Flexible AC Transmission Systems (FACTS) Market with Covid-19 Impact Analysis by Compensation Type (Shunt, Series, and Combined), Generation Type, Vertical, Component, Application, Functionality, and Geography - Global Forecast to 2025

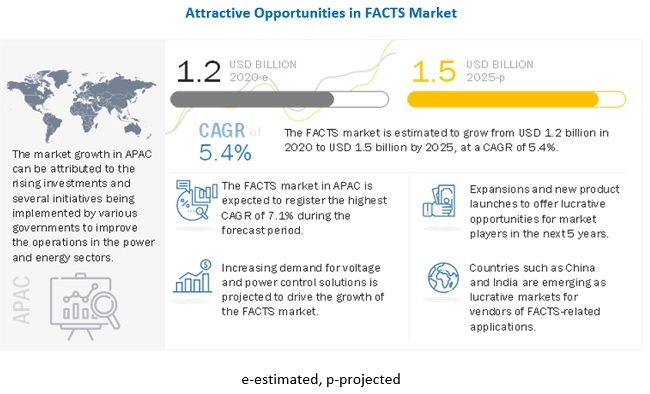

The flexible AC transmission systems market is projected to reach USD 1.5 billion by 2025 from USD 1.2 billion in 2020; it is expected to grow at a CAGR of 5.4% during the forecast period.

The growth of the FACTS market is driven by the increasing benefits offered by FACTS, growth in transmission lines, rising focus on energy generation using renewable sources, and rising demand for STATCOM devices for voltage control. Further, rising investments in transmission networks, and potential opportunities in APAC are the opportunities for FACTS manufacturers.

To know about the assumptions considered for the study, Request for Free Sample Report

Growing utilization of renewable energy into power grids

The efforts to reduce carbon emissions by using renewable sources such as wind, hydro, and solar in power generation are increasing across the world. In developed regions, such as the Americas and Europe, there is an increasing need for enhanced power transfer capability on existing transmission lines to meet the growing demand for electricity.

The electricity system needs to be modified to ensure clean, sustainable, and environment-friendly electricity generation. FACTS are being used to integrate renewable energy sources in transmission networks to maintain system stability, power supply quality, and reliability.

Flexible AC Transmission Systems Market Dynamics

Driver: Growth in transmission lines

From the past few years, governments are focusing on increasing the generation capacity and expansion of grid infrastructure. Due to this, an extensive network of transmission lines has been developed to produce electricity from stations and distribute them to consumers.

Ongoing expansion of utility-based transmission networks, coupled with rising investments toward the renovation of the existing grid infrastructure, will augment the power transmission market. Favorable regulatory reforms pertaining to the combination of a sustainable electric network along with ongoing expansion of cross-border interconnections will positively influence the power transmission sector growth.

Rapid industrial expansion to strengthen volume manufacturing by industry players, coupled with an inclination toward the assimilation of renewable energy infrastructure, will further stimulate the product demand. Countries such as China, the US, and India are increasing their transmission line length. Therefore, the growth in transmission lines is fueling the growth of the FACTS market.

Restraint: High installation cost

The initial cost involved in the installation of FACTS is relatively high because of which most industries and utility players are reluctant to adopt this technology. The relatively high initial cost investment over its counterparts acts as a restraint in the deployment of FACTS across the world.

However, when the cost is evaluated against the anticipated benefits, the financial benefits and return on investment, such as additional yearly sales due to increased power transfer capacity offered by FACTS, outweigh the initial investment cost. The impact of this restraint is currently moderate and is expected to subside in the coming years due to compact sizes and decreasing prices of FACTS devices.

Opportunity: Rising investments in transmission network

There is a steady increase in the global transmission investment spending, from USD 82 billion in 2016 to USD 87 billion in 2018. This increase is attributed to renewable energy generation and large-scale interconnection projects. Further, investment in long-distance and large-capacity transmission lines accounted for about USD 45 billion of the transmission investment in 2017.

Challenge: Size and communication limitations in FACTS

FACTS devices offer numerous benefits, such as increased stability, high reliability, high power quality, environmental benefits, and increased flexibility and financial benefits, over their conventional counterparts.

However, there are several issues that need to be addressed for the successful deployment of FACTS devices on a large scale. Proper size and setting of FACTS devices play a crucial role in deciding the overall cost of the device as the size of FACTS is directly proportional to the cost and desired performance characteristics of the overall system.

Flexible AC Transmission Systems Market Segment Overview

Shunt compensation segment to dominate FACTS market, by compensation type, from 2020 to 2025

In shunt compensation, FACTS are connected in parallel with the power system transmission line. Shunt compensation is actively used in power transmission and distribution networks to reduce power losses and voltage drops.

Moreover, shunt compensation is used for various applications, such as voltage stabilization, dynamic reactive power control, increased transmission capacity, power oscillation damping, higher transient stability, system voltage balance maintenance, reduced transmission losses, and voltage control.

STATCOM segment to dominate FACTS market, by shunt compensation, during forecast period

The shunt compensation market, by type, is segmented into STATCOM and SVC. STATCOM is likely to be a major revenue generator for the shunt compensation market during the forecast period.

STATCOM is a power electronic device that uses commutated devices such as GTO, IGBT to regulate the reactive power flow through a power network, thereby increasing the stability of power networks. STATCOM is mainly used for voltage stability. The increasing demand for electricity, growing need for renewable electricity generation, rising stringent regulations by regulatory authorities pertaining to power quality, and increasing need for upgrading aging transmission infrastructure are among the factors driving the growth of the STATCOM market, which would, in turn, boost the growth of the FACTS market.

