European Paints and Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyester, PU, Fluoropolymer, Vinyl), Technology (Waterborne, Solvent borne, Powder), End-use (Architectural and Industrial), and Country - Global Forecast to 2028

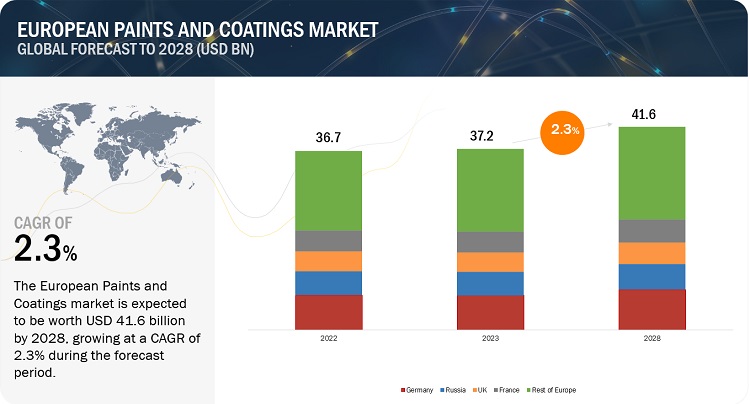

The European Paints and Coatings market is projected to grow from USD 37.2 billion in 2023 to USD 41.6 billion by 2028, at a CAGR of 2.3% between 2023-2028 respectively. High demand for sustainable coatings from professional and DIY industries will lead to an increase in the market for European Paints and Coatings.

Attractive Opportunities in the European Paints and Coatings Market

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Market Dynamics

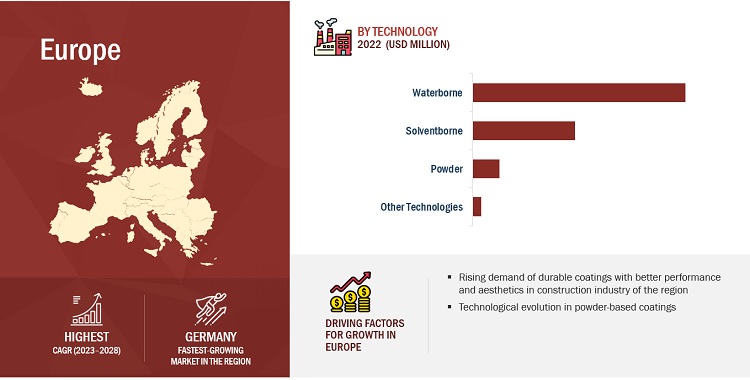

Driver: Technological evolution in powder-based coatings

Technological advancements in advanced curing methods, powder coating materials, and their unique applications have enhanced the use of powder coatings in heat-sensitive substrates. Medium-density fibreboard (MDF), a combination panel bonding synthetic resin with wood particles, is one of the most important advancements in powder coatings. Owing to its low porosity and homogeneous surface MDF is suitable for powder coating applications. Powder coatings are increasingly used on MDF products for finishing. The MDF products include doors, kitchen and bath cabinets, office furniture, store fixtures and displays, and ready-to-assemble furniture for offices and homes. Furthermore, the powder coatings have also rendered the coating failure problem to enhance the longevity of a coated asset. Nowadays, Hyper-durable powder coating technology is well-positioned to take on the high-performance architectural market for skyscrapers and other monumental building products.

Restraint: Requirement of more curing time for waterborne paints and coatings

Waterborne paints and coatings have become increasingly prevalent in all industries, from industrial to automotive applications, to help reduce the environmental impact of painting processes. But the drying and curing of waterborne coatings require more time than that of solvent-borne coatings and can become very critical depending on the volume. In addition, waterborne coatings have excellent flow properties that change with humidity, affecting the coating application. During high humidity, water does not easily evaporate and gets trapped on the surface of the substrate resulting in poor cure and a decrease in performance. Sometimes to accelerate the cure time, heat is used, which can disrupt the substrate surface. Waterborne coatings are also sensitive to freezing conditions. Many waterborne coatings are not usable after freezing.

Opportunities: Attractive prospects for powder coatings in the electric vehicles segment

The increasing awareness of powder coatings as an eco-friendly solution with zero-VOC and zero hazardous components create an attractive opportunity in the industrial coatings market. Of the powder coatings used in the automotive industry, 25% is used on wheels, 15% on exterior trim parts, and 40% for under-the-hood components, leaving 20% in miscellaneous applications. Powder coatings used for under-the-hood components will gradually shift from protecting the drive train for internal combustion engines (ICE) to protecting components for the electric powertrain, which offers attractive opportunities for powder coating material and equipment manufacturers.

