Heat Resistant Polymers Market by Type (Fluoropolymers, Polyimides, Polyphenylene Sulfide, PBI, Peek), End-Use Industry (Transportation, Electronics & Electrical), and Region - Global Forecast to 2021

[144 Pages Report] The Heat Resistant Polymers Market is projected to grow from USD 12.03 Billion in 2016 to USD 16.67 Billion by 2021, at a CAGR of 6.7% from 2016 to 2021.

The objectives of this study are:

- To define, describe, and forecast the heat resistant polymers market based on type, end-use industry, and region

- To estimate and forecast the heat resistant polymers market size, in terms of value and volume

- To estimate and forecast the heat resistant polymers market based on type and end-use industry in key regions, namely, North America, Europe, Asia-Pacific, Middle East & Africa, and South America

- To identify and analyze the key drivers, restraints, and opportunities influencing the heat resistant polymers market

- To analyze region-specific trends in North America, Europe, Asia-Pacific, Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To strategically identify and profile key market players and analyze their core competencies

- To track and analyze recent developments in the heat resistant polymers market, such as partnerships, agreements, collaborations, mergers & acquisitions, new product developments, and expansions

The years considered for the study are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

For company profiles in the report, 2016 has been considered as the base year. In certain cases, wherein information is unavailable for the base year, the years prior to it have been considered.

Research Methodology

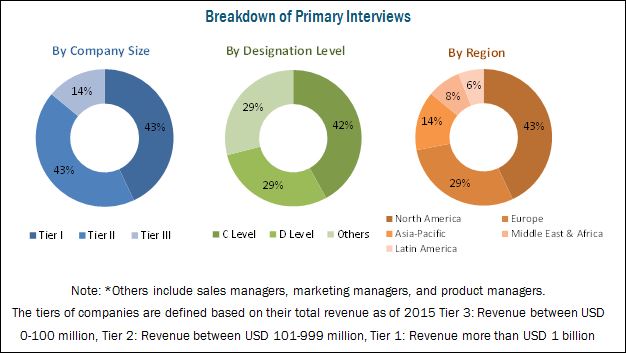

This study aims to estimate the heat resistant polymers market size for 2016 and projects its demand till 2021. It also provides a detailed qualitative and quantitative analysis of the heat resistant polymers market. Various secondary sources that include directories, industry journals, various associations, and databases, such as SPI: The Plastics Industry Trade Association, Manufacturers Association for Plastics Processors, Plastics Europe, have been used to identify and collect information useful for this extensive, commercial study of the heat resistant polymers market. Primary sources, such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the heat resistant polymers market. Breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Companies operating in the global heat resistant polymers market include Arkema SA (France), E. I. du Pont de Nemours And Company (U.S.), Dongyue Group Ltd. (China), DIC Corporation (Japan), Honeywell International Inc. (U.S.), Parkway Products Inc. (U.S.), Schulman AG (U.S.), Caledonian Ferguson Timpson Ltd (Scotland), Panjin Zhongrun High Performance Polymers Co. Ltd (China), Quadrant EPP Surlon India Ltd (India), Tri-Mack Plastics Manufacturing Corp. (U.S.), Huntsman Corporation (U.S.), PolyOne Corporation (U.S.), BASF SE (Germany), Evonik Industries AG (Germany), Celanese Corporation (U.S.), Solvay S.A. (Belgium), Victrex PLC (U.K.), Saudi Arabia Basic Industries Corporation (SABIC) (Saudi Arabia), Covestro (Germany), The Dow Chemical Company (U.S.), Daikin Industries, Ltd. (Japan), Kuraray Co., Ltd. (Japan), RTP Company, Inc. (U.S.), and Ensinger GmbH (U.K.).

Key Target Audience

- Manufacturers of Heat Resistant Polymers

- Traders, Distributors, and Suppliers of Heat Resistant Polymers

- End-Use Industries Operating in Heat Resistant Polymers Supply Chain

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- Environment Support Agencies

- National & Local Government Organizations/Agencies

- R&D Institutions

- Investment Banks and Private Equity Firms

Scope of the report: This research report categorizes the global heat resistant polymers market based on grade, product form, end-use industry, and region, forecasting revenues as well as analyzing trends in each of the submarkets.

