IoT Cloud Platform Market by Offering (Platform and Service), Deployment Mode (Public Cloud, Private Cloud, and Hybrid), Organization Size, Application Area (Building & Home Automation and Connected Healthcare), and Region - Global Forecast to 2025

IoT Cloud Platform Market Size & Forecast

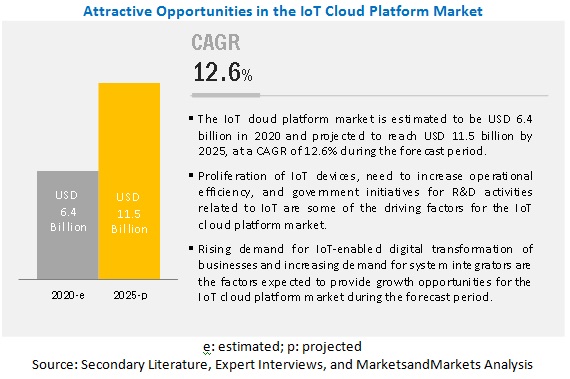

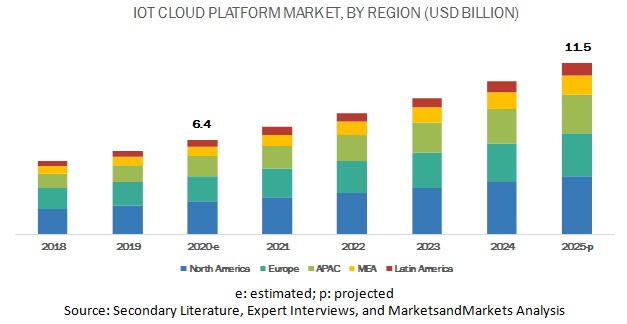

The global IoT Cloud Platform Market size was valued at USD 6.4 billion in 2020 and is expected to grow at a CAGR of 12.6% from 2020 to 2025. The revenue forecast for 2025 is projected to reach $11.5 billion. The base year for estimation is 2019, and the historical data spans from 2020 to 2025. Major factors expected to drive the growth of the IoT cloud platform market include the proliferation of IoT devices, need to increase operational efficiency, rapidly decreasing costs of IoT-based sensors connectivity hardware, and government initiatives for Research and Development (R&D) activities related to IoT, emergence of Internet Protocol version 6 (IPv6), and the shift from on-premises to cloud-based data management strategy.

Based on platform, the device management segment to hold the largest market size during the forecast period

The Information Technology (IT) vertical is expected to hold the largest market size during the forecast period. The IoT cloud platform market is a platform-driven market. The platform plays a crucial role in handling all the IoT and cloud operations related activities that include collecting data from IoT-enabled devices to the storage and analysis of collected data for gaining real-time insights. The rising number IoT devices in various application areas is major factor driving the growth of platform segment of market.

Based on services, the managed services segment to grow at a higher CAGR during the forecast period

Managed services are estimated to register a higher growth rate during the forecast period, compared to professional services. Managed services assess the business network, monitor the health of the infrastructure, and perform remote maintenance activities. These services provide security and expert assurance, thereby helping the entire business to be more productive. The growing need to outsource services for the maintenance of IoT cloud platform is anticipated to drive the demand for managed services in the market. Managed services help companies reduce the operational pressure on IT staff and allow the staff to focus more on mission-critical processes.

Based on deployment mode, the public cloud to hold the largest market size during the forecast period

The public cloud segment is estimated to hold the largest market size during the forecast period. The growth of the public cloud segment is mainly governed by factors, such as easy deployment, flexibility, and cost-effective pricing structure. The growing investment on the public cloud infrastructure by various developed economies, such as the US, China, the UK, Australia, and Canada is anticipated to drive the demand for public cloud deployment mode in the IoT cloud platform market.

Based on application area, the connected healthcare segment to grow at the highest CAGR during the forecast period

The application of IoT cloud platform in the connected healthcare has widened, due to the increasing use of embedded sensors, availability of fast cellular networks, and rising adoption of wireless devices. Communication between sensors and devices enables healthcare organizations to streamline their clinical operations, manage workflows, and aid in real-time patient care, even from remote locations. Hence, healthcare organizations are focusing on implementing robust applications and connected technologies. Some of the major applications of IoT in connected healthcare area are remote patient monitoring, healthcare workflow management, medication management, and medical asset tracking.