Challenge: Stringent environmental regulations

Based only on the concentration of VOC in exhaust gases, some legislators continue to limit emission values. This leads to approval for high mass emissions processes that require high airflows as compared to low mass emissions that need only very low airflows. The concentration approach also ignores the reduced atmospheric emissions when low-VOC coatings are used. VOC limits in Europe affecting the coatings industry are governed by two main legislations, namely: The Paint Product Directive (Directive 2004/42/CE), which is enacted in the UK by the Volatile Organic Compounds in Paints, Varnishes, and Vehicle Refinishing Products Regulations 2012 SI 2012 No 1715. The Industrial Emissions Directive (IED – Directive 2010/75/EU) limits VOC emissions in certain industrial activities, enacted in the UK by the Environmental Permitting (England and Wales) Regulations 2010 SI 675.

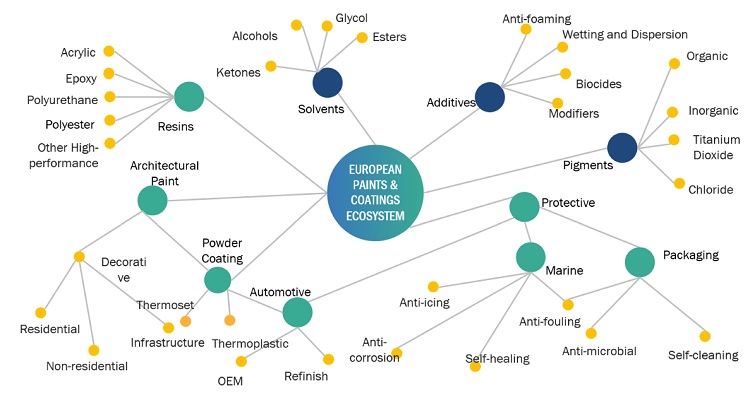

Market Ecosystem: European Paints & Coatings

Paints and Coatings are formed of solvent, binder, additives, hardeners, and pigments which are supplied by a number of raw material manufacturers and suppliers or distributors. These are used for their esthetic and protective haracteristics in residential, non-residential, commercial and industrial applications such as automotive, marine, awerospace, wood, protective, and coil coatings. The paints and coatings industry is nowadays focusing on advanced, cost-effective, high-performance materials that offer permeability, thereby increasing the product’s shelf life. It is undergoing continuous technological up-gradation concerning the design and development of raw materials.

Industrial end-use industry is the fastest-growing segment in Europe between 2023 and 2028.

An industrial coating or paint is defined by its protective rather than its aesthetic properties, although it often provides both. They are used for corrosion control of steel or concrete, but this is a complex market segment with numerous applications. Industrial application is segmented into general industrial, automotive OEM, automotive refinish, wood, protective, marine, coil, packaging, aerospace, and others. The outbreak of the COVID-19 pandemic and consequent containment measures widely introduced by Member States significantly impacted the EU’s industrial production in 2020. Industrial production in European Union decreased by 7 % in the same year compared with 2019, which has recovered in 2021 by 8 % compared with 2020. The recent increase was recorded in almost all industrial activities, with the highest peak in manufacturing basic metals and fabricated metal products, followed by manufacturing chemical products, including paints and coatings.

Powder-based Coating is the largest segment in the Industrial end-use market of Europe between 2023 and 2028.

Powder-based coatings are of two types: thermosets and thermoplastics. Thermosets incorporate cross-linker into the formulation. The powder is baked and reacted with other chemical groups in the powder to polymerize, improving the performance properties. Whereas, thermoplastics do not undergo any additional action during the baking process but rather only flows out into the final coating. Powder coatings offer attractive opportunities from a pollution prevention standpoint because no solvents are used in the coating formulation. These have high transfer efficiency with no hazardous waste to dispose off.

Germany is the fastest-growing European Paints and Coatings market.

Germany is the largest economy in the European region and the fourth largest globally. It is the most industrialized and populous country in Europe. The country accounts for the largest share of decorative as well as industrial coatings market in Europe. Also, it is a leading exporter of decoarative coatings globally and accounted for an export percentage of 16.9 in the year 2021. The growth in the construction sector is expected to outpace the overall economic growth of the country.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

