High Performance Data Analytics (HPDA) Market by Component (Hardware, Software, and Services), Data Type (Unstructured, Semi-Structured and Structured), Deployment Model (On-Premises and On-Demand), Vertical, and Region - Global forecast to 2021

[152 Pages Report] The High Performance Data Analytics Market expected to grow from USD 25.71 billion in 2016 to USD 78.26 billion by 2021, at a CAGR of 24.9 % from 2016 to 2021. HPDA refers to big data analytics being carried out on High-Performance Computing (HPC) methods. This technology has the ability to get data at high rates and then involving advanced analytical software to extract actionable insights. The supercomputers deploying HPC with advanced analytics are robust and dynamic systems that are made to handle complex queries, multiple variables, and quick turnaround requirements. Enterprises are keen on adopting this technology as it helps them with advanced analytical modelling techniques like stochastic modeling in the financial services or parametric modeling in the manufacturing sector to bring about transformational meaning to the data. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Proliferation of open source frameworks (Hadoop) for big data analytics

- Ability of powerful HPC systems to process data at higher resolutions

Restraints

- High investment cost involved in the deployment of HPC systems

- Government rules and regulations

Opportunities

- Incapability of traditional BI and analytical approaches to provide HPDA solutions

- Unmanageable amount of data volume across various industries

Challenges

- Complexity in programming due to massive parallelization

- Difficulty in getting sponsorship for R&D for innovation in scientific and engineering computational tools

Proliferation of open source frameworks (Hadoop) for big data analytics

Hadoop is the current choice for software vendors because of its innate quality of handling large voluminous unstructured amount of data with ease. The software leverages on its deployment vis-ΰ-vis the traditional database software as it offers scalability. Scalability allows more servers to be accommodated in the near future, if the need arises. Moreover, Hadoop is resilient to failure as it ensures the replication of data to other nodes in clusters. Thus, in the case of manmade or natural calamities, the data backup ensures operational continuity. The HPDA market, which is governed by advanced analytics on high-performance computers deploys Hadoop as its first choice as it helps data scientists to handle voluminous data in real time, thereby improving performance in the storage hierarchy.

The following are the major objectives of the study.

- To describe and forecast the High Performance Data Analytics (HPDA) market, in terms of components, data types, deployment models, and verticals

- To describe and forecast the High Performance Data Analytics (HPDA) market by region North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of High Performance Data Analytics (HPDA) market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the High Performance Data Analytics (HPDA) ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the High Performance Data Analytics (HPDA) market

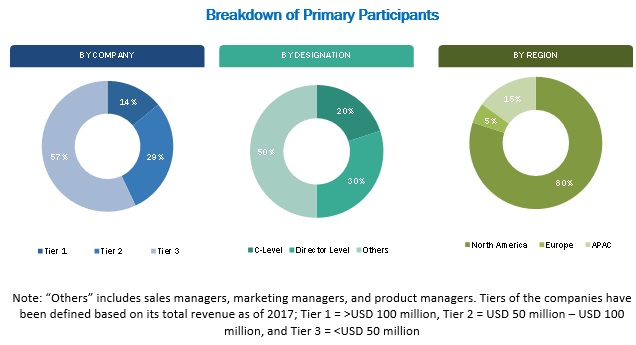

During this research study, major players operating in the High Performance Data Analytics (HPDA) market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The High Performance Data Analytics (HPDA) market comprises a network of players involved in the research and product development; system integrator; software and service provider; distribution and sale; and post-sales services. Key players considered in the analysis of the High Performance Data Analytics (HPDA) market are Cisco systems (US), SAP SE (Germany), Red Hat Inc. (US), Dell Inc. (US), Teradata Corporation (US), SAS Institute (US), IBM Corporation (US), Hewlett Packard Enterprises (US), Oracle Corporation (US), Microsoft Corporation (US), Intel Corporation (US), Cray Inc. (US), Juniper Networks (US), and ATOS SE (France).

