Lawful Interception Market by Component, Network (Fixed Network, Mobile Network), Network Technology Type, Communication Content, Mediation Device, Type of Interception, End User (Lawful Enforcement Agencies, Government) & Region - Global Forecast to 2026

Updated on : March 21, 2024

Lawful Interception Market Overview

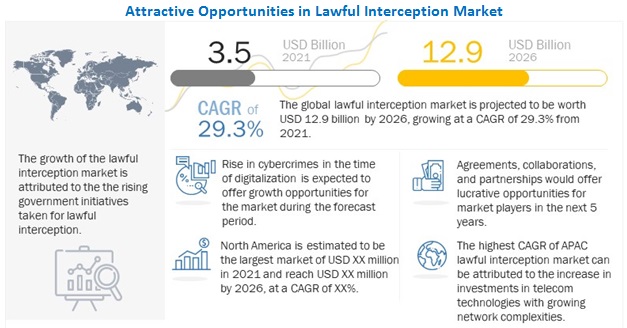

The Lawful Interception Market is expected to grow at a CAGR of 29.3% from 2022 to 2026. Its size crossed $3.5 billion in 2022 with a projected revenue of around $12.9 billion by the end of 2026. Lawful interception is a process that enables a Law Enforcement Agency (LEA) to perform electronic surveillance on an individual as authorized by judicial or administrative order. Lawful interception is a security process in which a Service Provider (SP) or network operator collects and provides law enforcement officials with intercepted communications, such as telephone calls or email messages, of private individuals or organizations.

To know about the assumptions considered for the study, Request for Free Sample Report

Lawful Interception Market Dynamics

Driver: Lawful interception of the internet

Lawful Interception is the process of secretly intercepting within a network communication between parties of interest to law enforcement agencies. Lawful interception of the internet is an important and powerful tool in criminal and security investigations. It is not just used for the gathering of evidence for court cases, but also to identify networks of relationships between suspected criminals. Lawful interception (LI) has evolved over the past few decades from target-based monitoring & interception of telecom conversations to the monitoring & interception of packet-switched (IP) communications. With the increasing number of cybercrimes, there is a rise in the adoption of lawful interception of the internet.

Restraint: Protection and secrecy of the intercepted data

To capture communication data, governments of various countries have mandated network providers to integrate the interception system. In this case, maintaining the secrecy of the individuals becomes a major restraint in the lawful interception market, since a balance has to be maintained between security rights and the privacy of the individuals and enterprises. The interception of communication content acts as an intruder on the essential privacy rights of the citizens, raising ethical concerns for individuals and enterprises. To achieve this balance of technological aspects and ethical concerns, rather than being provided as an add-on to the core technology, lawful interception products must be designed.

Opportunity: Improved network technologies

In most of the developed and growing countries, lawful interception is mandatory for national security and real-time surveillance. PSTN enabled lawful interception with the interception of telephony services; however, the advancement in technologies, such as Voice over IP (VoIP) and wireless, has enabled the mobility of users, thereby increasing the scope for unlawful activities and generating a huge amount of data traffic and security threats. This can result in actuating the existing demand for lawful interception in telecom service companies, ISPs, network operators, and SPs for lawfully locating, intercepting, monitoring, and analyzing wired and wireless communications.

Challenge: Lawful interception - a legal requirement of a CSP

Lawful interception is a legal requirement of a CSP (Communication Service Provider) under national law and regulation. The most important foundation of general requirements was a CS (circuit-switched) system. The debate began because of the need to monitor IP network requirements. The current challenges are the separation of services and access, the cross-border structure of IP networks contradicting LI's national requirements, and seamless handover between different access technologies. These challenges put an additional burden on the enforcement agency (LEA).

By Component, the solution segment to have a higher growth during the forecast period

The standalone lawful interception solution aids in the performance of lawful interception activities in order to meet government-mandated legal standards. The solution includes surveillance tools for both fixed and mobile networks, allowing telecom operators and ISPs to comply with their legal obligations to intercept calls and data while preserving the highest level of privacy protection. The solution window gives end-to-end solutions for the whole intelligence cycle required for an individual or organization to be intercepted. The entire intelligence cycle begins with full-spectrum intelligence capabilities being delivered to Law Enforcement Agencies, Intelligence Organizations, and Signal Intelligence (SIGINT) Agencies. Vendors offering lawful interception solutions and services should comply with international lawful interception standards of ETSI, 3GPP, and ATIS/ANSI and specific country regulations as per the interception

By Service, the professional services segment to dominate the market during the forecast period

Local interception vendors provide professional services to help users organize, design, analyze, implement, and manage technological systems. In the lawful interception environment, the services are critical. Consulting, support, and maintenance, as well as training and education, are some of the services available. SPs must have a high level of technical abilities and competence because of the complicated nature of these services. There are various vendors in the lawful interception ecosystem that provide services, such as consulting on client-specific requirements, providing educational support to their clients, such as training and classroom lectures to help them understand the solution and processes, and accessing that is associated with the project to deploy a new lawful interception solution