- By Type:

- Fluoropolymers

- Polyimides

- Polyphenylene Sulfide

- Polybenzimidazole (PBI)

- Polyether Ether Ketone (PEEK)

- Others

- By End-Use Industry:

- Electronics & Electrical

- Transportation

- Others

- By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Available Customizations

By End-Use Industry Application Analysis

- Further breakdown of the application segment into sub segments, wherein heat resistant polymers are used

Country Analysis

- Value analysis of heat resistant polymers consumption in terms of capacity and type

The heat resistant polymers market is estimated at USD 12.03 Billion in 2016, and is projected to reach USD 16.67 Billion by 2021, at a CAGR of 6.7% from 2016 to 2021. The market for heat resistant polymers is projected to grow with the increasing demand for lightweight and high temperature plastics in the global transportation industry.

The fluoropolymer grade segment is estimated to lead the heat resistant polymers market in 2016, in terms of value. The large share of this segment can be attributed to its versatile properties, such as high chemical resistance, including resistance for solvents, acids, and bases; high dimensional stability; and the most important being the non-stick or friction reducing property. This is expected to further boost the demand for these polymers in the automotive and aerospace industries in Asia-Pacific and North America regions.

The transportation segment is estimated to account for the largest share of the heat resistant polymers market in 2016. This large share can be attributed to the increasing applications of heat resistant polymers in vehicles to make vehicles more light, compact, and fuel efficient by replacing metallic parts with these plastics. The application of heat resistant polymers is aimed to improve the service life of under-the-hood components. Apart from this, heat resistant polymers are lightweight alternatives to metals that corrode when exposed to salts or automotive fluids. This is also expected to drive the growth of the heat resistant polymers in the transportation end-use industry. Fuel systems, electrical & electronics components, induction systems, coolant systems, engine components, powertrain, brake systems, sockets, and transmission components are some of the dominant automotive applications of heat resistant polymers.

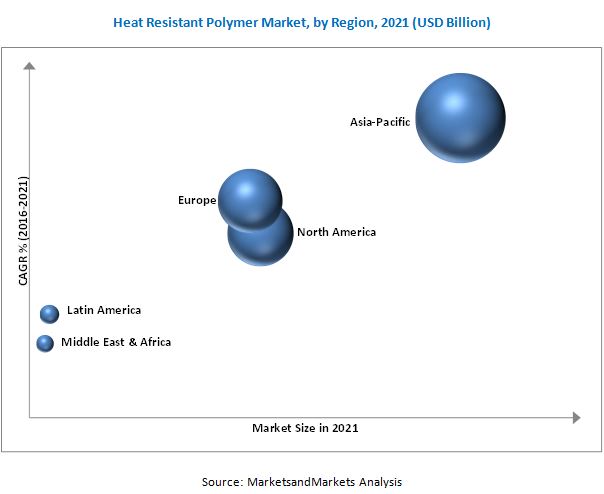

Asia-Pacific is estimated to account for the largest market share in 2016, owing to the rise in demand for heat resistant polymers in this region. The Asia-Pacific heat resistant polymers market is also projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing demand from the electronics & electrical and transportation end-use industries, which account for the majority share of the total market, and improving economic conditions leading to high demand for electronic goods in China and India.

The factor inhibiting the growth of the heat resistant polymers market is the high processing cost of heat resistant polymers as compared to ETP. Key players operating in the global heat resistant polymers market are Arkema SA (France), E. I. du Pont de Nemours And Company (U.S.), Dongyue Group Ltd. (China), DIC Corporation (Japan), Honeywell International Inc. (U.S.), Parkway Products Inc. (U.S.), Schulman AG (U.S.), Caledonian Ferguson Timpson Ltd (Scotland), Panjin Zhongrun High Performance Polymers Co. Ltd (China), Quadrant EPP Surlon India Ltd (India), Tri-Mack Plastics Manufacturing Corp. (U.S.), Huntsman Corporation (U.S.), PolyOne Corporation (U.S.), BASF SE (Germany), Evonik Industries AG (Germany), Celanese Corporation (U.S.), Solvay S.A. (Belgium), Victrex PLC (U.K.), Saudi Arabia Basic Industries Corporation (SABIC) (Saudi Arabia), Covestro (Germany), The Dow Chemical Company (U.S.), Daikin Industries, Ltd. (Japan), Kuraray Co., Ltd. (Japan), RTP Company, Inc. (U.S.), and Ensinger GmbH (U.K.). New product launches, expansions, acquisitions, agreements, and joint ventures are some of the key strategies adopted by market players to achieve growth in the global heat resistant polymer market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Limitations

1.5 Stakeholders

1.6 Currency

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Opportunities in the Heat Resistant Polymers Market