Second generation segment to capture larger market share during forecast period

Static synchronous compensator (STATCOM) belongs to the second generation of the FACTS family. STATCOM is based on power electronics voltage source converters (VSC). Second generation devices of FACTS exchange active and reactive power as well as are capable of absorbing or generating these automatically.

The devices of this generation have characteristics such as small and compact size, high response speed, and no harmonic errors. In 1991, Mitsubishi Electric Power Products became the first company to develop commercial STATCOM and install it at the Inuyama substation (Japan).

Utilities vertical held largest market share in 2020

Based on vertical, the FACTS market is segmented into utilities, railways, renewables, and industrial. The applications of FACTS in electrical utilities include voltage control, network stabilization, increased transmission capacity, power oscillation damping, and power flow control.

FACTS devices also provide an economical and efficient solution to ease the pressure on existing transmission lines and save high investment cost that is required for building new network extensions. This is expected to increase the demand for FACTS in utilities. Companies such as ABB, GE, and Siemens provide FACTS to the electric utilities because of heavy demands for the generation of electricity.

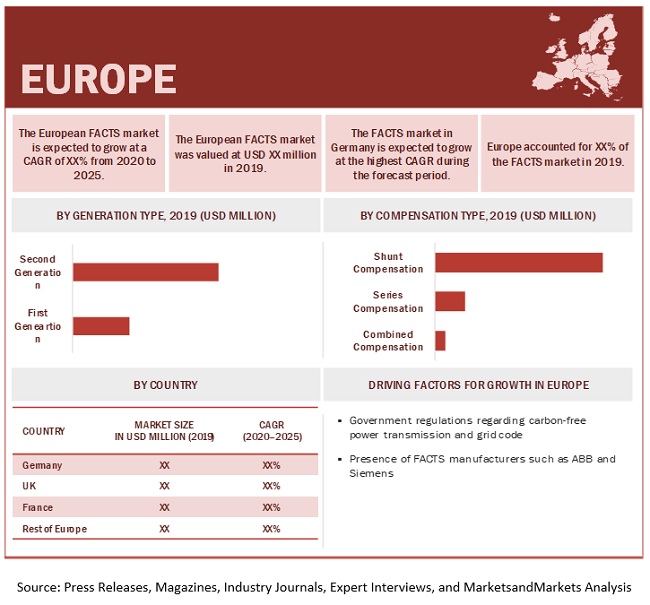

Europe accounted for largest share of FACTS market in 2019

The FACTS market is segmented into the Americas, Europe, APAC, and RoW. The rising industrial production, along with the expanding population, is increasing the demand for electricity across the European countries.

This is resulting in the growth of FACTS in this region. Further, government regulations regarding carbon-free power transmission and grid code in Europe are expected to drive the FACTS market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Flexible AC Transmission Systems Industry

The FACTS market is dominated by a few globally established players such as ABB (Hitachi) (ABB, Switzerland), General Electric Company (GE, US), Siemens AG (Siemens, Germany), Mitsubishi Electric Corporation (Mitsubishi Electric, Japan), Infineon Technologies AG (Infineon, Germany), American Superconductor (AMSC, US), NR Electric Co., Ltd. (NR Electric, China), Hyosung Heavy Industries (Hyosung, South Korea), and Rongxin Power Ltd. (RXPE, UK).

Flexible AC Transmission Systems Market Report Scope

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 1.2 billion |

| Revenue Forecast in 2025 | USD 1.5 billion |

| Growth Rate | 5.4% |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

|

|

Geographies covered |

|

|

Market Leaders |

ABB (Hitachi) (ABB, Switzerland), Siemens AG (Siemens, Germany), Mitsubishi Electric Corporation (Mitsubishi Electric, Japan), Infineon Technologies AG (Infineon, Germany), NR Electric Co., Ltd. (NR Electric, China), Hyosung Heavy Industries (Hyosung, South Korea), and Rongxin Power Ltd. (RXPE, UK). |

|

Top Companies in North America |

General Electric Company (GE, US), American Superconductor (AMSC, US), |

|

Key Market Driver |

Growth in Transmission Lines |

|

Key Market Opportunity |

Rising Investments in Transmission Network |

|

Largest Growing Region |

Europe |

|

Largest Market Share Segment |

Second Generation Segment |

The study categorizes the FACTS market based on vertical, generation type, application, functionality, components, and compensation type at the regional and global levels.

Flexible AC Transmission Systems Market, by Compensation Type:

- Shunt compensation

- Series compensation

- Combined compensation

Flexible AC Transmission Systems Market, by Generation Type:

- First generation

- Second generation

Functions of Flexible AC Transmission Systems:

- Voltage control

- Network stabilization

- Transmission capacity

- Harmonic suppression

Components of Flexible AC Transmission Systems:

- Power electronics devices

- Phase shifting transformers

- Protection and control systems

Flexible AC Transmission Systems Market, by Application:

- Voltage control

- Power control

Flexible AC Transmission Systems Market, by Vertical:

- Utilities

- Renewables

- Industrial

- Railways

Flexible AC Transmission Systems Market, By Region

- Americas

- Europe

- Asia Pacific (APAC)

- RoW

Recent Developments

- In May 2020, GE Renewable Energy’s Grid Solutions business energized the DRC (Dynamic Reactive Compensator) project for National Grid in the UK. This project is a part of the largest utility-grade STATCOM scheme in Europe.

- In October 2019, Rongxin Huiko Electric (RXHK) received a contract to provide 1 set of ±400kV 1,100MW VSC HVDC converter valves for China Three Gorges’ (CTG)/CGN Rudong Offshore Wind Farm demonstration project. The construction and equipment installation are anticipated to be scheduled by September 2020.