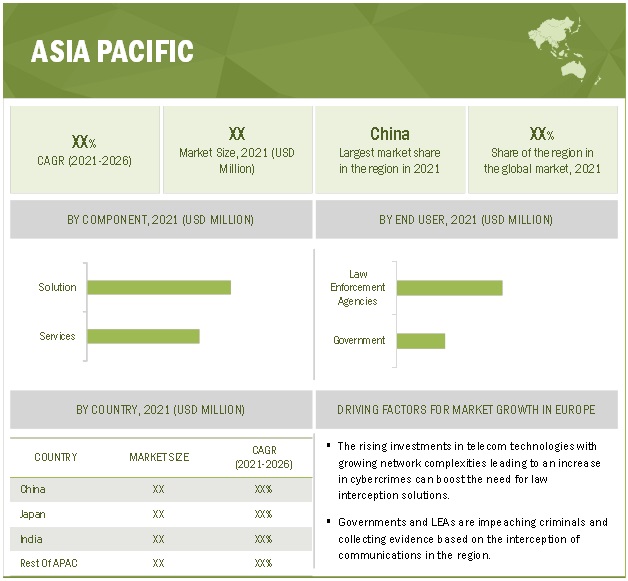

APAC to grow at the highest CAGR during the forecast period

APAC is one of the fastest-growing economies due to the growing network technologies, digital infrastructure, and smartphone and internet penetration. These factors have stimulated the cases of cybercrimes by using social networks for subversive activities and terrorism in the region. Countries such as India, China, and Japan contribute a major share to APAC’s economy. These countries are experiencing a major threat from hacker groups or terror networks with the increasing penetration of digital infrastructure and heavy investment on network technologies by key industry telecom players in the region.

To know about the assumptions considered for the study, download the pdf brochure

Lawful Interception Market Players

The report includes the study of key players Lawful interception market. It profiles major vendors in the Lawful interception market. The major vendors in the Lawful interception market include Utimaco (Germany), Vocal Technologies(US), AQSACOM (US), Verint (US), BAE Systems (UK), Cisco (US), Ericsson (Sweden), SS8 Networks. (US), Elbit Systems (US), Matison (Croatia), Shoghi (India), Comint (Mexico), Signalogic (US), IPS S.P.A (Rome), Tracespan (Isreal), Accuris Networks (US), EVE Compliancy Solutions (Netherlands), Squire Technologies (UK), Incognito Software (Canada), GL Communications (US), Septier Communications (Isreal), NetQuest (NJ), ETSI (France), Atos (France), Trovicor (Dubai). These players have adopted various strategies to grow in the global offering Lawful interception market. The study includes an in-depth competitive analysis of these key players in the offering Lawful interception market with their company profiles, recent developments, and key market strategies.

Lawful Interception Market Report Scope

|

Report Metrics |

Details |

|

Market value in 2021 |

USD 3.5 Billion |

|

Market value in 2026 |

USD 12.9 Billion |

|

Market Growth Rate |

29.3% CAGR |

|

Largest Market |

APAC |

|

Lawful Interception Market Drivers |

|

|

Lawful Interception Market Opportunities |

|

|

Segments covered |

By Component, Network, Network Technology, Communication Content, Mediation Device Interface, Type of Interception, End User and Region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Utimaco (Germany), Vocal Technologies(US), AQSACOM (US), Verint (US), BAE Systems (UK), Cisco (US), Ericsson (Sweden), SS8 Networks. (US), Elbit Systems (US), Matison (Croatia), Shoghi (India), Comint (Mexico) Signalogic (US) And many more |

This research report categorizes the Lawful Interception Market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Solutions

-

Services

- Professional Services

- Managed Services

By Network:

- Fixed Network

- Mobile Network

By Network Technology:

- Digital Subscriber Line (DSL)

- Integrated Services for Digital Networks (ISDN)

- Long Term Evolution (LTE)

- Public Switch Telephone Network (PSTN)

- Voice Over Internet Protocol (VOIP)

- Wireless Local Area Network (WLAN)

- Worldwide Interoperability for Microwave Access (WIMAX)

- Others

By Communication Content:

- Voice Communication

- Video

- Text Messaging

- Faxcimile

- Digital Pictures

- File Transfer

By Mediation Device:

- Routers

- Switches

- Gateway

-

Handover Interface

O Handover Interface 1

o Handover Interface 2

o Handover Interface 3 - Intercept Access Point (IAP)

- Management Server

By Type Of Interception:

- Active Interception

- Passive Interception

- Hybrid Interception

By End User:

- Lawful Enforcement Agencies

- Government

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Rest of Europe

-

APAC

- Japan

- China

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In November 2021, SS8 partnered with Ocient to harness petabytes of data for lawful intelligence in interactive time.

