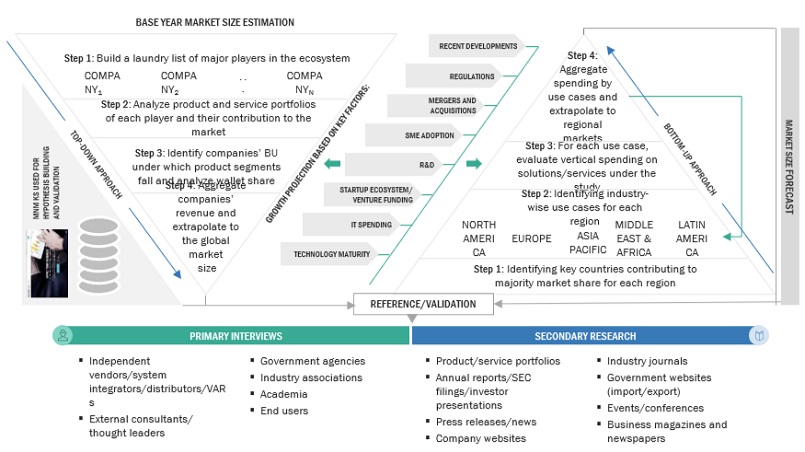

The study involved four major activities to estimate the current market size for the EFSS market. An exhaustive secondary research was done to collect information on the EFSS market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the EFSS market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg Business Week, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard, and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

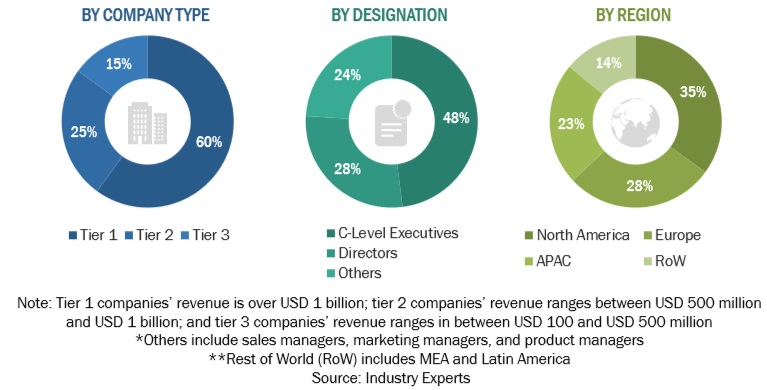

The EFSS market comprises several stakeholders, such as EFSS operators, EFSS service providers, venture capitalists, government organizations, regulatory authorities, policymakers and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side of the EFSS market consists of all the firms operating in several industry verticals. The supply side includes EFSS providers, offering EFSS solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the EFSS market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global EFSS market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The bottom-up procedure was employed to arrive at the overall market size of the EFSS market from the revenues of the key players (companies) and their market shares. The calculation was done based on estimations and by verifying their revenues through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of the other individual segments (offering, deployment mode, business function, application, vertical, and region) via percentage splits of market segments from the secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

-

The pricing trend is assumed to vary over time.

-

All the forecasts are made with the standard assumption that the accepted currency is USD.

-

For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

-

All the forecasts are made under the standard assumption that the globally accepted currency USD, remains constant during the next five years.

-

Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

-

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on geospatial analytics based on some of the key use cases. These factors for the geospatial analytics per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Market Size Estimation: Top Down And Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Enterprise file synchronization and sharing (also known as EFSS and enterprise file sync and share) refers to software services that enable organizations to securely synchronize and share documents, photos, videos, and files from multiple devices with employees, external customers and partners. Organizations often adopt these technologies to prevent employees from using consumer-based file sharing apps to store, access, and manage corporate data that is outside of the IT department’s control and visibility

Key Stakeholders

-

EFSS Solution Vendors

-

Mobile Device Manufacturers

-

EFSS Service Providers

-

Mobile Device End-Users

-

Application Developers

-

Manufacturers of Mobile Device Operation Systems

-

System Integrators

-

Information Technology (IT) Developers

-

Third-party Vendors

-

Cloud Service Providers

-

Network Operators

-

Infrastructure Providers

-

EFSS End-Users

-

Government Agencies and Organizations

-

Regulatory and Compliance Agencies

Report Objectives

-

To describe and forecast the size of the Enterprise File Synchronization and Sharing (EFSS) market by offering, business function, application, vertical and region

-

To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the EFSS market

-

To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall EFSS market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments

-

To profile key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

-

To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

-

Further breakup of the North American market for EFSS

-

Further breakup of the European market for EFSS

-

Further breakup of the Asia Pacific market for EFSS

-

Further breakup of the Latin American market for EFSS

-

Further breakup of the Middle East & Africa market for EFSS

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Enterprise File Synchronization and Sharing (EFSS) Market