Innovation Management Market Size, Share, Growth & Latest Trends

Innovation Management Market by Solutions (Idea Management, Portfolio & Project Management, Digital Twin & Simulation, Sustainability Management), Function (Product Innovation, Process Innovation, Business Model Innovation) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The innovation management market is projected to expand from USD 2.98 billion in 2025 to USD 5.38 billion by 2030, at a CAGR of 12.6% during the forecast period. Innovation management is vital for organizations to stay competitive in an era of rapid technological change and market disruption. Innovation management has become a board-level discipline across enterprises because it systematically converts ideas into outcomes—speeding time-to-value, de-risking bets, and scaling what works. Leaders anchor it in dedicated networks and platforms. For instance, Accenture runs connected innovation centers that span the full lifecycle from idea to industrialization, tying strategy, design, and tech execution together. Deloitte institutionalizes research-to-practice loops via the Deloitte AI Institute, publishing enterprise adoption findings that shape clients’ roadmaps.

KEY TAKEAWAYS

-

BY FUNCTIONThe functions in the innovation management market have been categorized into product innovation management, process innovation management, business model innovation management, and other functions (service innovation management, organizational innovation management). These functions offer insight into the various innovation management solutions and services used by enterprises worldwide to optimize their performance and growth.

-

BY VERTICALInnovation management for the BFSI companies serves as a boon as it enables the development of new products and processes, improves efficiency and profitability, and overcomes institutional obstacles.

-

BY REGIONAsia Pacific is expected to grow the fastest, at a CAGR of 16.3%, fueled by some of the world's fastest-growing economies, including China and India. These areas are known for their young, tech-savvy populations that are driving a demand for innovation.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships, collaborations, and investments. For instance, Deloitte India announced a strategic collaboration with HCLSoftware, the enterprise software division of HCLTech, to drive innovation and digital transformation for Global 2000 enterprises across key industries, including financial services, government and public sectors, consumer markets, and healthcare.

Content

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Innovation management can help businesses collect and analyze data and make better decisions about everything from product development to marketing campaigns. This can enable businesses to stay ahead of the competition. The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of innovation management solution providers, and target applications are the clients of innovation management solution providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of innovation management solution providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise of open innovation models

-

Focus on sustainability and ESG goals

Level

-

High implementation and maintenance costs

-

Inefficiency of enterprises to track reliable RoI

Level

-

Sustainability-driven product innovation

-

AI-driven predictive innovation

Level

-

Cross-functional coordination

-

Talent shortage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise of Open Innovation Models

The open innovation paradigm is gaining momentum as businesses increasingly realize that the best ideas and solutions may come from outside their own walls. By engaging external partners—such as startups, universities, suppliers, and even customers—companies can accelerate product development, tap into specialized expertise, and access new markets more quickly. Open innovation models also distribute risk by allowing shared investment in R&D efforts. Digital innovation platforms have become the backbone of these collaborations, offering secure environments for joint ideation, knowledge sharing, and project execution, while safeguarding intellectual property through permissions and access controls. This collaborative approach fosters diversity in thinking, enhances creativity, and enables organizations to rapidly test and scale innovations that meet emerging market needs.

Restraint: Inefficiency of enterprises to track reliable return on investment (RoI)

The implementation of innovation management solutions can greatly enhance business operations for enterprises. However, there is a lack of measurable metrics for evaluating the return on investment (RoI) resulting from the use of these solutions and services. This means that enterprises using innovation management solutions may struggle to generate reliable RoI data. To effectively track the level of stakeholder participation in innovative strategies, such as employees, customers, and partners, innovation management platforms should be integrated with the implemented strategies of various enterprises. This would allow for the identification of certain KPIs to track business value generated by innovations. Enterprises must consider the right KPIs in line with top-level management to accurately measure the success of innovation management solutions. They should also be aware of the value addition resulting from the implementation of selected ideas in their businesses. However, if decision-makers in enterprises cannot connect ideas to their business performance, then innovation management platforms will not add value to existing processes. The inability of enterprises to effectively track reliable RoI from innovation management solutions can act as a hindrance to the growth of the innovation management market.