- In August 2020, SS8 announced that it has expanded its Intellego XT product to include scalable real-time metadata analysis and advanced metadata queries, which would significantly increase data processing volumes and higher processing speeds.

- In July 2020, SS8 announced that it has expanded its real-time data analysis capabilities to include location data. Used by law enforcement agencies, the “Globe” component of their Intellego XT monitoring center provides mapping and timeline visualization of location intelligence for suspects of interest.

- In May 2019, The company launched, Luminar, a cyber intelligence solution, to identify and mitigate cyber threats. It leverages present and past threat intelligence repositories to curb cyberattacks in the future.

- In June 2018, ALIS is enhanced to meet the local country’s lawful cyber intelligence and GDPR compliance suitable for CSPs with cloud-based or SaaS communications solutions.

Frequently Asked Questions (FAQ):

How is the Lawful interception market expected to grow in the next five years?

According to MarketsandMarkets, the Lawful interception market size is expected to grow USD 3.5 billion in 2021 to USD 12.9 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 29.3% during the forecast period.

Which region has the largest market share in the Lawful interception market?

North America is estimated to hold the largest market share in Lawful interception market in 2021. North America is one of the technologically advanced markets in the world. It drives the large-scale implementation Lawful interception market in the US.

What are the major factors driving Lawful interception market?

The major drivers Lawful interception market are rapid adoption of advanced technologies, and government initiatives for lawful interception.

Who are the major vendors in Lawful interception market?

Major vendors in Lawful interception market include Utimaco, Vocal Technologies, Verint, BAE Systems, and AQSACOM. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL LAWFUL INTERCEPTION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary profiles

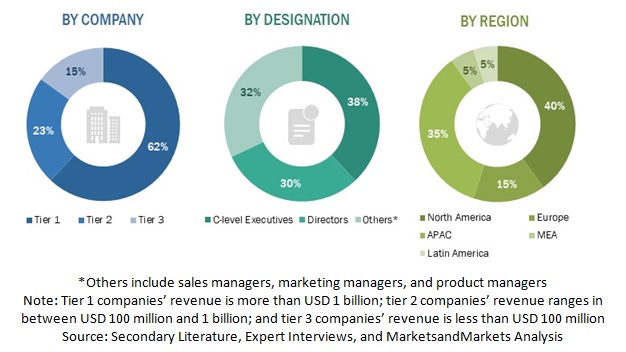

FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

TABLE 2 PRIMARY INTERVIEWS

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE): REVENUE OF SOLUTIONS/SERVICES OF THE LAWFUL INTERCEPTION MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF LAWFUL INTERCEPTION

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

TABLE 4 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 10 LAWFUL INTERCEPTION MARKET SIZE, 2021–2026 (USD MILLION)

FIGURE 11 FASTEST-GROWING SEGMENTS IN MARKET DURING 2021–2026

FIGURE 12 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL LAWFUL INTERCEPTION MARKET

FIGURE 13 INCREASED SUBVERSIVE ACTIVITIES AND TERRORISM, AND INCREASED CYBERCRIMES IN THE ERA OF DIGITALIZATION IS DRIVING THE GLOBAL MARKET

4.2 MARKET SHARE, BY COMPONENT

FIGURE 14 SOLUTIONS TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

4.3 MARKET SHARE, BY NETWORK

FIGURE 15 MOBILE NETWORK TO LEAD THE MARKET BY 2021 AND 2026

4.4 MARKET SHARE, BY END USER

FIGURE 16 APPLICATION BY LAW ENFORCEMENT AGENCIES TO LEAD THE MARKET THROUGH 2026

4.5 MARKET: MARKET INVESTMENT SCENARIO

FIGURE 17 ASIA PACIFIC CONSIDERED AS THE BEST MARKET TO INVEST IN DURING 2021–2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 61)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: LAWFUL INTERCEPTION MARKET

