technology

- Life science

- PCR

- Master mixes

- Kits

- Individual reagent

- Cell culture

- Sera

- Media and regents

- IVD

- Microbiology culture

- Hematology

- Immunoassay

- Clinical chemistry

- Molecular diagnostics

- Expression and transfection

- PCR

- Analytical

- Chromatography

- By reagents type

- Solvent

- Chemical

- Adsorbents

- By types of chromatography

- Liquid Chromatography

- Gas Chromatography

- Ion Chromatography

- Super critical Fluid Chromatography

- By reagents type

- Mass Spectrometry

- Proteomics

- Drug Discovery

- Clinical Testing

- Genomics

- Others

- Electrophoresis

- Gel

- Dye

- Buffer

- Flow Cytometry

- Cell-based flow cytometry

- Bead-based flow cytometry

- Chromatography

- Life science

- Global life science and analytical reagents market, by applications

- Protein synthesis and purification

- Gene expression

- DNA and RNA analysis

- Drug testing

- Life science and analytical reagents market, by geography

- North America

- Europe

- Asia

- ROW

Each section of the report offers market data for the various market segments and geographies. It also provides market trends with respect to drivers, restraints, and opportunities. The reports Strategy section sketches the competitive landscape, featuring about 26 company profiles.

The biotechnology (life sciences and analytical) reagents market is vast, consisting of several different technologies such as PCR, cell culture, IVD, expression and transfection, chromatography, spectrometry, electrophoresis, and flow cytometry. These reagents are used extensively in research and development activities, with academic/government and research centers being one of the major users. The use of biotechnology reagents for protein purification, and disease diagnosis is on the rise; flow cytometry, for example, is being used for diagnosis of all four types of leukemia.

This market is growing at a rapid rate, due to the continuous requirement of biotechnology reagents in research centers, laboratories, and pharmaceutical and biotechnology industries. The extensive therapeutic use of reagents, increasing commercial applications, and use in basic research is influencing the growth of this market. Advances in life science research, technology innovations (human genome mapping), and emergence of proteomics has enabled industry growth, as such high-end research projects require quality reagents with high throughput capacity.

This life sciences and analytical reagents report forecasts the size of the market over a period of five years, 2011 2016. It analyzes key trends, and divides the market by segments and into various geographic regions. It also discusses key drivers, restraints, and opportunities of the market and its sub markets.

North America dominated the life sciences and analytical reagents market in 2011. Successful completion of the first phase of the Human Genome Project, ahead of schedule, has given rise in the U.S. reagent market. Investments, government funding, and new products are driving the U.S. reagents market. The Asian market, however, shows greater opportunities, when compared to other regions, with the highest CAGR of 11.8% from 2011 to 2016; due to increased research outsourcing activities in the life technology field.

Life Sciences & Analytical Reagents Market, By End Users, 2011

Source: Annual Reports/SEC Filings, Analytical and Life Science Systems Association, Journal of The American Society for Mass Spectrometry, European Diagnostic Manufacturers Association, Expert Interviews, MnM Analysis