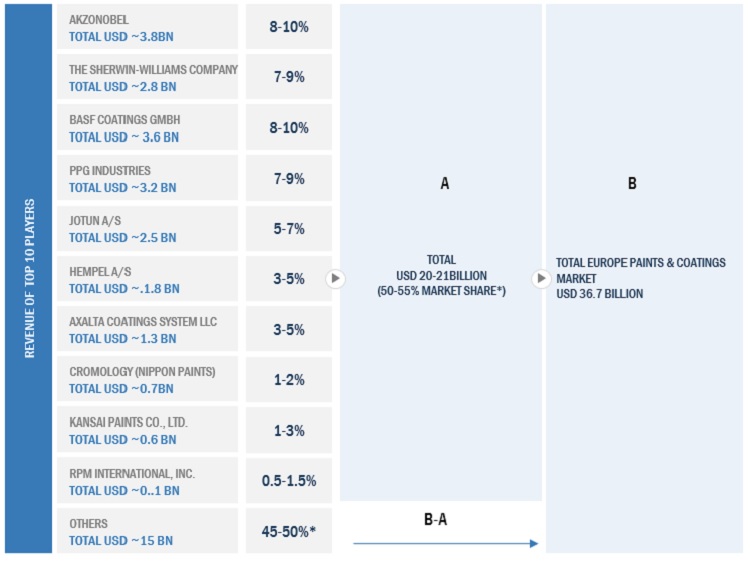

Akzo Nobel NV (Netherlands), PPG Industries, Inc. (US), The Sherwin-Williams Company (US), BASF Coatings GmbH (Germany), Jotun A/S (Norway), and Axalta Coating Systems LLC (US) are the key players in the global European Paints and Coatings market.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Scope of the report

|

Report Metric |

Details |

|

Years Considered for the Study |

2019-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) and Volume (Kiloton) |

|

Segments |

By Resin Type, Technology, End-use Industry, and Country |

|

Countries covered |

Germany, Russia, the UK, France, Italy, Spain, Turkey, Poland, Sweden, Denmark, Norway, Finland, Lithuania, Latvia, Estonia, and the Rest of Europe |

|

Companies profiled |

Akzo Nobel NV (Netherlands), PPG Industries, Inc. (US), The Sherwin-Williams Company (US), BASF Coatings GmbH (Germany), Jotun A/S (Norway), and Axalta Coating Systems LLC (US). A total of 25 players have been covered. |

This research report categorizes the European Paints and Coatings market based on resin type, technology, end-use industry, and region.

By Resin Type:

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Fluoropolymer

- Vinyl

- Other Resins

By Technology:

- Waterborne

- Solventborne

- Powder

- Other Technologies

By End-use Industry:

- Architectural

- Industrial

By Country:

- Germany

- Russia

- UK

- France

- Italy

- Spain

- Turkey

- Poland

- Sweden

- Denmark

- Norway

- Finland

- Lithuania

- Latvia

- Estonia

- Rest of Europe Europe

Recent Developments

- In December 2022, Akzo Nobel completed the acquisition of the wheel-liquid coatings business of Lankwitzer Lackfabrik GmbH, a deal that strengthened the company’s performance coatings portfolio. The acquired business will complement Akzo Nobel’s existing powder coatings offering and expand the range of innovative products the company supplies.

- In June 2021, PPG acquired Tikkurila, which helped the company to expand paint and coating options with Tikkurila’s environment-friendly decorative products and high-quality industrial coatings.

- In April 2020, The company launched the scuff-resistant Dulux Easy Care+ for stain-free walls. It forms a durable matte coating, providing extraordinary mechanical strength

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of European Paints and Coatings?

The European Paints and Coatings market is driven by increasing demand for premium paints and coatings.

What are the major applications for European Paints and Coatings?

The major applications of European Paints and Coatings are architectural and industrial.

Which technology is gaining popularity for European Paints and Coatings?

The powder based coatings are gaining popularity at the fastest rate in the European market.

Who are the major manufacturers?

Akzo Nobel NV (Netherlands), PPG Industries, Inc. (US), The Sherwin-Williams Company (US), BASF Coatings GmbH (Germany), Jotun A/S (Norway), and Axalta Coating Systems LLC (US) are some of the leading players operating in the global European Paints and Coatings market.

Why European Paints and Coatings are gaining market share?

The growth of this market is attributed to the increase in product efficiency, customer service, and advanced technology. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for premium paints- High demand for sustainable coatings from professional and DIY industries- Rising demand for durable coatings with better performance and aesthetics- Technological evolution in powder-based coatingsRESTRAINTS- Requirement of more curing time for waterborne paints and coatings- Trouble attaining thin films with powder coatingOPPORTUNITIES- Increased utilization of fluoropolymers in building and construction industry- Attractive prospects for powder coatings in EV industryCHALLENGES- Stringent environmental regulations- Challenges concerning wastewater disposal

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

-

5.5 KEY STAKEHOLDERS IN BUYING PROCESSINFLUENCE OF STAKEHOLDERS ON BUYING PROCESSBUYING CRITERIA

-

5.6 MACRO ECONOMIC INDICATORS AND KEY INDUSTRY TRENDSINTRODUCTIONTRENDS AND FORECAST OF GDPTRENDS IN AUTOMOTIVE INDUSTRY

-

5.7 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHRUSSIA–UKRAINE WARENERGY CRISIS IN EUROPE

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PRICING ANALYSIS

-

5.10 EUROPEAN PAINTS AND COATINGS ECOSYSTEM AND INTERCONNECTED MARKET

-

5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

- 5.12 TRADE ANALYSIS

-

5.13 STANDARDS AND REGULATORY LANDSCAPESBRITISH COATINGS FEDERATION- Decorative coatings- Vehicle refinish productsEU ECOLABELBIOCIDES PRODUCTS REGULATION (BPR)- Exclusion criteria- Active substances act as substitution