- In December 2018, the company signed an agreement to divest 80.1% of its Power Grids business to Hitachi. The power grids business also includes certain real estate properties, which were previously reported within Corporate and Others. The divestment is completed in the second quarter of 2020.

Frequently Asked Questions (FAQ):

What is the current size of the global FACTS market?

The FACTS market was valued at USD 1.2 billion in 2020 and is projected to reach USD 1.5 billion by 2025; it is expected to grow at a CAGR of 5.4% between 2020 and 2025.

What are the consequences of COVID-19 on supply chain of FACTS market?

The outbreak of the COVID-19 pandemic has not only affected the lives of the people but also impacted the world economy, thereby resulting in the global economic crisis. Most of the manufacturing activities worldwide have been affected owing to shutdowns caused by this pandemic. A large number of companies have shut down their manufacturing plants and are working on bare minimum capacities. The shortage of workforce, supply chain constraints, and delays in the renewable construction projects are directly impacting the commissioning of and renewable projects.

What are the latent opportunities in the FACTS market in the next five years?

To meet the growing demand for electricity, APAC countries are investing heavily in alternative energy generation sources, such as wind, solar, and hydropower for electricity generation. China, India, and other South Asian countries have planned extensively to expand the installed renewable capacity. The utilization of renewable resources for energy generation is expected to generate ample opportunities for FACTS in the transmission network in this region.

Which are the major companies in the FACTS market?

The FACTS market is dominated by a few globally established players such as ABB (Hitachi) (ABB, Switzerland), General Electric Company (GE, US), Siemens AG (Siemens, Germany), Mitsubishi Electric Corporation (Mitsubishi Electric, Japan), Infineon Technologies AG (Infineon, Germany), American Superconductor (AMSC, US), NR Electric Co., Ltd. (NR Electric, China), Hyosung Heavy Industries (Hyosung, South Korea), and Rongxin Power Ltd. (RXPE, UK). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 FACTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIZE) – BOTTOM UP MARKET ESTIMATION FOR FACTS, BY COMPENSATION TYPE

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach used to arrive at market share by bottom-up analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.2 Approach for capturing company-specific information in FACTS value chain

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach used to arrive at market share by top-down analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 8 SHUNT COMPENSATION SEGMENT TO DOMINATE FACTS MARKET, BY COMPENSATION TYPE, FROM 2020 TO 2025

FIGURE 9 STATCOM SEGMENT TO DOMINATE FACTS MARKET, BY SHUNT COMPENSATION, DURING FORECAST PERIOD

FIGURE 10 SECOND GENERATION SEGMENT TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 UTILITIES VERTICAL HELD LARGEST MARKET SHARE IN 2020

FIGURE 12 EUROPE ACCOUNTED FOR LARGEST SHARE OF FACTS MARKET IN 2019

3.1 COVID-19 IMPACT ON FACTS MARKET

FIGURE 13 COVID-19 IMPACT ON FACTS MARKET

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

4 PREMIUM INSIGHT (Page No. - 45)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN FACTS MARKET

FIGURE 14 INCREASING DEMAND FOR POWER AND VOLTAGE CONTROL SOLUTIONS TO DRIVE GROWTH OF FACTS MARKET

4.2 FACTS MARKET, BY APPLICATION

FIGURE 15 VOLTAGE CONTROL SEGMENT TO DOMINATE FACTS MARKET DURING FORECAST PERIOD

4.3 FACTS MARKET IN APAC, BY VERTICAL AND COUNTRY

FIGURE 16 UTILITIES AND CHINA TO ACCOUNT FOR LARGEST SHARES OF FACTS MARKET IN APAC IN 2025

4.4 FACTS MARKET, BY COMPENSATION TYPE

FIGURE 17 SHUNT COMPENSATION SEGMENT TO REGISTER HIGHEST CAGR FROM 2020 TO 2025

4.5 FACTS MARKET, BY REGION

FIGURE 18 APAC TO EXHIBIT HIGHEST CAGR IN FACTS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 FACTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing benefits offered by FACTS

5.2.1.2 Growth in transmission lines

5.2.1.3 Growing utilization of renewable energy into power grids

5.2.1.4 Rising demand for STATCOM devices for voltage control

FIGURE 20 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High installation cost

5.2.2.2 Delay or cancellation of projects due to COVID-19

TABLE 1 POLICY CHANGES FOR PROVIDING FLEXIBILITY OR DELAYING IN ENERGY PROJECTS

5.2.2.3 Trade restrictions imposed by the US on China

5.2.3 OPPORTUNITIES

5.2.3.1 Rising investments in transmission network

FIGURE 21 TRANSMISSION INVESTMENT – USD BILLION (2016–2018)