Major Market Developments

- In August 2016, HPE signed a definitive agreement to acquire SGI, a global leader in high-performance solutions for compute, data analytics, and data management. The acquisition would help HPE to further enhance its product portfolio related to high-growth big data analytics and HPC

- In April 2016, Dell launched new HPC system that simplifies configuration and speeds up deployment and time to results. The new system includes the latest Intel Xeon processor families that supports Intel Omni-path Architecture fabric and software in Dell HPC Lustre Storage and Dell HPC NFS Storage solutions

- In July 2015, IBM, along with NVDIA and Mellanox, unveiled a new design center in France. This design center would provide its end users an entire eco-system of HPC, data analytics, enterprise computing software, and many more on POWER platform. This move would further strengthen the hold of all three companies on the French and European market

Target Audience:

- High Performance Data Analytics (HPDA) software vendors

- Cloud Service Providers (CSPs)

- Managed Service Providers (MSPs)

- System integrators

- Networking companies

- Third-party providers

- Value-Added Resellers (VARs)

- Government agencies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Technology providers

Report Scope:

By Component

- Hardware

- Server

- Storage

- Software

- Services

- Managed services

- Professional services

- Consulting Services

- Education and training

- Support and maintenance

By High Performance Data Analytics (HPDA) data type

- Unstructured

- Semi-structured

- Structured

By Deployment Model

- On-premises

- On-demand/On-cloud

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Manufacturing

- Academia and Research

- Healthcare and life sciences

- Media and Entertainment

- Energy and Utilities

- Retail and Consumer Goods

- Transportation and Logistics

- IT and Telecommunications

- Others

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia Pacific (APAC)

- Latin America

Critical questions which the report answers

- What are new application areas which the High Performance Data Analytics (HPDA) companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American High Performance Data Analytics (HPDA) market

- Further breakdown of the European High Performance Data Analytics (HPDA) market

- Further breakdown of the APAC High Performance Data Analytics (HPDA) market

- Further breakdown of the MEA High Performance Data Analytics (HPDA) market

- Further breakdown of the Latin American High Performance Data Analytics (HPDA) market

Company Information

- Detailed analysis and profiling of additional market players

The overall High Performance Data Analytics (HPDA) market is expected to grow from USD 25.71 billion in 2016 to USD 78.26 billion by 2021 at a CAGR of 24.9% during the forecast period. Proliferation of open source frameworks (Hadoop) for big data analytics and ability of powerful HPC systems to process data at higher resolutions are the key factors driving the growth of this market.

HPDA refers to big data analytics being carried out on High-Performance Computing (HPC) methods. This technology has the ability to get data at high rates and then involving advanced analytical software to extract actionable insights. The supercomputers deploying HPC with advanced analytics are robust and dynamic systems that are made to handle complex queries, multiple variables, and quick turnaround requirements. Enterprises are keen on adopting this technology as it helps them with advanced analytical modelling techniques like stochastic modeling in the financial services or parametric modeling in the manufacturing sector to bring about transformational meaning to the data.

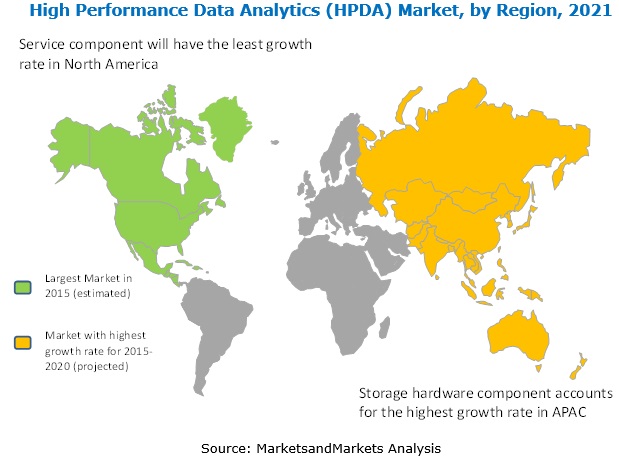

The High Performance Data Analytics (HPDA) market has been segmented, on the basis of component, data types, deployment model, and industry verticals. APAC is expected to grow at the highest CAGR during the forecast period. With new growth opportunities and initiatives taken by highly contributing countries like India, China, and others to promote the emerging technologies like IoT have provided tremendous opportunities to HPDA solution vendors in this region.