Based on region, North America to account for the largest market size during the forecast period

The IoT cloud platform market in North America is expected to provide maximum revenue opportunities to vendors, as it is likely to benefit from its technological advancements and its position as a developed region. The proliferation of IoT-enabled devices, significant R&D investment on IoT, and presence of key market players, such as Amazon Web Services (AWS), Google, Microsoft, IBM, and Cisco Systems are some of the major driving factors driving the adoption of IoT cloud platform in North America. Due to the early adoption of trending technologies, such as IoT, cloud, Artificial Intelligence (AI), big data, and mobility, North American organizations are keen on integrating IoT technologies into their processes. Though the US is a leader in the market in North America, Canada is also expected to witness a surge in the adoption of IoT cloud platforms.

Key Market Players

Key and emerging IoT cloud platform market players include AWS (US), Microsoft (US), Google (US), Cisco Systems (US), IBM (US), Oracle (US), Salesforce.com (US), SAP (Germany), PTC (US), Samsung (South Korea), Bosch.IO (Germany), Autodesk (US), AT&T (US), Alibaba Cloud (China), Telit (UK), Siemens (Germany), GE Digital (US), Ubidots (Colombia), Zoho Corporation (US), and Particle (US). These players have adopted various strategies to grow in the market. The companies are focused on inorganic and organic growth strategies to strengthen their market position.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Offering (Platform and Services), Deployment Mode (Public Cloud, Private Cloud, and Hybrid), Organization Size (Small and Medium-sized Enterprises [SMEs] and Large Enterprises), Application Area (Building and Home Automation, Smart Manufacturing, Smart Transportation, Connected Healthcare, Smart Retail, Smart Grid and Utilities, and Others), and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

AWS (US), Microsoft (US), Google (US), Cisco Systems (US), IBM (US), Oracle (US), Salesforce.com (US), SAP (Germany), PTC (US), Samsung (South Korea), Bosch.IO (Germany), Autodesk (US), AT&T (US), Alibaba Cloud (China), Telit (UK), Siemens (Germany), GE Digital (US), Ubidots (Colombia), Zoho Corporation (US), and Particle (US). |

The research report categorizes the IoT cloud platform market to forecast the revenues and analyze trends in each of the following subsegments:

By Offering

-

Platform

- Device Management

- Connectivity Management

- Application Enablement

-

Service

-

Professional Services

- Training and Consulting

- Integration and Deployment

- Support and Maintenance

- Managed Services

-

Professional Services

By Deployment Type

- Public Cloud

- Private Cloud

- Hybrid

By Organization Size

- SMEs

- Large Enterprises

By Application Area

- Building and Home Automation

- Smart Manufacturing

- Smart Transportation

- Connected Healthcare

- Smart Retail

- Smart Grid and Utilities

- Others (Smart Education, Smart Agriculture, Smart Hospitality, Connected Banking, telecom, and Security and Emergency)

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- India

- Rest of APAC

-

MEA

- Saudi Arabia

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2020, Microsoft Azure Security Center for IoT extended the support for Azure Real-Time Operating System (RTOS), in addition to Linux (Ubuntu, Debian), and Windows 10 IoT Core Operating Systems

- In January 2020, AWS partnered with BlackBerry, to develop a safe, secure, and intelligent connected vehicle software platform for in-vehicle applications.

- In December 2019, Cisco Systems introduced a new version of its Cisco IOx i.e. Cisco IOx 1.10.0.

- In November 2019, Google announced the acquisition of Fitbit, a leading wearable brand, for approximately USD 2.1 billion.

- In July 2019, Google opened a new data center and Google Cloud region in Nevada, US.

- In April 2019, IBM signed an agreement with SmartCone Technologies, to integrate SmartCone Technologies’ solutions with IBM Watson IoT Platform, to develop detection and alert systems.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming technology trends for the IoT cloud platform market?

- Which segment provides the most opportunities for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

How big is the global IoT cloud platform market?