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 MARKET SHARE

1.5.3 KEY DATA POINTS FROM SECONDARY SOURCES

1.5.4 KEY DATA POINTS FROM PRIMARY SOURCES

1.5.5 ASSUMPTIONS

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.2 MARKET SEGMENTATION

3.3 MARKET DYNAMICS

3.3.1 DRIVERS

3.3.1.1 High research and development expenditure by biotechnology companies

3.3.1.2 Increase in number of biotechnology firms

3.3.1.3 Growth in biopharmaceuticals

3.3.1.4 Advancement in technology

3.3.1.5 Protein profiling on a rise

3.3.2 RESTRAINT

3.3.2.1 High price of biopharmaceuticals

3.3.3 OPPORTUNITIES

3.3.3.1 Stem cell research

3.3.3.2 Environmental applications

3.4 BURNING ISSUE

3.4.1 CONTROVERSY ON FEDERAL FUNDING FOR STEM CELL RESEARCH

3.5 END-USER ANALYSIS

3.6 MARKET SHARE ANALYSIS

3.6.1 LIFE SCIENCES MARKET SHARE ANALYSIS

3.6.2 ANALYTICAL MARKET SHARE ANALYSIS

4 LIFE SCIENCES & ANALYTICAL REAGENTS MARKET, BY TECHNOLOGY

4.1 INTRODUCTION

4.2 LIFE SCIENCES

4.2.1 PCR

4.2.1.1 Market share analysis

4.2.1.2 Master mixes

4.2.1.3 PCR kits

4.2.2 CELL CULTURE

4.2.2.1 Market share analysis

4.2.2.2 Sera

4.2.2.3 Media and reagents

4.2.2.3.1 Amino acids & vitamins

4.2.2.3.2 Antibiotics & antimycotics

4.2.2.3.3 Buffers

4.2.2.3.4 Cell dissociation reagents

4.2.2.3.5 Growth supplements

4.2.2.3.6 Others

4.2.3 IVD

4.2.3.1 Market share analysis

4.2.3.2 Microbiology culture

4.2.3.3 Hematology

4.2.3.4 Immunoassay

4.2.3.5 Clinical chemistry

4.2.3.6 Molecular diagnostics

4.2.4 EXPRESSION & TRANSFECTION

4.2.4.1 Market share analysis

4.3 ANALYTICAL

4.3.1 CHROMATOGRAPHY

4.3.1.1 Market share analysis

4.3.1.2 Chromatography, by reagents types

4.3.1.3 Chromatography, by types

4.3.1.3.1 Liquid chromatography

4.3.1.3.2 Gas chromatography

4.3.1.3.3 Ion chromatography

4.3.1.3.4 Supercritical fluid chromatography

4.3.2 MASS SPECTROMETRY

4.3.2.1 Market share analysis

4.3.2.2 Mass spectrometry market, by applications

4.3.3 ELECTROPHORESIS

4.3.3.1 Market share analysis

4.3.3.1.1 Gel electrophoresis market share analysis

4.3.3.1.2 Capillary electrophoresis market share analysis

4.3.3.2 Gel

4.3.3.3 Dye

4.3.3.4 Buffer

4.3.4 FLOW CYTOMETRY

4.3.4.1 Market share analysis

4.3.4.2 Cell-based flow cytometry

4.3.4.3 Bead-based flow cytometry

5 GLOBAL LIFE SCIENCE & ANALYTICAL REAGENTS MARKET, BY APPLICATIONS

5.1 INTRODUCTION

5.2 PROTEIN SYNTHESIS & PURIFICATION

5.3 GENE EXPRESSION

5.4 DNA & RNA ANALYSIS

5.5 DRUG TESTING

6 GEOGRAPHICAL ANALYSIS

6.1 INTRODUCTION

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA

6.5 ROW

7 COMPETITIVE LANDSCAPE

7.1 ACQUISITIONS

7.2 COLLABORATIONS/AGREEMENTS/PARTNERSHIPS

7.3 NEW PRODUCTS LAUNCH

7.4 OTHERS

8 COMPANY PROFILES

8.1 ABBOTT LABORATORIES

8.1.1 OVERVIEW

8.1.2 FINANCIALS

8.1.3 PRODUCTS & SERVICES

8.1.4 STRATEGY

8.1.5 DEVELOPMENTS

8.2 AGILENT TECHNOLOGIES INC.

8.2.1 OVERVIEW

8.2.2 FINANCIALS

8.2.3 PRODUCTS & SERVICES

8.2.4 STRATEGY

8.2.5 DEVELOPMENTS

8.3 BECKMAN COULTER INC.

8.3.1 OVERVIEW

8.3.2 FINANCIALS

8.3.3 PRODUCTS & SERVICES

8.3.4 STRATEGY