The other countries of APAC include Singapore, Korea, Hong Kong, Indonesia, and Malaysia. The countries are looking forward to embracing the new technologies and adopting HPDA in their mainframe IT infrastructure. For example, supercomputers are aggressively deployed by local community in Singapore with several universities like Institute of HPC, A*Star Computational Resource Centre, and others. Therefore, the deployment of HPDA technology looks very bright in the region.

Unstructured, semi-structured, and structured are the major data types, which are driving the growth of High Performance Data Analytics (HPDA) market

Unstructured

Unstructured data refers to information which does not have a predefined data model or is organized in a proper manner. This data type usually does not reside in the traditional row column database of an enterprise. According to a study, around 2.7 quintillion bytes of data is generated per day in the world. The different sources of unstructured data are social media posts, sensors, digital photos, and other medium. Around 95 % of the digital data is present in the unstructured form. The metadata associated with the unstructured data helps in data handling and file processing.

Semi-structured

Semi-structured data is a cross between the structured and unstructured data. On one hand, the data lacks the strict data model structure; on the other hand, it is characterized by tags and other markers to differentiate the semantic elements within the data. Semi-structured data does not have the rigid structure of a relational database but does have some organizational properties that allows it to be analyzed easily. Semi-structured data can be found in documents, e-mails, tweets, and other social media, and is of profound relevance to the enterprises. Most of the data in the internet era is semi-structured and needs to be tailored as per organizational requirements.

Structured

Structured data is the organized form of data, usually text files, which is self-explanatory and does not require additional processing. The data is displayed in titled columns and rows, which can be easily ordered and processed by data mining tools. Analytical tools like predictive and prescriptive analytics can be easily applied on such data with high accuracy. The data is easily searchable by simple search engine algorithms and thereby it is to derive meaning from this data.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications of the High Performance Data Analytics (HPDA) market?

The high investment cost involved in the deployment of HPC systems and government rules and regulations are the major factors restraining the growth of the High Performance Data Analytics (HPDA) market. The major limitation of High Performance Data Analytics (HPDA) is Complexity in programming due to massive parallelization and Difficulty in getting sponsorship for R&D for innovation in scientific and engineering computational tools. This may limit the companies to invest in High Performance Data Analytics (HPDA). High Performance Data Analytics (HPDA) is yet to be embraced by many large enterprises and most of the Small and Medium-Sized Enterprises (SMEs), to leverage its potential for transforming business processes.

Key players in the market include Cisco systems (US), SAP SE (Germany), Red Hat Inc. (US), Dell Inc. (US), Teradata Corporation (US), SAS Institute (US), IBM Corporation (US), Hewlett Packard Enterprises (US), Oracle Corporation (US), Microsoft Corporation (US), Intel Corporation (US), Cray Inc. (US), Juniper Networks (US), and ATOS SE (France). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Vendor Dive Matrix Methodology

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the High Performance Data Analytics Market

4.2 Market Share of Components and Top Three Regions

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

4.5 Market Top Three Verticals

5 High Performance Data Analytics Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Data Type

5.2.3 By Deployment Model

5.2.4 By Vertical

5.2.5 By Region

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Proliferation of Open Source Frameworks (Hadoop) for Big Data Analytics

5.4.1.2 Ability of Powerful Hpc Systems to Process Data at Higher Resolutions

5.4.2 Restraints

5.4.2.1 High Investment Costs

5.4.2.2 Government Rules and Regulations

5.4.3 Opportunities

5.4.3.1 Incapability of Traditional Bi and Analytical Approaches to Provide high performance data analytics Solutions

5.4.3.2 Unmanageable Amount of Data Volume Across Various Industries

5.4.4 Challenges

5.4.4.1 Complexity in Programming Due to Massive Parallelization

5.4.4.2 Difficulty in Getting Sponsorship for R&D for Innovation in Scientific and Engineering Computational Tools

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 High-Performance Data Analytics Standards