5.2.3.2 Potential opportunities in APAC

5.2.3.3 Focus on increasing domestic production and localization in the post-COVID-19 era

5.2.4 CHALLENGES

5.2.4.1 Size and communication limitations in FACTS

5.2.4.2 Adverse impacts of lockdowns and social distancing on FACTS market

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: FACTS MARKET

6 FUNCTIONS OF FLEXIBLE AC TRANSMISSION SYSTEM (Page No. - 54)

6.1 INTRODUCTION

6.2 VOLTAGE CONTROL

6.2.1 DEVICES SUCH AS STATCOM AND SVC ARE USED FOR VOLTAGE CONTROL

6.3 NETWORK STABILIZATION

6.3.1 SHUNT AND SERIES COMPENSATION ARE USED FOR NETWORK STABILIZATION

6.4 TRANSMISSION CAPACITY

6.4.1 SERIES COMPENSATION IS A COST EFFECTIVE WAY TO INCREASE TRANSMISSION CAPACITY

6.5 HARMONIC SUPPRESSION

6.5.1 SVC AND STATCOM ARE USED FOR HARMONIC SUPPRESSION

7 COMPONENTS OF FLEXIBLE AC TRANSMISSION SYSTEM (Page No. - 55)

7.1 INTRODUCTION

7.2 POWER ELECTRONIC DEVICES

7.2.1 CAPACITOR BANKS

7.2.1.1 Capacitor banks are used to increase power transmission capability

7.2.2 THYRISTORS

7.2.2.1 Thyristors are used to deliver high power in FACTS devices

7.2.3 REACTORS

7.2.3.1 Reactors are used to limit the effects of overvoltage in transmission line

7.3 PHASE SHIFTING TRANSFORMERS

7.3.1 PHASE SHIFTING TRANSFORMERS ARE USED TO CHANGE EFFECTIVE PHASE DISPLACEMENT BETWEEN INPUT VOLTAGE AND OUTPUT VOLTAGE OF TRANSMISSION LINE

7.4 PROTECTION AND CONTROL SYSTEMS

7.4.1 PROTECTION AND CONTROL SYSTEMS ARE USED TO ENSURE PROPER NETWORK RELIABILITY

8 FACTS MARKET, BY COMPENSATION TYPE (Page No. - 57)

8.1 INTRODUCTION

TABLE 2 FACTS MARKET, BY COMPENSATION TYPE, 2016–2019 (USD MILLION)

TABLE 3 FACTS MARKET, BY COMPENSATION TYPE, 2020–2025 (USD MILLION)

TABLE 4 FACTS MARKET, BY SHUNT COMPENSATION TYPE, 2016–2019 (USD MILLION)

TABLE 5 FACTS MARKET, BY SHUNT COMPENSATION TYPE, 2020–2025 (USD MILLION)

8.2 SHUNT COMPENSATION

TABLE 6 FACTS MARKET FOR SHUNT COMPENSATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 FACTS MARKET FOR SHUNT COMPENSATION, BY REGION, 2020–2025 (USD MILLION)

8.2.1 STATIC VAR COMPENSATION (SVC)

8.2.1.1 Need for line voltage control is likely to increase the demand for static VAR compensation

TABLE 8 FACTS MARKET FOR SVC SHUNT COMPENSATION, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 9 FACTS MARKET FOR SVC SHUNT COMPENSATION, BY REGION, 2020–2025 (USD THOUSAND)

8.2.2 STATIC COMPENSATOR (STATCOM)

8.2.2.1 APAC to witness highest growth for static compensator (STATCOM)

TABLE 10 FACTS MARKET FOR STATCOM SHUNT COMPENSATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 FACTS MARKET FOR STATCOM SHUNT COMPENSATION, BY REGION, 2020–2025 (USD MILLION)

8.3 SERIES COMPENSATION

TABLE 12 FACTS MARKET FOR SERIES COMPENSATION, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 13 FACTS MARKET FOR SERIES COMPENSATION, BY REGION, 2020–2025(USD THOUSAND)

8.3.1 FIXED SERIES CAPACITOR

8.3.1.1 Need for minimum voltage profile to increase demand for fixed series capacitor

8.3.2 THYRISTOR SERIES CAPACITOR

8.3.2.1 Need for more power transfer capability over existing transmission networks boosting demand for thyristor series capacitors

8.4 COMBINED COMPENSATION

8.4.1 APAC WAS LARGEST SHAREHOLDER FOR COMBINED COMPENSATION IN 2019

TABLE 14 FACTS MARKET FOR COMBINED COMPENSATION, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 15 FACTS MARKET FOR COMBINED COMPENSATION, BY REGION, 2020-2025 (USD THOUSAND)

FIGURE 23 PRE- AND POST-COVID-19 ANALYSIS OF FACTS MARKET FOR SHUNT COMPENSATION TYPE, 2020–2025 (USD MILLION)

8.5 IMPACT OF COVID-19 ON COMPENSATION TYPE

9 FLEXIBLE AC TRANSMISSION SYSTEM MARKET, BY APPLICATION (Page No. - 65)

9.1 INTRODUCTION

TABLE 16 FACTS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 FACTS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 VOLTAGE CONTROL

9.2.1 VOLTAGE CONTROL DOMINATED FACTS MARKET, IN TERMS OF SIZE, IN 2019

TABLE 18 FACTS MARKET FOR VOLTAGE CONTROL, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 FACTS MARKET FOR VOLTAGE CONTROL, BY REGION, 2020–2025 (USD MILLION)

9.3 POWER CONTROL

9.3.1 AMERICAS HELD LARGEST SHARE OF POWER CONTROL MARKET IN 2019

TABLE 20 FACTS MARKET FOR POWER CONTROL, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 21 FACTS MARKET FOR POWER CONTROL, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 22 FACTS MARKET FOR POWER CONTROL IN AMERICAS, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 FACTS MARKET FOR POWER CONTROL IN AMERICAS, BY REGION, 2020–2025 (USD MILLION)

FIGURE 24 PRE- AND POST-COVID-19 ANALYSIS OF FACTS MARKET FOR VOLTAGE CONTROL, 2020–2025 (USD MILLION

9.4 IMPACT OF COVID-19 ON APPLICATIONS

10 FLEXIBLE AC TRANSMISSION SYSTEM MARKET, BY VERTICAL (Page No. - 70)

10.1 INTRODUCTION

TABLE 24 FACTS MARKET, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 25 FACTS MARKET, BY VERTICAL, 2020–2025 (USD MILLION)

