Electronic Films Market by Film Type (Non-Conductive and Conductive), Material Type (Polymer, ITO on Glass, ITO on Pet, and Metal Mesh), Application (Electronic Display, PCB, and Semiconductors), and Region - Global Forecast to 2023

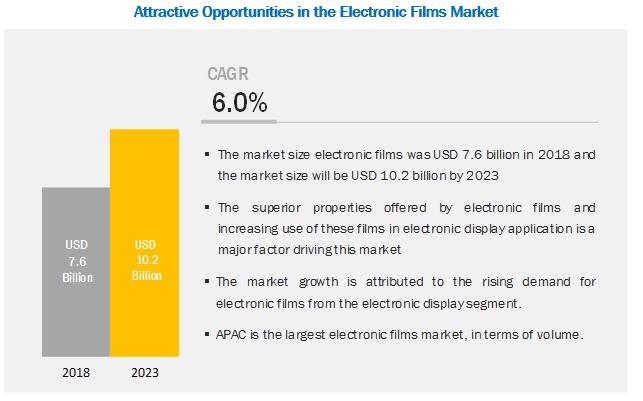

[121 Pages Report] The electronic films market is projected to grow from USD 7.6 billion in 2018 to USD 10.2 billion by 2023, at a CAGR of 6.0% during the forecast period. The study involved four major activities in estimating the current market size for electronic films. Exhaustive secondary research was done to collect information on the market, the peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg, Industrial Film Association, and BusinessWeek were referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

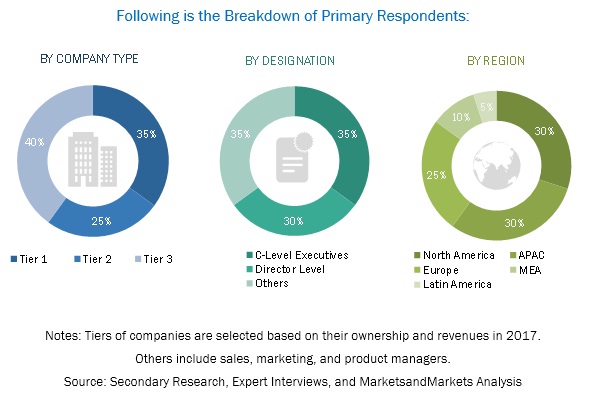

The electronic films market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the electronics industry and the rise in consumer demand. The supply side is characterized by advancements in technology and diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the electronic films market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in the electronics industry.

Report Objectives

- To define, describe, and forecast the electronic films market, in terms of volume and value

- To provide detailed information about the key factors—drivers, restraints, opportunities, and challenges, influencing the growth of this market

- To estimate and forecast the market by material type, by film type, and by application

- To analyze and forecast the market size on the basis of regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America along with their major countries

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders

- To analyze recent market developments and competitive strategies, such as expansion, acquisition, partnership & joint venture, and new product launch and draw a competitive landscape

- To strategically profile the key players in the market and comprehensively analyze their market shares

Scope Of The Report

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This research report categorizes the electronic films market based on film type, material type, application, and region.

On the basis of film type, the electronic films market has been segmented as follows:

- Non-conductive

- Conductive

On the basis of material type, the electronic films market has been segmented as follows:

- Polymer

- ITO on Glass

- ITO on PET

- Metal Mesh

- Others (silver nanowire, carbon nanotubes, PEDOT, and micro fine wire)

On the basis of application, the electronic films market has been segmented as follows:

- Electronic Display

- Printed Circuit Boards

- Semiconductors

- Others (wires & cables and photovoltaics)

On the basis of region, the electronic films market has been segmented as follows:

- APAC

- North America

- Europe

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of regional analysis, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The electronic films market is projected to grow from USD 7.6 billion in 2018 to USD 10.2 billion by 2023, at a CAGR of 6.0% during the forecast period. The market is growing due to the high demand for electronic displays from smartphones, tablets, and other similar consumer electronic devices. Electronic films are used in this application as they exhibit properties such as chemical resistance, high-temperature tolerance, low coefficient of friction, optical transparency, conductivity, UV & weather resistance, moisture resistance, high insulation, low surface energy, and low dielectric constant.

By film type, the non-conductive film type is expected to have the largest demand during the forecast period.