6.3.1 European Technology Platform for High-Performance Computing (Etp4hpc)

6.3.2 The High-Performance Computing Act of 1991

6.4 Strategic Benchmarking

7 High Performance Data Analytics Market Analysis, By Component (Page No. - 45)

7.1 Introduction

7.2 Hardware

7.2.1 Server

7.2.2 Storage

7.3 Software

7.4 Services

7.4.1 Professional Services

7.4.1.1 System Integration and Deployment

7.4.1.2 Training, Support, and Maintenance Services

7.4.1.3 Consulting Services

7.4.2 Managed Services

8 High Performance Data Analytics Market Analysis, By Data Type (Page No. - 53)

8.1 Introduction

8.2 Unstructured

8.3 Semi-Structured

8.4 Structured

9 High Performance Data Analytics Market Analysis, By Deployment Model (Page No. - 57)

9.1 Introduction

9.2 On-Premises

9.3 On-Demand

10 High Performance Data Analytics Market Analysis, By Vertical (Page No. - 61)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Government and Defense

10.4 Manufacturing

10.5 Academia and Research

10.6 Healthcare and Life Sciences

10.7 Media and Entertainment

10.8 Energy and Utility

10.9 Retail and Consumer Goods

10.10 Transportation and Logistics

10.11 IT and Telecommunication

10.12 Others

11 Geographic Analysis (Page No. - 77)

11.1 Introduction

11.2 North America

11.2.1 United States (U.S.)

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Rest of Asia-Pacific

11.5 Middle East and Africa

11.5.1 Middle East

11.5.2 Africa

11.6 Latin America

11.6.1 Mexico

11.6.2 Brazil

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 High-Performance Data Analytics: Vendor Comparison

12.2.1 Introduction

12.2.2 High-Performance Data Analytics: Product Portfolio Comparison

12.3 Competitive Situations and Trends

12.3.1 Partnerships, Agreements, and Collaborations

12.3.2 New Product Launches

12.3.3 Expansion

12.3.4 Mergers and Acquisitions

13 Company Profiles (Page No. - 105)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 Introduction

13.2 Cisco Systems and SAP SE (Collaborative Products)

13.3 Red Hat, Inc. and Dell, Inc. (Collaborative Products)

13.4 Teradata and SAS Institute (Collaborative Products)

13.5 IBM Corporation

13.6 Hewlett-Packard Enterprise

13.7 Oracle Corporation

13.8 Microsoft Corporation

13.9 Intel Corporation

13.10 Cray, Inc.

13.11 Juniper Networks

13.12 ATOS SE

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 141)

14.1 Key Insights

14.2 Recent Developments

14.3 Discussion Guide

14.4 Knowledge Store: Marketsandmarkets Subscription Portal

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (69 Tables)

Table 1 High Performance Data Analytics Market Size and Growth Rate, 20142021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Component, 20142021 (USD Billion)

Table 3 Market Size, By Service, 20142021 (USD Billion)

Table 4 Server: Market Size, By Region, 20142021 (USD Billion)

Table 5 Storage: Market Size, By Region, 20142021 (USD Billion)

Table 6 Software: Market Size, By Region, 20142021 (USD Billion)

Table 7 Services: Market Size, By Region, 20142021 (USD Billion)

Table 8 Professional Services: Market Size, By Region, 20142021 (USD Billion)

Table 9 Managed Services: Market Size, By Region, 20142021 (USD Billion)

Table 10 High Performance Data Analytics Market Size, By Data Type, 20142021 (USD Billion)

Table 11 Unstructured Data Type: Market Size, By Region, 20142021 (USD Billion)