10.2 UTILITIES

10.2.1 UTILITIES TO DOMINATE FACTS MARKET IN COMING YEARS

TABLE 26 FACTS MARKET FOR UTILITIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 FACTS MARKET FOR UTILITIES, BY REGION, 2020–2025 (USD MILLION)

10.3 RENEWABLES

10.3.1 MARKET FOR RENEWABLES TO REGISTER HIGHEST CAGR

TABLE 28 FACTS MARKET FOR RENEWABLES, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 29 FACTS MARKET FOR RENEWABLES, BY REGION, 2020–2025 (USD THOUSAND)

10.4 INDUSTRIAL

10.4.1 INCREASING NEED FOR POWER QUALITY AND STABILITY IS BOOSTING DEMAND FOR FACTS IN INDUSTRIAL VERTICAL

TABLE 30 FACTS MARKET FOR INDUSTRIAL, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 31 FACTS MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (USD THOUSAND)

10.5 RAILWAYS

10.5.1 APAC HELD LARGEST SHARE OF THE MARKET FOR RAILWAYS IN 2019

TABLE 32 FACTS MARKET FOR RAILWAYS, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 33 FACTS MARKET FOR RAILWAYS, BY REGION, 2020–2025 (USD THOUSAND)

FIGURE 25 PRE- AND POST-COVID-19 ANALYSIS OF FACTS MARKET FOR UTILITIES, 2020–2025 (USD MILLION)

10.6 IMPACT OF COVID-19 ON VERTICALS OF THE MARKET

11 FLEXIBLE AC TRANSMISSION SYSTEM MARKET, BY GENERATION TYPE (Page No. - 77)

11.1 INTRODUCTION

TABLE 34 FACTS MARKET, BY GENERATION TYPE, 2016–2019 (USD MILLION)

TABLE 35 FACTS MARKET, BY GENERATION TYPE, 2020–2025 (USD MILLION)

11.2 FIRST GENERATION

11.2.1 SVC AND SERIES COMPENSATION ARE FIRST GENERATION FACTS DEVICES

TABLE 36 FACTS MARKET FOR FIRST GENERATION TYPE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 FACTS MARKET FOR FIRST GENERATION TYPE, BY REGION, 2020–2025 (USD MILLION)

11.3 SECOND GENERATION

11.3.1 EUROPE ACCOUNTED LARGEST SHARE FOR SECOND GENERATION FACTS DEVICES

TABLE 38 FACTS MARKET FOR SECOND GENERATION TYPE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 FACTS MARKET FOR SECOND GENERATION TYPE, BY REGION, 2020–2025 (USD MILLION)

FIGURE 26 PRE- AND POST-COVID-19 ANALYSIS OF FACTS MARKET FOR SECOND GENERATION TYPE, 2020–2025 (USD MILLION)

11.4 IMPACT OF COVID-19 ON GENERATION TYPES

12 GEOGRAPHIC ANALYSIS (Page No. - 82)

12.1 INTRODUCTION

FIGURE 27 FACTS MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 40 FACTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 FACTS MARKET, BY REGION, 2020–2025 (USD MILLION)

12.2 AMERICAS

FIGURE 28 AMERICAS: SNAPSHOT OF FACTS MARKET

TABLE 42 FACTS MARKET IN AMERICAS, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 FACTS MARKET IN AMERICAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 44 FACTS MARKET IN AMERICAS, BY COMPENSATION TYPE, 2016–2019 (USD THOUSAND)

TABLE 45 FACTS MARKET IN AMERICAS, BY COMPENSATION TYPE, 2020–2025 (USD THOUSAND)

TABLE 46 FACTS MARKET IN AMERICAS, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 47 FACTS MARKET IN AMERICAS, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 48 FACTS MARKET IN AMERICAS, BY GENERATION TYPE, 2016–2019 (USD MILLION)

TABLE 49 FACTS MARKET IN AMERICAS, BY GENERATION TYPE, 2020–2025 (USD MILLION)

TABLE 50 FACTS MARKET IN AMERICAS, BY VERTICAL, 2016–2019 (USD THOUSAND)

TABLE 51 FACTS MARKET IN AMERICAS, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 52 FACTS MARKET IN AMERICAS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 53 FACTS MARKET IN AMERICAS, BY APPLICATION, 2020–2025 (USD MILLION)

12.2.1 NORTH AMERICA

TABLE 54 FACTS MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 55 FACTS MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 56 FACTS MARKET IN NORTH AMERICA, BY COMPENSATION TYPE, 2016–2019 (USD THOUSAND)

TABLE 57 FACTS MARKET IN NORTH AMERICA, BY COMPENSATION TYPE, 2020–2025 (USD THOUSAND)

TABLE 58 FACTS MARKET IN NORTH AMERICA, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 59 FACTS MARKET IN NORTH AMERICA, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 60 FACTS MARKET IN NORTH AMERICA, BY GENERATION TYPE, 2016–2019 (USD MILLION)

TABLE 61 FACTS MARKET IN NORTH AMERICA, BY GENERATION TYPE, 2020–2025 (USD MILLION)

TABLE 62 FACTS MARKET IN NORTH AMERICA, BY VERTICAL, 2016–2019 (USD THOUSAND)

TABLE 63 FACTS MARKET IN NORTH AMERICA, BY VERTICAL, 2020–2025(USD THOUSAND)

TABLE 64 FACTS MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 65 FACTS MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