-

5.14 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

-

5.15 CASE STUDIES

- 5.16 TECHNOLOGY ANALYSIS

- 5.17 KEY CONFERENCES AND EVENTS IN 2023

-

5.18 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 ACRYLIC RESINEXTENSIVE APPLICATION OF ACRYLIC PAINTS AND COATINGS TO DRIVE ACRYLIC RESIN MARKET

-

6.3 ALKYD RESINOUTSTANDING MECHANICAL QUALITIES AND SUPERIOR DYEING SPEED OF ALKYD RESIN TO BOOST ALKYD RESIN MARKET

-

6.4 EPOXY RESINGROWING DEMAND FOR HIGH-PERFORMANCE THERMOSETTING RESINS TO DRIVE MARKET FOR EPOXY PAINTS AND COATINGS

-

6.5 POLYESTER RESINRISING DEMAND FOR COATINGS WITH OUTSTANDING MECHANICAL PROPERTIES TO BOOST MARKET FOR POLYESTER RESIN

-

6.6 POLYURETHANE RESINGROWING DEMAND FOR EFFECTIVE COATING MATERIALS FROM TEXTILE SECTOR TO DRIVE MARKET FOR POLYURETHANE RESIN

-

6.7 FLUOROPOLYMER RESININCREASING ADOPTION OF NON-STICK SURFACE COATING MATERIALS TO PROPEL MARKET FOR FLUOROPOLYMER RESIN

-

6.8 VINYL RESINGROWING ADOPTION OF WATER-BASED COATINGS IN ARCHITECTURE SECTOR TO DRIVE MARKET FOR VINYL RESIN

- 6.9 OTHER RESIN TYPES

- 7.1 INTRODUCTION

-

7.2 WATERBORNEADOPTION OF ENVIRONMENTAL-FRIENDLY RAW MATERIALS TO DRIVE MARKET FOR WATERBORNE COATINGS

-

7.3 SOLVENTBORNEGROWING NEED FOR HIGH-PERFORMANCE COATING APPLICATIONS TO DRIVE DEMAND FOR SOLVENTBORNE COATINGS

-

7.4 POWDERPREFERENCE FOR SUPERIOR-QUALITY AND COST-EFFICIENT COATINGS TO BOOST GROWTH OF POWDER COATINGS MARKET

- 7.5 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 ARCHITECTURALRISING POPULARITY OF ARCHITECTURAL AESTHETICS TO BOOST DEMAND FOR ARCHITECTURAL COATINGSRESIDENTIALNON-RESIDENTIALINFRASTRUCTURE

-

8.3 INDUSTRIALRISING ADOPTION OF CORROSION-FREE COATINGS TO DRIVE GROWTH OF INDUSTRIAL COATINGS MARKETGENERAL INDUSTRIAL- Rising demand for powder-coated products by homeowners to drive usage of coatings for general industrial purposesOEM- Growing sales of passenger and commercial vehicles to boost adoption of automotive OEM coatings- Passenger cars- Commercial vehicles- Heavy-duty equipment- Rail- Aerospace- MarineWOOD- Increase in construction and infrastructure activities to drive demand for coatings in wood industryOTHER END-USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 EUROPE: RECESSION IMPACTGERMANY- Favorable economic environment and rising demand for new homes to drive growthRUSSIA- Growing population to increase application of architectural paints and coatingsUK- Growing construction sector, along with government spending, to boost demand for architectural coatingsFRANCE- Reviving economy, coupled with investments in infrastructure, to boost demandITALY- New project finance rules and investment policies to boost marketSPAIN- Increase in housing units to boost demand for paints & coatingsTURKEY- Rapid urbanization and diversification in consumer goods to impact market positivelyPOLAND- Residential and other infrastructural projects to drive marketSWEDEN- New infrastructural projects to drive marketDENMARK- Government support for construction industry growth to drive demandNORWAY- Industrial segment to be dominant consumer of paints & coatingsFINLAND- Demand for new houses to drive architectural paints marketLITHUANIA- Wood industry to drive wood coatings marketLATVIA- Infrastructure and commercial buildings to drive marketESTONIA- Architectural segment to dominate marketREST OF EUROPE

-

10.1 OVERVIEWOVERVIEW OF STRATEGIES ADOPTED BY KEY EUROPEAN PAINTS AND COATINGS MARKET PLAYERS

-

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.3 STRENGTH OF PRODUCT PORTFOLIO

-

10.4 STARTUPS/SMES EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 10.5 MARKET SHARE ANALYSIS

-

10.6 TOP FIVE REVENUE ANALYSISAKZO NOBEL NVPPG INDUSTRIES, INC.THE SHERWIN-WILLIAMS COMPANYBASF COATINGS GMBHAXALTA COATING SYSTEMS LLC