Table 12 Semi-Structured Data Type: Market Size, By Region, 20142021 (USD Billion)

Table 13 Structured Data Type: Market Size, By Region, 20142021 (USD Billion)

Table 14 Market Size, By Deployment Model, 20142021 (USD Billion)

Table 15 On-Premises: Market Size, By Region, 20142021 (USD Billion)

Table 16 On-Demand: Market Size, By Region, 20142021 (USD Billion)

Table 17 High Performance Data Analytics Market Size, By Vertical, 20142021 (USD Billion)

Table 18 Banking, Financial Services, and Insurance: Market Size, By Region, 20142021 (USD Billion)

Table 19 Banking, Financial Services, and Insurance: Market Size, By Deployment Model 20142021 (USD Billion)

Table 20 Government and Defense: Market Size, By Region, 20142021 (USD Billion)

Table 21 Government and Defense: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 22 Manufacturing: Market Size, By Region, 20142021 (USD Billion)

Table 23 Manufacturing: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 24 Academia and Research: Market Size, By Region, 20142021 (USD Billion)

Table 25 Academia and Research: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 26 Healthcare and Life Sciences: Market Size, By Region, 20142021 (USD Billion)

Table 27 Healthcare and Life Sciences: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 28 Media and Entertainment: Market Size, By Region, 20142021 (USD Billion)

Table 29 Media and Entertainment : Market Size, By Deployment Model 20142021 (USD Billion)

Table 30 Energy and Utility: High Performance Data Analytics Market Size, By Region, 20142021 (USD Billion)

Table 31 Energy and Utility: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 32 Retail and Consumer Goods: Market Size, By Region, 20142021 (USD Billion)

Table 33 Retail and Consumer Goods: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 34 Transportation and Logistics: Market Size, By Region, 20142021 (USD Billion)

Table 35 Transportation and Logistics: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 36 IT and Telecommunication: Market Size, By Region, 20142021 (USD Billion)

Table 37 IT and Telecommunication: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 38 Others: high performance data analytics Market Size, By Region, 20142021 (USD Billion)

Table 39 Others: Market Size, By Deployment Model. 20142021 (USD Billion)

Table 40 High Performance Data Analytics Market Size, By Region, 20142021 (USD Billion)

Table 41 North America: Market Size, By Country, 20142021 (USD Billion)

Table 42 North America: Market Size, By Vertical, 20142021 (USD Billion)

Table 43 North America: Market Size, By Component, 20142021 (USD Billion)

Table 44 North America: Market Size, By Data Type, 20142021 (USD Billion)

Table 45 North America: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 46 Europe: High Performance Data Analytics Market Size, By Country, 20142021 (USD Billion)

Table 47 Europe: Market Size, By Vertical, 20142021 (USD Billion)

Table 48 Europe: Market Size, By Component 20142021 (USD Billion)

Table 49 Europe: Market Size, By Data Type, 20142021 (USD Billion)

Table 50 Europe: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 51 Asia-Pacific: Market Size, By Country, 20142021 (USD Billion)

Table 52 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Billion)

Table 53 Asia-Pacific: Market Size, By Component, 20142021 (USD Billion)

Table 54 Asia-Pacific: Market Size, By Data Type, 20142021 (USD Billion)

Table 55 Asia-Pacific: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 56 Middle East and Africa: Market Size, By Sub-Region , 20142021 (USD Billion)

Table 57 Middle East and Africa: Market Size, By Vertical, 20142021 (USD Billion)

Table 58 Middle East and Africa: Market Size, By Component, 20142021 (USD Billion)

Table 59 Middle East and Africa: Market Size, By Data Type, 20142021 (USD Billion)

Table 60 Middle East and Africa: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 61 Latin America: Market Size, By Country, 20142021 (USD Billion)

Table 62 Latin America: Market Size, By Vertical, 20142021 (USD Billion)

Table 63 Latin America: Market Size, By Component, 20142021 (USD Billion)

Table 64 Latin America: Market Size, By Data Type, 20142021 (USD Billion)