8.3.5 DEVELOPMENTS

8.4 BECTON, DICKINSON AND COMPANY (BD)

8.4.1 OVERVIEW

8.4.2 FINANCIALS

8.4.3 PRODUCTS & SERVICES

8.4.4 STRATEGY

8.4.5 DEVELOPMENTS

8.5 BIOMERIEUX

8.5.1 OVERVIEW

8.5.2 FINANCIALS

8.5.3 PRODUCTS & SERVICES

8.5.4 STRATEGY

8.5.5 DEVELOPMENTS

8.6 BIO-RAD LABORATORIES INC.

8.6.1 OVERVIEW

8.6.2 FINANCIALS

8.6.3 PRODUCTS & SERVICES

8.6.4 STRATEGY

8.6.5 DEVELOPMENTS

8.7 GE HEALTHCARE

8.7.1 OVERVIEW

8.7.2 FINANCIALS

8.7.3 PRODUCTS & SERVICES

8.7.4 STRATEGY

8.7.5 DEVELOPMENTS

8.8 HOEFER INC.

8.8.1 OVERVIEW

8.8.2 FINANCIALS

8.8.3 PRODUCTS & SERVICES

8.8.4 STRATEGY

8.8.5 DEVELOPMENTS

8.9 LIFE TECHNOLOGIES CORPORATION

8.9.1 OVERVIEW

8.9.2 FINANCIALS

8.9.3 PRODUCTS & SERVICES

8.9.4 STRATEGY

8.9.5 DEVELOPMENTS

8.10 LONZA GROUP LTD.

8.10.1 OVERVIEW

8.10.2 FINANCIALS

8.10.3 PRODUCTS & SERVICES

8.10.4 STRATEGY

8.10.5 DEVELOPMENTS

8.11 MERIDIAN BIOSCIENCES INC.

8.11.1 OVERVIEW

8.11.2 FINANCIALS

8.11.3 PRODUCTS & SERVICES

8.11.4 STRATEGY

8.11.5 DEVELOPMENTS

8.12 MERCK MILLIPORE

8.12.1 OVERVIEW

8.12.2 FINANCIALS

8.12.3 PRODUCTS & SERVICES

8.12.4 STRATEGY

8.12.5 DEVELOPMENTS

8.13 PERKINELMER

8.13.1 OVERVIEW

8.13.2 FINANCIALS

8.13.3 PRODUCTS & SERVICES

8.13.4 STRATEGY

8.13.5 DEVELOPMENTS

8.14 PROMEGA CORPORATION

8.14.1 OVERVIEW

8.14.2 FINANCIALS

8.14.3 PRODUCTS & SERVICES

8.14.4 STRATEGY

8.14.5 DEVELOPMENTS

8.15 QUALITY BIOLOGICAL INC.

8.15.1 OVERVIEW

8.15.2 FINANCIALS

8.15.3 PRODUCTS & SERVICES

8.15.4 STRATEGY

8.16 ROCHE DIAGNOSTICS LIMITED

8.16.1 OVERVIEW

8.16.2 FINANCIALS

8.16.3 PRODUCTS & SERVICES

8.16.4 STRATEGY

8.16.5 DEVELOPMENTS

8.17 SIEMENS HEALTHCARE

8.17.1 OVERVIEW

8.17.2 FINANCIALS

8.17.3 PRODUCTS & SERVICES

8.17.4 STRATEGY

8.18 SIGMA ALDRICH CORPORATION

8.18.1 OVERVIEW

8.18.2 FINANCIALS

8.18.3 PRODUCTS & SERVICES

8.18.4 STRATEGY

8.18.5 DEVELOPMENTS

8.19 STRATEGIC DIAGNOSTICS INC. (SDIX)

8.19.1 OVERVIEW

8.19.2 FINANCIALS

8.19.3 PRODUCTS & SERVICES

8.19.4 STRATEGY

8.19.5 DEVELOPMENTS

8.20 SYSMEX CORPORATION

8.20.1 OVERVIEW

8.20.2 FINANCIALS

8.20.3 PRODUCTS & SERVICES

8.20.4 STRATEGY

8.20.5 DEVELOPMENTS

8.21 TAKARA BIO INC.

8.21.1 OVERVIEW

8.21.2 FINANCIALS

8.21.3 PRODUCTS & SERVICES

8.21.4 STRATEGY

8.21.5 DEVELOPMENTS

8.22 TECHNE CORPORATION

8.22.1 OVERVIEW

8.22.2 FINANCIALS

8.22.3 PRODUCTS & SERVICES

8.22.4 STRATEGY

8.22.5 DEVELOPMENTS

8.23 THERMO FISHER SCIENTIFIC INC.

8.23.1 OVERVIEW

8.23.2 FINANCIALS

8.23.3 PRODUCTS & SERVICES

8.23.4 STRATEGY

8.23.5 DEVELOPMENTS

8.24 TOSOH CORPORATION

8.24.1 OVERVIEW

8.24.2 FINANCIALS

8.24.3 PRODUCTS & SERVICES

8.24.4 STRATEGY

8.24.5 DEVELOPMENTS

8.25 WATERS CORPORATION

8.25.1 OVERVIEW

8.25.2 FINANCIALS

8.25.3 PRODUCTS & SERVICES

8.25.4 STRATEGY

8.25.5 DEVELOPMENTS

8.26 W.R. GRACE & CO.

8.26.1 OVERVIEW

8.26.2 FINANCIALS

8.26.3 PRODUCTS & SERVICES

8.26.4 STRATEGY

8.26.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 GLOBAL LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 2 NATIONAL INSTITUTES OF HEALTH (NIH) STEM CELL RESEARCH FUNDING, FY 2005 2011 ($MILLION)