12.2.1.1 US

12.2.1.1.1 US is largest market for FACTS in North America

TABLE 66 FACTS MARKET IN US, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 67 FACTS MARKET IN US, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 68 FACTS MARKET IN US, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 69 FACTS MARKET IN US, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.2.1.2 Rest of North America

TABLE 70 FACTS MARKET IN REST OF NORTH AMERICA, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 71 FACTS MARKET IN REST OF NORTH AMERICA, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 72 FACTS MARKET IN REST OF NORTH AMERICA, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 73 FACTS MARKET IN REST OF NORTH AMERICA, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.2.2 SOUTH AMERICA

TABLE 74 FACTS MARKET IN SOUTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 75 FACTS MARKET IN SOUTH AMERICA, BY COUNTRY, 2020–2025(USD MILLION)

TABLE 76 FACTS MARKET IN SOUTH AMERICA, BY COMPENSATION TYPE, 2016–2019 (USD THOUSAND)

TABLE 77 FACTS MARKET IN SOUTH AMERICA, BY COMPENSATION TYPE, 2020–2025 (USD THOUSAND)

TABLE 78 FACTS MARKET IN SOUTH AMERICA, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 79 FACTS MARKET IN SOUTH AMERICA, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 80 FACTS MARKET IN SOUTH AMERICA, BY GENERATION TYPE, 2016–2019 (USD MILLION)

TABLE 81 FACTS MARKET IN SOUTH AMERICA, BY GENERATION TYPE, 2020–2025 (USD MILLION)

TABLE 82 FACTS MARKET IN SOUTH AMERICA, BY VERTICAL, 2016–2019 (USD THOUSAND)

TABLE 83 FACTS MARKET IN SOUTH AMERICA, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 84 FACTS MARKET IN SOUTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 85 FACTS MARKET IN SOUTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

12.2.2.1 Brazil

12.2.2.1.1 Increase in investment for expansion of energy infrastructure drives FACTS markets in Brazil

TABLE 86 FACTS MARKET IN BRAZIL, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 87 FACTS MARKET IN BRAZIL, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 88 FACTS MARKET IN BRAZIL, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 89 FACTS MARKET IN BRAZIL, BY APPLICATION, 2020–2025 (USD MILLION)

12.2.2.2 Rest of South America

TABLE 90 FACTS MARKET IN REST OF SOUTH AMERICA, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 91 FACTS MARKET IN REST OF SOUTH AMERICA, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 92 FACTS MARKET IN REST OF SOUTH AMERICA, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 93 FACTS MARKET IN REST OF SOUTH AMERICA, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.3 EUROPE

FIGURE 29 EUROPE: SNAPSHOT OF FACTS MARKET

TABLE 94 FACTS MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 FACTS MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 96 FACTS MARKET IN EUROPE, BY COMPENSATION TYPE, 2016–2019 (USD THOUSAND)

TABLE 97 FACTS MARKET IN EUROPE, BY COMPENSATION TYPE, 2020–2025 (USD THOUSAND)

TABLE 98 FACTS MARKET IN EUROPE, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 99 FACTS MARKET IN EUROPE, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 100 FACTS MARKET IN EUROPE, BY GENERATION TYPE, 2016–2019 (USD MILLION)

TABLE 101 FACTS MARKET IN EUROPE, BY GENERATION TYPE, 2020–2025 (USD MILLION)

TABLE 102 FACTS MARKET IN EUROPE, BY VERTICAL, 2016–2019 (USD THOUSAND)

TABLE 103 FACTS MARKET IN EUROPE, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 104 FACTS MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 105 FACTS MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

12.3.1 UK

12.3.1.1 UK is the major consumer of FACTS in Europe

TABLE 106 FACTS MARKET IN UK, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 107 FACTS MARKET IN UK, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 108 FACTS MARKET IN UK, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 109 FACTS MARKET IN UK, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.3.2 GERMANY

12.3.2.1 Facts markets in Germany to register highest CAGR during forecast period

TABLE 110 FACTS MARKET IN GERMANY, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 111 FACTS MARKET IN GERMANY, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 112 FACTS MARKET IN GERMANY, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 113 FACTS MARKET IN GERMANY, BY APPLICATION, 2020–2025 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Smart grid infrastructure to drive facts market in France

TABLE 114 FACTS MARKET IN FRANCE, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 115 FACTS MARKET IN FRANCE, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 116 FACTS MARKET IN FRANCE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 117 FACTS MARKET IN FRANCE, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.3.4 REST OF EUROPE

TABLE 118 FACTS MARKET IN REST OF EUROPE, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 119 FACTS MARKET IN REST OF EUROPE, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 120 FACTS MARKET IN REST OF EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 121 FACTS MARKET IN REST OF EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

12.4 APAC

FIGURE 30 APAC: SNAPSHOT OF FACTS MARKET

TABLE 122 FACTS MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 123 FACTS MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 124 FACTS MARKET IN APAC, BY COMPENSATION TYPE, 2016–2019 (USD MILLION)

TABLE 125 FACTS MARKET IN APAC, BY COMPENSATION TYPE, 2020–2025 (USD MILLION)

TABLE 126 FACTS MARKET IN APAC, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 127 FACTS MARKET IN APAC, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 128 FACTS MARKET IN APAC, BY GENERATION TYPE, 2016–2019 (USD MILLION)

TABLE 129 FACTS MARKET IN APAC, BY GENERATION TYPE, 2020–2025 (USD MILLION)

TABLE 130 FACTS MARKET IN APAC, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 131 FACTS MARKET IN APAC, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 132 FACTS MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 133 FACTS MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.1 CHINA