Electronic films are in two types – non-conductive and conductive. The non-conductive film segment is expected to lead the electronic films market during the forecast period. These films are known for their significant physical properties such as high-temperature tolerance, low coefficient of friction, chemical inertness, weather/UV resistance, and negligible moisture absorption. High demand for non-conductive films from electronic display, PCBs, and semiconductor manufacturers is driving its market. The roll out of 5G in China by 2020 and adoption of digital signage will boost the demand for PCBs and electronic display.

By material type, polymer is extimated to be the largest material type segment of the electronic films market in 2018.

The polymer material type is expected to dominate the electronic films market in 2018 because the films based on this material are used in various applications such as electronic display, semiconductors, and PCBs, whereas films based on other materials are mainly used in electronic displays. Furthermore, the use of polymer material type is expected to rise in the future due to upcoming 5G in China by 2020 and rapid use of PCB in automotive electronics

Electronic display is projected to be the largest application of electronic films during the forecast period.

Electronic films are used in electronic display, PCBs, semiconductors, and other applications. They are majorly used in the electronic display application. There is a rising preference for large screen size LCDs in residential and commercial destinations. Large screen size LCDs have a larger surface area, and this leads to higher consumption of electronic films. Digital signage uses technologies such as LCD and LED in public spaces, stadiums, retail stores, hotels, and restaurants. The demand for digital signage is increasing due to the flourishing retail industry. Furthermore, over the past few years, display technology has undergone radical changes, which has led to the increased adoption of OLED (organic light emitting diode), QDLED (quantum dot light emitting diode), and EPD (electronic paper display) technologies.

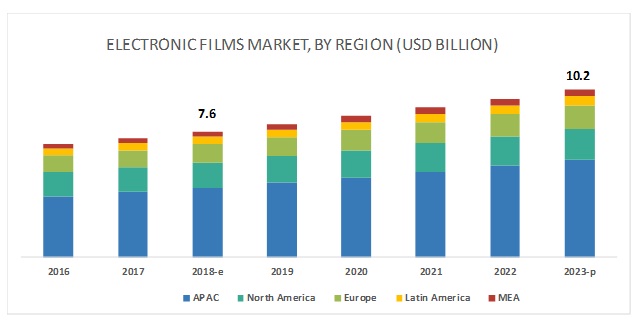

APAC is expected to lead the electronic films market during the forecast period.

APAC is a key electronic films market. Majority of the electronic films manufacturers across the region are constantly involved in product innovations. The manufacturers are adopting various growth strategies to strengthen their position in the market.

The electronic films market comprises major solution providers, such as DowDuPont (US), Toray Industries Inc. (Japan), Gunze (Japan), Nitto Denko Corporation (Japan), Saint-Gobain S.A. (France), The Chemours Company (US), Toyobo Co, Ltd. (Japan), Teijin Ltd. (Japan), TDK Corporation (Japan), and 3M (US). The study includes an in-depth competitive analysis of these key players in the electronic films market, with their company profiles, recent developments, and key market strategies.

DowDuPont is one of the prominent players in the electronic films market. The company has a strong focus on R&D to increase its technology-driven product portfolio. As a part of its growth strategy, the company is highly focused on new product developments and expansions. For instance, in May 2018, the company increased the production capacity of its Kapton polyimide film by up to 20%. This helped the company to meet the high demand for Kapton polyimide film for Interconnect Solutions of the DuPont Electronics & Imaging segment.

Recent Developments

- In May 2018, DowDuPont (US) increased the production capacity of its Kapton polyimide film by up to 20%. This helped the company to meet the high demand for Kapton polyimide film for Interconnect Solutions of the DuPont Electronics & Imaging segment.

- In April 2017, Saint-Gobain S.A. (France) launched ultra-wide-web coater for reactive sputtering at its manufacturing facility in San Diego, California. It is a technique for depositing thin layers of metals, ceramics, and oxides on to films. This will help the company to enhance NORFILM’s capability to deliver high-quality and highly engineered products to customers.

- In June 2016, Nitto Denko Corporation (Japan) acquired the functional film business used for automotive side curtain airbags from Nolax Holding (Switzerland). With this acquisition, the company expanded its product portfolio to cater to the automotive and transportation industries effectively.

Key questions addressed by the report

- Which are the major applications of electronic films?

- Which application is the major consumer of electronic films?

- Which region is the largest and fastest-growing market for electronic films?

- Which material is mostly used in conductive films?

- What are the major strategies adopted by leading market players?

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of electronic film market?

What are the material types used for manufacturing electronic film?

Which are the major product types of electronic film?