What is growth rate of the IoT cloud platform market?

What are the key trends affecting the global IoT cloud platform market?

Who are the key players in IoT cloud platform market?

What is the IoT cloud platform market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primaries

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

4.2 NORTH AMERICA IOT CLOUD PLATFORM MARKET, BY OFFERING AND COUNTRY

4.3 IOT CLOUD PLATFORM MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Proliferation of IoT devices

5.2.1.2 Shift from on-premises to cloud-based data management strategy

5.2.1.3 Need to increase operational efficiency

5.2.1.4 Government initiatives in R&D activities related to IoT

5.2.1.5 Emergence of IPv6

5.2.1.6 Rapidly decreasing costs of IoT-based sensors and connectivity hardware

5.2.2 RESTRAINTS

5.2.2.1 Absence of standardization in IoT protocols

5.2.2.2 Lack of technically skilled workforce

5.2.2.3 Complexities in managing unstructured data

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for IoT-enabled digital transformation of businesses

5.2.3.2 Increasing demand for system integrators

5.2.4 CHALLENGES

5.2.4.1 Issues related to data security and privacy

5.2.4.2 Interoperability issues of legacy infrastructure and communication networks

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN ANALYSIS

5.3.2 IMPACT OF DISRUPTIVE TECHNOLOGIES

5.3.2.1 Edge computing

5.3.2.2 5G

5.3.2.3 Digital twin

5.3.2.4 MQTT protocol

5.3.3 INDUSTRY USE CASES

5.3.3.1 Use case 1: Consumer electronics and home appliances

5.3.3.2 Use case 2: Retail

5.3.3.3 Use case 3: Smart city

5.3.3.4 Use case 4: Agriculture

5.3.3.5 Use case 5: Healthcare

6 IMPACT OF COVID-19 ON THE IOT CLOUD PLATFORM MARKET (Page No. - 53)

6.1 MARKET DYNAMICS DURING THE COVID-19 OUTBREAK

6.1.1 DRIVERS

6.1.1.1 Growth in the adoption of work-from-home policy

6.1.1.2 Increasing adoption of wearables

6.1.2 OPPORTUNITIES

6.1.2.1 Rising demand for telemedicine

6.1.2.2 Drones for enforcement of compliance

6.1.3 CHALLENGES

6.1.3.1 Huge decline in the operations and manufacturing

6.1.3.2 Disruption in logistics and supply chain

6.2 INDUSTRY-WISE USE CASES: COVID-19 IMPACT

6.2.1 HEALTHCARE

6.2.2 MANUFACTURING

6.2.3 TRANSPORTATION

6.2.4 RETAIL

6.2.5 UTILITIES

6.2.6 GOVERNMENT AND DEFENSE

6.2.7 BANKING, FINANCIAL SERVICES, AND INSURANCE

6.3 COVID-19 IMPACT ON OFFERINGS

6.3.1 COVID-19 IMPACT ON THE ADOPTION OF PLATFORMS

6.3.2 COVID-19 IMPACT ON THE ADOPTION OF SERVICES

6.4 COVID-19 IMPACT ON REGIONS

6.4.1 COVID-19 IMPACT ON NORTH AMERICA

6.4.2 COVID-19 IMPACT ON EUROPE

6.4.3 COVID-19 IMPACT ON ASIA PACIFIC

6.4.4 COVID-19 IMPACT ON MIDDLE EAST AND AFRICA

6.4.5 COVID-19 IMPACT ON LATIN AMERICA

7 IOT CLOUD PLATFORM MARKET, BY OFFERING (Page No. - 64)

7.1 INTRODUCTION

7.2 PLATFORM

7.2.1 DEVICE MANAGEMENT

7.2.1.1 Device management: market drivers

7.2.2 CONNECTIVITY MANAGEMENT

7.2.2.1 Connectivity management: market drivers

7.2.3 APPLICATION ENABLEMENT

7.2.3.1 Application enablement: market drivers

7.3 SERVICE

7.3.1 PROFESSIONAL SERVICES