- 10.7 MARKET RANKING ANALYSIS

-

10.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 10.9 COMPETITIVE BENCHMARKING

- 10.10 STRATEGIC DEVELOPMENTS

-

11.1 MAJOR PLAYERSAKZO NOBEL N.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPPG INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE SHERWIN-WILLIAMS COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF COATINGS GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAXALTA COATING SYSTEMS LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRPM INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- MnM viewJOTUN A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEMPEL A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKANSAI PAINT CO., LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCROMOLOGY (NIPPON PAINT HOLDINGS CO., LTD.)- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

11.2 OTHER COMPANIESDAW SE- DAW SE: Company overview- Products/Solutions/Services offeredBECKERS GROUP- Beckers Group: Company overview- Products/Solutions/Services offered- Recent developmentsBRILLUX GMBH & CO. KG- Brillux GmbH & Co. KG: Company overview- Products/Solutions/Services offeredTEKNOS GROUP- Teknos Group: Company overview- Products/Solutions/Services offered- Recent developmentsMANKIEWICZ GEBR. & CO.- Mankiewicz Gebr. & Co.: Company overview- Products/Solutions/Services offeredMEFFERT AG FARBWERKE- Meffert AG Farbwerke: Company overview- Products/Solutions/Services offeredCORCORPORACAO INDUSTRIAL DO NORTE- Corporacao Industrial Do Norte: Company overview- Products/Solutions/Services offeredFLUGGER GROUP A/S- Flugger Group A/S: Company overview- Products/Solutions/Services offered- Recent developmentsIVM CHEMICALS- IVM Chemicals: Company overview- Products/Solutions/Services offeredTIGER COATINGS GMBH & CO. KG- Tiger Coatings GmbH & Co. KG: Company overview- Products/Solutions/Services offeredSTO CORP.- Sto Corp.: Company overview- Products/Solutions/Services offeredREMMERS- Remmers: Company overview- Products/Solutions/Services offeredMIPA SE- MIPA SE: Company overview- Products/Solutions/Services offeredWEILBURGER COATINGS GMBH- Weilburger Coatings GmbH: Company overview- Products/Solutions/Services offered- Recent developmentsFREILACKE- FreiLacke: Company overview- Products/Solutions/Services offered

-

12.1 INTRODUCTIONLIMITATION

-

12.2 PAINTS & COATINGSECOSYSTEM AND INTERCONNECTED MARKET

-

12.3 COATING RESINS MARKETMARKET DEFINITIONMARKET OVERVIEWCOATING RESINS MARKET, BY RESIN TYPE- Acrylic- Alkyd- Vinyl- Polyurethane- Epoxy- Polyester- Amino- OthersCOATING RESINS MARKET, BY TECHNOLOGY- Waterborne coatings- Solventborne coatings- Powder coatings- OthersCOATING RESINS MARKET, BY APPLICATION- Architectural coatings- Marine & protective coatings- General industrial coatings- Automotive coatings- Wood coatings- Packaging coatings- OthersCOATING RESINS MARKET, BY REGION- Asia Pacific- Europe- North America- Middle East & Africa- South America

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 EUROPEAN PAINTS AND COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 EUROPEAN PAINTS AND COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS (%)

- TABLE 6 KEY BUYING CRITERIA FOR EUROPEAN PAINTS AND COATINGS

- TABLE 7 AUTOMOTIVE INDUSTRY PRODUCTION (2020–2021)

- TABLE 8 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2020–2028

- TABLE 9 EUROPEAN PAINTS AND COATINGS MARKET: SUPPLY CHAIN

- TABLE 10 COUNTRY-WISE EXPORT DATA FOR AQUEOUS MEDIUM, 2019–2022 (USD THOUSAND)

- TABLE 11 COUNTRY-WISE IMPORT DATA FOR AQUEOUS MEDIUM, 2019–2022 (USD THOUSAND)

- TABLE 12 COUNTRY-WISE EXPORT DATA FOR NON-AQUEOUS MEDIUM, 2019–2022 (USD THOUSAND)

- TABLE 13 COUNTRY-WISE IMPORT DATA FOR NON-AQUEOUS MEDIUM, 2019–2022 (USD THOUSAND)

- TABLE 14 RECENT PATENTS BY OWNERS

- TABLE 15 PAINTS AND COATINGS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018–2021 (USD MILLION)

- TABLE 18 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022–2028 (USD MILLION)

- TABLE 19 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018–2021 (KILOTON)

- TABLE 20 EUROPEAN PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022–2028 (KILOTON)

- TABLE 21 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018–2021 (USD MILLION)

- TABLE 22 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022–2028 (USD MILLION)

- TABLE 23 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018–2021 (KILOTON)

- TABLE 24 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022–2028 (KILOTON)

- TABLE 25 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018–2021 (USD MILLION)

- TABLE 26 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022–2028 (USD MILLION)