4.2 Heat Resistant Polymers Market, By Type

4.3 Heat Resistant Polymers Market, By Type and End-Use Industry

4.4 Heat Resistant Polymers Market Growth

4.5 Heat Resistant Polymers Market, By End-Use Industry

4.6 Heat Resistant Polymers Market: Developing and Developed Countries

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand in Automotive and Aerospace Industries

5.2.1.2 Replacement of Conventional Materials

5.2.2 Restraints

5.2.2.1 High Cost of Heat Resistant Polymers

5.2.3 Opportunities

5.2.3.1 Increasing Demand in Developing Nations

5.2.3.2 Special Attributes of Heat Resistant Polymers

5.2.4 Challenges

5.2.4.1 Difficulty in Processing Heat Resistant Polymers

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Revenue Pocket Matrix

6.3 Economic Indicators

6.3.1 Industry Outlook

6.3.1.1 Electronics & Electrical Industry

6.3.1.2 Automotive Industry

6.4 Porters Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Buyers

6.4.4 Bargaining Power of Suppliers

6.4.5 Intensity of Competitive Rivalry

7 Heat Resistant Polymers Market, By Type (Page No. - 44)

7.1 Introduction

7.2 Fluoropolymers

7.3 Polyimides

7.4 Polyphenylene Sulfide

7.5 Polybenzimidazole

7.6 Polyether Ether Ketone

7.7 Others

8 Heat Resistant Polymers Market, By End-Use Industry (Page No. - 53)

8.1 Introduction

8.2 Transportation

8.2.1 Fuel Systems

8.2.2 Induction Systems

8.2.3 Coolant Systems

8.3 Electronics & Electrical

8.3.1 Circuit Breaks

8.3.2 Connectors

8.3.3 Motor Brush Card

8.4 Other Industries

9 Heat Resistant Polymers Market, By Region (Page No. - 60)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 Thailand

9.2.5 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 U.K.

9.4.3 Italy

9.4.4 Spain

9.4.5 France

9.4.6 Switzerland

9.4.7 Russia

9.4.8 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 South Africa

9.5.3 Rest of Middle East & Africa

9.6 Latin America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 99)

10.1 Introduction

10.1.1 Dynamics

10.1.2 Innovators

10.1.3 Vanguards

10.1.4 Emerging

10.2 Competitive Benchmarking

10.2.1 Product Offerings

10.2.2 Business Strategy

11 Company Profiles (Page No. - 103)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 BASF SE

11.2 Arkema SA

11.3 Evonik Industries AG

11.4 Daikin Industries, Ltd.

11.5 Celanese Corporation

11.6 Solvay S.A.

11.7 Kuraray Co., Ltd.

11.8 E. I. Du Pont De Nemours and Company

11.9 Victrex PLC

11.10 Saudi Arabia Basic Industries Corporation (SABIC)

11.11 Other Major Companies

11.11.1 Dongyue Group Ltd.

11.11.2 DIC Corporation

11.11.3 Honeywell International Inc.

11.11.4 Covestro

11.11.5 Parkway Products Inc.

11.11.6 Schulman AG

11.11.7 Caledonian Ferguson Timpson Ltd

11.11.8 Panjin Zhongrun High Performance Polymers Co. Ltd

11.11.9 Quadrant EPP Surlon India Ltd

11.11.10 Tri-Mack Plastics Manufacturing Corp.

11.11.11 The DOW Chemical Company

11.11.12 Huntsman Corporation

11.11.13 Polyone Corporation

11.11.14 RT P Company, Inc.

11.11.15 Ensinger GmbH

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 137)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (102 Tables)

Table 1 Global Heat Resistant Polymers Market Snapshot

Table 2 Global Semiconductor Sales, By Region (USD Billion)

Table 3 Global Semiconductor Sales, By Product (USD Billion)

Table 4 Estimated International Car Sales Outlook, 2011-2016 (Million Units)

Table 5 Heat Resistant Polymers Market, By Type, 20142021 (Kilotons)

Table 6 Heat Resistant Polymers Market, By Type, 20142021 (USD Billion)

Table 7 Heat Resistant Fluoropolymers Market, By Region, 20142021 (Kilotons)

Table 8 Heat Resistant Fluoropolymers Market, By Region, 20142021 (USD Billion)

Table 9 Heat Resistant Polyimides Market, By Region, 20142021 (Kilotons)

Table 10 Heat Resistant Polyimides Market, By Region, 20142021 (USD Million)

Table 11 Heat Resistant Polyphenylene Sulfide Market, By Region, 20142021 (Kilotons)