12.4.1.1 China to hold largest share of facts market in APAC during forecast period

TABLE 134 FACTS MARKET IN CHINA, BY SHUNT COMPENSATION, 2016–2019 (USD MILLION)

TABLE 135 FACTS MARKET IN CHINA, BY SHUNT COMPENSATION, 2020–2025 (USD MILLION)

TABLE 136 FACTS MARKET IN CHINA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 137 FACTS MARKET IN CHINA, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.2 INDIA

12.4.2.1 Government support for expansion of transmission network to drive facts market in India

TABLE 138 FACTS MARKET IN INDIA, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 139 FACTS MARKET IN INDIA, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 140 FACTS MARKET IN INDIA, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 141 FACTS MARKET IN INDIA, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.4.3 SOUTH KOREA

12.4.3.1 Requirement for constructing new transmission lines drives facts market in South Korea

TABLE 142 FACTS MARKET IN SOUTH KOREA, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 143 FACTS MARKET IN SOUTH KOREA, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 144 FACTS MARKET IN SOUTH KOREA, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 145 FACTS MARKET IN SOUTH KOREA, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.4.4 REST OF APAC

TABLE 146 FACTS MARKET IN REST OF APAC, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 147 FACTS MARKET IN REST OF APAC, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 148 FACTS MARKET IN REST OF APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 149 FACTS MARKET IN REST OF APAC, BY APPLICATION, 2020–2025(USD MILLION)

12.5 ROW

TABLE 150 FACTS MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 151 FACTS MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 152 FACTS MARKET IN ROW, BY COMPENSATION TYPE, 2016–2019 (USD THOUSAND)

TABLE 153 FACTS MARKET IN ROW, BY COMPENSATION TYPE, 2020–2025 (USD THOUSAND)

TABLE 154 FACTS MARKET IN ROW, BY SHUNT COMPENSATION, 2016–2019(USD THOUSAND)

TABLE 155 FACTS MARKET IN ROW, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 156 FACTS MARKET IN ROW, BY GENERATION TYPE, 2016–2019 (USD MILLION)

TABLE 157 FACTS MARKET IN ROW, BY GENERATION TYPE, 2020–2025 (USD MILLION)

TABLE 158 FACTS MARKET IN ROW, BY VERTICAL, 2016–2019 (USD THOUSAND)

TABLE 159 FACTS MARKET IN ROW, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 160 FACTS MARKET IN ROW, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 161 FACTS MARKET IN ROW, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.5.1 MIDDLE EAST

12.5.1.1 Growing number of oil & gas industries in the Middle East to drive FACTS market

TABLE 162 FACTS MARKET IN MIDDLE EAST, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 163 FACTS MARKET IN MIDDLE EAST, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 164 FACTS MARKET IN MIDDLE EAST, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 165 FACTS MARKET IN MIDDLE EAST, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.5.2 AFRICA

12.5.2.1 Africa to hold larger share of FACTS market in RoW

TABLE 166 FACTS MARKET IN AFRICA, BY SHUNT COMPENSATION, 2016–2019 (USD THOUSAND)

TABLE 167 FACTS MARKET IN AFRICA, BY SHUNT COMPENSATION, 2020–2025 (USD THOUSAND)

TABLE 168 FACTS MARKET IN AFRICA, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 169 FACTS MARKET IN AFRICA, BY APPLICATION, 2020–2025 (USD THOUSAND)

12.6 COVID-19 IMPACT ON MAJOR REGIONS

FIGURE 31 PRE- VS. POST-COVID-19 COMPARISON FOR AMERICAS FACTS MARKET

FIGURE 32 PRE- VS. POST-COVID-19 COMPARISON FOR APAC FACTS MARKET

13 COMPETITIVE LANDSCAPE (Page No. - 122)

13.1 OVERVIEW

FIGURE 33 PRODUCT DEVELOPMENTS KEY GROWTH STRATEGY FROM 2017 TO 2020

13.2 RANKING ANALYSIS OF KEY PLAYERS IN FLEXIBLE AC TRANSMISSION SYSTEM MARKET

FIGURE 34 FLEXIBLE AC TRANSMISSION SYSTEM MARKET: RANKING OF KEY COMPANIES

13.3 COMPETITIVE SITUATIONS AND TRENDS

13.3.1 PRODUCT DEVELOPMENTS

TABLE 170 PRODUCT DEVELOPMENTS, 2017–2020

13.3.2 AGREEMENTS

TABLE 171 AGREEMENTS, 2018–2020

13.3.3 COLLABORATION

TABLE 172 COLLABORATION, 2018–2019

13.3.4 CONTRACTS

TABLE 173 CONTRACTS, 2017–2019

13.3.5 DIVESTMENTS

TABLE 174 DIVESTMENTS, 2018–2019

13.3.6 EXPANSION

TABLE 175 EXPANSION, 2018–2019

13.3.7 PARTNERSHIPS

TABLE 176 PARTNERSHIPS, 2018–2020

13.3.8 ACQUISITIONS

TABLE 177 ACQUISITIONS, 2018–2020

13.4 COMPETITIVE LEADERSHIP MAPPING, 2019

13.4.1 VISIONARY LEADERS

13.4.2 DYNAMIC DIFFERENTIATORS

13.4.3 INNOVATORS

13.4.4 EMERGING COMPANIES

FIGURE 35 FLEXIBLE AC TRANSMISSION SYSTEM MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