TABLE 3 GLOBAL LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 4 LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 5 GLOBAL LIFE SCIENCES REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 6 LIFE SCIENCES REAGENTS MARKET REVENUE, BY GEOGRAPHY,2009 2016 ($MILLION)

TABLE 7 GLOBAL PCR REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 8 PCR REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 9 PCR MASTER MIXES MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 10 PCR KITS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 11 GLOBAL CELL CULTURE MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 12 CELL CULTURE MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 13 SERA MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 14 CELL CULTURE MEDIA & REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 15 GLOBAL CELL CULTURE MEDIA & REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 16 AMINO ACIDS & VITAMINS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 17 CELL CULTURE ANTIBIOTICS & ANTIMYCOTICS REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 18 CELL CULTURE BUFFERS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 19 CELL CULTURE DISSOCIATION REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 20 CELL CULTURE GROWTH SUPPLEMENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 21 GLOBAL OTHER CELL CULTURE REAGENTS & MEDIA SUPPLEMENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 22 GLOBAL IVD REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 23 IVD REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 24 MICROBIOLOGY CULTURE REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 25 HEMATOLOGY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 26 IMMUNOASSAY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 27 CLINICAL CHEMISTRY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 28 MOLECULAR DIAGNOSTICS REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 29 EXPRESSION & TRANSFECTION REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 30 GLOBAL ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 31 ANALYTICAL REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 32 CHROMATOGRAPHY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 33 CHEMICALS USED IN PROTEIN CHROMATOGRAPHY

TABLE 34 GLOBAL CHROMATOGRAPHY MARKET REVENUE, BY REAGENTS TYPES, 2009 2016 ($MILLION)

TABLE 35 SOLVENT MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 36 CHEMICAL MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 37 ADSORBENT MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 38 GLOBAL CHROMATOGRAPHY MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 39 LIQUID CHROMATOGRAPHY MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 40 GAS CHROMATOGRAPHY MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 41 ION CHROMATOGRAPHY MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 42 SUPER CRITICAL FLUID CHROMATOGRAPHY MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 43 MASS SPECTROMETRY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 44 GLOBAL MASS SPECTROMETRY REAGENTS MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 45 PROTEOMICS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 46 DRUG DISCOVERY MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 47 CLINICAL TESTING MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 48 GENOMICS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 49 OTHERS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 50 GLOBAL ELECTROPHORESIS REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 51 ELECTROPHORESIS REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 52 GEL ELECTROPHORESIS REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 53 DYE ELECTROPHORESIS REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 54 BUFFER ELECTROPHORESIS REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 55 GLOBAL FLOW CYTOMETRY REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 56 FLOW CYTOMETRY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 57 CELL-BASED FLOW CYTOMETRY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 58 BEAD-BASED FLOW CYTOMETRY REAGENTS MARKET REVENUE, BY GEOGRAPHY, 2009 2016 ($MILLION)

TABLE 59 GLOBAL LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 60 PROTEIN SYNTHESIS & PURIFICATION MARKET REVENUE, BY GEOGRAPHY, 2009 2016($MILLION)

TABLE 61 GENE EXPRESSION MARKET REVENUE, BY GEOGRAPHY, 2009 2016($MILLION)

TABLE 62 DNA & RNA ANALYSIS MARKET REVENUE, BY GEOGRAPHY, 2009 2016($MILLION)

TABLE 63 DRUG TESTING MARKET REVENUE, BY GEOGRAPHY, 2009 2016($MILLION)

TABLE 64 NORTH AMERICA: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 65 NORTH AMERICA: LIFE SCIENCES REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 66 NORTH AMERICA: PCR REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 67 NORTH AMERICA: CELL CULTURE MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 68 NORTH AMERICA: IVD REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 69 NORTH AMERICA: ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 70 NORTH AMERICA: CHROMATOGRAPHY MARKET REVENUE, BY REAGENTS TYPES, 2009 2016 ($MILLION)