Table 12 Heat Resistant Polyphenylene Sulfide Market, By Region, 20142021 (USD Million)

Table 13 Heat Resistant PBI Market, By Region, 20142021 (Kilotons)

Table 14 Heat Resistant PBI Market, By Region, 20142021 (USD Million)

Table 15 Heat Resistant Peek Market, By Region, 20142021 (Kilotons)

Table 16 Heat Resistant Peek Market, By Region, 20142021 (USD Million)

Table 17 Other Heat Resistant Polymers Market, By Region, 20142021 (Kilotons)

Table 18 Other Heat Resistant Polymers Market, By Region, 20142021 (USD Billion)

Table 19 Heat Resistant Polymers Market Size, By End-Use Industry, 20142021 (Kilotons)

Table 20 Heat Resistant Polymers Market Size, By End-Use Industry, 20142021 (USD Billion)

Table 21 Heat Resistant Polymers Market for Transportation End-Use Industry, By Region, 20142021 (Kilotons)

Table 22 Heat Resistant Polymers Market for Transportation End-Use Industry, By Region, 20142021 (USD Billion)

Table 23 Heat Resistant Polymers Market for Electronics & Electrical End-Use Industry, By Region, 20142021 (Kilotons)

Table 24 Heat Resistant Polymers Market for Electronics & Electrical End-Use Industry, By Region, 20142021 (USD Billion)

Table 25 Heat Resistant Polymers Market for Other End-Use Industries, By Region, 20142021 (Kilotons)

Table 26 Heat Resistant Polymers Market for Other End-Use Industries, By Region, 20142021 (USD Billion)

Table 27 Heat Resistant Polymers Market, By Region, 20142021 (Kilotons)

Table 28 Heat Resistant Polymers Market, By Region, 20142021 (USD Billion)

Table 29 Asia-Pacific Heat Resistant Polymers Market, By Country, 20142021 (Kilotons)

Table 30 Asia-Pacific Heat Resistant Polymers Market, By Country, 20142021 (USD Billion)

Table 31 Asia-Pacific Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 32 Asia-Pacific Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Billion)

Table 33 Asia-Pacific Heat Resistant Polymers Market, By Type, 20142021 (Kilotons)

Table 34 Asia-Pacific Heat Resistant Polymers Market, By Type, 20142021 (USD Billion)

Table 35 China: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 36 China: By Market, By End-Use Industry, 20142021 (USD Billion)

Table 37 Japan: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 38 Japan: By Market, By End-Use Industry, 20142021 (USD Million)

Table 39 India: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 40 India: By Market, By End-Use Industry, 20142021 (USD Million)

Table 41 Thailand: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 42 Thailand: By Market, By End-Use Industry, 20142021 (USD Million)

Table 43 Rest of Asia-Pacific: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 44 Rest of Asia-Pacific: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Million)

Table 45 North America By Market, By Country, 20142021 (Kilotons)

Table 46 North America By Market, By Country, 20142021 (USD Billion)

Table 47 North America By Market, By End-Use Industry, 20142021 (Kilotons)

Table 48 North America By Market, By End-Use Industry, 20142021 (USD Billion)

Table 49 North America By Market, By Type, 20142021 (Kilotons)

Table 50 North America By Market, By Type, 20142021 (USD Billion)

Table 51 U.S.: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 52 U.S.: By Market, By End-Use Industry, 20142021 (USD Million)

Table 53 Canada: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 54 Canada: By Market, By End-Use Industry, 20142021 (USD Million)

Table 55 Mexico: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 56 Mexico: By Market, By End-Use Industry, 20142021 (USD Million)

Table 57 Europe Heat Resistant Polymers Market, By Country, 20142021 (Kilotons)

Table 58 Europe By Market, By Country, 20142021 (USD Billion)

Table 59 Europe By Market, By End-Use Industry, 20142021 (Kilotons)

Table 60 Europe By Market, By End-Use Industry, 20142021 (USD Billion)

Table 61 Europe By Market, By Type, 20142021 (Kilotons)

Table 62 Europe By Market, By Type, 20142021 (USD Billion)

Table 63 Germany: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 64 Germany: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Million)

Table 65 U.K.: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 66 U.K.: By Market, By End-Use Industry, 20142021 (USD Million)

Table 67 Italy: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 68 Italy: By Market, By End-Use Industry, 20142021 (USD Million)

Table 69 Spain: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 70 Spain: By Market, By End-Use Industry, 20142021 (USD Million)

Table 71 France: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 72 France: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Million)