What are the opportunities for electronic film in recent future?

How is the electronic film market Aligned?

Who are the major manufacturers?

What are the major applications for electronic film?

What is the biggest Restraint for electronic film?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Electronic Films Market

4.2 Electronic Films Market, By Film Type

4.3 Electronic Films Market, By Material Type

4.4 Electronic Films Market Size, By Application

4.5 Electronic Films Market, By Application and Region

4.6 Electronic Films Market, By Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Tablets, Smartphones, and Other Similar Consumer Electronic Devices

5.2.1.2 Growing Preference for Touch-Enabled LCD Panels

5.2.1.3 High-Performance Properties of Polymer-Based Electronic Films

5.2.2 Restraints

5.2.2.1 High Technology Development and Manufacturing Cost of Electronic Films

5.2.2.2 High Volatility in Prices of ITO

5.2.3 Opportunities

5.2.3.1 Continuous Development of Application Products

5.2.3.2 Development of PCBs Due to the Expected 5G Rollout

5.2.4 Challenges

5.2.4.1 Difficulty in Processing

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Bargaining Power of Suppliers

5.3.3 Bargaining Power of Buyers

5.3.4 Threat of New Entrants

5.3.5 Intensity of Competitive Rivalry

6 Electronic Films Market, By Film Type (Page No. - 42)

6.1 Introduction

6.2 Non-Conductive Films

6.2.1 APAC is Expected to Dominate the Non-Conductive Electronic Films Market

6.3 Conductive Films

6.3.1 APAC is Expected to Be the Fastest-Growing Conductive Electronic Films Market

7 Electronic Films Market, By Material Type (Page No. - 48)

7.1 Introduction

7.2 Polymer

7.2.1 Polymer is Likely to Be the Dominating Material Type in the Electronic Films Market

7.3 ITO on Glass

7.3.1 ITO on Glass Material is Expected to Have High Demand From the Electronic Display Application

7.4 ITO on PET

7.4.1 Growing Demand for Touch Panels Drives the ITO on PET Material Type Segment

7.5 Metal Mesh

7.5.1 APAC is Projected to Be the Fastest-Growing Electronic Films Market for Metal Mesh

7.6 Others

8 Electronic Films Market, By Application (Page No. - 58)

8.1 Introduction

8.2 Electronic Display

8.2.1 Electronic Display is Likely to Be the Largest Application of Electronic Films

8.3 Printed Circuit Boards

8.3.1.1 APAC is Projected to Register the Highest CAGR in the Printed Circuit Boards Segment

8.4 Semiconductors

8.4.1.1 Semiconductors is Expected to Be the Largest Application in North America

8.5 Others

9 Electronic Films Market, By Region (Page No. - 67)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 China is the Largest Electronic Films Market

9.2.2 Japan

9.2.2.1 Competitive Prices From Chinese Manufacturers Have Restrained Electronic Display Manufacturing

9.2.3 South Korea

9.2.3.1 Presence of Electronics and Semiconductors Manufacturers is Likely to Boost the Demand for Electronic Displays

9.2.4 Taiwan

9.2.4.1 Foreign Investments and Low Cost of Production are Driving the Market

9.2.5 India

9.2.5.1 Rising Demand for Smartphones and Display Units is Likely to Drive the Electronic Films Market

9.2.6 Rest of APAC

9.3 North America

9.3.1 US

9.3.1.1 US Dominates the North American Market Due to the High Demand for Electronic Films in the Country

9.3.2 Canada

9.3.2.1 Tvs and Communication Systems are the Major Consumers of Electronic Films in Canada

9.4 Europe

9.4.1 Germany

9.4.1.1 Demand for Electronic Films is High Due to the Country’s Large Electronics Industry and Technological Leadership

9.4.2 France

9.4.2.1 Electronic Display Application is Expected to Drive the Electronic Films Market

9.4.3 UK

9.4.3.1 Presence of A Large Number of Semiconductor Design Houses is Expected to Drive the Electronic Films Market

9.4.4 Italy

9.4.4.1 Increasing Consumption of Smartphones is Driving the Market

9.4.5 Russia

9.4.5.1 Steady Growth of the Microelectronics Industry is Expected to Drive the Market

9.4.6 Rest of Europe

9.5 Latin America

9.5.1 Mexico

9.5.1.1 Mexico is Expected to Be the Largest Electronic Films Market

9.5.2 Brazil

9.5.2.1 Increasing Use of Smartphones and Other Touch Display Devices is Expected to Boost the Demand for Electronic Films