14 COMPANY PROFILE (Page No. - 133)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View, and COVID-19 Update)*

14.1.1 ABB (HITACHI)

FIGURE 36 ABB: COMPANY SNAPSHOT

14.1.2 RONGXIN POWER ENGINEERING LTD (RXPE)

14.1.3 GENERAL ELECTRIC (GE)

FIGURE 37 GENERAL ELECTRIC: COMPANY SNAPSHOT

14.1.4 SIEMENS

FIGURE 38 SIEMENS: COMPANY SNAPSHOT

14.1.5 MITSUBISHI ELECTRIC

FIGURE 39 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

14.1.6 AMERICAN SUPERCONDUCTOR

FIGURE 40 AMERICAN SUPERCONDUCTOR: COMPANY SNAPSHOT

14.1.7 INFINEON

FIGURE 41 INFINEON: COMPANY SNAPSHOT

14.1.8 NR ELECTRIC

14.1.9 HYOSUNG HEAVY INDUSTRIES

14.1.10 INGETEAM POWER TECHNOLOGY

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View, and COVID-19 Update might not be captured in case of unlisted companies.

14.2 RIGHT TO WIN

14.3 OTHER IMPORTANT PLAYERS

14.3.1 BHARAT HEAVY ELECTRICALS LIMITED (BHEL)

14.3.2 QUANTA TECHNOLOGY

14.3.3 COMSYS

14.3.4 MERUS POWER DYNAMICS OY

14.3.5 SIEYUAN ELECTRIC CO., LTD.

14.3.6 SIGNATORY PVT. LTD.

14.3.7 JEMA ENERGY SA

14.3.8 FREQCON GMBH

14.3.9 CLARIANT POWER SYSTEM LIMITED

14.3.10 BEIJING POWER EQUIPMENT GROUP CO LTD(BPEG)

15 ADJACENT MARKET: DIGITAL SUBSTATION MARKET (Page No. - 169)

15.1 MARKET DEFINITION

15.1.1 INCLUSIONS AND EXCLUSIONS

TABLE 178 DIGITAL SUBSTATION MARKET, BY MODULE, 2017–2025 (USD MILLION)

TABLE 179 DIGITAL SUBSTATION MARKET FOR HARDWARE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 180 DIGITAL SUBSTATION MARKET, BY TYPE, 2017–2025 (USD BILLION)

TABLE 181 DIGITAL SUBSTATION MARKET, BY INSTALLATION TYPE, 2017–2025 (USD BILLION)

TABLE 182 DIGITAL SUBSTATION MARKET, BY VOLTAGE, 2017–2025 (USD MILLION)

TABLE 183 DIGITAL SUBSTATION MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 184 DIGITAL SUBSTATION MARKET, BY REGION, 2017–2025 (USD BILLION)

16 APPENDIX (Page No. - 173)

16.1 INSIGHTS FROM INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

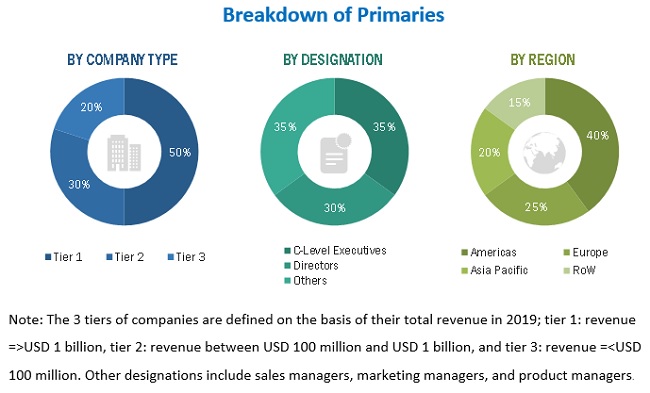

The study involved four major activities in estimating the size of the FACTS market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study includes FACTS technical blogs, annual reports, press releases, SEC filings, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases.

In the FACTS market report, both top-down and bottom-up approaches have been used to estimate and validate the market sizes of segments and subsegments, along with other dependent submarkets. The key players in the FACTS market have been identified through secondary research, and their market presence has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the FACTS market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (end use verticals) and supply-side (FACTS manufacturers) players across four major regions, namely, Americas, Europe, Asia Pacific, and Rest of the World (the Middle East & Africa). Approximately 70% and 30% of primary interviews have been conducted from the supply and demand side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the FACTS market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying market energy projects in each country

- Identifying the major applications of FACTS-related products

- Estimating the size of the market in each region by adding the sizes of country-wise markets

- Tracking the ongoing and upcoming implementation of FACTS projects by various companies in each region and forecasting the size of the FACTS market based on these developments and other critical parameters, including COVID-19 related impacts

- Arriving at the size of the global market by adding the sizes of region-wise markets

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The main objectives of this study are as follows:

- To define, describe, and forecast the FACTS market, in terms of value, by, generation type, compensation type, vertical, application, and region

- To forecast the market, for various segments with respect to four main regions—the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall FACTS market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the FACTS market growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the FACTS market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the FACTS market landscape

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the FACTS market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of FACTS market

- Profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Flexible AC Transmission Systems (FACTS) Market

I`d like to receive the report as pdf, plus all data tables as excel file: split by compensation, by application, by industry vertical detailed out by region or country if possible.

Hi team, I would like to know if it is possible to buy sections of this report say some tables which are of interest for my current use? What would the price per table if that is possible?

Do you have any specific reports on a)Global Shunt Capacitors (high voltage) market. (b)Global High Voltage Air Core Reactors market?

What would be the price for all the tables related to North America? I am only interested in this region.

I am interested to understand different components used at converter stations in HVDC line and their manufacturers. Can you provide competitive analysis for the same?