7.3.1.1 Training and consulting

7.3.1.1.1 Training and consulting: market drivers

7.3.1.2 Integration and deployment

7.3.1.2.1 Integration and deployment: market drivers

7.3.1.3 Support and maintenance

7.3.1.3.1 Support and maintenance: market drivers

7.3.2 MANAGED SERVICES

7.3.2.1 Managed services: market drivers

8 IOT CLOUD PLATFORM MARKET, BY DEPLOYMENT MODE (Page No. - 81)

8.1 INTRODUCTION

8.2 PUBLIC CLOUD

8.2.1 PUBLIC CLOUD: MARKET DRIVERS

8.3 PRIVATE CLOUD

8.3.1 PRIVATE CLOUD: MARKET DRIVERS

8.4 HYBRID

8.4.1 HYBRID: MARKET DRIVERS

9 IOT CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE (Page No. - 87)

9.1 INTRODUCTION

9.2 LARGE ENTERPRISES

9.2.1 LARGE ENTERPRISES: MARKET DRIVERS

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

10 IOT CLOUD PLATFORM MARKET, BY APPLICATION AREA (Page No. - 92)

10.1 INTRODUCTION

10.2 BUILDING AND HOME AUTOMATION

10.2.1 BUILDING AND HOME AUTOMATION: MARKET DRIVERS

10.3 SMART TRANSPORTATION

10.3.1 SMART TRANSPORTATION: MARKET DRIVERS

10.4 CONNECTED HEALTHCARE

10.4.1 CONNECTED HEALTHCARE: MARKET DRIVERS

10.5 SMART MANUFACTURING

10.5.1 SMART MANUFACTURING: MARKET DRIVERS

10.6 SMART RETAIL

10.6.1 SMART RETAIL: MARKET DRIVERS

10.7 SMART GRID AND UTILITIES

10.7.1 SMART GRID AND UTILITIES: MARKET DRIVERS

10.8 OTHERS

11 IOT CLOUD PLATFORM MARKET, BY REGION (Page No. - 105)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 UNITED STATES

11.2.1.1 United States: market drivers

11.2.2 CANADA

11.2.2.1 Canada: market drivers

11.3 EUROPE

11.3.1 UNITED KINGDOM

11.3.1.1 United Kingdom: market drivers

11.3.2 GERMANY

11.3.2.1 Germany: market drivers

11.3.3 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 CHINA

11.4.1.1 China: market drivers

11.4.2 INDIA

11.4.2.1 India: market drivers

11.4.3 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.1.1 Saudi Arabia: market drivers

11.5.2 UNITED ARAB EMIRATES

11.5.2.1 United Arab Emirates: market drivers

11.5.3 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 BRAZIL

11.6.1.1 Brazil: market drivers

11.6.2 MEXICO

11.6.2.1 Mexico: market drivers

11.6.3 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 140)

12.1 COMPETITIVE LEADERSHIP MAPPING

12.1.1 EVALUATION CRITERIA

12.1.2 VISIONARY LEADERS

12.1.3 DYNAMIC DIFFERENTIATORS

12.1.4 INNOVATORS

12.1.5 EMERGING COMPANIES

12.2 STRENGTH OF PRODUCT PORTFOLIO (20 PLAYERS)

12.3 BUSINESS STRATEGY EXCELLENCE (20 PLAYERS)

12.4 RANKING OF TOP MARKET PLAYERS IN THE IOT CLOUD PLATFORM MARKET, 2020

13 COMPANY PROFILES (Page No. - 145)

13.1 INTRODUCTION

13.2 AWS

(Business Overview, Solutions and Services Offered, Recent Developments, and MNM View)*

13.3 MICROSOFT

13.4 GOOGLE

13.5 CISCO SYSTEMS

13.6 IBM

13.7 ORACLE

13.8 SALESFORCE.COM

13.9 SAP

13.10 PTC

13.11 SAMSUNG

13.12 BOSCH.IO

13.13 AUTODESK

13.14 AT&T

13.15 ALIBABA CLOUD

13.16 TELIT

13.17 SIEMENS

13.18 GE DIGITAL

13.19 UBIDOTS

13.20 ZOHO CORPORATION

13.21 PARTICLE

*Details on Business Overview, Solutions and Services Offered, Recent Developments, and MNM View might not be captured in case of unlisted companies.