9.5.3 Rest of Latin America

9.6 MEA

9.6.1 South Africa

9.6.1.1 Growing Demand for Smartphones is Likely to Boost the Market

9.6.2 Saudi Arabia

9.6.2.1 Increasing Demand for Electronic Display Devices is Expected to Drive the Market

9.6.3 Rest of MEA

9.7 Introduction

9.7.1 Competitive Situation and Trends

9.7.2 New Product Launch

9.7.3 Expansion

9.7.4 Partnership & Joint Venture

9.7.5 Acquisition

10 Company Profiles (Page No. - 98)

10.1 Dowdupont

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Developments

10.1.4 MnM View

10.2 Gunze

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 MnM View

10.3 Nitto Denko Corporation

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.3.4 SWOT Analysis

10.3.5 MnM View

10.4 Saint-Gobain S.A.

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 SWOT Analysis

10.4.5 MnM View

10.5 Toray Industries Inc.

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.5.5 MnM View

10.6 The Chemours Company

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 SWOT Analysis

10.6.4 MnM View

10.7 Toyobo Co., Ltd

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 Recent Developments

10.7.4 MnM View

10.8 Teijin Ltd.

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 MnM View

10.9 TDK Corporation

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 MnM View

10.10 3M

10.10.1 Business Overview

10.10.2 Products Offered

10.10.3 Recent Developments

10.10.4 SWOT Analysis

10.10.5 MnM View

10.11 Other Companies

10.11.1 Coveris

10.11.2 SKC Inc.

10.11.3 Daikin

10.11.4 Mitsubishi Chemical Holdings

10.11.5 Oike & Co. Ltd.

10.11.6 Eastman Chemical Company

10.11.7 C3 Nano

10.11.8 Dontech Inc.

10.11.9 SABIC

10.11.10 Canatu Oy

10.12 Discussion Guide

10.13 Introducing RT: Real-Time Market Intelligence

10.14 Available Customizations

10.15 Related Reports

List of Tables (44 Tables)

Table 1 Electronic Films Market Size, 2016–2023

Table 2 Electronic Films Market Size, By Film Type, 2016–2023 (USD Million)

Table 3 Electronic Films Market Size, By Film Type, 2016–2023 (Kiloton)

Table 4 Non-Conductive Electronic Films Market Size, By Region, 2016–2023 (USD Million)

Table 5 Non-Conductive Electronic Films Market Size, By Region, 2016–2023 (Kiloton)

Table 6 Conductive Electronic Films Market, By Region, 2016–2023 (USD Million)

Table 7 Conductive Electronic Films Market Size, By Region, 2016–2023 (Kiloton)

Table 8 Electronic Films Market Size, By Material Type, 2016–2023 (USD Million)

Table 9 Electronic Films Market Size, By Material Type, 2016–2023 (Kiloton)

Table 10 Polymer: By Market Size In, By Region, 2016–2023 (USD Million)

Table 11 Polymer: By Market Size, By Region, 2016–2023 (Kiloton)

Table 12 ITO on Glass: By Market Size, By Region, 2016–2023 (USD Million)

Table 13 ITO on Glass: By Market Size, By Region, 2016–2023 (Kiloton)

Table 14 ITO on PET: By Market Size, By Region, 2016–2023 (USD Million)

Table 15 ITO on PET: By Market Size, By Region, 2016–2023 (Kiloton)

Table 16 Metal Mesh: By Market Size, By Region, 2016–2023 (USD Million)

Table 17 Metal Mesh: By Market Size, By Region, 2016–2023 (Kiloton)

Table 18 Others: By Market Size, By Region, 2016–2023 (USD Million)

Table 19 Others: By Market Size, By Region, 2016–2023 (Kiloton)

Table 20 By Market Size, By Application, 2016–2023 (USD Million)

Table 21 By Market Size, By Application, 2016–2023 (Kiloton)

Table 22 By Market Size in Electronic Display Application, By Region, 2016–2023 (USD Million)

Table 23 By Market Size in Electronic Display Application, By Region, 2016–2023 (Kiloton)

Table 24 By Market Size in Printed Circuit Boards Application, By Region, 2016–2023 (USD Million)

Table 25 By Market Size in Printed Circuit Boards Application, By Region, 2016–2023 (Kiloton)

Table 26 By Market Size in Semiconductors Application, By Region, 2016–2023 (USD Million)