Opportunity: Sustainability-driven product innovation

Sustainability-driven product innovation is becoming a powerful growth opportunity as environmental, social, and governance (ESG) priorities take center stage. Consumers and regulators are pressuring companies to design eco-friendly, resource-efficient, and ethically produced products. Innovation management platforms help organizations capture and evaluate sustainability-focused ideas, assess their feasibility, and track performance against ESG goals. This shift is also opening new markets for green products, enhancing brand loyalty, and creating long-term competitive differentiation for businesses that lead in sustainability innovation.

Challenge: Cross-functional coordination

Cross-functional coordination is a significant barrier to effective innovation. Successful innovation often requires input from diverse departments—R&D, marketing, operations, finance, and legal—but silos, competing priorities, and communication gaps can slow progress. In large organizations, global teams add another layer of complexity due to time zone differences and cultural variations. This misalignment can cause delays in decision-making, resource conflicts, and inconsistent execution. Digital collaboration tools and structured governance models can address some of these issues, but achieving seamless coordination requires strong leadership commitment and process discipline.

Innovation Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of a digital innovation hub for clients in transportation & logistics, enabling co-creation with startups and ecosystem partners | Faster prototyping cycles, improved collaboration across stakeholders, reduced time-to-market for new solutions |

|

Implementation of innovation management frameworks in retail organizations to identify, prioritize, and scale new customer experience initiatives | Improved customer engagement, streamlined innovation portfolio, measurable ROI from new retail solutions |

|

Integration of the SAP Innovation Management platform for aerospace & defense clients to manage R&D pipelines and track the idea-to-product lifecycle | Increased R&D efficiency, transparent idea evaluation, faster commercialization of aerospace technologies |

|

Establishment of corporate innovation accelerators for logistics clients, focusing on sustainability, automation, and digital supply chains | Enhanced supply chain resilience, reduced operational costs, improved sustainability outcomes |

|

Deployment of structured innovation programs for manufacturing & construction clients, focusing on digital twins, AI, and Industry 4.0 | Stronger competitive positioning, improved productivity, reduced operational risks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The innovation management market is highly competitive and comprises many vendors who offer solutions to a specific or niche market segment. Several changes have occurred in the market in recent years. The vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Innovation Management Market, By Offering

The solution segment is expected to account for the largest market size in 2024 among offerings. Idea management solutions account for a major share among solutions and are a critical pillar of innovation management, as they provide structured platforms for capturing, evaluating, and prioritizing ideas from employees, customers, and partners. These solutions enable enterprises to transform scattered creativity into actionable innovation, fostering a culture of collaboration and inclusivity. By digitizing the idea lifecycle—from submission and crowdsourcing to evaluation and implementation—they ensure transparency and faster decision-making. Organizations like Accenture and Deloitte integrate idea management platforms into their innovation hubs to accelerate problem-solving and co-creation with clients. Similarly, platforms such as Medallia Ideas and Miro help enterprises crowdsource insights, track idea progress, and link innovations to measurable business outcomes. Idea management solutions are particularly vital in industries such as BFSI, healthcare, and manufacturing, where continuous product and process improvement is essential. In North America and Europe, adoption is fueled by digital transformation initiatives, while Asia Pacific shows high growth due to expanding startup ecosystems and collaborative innovation models. These solutions also reduce the risk of missed opportunities by surfacing high-potential ideas that might otherwise be overlooked. Ultimately, idea management strengthens competitiveness, accelerates time-to-market, and ensures that innovation is systematic, scalable, and aligned with strategic goals, turning creativity into tangible business value.