13.22 RIGHT-TO-WIN

14 APPENDIX (Page No. - 191)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (122 Tables)

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2016–2018

TABLE 2 FACTOR ANALYSIS

TABLE 3 USE CASES: HEALTHCARE

TABLE 4 USE CASES: MANUFACTURING

TABLE 5 USE CASES: TRANSPORTATION

TABLE 6 USE CASES: RETAIL

TABLE 7 USE CASES: UTILITIES

TABLE 8 USE CASES: GOVERNMENT AND DEFENSE

TABLE 9 USE CASES: BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 10 IOT CLOUD PLATFORM MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 11 OFFERING: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 12 PLATFORM: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 NORTH AMERICA: PLATFORM MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 DEVICE MANAGEMENT: IOT CLOUD PLATFORM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 NORTH AMERICA: DEVICE MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 CONNECTIVITY MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 NORTH AMERICA: CONNECTIVITY MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 APPLICATION ENABLEMENT: IOT CLOUD PLATFORM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 NORTH AMERICA: APPLICATION ENABLEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 OFFERING: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 21 SERVICE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 NORTH AMERICA: SERVICE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 SERVICE: IOT CLOUD PLATFORM MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 24 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 NORTH AMERICA: PROFESSIONAL SERVICES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 TRAINING AND CONSULTING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 NORTH AMERICA: TRAINING AND CONSULTING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 INTEGRATION AND DEPLOYMENT: IOT CLOUD PLATFORM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: INTEGRATION AND DEPLOYMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: SUPPORT AND MAINTENANCE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 MANAGED SERVICES: IOT CLOUD PLATFORM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 IOT CLOUD PLATFORM MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 35 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: PUBLIC CLOUD MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: PRIVATE CLOUD MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 HYBRID: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: HYBRID MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 41 IOT CLOUD PLATFORM MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 42 LARGE ENTERPRISE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 SMALL AND MEDIUM-SIZED ENTERPRISES: IOT CLOUD PLATFORM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 IOT CLOUD PLATFORM MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 47 BUILDING AND HOME AUTOMATION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: BUILDING AND HOME AUTOMATION MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 SMART TRANSPORTATION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: SMART TRANSPORTATION MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 CONNECTED HEALTHCARE:MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: CONNECTED HEALTHCARE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 SMART MANUFACTURING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: SMART MANUFACTURING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 SMART RETAIL: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: SMART RETAIL MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 SMART GRID AND UTILITIES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: SMART GRID AND UTILITIES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 OTHERS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: OTHER APPLICATION AREAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 IOT CLOUD PLATFORM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: IOT CLOUD PLATFORM MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 UNITED STATES: MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 72 UNITED STATES: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 73 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 76 UNITED STATES: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 82 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 83 CANADA: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 84 EUROPE: IOT CLOUD PLATFORM MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 92 UNITED KINGDOM: MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 93 UNITED KINGDOM: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 98 UNITED KINGDOM: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 99 ASIA PACIFIC: IOT CLOUD PLATFORM MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA: IOT CLOUD PLATFORM MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 115 LATIN AMERICA: IOT CLOUD PLATFORM MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

TABLE 116 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2018–2025 (USD MILLION)

TABLE 117 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 118 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 119 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 120 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 121 LATIN AMERICA: MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

LIST OF FIGURES (43 Figures)

FIGURE 1 IOT CLOUD PLATFORM MARKET: RESEARCH DESIGN

FIGURE 2 DATA TRIANGULATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF PLATFORMS AND SERVICES OF THE MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2- BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PLATFORMS/SERVICES OF THE IOT CLOUD PLATFORM MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 3 - TOP-DOWN (DEMAND SIDE): SHARE OF THE IOT CLOUD PLATFORM MARKET THROUGH OVERALL IOT TECHNOLOGY SPENDING