5.2.1 DRIVERS

5.2.1.1 Lawful interception of the internet

5.2.1.2 Government initiatives for lawful interception

5.2.1.3 Rise in cybercrimes in the time of digitalization

5.2.1.4 Rise in dissident activities and terrorism

5.2.2 RESTRAINTS

5.2.2.1 Legal obligations related to information security, human rights, and privacy

5.2.2.2 Protection and secrecy of the intercepted data

5.2.3 OPPORTUNITIES

5.2.3.1 Law and procedures for the interception of phone and computer data

5.2.3.2 Law enforcement monitoring facility against criminal activities

5.2.3.3 Lawful interception in 5G networks

5.2.3.4 Improved network technologies

5.2.4 CHALLENGES

5.2.4.1 Lawful interception - a legal requirement of a CSP

5.2.4.2 Changing communication patterns expanding the scope of monitoring

5.2.4.3 Surveillance of applications

5.2.4.4 Cross-frontier regulatory frameworks

5.2.4.5 Lawful interception in over-the-top services

5.3 COVID-19 IMPACT ON MARKET DYNAMICS

5.3.1 CUMULATIVE GROWTH ANALYSIS

5.3.1.1 Drivers and opportunities

5.3.1.2 Restraints and challenges

5.3.1.3 Cumulative growth impact

5.4 REGULATORY IMPACT

5.5 USE CASES

5.5.1 USE CASE 1: TROVICOR

5.5.2 USE CASE 2: LUCENT TECHNOLOGIES

5.5.3 USE CASE 3: SS8 NETWORKS

5.5.4 USE CASE 4: LI FOR 3G NETWORKS USING ALIS

5.5.5 USE CASE 5: ACCOLADE TECHNOLOGY

5.6 VALUE CHAIN ANALYSIS

FIGURE 19 LAWFUL INTERCEPTION MARKET: VALUE CHAIN ANALYSIS

5.7 ECOSYSTEM

TABLE 5 MARKET: ECOSYSTEM

5.8 PATENT ANALYSIS

FIGURE 20 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 6 TOP TWENTY PATENT OWNERS (UNITED STATES)

FIGURE 21 NUMBER OF PATENTS GRANTED IN A YEAR, 2012-2021

5.9 PRICING ANALYSIS

5.10 TECHNOLOGY ANALYSIS

5.10.1 5G

5.10.2 DEEP PACKET INSPECTION (DPI)

5.10.3 VOICE OVER IP (VOIP)

5.10.4 PUBLIC SWITCHED TELEPHONE NETWORK (PSTN)

5.10.5 INTEGRATED SERVICES DIGITAL NETWORK (ISDN)

5.11 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 22 TRENDS IMPACTING CUSTOMERS: LAWFUL INTERCEPTION MARKET

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES MODEL

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 BARGAINING POWER OF SUPPLIERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

6 LAWFUL INTERCEPTION MARKET, BY COMPONENT (Page No. - 76)

6.1 INTRODUCTION

FIGURE 23 LAWFUL INTERCEPTION SERVICES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 9 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: LAWFUL INTERCEPTION MARKET DRIVERS

6.2.2 SOLUTIONS: LAWFUL INTERCEPTION COVID-19 IMPACT

TABLE 10 LAWFUL INTERCEPTION SOLUTIONS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 LAWFUL INTERCEPTION SOLUTIONS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 12 LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 24 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

6.3.1 SERVICES: LAWFUL INTERCEPTION MARKET DRIVERS

TABLE 14 LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 15 LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

TABLE 16 PROFESSIONAL LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 PROFESSIONAL LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 MANAGED SERVICES

TABLE 18 MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 LAWFUL INTERCEPTION MARKET, BY NETWORK (Page No. - 84)

7.1 INTRODUCTION

FIGURE 25 LAWFUL INTERCEPTION THROUGH MOBILE NETWORK TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.1 NETWORK: MARKET DRIVERS

7.1.2 NETWORK: LAWFUL INTERCEPTION COVID-19 IMPACT

TABLE 20 MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 21 MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

7.2 FIXED NETWORK

TABLE 22 FIXED NETWORK MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 FIXED NETWORK MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 MOBILE NETWORK

TABLE 24 MANAGED NETWORK MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 MANAGED NETWORK MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 LAWFUL INTERCEPTION MARKET, BY NETWORK TECHNOLOGY TYPE (Page No. - 89)

8.1 DIGITAL SUBSCRIBER LINE (DSL)

8.2 INTEGRATED SERVICES FOR DIGITAL NETWORK (ISDN)

8.3 LONG-TERM EVOLUTION (LTE)

8.4 PUBLIC SWITCH TELEPHONE NETWORK (PSTN)

8.5 VOICE OVER INTERNET PROTOCOL (VOIP)

8.6 WIRELESS LOCAL AREA NETWORK (WLAN)

8.7 WORLDWIDE INTEROPERABILITY FOR MICROWAVE ACCESS (WIMAX)

8.8 OTHERS

9 MARKET, BY COMMUNICATION CONTENT (Page No. - 92)

9.1 VOICE COMMUNICATION

9.2 VIDEO

9.3 TEXT MESSAGING

9.4 FACSIMILE

9.5 DIGITAL PICTURES

9.6 FILE TRANSFER

10 LAWFUL INTERCEPTION MARKET, BY MEDIATION DEVICE (Page No. - 94)

10.1 INTRODUCTION

10.2 ROUTERS

10.3 SWITCHES

10.4 GATEWAY

10.5 HANDOVER INTERFACE

10.5.1 HANDOVER INTERFACE 1

10.5.2 HANDOVER INTERFACE 2

10.5.3 HANDOVER INTERFACE 3

10.6 INTERCEPT ACCESS POINT (IAP)

10.7 MANAGEMENT SERVER

11 MARKET, BY TYPE OF INTERCEPTION (Page No. - 96)

11.1 INTRODUCTION

11.2 ACTIVE INTERCEPTION

11.3 PASSIVE INTERCEPTION

11.4 HYBRID INTERCEPTION

12 LAWFUL INTERCEPTION MARKET, BY END USER (Page No. - 97)

12.1 INTRODUCTION

FIGURE 26 GOVERNMENT END USE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