- TABLE 27 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018–2021 (KILOTON)

- TABLE 28 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2022–2028 (KILOTON)

- TABLE 29 PROPERTIES AND APPLICATIONS OF ACRYLIC PAINTS AND COATINGS

- TABLE 30 ACRYLIC-BASED PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 31 ACRYLIC-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 32 ACRYLIC-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 33 ACRYLIC-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 34 PROPERTIES AND APPLICATIONS OF ALKYD RESIN

- TABLE 35 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 36 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 37 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 38 ALKYD-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 39 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 40 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 41 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 42 POLYURETHANE-BASED ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 43 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 44 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2022–2028 (USD MILLION)

- TABLE 45 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018–2021 (KILOTON)

- TABLE 46 EUROPEAN PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2022–2028 (KILOTON)

- TABLE 47 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 48 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 49 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 50 WATERBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 51 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 52 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 53 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 54 SOLVENTBORNE: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 55 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 56 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 57 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 58 POWDER: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 59 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 60 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 61 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 62 EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 63 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 64 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 65 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 66 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 67 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 68 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 69 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 70 ARCHITECTURAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 71 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 72 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 73 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 74 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 75 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 76 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 77 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 78 INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 79 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 80 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 81 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 82 GENERAL INDUSTRIAL: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 83 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 84 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 85 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 86 OEM: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 87 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 88 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 89 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 90 WOOD: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 91 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 92 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 93 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 94 OTHER END-USE INDUSTRIES: EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 95 MAJOR INFRASTRUCTURE PROJECTS IN EUROPE

- TABLE 96 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 97 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 98 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 99 EUROPEAN PAINTS & COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 100 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 101 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 102 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 103 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 104 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 105 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 106 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 107 GERMANY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 108 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 109 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 110 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 111 RUSSIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 112 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 113 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 114 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 115 RUSSIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 116 MAJOR INFRASTRUCTURE PROJECTS IN UK

- TABLE 117 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 118 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 119 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 120 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 121 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 122 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 123 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 124 UK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 125 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 126 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 127 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 128 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 129 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 130 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 131 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 132 FRANCE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 133 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 134 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 135 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 136 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 137 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 138 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 139 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 140 ITALY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 141 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 142 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 143 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 144 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 145 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 146 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 147 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 148 SPAIN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 149 MAJOR INFRASTRUCTURE PROJECTS IN TURKEY

- TABLE 150 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 151 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 152 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 153 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 154 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 155 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 156 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 157 TURKEY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 158 MAJOR INFRASTRUCTURE PROJECTS IN POLAND

- TABLE 159 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 160 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 161 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 162 POLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 163 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 164 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 165 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 166 POLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 167 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 168 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 169 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 170 SWEDEN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 171 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 172 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 173 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 174 SWEDEN: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 175 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 176 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 177 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 178 DENMARK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 179 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 180 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 181 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 182 DENMARK: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 183 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 184 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 185 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 186 NORWAY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 187 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 188 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 189 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 190 NORWAY: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 191 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 192 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 193 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 194 FINLAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 195 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 196 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 197 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 198 FINLAND: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 199 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 200 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 201 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 202 LITHUANIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 203 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 204 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 205 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 206 LITHUANIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 207 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 208 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 209 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 210 LATVIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 211 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 212 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 213 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 214 LATVIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 215 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 216 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 217 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 218 ESTONIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 219 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 220 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 221 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 222 ESTONIA: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 223 REST OF EUROPE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 224 REST OF EUROPE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 225 REST OF EUROPE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 226 REST OF EUROPE: PAINTS & COATINGS MARKET SIZE, BY -USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 227 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 228 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 229 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 230 REST OF EUROPE: INDUSTRIAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 231 MARKET RANKING ANALYSIS, 2022

- TABLE 232 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 233 COMPANY REGION FOOTPRINT

- TABLE 234 OVERALL COMPANY FOOTPRINT

- TABLE 235 STRATEGIC DEVELOPMENTS ADOPTED BY KEY PLAYERS

- TABLE 236 MOST FOLLOWED STRATEGIES BY KEY COMPANIES

- TABLE 237 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 238 DETAILED LIST OF KEY MARKET PLAYERS

- TABLE 239 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 240 PRODUCT LAUNCHES, 2019–2023

- TABLE 241 DEALS, 2019–2023

- TABLE 242 AKZO NOBEL N.V.: BUSINESS OVERVIEW

- TABLE 243 AKZO NOBEL N.V.: PRODUCT LAUNCHES

- TABLE 244 AKZO NOBEL N.V.: DEALS

- TABLE 245 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 246 PPG INDUSTRIES, INC.: DEALS

- TABLE 247 PPG INDUSTRIES, INC.: OTHERS

- TABLE 248 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 249 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 250 THE SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 251 BASF COATINGS GMBH: COMPANY OVERVIEW