REGION

North America is estimated to account for the largest market share during the forecast period

Innovation management in North America holds a leading position globally, driven by advanced digital ecosystems, strong R&D investments, and the presence of major technology and consulting firms. The US dominates with its thriving startup ecosystem, government support for R&D, and industry collaborations that foster the rapid commercialization of ideas. Canada, meanwhile, is increasingly investing in innovation hubs and incubators, especially in AI, clean energy, and healthcare innovation. North American enterprises are focusing on structured idea management, business model innovation, and sustainability-driven innovation to stay ahead in competitive markets. Developments such as Accenture’s innovation hubs, Medallia’s AI-driven experience solutions, and GE’s open innovation initiatives highlight the region’s commitment to systematic innovation. The growing adoption of cloud-based platforms, AI, and data analytics further accelerates the region’s innovation capabilities. Additionally, industries like BFSI, healthcare, and manufacturing are leveraging innovation management to improve customer experience, efficiency, and resilience. With a strong emphasis on sustainability, digital transformation, and cross-industry collaboration, North America continues to set benchmarks for global innovation management practices.

Innovation Management Market: COMPANY EVALUATION MATRIX

In the innovation management market matrix, Accenture (Star) leads with a strong market presence and a wide product portfolio. It helps organizations identify growth opportunities, build innovation roadmaps, and scale new business models. Questel (Pervasive player) is gaining traction as it streamlines idea capture, evaluation, and execution, enabling organizations to accelerate innovation, reduce risks, and maximize ROI.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.64 Billion |

| Market Forecast in 2030 (value) | USD 5.38 Billion |

| Growth Rate | 12.60% |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By offering, function, vertical, and region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Innovation Management Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- July 2025 : Planview announced a strategic partnership with Mindsprint to transform digital value chains with integrated project and portfolio management.

- June 2025 : Deloitte India announced a strategic collaboration with HCLSoftware, the enterprise software division of HCLTech, to drive innovation and digital transformation for Global 2000 enterprises across key industries, including financial services, government and public sectors, consumer markets, and healthcare.

- June 2025 : EY announced the launch of risk management solutions on the EY.ai Agentic platform integrated with NVIDIA AI technology.

- June 2025 : KPMG launched KPMG Workbench, a multi-agent AI platform, transforming client delivery and ways of working across the global organization.

- January 2025 : Siemens launched a startup program to empower startups with cutting-edge technology and collaborated with Amazon Web Services (AWS) to deliver access to the Siemens Xcelerator ecosystem and accelerate innovation at startups.

Table of Contents

Methodology

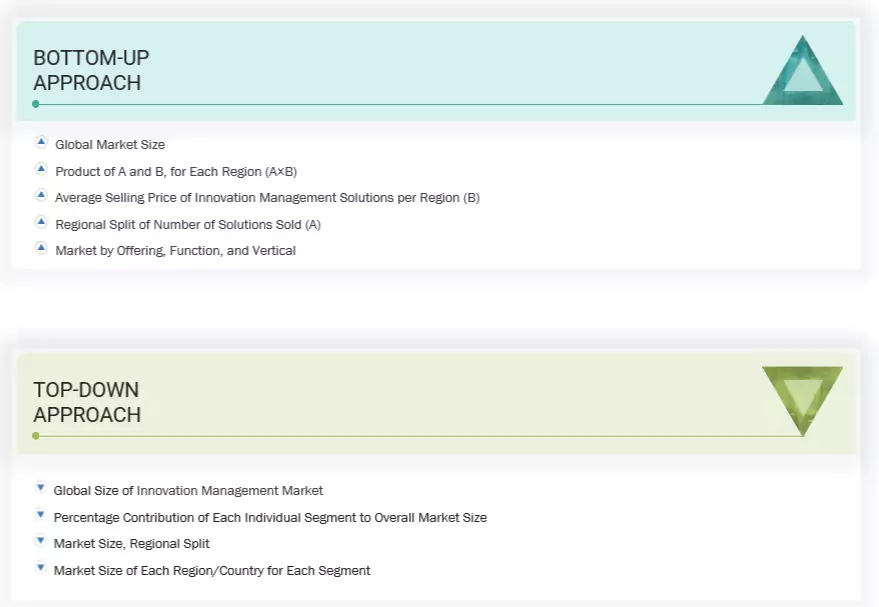

This research study involved four major activities in estimating the innovation management market size. Exhaustive secondary research was carried out to collect important information about the market and peer markets. The next step involved validating these findings and assumptions and sizing them with the help of primary research and industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. After the market breakdown, data triangulation was utilized to estimate the sizes of segments and sub-segments.