12.1.1 END USER: MARKET DRIVERS

12.1.2 END USER: LAWFUL INTERCEPTION COVID-19 IMPACT

TABLE 26 MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 27 MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

12.2 LAW ENFORCEMENT AGENCIES

TABLE 28 MARKET SIZE FOR LAW ENFORCEMENT AGENCIES, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 MARKET SIZE FOR LAW ENFORCEMENT AGENCIES, BY REGION, 2021–2026 (USD MILLION)

12.3 GOVERNMENT

TABLE 30 MARKET SIZE FOR GOVERNMENT, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 MARKET SIZE FOR GOVERNMENT, BY REGION, 2021–2026 (USD MILLION)

13 LAWFUL INTERCEPTION MARKET, BY REGION (Page No. - 101)

13.1 INTRODUCTION

FIGURE 27 NORTH AMERICA TO LEAD THE MARKET DURING 2021–2026

FIGURE 28 ASIA PACIFIC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 32 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

13.2.1 NORTH AMERICA: MARKET DRIVERS

13.2.2 NORTH AMERICA: IMPACT OF COVID-19 ON THE MARKET

13.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

TABLE 34 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: LAWFUL INTERCEPTION SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 37 NORTH AMERICA: LAWFUL INTERCEPTION SOLUTIONS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 39 NORTH AMERICA: LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: LAWFUL INTERCEPTION MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: PROFESSIONAL LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 43 NORTH AMERICA: PROFESSIONAL LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 45 NORTH AMERICA: MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: FIXED NETWORK LAWFUL INTERCEPTION MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: FIXED NETWORK MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MOBILE NETWORK MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: MOBILE NETWORK MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE FOR GOVERNMENT, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE FOR GOVERNMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: LEA MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: LEA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

13.2.4 UNITED STATES

TABLE 60 US: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 61 US: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 62 US: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 63 US: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 64 US: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 65 US: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 66 US: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 67 US: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.2.5 CANADA

TABLE 68 CANADA: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.3 EUROPE

13.3.1 EUROPE: MARKET DRIVERS

13.3.2 EUROPE: IMPACT OF COVID-19 ON THE MARKET

13.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 76 EUROPE: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 78 EUROPE: SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 79 EUROPE: SOLUTIONS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 80 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 81 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 84 EUROPE: PROFESSIONAL LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 85 EUROPE: PROFESSIONAL LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 86 EUROPE: MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 87 EUROPE: MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 EUROPE: LAWFUL INTERCEPTION MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 90 EUROPE: FIXED NETWORK MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 91 EUROPE: FIXED NETWORK MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 92 EUROPE: MOBILE NETWORK MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 93 EUROPE: MOBILE NETWORK MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE FOR GOVERNMENT, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE FOR GOVERNMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE FOR LAW ENFORCEMENT AGENCIES, BY COUNTRY,2016–2020 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE FOR LAW ENFORCEMENT AGENCIES, BY COUNTRY, 2021–2026 (USD MILLION)

13.3.4 UNITED KINGDOM

TABLE 100 UK: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 101 UK: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 102 UK: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 103 UK: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 104 UK: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 105 UK: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 106 UK: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 107 UK: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.3.5 GERMANY

TABLE 108 GERMANY: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 109 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 110 GERMANY: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 111 GERMANY: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 112 GERMANY: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 113 GERMANY: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 114 GERMANY: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 115 GERMANY: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.3.6 FRANCE

TABLE 116 FRANCE: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 117 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 118 FRANCE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 119 FRANCE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 120 FRANCE: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 121 FRANCE: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 122 FRANCE: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 123 FRANCE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.3.7 SPAIN

TABLE 124 SPAIN: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 125 SPAIN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 126 SPAIN: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 127 SPAIN: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 128 SPAIN: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 129 SPAIN: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 130 SPAIN: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 131 SPAIN: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.3.8 REST OF EUROPE

TABLE 132 REST OF EUROPE: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 134 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 135 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: LAWFUL INTERCEPTION MARKET SNAPSHOT