Table 73 Switzerland: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 74 Switzerland: By Market, By End-Use Industry, 20142021 (USD Million)

Table 75 Russia: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 76 Russia: By Market, By End-Use Industry, 20142021 (USD Million)

Table 77 Rest of Europe: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 78 Rest of Europe: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Million)

Table 79 Middle East & Africa By Market, By Country, 20142021 (Kilotons)

Table 80 Middle East & Africa By Market, By Country, 20142021 (USD Million)

Table 81 Middle East & Africa By Market, By End-Use Industry, 20142021 (Kilotons)

Table 82 Middle East & Africa By Market, By End-Use Industry, 20142021 (USD Million)

Table 83 Middle East & Africa By Market, By Type, 20142021 (Kilotons)

Table 84 Middle East & Africa By Market, By Type, 20142021 (USD Million)

Table 85 Saudi Arabia: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 86 Saudi Arabia: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Million)

Table 87 South Africa: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 88 South Africa: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Million)

Table 89 Rest of Middle East & Africa: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (Kilotons)

Table 90 Rest of Middle East & Africa: Heat Resistant Polymers Market, By End-Use Industry, 20142021 (USD Million)

Table 91 Latin America By Market, By Country, 20142021 (Kilotons)

Table 92 Latin America By Market, By Country, 20142021 (USD Million)

Table 93 Latin America By Market, By End-Use Industry, 20142021 (Kilotons)

Table 94 Latin America By Market, By End-Use Industry, 20142021 (USD Million)

Table 95 Latin America By Market, By Type, 20142021 (Kilotons)

Table 96 Latin America By Market, By Type, 20142021 (USD Billion)

Table 97 Brazil: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 98 Brazil: By Market, By End-Use Industry, 20142021 (USD Million)

Table 99 Argentina: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 100 Argentina: By Market, By End-Use Industry, 20142021 (USD Million)

Table 101 Rest of Latin America: By Market, By End-Use Industry, 20142021 (Kilotons)

Table 102 Rest of Latin America: By Market, By End-Use Industry, 20142021 (USD Million)

List of Figures (33 Figures)

Figure 1 Heat Resistant Polymers Market: Research Design

Figure 2 Market Size Estimation: Top-Down Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 The Transportation End-Use Industry Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 5 Fluoropolymers Was the Largest Heat Resistant Polymers Type in 2016

Figure 6 Heat Resistant Polymers Market in Asia-Pacific is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Emerging Economies to Drive the Growth of Heat Resistant Polymers Market During the Forecast Period

Figure 8 PBI Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Fluoropolymers Type & Transportation End-Use Industry Segment to Account for the Largest Share of the Heat Resistant Polymers Market in 2016

Figure 10 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 11 Transportation Industry is Estimated to Have the Largest Market Size During the Forecast Period

Figure 12 Heat Resistant Polymers Market in Developing Countries to Grow at A Higher Rate During the Forecast Period

Figure 13 Growing Demand From Automotive & Aerospace Industries to Fuel the Heat Resistant Polymers Market Growth

Figure 14 Revenue Pocket Matrix: Heat Resistant Polymers Market, By End-Use Industry, 2016

Figure 15 Revenue Pocket Matrix: Heat Resistant Polymers Market, By Type, 2016

Figure 16 Porters Five Forces Analysis: Heat Resistant Polymers Market

Figure 17 Polyphenylene Sulfide to Grow at Highest CAGR Between 2016 & 2021

Figure 18 Transportation End-Use Industry is Estimated to Be the Largest Segment From 2016 to 2021

Figure 19 Heat Resistant Polymers Market: Regional Snapshot (2016-2021)

Figure 20 Asia-Pacific Heat Resistant Polymers Market Snapshot

Figure 21 North America Heat Resistant Polymers Market Snapshot

Figure 22 Europe Heat Resistant Polymers Market Snapshot

Figure 23 Dive Chart

Figure 24 BASF SE: Company Snapshot

Figure 25 Arkema SA: Company Snapshot

Figure 26 Evonik Industries AG: Company Snapshot

Figure 27 Daikin Industries, Ltd.: Company Snapshot

Figure 28 Celanese Corporation: Company Snapshot

Figure 29 Solvay S.A.: Company Snapshot

Figure 30 Kuraray Co., Ltd: Company Snapshot

Figure 31 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 32 Victrex PLC: Company Snapshot

Figure 33 Saudi Arabia Basic Industries Corporation (SABIC): Company Snapshot

Growth opportunities and latent adjacency in Heat Resistant Polymers Market