Secondary Research

The revenue generated by the companies offering innovation management solutions to various end users was determined based on secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to to identify and collect information for the study. These include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from innovation management solution vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use innovation management solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their use of innovation management solutions which is expected to affect the overall innovation management market growth.

Note: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies have revenues between USD 500

million and 1 billion, and Tier 3 companies have revenues less than USD 500 million. Other designations

include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the innovation management market. These methods were also used extensively to estimate the size of various subsegments in the market.

Innovation Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the above estimation process, the innovation management market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The innovation management market size was validated using top-down and bottom-up approaches.

Market Definition

Innovation management is the systematic promotion of innovation in organizations and includes planning, organizing, managing, prioritizing, and controlling the innovation process of enterprises. It helps shape organizations' structure and business processes by successfully implementing new ideas from internal or external stakeholders. Innovation management solutions focus on adding value to customers, employees, citizens, students, and faculty. Innovative ideas, experience, and knowledge sharing add value to organizations and bring a sense of engagement among employees and customers, thereby promoting efficiency, workplace innovation, and continuous improvement. Enterprises make use of crowdsourcing techniques to share, collaborate, evaluate, prioritize, find, and carry out advancements in innovation management solutions.

Stakeholders

- Innovation Management Solution and Service Providers

- Government Organizations, Forums, Alliances, and Associations

- Consulting Service Providers

- Value-added Resellers (VARs)

- End Users

- System Integrators

- Research Organizations

- Consulting Companies

- Software Vendors

Report Objectives

- To determine, segment, and forecast the innovation management market by offering, function, vertical, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments, and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, product launches and developments, partnerships, agreements, collaborations, business expansions, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the definition of innovation management?

Innovation management is the systematic promotion of innovation in organizations and includes planning, organizing, managing, prioritizing, and controlling the innovation process of enterprises. It helps shape organizations' structure and business processes by successfully implementing new ideas from internal or external stakeholders. Innovation management solutions focus on adding value to customers, employees, citizens, students, and faculty. Innovative ideas, experience, and knowledge sharing add value to organizations and bring a sense of engagement among employees and customers, thereby promoting efficiency, workplace innovation, and continuous improvement. Enterprises make use of crowdsourcing techniques to share, collaborate, evaluate, prioritize, find, and carry out advancements in innovation management solutions.

What is the size of the innovation management market?

The innovation management market is projected to grow from USD 2.98 billion in 2025 to USD 5.38 billion by 2030, at a CAGR of 12.6% during the forecast period.

What are the major drivers of the innovation management market?

Major drivers of the innovation management market include the adoption of digital innovation platforms, increasing need for continuous business transformation, rise of open innovation models, focus on sustainability and ESG goals, digital transformation & emerging technologies, sustainability & regulatory compliance, and government support & R&D investments.

Which are the key players operating in the innovation management market?

The major players in the innovation management market include Accenture (Ireland), Deloitte (UK), SAP (Germany), PwC (UK), EY (UK), Boston Consulting Group (US), KPMG (Netherlands), Siemens (Germany), Planview (US), Questel (France), Medallia (US), insightsoftware (US), GE Vernova (US), Miro (US), Wellspring (US), Qmarkets (Israel), Brightidea (US), HYPE Innovation (Germany), Plus Innovations (India), IdeaScale (US), InnovationCast (Portugal), Bloomflow (France), Wazoku (UK), ITONICS (Germany), Induct (Norway), Interact Software (US), Yambla (US), IdeaWake (US), LoopedIn (UK), and Ideanote (Denmark). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches/enhancements, and acquisitions, to expand their footprint in the innovation management market.

What are the opportunities for new entrants in the innovation management market?

Opportunities in the innovation management market include SME-focused innovation platforms, AI-powered idea management, sustainability-focused innovation, integration with collaboration tools, crowdsourced innovation & open innovation networks, and cloud-native & mobile-first solutions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Innovation Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Innovation Management Market