TABLE 71 NORTH AMERICA: CHROMATOGRAPHY MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 72 NORTH AMERICA: MASS SPECTROMETRY MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 73 NORTH AMERICA: ELECTROPHORESIS REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 74 NORTH AMERICA: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 75 EUROPE: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 76 EUROPE: LIFE SCIENCES REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 77 EUROPE: PCR REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 78 EUROPE: CELL CULTURE MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 79 EUROPE: IVD REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 80 EUROPE: ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 81 EUROPE: CHROMATOGRAPHY MARKET REVENUE, BY REAGENTS TYPES, 2009 2016 ($MILLION)

TABLE 82 EUROPE: CHROMATOGRAPHY MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 83 EUROPE: MASS SPECTROMETRY MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 84 EUROPE: ELECTROPHORESIS REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 85 EUROPE: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 86 ASIA: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 87 ASIA: LIFE SCIENCES REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 88 ASIA: PCR REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 89 ASIA: CELL CULTURE MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 90 ASIA: IVD REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 91 ASIA: ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 92 ASIA: CHROMATOGRAPHY MARKET REVENUE, BY REAGENTS TYPES, 2009 2016 ($MILLION)

TABLE 93 ASIA: CHROMATOGRAPHY MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 94 ASIA: MASS SPECTROMETRY MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 95 ASIA: ELECTROPHORESIS REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 96 ASIA: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 97 ROW: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 98 ROW: LIFE SCIENCES REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 99 ROW: PCR REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 100 ROW: CELL CULTURE MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 101 ROW: IVD REAGENTS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 102 ROW: ANALYTICAL REAGENTS MARKET REVENUE, BY TECHNOLOGY, 2009 2016 ($MILLION)

TABLE 103 ROW: CHROMATOGRAPHY MARKET REVENUE, BY REAGENTS TYPES, 2009 2016 ($MILLION)

TABLE 104 ROW: CHROMATOGRAPHY MARKET REVENUE, BY TYPES, 2009 2016 ($MILLION)

TABLE 105 ROW: MASS SPECTROMETRY MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 106 ROW: ELECTROPHORESIS MARKET REVENUE, BY PRODUCTS, 2009 2016 ($MILLION)

TABLE 107 ROW: LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY APPLICATIONS, 2009 2016 ($MILLION)

TABLE 108 ACQUISITIONS, 2009 2012

TABLE 109 COLLABORATIONS/AGREEMENTS/PARTNERSHIPS, 2010 2012

TABLE 110 NEW PRODUCTS LAUNCH, 2009 2012

TABLE 111 OTHERS, 2009 2012

TABLE 112 ABBOTT: TOTAL SALES AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 113 ABBOTT: TOTAL SALES, BY SEGMENTS, 2009 2011($MILLION)

TABLE 114 ABBOTT: TOTAL SALE, BY GEOGRAPHY, 2009 2010 ($MILLION)

TABLE 115 AGILENT: TOTAL REVENUE AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 116 AGILENT: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 117 AGILENT: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 118 DANAHER CORP: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 119 DANAHER CORP: R&D EXPENDITURE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 120 DANAHER CORP: TOTAL REVENUE, BY SEGMENTS, 2009 2011($MILLION)

TABLE 121 DANAHER CORP: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 122 BECTON, DICKINSON AND COMPANY: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 123 BECTON, DICKINSON AND COMPANY: TOTAL REVENUE, BY SEGMENTS, 2009 2011($MILLION)

TABLE 124 BECTON, DICKINSON AND COMPANY: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 125 BIOMERIEUX: TOTAL SALES AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 126 BIOMERIEUX: TOTAL SALES, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 127 BIOMERIEUX: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 128 BIO-RAD: TOTAL SALES AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 129 BIO-RAD: TOTAL SALES, BY SEGMENTS, 2008 2010 ($MILLION)

TABLE 130 BIO-RAD: TOTAL REVENUE, BY GEOGRAPHY, 2008 2010 ($MILLION)

TABLE 131 GENERAL ELECTRIC COMPANY: TOTAL REVENUE AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 132 GENERAL ELECTRIC COMPANY: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 133 GENERAL ELECTRIC COMPANY: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 134 HARVARD BIOSCIENCES: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 135 HARVARD BIOSCIENCES: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 136 LIFE TECHNOLOGIES CORP: TOTAL REVENUE AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 137 LIFE TECHNOLOGIES CORP: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 138 LIFE TECHNOLOGIES CORP: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 139 LONZA: TOTAL SALES AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 140 LONZA: TOTAL SALES, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 141 LONZA: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 142 MERIDIAN BIOSECINCE INC.: TOTAL REVENUE & R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 143 MERIDIAN BIOSECINCE INC.: TOTAL REVENUE, BY SEGMENTS, 2009 2011($MILLION)