Table 65 Latin America: Market Size, By Deployment Model, 20142021 (USD Billion)

Table 66 Partnerships, Agreements, and Collaborations, 20152016

Table 67 New Product Launches, 2016

Table 68 Expansion, 2015

Table 69 Mergers and Acquisitions, 2016

List of Figures (55 Figures)

Figure 1 High Performance Data Analytics Market: Market Segmentation

Figure 2 High Performance Data Analytics Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 High Performance Data Analytics Market: Assumptions

Figure 8 Top Three Largest Revenue Segments of the Market, 20162021

Figure 9 North America is Expected to Hold the Largest Market Share in the Market

Figure 10 Growth Trends in the High-Performance Data Analytics Market

Figure 11 Asia-Pacific is Expected to Have the Highest Growth Opportunity in the Market During the Forecast Period

Figure 12 Market Investment Scenario: Asia-Pacific is the Best Market to Invest in During the Forecast Period

Figure 13 Banking, Financial Services, and Insurance is Estimated to Have the Largest Market Size During the Forecast Period

Figure 14 Market Segmentation: By Component

Figure 15 Market Segmentation: By Data Type

Figure 16 Market Segmentation: By Deployment Model

Figure 17 Market Segmentation: By Vertical

Figure 18 Market Segmentation: By Region

Figure 19 Market Evolution

Figure 20 Market Drivers, Restraints, Opportunities, and Challenges

Figure 21 Market Value Chain Analysis

Figure 22 Market Strategic Benchmarking

Figure 23 Software Component is Expected to Have the Largest Market Size

Figure 24 Unstructured Data Type is Estimated to Have the Largest Market Size During Forecast Period

Figure 25 On-Premises Deployment Model is Estimated to Have the Largest Market Size During Forecast Period

Figure 26 Banking, Financial Services, and Insurance Vertical is Estimated to Have the Largest Market Size During the Forecast Period

Figure 27 North America is Expected to Have the Largest Market Size in the High-Performance Data Analytics Market During the Forecast Period

Figure 28 North America Market Snapshot

Figure 29 Asia-Pacific Market Snapshot

Figure 30 Companies Adopted Partnership, Agreement & Collaboration and New Product Launch as the Key Growth Strategies From 2012 to 2016

Figure 31 Evaluation Overview Table: Product Offering

Figure 32 Market Evaluation Framework

Figure 33 Battle for Market Share: Partnership, Collaboration & Agreement and New Product Launch are the Key Strategies

Figure 34 Cisco Systems, Inc.: Company Snapshot

Figure 35 SAP SE: Company Snapshot

Figure 36 Cisco Systems and SAP SE: SWOT Analysis

Figure 37 Red Hat, Inc.: Company Snapshot

Figure 38 Red Hat, Inc. and Dell, Inc.: SWOT Analysis

Figure 39 Teradata Corporation:Company Snapshot

Figure 40 SAS Institute:Company Snapshot

Figure 41 Teradata Corporation and SAS Institute: SWOT Analysis

Figure 42 IBM Corporation: Company Snapshot

Figure 43 IBM Corporation: SWOT Analysis

Figure 44 Hewlett-Packard Enterprise: Company Snapshot

Figure 45 Hewlett-Packard Enterprise: SWOT Analysis

Figure 46 Oracle Corporation: Company Snapshot

Figure 47 Oracle Corporation: SWOT Analysis

Figure 48 Microsoft Corporation: Company Snapshot

Figure 49 Microsoft Corporation: SWOT Analysis

Figure 50 Intel Corporation: Company Snapshot

Figure 51 Cray, Inc.: Company Snapshot

Figure 52 Juniper Networks: Company Snapshot

Figure 53 ATOS SE: Company Snapshot

Figure 54 Partnerships, Collaborations, and Agreements , 20122014

Figure 55 New Product Launches, 20122015

Growth opportunities and latent adjacency in High Performance Data Analytics (HPDA) Market