13.4.1 ASIA PACIFIC: MARKET DRIVERS

13.4.2 ASIA PACIFIC: IMPACT OF COVID-19 ON THE MARKET

13.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: LAWFUL INTERCEPTION SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: LAWFUL INTERCEPTION SOLUTIONS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: LAWFUL INTERCEPTION MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: LAWFUL INTERCEPTION PROFESSIONAL SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: PROFESSIONAL LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: MANAGED LAWFUL INTERCEPTION SERVICES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 152 ASIA PACIFIC: LAWFUL INTERCEPTION MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 154 ASIA PACIFIC: FIXED NETWORK MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: FIXED NETWORK MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 156 ASIA PACIFIC: MOBILE NETWORK MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 157 ASIA PACIFIC: MOBILE NETWORK MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE FOR GOVERNMENT, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE FOR GOVERNMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: LEA MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: LEA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.4.4 JAPAN

TABLE 166 JAPAN: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 167 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 168 JAPAN: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 169 JAPAN: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 170 JAPAN: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 171 JAPAN: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 172 JAPAN: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 173 JAPAN: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.4.5 CHINA

TABLE 174 CHINA: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 175 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 176 CHINA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 177 CHINA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 178 CHINA: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 179 CHINA: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 180 CHINA: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 181 CHINA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.4.6 INDIA

TABLE 182 INDIA: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 183 INDIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 184 INDIA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 185 INDIA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 186 INDIA: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 187 INDIA: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 188 INDIA: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 189 INDIA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

TABLE 190 REST OF APAC: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 191 REST OF APAC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 192 REST OF APAC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 193 REST OF APAC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 194 REST OF APAC: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 195 REST OF APAC: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 196 REST OF APAC: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 197 REST OF APAC: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

13.5 MIDDLE EAST & AFRICA

13.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

13.5.2 MIDDLE EAST & AFRICA: IMPACT OF COVID-19 ON THE MARKET

13.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 198 MIDDLE EAST & AFRICA: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.5.4 MIDDLE EAST

13.5.5 AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: MARKET DRIVERS

13.6.2 LATIN AMERICA: IMPACT OF COVID-19 ON THE MARKET

13.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 208 LATIN AMERICA: LAWFUL INTERCEPTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY NETWORK, 2016–2020 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY NETWORK, 2021–2026 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY END USER, 2016–2020 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

13.6.4 BRAZIL

13.6.5 MEXICO

13.6.6 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 164)

14.1 OVERVIEW

14.2 MARKET STRUCTURE

TABLE 218 LAWFUL INTERCEPTION MARKET: DEGREE OF COMPETITION

14.3 HISTORICAL REVENUE ANALYSIS

FIGURE 31 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2016–2020

14.4 MARKET EVALUATION FRAMEWORK

FIGURE 32 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN THE MARKET BETWEEN 2019 AND 2021

14.5 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 33 MARKET: REVENUE ANALYSIS

14.6 RANKING OF KEY PLAYERS

FIGURE 34 RANKING OF KEY MARKET PLAYERS

FIGURE 35 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET DURING 2018-2021

14.7 COMPANY EVALUATION MATRIX

14.7.1 STARS

14.7.2 EMERGING LEADERS

14.7.3 PERVASIVE LEADERS

14.7.4 PARTICIPANTS

FIGURE 36 GLOBAL LAWFUL INTERCEPTION MARKET: COMPANY EVALUATION MATRIX, 2021

14.8 PRODUCT PORTFOLIO ANALYSIS OF MAJOR PLAYERS

TABLE 219 COMPANY FOOTPRINT ANALYSIS: MARKET

TABLE 220 COMPANY OFFERING FOOTPRINT: MARKET

TABLE 221 COMPANY END USER FOOTPRINT: MARKET

TABLE 222 COMPANY REGION FOOTPRINT: MARKET

14.9 COMPETITIVE SCENARIO

14.9.1 NEW SERVICE/PRODUCT LAUNCHES

TABLE 223 NEW SERVICE/PRODUCT LAUNCHES, 2018–2021

14.9.2 DEALS

TABLE 224 DEALS, 2018–2021

14.1 STARTUP/SME EVALUATION MATRIX

14.10.1 PROGRESSIVE COMPANIES

14.10.2 RESPONSIVE COMPANIES

14.10.3 DYNAMIC COMPANIES

14.10.4 STARTING BLOCKS

FIGURE 37 LAWFUL INTERCEPTION MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX

15 COMPANY PROFILES (Page No. - 175)

15.1 MAJOR PLAYERS

(Business overview, Products offered, MNM view, Key strengths/right to win, Strategic choices made, and Weakness and competitive threats)*