TABLE 144 MERIDIAN BIOSECINCE INC.: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 145 MERCK MILLIPORE: TOTAL REVENUE AND R&D EXPENDITURE, 2010 2011 ($MILLION)

TABLE 146 MERCK MILLIPORE: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 147 MERCK MILLIPORE: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 148 PERKINELMER: TOTAL SALES AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 149 PERKINELMER: TOTAL SALES, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 150 PERKINELMER: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 151 ROCHE DIAGNOSTICS LTD.: TOTAL REVENUE AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 152 ROCHE DIAGNOSTICS LTD.: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 153 ROCHE DIAGNOSTICS LTD.: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 154 SIEMENS AG: TOTAL REVENUE AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 155 SIEMENS AG: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 156 SIEMENS AG: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 157 SIGMA-ALDRICH: SALES AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 158 SIGMA-ALDRICH: TOTAL SALES, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 159 SIGMA-ALDRICH: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 160 SDIX: TOTAL SALES AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 161 SDIX: TOTAL SALES, BY SEGMENTS, 2008 2010 ($THOUSAND)

TABLE 162 SDIX: TOTAL REVENUE, BY GEOGRAPHY, 2008 2010 ($MILLION)

TABLE 163 SYSMEX CORP: TOTAL REVENUE AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 164 SYSMEX CORP: TOTAL REVENUE, BY BUSINESS SEGMENTS, 2009 2011 ($MILLION)

TABLE 165 SYSMEX CORP: TOTAL REVENUE, BY PRODUCT SEGMENTS, 2009 2011 ($MILLION)

TABLE 166 SYSMEX CORP: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 167 TAKARA: TOTAL SALES AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 168 TAKARA: TOTAL SALES, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 169 TECHNE CORP: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 170 TECHNE CORP: R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 171 TECHEN CORP: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 172 TECHNE CORP: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 173 THERMO FISHER SCIENTIFIC INC.: TOTAL REVENUE AND R&D EXPENSES, 2009 2011 ($MILLION)

TABLE 174 THERMO FISHER SCIENTIFIC INC.: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 175 THERMO FISHER SCIENTIFIC INC.: TOTAL REVENUES, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 176 TOSOH CORP: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 177 TOSOH CORP: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 178 TOSOH CORP: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 179 WATERS CORPORATION: TOTAL REVENUES AND R&D EXPENDITURE, 2009 2011 ($THOUSANDS)

TABLE 180 WATERS: TOTAL SALES, BY GEOGRAPHY, 2009 2011 ($THOUSAND)

TABLE 181 WATERS: TOTAL SALES, BY SEGMENTS, 2009 2011 ($THOUSAND)

TABLE 182 W.R. GRACE & CO.: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 183 W.R. GRACE & CO.: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 184 W.R. GRACE & CO.: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

LIST OF FIGURES

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 GLOBAL LIFE SCIENCES & ANALYTICAL REAGENTS MARKET REVENUE, BY END-USERS, 2008 2016 ($BILLION)

FIGURE 3 INDIA: GROSS ENROLMENT RATIO (%)

FIGURE 4 GLOBAL LIFE SCIENCES REAGENTS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 5 GLOBAL ANALYTICAL REAGENTS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 6 GLOBAL PCR REAGENTS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 7 GLOBAL CELL CULTURE REAGENTS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 8 GLOBAL IVD REAGENTS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 9 GLOBAL EXPRESSION & TRANSFECTION REAGENTS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 10 GLOBAL CHROMATOGRAPHY MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 11 GLOBAL MASS SPECTROMETRY MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 12 GLOBAL GEL ELECTROPHORESIS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 13 GLOBAL CAPILLARY ELECTROPHORESIS MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 14 GLOBAL FLOW CYTOMETRY MARKET SHARE ANALYSIS, BY PLAYERS, 2011

FIGURE 15 GLOBAL LIFE SCIENCES & ANALYTICAL REAGENTS MARKET, BY GEOGRAPHY, 2011 (%)

FIGURE 16 KEY GROWTH STRATEGIES, JANUARY 2009 MARCH 2012

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Life Sciences & Analytical Reagents Market