- TABLE 252 BASF COATINGS GMBH: DEALS

- TABLE 253 AXALTA COATING SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 254 AXALTA COATING SYSTEMS LLC: PRODUCT LAUNCHES

- TABLE 255 AXALTA COATING SYSTEMS LLC: DEALS

- TABLE 256 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 257 JOTUN A/S: COMPANY OVERVIEW

- TABLE 258 JOTUN A/S: PRODUCT LAUNCHES

- TABLE 259 HEMPEL A/S: COMPANY OVERVIEW

- TABLE 260 HEMPEL A/S: PRODUCT LAUNCHES

- TABLE 261 HEMPEL A/S: DEALS

- TABLE 262 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- TABLE 263 KANSAI PAINTS CO., LTD.: DEALS

- TABLE 264 CROMOLOGY (NIPPON PAINT HOLDINGS CO., LTD.): COMPANY OVERVIEW

- TABLE 265 CROMOLOGY (NIPPON PAINT HOLDINGS CO., LTD.): PRODUCT LAUNCHES

- TABLE 266 BECKERS GROUP: DEALS

- TABLE 267 TEKNOS GROUP: PRODUCT LAUNCHES

- TABLE 268 TEKNOS GROUP: DEALS

- TABLE 269 FLUGGER GROUP: PRODUCT LAUNCHES

- TABLE 270 FLUGGER GROUP: DEALS

- TABLE 271 IVM CHEMICALS: DEALS

- TABLE 272 WEILBURGER COATIINGS GMBH: DEALS

- TABLE 273 COATING RESINS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 274 COATING RESINS MARKET, BY RESIN TYPE, 2021–2026 (USD MILLION)

- TABLE 275 COATING RESINS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 276 COATING RESINS MARKET, BY RESIN TYPE, 2021–2026 (KILOTON)

- TABLE 277 COATING RESINS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 278 COATING RESINS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

- TABLE 279 COATING RESINS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 280 COATING RESINS MARKET, BY TECHNOLOGY, 2021–2026 (KILOTON)

- TABLE 281 COATING RESINS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 282 COATING RESINS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 283 COATING RESINS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 284 COATING RESINS MARKET, BY APPLICATION, 2021–2026 (KILOTON)

- TABLE 285 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017–2020 (USD MILLION)

- TABLE 286 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021–2026 (USD MILLION)

- TABLE 287 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017–2020 (KILOTON)

- TABLE 288 ARCHITECTURAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021–2026 (KILOTON)

- TABLE 289 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017–2020 (USD MILLION)

- TABLE 290 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021–2026 (USD MILLION)

- TABLE 291 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2017–2020 (KILOTON)

- TABLE 292 INDUSTRIAL COATING RESINS MARKET, BY SUB-APPLICATION, 2021–2026 (KILOTON)

- TABLE 293 COATING RESINS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 294 COATING RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 295 COATING RESINS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 296 COATING RESINS MARKET, BY REGION, 2021–2026 (KILOTON)

- FIGURE 1 EUROPEAN PAINTS AND COATINGS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET ESTIMATION: SUPPLY SIDE

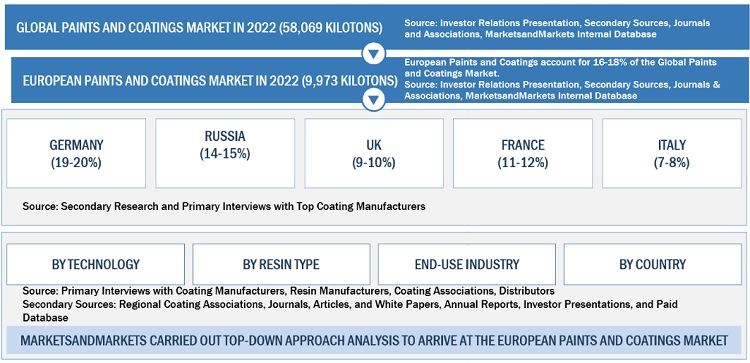

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 EUROPEAN PAINTS AND COATINGS MARKET: DATA TRIANGULATION

- FIGURE 5 ACRYLIC TO BE MOST WIDELY USED RESIN TYPE IN MARKET

- FIGURE 6 WATERBORNE TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE OF MARKET

- FIGURE 7 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 8 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS BETWEEN 2023 AND 2028