15.1.1 UTIMACO

TABLE 225 UTIMACO: BUSINESS OVERVIEW

TABLE 226 UTIMACO: PRODUCTS OFFERED

15.1.2 VOCAL TECHNOLOGIES

TABLE 227 VOCAL TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 228 VOCAL TECHNOLOGIES: PRODUCTS OFFERED

15.1.3 AQSACOM

TABLE 229 AQSACOM: BUSINESS OVERVIEW

TABLE 230 AQSACOM: PRODUCTS OFFERED

TABLE 231 AQSACOM: PRODUCT LAUNCHES

15.1.4 VERINT

TABLE 232 VERINT: BUSINESS OVERVIEW

FIGURE 38 VERINT: COMPANY SNAPSHOT

TABLE 233 VERINT: PRODUCTS OFFERED

TABLE 234 VERINT: PRODUCT LAUNCHES

15.1.5 BAE SYSTEMS

TABLE 235 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 39 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 236 BAE SYSTEMS: PRODUCTS OFFERED

15.1.6 CISCO

TABLE 237 CISCO: BUSINESS OVERVIEW

FIGURE 40 CISCO: COMPANY SNAPSHOT

TABLE 238 CISCO: PRODUCTS OFFERED

15.1.7 ERICSSON

TABLE 239 ERICSSON: BUSINESS OVERVIEW

FIGURE 41 ERICSSON: COMPANY SNAPSHOT

TABLE 240 ERICSSON: PRODUCTS OFFERED

15.1.8 ATOS

TABLE 241 ATOS: BUSINESS OVERVIEW

FIGURE 42 ATOS: COMPANY SNAPSHOT

TABLE 242 ATOS: PRODUCTS OFFERED

15.1.9 SS8 NETWORKS

TABLE 243 SS8 NETWORKS: BUSINESS OVERVIEW

TABLE 244 SS8 NETWORKS: PRODUCTS OFFERED

TABLE 245 SS8 NETWORKS: PRODUCT LAUNCHES

TABLE 246 SS8 NETWORKS: DEALS

15.1.10 TROVICOR NETWORKS

TABLE 247 TROVICOR NETWORKS: BUSINESS OVERVIEW

TABLE 248 TROVICOR NETWORKS: PRODUCTS OFFERED

15.2 STARTUP/SMES PLAYERS

15.2.1 ELBIT SYSTEMS

15.2.2 SHOGHI COMMUNICATIONS

15.2.3 IPS S.P.A

15.2.4 ACCURIS NETWORKS

15.2.5 INCOGNITO SOFTWARE

15.2.6 GL COMMUNICATION INC.

15.2.7 ETSI

15.2.8 NETQUEST

15.2.9 MATISON

15.2.10 SEPTIER COMMUNICATION

15.2.11 SQUIRE TECHNOLOGIES

15.2.12 EVE COMPLIANCY SOLUTIONS

15.2.13 TRACESPAN COMMUNICATIONS

15.2.14 SIGNALOGIC

15.2.15 COMINT

*Details on Business overview, Products offered, MNM view, Key strengths/right to win, Strategic choices made, and Weakness and competitive threats not be captured in case of unlisted companies.

16 ADJACENT MARKETS (Page No. - 207)

16.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 249 ADJACENT MARKETS AND FORECASTS

16.2 LIMITATIONS

16.3 CYBERSECURITY MARKET

TABLE 250 CYBERSECURITY MARKET SIZE FOR ADVANCED THREAT PROTECTION, BY REGION, 2015–2020 (USD MILLION)

TABLE 251 CYBERSECURITY MARKET SIZE FOR ADVANCED THREAT PROTECTION, BY REGION, 2020–2026 (USD MILLION)

TABLE 252 CYBERSECURITY MARKET SIZE FOR THREAT INTELLIGENCE PLATFORM, BY REGION, 2015–2020 (USD MILLION)

TABLE 253 CYBERSECURITY MARKET SIZE FOR THREAT INTELLIGENCE PLATFORM, BY REGION, 2020–2026 (USD MILLION)

TABLE 254 CYBERSECURITY MARKET SIZE FOR SECURITY AND INFORMATION EVENT MANAGEMENT, BY REGION, 2015–2020 (USD MILLION)

TABLE 255 CYBERSECURITY MARKET SIZE FOR SECURITY AND INFORMATION EVENT MANAGEMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 256 CYBERSECURITY MARKET SIZE FOR LAWFUL INTERCEPTION, BY REGION, 2015–2020 (USD MILLION)

TABLE 257 CYBERSECURITY MARKET SIZE FOR LAWFUL INTERCEPTION, BY REGION, 2020–2026 (USD MILLION)

TABLE 258 CYBERSECURITY MARKET SIZE FOR NETWORK ACCESS CONTROL, BY REGION, 2015–2020 (USD MILLION)

TABLE 259 CYBERSECURITY MARKET SIZE FOR NETWORK ACCESS CONTROL, BY REGION, 2020–2026 (USD MILLION)