FIGURE 6 COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

FIGURE 7 IOT CLOUD PLATFORM MARKET SIZE, 2018–2025

FIGURE 8 PLATFORM SEGMENT TO LEAD THE IOT CLOUD PLATFORM MARKET IN 2020

FIGURE 9 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE IN 2020

FIGURE 10 LARGE ENTERPRISES SEGMENT TO LEAD THE MARKET IN 2020

FIGURE 11 BUILDING AND HOME AUTOMATION SEGMENT TO LEAD THE MARKET IN 2020

FIGURE 12 IOT CLOUD PLATFORM MARKET: REGIONAL SNAPSHOT WITH KEY COUNTRIES

FIGURE 13 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 14 RISING DEMAND FOR IOT-ENABLED DIGITAL TRANSFORMATION OF BUSINESSES TO PROVIDE GROWTH OPPORTUNITIES FOR THE MARKET DURING THE FORECAST PERIOD

FIGURE 15 PLATFORM SEGMENT AND UNITED STATES TO LEAD THE NORTH AMERICA MARKET IN 2020

FIGURE 16 INDIA AND UAE TO GROW AT THE FASTEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 17 IOT CLOUD PLATFORM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 18 IOT CLOUD PLATFORM MARKET: VALUE CHAIN ANALYSIS

FIGURE 19 EFFECT OF COVID-19 ON COLOMBIA, PERU, AND CHILE

FIGURE 20 SERVICE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 21 APPLICATION ENABLEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 22 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 23 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 24 HYBRID SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 25 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 26 CONNECTED HEALTHCARE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 27 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 28 NORTH AMERICA: IOT CLOUD PLATFORM MARKET SNAPSHOT

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 30 IOT CLOUD PLATFORM MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN IOT CLOUD PLATFORM MARKET

FIGURE 32 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN IOT CLOUD PLATFORM MARKET

FIGURE 33 RANKING OF TOP MARKET PLAYERS, 2020

FIGURE 34 AWS: COMPANY SNAPSHOT

FIGURE 35 MICROSOFT: COMPANY SNAPSHOT

FIGURE 36 GOOGLE: COMPANY SNAPSHOT

FIGURE 37 CISCO SYSTEMS: COMPANY SNAPSHOT

FIGURE 38 IBM: COMPANY SNAPSHOT

FIGURE 39 ORACLE: COMPANY SNAPSHOT

FIGURE 40 SALESFORCE.COM: COMPANY SNAPSHOT

FIGURE 41 SAP: COMPANY SNAPSHOT

FIGURE 42 PTC: COMPANY SNAPSHOT

FIGURE 43 SAMSUNG: COMPANY SNAPSHOT

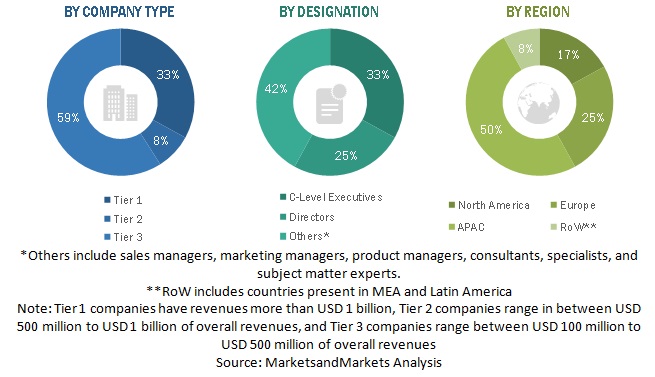

The study involved four major activities in estimating the current size of the Internet of Things (IoT) cloud platform market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the IoT cloud platform market.

Secondary Research

In the secondary research process, various secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; and regulatory bodies. The data was also collected from secondary sources, such as such as Internet of Things Consortium, and European Research Cluster on the Internet of Things, and IoT India Congress.

Primary Research

Various primary sources from both the supply and demand sides of the IoT cloud platform market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing IoT cloud platform in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make market estimations and forecast the IoT cloud platform market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the IoT cloud platform market by offering, deployment mode, organization size, application area, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyse their market rankings and core competencies

- To analyze competitive developments, such as acquisitions; new product launches and product enhancements; business expansions; agreements, collaborations, and partnerships; and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the Germany IoT cloud platform market, by offering

- Further breakup of the China market, by offering

- Further breakup of the India market, by offering

- Further breakup of the Brazil market, by offering

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in IoT Cloud Platform Market