Table 27 By Market Size in Semiconductors Application, By Region, 2016–2023 (Kiloton)

Table 28 By Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 29 By Market Size in Other Applications, By Region, 2016–2023 (Kiloton)

Table 30 By Market Size, By Region, 2018–2023 (USD Million)

Table 31 By Market Size, By Region, 2018–2023 (Kiloton)

Table 32 Latin America: Electronic Films Market Size, By Material Type, 2016–2023 (Kiloton)

Table 33 MEA: By Market Size, By Country, 2016–2023 (USD Million)

Table 34 MEA: By Market Size, By Country, 2016–2023 (Kiloton)

Table 35 MEA: By Market Size, By Application, 2016–2023 (USD Million)

Table 36 MEA: By Market Size, By Application, 2016–2023 (Kiloton)

Table 37 MEA: By Market Size, By Film Type, 2016–2023 (USD Million)

Table 38 MEA: By Market Size, By Film Type, 2016–2023 (Kiloton)

Table 39 MEA: By Market Size, By Material Type, 2016–2023 (USD Million)

Table 40 MEA: By Market Size, By Material Type, 2016–2023 (Kiloton)

Table 41 New Product Launch, 2014–2018

Table 42 Expansion, 2014–2018

Table 43 Agreements, 2014–2018

Table 44 Acquisition, 2014–2018

List of Figures (45 Figures)

Figure 1 Electronic Films: Market Segmentation

Figure 2 Electronic Films Market: Research Design

Figure 3 Electronic Films Market: Bottom-Up Approach

Figure 4 Electronic Films Market: Top-Down Approach

Figure 5 Non-Conductive Film Type to Dominate the Market

Figure 6 Metal Mesh to Be the Fastest-Growing Material Type Segment of the Electronic Films Market

Figure 7 Electronic Display to Be the Largest Application Segment

Figure 8 APAC Led the Electronic Films Market

Figure 9 China to Register the Highest CAGR in the Electronic Films Market

Figure 10 Overview of Factors Governing the Electronic Films Market

Figure 11 Electronic Films Market: Porter’s Five Forces Analysis

Figure 12 Non-Conductive to Be the Largest Film Type

Figure 13 APAC to Be the Largest Non-Conductive Electronic Films Market

Figure 14 APAC is the Largest Conductive Electronic Films Market

Figure 15 Polymer Material Type Dominates the Electronic Films Market

Figure 16 Polymer to Have A High Demand in the APAC Electronic Films Market

Figure 17 ITO on Glass to Have A High Demand in APAC Electronic Films Market

Figure 18 ITO on PET Material to Have A High Demand in the APAC Electronic Films Market

Figure 19 Metal Mesh Material Type to Have A High Demand in the APAC Electronic Films Market

Figure 20 Electronic Display Application to Dominate the Market

Figure 21 APAC to Lead the Electronic Films Market in Electronic Display Application

Figure 22 APAC to Be the Largest Electronic Films Market in Printed Circuit Boards Application

Figure 23 North America to Lead the Electronic Films Market in the Semiconductors Application

Figure 24 China to Be the Fastest-Growing Electronic Films Market

Figure 25 APAC: Electronic Films Market

Figure 26 North America: Electronic Films Market

Figure 27 Europe: Electronic Films Market

Figure 28 Mexico to Be the Largest Electronic Films Market in Latin America

Figure 29 South Africa to Be the Largest Electronic Films Market in MEA

Figure 30 Companies Adopted New Product Launches as the Key Growth Strategy Between 2014 and 2018

Figure 31 Dowdupont: Company Snapshot

Figure 32 Gunze: Company Snapshot

Figure 33 Nitto Denko Corporation: Company Snapshot

Figure 34 Nitto Denko Corporation: SWOT Analysis

Figure 35 Saint Gobain S.A.: Company Snapshot

Figure 36 Saint Gobain S.A.: SWOT Analysis

Figure 37 Toray Industries Inc.: Company Snapshot

Figure 38 Toray Industries Inc.: SWOT Analysis

Figure 39 The Chemours Company: Company Snapshot

Figure 40 The Chemours Company: SWOT Analysis

Figure 41 Toyobo Co., Ltd: Company Snapshot

Figure 42 Teijin Ltd.: Company Snapshot

Figure 43 TDK Corporation: Company Snapshot

Figure 44 3M: Company Snapshot

Figure 45 3M: SWOT Analysis

Growth opportunities and latent adjacency in Electronic Films Market