TABLE 260 CYBERSECURITY MARKET SIZE FOR ANTIVIRUS/ANTIMALWARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 261 CYBERSECURITY MARKET SIZE FOR ANTIVIRUS/ANTIMALWARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 262 CYBERSECURITY MARKET SIZE FOR FIREWALL, BY REGION, 2015–2020 (USD MILLION)

TABLE 263 CYBERSECURITY MARKET SIZE FOR FIREWALL, BY REGION, 2020–2026 (USD MILLION)

TABLE 264 CYBERSECURITY MARKET SIZE FOR SECURE WEB GATEWAY, BY REGION, 2015–2020 (USD MILLION)

TABLE 265 CYBERSECURITY MARKET SIZE FOR SECURE WEB GATEWAY, BY REGION, 2020–2026 (USD MILLION)

TABLE 266 CYBERSECURITY MARKET SIZE FOR SECURITY ORCHESTRATION AUTOMATION AND RESPONSE, BY REGION, 2015–2020 (USD MILLION)

TABLE 267 CYBERSECURITY MARKET SIZE FOR SECURITY ORCHESTRATION AUTOMATION AND RESPONSE, BY REGION, 2020–2026 (USD MILLION)

TABLE 268 CYBERSECURITY MARKET SIZE FOR IDENTITY AND ACCESS MANAGEMENT, BY REGION, 2015–2020 (USD MILLION)

TABLE 269 CYBERSECURITY MARKET SIZE FOR IDENTITY AND ACCESS MANAGEMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 270 CYBERSECURITY MARKET SIZE FOR ENCRYPTION, BY REGION, 2015–2020 (USD MILLION)

TABLE 271 CYBERSECURITY MARKET SIZE FOR ENCRYPTION, BY REGION, 2020–2026 (USD MILLION)

TABLE 272 CYBERSECURITY MARKET SIZE FOR DISASTER RECOVERY, BY REGION, 2015–2020 (USD MILLION)

TABLE 273 CYBERSECURITY MARKET SIZE FOR DISASTER RECOVERY, BY REGION, 2020–2026 (USD MILLION)

TABLE 274 CYBERSECURITY MARKET SIZE FOR INTRUSION DETECTION AND PREVENTION SYSTEM, BY REGION, 2015–2020 (USD MILLION)

TABLE 275 CYBERSECURITY MARKET SIZE FOR INTRUSION DETECTION AND PREVENTION SYSTEM, BY REGION, 2020–2026 (USD MILLION)

TABLE 276 CYBERSECURITY MARKET SIZE FOR RISK AND COMPLIANCE MANAGEMENT, BY REGION, 2015–2020 (USD MILLION)

TABLE 277 CYBERSECURITY MARKET SIZE FOR RISK AND COMPLIANCE MANAGEMENT, BY REGION, 2020–2026 (USD MILLION)

17 APPENDIX (Page No. - 218)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

Extensive secondary sources, directories, and databases, such as Factiva, Hoovers, and Bloomberg Businessweek, were used to identify and collect information useful for this comprehensive market research study on the global Lawful Interception Market.

Secondary Research

The market size of companies offering Lawful Interception solutions and services to various segments is based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of the major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; articles from recognized authors; directories; and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by the primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing automated testing applications across industry verticals. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians, and technologists.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the lawful interception market. The first approach involves the estimation of the market size by summation of companies’ revenue generated through the lawful interception solutions and services.

In this approach for market estimation, we have identified the key companies offering lawful Interception solutions, such as Cisco, Vocal Technologies, Utimaco, AQSACOM, Ericsson, SS8 Networks, Verint, Matison, Shoghi, Comint, Signalogic, and IPS, which contribute almost 60% of the global lawful interception market. After confirming these companies through primary interviews with industry experts, we have estimated their total revenue through annual reports, SEC filings, and paid databases. These companies’ revenue pertaining to the Business Units (BUs) that offer lawful interception solutions were identified through similar sources. Then through primaries, we have collected the data of the revenue generated through specific lawful interception solutions. Collective revenue of key companies that offer lawful interception solutions comprised 55–60% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed by smaller players (part of the unorganized market), the market size of organized players (55–60%) and unorganized players (40–45%) collectively was assumed to be the market size of the global lawful interception market for FY 2021

Data Triangulation

Report Objectives

- To define, describe, and forecast the Lawful Interception Market by component, network, network technology, communication content, mediation device interface, type of interception, end user and region.

- To determine and forecast the global Market based on component, network, network technology, communication content, mediation device interface, type of interception, end user and region with respect to individual growth trends and contributions toward the overall market

- To forecast the size of the market segments with respect to five main regions—North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total Lawful Interception Market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the Market

- To profile the key market players comprising top vendors, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as acquisitions; new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities, in the market

- To analyze the impact of the COVID-19 outbreak on the growth of the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lawful Interception Market