- FIGURE 9 ACRYLIC RESIN TYPE TO BE LARGEST SEGMENT BY 2028

- FIGURE 10 GERMANY AND ARCHITECTURAL END-USE INDUSTRY DOMINATED PAINTS AND COATINGS MARKETS IN 2022

- FIGURE 11 GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN EUROPEAN PAINTS AND COATINGS MARKET

- FIGURE 13 PORTER'S FIVE FORCES ANALYSIS: EUROPEAN PAINTS AND COATINGS MARKET

- FIGURE 14 KEY BUYING CRITERIA FOR EUROPEAN PAINTS AND COATINGS

- FIGURE 15 EUROPEAN PAINTS AND COATINGS: VALUE CHAIN ANALYSIS

- FIGURE 16 AVERAGE PRICE COMPETITIVENESS IN EUROPEAN PAINTS AND COATINGS MARKET, BY COUNTRY

- FIGURE 17 AVERAGE PRICE COMPETITIVENESS IN EUROPEAN PAINTS AND COATINGS MARKET, BY TECHNOLOGY, 2022

- FIGURE 18 AVERAGE PRICE COMPETITIVENESS IN EUROPEAN PAINTS AND COATINGS MARKET, BY COMPANY, 2022

- FIGURE 19 EUROPEAN PAINTS AND COATINGS MARKET: ECOSYSTEM

- FIGURE 20 NUMBER OF PATENTS PUBLISHED, 2016–2023

- FIGURE 21 PATENTS PUBLISHED BY JURISDICTIONS, 2016–2023

- FIGURE 22 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2016–2023

- FIGURE 23 ACRYLIC SEGMENT TO LEAD MARKET FOR EUROPEAN PAINTS & COATINGS BY 2028

- FIGURE 24 ACRYLIC SEGMENT TO LEAD MARKET FOR EUROPEAN ARCHITECTURAL PAINTS & COATINGS BY 2028

- FIGURE 25 POLYURETHANE REMAINS DOMINANT RESIN TYPE IN EUROPEAN INDUSTRIAL PAINTS & COATINGS MARKET

- FIGURE 26 WATERBORNE SEGMENT TO LEAD EUROPEAN PAINTS & COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 27 ARCHITECTURAL SEGMENT TO ACHIEVE HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 EUROPEAN PAINTS & COATINGS MARKET SNAPSHOT

- FIGURE 29 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN EUROPEAN PAINTS & COATINGS MARKET

- FIGURE 31 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES, 2022

- FIGURE 32 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 33 REVENUE ANALYSIS OF TOP PLAYERS, 2018–2022

- FIGURE 34 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 35 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 36 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 37 BASF COATINGS GMBH: COMPANY SNAPSHOT

- FIGURE 38 AXALTA COATING SYSTEMS LLC: COMPANY SNAPSHOT

- FIGURE 39 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 40 JOTUN A/S: COMPANY SNAPSHOT

- FIGURE 41 HEMPEL A/S: COMPANY SNAPSHOT

- FIGURE 42 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 43 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 44 PAINTS & COATINGS: ECOSYSTEM

The study involves four major activities in estimating the current market size of European Paints and Coatings. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

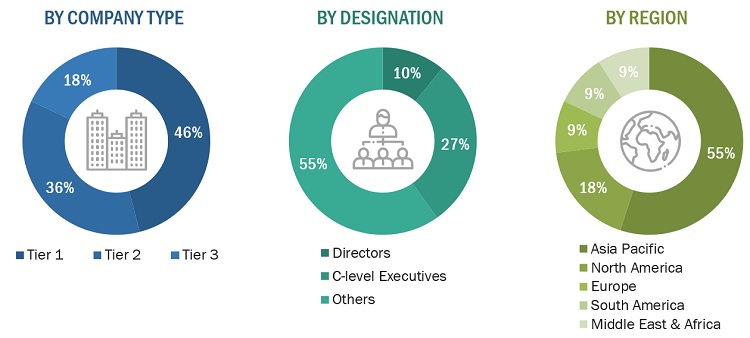

Primary Research

The European Paints and Coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as residential, remodel and repaint, non-residential, general industrial, automotive OEM, and wood, etc. Advancements in formulations characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the European Paints and Coatings market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global European Paints and Coatings Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Paint is any liqid mixture that converts into solid film after application to a surface in a thin layer. A coating is a covering that is applied to a surface for decoration and protection. It includes all organic and inorganic coatings: enamels, varnishes, emulsions, and bituminous coatings. The word coating is used broadly to refer to any colored or clear product, and the word paint is used to describe a pigmented product with an organic or inorganic binder.

Key Stakeholders

- Manufacturers of Paints & Coatings and their raw materials

- Manufacturers of Paints & Coatings for various applications in sectors such as automotive, aerospace, construction, marine, wood, rail, packaging, and commercial

- Traders, Distributors, and Suppliers of Paints & Coatings

- Regional manufacturers’ Associations and Paints & Coatings Associations

- Government and Regional Agencies and Research Organizations

Report Objectives

- To analyze and forecast the size of the European Paints and Coatings market in terms of value and volume

- To define, describe, and forecast the European Paints and Coatings market by resin type, technology, end-use industry, and country

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market size of the European paints and coatings market concerning the various major countries in Europe

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches, and investments & expansions, in the European Paints and Coatings market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the European Paints and Coatings market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the European Paints and Coatings market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in European Paints and Coatings Market